In a world increasingly driven by digital innovation, cryptocurrency has emerged as one of the most fascinating and disruptive financial technologies of the 21st century. But what exactly is cryptocurrency, and could these digital assets eventually replace the cash in your wallet? Whether you're a curious newcomer or looking to deepen your understanding, this comprehensive guide will walk you through everything you need to know about cryptocurrency and its potential to revolutionize our financial systems.

What Is Cryptocurrency? Understanding the Basics

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, operates on decentralized networks called blockchains, and functions independently of central banks. Unlike traditional currencies issued by governments (known as fiat currencies), cryptocurrencies exist solely in electronic form.

The concept of cryptocurrency first captured public attention in 2009 with the launch of Bitcoin by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies (often called altcoins) have been created, each with its own unique features and purposes.

Key Characteristics of Cryptocurrency

-

Decentralization: Most cryptocurrencies operate on distributed networks without a central authority, using blockchain technology to verify and record transactions.

-

Limited Supply: Many cryptocurrencies, like Bitcoin, have a predetermined maximum supply, creating scarcity that contrasts with fiat currencies which can be printed indefinitely.

-

Transparency: Blockchain technology enables public verification of all transactions, though the identities of the participants typically remain anonymous.

-

Security: Cryptocurrencies use advanced cryptographic techniques to secure transactions and control the creation of new units.

How Does Cryptocurrency Work? The Blockchain Explained

At the heart of most cryptocurrencies lies blockchain technology—a revolutionary system that serves as a distributed digital ledger. But how exactly does it work?

Understanding Blockchain Technology

A blockchain is essentially a chain of blocks, each containing a list of transactions. When a new transaction occurs:

- It's grouped with other recent transactions into a "block"

- This block is verified by a network of computers (miners or validators) solving complex mathematical problems

- Once verified, the block is added to the existing chain in chronological order

- The transaction becomes permanent and immutable

This process creates a transparent and tamper-resistant record of all transactions, eliminating the need for trusted third parties like banks to verify transactions.

Mining and Transaction Verification

In many cryptocurrencies like Bitcoin, transaction verification happens through a process called mining:

- Mining: Computers compete to solve complex cryptographic puzzles

- Proof of Work: The first to solve the puzzle gets to add the new block to the blockchain

- Rewards: Miners receive newly created cryptocurrency as a reward

Some newer cryptocurrencies use alternative consensus mechanisms like Proof of Stake, which requires validators to hold and "stake" tokens rather than solving computational puzzles.

Popular Cryptocurrencies in Today's Market

While Bitcoin was the first cryptocurrency and remains the market leader, thousands of alternative cryptocurrencies now exist, each with different features and use cases.

Bitcoin (BTC)

Bitcoin remains the most valuable and recognized cryptocurrency. Created as a peer-to-peer electronic cash system, it's now often viewed as "digital gold" and a store of value. With a capped supply of 21 million coins, Bitcoin's scarcity is a key feature that attracts investors.

Ethereum (ETH)

Ethereum goes beyond simple currency functionality by enabling developers to create decentralized applications (dApps) and smart contracts—self-executing agreements with the terms written directly into code. This versatility has made Ethereum the foundation for many blockchain innovations, including decentralized finance (DeFi) services.

Other Notable Cryptocurrencies

- Ripple (XRP): Designed for fast, low-cost international payments

- Litecoin (LTC): Created as a "lighter" version of Bitcoin with faster transaction confirmation

- Cardano (ADA): Focuses on sustainability, scalability, and transparency

- Solana (SOL): Prioritizes high transaction speeds and low costs

Each cryptocurrency has its own unique approach to addressing various limitations of traditional financial systems.

