The multi-period model

(Notatioin)

-

time : t=0,1,2,3,⋯,T

-

Z0,Z1,⋯,ZT−1:iid

{P(Zt=u)=puP(Zt=d)=pd

-

bond dynamics

Bt=(1+R)t

-

stock dynamics

{St+1=StZtS0=s

-

P(St=sujdt−j)=(tj)pujpdt−j

(1) Portfolio (strategy)

A portfolio h={ht=(xt,yt)∣t=1,2,⋯,T} with h0=h1 is a stochastic process and each ht is a random variable.

xt is the value of bonds hold on [t−1,t),

yt is the number of stocks hold on [t−1,t).

(2) Value process Vth

It means the total asset price of h just before time t

Vth=xt(1+R)+ytSt is on [t−1,t)

(3) Self-financing

A portfolio h is called self-financing if

xt(1+R)+ytSt=xt+1+yt+1St for all t.

For example, monthly income or spending it for living are not self-financing.

(4) Arbitrage portfolio

A self-financing portfolio is said to be an arbitrage portfolio h if

- first day : V0h=0

- after : P(VTh≥0)=1 & P(VTh>0)>0

(Lemma)

If the multi-period model is arbitrage free, d≤1+R≤u.

(5) Contigent claim (Financial derivative)

Φ:R→R is a contract function from x to Φ(x).

X=Φ(x) is called a contigent claim.

(Notation)

Π(t;X) is the price of X at time t such that X=Φ(x).

In the case of European call option, Π(3;X)=Φ(S3)=(S3−K)+

(6) Hedging portfolio

A contigent claim X is called reachable if there is a self-financing portfolio h={h1,h2,⋯,hT} such that VTh=X. and such h is called hedging portfolio(replicating portfolio). If all claims are reachable, the market is said to be complete.

We want to find hedging portfolio ht=(xt,yt) such that

Φ(ST)=VTh.

We can apply the method of the one-period model repeatedly.

