The cryptocurrency market is once again a whirlwind of excitement, with dizzying price surges and talk of unprecedented gains. Bitcoin flirts with new highs, Ethereum smashes resistance levels, and a fresh wave of altcoins promises exponential returns. This electrifying atmosphere, reminiscent of past bull runs, inevitably raises a critical question: are we witnessing sustainable growth, or is a dangerous bubble in cryptocurrency inflating, poised to burst?

Navigating the crypto landscape requires a keen eye and a steady hand. The allure of quick profits can be intoxicating, but understanding the underlying dynamics, recognizing potential pitfalls, and making informed decisions is paramount. This post will delve into the complexities of the current market, exploring the factors fueling the rally, the tell-tale signs of a potential bubble, and strategies to help you navigate this volatile yet transformative space.

What Exactly is a "Bubble" in Financial Markets?

Before we dissect the crypto market, let's clarify what a financial bubble truly entails. In essence, a market bubble occurs when the price of an asset (like stocks, real estate, or cryptocurrencies) rises to levels significantly exceeding its intrinsic or fundamental value.

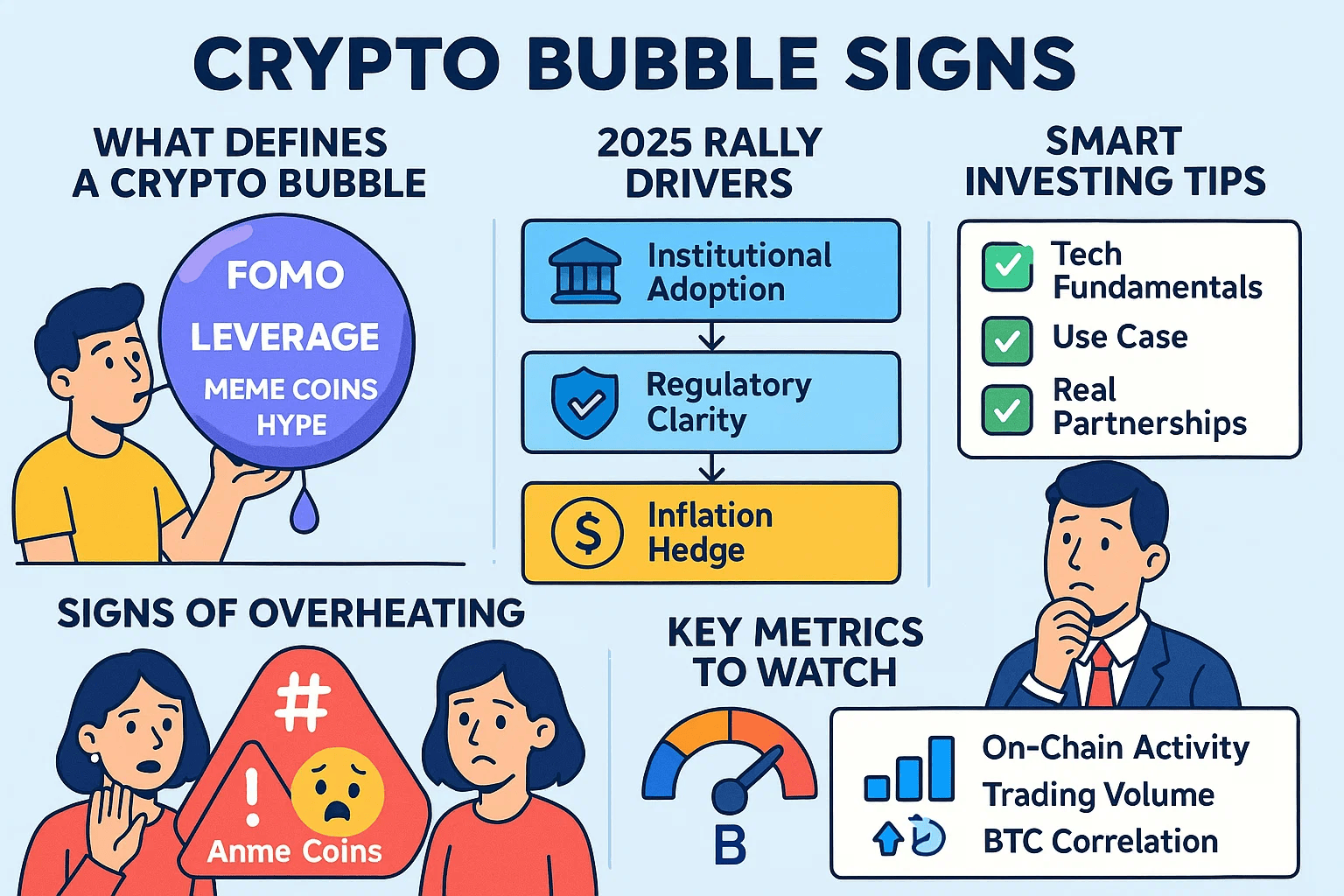

This phenomenon is typically driven by:

- Speculative Frenzy: Investors buy assets not for their underlying worth, but with the expectation that prices will continue to rise, allowing them to sell to someone else at a higher price (the "greater fool theory").

- Herd Mentality: As prices climb, more investors jump on the bandwagon, driven by Fear Of Missing Out (FOMO), further inflating the asset's price.

- Over-Enthusiasm and Hype: Often fueled by media narratives, influencer endorsements, or perceived revolutionary potential, leading to irrational exuberance.

Bubbles follow a somewhat predictable pattern:

1. Stealth Phase: Early adopters and smart money begin investing.

2. Awareness Phase: Institutional investors and more media attention arrive. Prices start a more noticeable ascent.

3. Mania Phase: Widespread public participation, media saturation, and often a detachment from fundamentals. This is where the bubble in cryptocurrency concerns become most acute.

4. Blow-off Top: Prices reach unsustainable peaks, and a sharp, sudden decline (the "burst") begins as smart money starts to exit.

5. Panic/Capitulation: Widespread selling occurs as investors try to cut losses, often leading to a prolonged downturn.

Understanding this framework is crucial for analyzing whether current cryptocurrency trends exhibit bubble-like characteristics.

