If you're new to cryptocurrency, understanding how to securely store your digital assets is crucial. Unlike traditional banking systems, where a financial institution safeguards your money, in the world of cryptocurrencies like Bitcoin or Ethereum, you are responsible for securing your own funds. This means choosing the right type of wallet—whether it's a hot wallet connected to the internet or a cold wallet that keeps your private keys offline—is one of the most important decisions you’ll make as a crypto user.

This comprehensive guide will walk you through everything you need to know about cryptocurrency wallets, including:

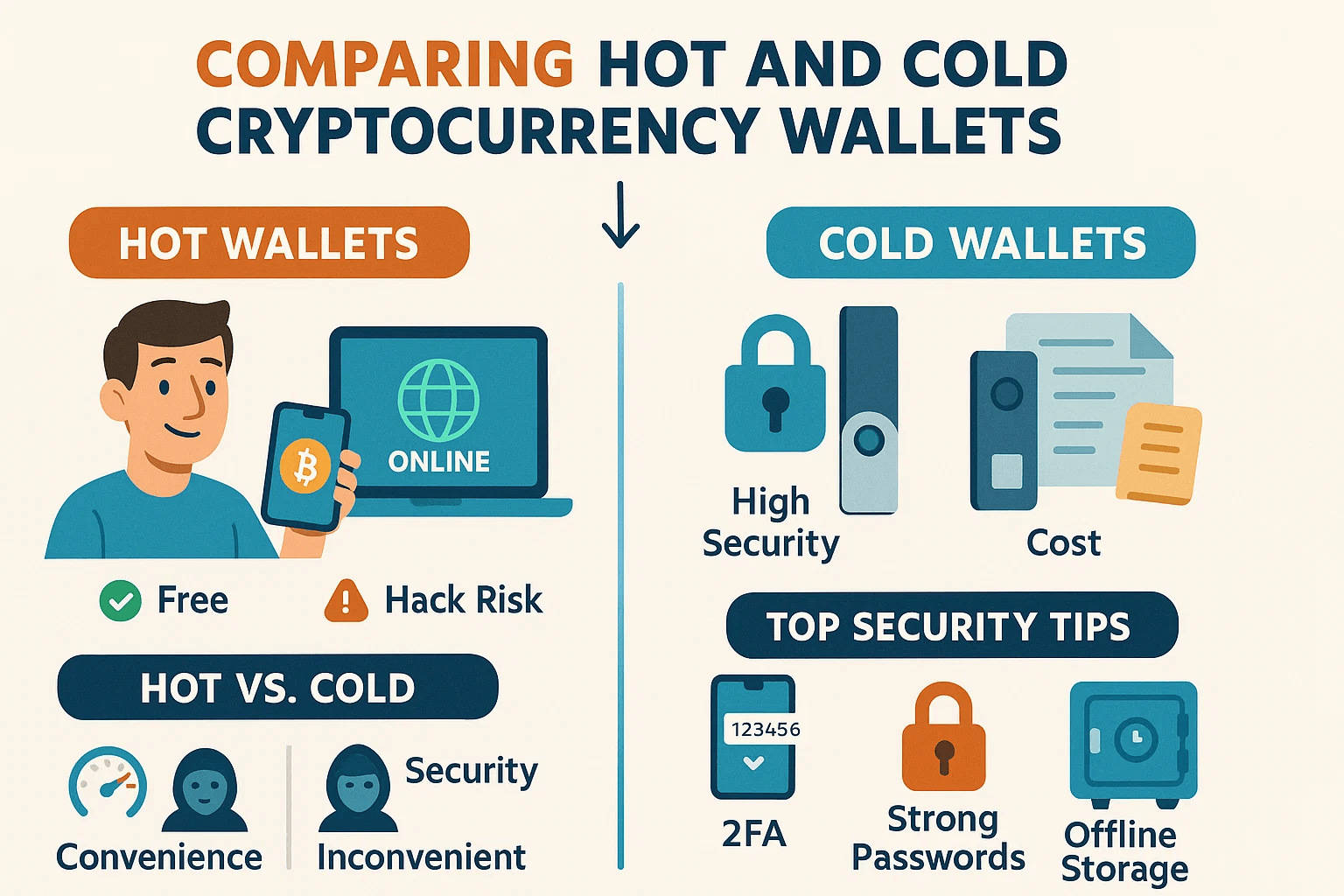

- The fundamental difference between hot wallets vs. cold wallets

- How each type of wallet impacts crypto security

- Pros and cons of different wallet types

- Best practices for managing your private keys

- Recommendations for both beginners and advanced users

Let’s dive into the world of crypto wallets and explore which option might be best suited for your needs.

What Is a Cryptocurrency Wallet?

A cryptocurrency wallet isn't a physical container for your coins—it's a tool that stores your private and public keys, allowing you to interact with the blockchain. These keys are essential because they prove ownership of your crypto and enable transactions. Think of your wallet as a keychain that gives you access to your digital assets stored on the decentralized ledger known as the blockchain.

Key Functions of a Crypto Wallet:

- Stores Private Keys: Secret codes used to authorize outgoing transactions.

