The world of cryptocurrency is known for its exhilarating highs and, at times, its stomach-churning lows. Among the most dramatic phenomena is the "crypto bubble," a period of rapid price inflation driven by fervent enthusiasm, only to be followed by an often-sudden and sharp decline – the dreaded cryptocurrency bubble burst. For investors and enthusiasts alike, understanding what triggers these bursts is not just academic; it's crucial for navigating this volatile landscape.

A crypto bubble occurs when the price of digital assets soars far beyond any realistic measure of their intrinsic or practical value, often fueled by hype and speculative trading. But what transforms this unsustainable ascent into a precipitous fall? This post delves into the core reasons and catalysts that cause a bubble in cryptocurrency to burst, examining the mechanics of the crash and the lessons we can glean from these market-shaking events.

First, What Inflates a Crypto Bubble? Understanding the Precursors

Before a bubble can burst, it must first form. Several factors contribute to the initial inflation of a cryptocurrency bubble, creating an environment ripe for a future correction. These are often the same elements that, when they shift or reach a breaking point, can trigger the burst.

The Role of Hype and Speculation

The crypto space is particularly susceptible to hype. Exciting narratives about revolutionary technology, coupled with stories of early investors achieving astronomical returns, can create a powerful feedback loop.

Media Amplification: Social media platforms, news outlets, and influencer marketing can quickly spread enthusiasm, often without a balanced view of the risks.

Speculative Frenzy: Many participants in a bubble are not investing based on fundamentals but are speculating on continued price increases. They buy with the expectation of selling to someone else at a higher price – a behavior classic to bubble formation. This "greater fool theory" can sustain a bubble for a surprisingly long time.

Influence of Easy Access and FOMO (Fear of Missing Out)

The proliferation of user-friendly crypto exchanges and trading apps has democratized access to these assets. While this is positive for adoption, it also means a larger influx of inexperienced investors.

Low Barriers to Entry: Anyone with an internet connection can often start trading with small amounts, drawing in a wide retail audience.

FOMO: As prices climb, the fear of missing out on perceived easy profits becomes a powerful psychological driver. This often leads to impulsive investment decisions without proper due diligence, pushing prices even higher.

The Perils of Low Regulatory Oversight

Historically, the cryptocurrency market has operated with less regulatory scrutiny than traditional financial markets.

Market Manipulation: This environment can be more susceptible to practices like "pump-and-dump" schemes, wash trading, and other manipulative activities that artificially inflate prices and trading volumes.

Lack of Investor Protection: Fewer safeguards mean that when things go wrong, retail investors may have little recourse.

These elements combine to create a market detached from underlying value, setting the stage for an eventual cryptocurrency bubble burst.

