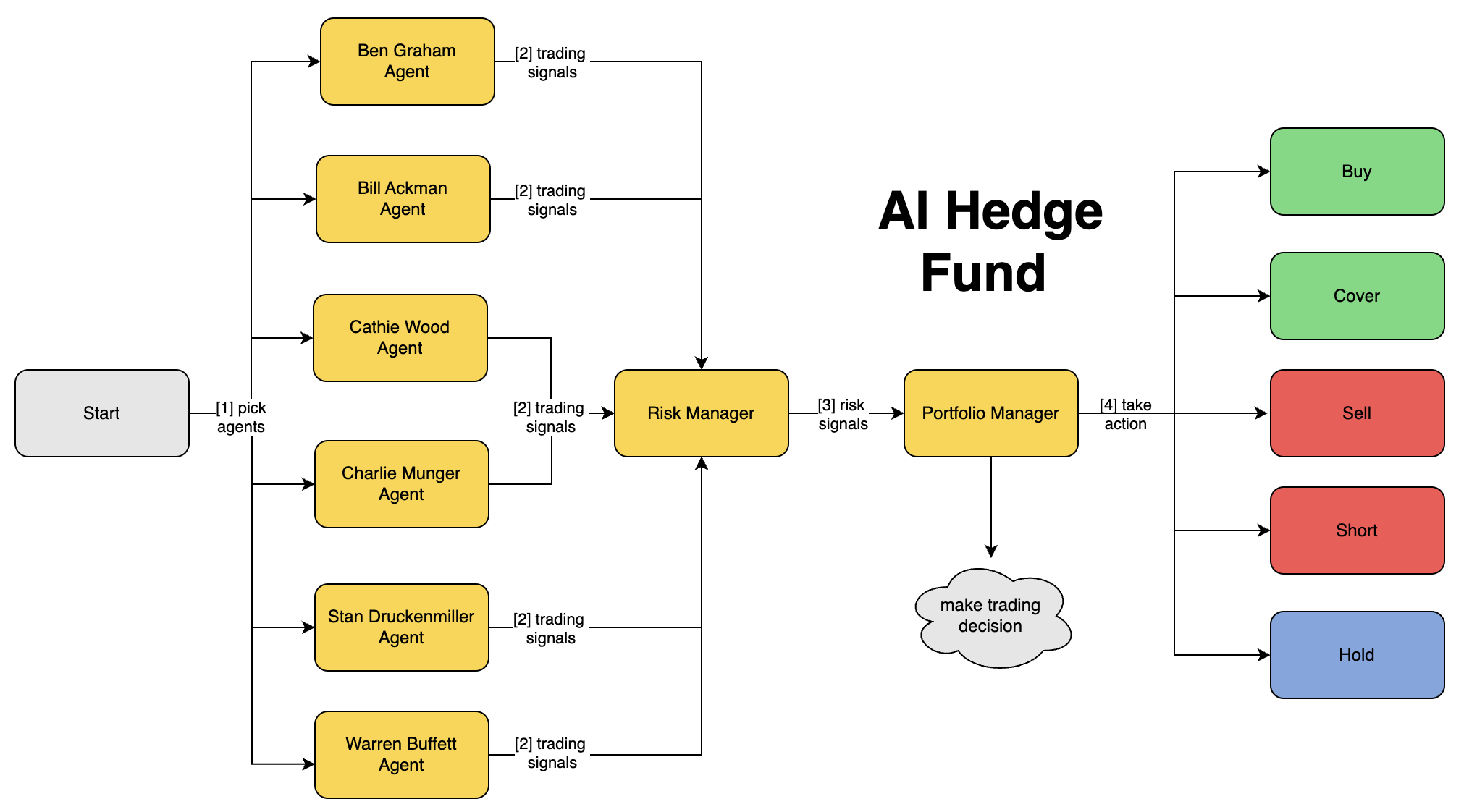

이 시스템은 벤 그레이엄, 빌 액크만, 캐시 우드, 찰리 멍거, 스탠리 드러켄밀러, 워렌 버핏과 같은 전설적인 투자자들의 투자 철학을 모방한 에이전트들과 가치평가, 시장 심리, 기본적 분석, 기술적 분석을 수행하는 특수 에이전트들이 함께 작동하는 흥미로운 구조를 가지고 있습니다.

