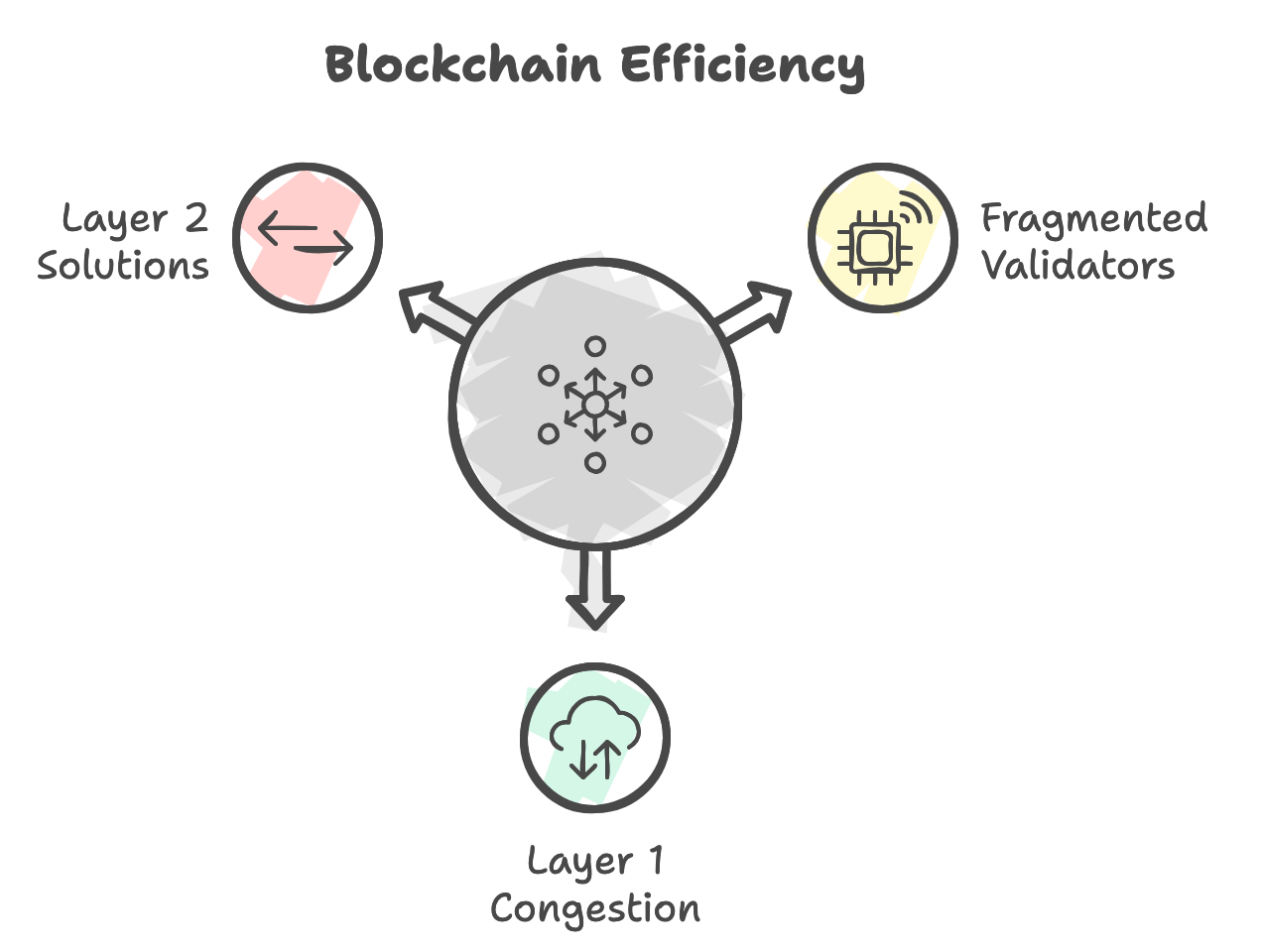

Blockchain technology is growing rapidly, and so is the number of validators securing various Layer 1 and Layer 2 blockchains. Yet, despite this growth, many users still experience network slowdowns, high transaction fees, and congestion. To address these challenges, we need to look beyond just adding more validators and consider more innovative solutions. In this post, we'll explore two approaches—mathematical and economic—to tackle these issues and pave the way for faster, more efficient blockchain networks.