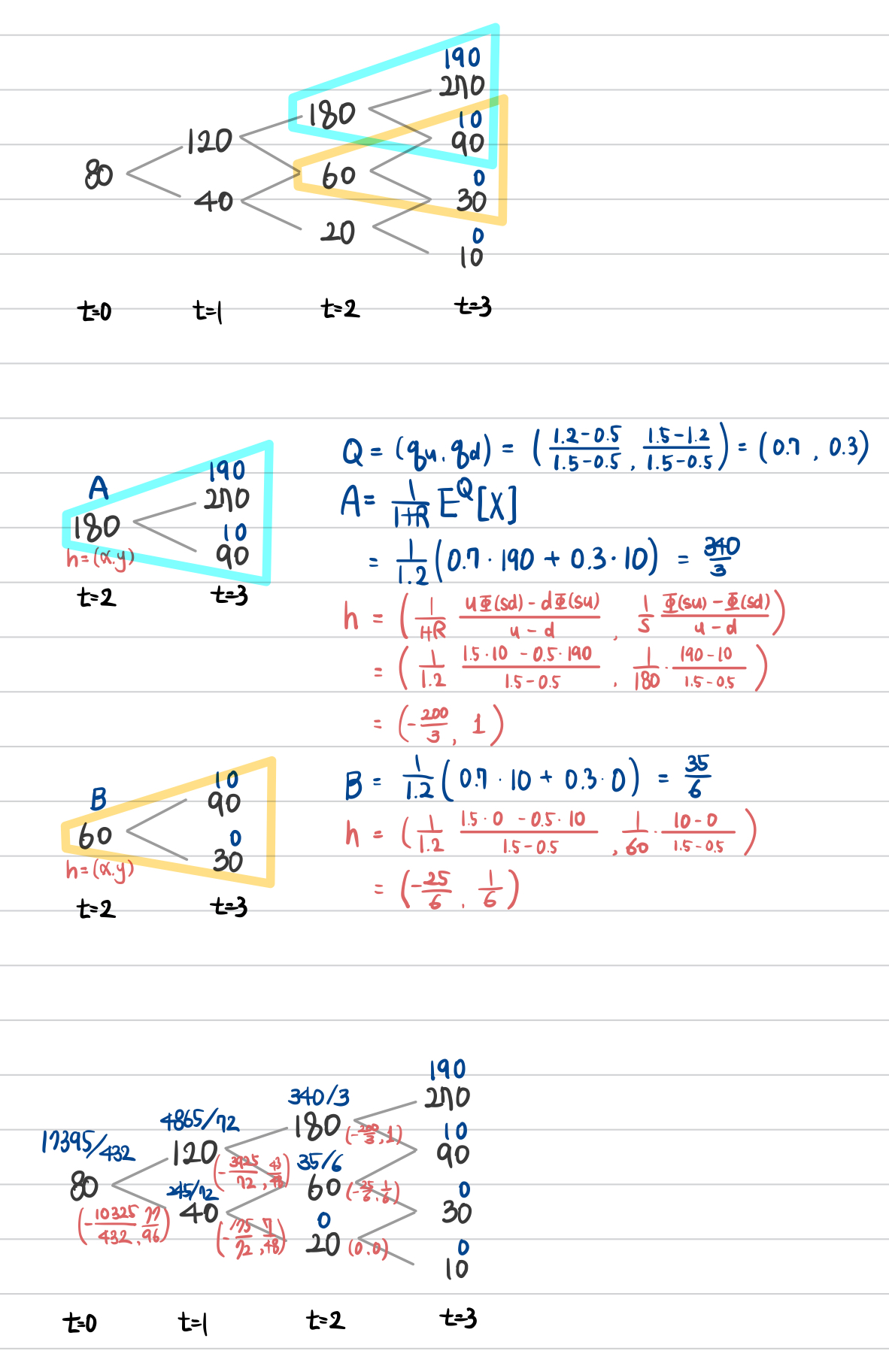

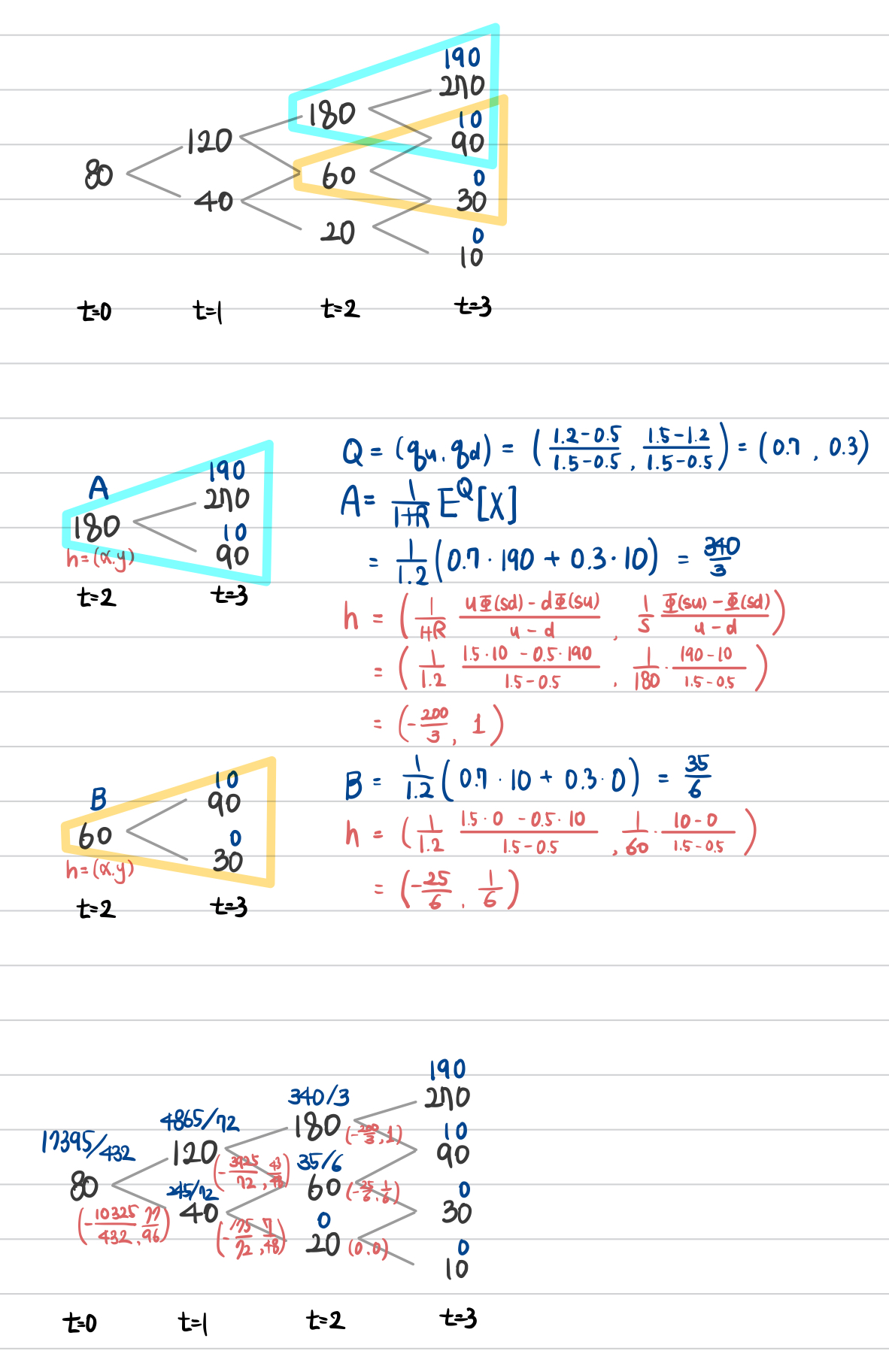

(7) Example

- T=3,s=80,R=1.2

- u=1.5,d=0.5

- X=(S3−80)+ : European call option

∴Π(0;X)=17395/432≒40.2662

∴h0≒(−23.9005,0.8021)