1. Understanding the Business Model of GM

a. Automobiles and Parts

- 88% of the entire business

b. GM Financial

- Automotive financing services

c. Cruise

- Self-driving vehicle company

d. GM China

- Equity income from the joint ventures in China

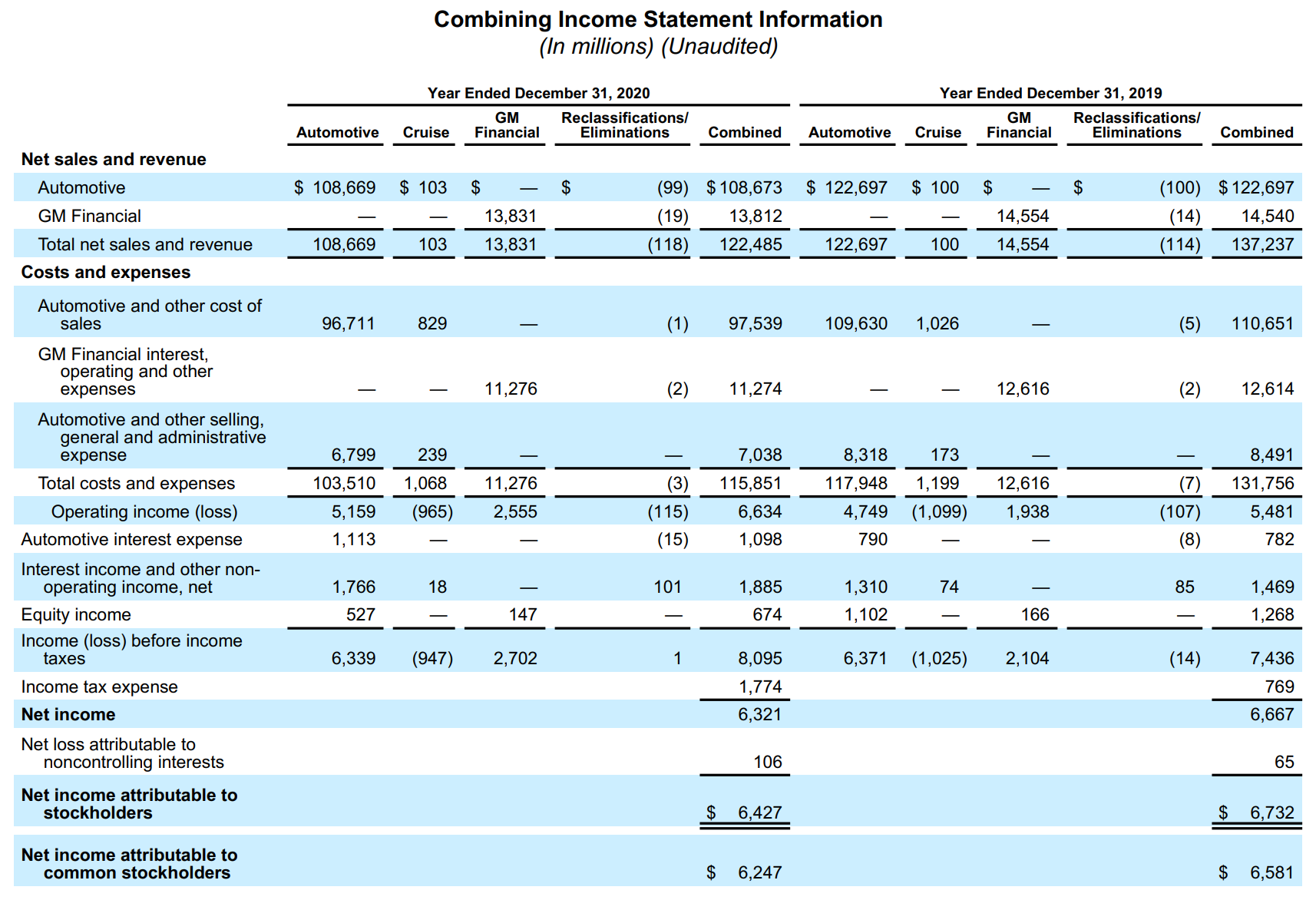

2. Interpreting the annual Reports in 2020 (Consensus)

(Source: https://investor.gm.com/static-files/4ca19a5d-49d1-426a-932d-0d0c1dc89baa)

We can't just use the consensus EBITDA! We need to recalcuate the EBITDA for each divison/subsidiary company.

