(Franco-Pedroso, J., 2019) Generating Virtual Scenarios of Multivariate Financial Data for Quantitative Trading Applications

Franco-Pedroso, J., Gonzalez-Rodriguez, J., Cubero, J., Planas, M., Cobo, R., & Pablos, F. (2019). Generating Virtual Scenarios of Multivariate Financial Data for Quantitative Trading Applications. The Journal of Financial Data Science, 1(2), 55–77.

1 Introduction

2 Assessment of simulated financial time series

3 Evaluation of stochastic models as simulation methods

4 Generation of virtual scenarios for multivariate data

5 Generation of new artificial assets

6 Analysis of long-term high-dimensional virtual scenarios

7 Conclusion and future work

- To develop a technique that

- allows to simulate virtual scenario of given financial market

- involving hundres/thousands of assets

- for time period of arbitrary lengthwhere : virtual scenario, : given financial market, : the set of assets and is a proper function.

| Section | Question | |

|---|---|---|

| 2 | How to evaluate simulated scenarios? | Just sanity check |

| 3 | Limitation of existing models | |

| 4 | Proposed model to generate virtual scenarios | |

| 5 | Proposed method to generate artificial assets | |

| 6 | Sec4+Sec5 and Evalutaion |

How to evaluate simulated scenarios?

- Assessment of simulated financial time series

- Data desciption

- Stock prices/returns

- Period : 2000/01/01 ~ 2016/04/29

- 330 stocks in S&P500 index

- Market index

- Equally weighted

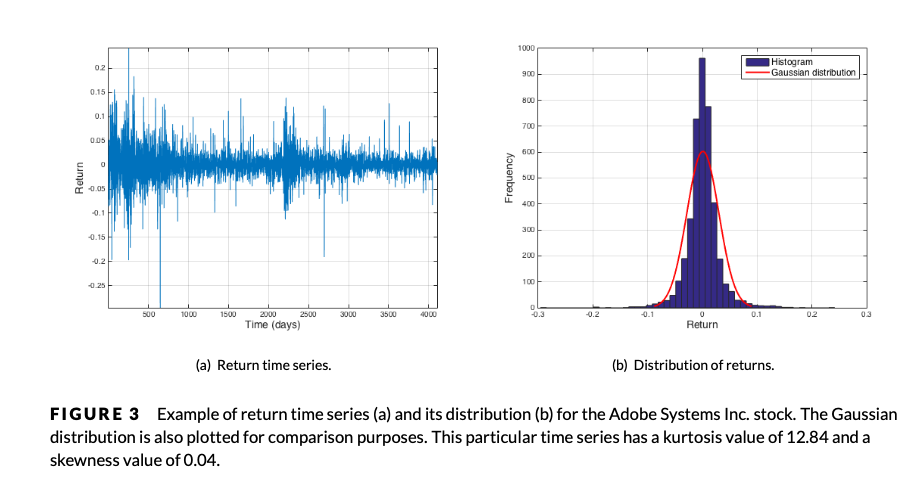

- Empirical properties of financial time series

- Distributional properties (of asset returns)

- shape-piked, fat-tailed : larger kurtosis (> 3)