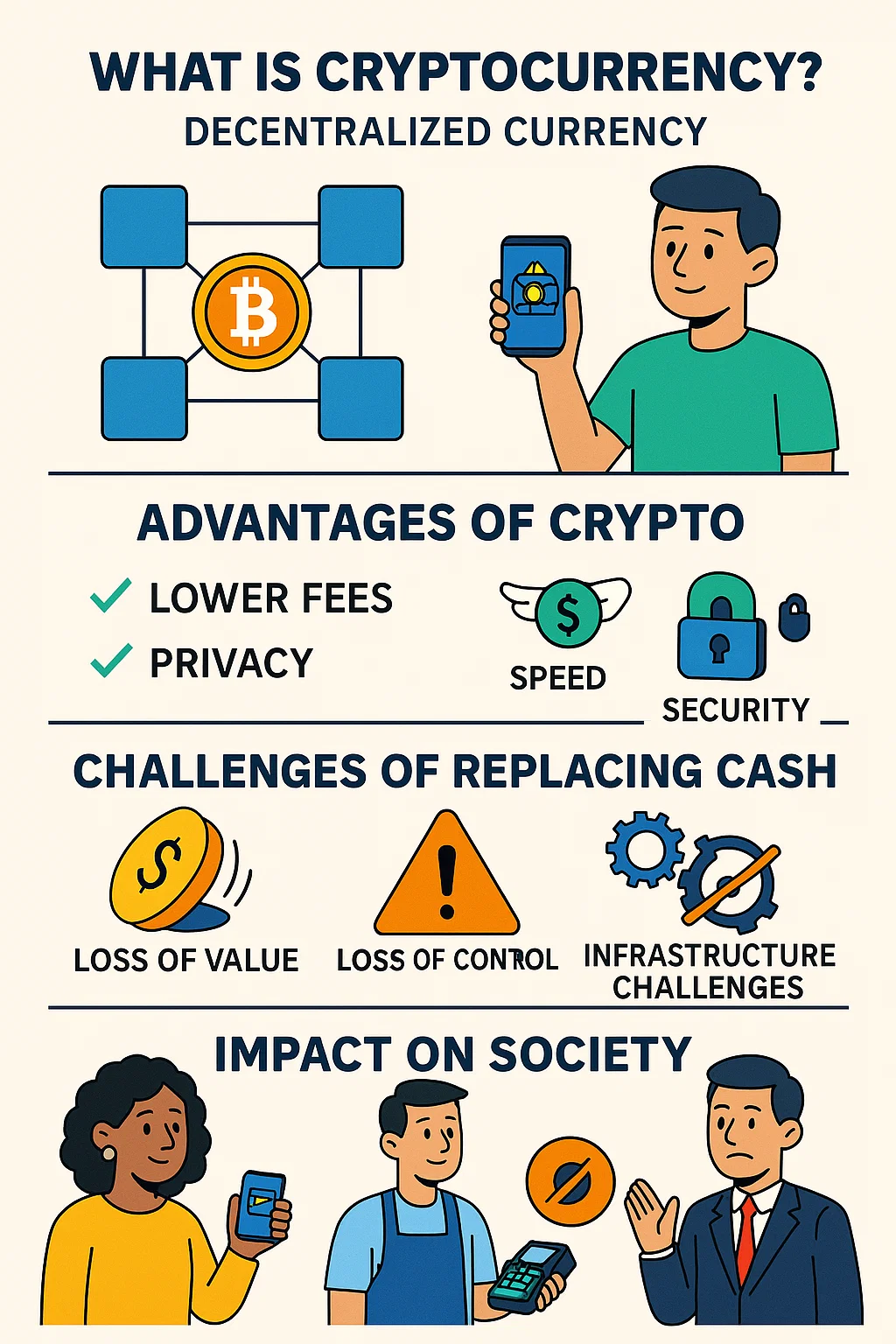

Could Cryptocurrencies Replace Cash? Examining the Possibilities

As cryptocurrencies continue to evolve and gain adoption, an intriguing question emerges: could they eventually replace traditional cash entirely? Let's explore the potential advantages and challenges of this scenario.

Advantages of a Cryptocurrency-Based Economy

Reduced Manipulation: Unlike fiat currencies that can be manipulated by central banks through mechanisms like quantitative easing, many cryptocurrencies have fixed or predictable issuance schedules that cannot be easily altered.

Elimination of Intermediaries: Cryptocurrencies enable direct peer-to-peer transactions without banks or payment processors, potentially reducing transaction costs and increasing efficiency.

Financial Inclusion: In regions with limited banking infrastructure, cryptocurrencies could provide financial services to the unbanked population who have internet access but no traditional bank accounts.

Support for New Economic Models: Some analysts suggest cryptocurrencies could better support concepts like universal basic income through programmatic, transparent distribution.

Enhanced Privacy: While not completely anonymous, cryptocurrencies can offer greater privacy in transactions compared to traditional banking systems that track all customer activities.