깃허브 주소: https://github.com/virattt/ai-hedge-fund.git

Benjamin Graham AI 에이전트: 가치 투자의 원칙을 코드로 구현하기

벤 그레이엄의 투자 원칙

벤 그레이엄의 투자 철학은 다음과 같은 핵심 원칙을 바탕으로 합니다:

- 안전마진(Margin of Safety): 본질적 가치보다 낮은 가격에 구매

- 재무적 안정성: 낮은 부채비율과 충분한 유동성

- 수익 안정성: 여러 해에 걸친 안정적인 수익

- 배당 기록: 안정적인 배당금 지급 이력

- 투기적 가정 배제: 높은 성장 가정보다 입증된 지표에 집중

코드로 보는 벤 그레이엄 에이전트

def ben_graham_agent(state: AgentState):

"""

Analyzes stocks using Benjamin Graham's classic value-investing principles:

1. Earnings stability over multiple years.

2. Solid financial strength (low debt, adequate liquidity).

3. Discount to intrinsic value (e.g. Graham Number or net-net).

4. Adequate margin of safety.

"""

data = state["data"]

end_date = data["end_date"]

tickers = data["tickers"]

analysis_data = {}

graham_analysis = {}

for ticker in tickers:

progress.update_status("ben_graham_agent", ticker, "Fetching financial metrics")

metrics = get_financial_metrics(ticker, end_date, period="annual", limit=10)

progress.update_status("ben_graham_agent", ticker, "Gathering financial line items")

financial_line_items = search_line_items(ticker, ["earnings_per_share", "revenue", "net_income", "book_value_per_share", "total_assets", "total_liabilities", "current_assets", "current_liabilities", "dividends_and_other_cash_distributions", "outstanding_shares"], end_date, period="annual", limit=10)

progress.update_status("ben_graham_agent", ticker, "Getting market cap")

market_cap = get_market_cap(ticker, end_date)

# 세부 분석 수행

progress.update_status("ben_graham_agent", ticker, "Analyzing earnings stability")

earnings_analysis = analyze_earnings_stability(metrics, financial_line_items)

progress.update_status("ben_graham_agent", ticker, "Analyzing financial strength")

strength_analysis = analyze_financial_strength(metrics, financial_line_items)

progress.update_status("ben_graham_agent", ticker, "Analyzing Graham valuation")

valuation_analysis = analyze_valuation_graham(metrics, financial_line_items, market_cap)

# 종합 점수 계산

total_score = earnings_analysis["score"] + strength_analysis["score"] + valuation_analysis["score"]

max_possible_score = 15 # 세 분석 함수에서 획득 가능한 최대 점수

# 총 점수를 신호로 변환

if total_score >= 0.7 * max_possible_score:

signal = "bullish"

elif total_score <= 0.3 * max_possible_score:

signal = "bearish"

else:

signal = "neutral"이 코드는 벤 그레이엄의 투자 원칙을 따라 주식을 분석하는 에이전트의 핵심 로직입니다. 각 종목에 대해 다음과 같은 분석을 수행합니다:

- 재무 지표 수집

- 수익 안정성 분석

- 재무 건전성 분석

- 그레이엄 방식의 가치 평가

- 종합 점수 계산 및 투자 신호 생성

수익 안정성 분석

def analyze_earnings_stability(metrics: list, financial_line_items: list) -> dict:

"""

Graham wants at least several years of consistently positive earnings (ideally 5+).

We'll check:

1. Number of years with positive EPS.

2. Growth in EPS from first to last period.

"""

score = 0

details = []

# 데이터 확인

if not metrics or not financial_line_items:

return {"score": score, "details": "Insufficient data for earnings stability analysis"}

# EPS 값 추출

eps_vals = []

for item in financial_line_items:

if item.earnings_per_share is not None:

eps_vals.append(item.earnings_per_share)

if len(eps_vals) < 2:

details.append("Not enough multi-year EPS data.")

return {"score": score, "details": "; ".join(details)}

# 1. 지속적인 양의 EPS

positive_eps_years = sum(1 for e in eps_vals if e > 0)

total_eps_years = len(eps_vals)

if positive_eps_years == total_eps_years:

score += 3

details.append("EPS was positive in all available periods.")

elif positive_eps_years >= (total_eps_years * 0.8):

score += 2

details.append("EPS was positive in most periods.")

else:

details.append("EPS was negative in multiple periods.")