- skewness : individual stock/marker index

- rolling metric : time-varying dynamics

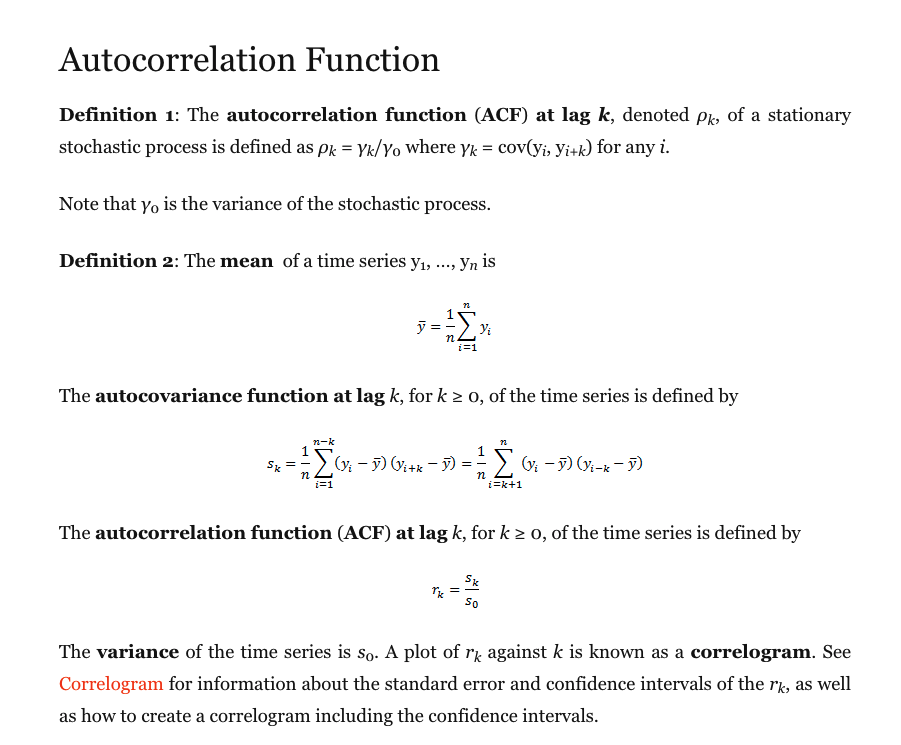

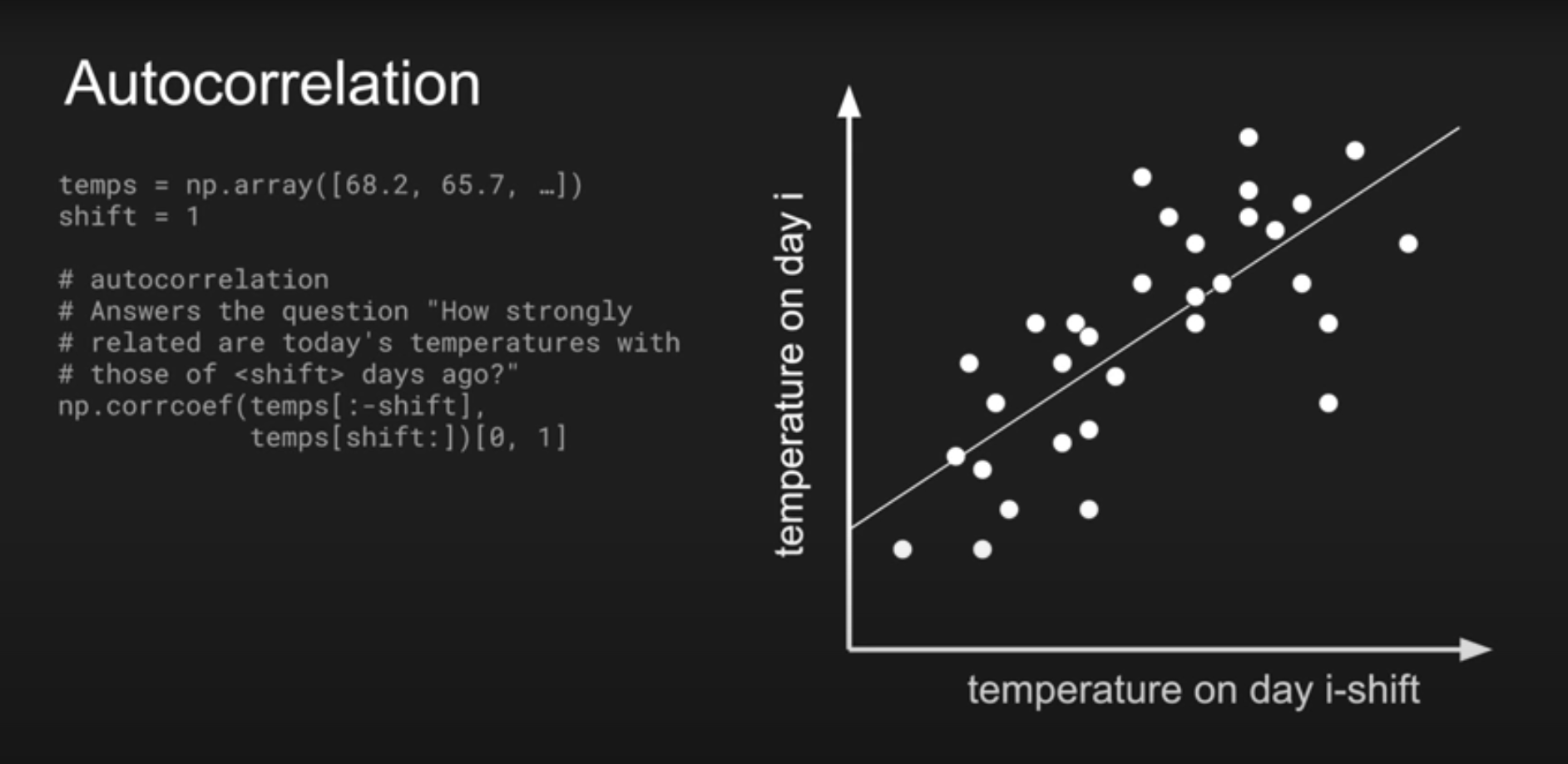

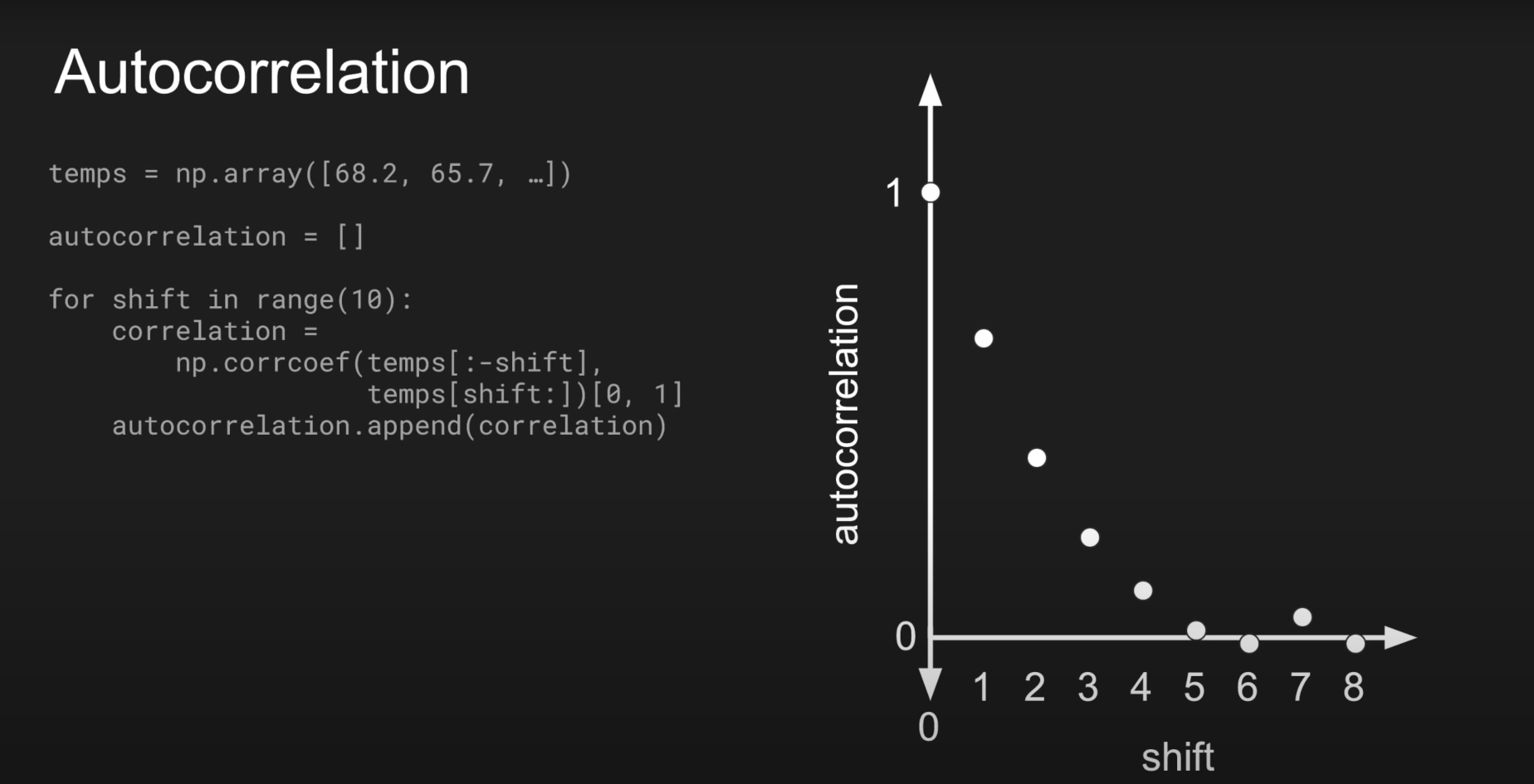

- Dependency properties

- Volatility clustering : ACF(Autocorrelation function) of absolute/squared returns

- Pathwise properties

- The irregularity of the trajectory

- meaused by the number of (linear) trends (segments) over a given time period

- Trend ratio

- = the return / (the period of the contained trend / the noise level)

- = (the return * the noise level) / the period of the contained trend

- Cross-asset relationships

- Correlation coefficient matrix

- What about dynamic behavior? (time-varying)

- Number of trends (linear segments) in Market index!

