Railway Telematics Market — Growth, Forecast & Key Drivers

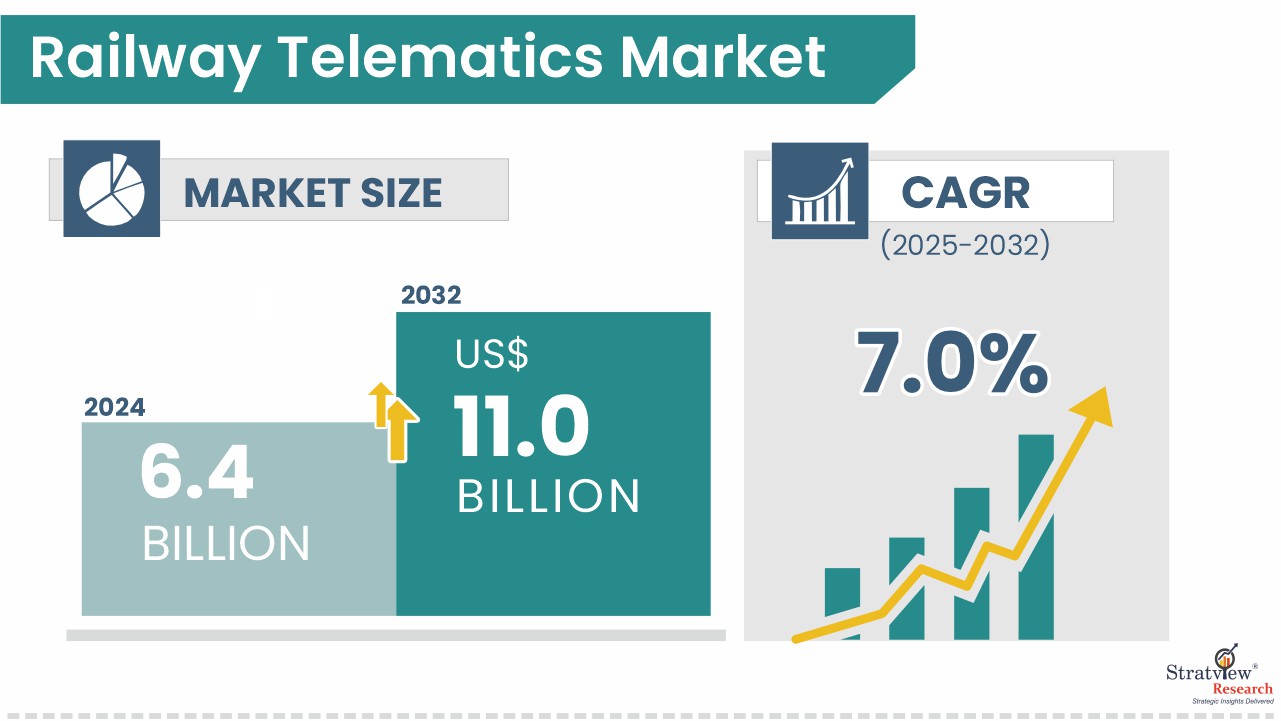

Railway telematics refers to a suite of technologies—GPS, sensors, data-analytics, IoT, telematics control units etc.—that enable real-time monitoring, control, and predictive maintenance for railway systems. As rail networks worldwide push to become safer, more efficient, and smarter, telematics is increasingly central. According to Stratview Research, the Railway Telematics Market was valued at USD 6.40 billion in 2024, growing from about USD 5.96 billion in 2023 with a year-on-year growth of around 7.4%. The market is projected to expand to USD 11.08 billion by 2032, at a CAGR of ~7.0% over the forecast period (2025-2032).

Request a Free Sample Report Here:

https://www.stratviewresearch.com/Request-Sample/4156/railway-telematics-market.html#form

Drivers

Several factors are fuelling this growth:

-

Government initiatives for smart railways: Many nations are investing in modernization of their rail systems—digital signalling, tracking, train control systems—and hence demand for telematics solutions is rising. Stratview identifies government support as a key driver.

-

Growing demand for smart ticketing and passenger convenience: Integration of telematics with ticketing, real-time passenger information, and comfort/safety enhancements is boosting uptake. Passengers expect timely updates, safer rides, and better service.

-

Freight & asset tracking needs: The freight rail segment demands more real-time monitoring of goods, schedules, and equipment condition. With rising global trade and logistics, telematics help optimize operations. While Stratview’s primary segmentation is by solution, component, etc., complementary reports also highlight this driver.

-

Need for predictive maintenance and reduced downtime: Sensors and connectivity allow early fault detection, condition monitoring, and avoiding expensive breakdowns. Rail operators are keen to reduce maintenance costs while ensuring safety.

Trends

Key trends shaping how the railway telematics market is evolving:

• Fleet Management solutions leading: Among different telematics-solutions (fleet management, train tracking, remote data access, etc.), fleet management is expected to be a dominant growth segment under Stratview’s report, driving much of market expansion.

• Components: Telematics Control Units (TCUs) and sensors: The component side is being led by telematics control units. These, together with advanced sensors, are critical for enabling data collection and communication. The growth in these component segments reflect the push for richer, real-time, and more granular monitoring.

• Regional growth: Asia-Pacific fastest, North America & Europe large in current size: The Asia-Pacific region is expected to be the fastest-growing region for railway telematics, per Stratview. Meanwhile, North America and Europe continue to be big markets due to existing rail infrastructure, regulatory regimes, and investments.

• Emphasis on safety, regulatory compliance, and passenger experience: As public expectations rise (safety, punctuality, comfort), and as regulatory norms around rail operations get stricter, telematics solutions that help with compliance (signal violation warnings, speed monitoring, fire or hazard detection, etc.) are in demand. Also, features like passenger information systems, remote diagnostics etc., are getting traction.

• Smart / digital city / infrastructure integration: Telematics for rail networks is aligning with broader “smart transport / smart cities” agendas. Integration with digital signaling, IoT infrastructure, cloud platforms, and big data analytics is increasingly standard.

Conclusion

The railway telematics market is on a strong growth trajectory. With a base size of about USD 6.40 billion in 2024 and forecasts pointing to USD 11.08 billion by 2032, the market offers significant opportunities. For companies involved in telematics control units, sensors, software, services, and fleet management, the focus should be on improving reliability, real-time analytics, safety, and integrating with broader digital infrastructure.

Rail operators and policy makers who invest in modernizing infrastructure, regulatory compliance, and enhancing passenger safety and satisfaction will likely drive the next wave of adoption. Where the market will differentiate is likely in component quality (TCU, sensors), do-it-all vs modular solutions, cloud/data analytics capabilities, and regional adaptation (especially in Asia). All in all, the future looks promising for railway telematics.