Marine Coatings Market — Growth Driven by Regulation & Shipbuilding

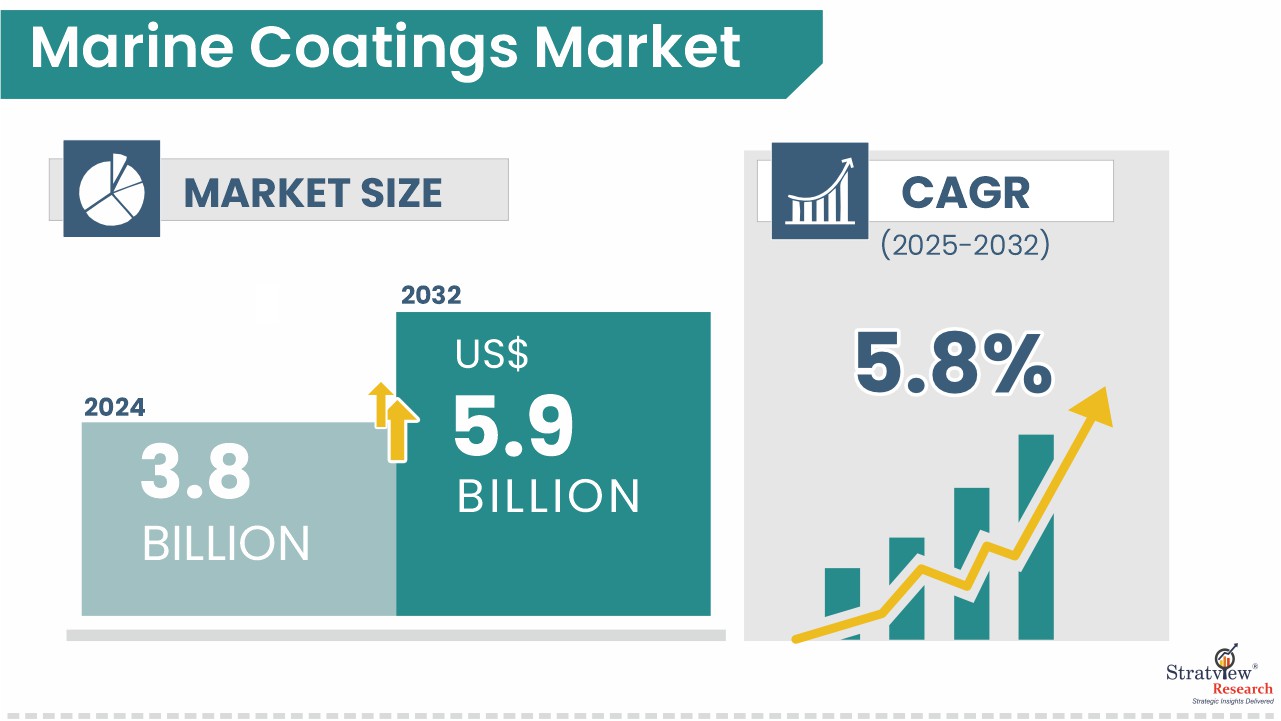

The marine coatings market encompasses paints and coatings used to protect ships, offshore vessels, ports, marine structures, and recreational boats against corrosion, fouling, UV damage, and abrasion. According to Stratview Research, the marine coatings market is expected to achieve a healthy Compound Annual Growth Rate (CAGR) of about 5.8% during a forecast period following 2024. Key players include Jotun, AkzoNobel, Sherwin-Williams, Hempel, Chugoku Marine Paints, Nippon Paint and others.

Download the Fee Sample Report Here:

https://www.stratviewresearch.com/Request-Sample/1172/marine-coatings-market.html#form

Drivers

Several forces are fuelling demand for marine coatings:

• Shipbuilding & repair activity: Growth in global maritime trade means more ships being built, plus an aging fleet that needs regular maintenance and repair (dry docking, repainting etc.), which all require coatings. Stratview notes that increasing demand from the shipbuilding and repair segment is one of the primary drivers.

• Harsh marine environmental challenges: Salt water, biofouling (organisms sticking to hulls), abrasion, UV exposure all degrade surfaces; coatings protect against these, extending service life and reducing maintenance costs.

• Regulatory pressure & environmental norms: Stringent rules (e.g. IMO – International Maritime Organization) on emissions, pollutants, volatile organic compounds (VOCs), and biocide usage are pushing coatings makers to develop more eco-friendly, water-based, low-VOC, or biocide-free and foul-release formulations.

• Fuel efficiency & cost savings: Fouling on hulls increases drag and fuel consumption. Coatings that reduce biofouling or are smooth/antifouling help reduce fuel costs; over life cycle, operators favor coatings that deliver good performance and lower operating cost.

Trends

Here are some of the key behavioral and technological trends in the marine coatings market:

• Eco-friendly and water-based coatings gaining traction: Due to environmental concerns, coatings with fewer solvents, lower VOCs, or biocide-free are increasingly preferred. Water-based coatings in particular are growing faster.

• Innovations in antifouling & foul-release coatings: New materials including nanotechnology, slick / low surface energy finishes, coatings that are self-polishing etc., help in reducing maintenance, improving longevity, and minimizing environmental impact.

• Leisure and recreational boats segment growth: The leisure boat / yacht sector is expanding (driven by rising disposable income, tourism, boating hobbies), increasing demand for marine coatings not just for function, but also aesthetics and durability. Stratview has separate reports showing positive CAGR (~6-7%) in this sub-segment.

• Regional leadership shifting to Asia-Pacific: Many shipbuilding hubs are in Asia-Pacific (China, South Korea, Japan, India etc.), which leads in demand for new ships and repairs. This region holds large market share and is expected to have strong growth. Latin America also shows growth in certain reports.

Conclusion

The marine coatings market is poised for steady growth—fueled by rising shipbuilding and repair activity, tighter environmental regulation, and a demand for performance coatings (anti-fouling, anti-corrosion, etc.). While Stratview places the CAGR in the vicinity of ~4.5% in some forecasts, other studies suggest perhaps higher (~5-6%) depending on regions and application segments.

For stakeholders (manufacturers, formulators, ship operators), the opportunity lies in innovating coatings that meet environmental standards (low VOC, biocide-free), reduce life-cycle costs (fuel savings, less maintenance), and appeal in fast-growing regions (Asia-Pacific, Latin America). Challenges include regulatory compliance, raw material cost fluctuations, and ensuring durability under tough marine conditions. Overall, those able to combine sustainability, performance, and cost-effectiveness are most likely to succeed.