# 2. 가장 오래된 기간부터 최신까지의 EPS 성장

if eps_vals[-1] > eps_vals[0]:

score += 1

details.append("EPS grew from earliest to latest period.")

else:

details.append("EPS did not grow from earliest to latest period.")

return {"score": score, "details": "; ".join(details)}벤 그레이엄은 최소 5년 이상의 지속적인 양의 수익을 중요시했습니다. 이 함수는:

1. 양의 EPS가 있는 연도 수 확인

2. 첫 기간부터 마지막 기간까지의 EPS 성장 확인

을 통해 수익 안정성을 평가합니다.

재무 건전성 분석

def analyze_financial_strength(metrics: list, financial_line_items: list) -> dict:

"""

Graham checks liquidity (current ratio >= 2), manageable debt,

and dividend record (preferably some history of dividends).

"""

score = 0

details = []

if not financial_line_items:

return {"score": score, "details": "No data for financial strength analysis"}

latest_item = financial_line_items[-1]

total_assets = latest_item.total_assets or 0

total_liabilities = latest_item.total_liabilities or 0

current_assets = latest_item.current_assets or 0

current_liabilities = latest_item.current_liabilities or 0

# 1. 유동비율(Current ratio)

if current_liabilities > 0:

current_ratio = current_assets / current_liabilities

if current_ratio >= 2.0:

score += 2

details.append(f"Current ratio = {current_ratio:.2f} (>=2.0: solid).")

elif current_ratio >= 1.5:

score += 1

details.append(f"Current ratio = {current_ratio:.2f} (moderately strong).")

else:

details.append(f"Current ratio = {current_ratio:.2f} (<1.5: weaker liquidity).")

# 2. 부채 대 자산 비율

if total_assets > 0:

debt_ratio = total_liabilities / total_assets

if debt_ratio < 0.5:

score += 2

details.append(f"Debt ratio = {debt_ratio:.2f}, under 0.50 (conservative).")

elif debt_ratio < 0.8:

score += 1

details.append(f"Debt ratio = {debt_ratio:.2f}, somewhat high but could be acceptable.")

else:

details.append(f"Debt ratio = {debt_ratio:.2f}, quite high by Graham standards.")

# 3. 배당금 지급 이력

div_periods = [item.dividends_and_other_cash_distributions for item in financial_line_items

if item.dividends_and_other_cash_distributions is not None]

if div_periods:

# 많은 데이터 피드에서 배당금 유출은 음수로 표시됨

div_paid_years = sum(1 for d in div_periods if d < 0)

if div_paid_years > 0:

# 예: 기간의 절반 이상에서 배당금을 지급한 경우

if div_paid_years >= (len(div_periods) // 2 + 1):

score += 1

details.append("Company paid dividends in the majority of the reported years.")

else:

details.append("Company has some dividend payments, but not most years.")

else:

details.append("Company did not pay dividends in these periods.")

return {"score": score, "details": "; ".join(details)}재무 건전성 분석은 다음 세 가지 측면을 평가합니다:

1. 유동비율(Current ratio) - 2.0 이상이면 탁월

2. 부채 대 자산 비율 - 0.5 미만이면 보수적으로 양호

3. 배당금 지급 이력 - 기간의 절반 이상 배당금 지급 시 추가 점수

그레이엄 방식의 가치 평가

def analyze_valuation_graham(metrics: list, financial_line_items: list, market_cap: float) -> dict:

"""

Core Graham approach to valuation:

1. Net-Net Check: (Current Assets - Total Liabilities) vs. Market Cap

2. Graham Number: sqrt(22.5 * EPS * Book Value per Share)

3. Compare per-share price to Graham Number => margin of safety

"""

# 데이터 확인

if not financial_line_items or not market_cap or market_cap <= 0:

return {"score": 0, "details": "Insufficient data to perform valuation"}

latest = financial_line_items[-1]

current_assets = latest.current_assets or 0

total_liabilities = latest.total_liabilities or 0

book_value_ps = latest.book_value_per_share or 0

eps = latest.earnings_per_share or 0

shares_outstanding = latest.outstanding_shares or 0

details = []

score = 0

# 1. Net-Net 체크

# NCAV = Current Assets - Total Liabilities

# NCAV > Market Cap => 역사적으로 강한 매수 신호

net_current_asset_value = current_assets - total_liabilities

if net_current_asset_value > 0 and shares_outstanding > 0:

net_current_asset_value_per_share = net_current_asset_value / shares_outstanding

price_per_share = market_cap / shares_outstanding if shares_outstanding else 0

details.append(f"Net Current Asset Value = {net_current_asset_value:,.2f}")

details.append(f"NCAV Per Share = {net_current_asset_value_per_share:,.2f}")

details.append(f"Price Per Share = {price_per_share:,.2f}")

if net_current_asset_value > market_cap:

score += 4 # 매우 강한 그레이엄 신호

details.append("Net-Net: NCAV > Market Cap (classic Graham deep value).")

else:

# 부분적인 net-net 할인의 경우

if net_current_asset_value_per_share >= (price_per_share * 0.67):

score += 2

details.append("NCAV Per Share >= 2/3 of Price Per Share (moderate net-net discount).")

