Specialty Carbon Black Market — Growing Demand from Batteries, Plastics & Smart Materials

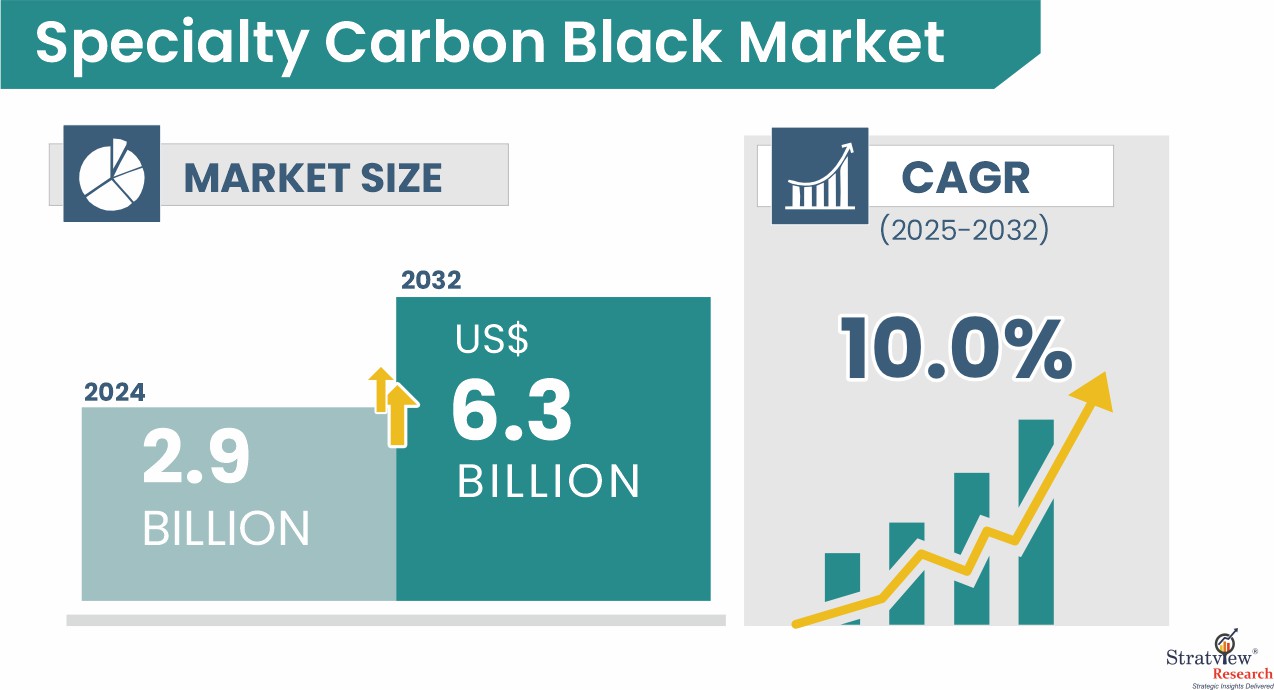

Specialty carbon black is the purer, high-performance form of carbon black with low levels of impurities (ash, sulphur etc.), engineered for enhanced conductivity, UV protection, pigmentation etc. As applications expand beyond rubber and tires into batteries, coatings, electronics, and packaging, its market is gaining momentum. According to Stratview Research, the specialty carbon black market was estimated at USD 2.9 billion in 2024 and is expected to reach USD 6.3 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of about 10.0% over 2025-2032.

Download the sample report here:

https://www.stratviewresearch.com/Request-Sample/600/specialty-carbon-black-market.html#form

Drivers

Several major forces are pushing this growth:

• Battery / EV & energy storage demand: The surge in electric vehicle adoption and energy storage systems is increasing demand for specialty carbon black as a conductive additive in lithium-ion battery electrodes. High surface area, good conductivity and purity are essential for performance, so premium grades are increasingly required.

• Plastics, packaging, and coatings growth: Plastics used in automotive, electronics and packaging require pigmentation, UV protection, and resistance to environmental degradation. Specialty carbon black is increasingly used in these fields to improve durability, color stability, and performance.

• Smart infrastructure & electronics: The rise of IoT, conductive polymers, anti-static materials, EMI shielding, and high-performance cables/coatings boosts the demand for specialty carbon black with controlled conductivity, purity, and structure.

• Regional market dynamics, especially Asia-Pacific: Asia-Pacific accounted for over 45% of the market share in 2024, driven by expanding electronics, packaging, automotive, and industrial sectors. Increasing disposable income, industrialization, and infrastructure growth in that region are helping propel demand.

Trends

Here are key trends shaping the specialty carbon black market:

• Plastic applications dominate: Among application types (plastics, inks, coatings, others), the plastic segment both dominates currently and is expected to see some of the highest incremental growth as more non-rubber uses emerge.

• Printing & packaging leading as an end-use: Printing & packaging is one of the top end-use industries using specialty carbon black, especially in food packaging, consumer goods, and product labeling. The demand for high pigment quality, UV stability, and color consistency drives this.

• Conductive grades growing fast: Grades that enable conductivity (for batteries, electronics, anti-static) are among the fastest-growing specialty segments. Requirements for electrical performance, low impurity, and material stability are pushing R&D for more refined conductive carbon blacks.

• Rising demand for higher purity / lower impurity levels: As specialty applications become more sensitive (e.g. electronics, batteries, high-end coatings), the demand increases for carbon blacks with lower ash, sulphur, and other contaminants. This requires more advanced processing or purification.

Conclusion

The specialty carbon black market is poised for strong growth, with size expected to more than double (from ~USD 2.9B in 2024 to ~USD 6.3B by 2032) under a ~10% CAGR. For producers and materials companies, opportunities lie in supplying high-purity grades, conductive carbon blacks, and formulations suitable for battery electrodes, electronics, coatings, and packaging.

Key success factors will include investment in advanced processing for purity and consistency, meeting regulatory and environmental norms, and locating manufacturing and R&D closer to high-growth regions (especially Asia-Pacific). Companies that can balance performance with cost, and who can customize grades for specific applications, will likely lead this evolving market.