Long Fiber Thermoplastics Market—Steady Recovery and Automotive Leadership

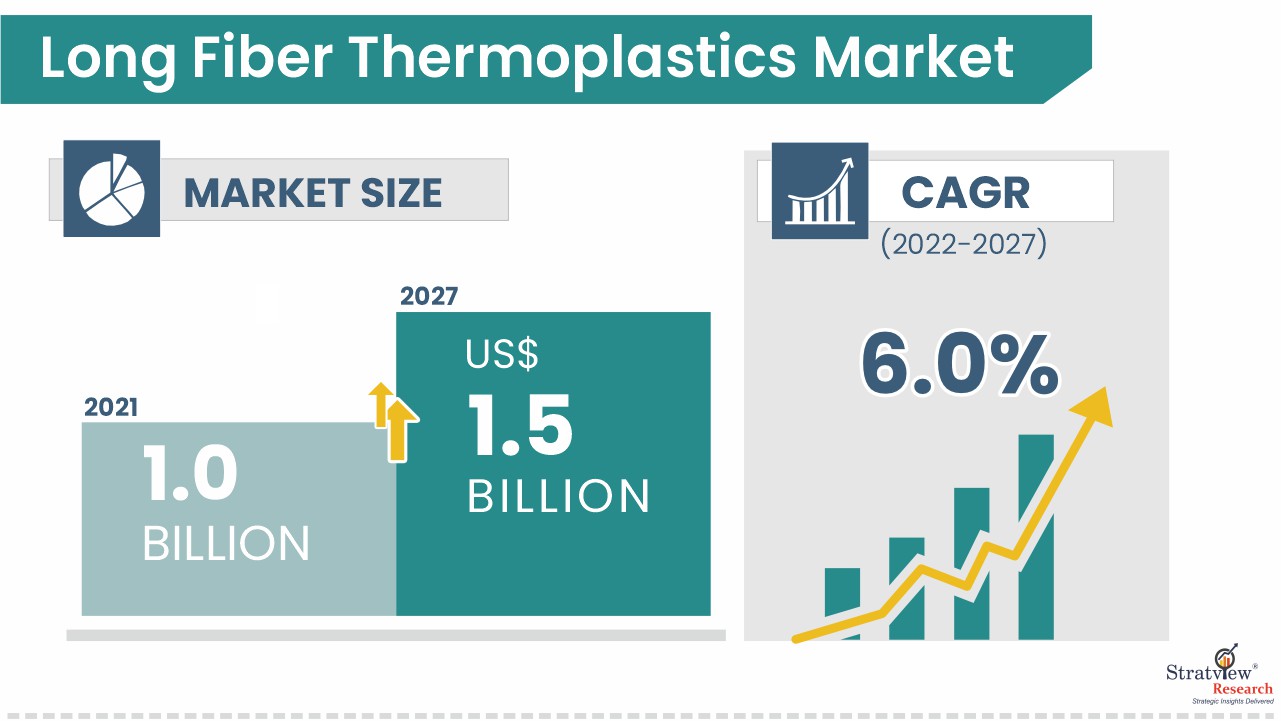

Long fiber thermoplastics (LFTs) are high-strength, high-temperature resistant composite materials made from thermoplastic resins reinforced with long continuous fibers. They are widely used in industries like automotive, consumer goods, sporting equipment, and industrial applications due to their favorable stiffness, toughness, and lightweight properties. Stratview Research estimates the global long fiber thermoplastics market at approximately USD 1,057.7 million in 2021. It is expected to grow at a moderate CAGR of 6% from 2022 to 2027, reaching USD 1,555.7 million by 2027.

Request the sample report here:

https://stratviewresearch.com/Request-Sample/793/long-fiber-thermoplastics-market.html#form

Market Drivers

1. Demand for Lightweight, High-Performance Materials: LFTs are increasingly adopted for their strength-to-weight advantages—crucial in automotive and other equipment seeking improved fuel efficiency and performance.

2. Automotive Segment’s Dominance: Automotive remains both the largest and fastest-growing end-use segment. Manufacturers rely on LFTs to produce durable, lightweight components to meet fuel efficiency and emissions targets.

3. Polypropylene (PP) Resin Advantage: PP-based LFTs hold over 50% market share in 2021. Their cost-effectiveness relative to alternatives is driving their continued dominance. Material suppliers and OEMs specifically focus efforts on PP-LFT enhancements.

4. Regional Leadership of Europe, Growth in Asia-Pacific: Europe held over 35% of the global market share in 2021 and remains the most dominant region, owing largely to its established automotive OEMs and LFT manufacturers located in countries such as Germany and Belgium. Meanwhile, the Asia-Pacific region is experiencing the highest CAGR (~7.6%) across the forecast period, fueled by rapid industrial expansion in China, Japan, and India.

Challenges

1. COVID-19 Disruption and Recovery: The LFT market plummeted by approximately 12% in 2020 due to pandemic-driven shutdowns across key end-use industries. While recovery began in 2021, regaining pre-pandemic sales levels only by 2022, it underscores vulnerability to global disruptions.

2. Balancing Cost vs. Performance: Although PP-LFT remains popular for affordability, the pressure to deliver higher-performance LFTs—especially in automotive and industrial applications—places strain on cost structures and supply chains.

3. Supply Chain and Regional Risk: Europe’s dominance brings infrastructure strength but also concentration risk. Asia-Pacific growth is promising, yet the evolving supply landscape may bring logistical and regulatory complexities.

Conclusion

The LFT market is steadily recovering from the pandemic, on course to reach USD 1.56 billion by 2027, thanks to its vital role in lightweighting—particularly within automotive. Europe maintains leadership as a manufacturing hub, while Asia-Pacific emerges as the fastest-growing market. PP-LFTs’ cost advantage keeps them central, but future advances will hinge on performance improvements and robust supply strategies. Market leaders should navigate recovery dynamics while investing in innovation and regional agility to harness the full potential of the 2022–2027 growth window.share, logic’s leadership, computers as the largest end-use, and 300 mm as the dominant size—all of which pinpoint where operational excellence matters most.).