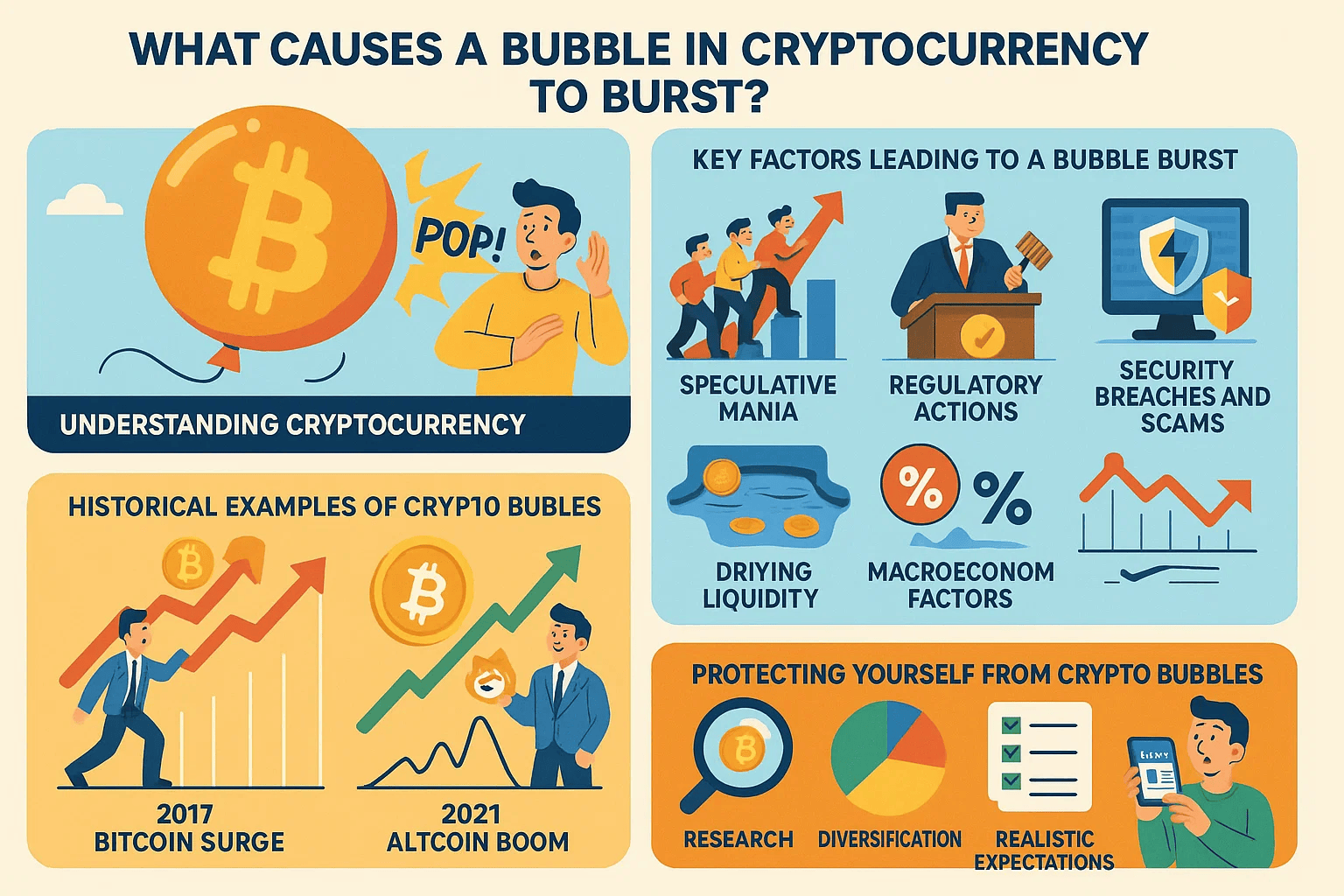

The Tipping Point: Key Catalysts That Cause a Cryptocurrency Bubble to Burst

While a bubble can sustain itself on hype and speculation for a period, there's always a tipping point. Several distinct catalysts can prick the bubble, leading to a rapid unwinding of prices.

- Market Saturation and Exhaustion of New Money

A bubble needs a continuous inflow of new money to sustain its upward trajectory.

Peak Hype: Eventually, the market reaches a point where almost everyone who is likely to be drawn in by the hype has already invested.

Diminishing Returns: As prices become extremely high, the perceived risk-reward ratio shifts, and new investors become more hesitant. When the inflow of new capital slows, the upward pressure on prices wanes.

- Negative News or Regulatory Crackdowns

The crypto market is highly sensitive to news, especially concerning regulation.

Government Intervention: Announcements of new, restrictive regulations, bans on trading or mining in key jurisdictions, or investigations into major exchanges or projects can send shockwaves through the market. This was a significant factor in several past crypto market crash events.

Security Concerns: Major security breaches, hacks of prominent platforms, or discovery of critical vulnerabilities in a leading cryptocurrency can shatter investor confidence.

- Technological Failures or Unfulfilled Promises

Many cryptocurrencies are built on complex technology and ambitious roadmaps.

Project Failures: If a high-profile project fails to deliver on its promises, experiences significant technical setbacks, or is revealed to be unviable, it can trigger a sell-off, potentially impacting broader market sentiment.

Scalability Issues: As networks grow, they can face challenges with transaction speed and costs. If these issues aren't addressed effectively, it can erode faith in the long-term viability of certain cryptocurrencies.

- Macroeconomic Shifts and Investor Sentiment Change

Broader economic conditions play a significant role.

Risk-Off Environment: During times of economic uncertainty, rising interest rates, or recession fears, investors tend to move away from speculative, high-risk assets like many cryptocurrencies and into safer havens.

Liquidity Squeeze: If central banks tighten monetary policy, reducing liquidity in the financial system, there's less speculative capital available to flow into crypto markets.

- Profit-Taking by Large Holders (Whales)

Early investors and large holders (often called "whales") may decide to realize their substantial paper profits.

Cascading Sell Orders: When whales begin to sell large amounts, it can trigger a cascade of sell orders as prices start to fall. Automated trading bots and stop-loss orders can exacerbate this downward momentum.

Panic Selling: As smaller investors see prices plummeting, panic sets in, leading to further selling as they try to cut their losses.

- Realization of Overvaluation (Loss of Confidence)

Ultimately, a bubble bursts when a critical mass of market participants realizes that prices are unsustainable and grossly overvalued.