The Problem: Validator Fragmentation

As more Layer 1 and Layer 2 blockchains emerge, each network recruits its own validators. These validators act like servers, validating transactions and securing the network in exchange for rewards. However, validators are fragmented across different networks, which creates inefficiencies. While each blockchain grows its own validator base, they don’t contribute to other chains, leading to isolated and under-utilized resources.

Furthermore, Layer 2 solutions built on top of Layer 1 blockchains (such as Optimistic Rollups and ZK-Rollups on Ethereum) still rely on Layer 1 for finalizing transactions. This means even if Layer 2 is faster, it can still suffer from slow finality when Layer 1 is congested.

Mathematical Approach: zk-Proofs as a Standard for Blockchain Efficiency

One way to address this fragmentation is through a mathematical approach that enables zk-proofing (Zero-Knowledge proofs) as a common standard, much like the TCP/IP protocol is for the internet. zk-proofs allow one party to prove the validity of information without revealing the underlying data, which can be incredibly powerful for blockchain scalability.

zk-Proofs: A Common Standard for Interoperability

If zk-proofing becomes a standard across blockchain networks, every blockchain could benefit from parallelized off-chain computation. Rather than performing all computations directly on-chain, participants could perform computations off-chain, generate zk-proofs of correctness, and submit only those proofs to the blockchain for verification.

This approach would:

- Increase Efficiency: Validators or participants could handle computations independently (even off-chain), and only submit zk-proofs of correctness to the blockchain, saving on-chain resources and speeding up transaction finality.

- Enable Parallelism: Multiple zk-proofs can be generated and verified across different chains in parallel. This opens up the possibility for validators to interact across different blockchains or even perform computations off-chain and submit them to multiple chains for verification.

Real-World Example: zk-Proofs for Asset Custody

Imagine a custodian periodically generating a zk-proof that they hold enough assets to meet withdrawal demands in case of a sudden "bank run." This proof could be submitted to multiple chains for verification, ensuring that the custodian is solvent without needing to expose sensitive asset details. This would allow for fast verification while enabling better transparency across chains.

By adopting zk-proofing as a standard, the blockchain ecosystem could efficiently scale up computation power, allowing the growing number of validators (or servers) to provide users with faster transaction speeds.