Fueling the Fire: Factors Driving the Current Cryptocurrency Surge

Several powerful forces are contributing to the current dynamism in the cryptocurrency market. While these factors can indicate healthy growth, they can also, in excess, contribute to bubble formation.

- Growing Institutional Adoption: A significant driver is the increasing interest and investment from large financial institutions, corporations, and even pension funds. Companies adding Bitcoin to their balance sheets and the launch of crypto-backed financial products like ETFs lend legitimacy and inject substantial capital into the market.

- Search for Inflation Hedges: In a global economic climate marked by uncertainty and rising inflation, many investors are turning to assets like Bitcoin, perceived as a "digital gold" or a store of value, to protect their purchasing power.

- Technological Advancements and Innovation: The underlying blockchain technology continues to evolve. Developments in Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and Web3 applications are creating new use cases and attracting both users and investment. This innovation fuels optimism about the long-term potential of digital assets.

- Regulatory Clarity (Emerging): While still a complex and evolving landscape, some influential jurisdictions are making strides toward establishing clearer regulatory frameworks for digital assets. This progress, though slow, can reduce uncertainty and encourage more conservative investors to enter the market.

- Retail Investor Enthusiasm: Accessible trading platforms and the pervasive influence of social media have made it easier than ever for retail investors to participate in the crypto market. This broad participation can drive significant demand.

These drivers paint a picture of a maturing asset class. However, the speed and intensity of price movements driven by these factors warrant careful scrutiny for signs of a bubble in cryptocurrency.

Warning Signs: Is a Bubble in Cryptocurrency Forming?

Despite the positive drivers, several red flags suggest that parts of the crypto market might be overheating, potentially indicating a bubble in cryptocurrency. Recognizing these signs is crucial for prudent decision-making.

- Meteoric Rise of Meme Coins: The proliferation and speculative trading of meme coins (cryptocurrencies often created as a joke or based on internet memes, like Dogecoin or Shiba Inu) with little to no underlying utility or value is a classic sign of irrational exuberance. When assets with minimal fundamentals achieve massive market capitalizations primarily through social media hype, it signals a disconnect from rational investment.