- Generates Public Addresses: Unique identifiers you share to receive crypto.

- Enables Transactions: Allows you to send, receive, and manage your crypto holdings.

- Interacts with Blockchain: Communicates with networks to verify balances and execute transfers.

There are two main categories of wallets: hot wallets (online) and cold wallets (offline). Each has its own advantages and trade-offs when it comes to convenience and security.

Understanding Hot Wallets: Convenience at a Cost

Hot wallets are software-based solutions that remain connected to the internet. They include mobile apps, desktop programs, and browser extensions like MetaMask or Coinbase Wallet. These wallets are ideal for frequent traders or users who regularly transact with crypto.

Advantages of Hot Wallets:

- ✅ Easy to Use: Intuitive interfaces and quick access to funds.

- ✅ Free or Low-Cost: Most hot wallets are free to download and use.

- ✅ Good for Small Amounts: Perfect for everyday spending or small investments.

Disadvantages of Hot Wallets:

- ❌ Security Risks: Vulnerable to phishing attacks, malware, and hacking due to constant online exposure.

- ❌ Private Keys Stored Online: If the service provider gets compromised, so could your funds.

- ❌ Limited Control: Some platforms may impose restrictions on certain transactions or currencies.

Examples of popular hot wallets include:

- MetaMask – Browser extension for Ethereum and ERC-20 tokens

- Trust Wallet – Mobile app supporting multiple blockchains

- Electrum – Lightweight Bitcoin wallet

While convenient, hot wallets should not be used for long-term storage of large sums of crypto.

Cold Wallets: Maximum Security for Long-Term Holders

For those holding significant amounts of cryptocurrency, cold wallets provide the highest level of security. These hardware devices store your private keys offline, making them nearly immune to online threats. Common examples include Ledger Nano S/X and Trezor Model One.

Advantages of Cold Wallets:

- ✅ Highly Secure: No internet connectivity means no remote hacking.

- ✅ Full Control Over Keys: You alone hold your private keys.

- ✅ Supports Multiple Currencies: Most cold wallets support dozens of cryptocurrencies.

Disadvantages of Cold Wallets:

- ❌ Cost: Ranges from $60–$150+, depending on features.

- ❌ Less Convenient: Requires physical interaction for each transaction.

- ❌ Risk of Physical Loss: Devices can be lost, damaged, or stolen if not properly secured.

Cold wallets work by generating and storing your private keys offline within a secure chip. When you want to make a transaction, you connect the device to your computer or smartphone, confirm the details directly on the wallet screen, and physically approve the transfer using buttons on the device itself.

Paper Wallets: A Less Popular Option

A paper wallet is a printed piece of paper containing your public and private keys along with QR codes for easy scanning. While technically a form of cold storage, paper wallets are rarely recommended today due to practical risks such as damage from fire, water, or fading ink, as well as the potential for theft or misplacement.

Why Paper Wallets Are Not Ideal:

- 🔥 Susceptible to physical damage

- 📜 Difficult to use without importing keys

- 🗝️ High risk of losing access permanently

Given these limitations, most experts advise opting for hardware wallets instead of paper versions unless absolutely necessary.

Hot Wallet vs. Cold Wallet: A Side-by-Side Comparison

| Feature | Hot Wallet | Cold Wallet |

|---|---|---|

| Internet Connection | Always online | Offline storage |

| Security Level | Lower | Highest |

| Ease of Use | Very user-friendly | Slightly more complex |

| Cost | Free or low-cost | $60–$150+ |

| Best For | Everyday use | Long-term storage |

Both wallet types have their place in a well-rounded crypto strategy. Many experienced investors use a combination: keeping small amounts in a hot wallet for daily transactions while storing the majority of their holdings in cold storage for maximum protection.

Importance of Wallet Security: Protecting Your Digital Assets

When it comes to cryptocurrency security, the responsibility lies entirely with you. There’s no bank or central authority to call if something goes wrong. That’s why implementing strong security practices is non-negotiable.

Essential Tips for Securing Your Wallet:

- Use Strong, Unique Passwords

- Enable Two-Factor Authentication (2FA)

- Keep Software Updated

- Avoid Public Wi-Fi for Transactions

- Never Share Your Private Keys or Seed Phrase

- Back Up Your Recovery Phrase in a Safe Location

Remember: Your seed phrase is the master backup for your wallet. Treat it like gold—store it somewhere safe and never share it with anyone.

Conclusion

Choosing the right cryptocurrency wallet depends on your individual needs, investment size, and how frequently you plan to transact. For everyday use, hot wallets offer unmatched convenience but come with higher security risks. On the other hand, cold wallets provide rock-solid protection for long-term holders willing to invest a bit more upfront.

No matter which type of wallet you choose, always prioritize security. Keep your recovery phrase safe, avoid phishing scams, and stay updated on best practices in the ever-evolving world of crypto.

If you’re ready to take control of your crypto future, start by selecting the wallet that aligns with your goals and lifestyle.

Ready to learn more about securing your digital assets? Explore our complete guide to cryptocurrency security and ensure your investments stay safe in the hands of only one person—you.