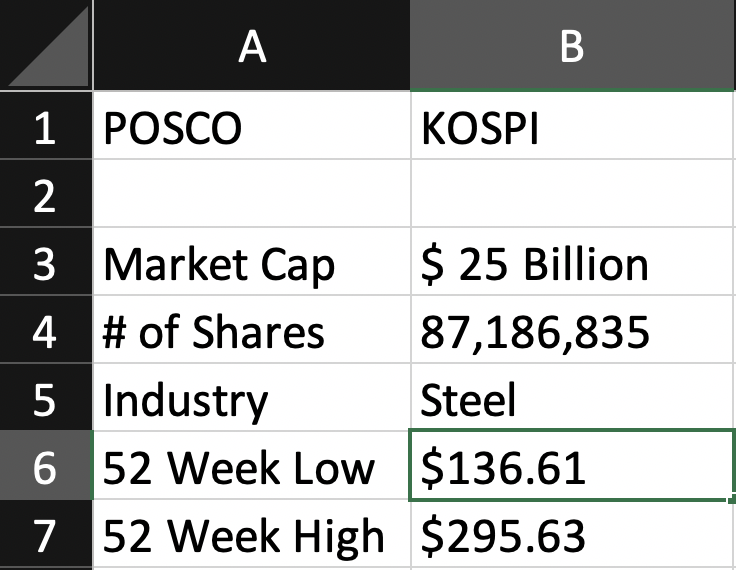

POSCO is a South Korean steel-making company, which is a 13th largest market cap company in KOSPI market.

- Steel Production: 40 million tons

- Exporting to 53 international countries.

- Credit Rating

- S&P: BBB+

- Moody's: Baa1

- NICE Rating: AA+

Since March 2020, it hit 52-week low of $136 and recently hit 52-week high of $295.

For the last 6 months, institutional investors have been heavily investing in this company while retail investors were selling.

Reasons for long is that since Steel industry is very sensitive to economic fluctuations, institutional investors are expecting economic recovery.

