[Trading Machine Project] Code Review : SGX-Full-OrderBook-Tick-Data-Trading-Strategy

Trading Machine Project

목록 보기

5/20

Code From

https://github.com/rorysroes/SGX-Full-OrderBook-Tick-Data-Trading-Strategy/tree/master

Overview

Data : 중국 A50 주가 지수 선물 (SGX:CN : FTSE–Xinhua China A50 Index)의 2014/01/02 Intraday OrderBook Tick Data (7 Hours)

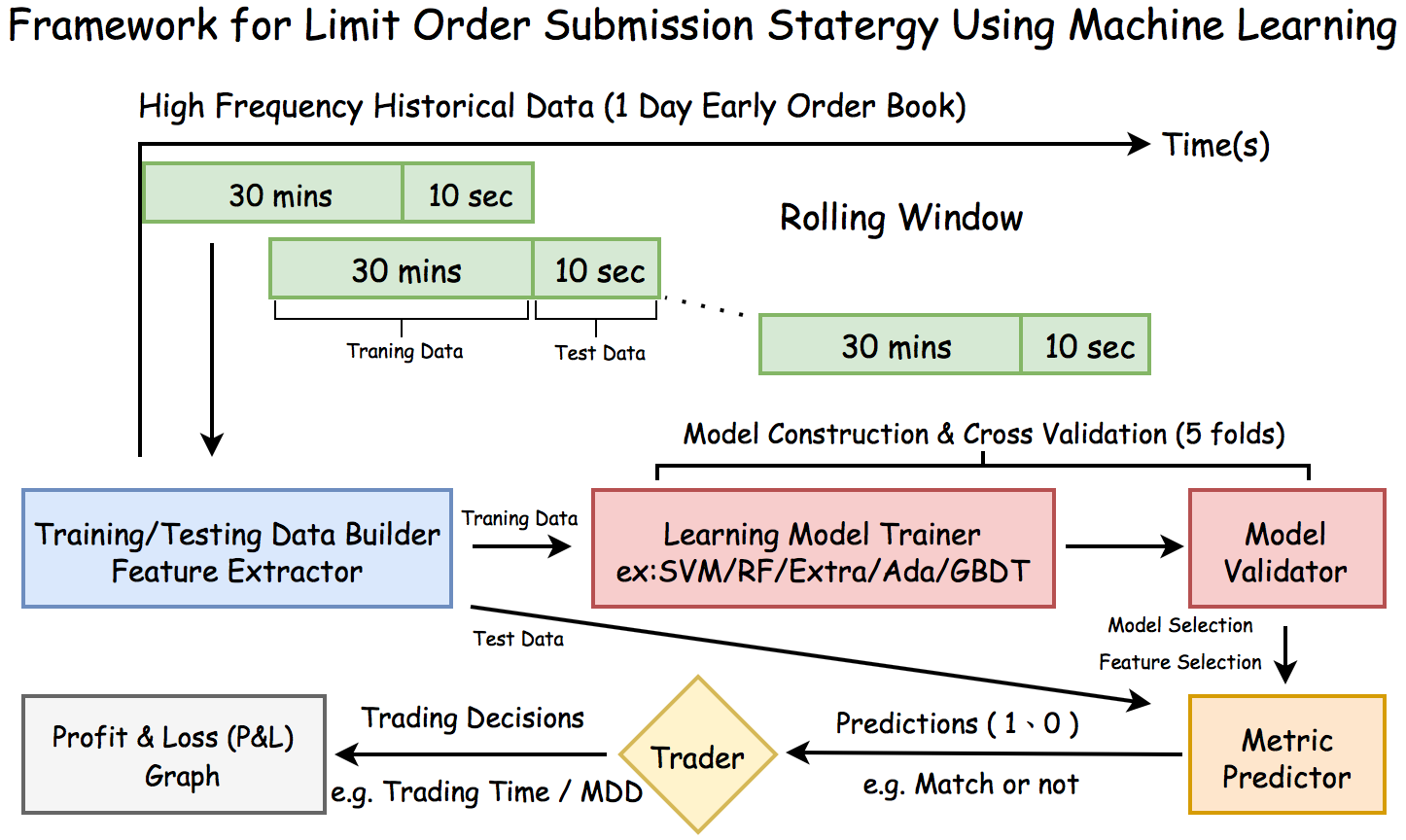

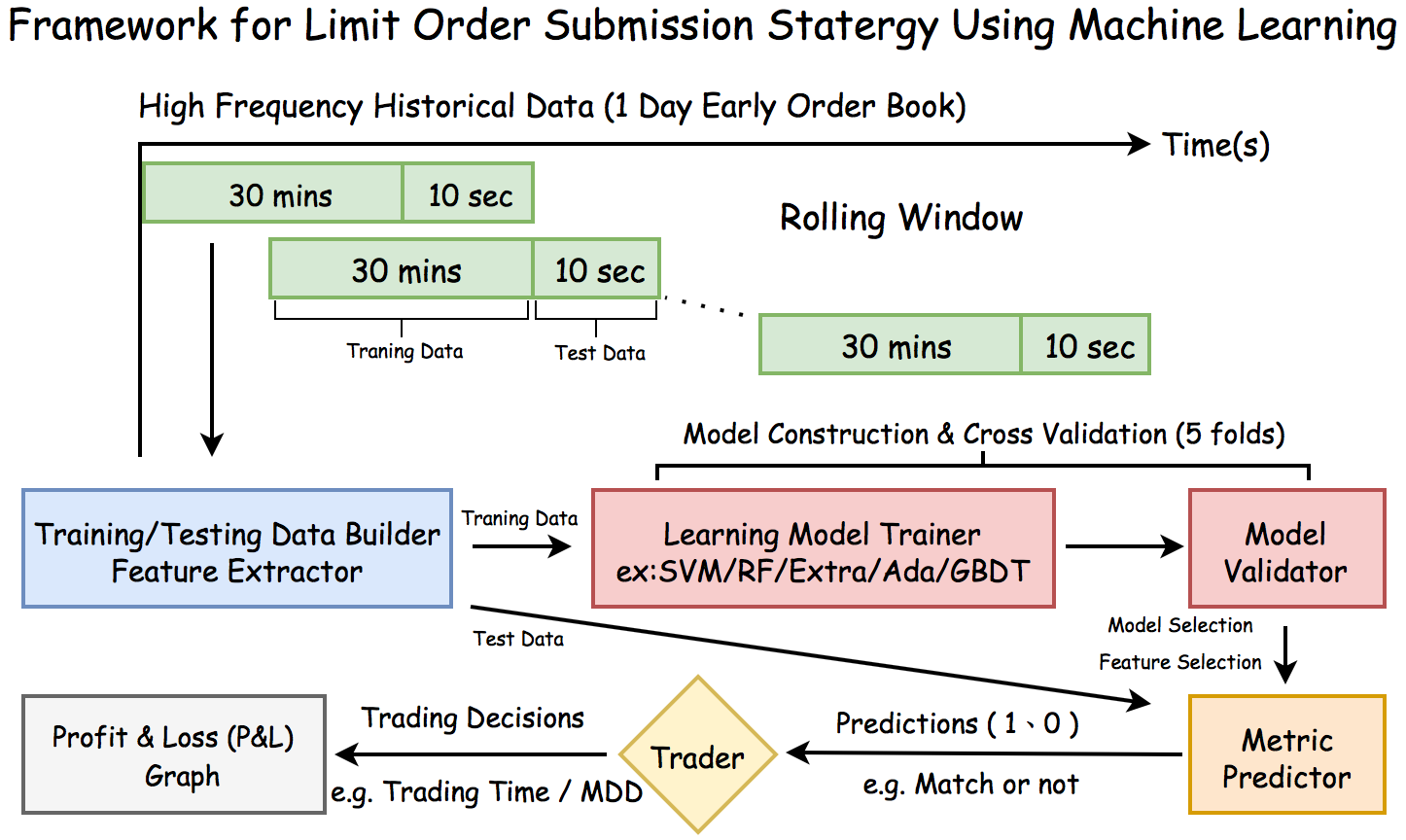

Purpose : 과거 30분을 Train 하여 향후 10초의 각각의 target을 Prediction

- target : 현재 시점 기준 bid_best_price가 600초 이후 체결이 될 것 인지 (1/0)

Workflow

Raw Data

- Timestamp

- Ask Price 1,2,3

- Bid Price 1,2,3

- Ask Size 1,2,3

- Bid Size 1,2,3

Feature Engineering

rise_ask()

- before_time 동안 ask1 price의 return을 계산

- before_time 기준 값들은 6m 00s ~ 20m 30s 까지 30s 단위로

weight_pecentage()

- 각 호가 깊이 별 가중치가 곱해진 bid ask 호가 비율 (Depth ratio)

- bid ask 호가 비율 상대적인 차이를 정규화하여 -1 ~ 1 사이 값으로 표시

def weight_pecentage(w1,w2,w3,ask_quantity_1,ask_quantity_2,ask_quantity_3,\

bid_quantity_1,bid_quantity_2,bid_quantity_3):

