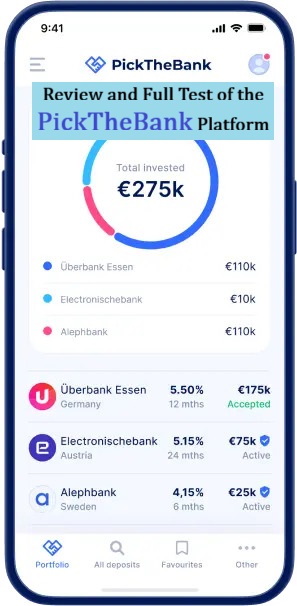

Review and Full Test of the PickTheBank Platform in 2025

Everything we need to know about the savings products offered by Pick The Bank in 2025: interest rates, products, partner banks all the information in this detailed review.

PickTheBank provides two main solutions for savers across Europe:

-

A savings platform that allows customers to open and manage fixed deposits directly with Lidion Bank, an EU-regulated Maltese bank.

-

A powerful comparison engine that lets users compare savings rates from over 1,000 banks across 25 EU countries.

Experts Review and Full Test of PickTheBank 2025

Why We're Reviewing It

The demand for high-yield savings options in Europe has grown rapidly as traditional banks continue to offer relatively low interest rates. Many savers now look beyond their local banks and home markets for better returns. PickTheBank emerged not as a bank itself but as a platform evolving from a trusted savings comparison website into a comprehensive deposit application and portfolio management service.

PickTheBank bridges the gap between European banks and retail savers by combining transparent rate comparison with easy access to deposit products. Its partnership with Lidion Bank ensures deposits are secure under EU banking regulations. The platform's user-friendly and multilingual interface makes it accessible to clients across Europe.

With interest rates reaching up to 2.25% in EUR, 3.8% in USD, and 3.35% in GBP, PickTheBank offers attractive savings opportunities often unavailable through local banks. This appeals especially to savers looking to diversify their portfolio with multiple currencies.

If you're looking for the best fixed deposits in the EU, particularly in USD or GBP, this platform is definitely worth a look. The ability to compare and apply for deposits in one place with security and transparency adds real value to your saving strategy.

Introduction to PickTheBank

Founded in Cyprus, where domestic banking options are limited, PickTheBank originally aggregated savings offers from across Europe. Realizing comparison alone wasn't sufficient for customers facing low local rates, PickTheBank partnered with Malta's Lidion Bank an EU-licensed bank with EU passport rights, to offer fixed deposits directly to retail clients in various member states.

Products and Deposit Terms

-

Fixed-term deposits with guaranteed returns

-

Currencies: EUR, USD, GBP

-

Interest rates: up to 2.25% (EUR), 3.8% (USD), 3.35% (GBP)

-

Terms: from 3 months up to 5 years

-

Interest payout: at maturity or annually depending on the product

-

Early termination: not allowed, but multiple term options are available

-

Taxation: no withholding tax in Malta full interest paid; taxes payable per country of residence.

-

Available to EU residents in line with Lidion Bank's passporting rights

Security, Risk, and Legal Considerations

-

Deposits held by Lidion Bank and covered by the Maltese Depositor Compensation Scheme up to €100,000 per depositor

-

Lidion Bank is fully licensed and regulated by the Maltese Financial Services Authority

-

Partnership between PickTheBank and Lidion Bank is confirmed and publicly documented

-

Funds transferred directly to the bank, adding an extra layer of safety

-

PickTheBank acts as a service partner facilitating communication and application; deposits are signed and governed by Lidion Bank's terms

User Experience

"

-

Account opening: 100% online, completed in ~5 minutes (if documents ready)

-

Onboarding: includes questionnaire + identity verification (passport/ID + proof of address)

-

Application platforms: desktop and mobile, with secure SMS code verification

-

Deposit approval: takes a few working hours by partner bank; pay-in details after approval

-

Support: multilingual platform

-

Live chat and email: response within 1 hour

-

Phone support: English only

- Funds transfers:

-

SEPA for EUR

-

Bank transfer for USD and GBP

-

No card or instant payment methods

-

Deposit confirmation: usually within a few hours on working days

-

Service scope:

-

Deposit replenishment and payout at maturity only

-

No daily banking or third-party transfers

Taxation

-

Lidion Bank charges no withholding tax on interest earned.

-

Clients must declare interest income as per their local tax regulations

Deposit Lifecycle

-

Applications valid for 30 days allowing fixed-rate locking.

-

Account holders can monitor balances and accrued interest online.

-

Principal and interest transferred to reference account upon maturity.

-

No automatic rollover; renewal offered about a week before maturity with a new application and interest payout.

Who Will Benefit Most

Savers looking for better interest rates than those offered by local banks will benefit most from this service. It is also ideal for individuals interested in diversifying their currency holdings across EUR, USD, and GBP. People who want an additional EU bank to enhance deposit protection and diversification will find this option valuable. Additionally, customers who appreciate straightforward digital processes and responsive customer support will benefit greatly.

Final Verdict

PickTheBank presents a strong option for savers dissatisfied with low local bank rates. Its USD and GBP rates rank among the best offered by EU banks, and EUR rates are competitive compared to many traditional banks. For savers looking to optimize and diversify their savings portfolio with an easy-to-use, transparent platform, PickTheBank is definitely worth considering.For more details and to explore their best fixed deposits, visit: best fixed deposits.