Economic Approach: Incentivizing Small Validators for Greater Participation

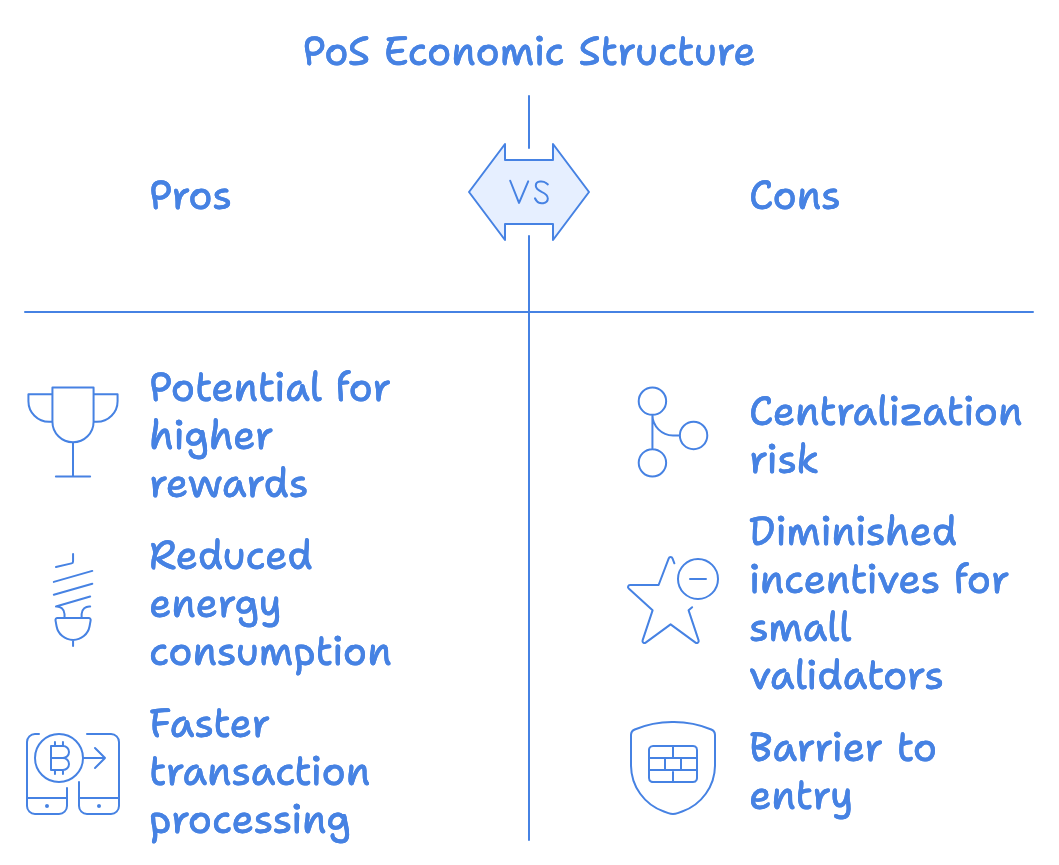

Another critical issue is the economic structure of Proof of Stake (PoS) networks, especially in Ethereum after its transition from Proof of Work (PoW). In PoW networks like Bitcoin, even a small miner with modest computational resources has a slim chance of mining a block and earning a significant reward. This incentivizes small participants to stay involved, as even a home miner has a chance at hitting the jackpot.

In PoS, however, small validators (or "home validators") face diminishing incentives. With large validators dominating the network, there’s little economic reason for smaller participants to run their own nodes, leading to centralization of the validator set.

Reviving Economic Incentives for Home Validators

To counter this, we can implement a feature similar to Bitcoin’s low-probability, high-reward system. Here's how it could work:

-

Emergency Validation by Small Validators: In the event that larger validators (or a significant portion of them) go offline or experience outages, smaller validators could step in to validate transactions. Even though they might not be as powerful as the larger nodes, they would provide enough computational power to keep the network running in a somewhat slower but functional state.

-

Lottery-Style Rewards: By giving smaller validators a chance (however small) to earn significant rewards when the larger validators are down or during network stress, we create incentives for "home validators" and smaller companies (20-30 person sized teams) to maintain and operate nodes. Over time, this would encourage more participation, improving the overall decentralization and resilience of the network.

This system mirrors Bitcoin’s incentive structure, where even small miners have a low chance of earning large rewards. In PoS, this feature would make smaller validators economically viable, enhancing the diversity and robustness of the validator set.

Conclusion: A Dual Approach to Blockchain Scalability

To tackle the current scalability and performance issues in blockchain networks, we need to rethink both the mathematical and economic foundations. By adopting zk-proofs as a common standard, we can unlock greater computational efficiency and enable validators to operate across multiple chains or off-chain. This would make blockchain networks faster and more responsive, even as the number of participants grows.

At the same time, an economic restructuring that incentivizes smaller validators can help decentralize the validator set and encourage more participants to contribute to network security. By creating lottery-style rewards and allowing smaller validators to step in during emergencies, PoS networks can maintain resilience and ensure that even home validators have a role to play.

Together, these approaches can solve the scalability and fragmentation issues facing blockchain today, paving the way for a future where users can enjoy fast, secure, and decentralized networks without the bottlenecks and inefficiencies of the present.