When I was started learning about quantitative trading, I was looking for the simplest algorithm with a good enough strategy that guarantees good return with backtesting.

And, I implemented two simple strategies.

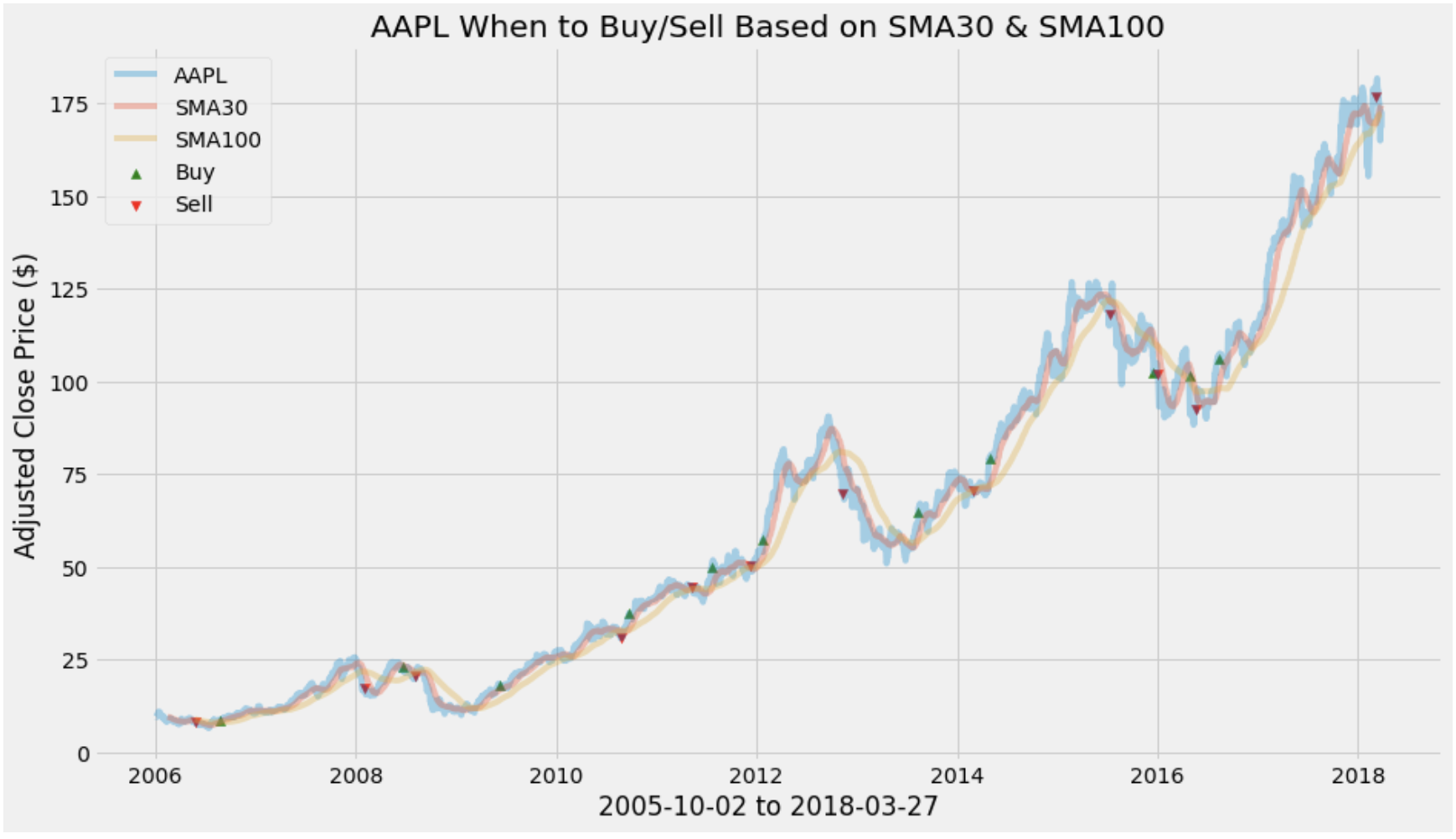

1. Buying at a Golden Cross, and Selling at a Death Cross using a Simple Moving Average.

2. Buy even more if Adaptive Moving Average trends higher.

Steps :

I imported the data using a quandl API rather than saving into my SQL.

import quandl

data = quandl.get("WIKI/AAPL", start_date="2006-01-01", end_date="2020-10-30")Then, I caculated a simple moving aveage with the window of 30days and 100 days. Historically speaking, calculating SMA with 50 days and 200 days is the most conventional way, but I went with 30 and 100 days as I believed the window of 2006 to 2020 wasn't enough of a data.

SMA30 = pd.DataFrame()

SMA30['Adj. Close'] = data['Adj. Close'].rolling(window=30).mean()

SMA100 = pd.DataFrame()

SMA100['Adj. Close'] = data['Adj. Close'].rolling(window=100).mean()I wanted to implement one more indicator other than the SMA30 and SMA100, so I calculated the average traded volume of 15 days and 50 days.

