What Is a Cryptocurrency Wallet? Your Ultimate Guide to Secure Crypto Storage

If you’re new to cryptocurrency, you’ve probably heard the term “crypto wallet” but aren’t sure what it means. A cryptocurrency wallet is not a physical wallet—it’s a tool that stores your private and public keys, enabling you to send, receive, and secure your digital assets on the blockchain. With cyberattacks on crypto platforms rising by 60% in 2023, understanding how wallets work and prioritizing security is critical.

This guide will walk you through:

- The basics of crypto wallets and how they interact with blockchain networks.

- Types of wallets (hot, cold, custodial, non-custodial) and their pros/cons.

- Security best practices to protect your assets from theft or loss.

- Key considerations for choosing the right wallet for your needs.

Let’s dive in!

Understanding Cryptocurrency Wallets: Beyond the Basics

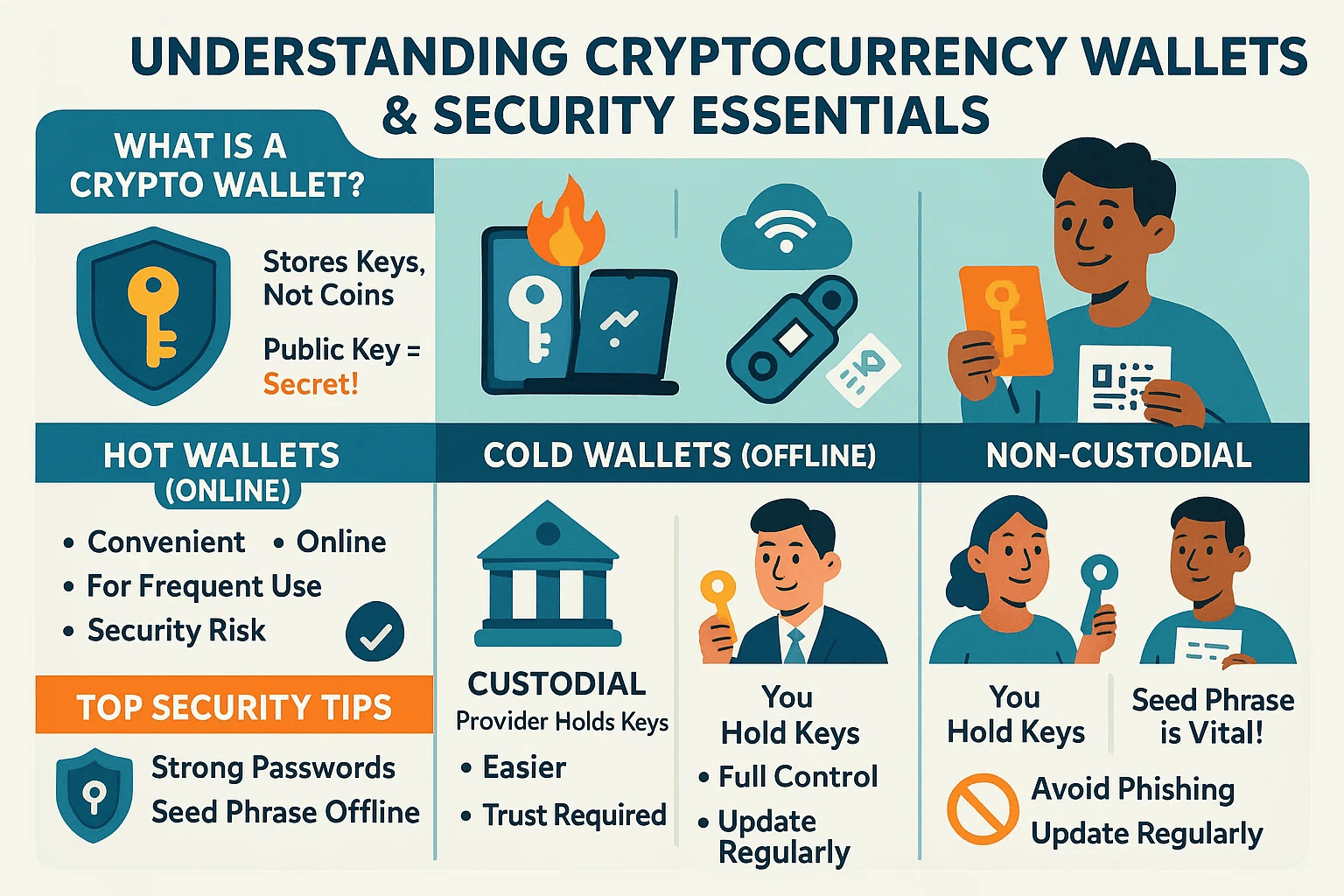

At its core, a cryptocurrency wallet doesn’t store coins like a traditional wallet holds cash. Instead, it manages the public and private keys required to access your funds on the blockchain. Think of your public key as your bank account number (shareable) and your private key as your PIN (must stay secret). Losing your private key means losing access to your assets forever.

Key Functions of a Crypto Wallet

- Stores public/private keys securely.

- Signs transactions digitally to authorize transfers.

- Interacts with blockchain networks to track balances.

- Enables crypto-to-fiat conversions (e.g., Bitcoin to USD).

Types of Cryptocurrency Wallets: Hot vs. Cold

Choosing the right wallet depends on your security needs, trading frequency, and risk tolerance. Here’s a breakdown of the two main categories:

Hot Wallets: Convenience with Trade-Offs

Hot wallets are internet-connected software wallets ideal for frequent traders. Examples include:

- Web-based wallets (e.g., exchange-hosted wallets).

- Mobile apps (e.g., Trust Wallet, Crypto.com App).

- Desktop wallets (e.g., Electrum for Bitcoin).

Pros: Easy to use, instant access, free to set up.

Cons: Vulnerable to hacking, phishing, and malware attacks.

Cold Wallets: Max Security for Long-Term Holders

Cold wallets are offline storage solutions perfect for securing large holdings. Examples include:

- Hardware wallets (e.g., Ledger, Trezor) – USB-like devices storing keys offline.