Weight_Ask = (w1 * ask_quantity_1 + w2 * ask_quantity_2 + w3 * ask_quantity_3)

Weight_Bid = (w1 * bid_quantity_1 + w2 * bid_quantity_2 + w3 * bid_quantity_3)

W_AB = Weight_Ask/Weight_Bid

W_A_B = (Weight_Ask - Weight_Bid)/(Weight_Ask + Weight_Bid)

return W_AB, W_A_Btraded_label_one_second()

- Target 변수 설정

각 시점의 bid_price_1 값이 600초 이후 ask_price_1들 중

최소값보다 큰 경우 1

현재 가장 비싸게 사는 가격이 미래 어느 시점의 가장 싸게 파는 가격보다 크다는 것은 가격 하락 의미하고, 현재 시점의 매수 호가가 Match 됨을 의미

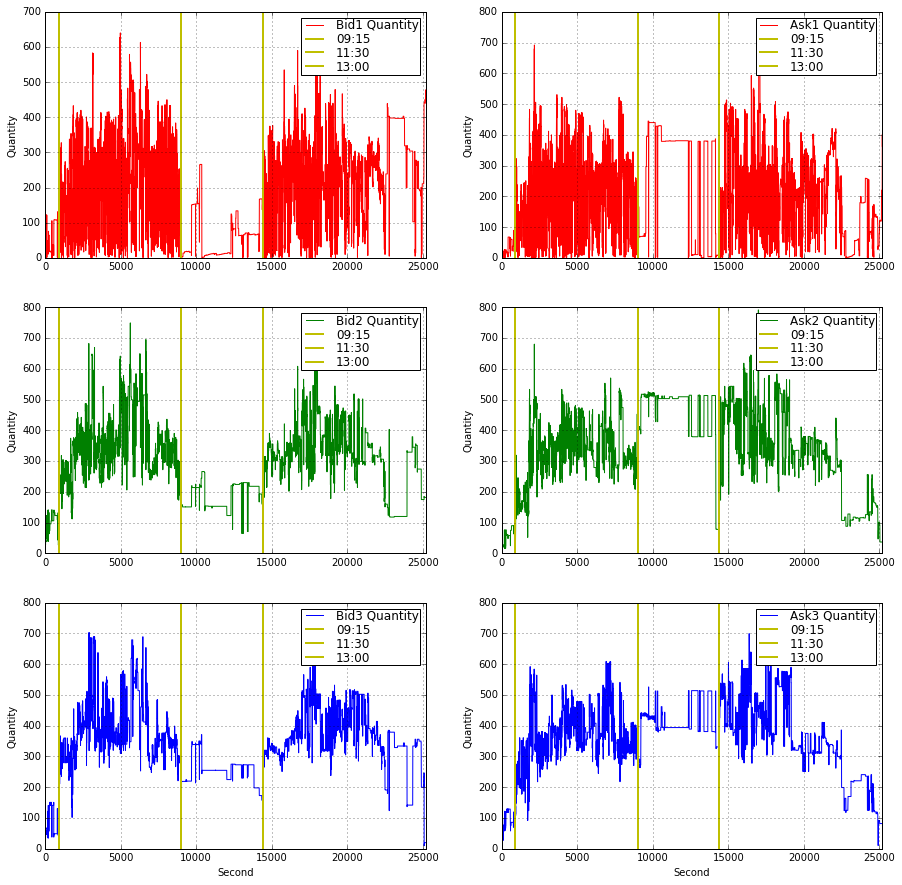

Time Separate

- 중국 주식시장 특성 상 점심시간 개념이 있기에 9:15 ~ 11:30 / 13:00 ~ 17:00 두 타임으로 Data Set 나눔

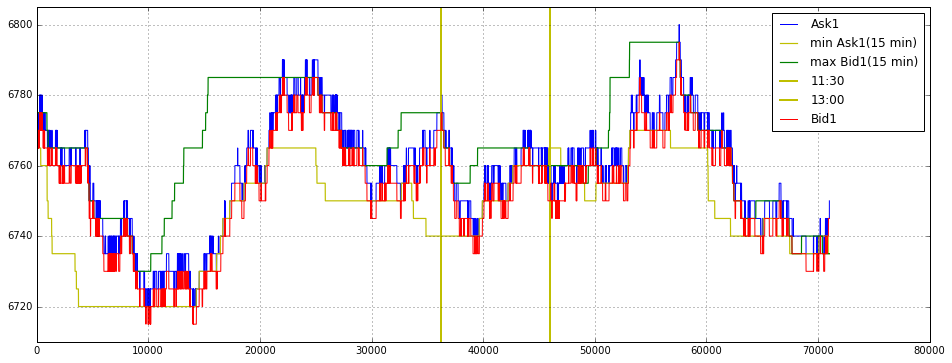

Plot

Quantity Plot

Price Plot

Return Plot

Machine Learning

Model Selection

- RandomForest Classifier

- ExtraTrees Classifier

- AdaBoost Classifier

- GradientBoosting Classifier

- SVC

Model Train / Test

- train 1800s / test 10s의 하나의 dataset을 10초 간격으로 Rolling Window 진행

- train data에 대해 모든 모델을 학습 후 Cross Vaildation (cv=5)

