1. Krafton's IPO Journey

1-1. About Krafton

Krafton Inc. is a South Korean video game holding company that developed Player Unknown's BattleGrounds (a.k.a PUBG). As PUBG became one of the most successful MMORPG games in the world, Krafton announced that it will launch its IPO.

1-2. Krafton's IPO Price

Krafton registered to offer 10,060,230 shares at between 458,000 won($405) and 557,000 won($493) at 28 trillion won ($24.6B) market cap. If Krafton hits the upper band, it would raise 5.6 trillion won($5 billion), which is a record. Also,

- Just for comparison, the current record is Samsung Life Insurance's 4.88 trillion won in 2010, and Coupang's $4.6 billion on the NYSE.

However, Krafton's valuation was questioned and should be lowered.

2. Reasons why its IPO prices should be cut

2-1. 96.7% of Krafton's operating income comes from PUBG alone.

-

Krafton's revenue has increased 53.6%; operating income has increased 115.4%; net income has increased 99.5% compared to last year. This is great, but, what if most of it relies on only one game?

-

Obviously, it is quite risky ("One-Game-Risk") that a company relies on only one game. To address this risk, Krafton announced that it will extend its IP game worldview, create various content including movie and messenger applications, and develop a new game.

2-2. Inappropriate selection of its peer group

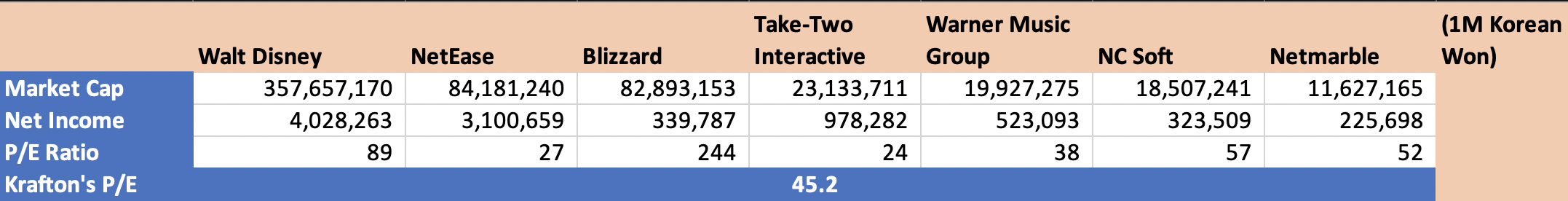

Krafton calculated its own P/E ratio in comparison to global/local peers including Walt Disney, Blizzard, and Warner Music Group.

-

Krafton claimed that companies such as Walt Disney and Warner Music Group were selected because Krafton plants to expand the scope of its content business. However, Disney and Warner's are business structures differ from Krafton's. Disney is one of the most successful OTT service providers and the album sales account for over 85% of the total revenue for Warner Music Group.

-

Plus, net income of Walt Disney dramatically decreased from Disney Land due to COVID-19, so Walt Disney's P/E Ratio rose dramatically. And, the net income of NC Soft also decreased dramatically, which made their P/E Ratio unusually high.

-

What's even more controversial about this valuation is that Krafton did not select Nexon Co. as a peer because Nexon is one of the major Korean game holding companies. The average P/E ratio would have been 33.5 if Disney and Warner were replaced with Nexon.

-

P/E Ratio of Kakao Games and Pearl Abyss (Korean game holding company that recently IPO'd) was 35.9 and 35.4 respectively.

Therefore, even after Krafton's IPO price was discounted 17.8% ~ 32.4% from listing on KOSPI (Korea Composite Stock Price Index), the P/E Ratio of 45.2 is absurdly high.

2-3. Inappropriately calculated its operating profit

In order to calculate its operating profit, Krafton simply multiplied the 1Q operating profit by 4, which is an inappropriate way to do it.

- Companies usually use more complex formulas like calculating the average operating profit over a certain period of time when estimating it, but Krafton simply multiplied its operating profit of the first quarter by 4.

- In fact, Krafton's operating profit decreased in the 2nd quarter, so it should have been calculated more meticulously.