- Directional similarity

- =the percentage of assets whose prices move in the same direction with market index (within a given direction)

- moving average with window size = 50, step size = 1

- Financial time series : returns? price?

- Usually, modeling return!

- Because, price is nonnegative

- (In 2.1, p.4) How to account for the correlation between assets by market index(=average of assets)?

- Can kurtosis grasp shape-pike property of asset dist'n?

- Definition of asset return?

- Large autocorrelation in large lag value

- (In 2.2.3, p.8) What is "the noise level?"

Existing models to generate scenario : Univariate

- Stochastic models

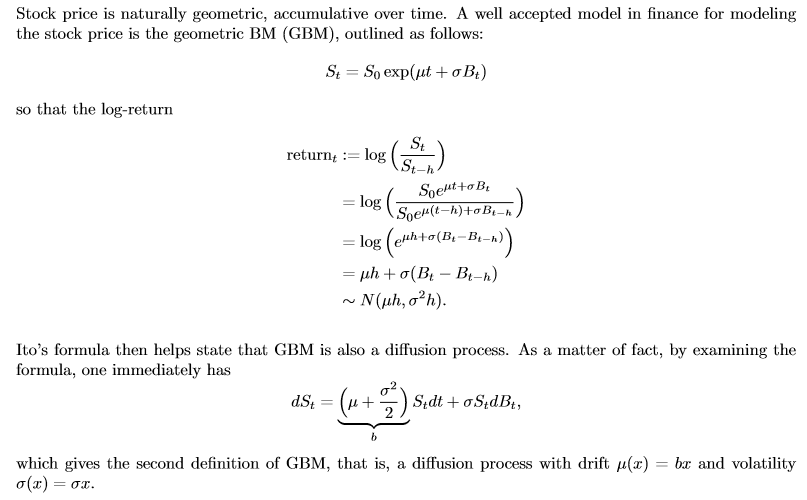

- GBM(the Geometric Brownian Motion)

- fails to reproduce the excess of kurtosis

- fails to reproduce the volatility clustering feature

- GBM(the Geometric Brownian Motion)