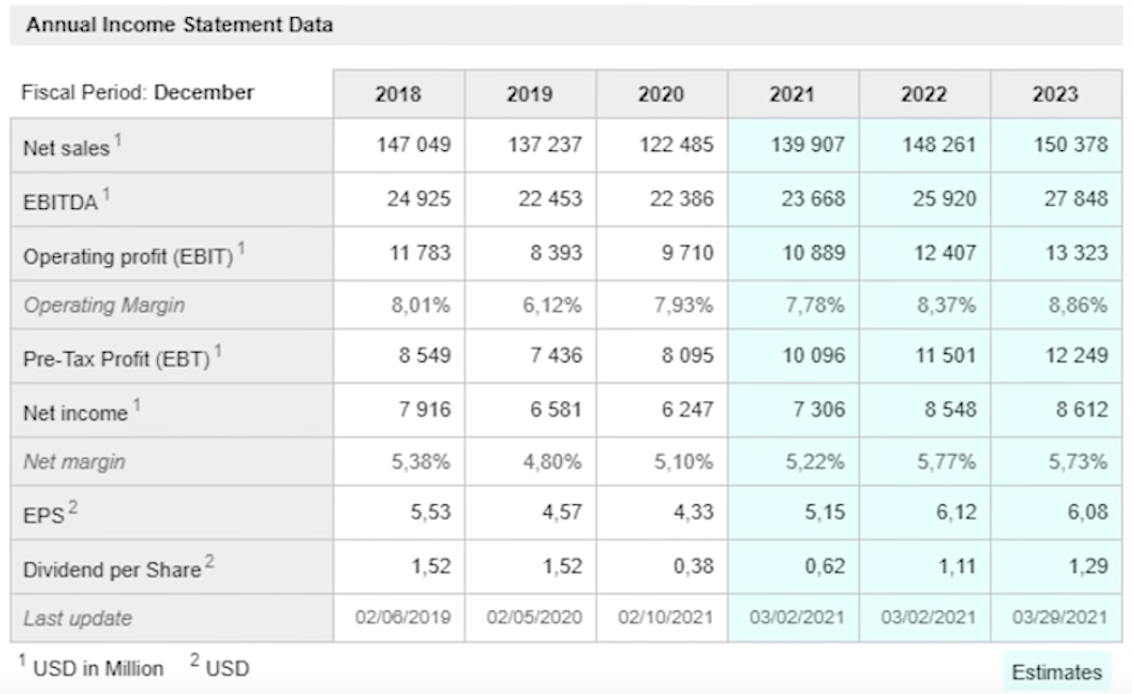

For example, we can extract consensus Operating profit (EBIT) and EBITDA from the income statement specifically in Automobiles below. We are calculating the "specific" EBITDA for this very sector.