Challenges and Concerns

Volatility: The value of most cryptocurrencies fluctuates dramatically, making them unreliable as a day-to-day medium of exchange. For cryptocurrencies to function as cash, stability is essential.

Infrastructure Requirements: Widespread cryptocurrency adoption would require significant infrastructure development to ensure accessibility for all citizens, including those with limited technological literacy.

Transition Difficulties: Any transition from cash to cryptocurrency would create challenges for those unable to adapt quickly, potentially leading to lost assets for some individuals.

Institutional Resistance: Established financial institutions and governments would likely resist a shift that diminishes their control over monetary systems.

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions, creating uncertainty that hampers adoption.

The Impact on Financial Institutions and Governments

A shift from cash to cryptocurrencies would profoundly affect traditional financial institutions and governmental powers.

Changes for Financial Institutions

Banks and other financial institutions would need to dramatically transform their business models in a cryptocurrency-dominant economy. Traditional roles like payment processing, custody services, and lending would either disappear or require complete reinvention.

Many forward-thinking financial institutions are already incorporating blockchain technology and cryptocurrency services, suggesting an evolutionary rather than revolutionary transition might be more likely.

Implications for Government Control

Perhaps the most significant impact would be on governmental monetary authority. Currently, governments exert considerable control through:

- Setting interest rates

- Adjusting currency supply in response to economic conditions

- Using currency as a tool for international policy

In a cryptocurrency-dominated system, these powers would be significantly reduced. Governments could no longer print money in response to crises, potentially limiting their ability to respond to economic emergencies.

Tax collection could also become more challenging, requiring new enforcement mechanisms for a digital currency landscape.

The Reality of Cryptocurrency Adoption

Despite the theoretical possibilities, current trends suggest a more nuanced future than complete replacement of cash.

Current State of Adoption

While cryptocurrency awareness and ownership have grown substantially, everyday usage remains limited:

- Many businesses that initially accepted Bitcoin have since stopped due to volatility concerns

- Daily transaction volumes for most cryptocurrencies pale in comparison to traditional payment systems

- The primary use case remains investment rather than everyday purchases

A More Likely Future: Coexistence

Rather than complete replacement, a more probable outcome is the coexistence of traditional and cryptocurrencies, each serving different purposes:

- Fiat currencies: Continuing to function as the primary medium for everyday transactions

- Stablecoins: Cryptocurrencies pegged to traditional currencies might bridge the gap between crypto and fiat

- Central Bank Digital Currencies (CBDCs): Many governments are exploring digitized versions of their national currencies, combining aspects of cryptocurrency technology with centralized control

- Cryptocurrencies: Serving specialized roles in international transactions, specific online ecosystems, or as investment assets

Preparing for a Cryptocurrency Future

Whether cryptocurrencies fully replace cash or simply become an important complement to traditional financial systems, understanding this technology has become increasingly valuable.

Steps for Individuals

- Education: Take time to understand the fundamental concepts of blockchain and cryptocurrency

- Security awareness: Learn about secure storage methods like hardware wallets and best practices for protection

- Gradual exploration: Consider allocating a small portion of investments to cryptocurrencies to gain practical experience

- Tax compliance: Stay informed about your jurisdiction's cryptocurrency tax requirements

Business Considerations

Businesses should consider:

- Evaluating whether accepting cryptocurrency payments makes sense for their customer base

- Understanding the accounting and tax implications of cryptocurrency transactions

- Exploring how blockchain technology might improve their operations beyond simply accepting cryptocurrency

Conclusion

Cryptocurrency represents one of the most significant financial innovations of our time, with the potential to dramatically reshape how we think about and use money. While a complete replacement of cash seems unlikely in the immediate future, cryptocurrencies are already influencing traditional financial systems and creating new opportunities for both individuals and businesses.

The question isn't necessarily whether cryptocurrencies will fully replace cash, but rather how these technologies will continue to evolve alongside traditional systems to create a more efficient, inclusive, and versatile global financial ecosystem.

As with any revolutionary technology, the future will likely be shaped not by the technology alone, but by how society chooses to adapt, regulate, and incorporate it into existing systems. For now, understanding cryptocurrency fundamentals puts you ahead of the curve in navigating this rapidly evolving landscape.

Ready to learn more about cryptocurrency and its potential? Explore our comprehensive resources on what is cryptocurrency today!