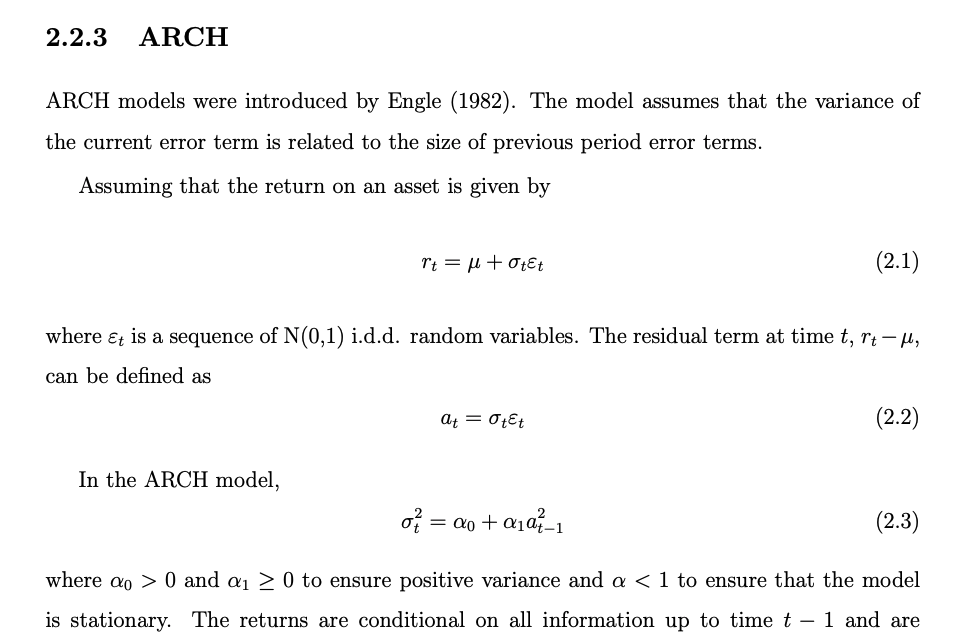

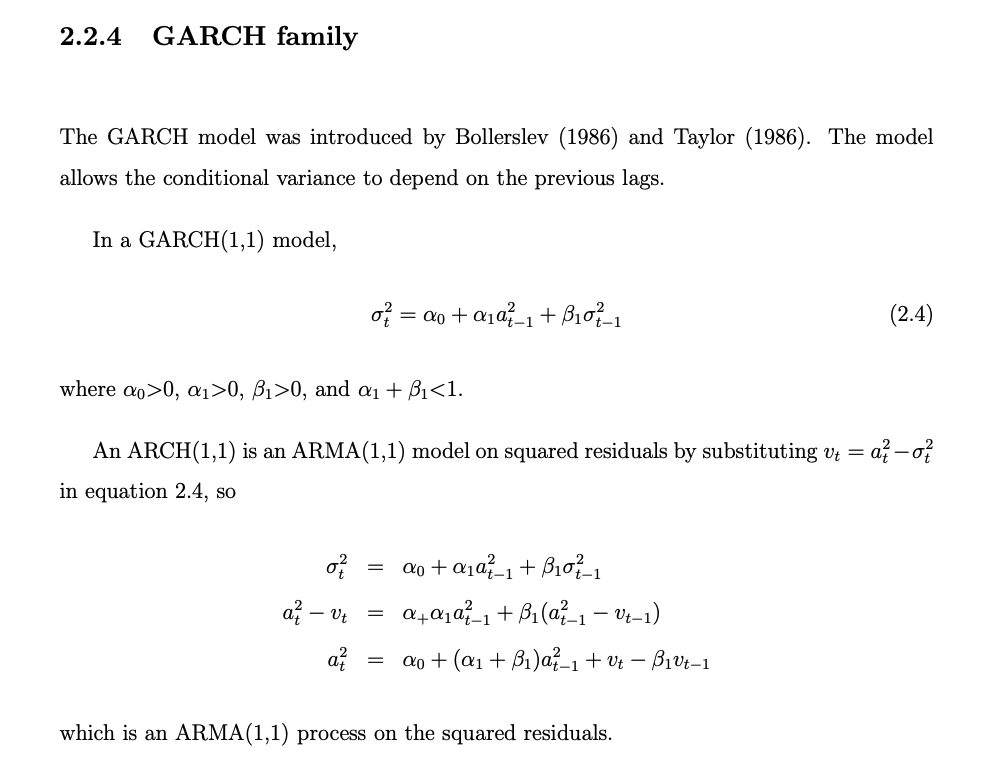

- Volatility models : ARCH, SV

- Modeling volatility as a time-varying process

- GARCH : reveals the volatility clustering & the excess kurtosis,

- But when analyzing rolling of them , GARCH model vary at a slower rate that in real stocks -> a different dist'n is needed

- GARCH + Student's t innovation

- the excess of kurtosis can be better reproduced & the variance of rolling kurtosis value is still low

- while rolling skewness values vary in a more similar range than that of the real stock

- Modeling volatility as a time-varying process

Generation of virtual scenarios for multivariate data

- Section4

Stage1) The analysis stage

- [Segmentation] Detecting of market trends

- Input : market index (eqally weighted)

- Output : change point, signs

- How:

- package

piecewise_regression - package

pwlf

- package

- cf. There is any seg method with alternating sign constraint?

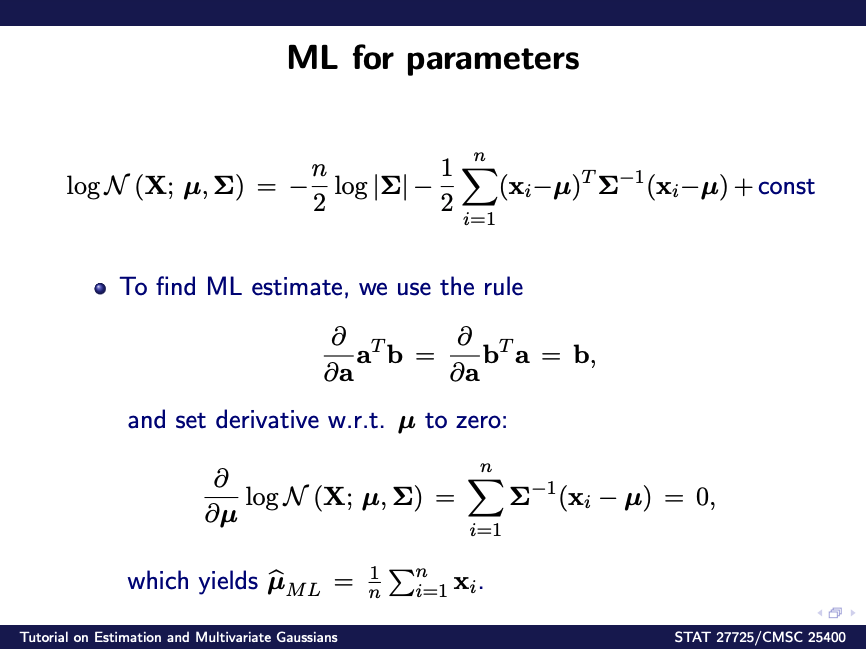

- [Estimation] Analyzing the multivariate data within each trends to capture both dynamic and statistical properties

- Within segment , (

- Let all obeserved return values :

- The corresponding set in sliding window :

- What is the step size of sliding window? 1?

