Humidity Sensor Market Share, Size, Price, Trends, Growth, Analysis, Key Players, Outlook, Report, Forecast 2025-2032

Humidity Sensor Market Expected to Surpass USD 8.9 Billion by 2030, Driven by Demand from Automotive, Healthcare, and Smart Devices

Market Estimation, Growth Drivers & Opportunities

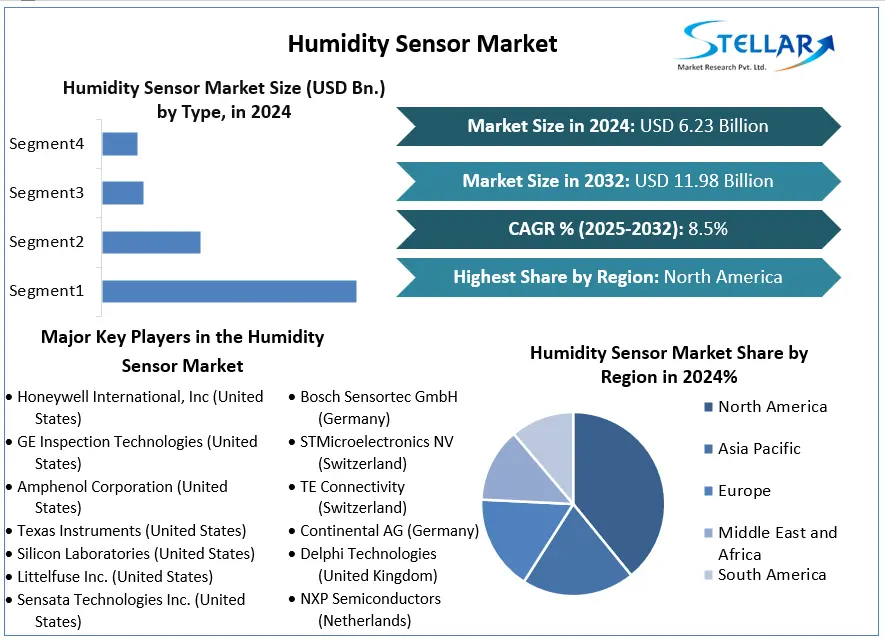

According to Stellar Market Research, the Humidity Sensor Market was valued at USD 5.7 billion in 2023 and is forecasted to reach USD 8.9 billion by 2030, growing at a CAGR of 6.6% during the forecast period. The growing demand for precise environmental monitoring and the integration of sensor technology in consumer and industrial devices are key drivers of market expansion.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/humidity-sensor-market/2295

Key growth drivers include:

Rising adoption in automotive and HVAC systems, where humidity control is essential for comfort and safety.

Growth in consumer electronics, including smartphones, wearables, and home automation devices that require environmental sensing.

Expansion of IoT infrastructure, particularly in smart cities and industrial automation, which leverages humidity data for energy optimization and process efficiency.

Increased healthcare applications, including medical devices and pharmaceutical storage that require regulated humidity conditions.

Opportunities:

Development of miniaturized, energy-efficient sensors for integration into compact electronic devices.

Growing use in agriculture and food storage, where humidity control is critical for product quality.

Emerging demand from battery and semiconductor manufacturing, where humidity sensitivity is crucial.

U.S. Market Trends and Investment in 2024

In 2024, the U.S. market saw a significant push for domestic semiconductor manufacturing through the CHIPS Act, fueling demand for precision humidity sensors in chip fabrication environments. The automotive sector also led investment in in-cabin air quality systems and battery thermal management, where humidity sensors are crucial. Additionally, American smart home companies like Honeywell and Nest (Google) expanded their portfolios with next-generation environmental monitoring devices featuring integrated humidity sensors. Federal initiatives supporting energy efficiency and climate control in buildings further reinforced market growth.

Market Segmentation: Leading Segment by Market Share

Among all applications, the Automotive Segment holds the largest market share. Vehicles increasingly rely on humidity sensors for climate control systems, defogging safety features, and battery efficiency in electric vehicles. The shift toward electric and autonomous vehicles has enhanced the need for multi-functional environmental sensors that ensure passenger comfort, battery life, and optimal system performance.

Competitive Analysis: Top 5 Companies in Global Market

Honeywell International Inc.

A leading innovator in sensor technology, Honeywell launched next-gen digital humidity sensors with faster response times and improved reliability in 2024. The company is investing in scalable sensor production to meet the growing needs of HVAC, automotive, and industrial clients.

Sensirion AG

The Swiss company expanded its SHT4x humidity and temperature sensor family in 2024, offering industry-leading precision and energy efficiency. Sensirion also introduced AI-assisted calibration technology, enhancing the performance of its sensors in complex environments.

TE Connectivity

TE Connectivity continues to dominate industrial and automotive sensor markets. In 2024, it introduced robust humidity sensors designed for harsh environmental conditions, supporting applications in off-road vehicles, marine systems, and renewable energy infrastructure.

Texas Instruments Inc.

Texas Instruments launched a new series of integrated environmental sensors featuring low power consumption and high durability. These are particularly suited for wearables, IoT devices, and industrial monitoring systems. TI also partnered with universities on sensor innovation through the CHIPS and Science Act funding.

Bosch Sensortec

A division of Bosch Group, the company released compact, high-performance BME688 sensors, combining humidity, gas, temperature, and pressure sensing into a single chip. In 2024, Bosch announced investment in its Reutlingen semiconductor plant to scale up sensor production for smart homes and EVs.

Regional Analysis

USA: The U.S. holds a significant share of the global humidity sensor market, thanks to industrial automation, automotive innovation, and strong consumer electronics demand. Government support through infrastructure and clean energy policies has encouraged adoption across sectors.

UK: The UK's focus on green buildings and sustainable agriculture is pushing the integration of humidity sensors in climate control systems and storage environments. Initiatives under the UK's Net Zero strategy also support IoT-driven monitoring tools in commercial spaces.

Germany: As a hub for automotive engineering, Germany is a major adopter of humidity sensors in vehicle systems. Government backing for EV development and smart manufacturing (Industry 4.0) continues to support the market’s growth.

France: France is investing in renewable energy and smart grid infrastructure, where humidity sensors are used to monitor environmental parameters critical to system performance and longevity. Building automation and HVAC modernization are also key growth areas.

Japan: Japan’s electronics and robotics industries remain strong drivers for high-precision sensor adoption. Leading firms have invested in AI-integrated sensing platforms for smart homes and medical applications. Regulatory focus on energy efficiency boosts deployment in buildings and transport.

China: China dominates in production and consumption, driven by aggressive growth in consumer electronics, automotive, and industrial automation. Government-led digital infrastructure initiatives and smart manufacturing programs continue to create strong demand for humidity sensors.

Conclusion

The Humidity Sensor Market is experiencing robust growth as digitalization, electrification, and automation redefine industries. With the expansion of smart technologies across consumer, industrial, and healthcare segments, the role of humidity sensors is becoming increasingly critical in ensuring environmental accuracy, safety, and efficiency.

Looking ahead, the major growth opportunities lie in:

IoT and wearable devices, where compact, low-power sensors are essential.

Smart agriculture and food logistics, requiring real-time monitoring of environmental conditions.

Electric vehicle thermal management and autonomous systems, where sensor accuracy is vital.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

sales@stellarmr.com