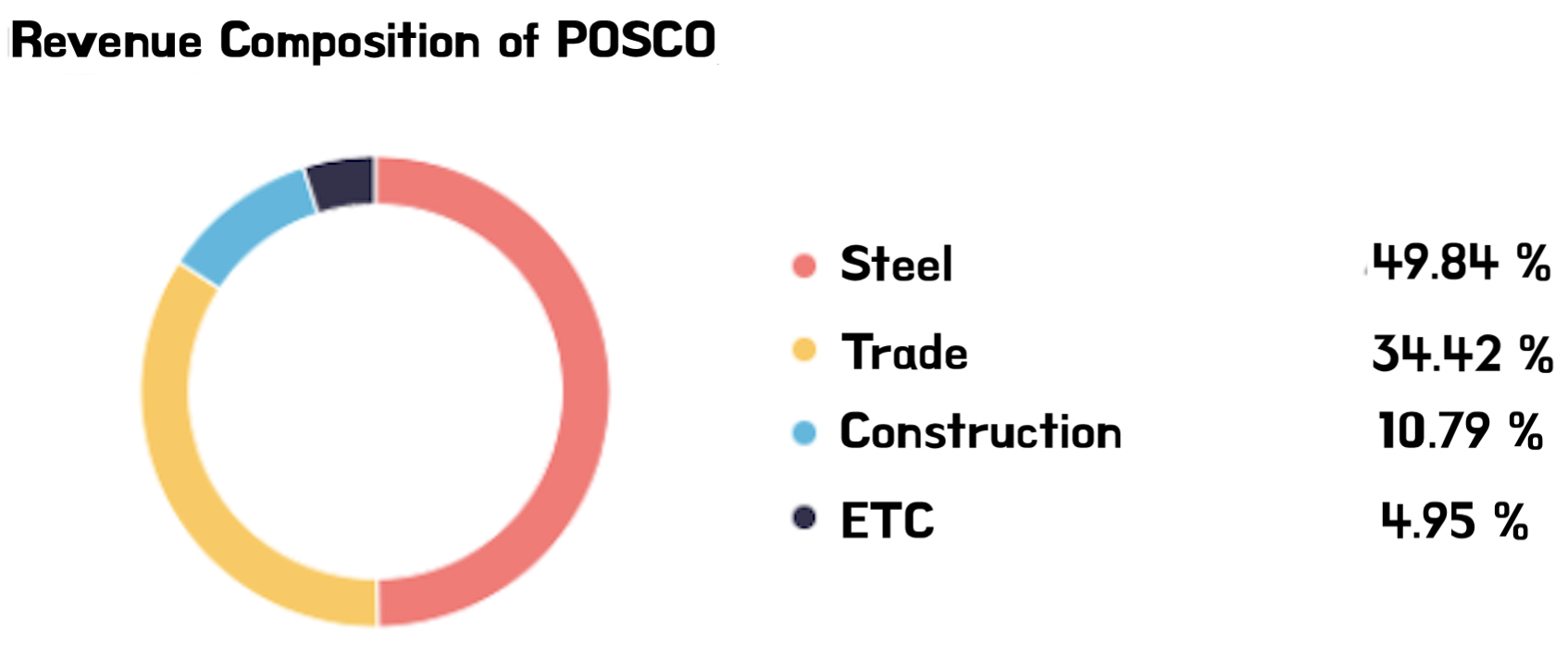

POSCO International (Trading Company) had generated $22 billion, which is $3 billion more than expected in 2020.

POSCO Construction had generated $7 billion, which is $0.5 billion more than expected in 2020.

POSCO Chemical had generated $3 billion, which is $0 billion more than expected in 2020.

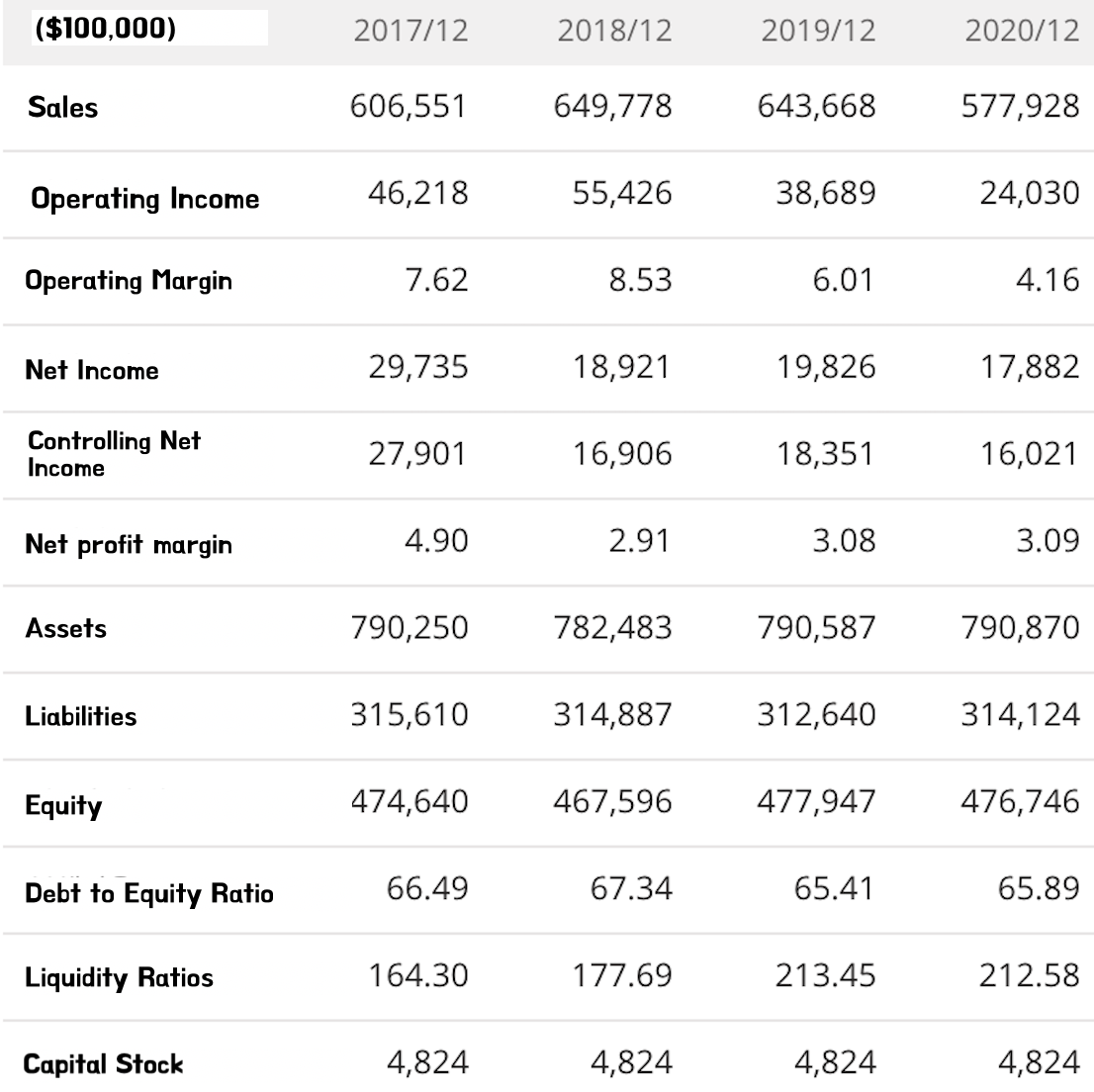

Strong Balancesheet, but in need of new growth engine.