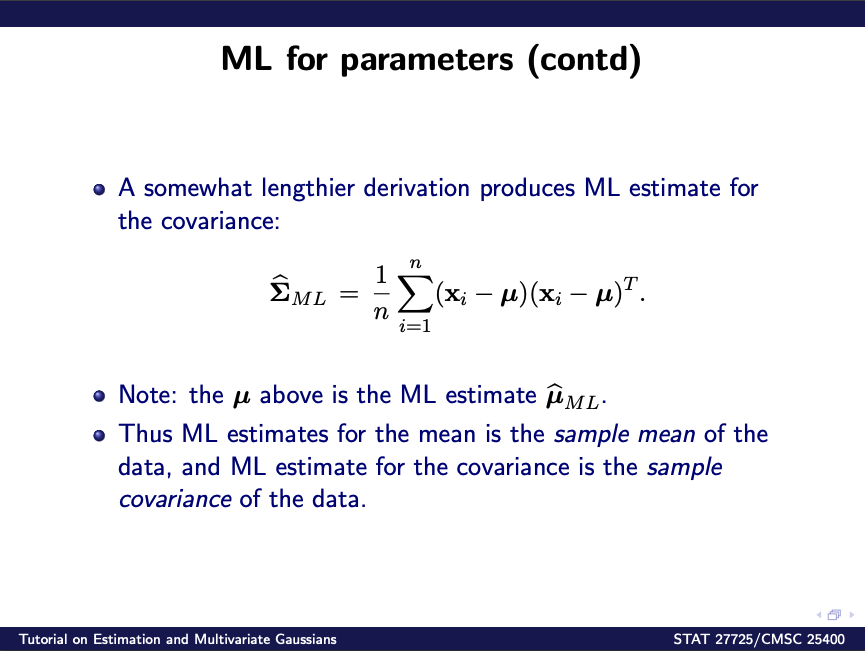

- Totally, there are normal distributions

- Input : data points {r}_{w(s)}^{L}, sliding window size

- Output :

- Within segment , (

- functions

def mul_normal_est(x, L):

w = len(x) - L + 1

for i in range(1, w):

# estimate the multivariate normal distribution

return mu_list, Sigma_list- Body

market_index = # market index data set (equally weighted)

detected_trends = trend_detection(market_index)

Segments = detected_trends['change_points']

for seg in Segments:

for win in Windows:

mu_hat = # estimation for mu in current sliding windows

Sigma_hat = # estimation for Sigma in current sliding windows

mu_trend = mu_trend.append(mu_hat)

Sigma_trend = Sigma_trend.append(Sigma_hat)

mu_total = mu_total.append(mu_trend)

Sigma_total = Sigma_total.append(Sigma_trend)Stage2) The synthesis stage

- [Hypothesizing] A stochastic sequence of trend is hypothesized

- What hypothesized means in accurate?

- cf. with constraint alternating signs!

- [Random generation] For each trend, learned parameters are recovered and multivariate random asset returns are generated for that trend

- Within a given trend, the sequence of parameters is recovered(estimated)

- random sampes are drawn(generated) from each multivariate Gaussian distribution totally, within a trend, generated points!

- The distribution of simulated asset returns is given by

- [Concatenation] Once the return values have been simulated for each trend to be generated, those returns paths are concatenated

Generation of new artificial assets

- Section5

PCA recovery-projection process

-

Applying PCA to asset returns,

where : a given data set with asset returns from trading days, : a transfomation matrix of eigenvectors, and : the projected asset returns (or components in PCA)

- In matrix form, can be represented as below:where : component, : eignevector and : (observed) asset return at time .

- In matrix form, can be represented as below:

-

In order to generate new artificial assets,

where : the projected asset returns (or components in PCA) (computed above), : an artificial transformation matrix (generated below), and : artificially generated assets

- In matrix form, can be represented as below:where : additional eigenvectors , : component, and : generated asset returns at time .

- In matrix form, can be represented as below:

-

How to generate additional eigenvecotors?

where and .