- Paper wallets – Physical prints of keys (less common due to risks of loss/damage).

Pros: Immune to online threats, highly secure.

Cons: Less convenient, higher upfront cost ($30–$150+).

Custodial vs. Non-Custodial Wallets: Who Controls Your Keys?

Custodial Wallets: Letting Exchanges Handle Security

Custodial wallets (e.g., Binance, Coinbase) are managed by third parties. While convenient, they require trusting the exchange with your private keys.

Best For: Beginners, frequent traders, or small balances.

Non-Custodial Wallets: Full Control, Full Responsibility

Non-custodial wallets (e.g., MetaMask, Crypto.com Onchain) give you full ownership of your keys. Recovery phrases (12–24 words) act as backups.

Best For: Long-term investors prioritizing security.

Pro Tip: Use both! Keep daily spending funds in a hot wallet and the majority in cold storage.

Securing Your Crypto Wallet: Best Practices

- Never Share Your Private Key – Treat it like your social security number.

- Enable Two-Factor Authentication (2FA) – Adds a layer of security for hot wallets.

- Backup Recovery Phrases Offline – Store them in a fireproof safe or safety deposit box.

- Use Hardware Wallets for Large Holdings – Cold storage is non-negotiable for significant investments.

- Avoid Public Wi-Fi for Transactions – Use a trusted network or VPN to prevent snooping.

NFT Wallets: Storing Digital Collectibles

If you own or trade NFTs, ensure your wallet supports standards like ERC-721 (Ethereum) or Cronos. Look for:

- Cross-chain compatibility (e.g., MetaMask, Trust Wallet).

- Integration with marketplaces (OpenSea, Rarible).

- User-friendly interfaces for managing collections.

Conclusion

A cryptocurrency wallet is your gateway to owning and securing digital assets. Whether you’re a casual trader or a long-term investor, choosing the right wallet—hot or cold, custodial or non-custodial—directly impacts your security. By following best practices like hardware storage, 2FA, and offline backups, you can protect your investments from theft or loss.

Remember: “Not your keys, not your coins.” Prioritize security today to avoid regrets tomorrow.

Ready to Secure Your Crypto Assets?

Explore our cryptocurrency security solutions to find the perfect wallet for your needs. From beginner-friendly apps to advanced hardware options, we’ll help you safeguard your digital future—starting today.