- Extreme Price Volatility: While volatility is inherent to crypto, excessively sharp price swings without clear fundamental catalysts can indicate speculative trading rather than value-driven investment.

- "This Time It's Different" Mentality: A common refrain during market bubbles is the belief that traditional valuation metrics no longer apply due to some new paradigm. While crypto is innovative, a complete disregard for financial principles is a warning sign.

- FOMO Dominates Decisions: When investment decisions are driven more by the fear of missing out on quick profits than by thorough research and due diligence, it's a strong indicator of a speculative bubble.

- Mainstream Mania & Unqualified "Experts": When dinner party conversations are dominated by crypto tips from individuals with little financial expertise, and celebrities heavily promote specific coins, it often signals that the market has reached a speculative peak.

- Excessive Media Hype: Constant, breathless media coverage focusing on astronomical gains rather than balanced analysis can contribute to herd behavior.

- Valuations Detached from Utility: If the market capitalization of a cryptocurrency or a sector within crypto (e.g., certain DeFi protocols or NFT projects) seems vastly out of proportion to its current user base, revenue generation, or real-world problem-solving capacity, it's a cause for concern.

The Double-Edged Sword: Leverage and Influencer Impact

Two specific elements can significantly amplify both the ascent and potential collapse of a bubble in cryptocurrency: high leverage and the outsized influence of social media personalities.

The Risks of High Leverage

Many cryptocurrency exchanges offer traders the ability to use high leverage, meaning they can control a large position with a relatively small amount of capital.

- Amplified Gains and Losses: Leverage can magnify profits if the market moves favorably, but it equally magnifies losses if the market turns.

- Cascading Liquidations: In a volatile market, a sudden price drop can trigger margin calls for leveraged traders. If they cannot meet these calls, their positions are forcibly liquidated, adding selling pressure to the market. This can create a domino effect, leading to a rapid and severe market crash – a common feature when a bubble bursts.

The Sway of Social Media Influencers

Social media platforms like X (formerly Twitter), YouTube, TikTok, and Reddit play a significant role in shaping crypto market sentiment.

- Hype and Pump-and-Dump Schemes: Influencers, whether intentionally or unintentionally, can hype specific cryptocurrencies, often those with low liquidity. This can lead to "pump-and-dump" schemes where prices are artificially inflated before early investors cash out, leaving later arrivals with significant losses.

- Information Asymmetry: While some influencers provide valuable insights, many lack deep expertise or may have undisclosed vested interests. Retail investors relying solely on such sources for investment decisions are at high risk.

- Echo Chambers: Social media algorithms can create echo chambers, reinforcing biased views and making it difficult for investors to access balanced information.

The combination of easily accessible leverage and pervasive influencer marketing creates a potent cocktail that can rapidly inflate a bubble in cryptocurrency and accelerate its subsequent collapse.

Navigating the Choppy Waters: Strategies for Investors

Given the potential for a bubble in cryptocurrency, how can investors navigate these uncertain waters? A proactive and informed approach is key.

- Focus on Fundamentals: Invest in projects with strong fundamentals: a clear use case, a solid development team, robust technology, active community engagement, and a viable tokenomics model. Avoid chasing hype without substance.

- Due Diligence is Non-Negotiable: Don't rely solely on social media or tips from friends. Research thoroughly. Read whitepapers, understand the project's goals, analyze its competition, and assess its long-term viability.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification across different types of cryptocurrencies (e.g., established coins like Bitcoin and Ethereum, promising altcoins with specific use cases) and even other asset classes can help mitigate risk.

- Invest Only What You Can Afford to Lose: This rule is paramount in any speculative market, especially cryptocurrency. The potential for high returns comes with high risk.

- Dollar-Cost Averaging (DCA): Instead of trying to time the market (which is notoriously difficult), consider investing a fixed amount of money at regular intervals, regardless of price. DCA can help average out your purchase price over time and reduce the impact of volatility.