Correction of expression

| Paper | Python |

|---|---|

| For a given dataset of asset returns from trading days (), a PCA transformation matrix can be obtained and these assets projected through , being the projected asset returns or components. - : a given dataset with asset returns and trading days () - : a PCA transformation matrix () - : the projected asset returns or components () If no dimension reduction is applied, is a transformation matrix of eigenvectors that maps the original vectors of asset returns into their components . -, where is a matrix whose column is eigenvector for | R = df_wide.copy() pca = PCA(n_components = n_comp) pca_fit_transform = pca.fit_transform(R.T) Y = pca.inverse_transform(pca_fit_transform) |

| The procedure used to generate those additional eigenvectors is to draw them from a multivariate normal distribution with parameters and . | COMPONENTS = pca.components_mu_hat_for_EV = list(map(lambda x : np.mean(x), COMPONENTS))Sigma_hat_for_EV = np.cov(COMPONENTS)W_prime = np.random.multivariate_normal(mu_hat_for_EV, Sigma_hat_for_EV, S_new) |

| The components are projected back to the original space by applying the inverse transformation. - : an artificial - : the components - : a new artificially generated set of assets | generated = np.matmul(pca_inverse_transform, W_prime.T) |

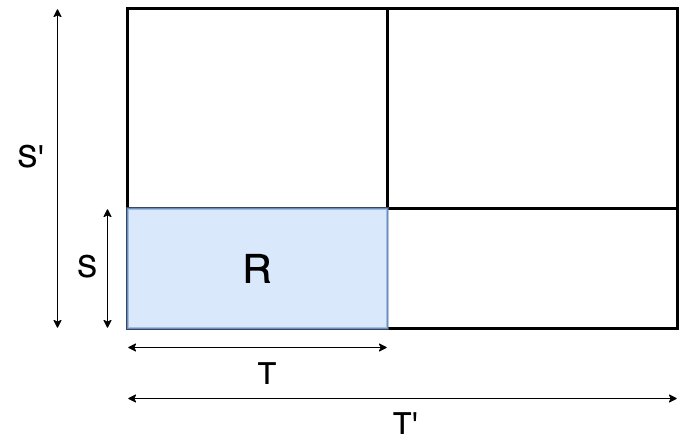

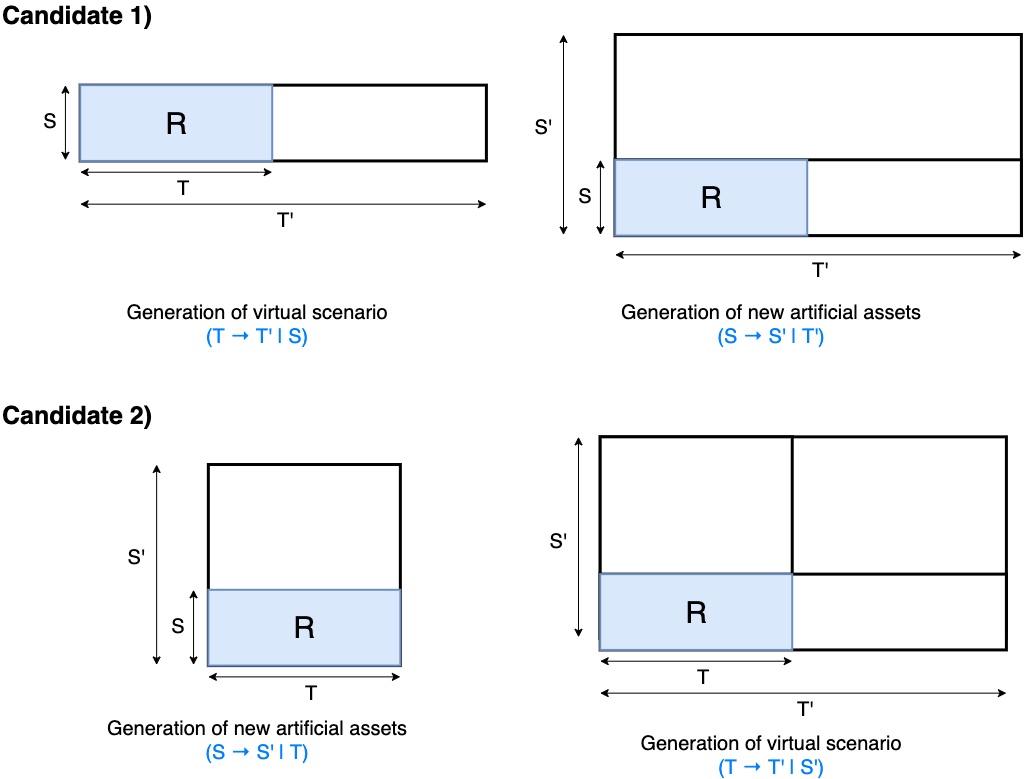

How to combine these techniques?