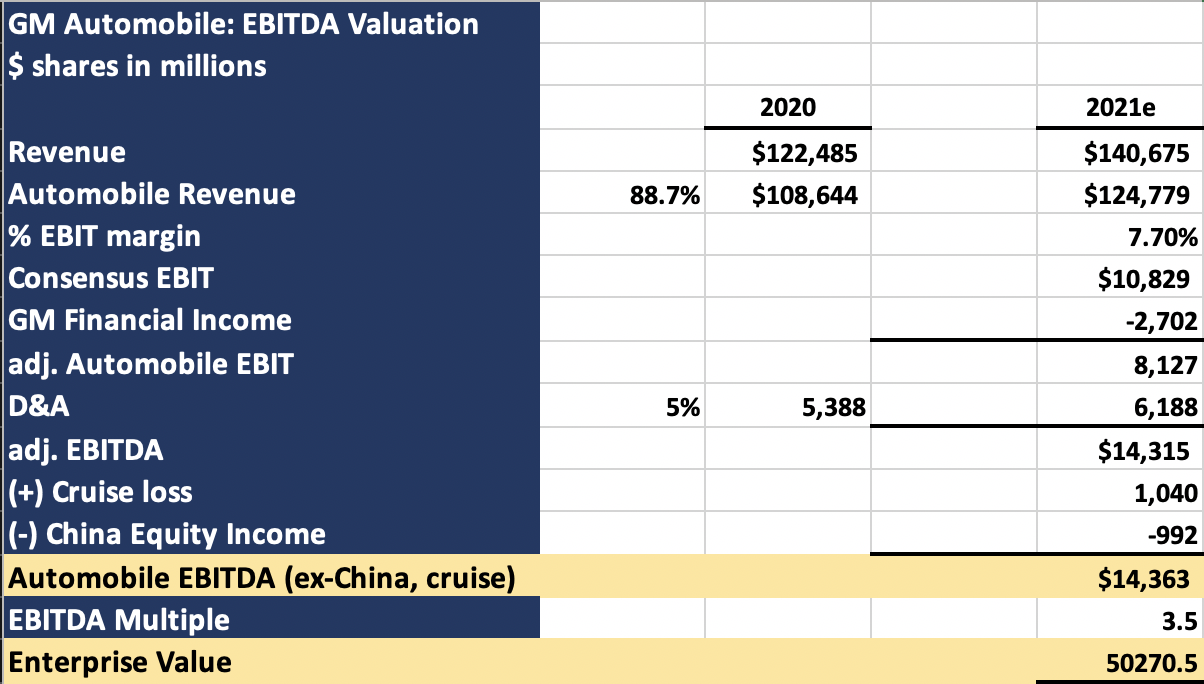

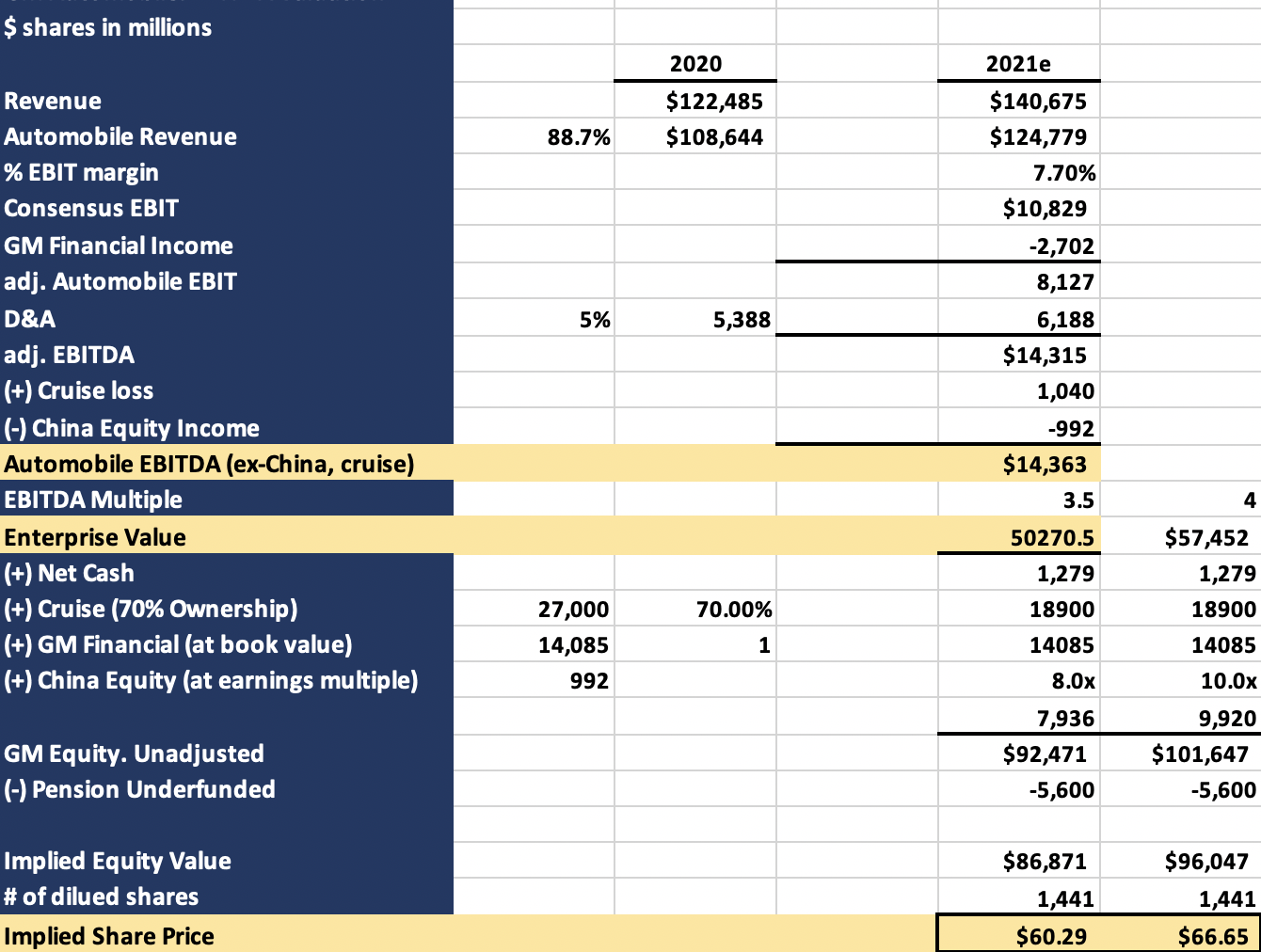

3. Estimating the EBITDA for the Automobiles

Automobiles generate 88.7% of the revenue. So, we estimate the pure revenue that Automobiles generate, which was $108,644 in 2020.

Next, we calculate the "adjusted EBIT" purely from Automobile by subtracting the income of GM Financial from the Concensus EBIT. Then, we add D&A to the adjusted EBIT.

We need to add and subtract the incomes coming from Cruise and China JV sectors. As a result, we get the Automotive EBITDA of $14,363.

Finally, we get the EBITDA Multiple from understanding the trend of how GM stocks were traded in the past, or referencing the Multiple of other similar companies like Ford.

