1. yfinance 사용법

-

Nvidia

1) 1/주가 수익 배율(PER) > 미국 AAA회사채 시장수익률

2) 배당 수익률 > 회사채 시장수익률×0.67

3) 주가 순자산 배율(PBR) < 0.65

4) 0 < 부채비율 <= 150%

5) 유동비율 >= 200%

2. FinanceDataReader 사용법

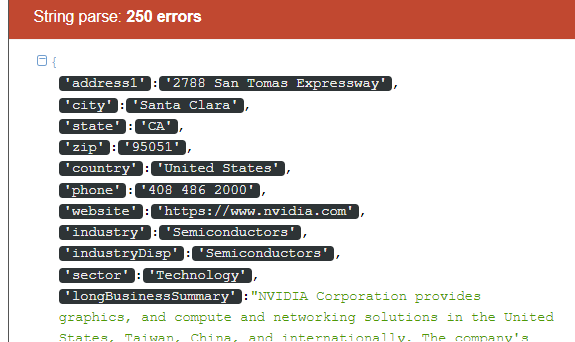

import yfinance as yf

yfinance를 사용해 NVDA 주식 정보 가져오기

stock = yf.Ticker("NVDA")

stock_info = stock.info

조건 1: 1/PER > 미국 AAA회사채 시장수익률

per = stock_info['trailingPE']

bond_yield = 0.0131 # 2023년 5월 29일 미국 AAA회사채 시장수익률

if per is not None and 1/per > bond_yield:

print("\033[40m조건 1: 만족\033[0m")

else:

print("\033[40m조건 1: 불만족\033[0m")

조건 2: 배당 수익률 > 회사채 시장수익률×0.67

div_yield = stock_info['dividendYield']

if div_yield is not None and div_yield > bond_yield*0.67:

print("\033[40m조건 2: 만족\033[0m")

else:

print("\033[40m조건 2: 불만족\033[0m")

조건 3: PBR < 0.65

pbr = stock_info['priceToBook']

if pbr is not None and pbr < 0.65:

print("\033[40m조건 3: 만족\033[0m")

else:

print("\033[40m조건 3: 불만족\033[0m")

조건 4: 0 < 부채비율 <= 150%

debt_ratio = stock_info['debtToEquity']

if debt_ratio is not None and 0 < debt_ratio <= 1.5:

print("\033[40m조건 4: 만족\033[0m")

else:

print("\033[40m조건 4: 불만족\033[0m")

조건 5: 유동비율 >= 200%

current_ratio = stock_info['currentRatio']

if current_ratio is not None and current_ratio >= 2:

print("\033[40m조건 5: 만족\033[0m")

else:

print("\033[40m조건 5: 불만족\033[0m")