-

The final goal

-

Candidate scenarios

- Candidate2 seems more reasonable!

- Candidate2 seems more reasonable!

Python source code

from datetime import datetime

import os

import traceback

N_rep = 3 # 1000 # number of repetitions

trial_id = 0

n_comp = 330 # number of PCs

S_new = 3 # 500 # size of artificial assets

N = 100 # 5000 # virtual scenario size (time length)

logger = make_logger()

for rep_idx in range(N_rep):

random.seed(rep_idx + 1)

logger.info("repeat = {} with random.seed({})".format(rep_idx + 1, rep_idx + 1))

start_time = datetime.now()

### Generating artificial assets

R = df_wide.copy()

try:

pca = PCA(n_components = n_comp)

pca_fit_transform = pca.fit_transform(R.T)

pca_inverse_transform = pca.inverse_transform(pca_fit_transform)

COMPONENTS = pca.components_

COMPONENTS.shape

mu_hat_for_EV = list(map(lambda x : np.mean(x), COMPONENTS))

Sigma_hat_for_EV = np.cov(COMPONENTS)

except Exception as e:

trace_back = traceback.format_exc()

message = str(e)+ "\n" + str(trace_back)

logger.error('[FAIL] %s', message)

W_prime = np.random.multivariate_normal(mu_hat_for_EV, Sigma_hat_for_EV, S_new)

generated = np.matmul(pca_inverse_transform, W_prime.T)

R_prime = pd.DataFrame(generated.T.copy())

P_prime_T = return_to_price(pd.DataFrame(generated))

### Estimation for multivariate normal

mu_total = []

Sigma_total = []

window_sizes = []

for seg in range(len(breakpoints) - 1): # [0]:

R_prime_seg = R_prime.iloc[:, breakpoints[seg]:(breakpoints[seg+1] + 1)]

seg_size = R_prime_seg.shape[1]

W = seg_size - L

window_sizes.append(W)

# print('>>> Seg {} : {} data points, {} windows'.format(seg + 1, seg_size, W))

mu_trend = []

Sigma_trend = []

for w in range(W):

R_prime_window = R_prime_seg.iloc[:, w:(w+L)]

mu_hat = R_prime_window.mean(axis=1)

Sigma_hat = np.cov(R_prime_window)

mu_trend.append(mu_hat)

Sigma_trend.append(Sigma_hat)

mu_total.append(mu_trend)

Sigma_total.append(Sigma_trend)

### Random generation & Concatenation

n_gen = int(np.ceil(N / sum(window_sizes)))

n_seg = np.asarray(mu_total).shape[0]

virtual_scenario = []

for seg in range(n_seg):

mu_trend = mu_total[seg]

Sigma_trend = Sigma_total[seg]

# print(">> Seg {}".format(seg + 1))

window_size = np.asarray(mu_trend).shape[0]

# print(">> window_size : {}".format(window_size))

for w in range(window_size):

mu_hat = mu_trend[w]

Sigma_hat = Sigma_trend[w]

generated_returns = np.random.multivariate_normal(mu_hat, Sigma_hat, n_gen)

virtual_scenario.extend(generated_returns.tolist())

vs_return0 = pd.DataFrame(virtual_scenario)

selected_idx = np.random.permutation(vs_return0.shape[0])[:N]

selected_idx.sort()

vs_return = vs_return0.iloc[selected_idx, :].reset_index(drop=True) # copy().take(selected_idx.sort()).reset_index(drop=True)

vs_price = return_to_price(vs_return)

virtual_market_index = vs_price.mean(axis=1)

# print('a:{0:05d}'.format(a))

save_dir = './results/repeats/rep_{0:04d}'.format(rep_idx + 1)

if not os.path.exists(save_dir):

os.makedirs(save_dir)

vs_return.to_csv(save_dir + '/vs_return.csv'.format(rep_idx + 1))

vs_price.to_csv(save_dir + '/vs_price.csv'.format(rep_idx + 1))

virtual_market_index.to_csv(save_dir + '/vs_market_index.csv'.format(rep_idx + 1))

end_time = datetime.now()

time_diff = end_time - start_time

tsecs = time_diff.total_seconds()

print(">> Repetition {} (spent {} mins)".format(rep_idx + 1, round(tsecs / 60, 2)))

del vs_return, vs_price, virtual_market_index