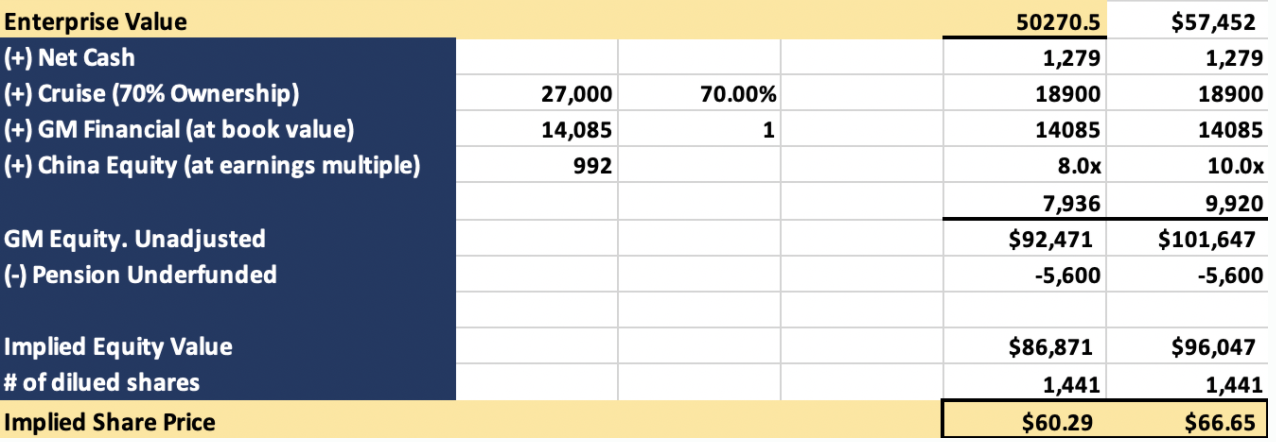

4. Calculating the Equity Value and the Share Price

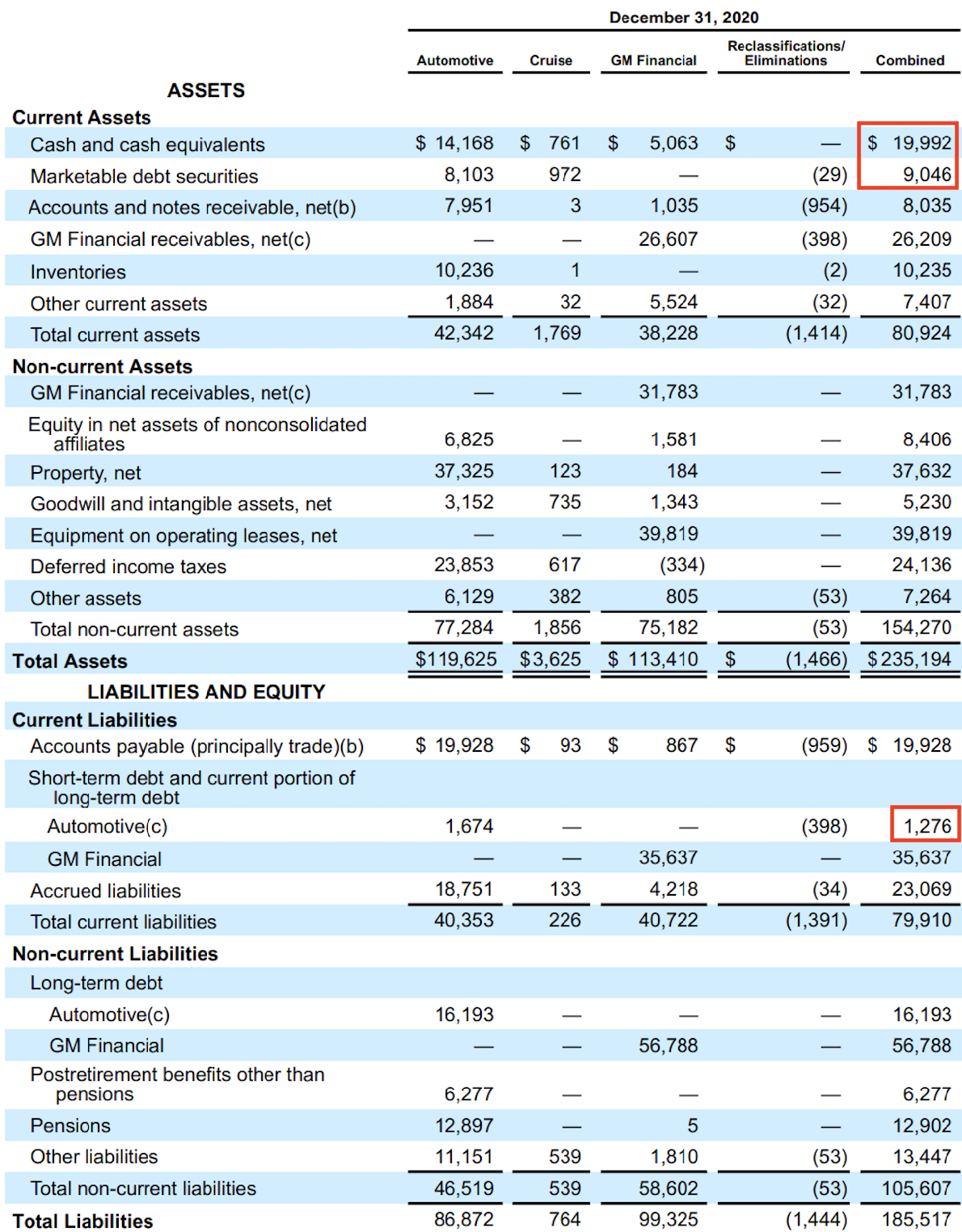

Liabilities < Net Cash !!!!

- So, we need to add Net Cash to the enterprise value

Then, we add the incomes from different sectors - Cruise with the 70% ownership, GM Financial (at book-value), and the China Equity. To be specific, we need to multiply the earnings multiple to the China Equity income because it's coming from owning a stake. Analysts use different values for the earnings mutiple, ranging from 8.00x to 10 .00x

Now, this is GM's unadjusted equity.

- In 2020, $50,271 + $1,279 (Net Cash) + $18,900 (Cruise) + $14,085 (GM Financial) + $992 (China Equity) * 8.0 (Earnings Multiple) = $92,471

- Similarly, in 2021, unadjusted equity = $101,647

In addition, GM thinks the pension is a part of the liabilities, so we need to the underfunded pension from the previous Equity Value as well.

- So, we get $86,871 in 2020, and $96,047 in 2021.

Finally, we can calculate the Implied Share Price from dividing the Implied Equity Value by the # of Diluted Shares, which are $60.29 and $66.65

Conclusion:

GM's execution and stategy in EV/AV industry is very undervalued, meaning GM shares should be traded at the higher end of its historical range.

- Popular for value investors

- Multiple expansion needs to happen!

- Multiple Expansion = When a buyer sells an asset for a higher multiple than the multiple that the buyer originally paid

- GM is not viewed as one of the "innovative" companies like Tesla. Rather, many investors view GM as traditional vehicle maker, which makes GM non-Growth stock.

Full Excel Model:

Great post! But I have a question about D&A?

I am still not sure how did you find D&A(5%)? Depreciation & Amortization?