Volume is a very helpful indicator in trading because volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. And, I decided to use significantly smaller numbers for volume.

# Calculating the average of volue of window of 50 days

VOL50 = pd.DataFrame()

VOL50['Adj. Volume'] = data['Adj. Volume'].rolling(window=50).mean()

# Calculating the average of volue of window of 15 days average

VOL15 = pd.DataFrame()

VOL15['Adj. Volume'] = data['Adj. Volume'].rolling(window=15).mean()After plotting the data, I acquired this chart:

Then, I implemented a "buy_sell" function that tells the program when to buy or sell.

# Function that tells you when to sell/buy

def buy_sell(data):

sigBuy = []

sigSell = []

flag = -1

for i in range(len(data)):

# GOLDEN CROSS & VOL50 > VOL200

if ((data['SMA30'][i] > data['SMA100'][i]) and (data['VOL15'][i] > data['VOL50'][i])):

if flag != 1:

sigBuy.append(data['AAPL'][i])

sigSell.append(np.nan)

flag = 1

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

# DEATH CROSS

elif data['SMA30'][i] < data['SMA100'][i]:

if flag != 0:

sigBuy.append(np.nan)

sigSell.append(data['AAPL'][i])

flag = 0

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

return [sigBuy, sigSell]And, I graphed a chart that displays the buy/sell tic marks:

- As you can see the tick marks are not perfect because between 2008 and 2010 period, you can see the program actually sold it a lower price.

- However, in the long term, I decided that this will give a sufficient profit.

Full Code:

import numpy as np

from datetime import datetime

import matplotlib.pyplot as plt

plt.style.use("fivethirtyeight")

#loading the data

import quandl

quandl.ApiConfig.api_key = "Wdq5f9Fa6Pq-h5zJjR5w"

data = quandl.get("WIKI/AAPL", start_date="2006-01-01", end_date="2020-10-30")

SMA30 = pd.DataFrame()

SMA30['Adj. Close'] = data['Adj. Close'].rolling(window=30).mean()

SMA100 = pd.DataFrame()

SMA100['Adj. Close'] = data['Adj. Close'].rolling(window=100).mean()

# Calculating the average of volue of window of 50 days

VOL50 = pd.DataFrame()

VOL50['Adj. Volume'] = data['Adj. Volume'].rolling(window=50).mean()

# Calculating the average of volue of window of 15 days average

VOL15 = pd.DataFrame()

VOL15['Adj. Volume'] = data['Adj. Volume'].rolling(window=15).mean()

# visualizing the data

plt.figure(figsize=(20,14.5))

plt.plot(data['Adj. Close'], label="AAPL")

plt.plot(SMA30['Adj. Close'], label="SMA30")

plt.plot(SMA100['Adj. Close'], label="SMA100")

plt.title("Apple Adjusted Close Prices History")

plt.xlabel("2006-01-01 to 2018-03-27")

plt.ylabel("Adjusted Close Price ($)")

plt.legend(loc="upper left")

# We're going to buy whenever SMA crosses the long-term average

# Anytime SMA30 crosses the SMA100 will be the signal to buy!!

buy = pd.DataFrame()

buy['AAPL'] = data['Adj. Close']

buy['SMA30'] = SMA30['Adj. Close']

buy['SMA100'] = SMA100['Adj. Close']

buy['VOL15'] = VOL15['Adj. Volume']

buy['VOL50'] = VOL50['Adj. Volume']

# Function that tells you when to sell/buy

def buy_sell(data):

sigBuy = []

sigSell = []

flag = -1

for i in range(len(data)):

# GOLDEN CROSS & VOL50 > VOL200

if ((data['SMA30'][i] > data['SMA100'][i]) and (data['VOL15'][i] > data['VOL50'][i])):

if flag != 1:

sigBuy.append(data['AAPL'][i])

sigSell.append(np.nan)

flag = 1

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

# DEATH CROSS

elif data['SMA30'][i] < data['SMA100'][i]:

if flag != 0:

sigBuy.append(np.nan)

sigSell.append(data['AAPL'][i])

flag = 0

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

else:

sigBuy.append(np.nan)

sigSell.append(np.nan)

return [sigBuy, sigSell]

buy_or_sell = buy_sell(buy)

buy['Signal to Buy'] = buy_or_sell[0]

buy['Signal to Sell'] = buy_or_sell[1]

# Visualize the data and strategize

plt.figure(figsize=(14,8))

plt.plot(buy['AAPL'], label = "AAPL", alpha=0.35)

plt.plot(buy['SMA30'], label = "SMA30", alpha=0.35)

plt.plot(buy['SMA100'], label = "SMA100", alpha=0.35)

plt.scatter(buy.index, buy['Signal to Buy'], label ="Buy", marker ="^", color='green')

plt.scatter(buy.index, buy['Signal to Sell'], label ="Sell", marker ="v", color='red')

plt.title('AAPL When to Buy/Sell Based on SMA30 & SMA100')

plt.xlabel("2005-10-02 to 2018-03-27")

plt.ylabel("Adjusted Close Price ($)")

plt.legend(loc="upper left")