- Understand Market Cycles: Crypto markets, like traditional markets, move in cycles. Familiarize yourself with historical patterns of bull runs and bear markets. This understanding can help you maintain perspective during periods of extreme optimism or pessimism.

- Beware of FOMO and FUD: Avoid making emotional decisions based on Fear Of Missing Out (FOMO) during rallies or Fear, Uncertainty, and Doubt (FUD) during downturns. Stick to your investment strategy.

- Take Profits Strategically: If you've made significant gains, consider taking some profits off the table. Rebalancing your portfolio periodically can help lock in gains and manage risk.

The Regulatory Tightrope: Impact on Market Stability

The regulatory landscape for cryptocurrencies remains a patchwork globally, creating both opportunities and uncertainties that can influence the formation or bursting of a bubble in cryptocurrency.

- Increased Scrutiny: Governments and financial regulators worldwide are intensifying their scrutiny of the crypto market. Concerns range from investor protection and financial stability to preventing illicit activities like money laundering and terrorist financing.

- Potential for Crackdowns: Sudden or stringent regulatory actions in major economies can send shockwaves through the market, potentially triggering sharp price corrections. Bans on certain crypto activities, stricter KYC/AML (Know Your Customer/Anti-Money Laundering) requirements, or unfavorable tax treatments can dampen investor sentiment.

- Positive Regulatory Developments: Conversely, clear and supportive regulatory frameworks can foster innovation, build trust, and attract institutional capital, contributing to more stable and sustainable market growth. The approval of Bitcoin ETFs in some jurisdictions is an example of how regulation can be perceived positively.

- Global Coordination Challenges: The decentralized and borderless nature of cryptocurrencies makes global regulatory coordination difficult. Inconsistencies between jurisdictions can create opportunities for regulatory arbitrage but also add to market complexity and risk.

Investors must stay informed about evolving regulatory trends, as they can significantly impact market dynamics and the overall stability of the cryptocurrency ecosystem.

Beyond the Hype: The Long-Term Outlook for Cryptocurrency

Regardless of whether the current market is experiencing a bubble in cryptocurrency, it's important to consider the long-term potential of the underlying technology and asset class.

- Transformative Technology: Blockchain technology, the foundation of most cryptocurrencies, has the potential to revolutionize various industries, from finance and supply chain management to digital identity and entertainment.

- Maturing Asset Class: Cryptocurrencies are gradually gaining acceptance as a legitimate asset class. The increasing involvement of institutional investors, the development of sophisticated financial products, and growing regulatory clarity are signs of this maturation.

- Continued Innovation: The pace of innovation in the crypto space remains rapid. New projects, protocols, and applications are constantly emerging, expanding the possibilities and utility of digital assets.

- Addressing Real-World Problems: Beyond speculation, many crypto projects aim to solve real-world problems, such as providing financial services to the unbanked, enhancing data security, or creating more transparent and efficient systems.

While market cycles and potential bubbles are part of the journey, the long-term trajectory of cryptocurrency will likely be determined by its ability to deliver tangible value and achieve widespread adoption.

Conclusion

So, is the current market a bubble in cryptocurrency? The answer is complex and multifaceted. There are certainly signs of speculative excess, particularly in certain segments of the market, driven by hype, retail FOMO, and readily available leverage. The meteoric rise of assets with little intrinsic value is a classic warning.

However, there are also strong fundamental drivers, including growing institutional adoption, technological innovation, and an increasing search for alternative stores of value. These factors suggest that not all a_sync_new_token_idxsgrowth is purely speculative.

Ultimately, only time will definitively tell if we are in a widespread, systemic bubble. Investors should proceed with a healthy dose of skepticism, prioritize thorough due-diligence, and focus on long-term value rather than chasing short-term, unsustainable gains. Understanding the risks, recognizing the warning signs, and adhering to a sound investment strategy are crucial for navigating the exhilarating yet perilous crypto seas.

Before diving deeper into specific investments, ensuring you have a solid grasp of the basics is essential. If you're looking to build that foundational knowledge, discover what cryptocurrency is and how it works to make more informed decisions in this dynamic market.