# 2. 그레이엄 넘버

# GrahamNumber = sqrt(22.5 * EPS * BVPS)

# 현재 주가와 비교

graham_number = None

if eps > 0 and book_value_ps > 0:

graham_number = math.sqrt(22.5 * eps * book_value_ps)

details.append(f"Graham Number = {graham_number:.2f}")

else:

details.append("Unable to compute Graham Number (EPS or Book Value missing/<=0).")

# 3. 그레이엄 넘버 대비 안전마진

if graham_number and shares_outstanding > 0:

current_price = market_cap / shares_outstanding

if current_price > 0:

margin_of_safety = (graham_number - current_price) / current_price

details.append(f"Margin of Safety (Graham Number) = {margin_of_safety:.2%}")

if margin_of_safety > 0.5:

score += 3

details.append("Price is well below Graham Number (>=50% margin).")

elif margin_of_safety > 0.2:

score += 1

details.append("Some margin of safety relative to Graham Number.")

else:

details.append("Price close to or above Graham Number, low margin of safety.")

return {"score": score, "details": "; ".join(details)}그레이엄 방식의 가치 평가는 다음과 같은 핵심 접근법을 사용합니다:

-

Net-Net 체크: (유동자산 - 총부채)와 시가총액 비교

- 순유동자산가치(NCAV)가 시가총액보다 크면 강한 매수 신호

-

그레이엄 넘버: sqrt(22.5 EPS 주당 장부가치)

- 그레이엄 넘버와 현재 주가 비교를 통한 안전마진 평가

-

안전마진 계산:

- 주가가 그레이엄 넘버보다 50% 이상 낮으면 높은 점수

- 20% 이상 낮으면 중간 점수

최종 투자 신호 생성

def generate_graham_output(

ticker: str,

analysis_data: dict[str, any],

model_name: str,

model_provider: str,

) -> BenGrahamSignal:

"""

Generates an investment decision in the style of Benjamin Graham:

- Value emphasis, margin of safety, net-nets, conservative balance sheet, stable earnings.

- Return the result in a JSON structure: { signal, confidence, reasoning }.

"""

template = ChatPromptTemplate.from_messages([

(

"system",

"""You are a Benjamin Graham AI agent, making investment decisions using his principles:

1. Insist on a margin of safety by buying below intrinsic value (e.g., using Graham Number, net-net).

2. Emphasize the company's financial strength (low leverage, ample current assets).

3. Prefer stable earnings over multiple years.

4. Consider dividend record for extra safety.

5. Avoid speculative or high-growth assumptions; focus on proven metrics.

Return a rational recommendation: bullish, bearish, or neutral, with a confidence level (0-100) and concise reasoning.

"""

),

(

"human",

"""Based on the following analysis, create a Graham-style investment signal:

Analysis Data for {ticker}:

{analysis_data}

Return JSON exactly in this format:

{{

"signal": "bullish" or "bearish" or "neutral",

"confidence": float (0-100),

"reasoning": "string"

}}

"""

)

])

# LLM을 사용하여 분석 데이터 기반의 투자 신호 생성

prompt = template.invoke({

"analysis_data": json.dumps(analysis_data, indent=2),

"ticker": ticker

})

# LLM 호출 및 결과 반환

return call_llm(

prompt=prompt,

model_name=model_name,

model_provider=model_provider,

pydantic_model=BenGrahamSignal,

agent_name="ben_graham_agent",

default_factory=create_default_ben_graham_signal,

)마지막으로, 이 함수는 모든 분석 데이터를 바탕으로 LLM(대형 언어 모델)을 사용하여 벤 그레이엄 스타일의 투자 신호를 생성합니다. 결과는 다음 형식으로 반환됩니다:

{

"signal": "bullish" 또는 "bearish" 또는 "neutral",

"confidence": 0-100 사이의 float 값,

"reasoning": "투자 결정에 대한 이유"

}