- test data (10s) 예측

- 위 과정이 하나의 Cycle

Result

- Accuracy : 예측한 10초(10개) 중 몇 개를 맞추었는지

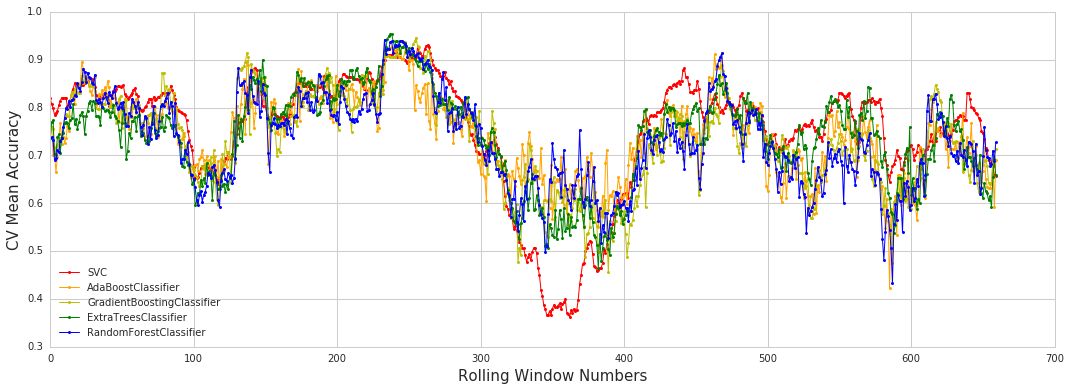

CV Accuracy

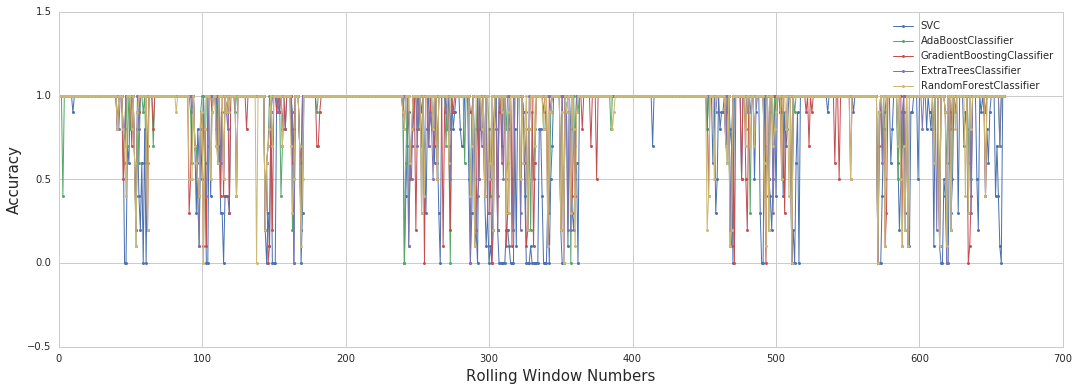

Test Accuracy

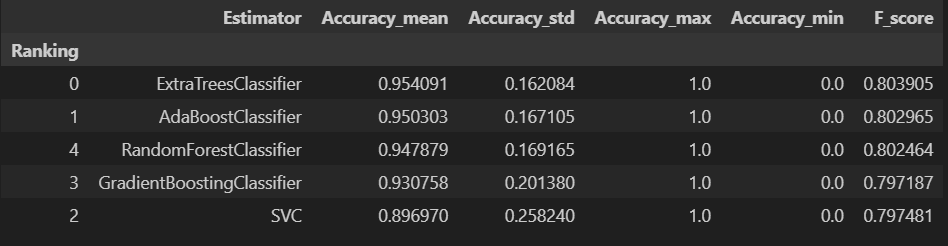

Good Day

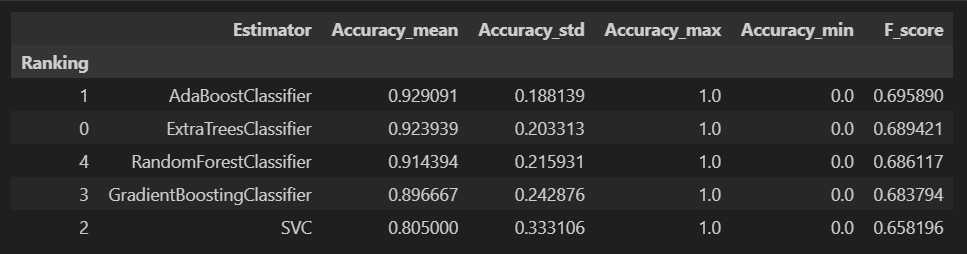

Bad Day

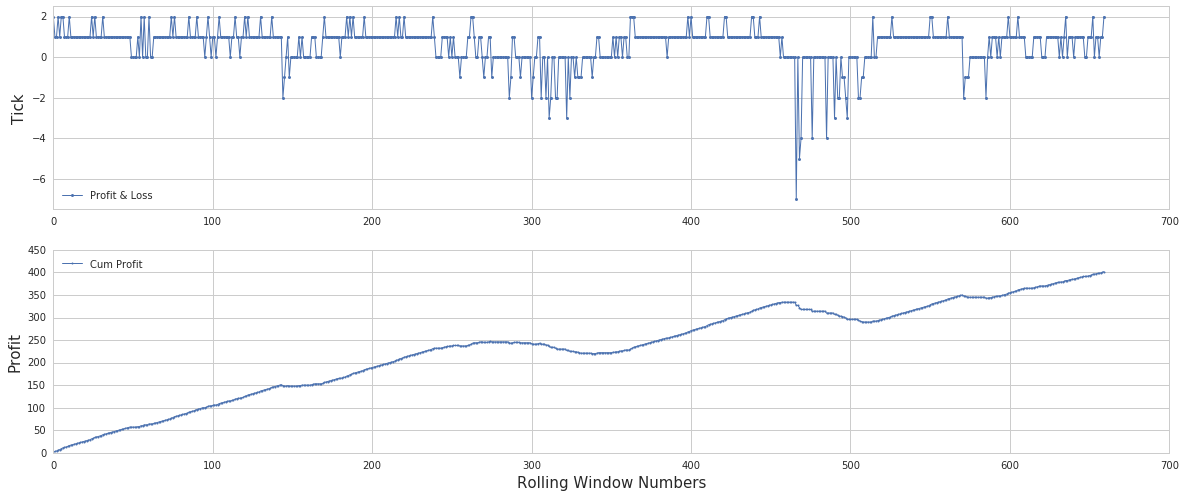

Profit & Loss

손익 계산에 사용된 데이터는 공개되지 않음

# data_2014['65'] ?????

# data_2014['66'] best ask

# data_2014['67'] best bid

# compute cum_profit and Best_cv_score

dict_ = {}

dict_['cum_profit'] = []

dict_['Best_cv_score'] = []

for day in range(0,1,1):

cum_profit_label = []

cum_profit = []

best_cv_score = []

spread = 0.2 * data_2014[day]['65'][1800:][9::10].values

loss = 0.2*(data_2014[0]['67'][1800:9000-600][9::10].values - data_2014[day]['67'][1800+600:9000][9::10].values)

for j in range(0,len(pip.cv_acc_day.values()[0][day]),1):

max_al = {}

for i in range(0,len(pip.keys),1):

max_al[pip.keys[i]] = np.array(pip.cv_acc_day[pip.keys[i]])[day][j]

# select best algorithm in cv = 5

top_cv_acc = sorted(max_al.items(),key = lambda x : x[1], reverse = True)[0:1][0]

best_cv_score.append(top_cv_acc[1])

submission = pip.predict_values_day[top_cv_acc[0]][day][j][-1]

true_value = pip.true_values_day[top_cv_acc[0]][day][j][-1]

if submission == true_value:

if submission == 1:

cum_profit_label.append(1)

cum_profit.append(spread[j])

elif submission == 0:

cum_profit_label.append(0)

cum_profit.append(0)

elif submission != true_value:

if submission == 1:

cum_profit_label.append(-1)

cum_profit.append(loss[j])

elif submission == 0:

cum_profit_label.append(0)

cum_profit.append(0)

dict_['cum_profit'].append(cum_profit)

dict_['Best_cv_score'].append(best_cv_score)Thought

- 16 호가 중 물량이 많은 N개의 호가만 뽑아서 호가 간 갭이 차이가 어느정도인지 상승률 혹은 차이값 Feature 추가 가능

- N초 대비 변화율을 Feature로 추가