Silicon Dioxide Price Trend: Market Analysis, Forecasts, and Strategic Procurement Insights

Silicon dioxide (SiO₂), commonly known as silica, is one of the most abundant and widely used industrial compounds. It plays a critical role across multiple sectors—from glass manufacturing and construction to semiconductors, food additives, and pharmaceutical excipients. With rising global demand, changing supply chains, and technological innovation, understanding the Silicon Dioxide Price Trend has become increasingly important for procurement teams, manufacturers, and investors.

Request for the Real Time Prices: https://www.procurementresource.com/resource-center/silicon-dioxide-price-trends/pricerequest

This in-depth article explores the latest price movements, historical data, market forecasts, regional variations, and key procurement considerations. It’s designed to help industry professionals make informed, data-driven sourcing decisions in a volatile global market.

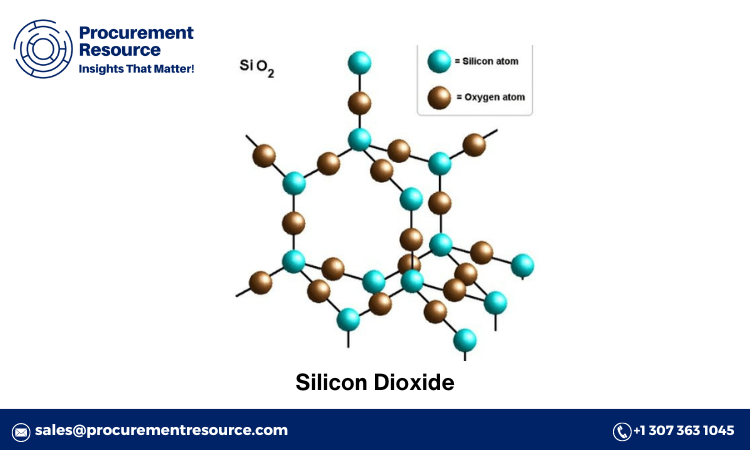

What is Silicon Dioxide?

Silicon dioxide is a naturally occurring compound found in quartz, sand, and many living organisms. It is used extensively in:- Glass and ceramics production

- Construction (as concrete and cement additive)

- Semiconductors and solar panels

- Pharmaceutical and food-grade applications (as anti-caking and flow agent)

- Rubber and plastics industries (as a reinforcing filler)

Silicon Dioxide Price Trend: Market Overview

The Silicon Dioxide Price Trend is influenced by a combination of macroeconomic, environmental, and sector-specific factors. From the global construction boom to semiconductor shortages, several key elements are impacting price dynamics.Key Factors Affecting Silicon Dioxide Prices:

1. Raw Material Supply & Mining Operations

Silicon dioxide is primarily sourced from quartz sand and silica-rich rocks. Disruptions in mining due to environmental regulations or labor shortages can reduce supply and drive prices higher.2. Energy and Transportation Costs

Silica processing and refinement are energy-intensive, and rising fuel and electricity prices (especially in Asia and Europe) have contributed to elevated costs.3. Environmental Compliance Costs

Stricter emission and waste disposal regulations—particularly in China and the EU—are increasing operational costs, which are reflected in the final product pricing.4. End-Use Sector Demand

- The semiconductor industry is increasingly demanding high-purity silica for wafer production.

- Construction and glass manufacturers drive bulk silica demand.

- Growth in food and pharma sectors increases demand for ultra-fine, food-grade silicon dioxide.

Historical Price Data & Market Forecast

Historical Overview:

Over the past five years, the Silicon Dioxide price trend has shown notable volatility:- Prices remained relatively stable with balanced supply-demand dynamics.

- Supply chain disruptions and energy crises (especially in Europe and China) caused moderate price hikes.

- The market experienced pressure from rising global inflation, logistics bottlenecks, and increased energy prices—resulting in upward price revisions across industrial-grade and high-purity silica categories.

Forecast Outlook

The Silicon Dioxide market is expected to grow steadily, driven by:- Rapid urbanization and construction in emerging economies

- Expanding semiconductor and solar PV production

- Increased demand for eco-friendly additives in food and pharma sectors

- Ongoing innovations in nanostructured silica and aerosil

Regional Insights: Silicon Dioxide Market by Geography

Asia-Pacific:

China is the largest producer and exporter of industrial silica. However, environmental crackdowns, mining restrictions, and energy limitations have periodically restricted output. India and Vietnam are emerging as alternative sources for certain grades of silica.North America:

The U.S. has significant natural reserves and a stable production capacity. Demand from electronics, pharmaceuticals, and construction drives domestic consumption. Prices are relatively steady, though affected by fuel and labor costs.Europe:

Environmental compliance and rising energy tariffs have impacted silica processing facilities in Germany, France, and Eastern Europe. The EU is increasingly importing high-purity silica for semiconductor and solar panel applications, making it vulnerable to global price shifts.Middle East, Latin America, Africa:

These regions are seeing rising demand in construction and industrial manufacturing. Limited domestic production makes them largely import-dependent, and prices often mirror global trends with added logistical premiums.Industry News and Developments

- High-Purity Silica for Semiconductors: Demand for ultra-pure silicon dioxide is rising as chip manufacturers expand in Asia, the U.S., and Europe.

- Green Silica Initiatives: Companies are developing bio-based and eco-friendly silica production technologies, reducing environmental footprints and aligning with ESG goals.

- Capacity Expansion: Key players are investing in new plants in Southeast Asia and the U.S. to meet growing demand from solar panel and electronics sectors.

- Technological Innovation: Nanotechnology is enabling the production of nano-silica, increasing demand in lithium-ion batteries, medical devices, and composites.

Market Insights & Competitive Landscape

The global silicon dioxide market is fragmented across several product grades—fumed silica, precipitated silica, colloidal silica, and quartz-based silica—with varied pricing dynamics.Leading Players:

- Evonik Industries

- Cabot Corporation

- PPG Industries

- Wacker Chemie AG

- Tokuyama Corporation

- Solvay SA

Buyers increasingly turn to Procurement Resource and similar platforms for market intelligence, supplier benchmarking, and real-time pricing to gain an edge in volatile markets.

Silicon Dioxide Price Chart & Data Visualization

Access to a Silicon Dioxide price chart is critical for procurement and strategy teams to analyze patterns and anticipate changes. Price datasets often include:- Monthly and quarterly average prices

- Region-specific data (Asia, EU, NAFTA, LATAM)

- Feedstock (quartz sand) correlation

- Energy and transportation cost overlays

Why Monitoring Silicon Dioxide Price Trends Matters

Whether you're sourcing for glass manufacturing, semiconductors, pharmaceuticals, or food processing, silica is a critical raw material. A deep understanding of price trends allows you to:- Improve budget accuracy for short- and long-term planning

- Secure optimal contract terms through market-based negotiation

- Avoid procurement shocks due to sudden supply disruptions

- Enhance competitiveness by timing purchases smartly

Access Market Data & Procurement Tools

For a competitive advantage, procurement teams should utilize verified sources offering:- Real-time and historical pricing

- Feedstock and derivative market analysis

- Industry news and regulatory updates

- Regional production and trade data

- Supplier and logistics performance tracking

Contact Information

Company Name: Procurement Resource

Contact Person: Ashish Sharma (Sales Representative)

Email: sales@procurementresource.com

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

UK: +44 7537171117

USA: +1 307 363 1045

Asia-Pacific (APAC): +91 1203185500

Connect With Us Online:

https://www.linkedin.com/company/procurement-resource-official/