Shift in Narrative: The prevailing narrative can shift from "this time it's different" to a more sober assessment of fundamentals.

Lack of Utility: If cryptocurrencies fail to gain meaningful real-world adoption or demonstrate clear use cases beyond speculation, their sky-high valuations become increasingly difficult to justify. This is a core reason why do crypto bubbles pop.

Signs a Crypto Bubble Burst is Imminent

While predicting the exact moment of a burst is nearly impossible, several warning signs often precede a cryptocurrency bubble burst:

Parabolic Price Moves: Prices go almost vertical, with increasingly rapid gains.

Extreme Hype & Euphoria: Media coverage becomes frenzied, and conversations are dominated by get-rich-quick stories. Everyone seems to be an expert.

Mainstream Mania: Your taxi driver or barista starts giving you crypto tips. This indicates widespread, often uninformed, retail participation.

High Valuations with No Fundamentals: Projects with little to no working product or clear use case achieve multi-billion dollar valuations.

Increased Leverage and Risky Behavior: More investors are using leverage to magnify their bets, and there's a proliferation of highly speculative, low-quality "altcoins."

"This Time It's Different" Mentality: Skeptics are dismissed, and proponents argue that traditional valuation metrics don't apply.

Divergence from Other Markets: Crypto prices may decouple significantly from traditional assets or show extreme volatility spikes.

The Anatomy of a Crash: How the Bubble Deflates

When a bubble bursts, the deflation process can be swift and brutal:

The Initial Shock: A catalyst (e.g., bad news, whale selling) causes an initial sharp price drop.

Panic Selling: This triggers fear, and investors rush to sell to avoid further losses. Liquidity dries up as buyers disappear.

Margin Calls: Leveraged traders face margin calls, forcing them to sell assets to cover their positions, adding to the downward pressure.

Contagion: The crash in one major cryptocurrency can spread to others as investors lose confidence in the entire sector (a common feature in a Bitcoin bubble burst affecting altcoins).

The Bottoming Process: After the initial crash, prices may bounce, but often there's a prolonged period of consolidation or further decline as the market seeks a new equilibrium based on more realistic valuations.

The Aftermath and Impact of a Burst Bubble

The consequences of a cryptocurrency bubble burst are far-reaching:

Significant Financial Losses: Many investors, especially those who bought near the peak, can lose substantial amounts of money.

Market Cleanup: The crash often weeds out weak projects, scams, and unsustainable business models, leaving stronger, more fundamentally sound projects to survive and grow.

Increased Regulatory Scrutiny: Regulators often intensify their focus on the crypto industry after a major crash, leading to new rules and oversight. This can be one of the delayed crypto crash causes for future stability, or a trigger if poorly implemented.

Damage to Investor Confidence: A severe burst can deter mainstream adoption and make investors wary of the crypto space for some time.

Innovation Slowdown (Temporary): Funding for new crypto projects may dry up temporarily as venture capital becomes more cautious.

Learning from the Ashes: Lessons from Past Crypto Bubble Bursts

History, even in the relatively short lifespan of cryptocurrencies, offers valuable lessons:

Do Your Own Research (DYOR): Understand the technology, use case, team, and tokenomics before investing. Don't rely solely on hype.

Beware of FOMO: Emotional investing is rarely successful. Stick to a sound investment strategy.

Diversification Matters: Don't put all your eggs in one crypto basket.

Understand Risk Tolerance: Only invest what you can afford to lose, especially in highly volatile assets.

Look for Utility: Focus on projects with real-world applications and sustainable value propositions.

Long-Term Perspective: Bubbles and bursts are part of market cycles. Genuine innovations often survive and thrive in the long run.

Conclusion: Navigating the Inevitable Cycles

Cryptocurrency bubbles and their subsequent bursts appear to be a recurring feature of this innovative yet volatile market. The potent mix of groundbreaking technology, intense speculation, global accessibility, and evolving regulation creates conditions where dramatic price swings are common. The catalysts for a cryptocurrency bubble burst are multifaceted, ranging from market saturation and regulatory actions to macroeconomic shifts and a simple, collective loss of faith in overinflated valuations.

While these events can be painful for those caught unprepared, they also serve as crucial market corrections, clearing out excesses and paving the way for more sustainable growth. By understanding the forces that inflate bubbles and the triggers that cause them to pop, investors can make more informed decisions and better navigate the exciting, yet challenging, world of digital assets.

Ready to deepen your understanding of the crypto world beyond the bubbles? Take the next step and explore our comprehensive resources on What is Cryptocurrency to build a solid foundation for your journey.