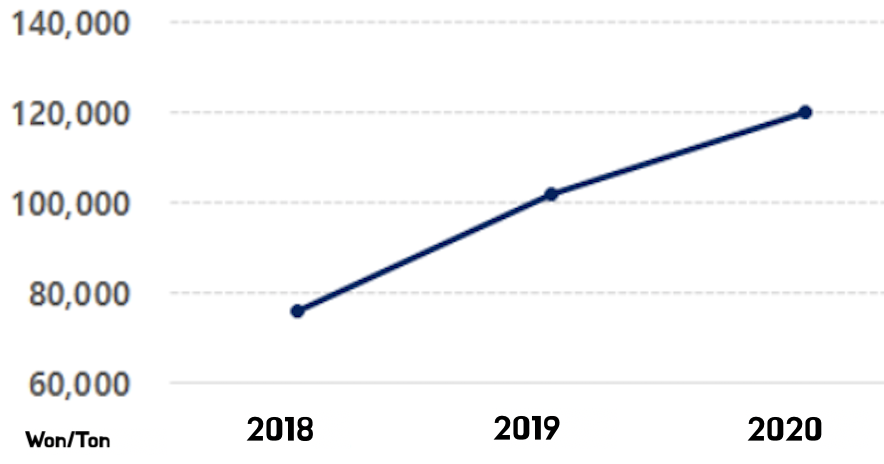

Price of Iron Ore

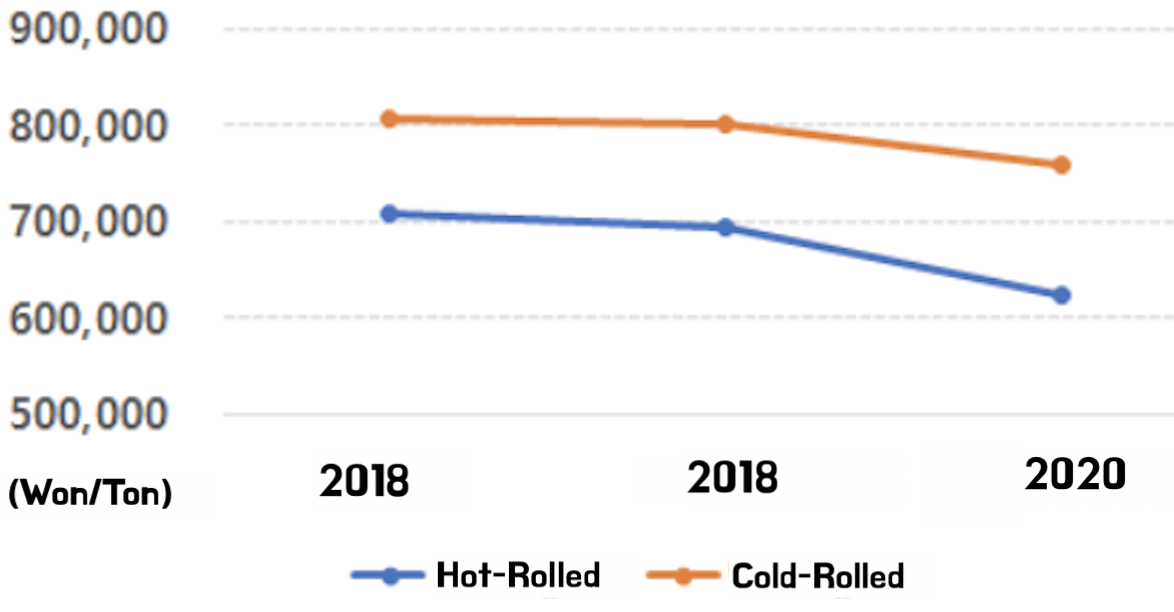

Price of Steel Products

- Decrease in revenue is caused by decrease in demand by automotive industry and dramatic increase in iron ore. Therefore, price of steel products greatly decreased.

Very thorough analysis of POSCO's recent performance and strategic directions! It's interesting to see how they are adapting to economic changes and focusing on sustainability with initiatives like ESG bonds and hydrogen production. The detailed insights into their financial health and investment trends provide a solid foundation for understanding their market position. Thanks for this deep dive into one of the major players in the Steel industry! If someone lives in Pakistan, and want to buy good quality steel made products or hire a steel manufacturing company, they should check this website: https://gujratsteel.com/