As a result of backtesting various strategies, we found that a simple strategy had a better win rate than one using a complex mix of market indicators. I believe one of the best strategies for automated trading is the countertrend trading strategy. This is because a technical rebound or decline almost always occurs in a bar with high trading volume, making it difficult to trade manually due to psychological and physical challenges. With the increasing prevalence of automated trading, confidence in technical rebounds or declines is likely to grow further.

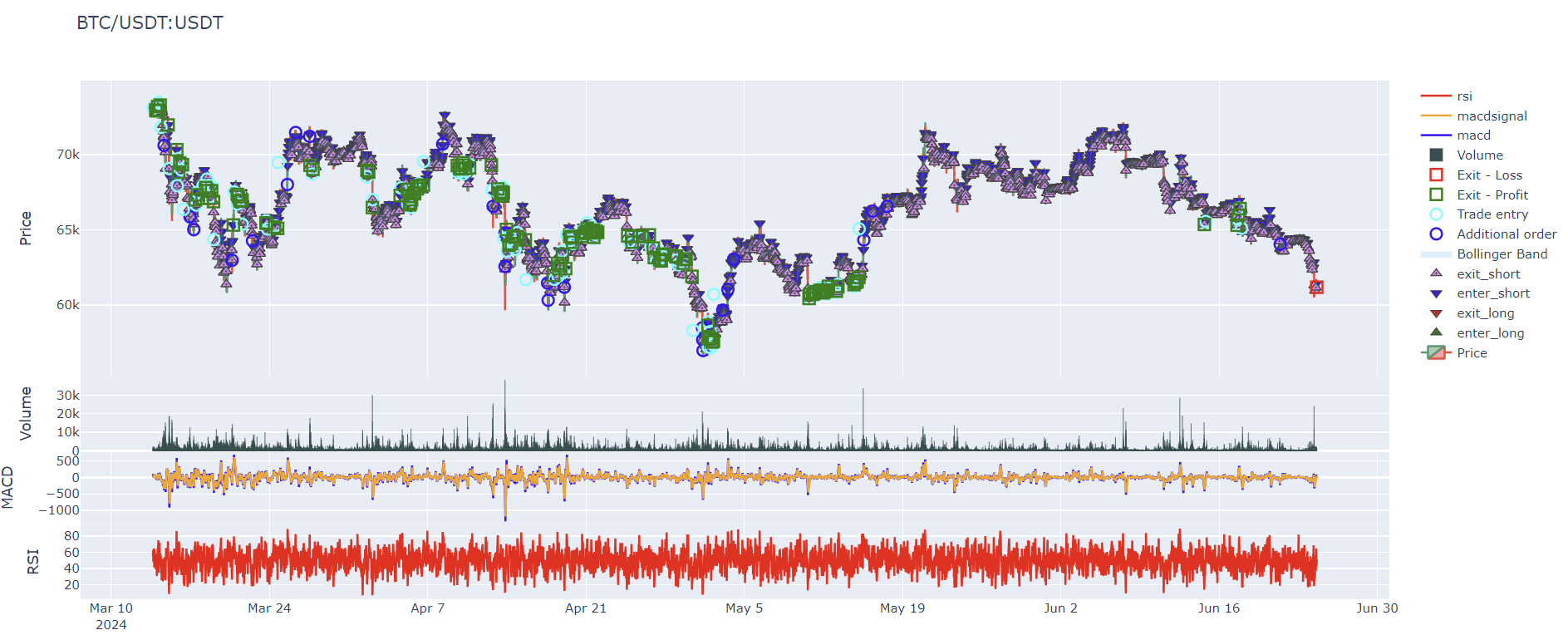

Therefore, I created a simple strategy using only Bollinger Bands, a simple yet powerful tool, and introduced the concept of "watering" to protect against situations where stop losses occur. There are many ways to implement this type of strategy. However, as mentioned earlier, it was more effective to keep the strategy simple rather than detailed, so the watering strategy was also kept simple. In cases where the bars continue without much trading volume, we avoid entering trades.

