1.문제

You are given a 0-indexed 2D integer array brackets where brackets[i] = [upperi, percenti] means that the ith tax bracket has an upper bound of upperi and is taxed at a rate of percenti. The brackets are sorted by upper bound (i.e. upperi-1 < upperi for 0 < i < brackets.length).

Tax is calculated as follows:

- The first upper0 dollars earned are taxed at a rate of percent0.

- The next upper1 - upper0 dollars earned are taxed at a rate of percent1.

- The next upper2 - upper1 dollars earned are taxed at a rate of percent2.

- And so on.

You are given an integer income representing the amount of money you earned. Return the amount of money that you have to pay in taxes. Answers within 10-5 of the actual answer will be accepted.

Example 1

Input: brackets = [[3,50],[7,10],[12,25]], income = 10

Output: 2.65000

Explanation:

Based on your income, you have 3 dollars in the 1st tax bracket, 4 dollars in the 2nd tax bracket, and 3 dollars in the 3rd tax bracket.

The tax rate for the three tax brackets is 50%, 10%, and 25%, respectively.

In total, you pay $3 * 50% + $4 * 10% + $3 * 25% = $2.65 in taxes.Example 2

Input: brackets = [[1,0],[4,25],[5,50]], income = 2

Output: 0.25000

Explanation:

Based on your income, you have 1 dollar in the 1st tax bracket and 1 dollar in the 2nd tax bracket.

The tax rate for the two tax brackets is 0% and 25%, respectively.

In total, you pay $1 * 0% + $1 * 25% = $0.25 in taxes.Example 3

Input: brackets = [[2,50]], income = 0

Output: 0.00000

Explanation:

You have no income to tax, so you have to pay a total of $0 in taxes.Constraints:

- 1 <= brackets.length <= 100

- 1 <= upperi <= 1000

- 0 <= percenti <= 100

- 0 <= income <= 1000

- upperi is sorted in ascending order.

- All the values of upperi are unique.

- The upper bound of the last tax bracket is greater than or equal to income.

2.풀이

1.for문을 돌면서 현재 bound - 이전 bound 값을 current 로 저장한다.

2. income >= current 라면 income -= current 를 해주고 tax에 더해준다. 그 다음 prev를 갱신해준다.

3. income < current 라면 tax에 일단 더해준다음 income을 0으로 만들어준다.

/**

* @param {number[][]} brackets

* @param {number} income

* @return {number}

*/

const calculateTax = function (brackets, income) {

let prev = 0;

let current = 0;

let tax = 0;

for (let i = 0; i < brackets.length; i++) {

current = brackets[i][0] - prev; // upperi - upper0

if (income >= current) {

// income 이 current 값보다 크다면 income에서 current를 빼주고 current * tax 비율 더해준다

income -= current;

tax += current * brackets[i][1];

prev = brackets[i][0];

} else {

// 아니라면 income을 0으로 만들고 더해준다

tax += income * brackets[i][1];

prev = brackets[i][0];

income = 0;

}

}

return (tax / 100).toFixed(5);

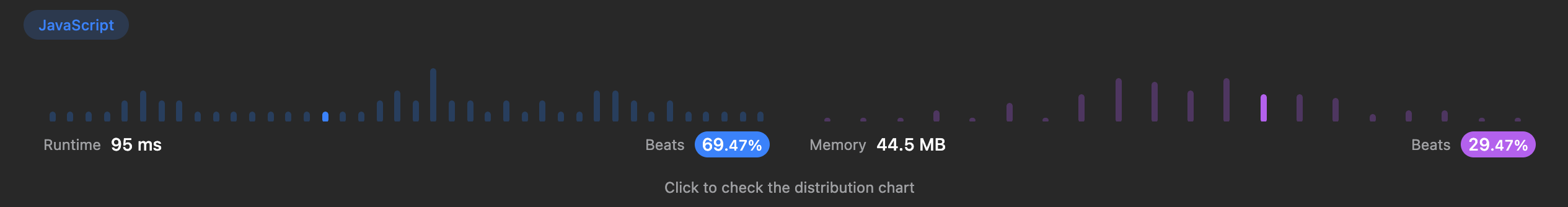

};3.결과