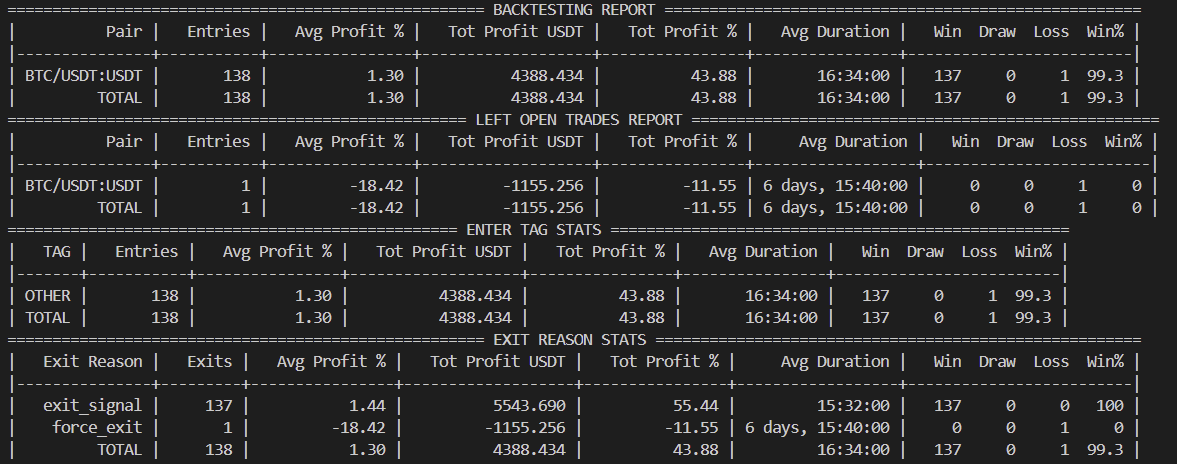

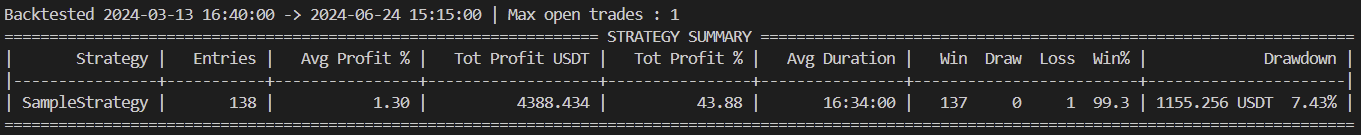

In fact, if you set a minimal ROI and make the stop loss extremely large, the backtesting strategy's win rate will naturally look good. This is because the market does not continuously rise or fall. Therefore, if you use a countertrend strategy with a very large stop loss and simply wait, you might eventually profit, giving the illusion of having created a great strategy. Freqtrade calculates the average position holding period according to the strategy. In actual trading, it's necessary to manage stop losses properly since automated trading strategies might not capture everything.

Freqtrade supports variable optimization with hyperopt as well as the freqai model, and we plan to study and apply that model as well.

The force exit at the end occurred due to a lack of data for backtesting, so the actual profit may be higher than reported. The stop loss was set at 50%, and leverage was tripled for each position. Thus, if the position reached -17% of the average, it would trigger a stop loss. Increasing leverage effectively reduces the stop loss threshold. While one might think that increasing leverage and improving the win rate would lead to better returns, the opposite result is often obtained. Therefore, finding the appropriate balance between stop loss and leverage is crucial.

Additionally, the trailing stop function is highly beneficial. By using a trailing stop effectively, you can expect compound profits through repeated confirmed sales, as it allows for faster collection of confirmed profits compared to not using it. Without a trailing stop and without the user manually closing the position, the freqtrade bot has to wait until an exit signal appears.

The backtesting period covered the last three months when Bitcoin was trading sideways between approximately 60k to 70k. The issue with a counter-trend trading strategy and a large stop loss is that if the market trend becomes strongly directional, the position size can grow large, and it takes a long time to exit. As an alternative, we considered using an indicator to determine the market trend. If a breakout occurs, we would terminate the existing counter-trend automatic trading strategy and switch to a trend trading strategy. We plan to implement and apply this approach.

This strategy development involves not only studying freqtrade but also actively trading by appropriately customizing the open-source platform.

2개의 댓글

In the fast-paced world of crypto trading, maximizing profits is an art, and trading bots are like the paintbrush that makes it all possible. As a seasoned trader, I’ve learned that a good bot can make the difference between watching the market from the sidelines and capturing real profits. These bots can analyze vast data in seconds, executing trades with precision and speed that no human can match. That’s where platforms like Etherhub.io come in. This site is a treasure chest of resources for those looking to make trading bots part of their strategy. With its easy-to-use interface, Etherhub allows you to automate trades, track multiple portfolios, and get the real-time analytics that matter most. Whether you're just starting or have been trading for years, tools like these make it possible to dive into opportunities as they happen. Bots can detect market trends and take advantage of micro-movements instantly, keeping you profitable even in volatile markets 😎Check out more about their unique features at https://etherhub.io and see how automation could turn your trades into a steady profit engine.

Creating my own auto-trading system has been an exciting and challenging journey. Utilizing various algorithms and strategies, I've aimed to maximize efficiency and profitability while trading on Pocket Option The platform's user-friendly interface and robust features have been instrumental in developing and testing my automated trades. This endeavor has deepened my understanding of market dynamics and enhanced my trading skills, making it a rewarding experience.