Why Do Bubbles in Cryptocurrency Keep Happening?

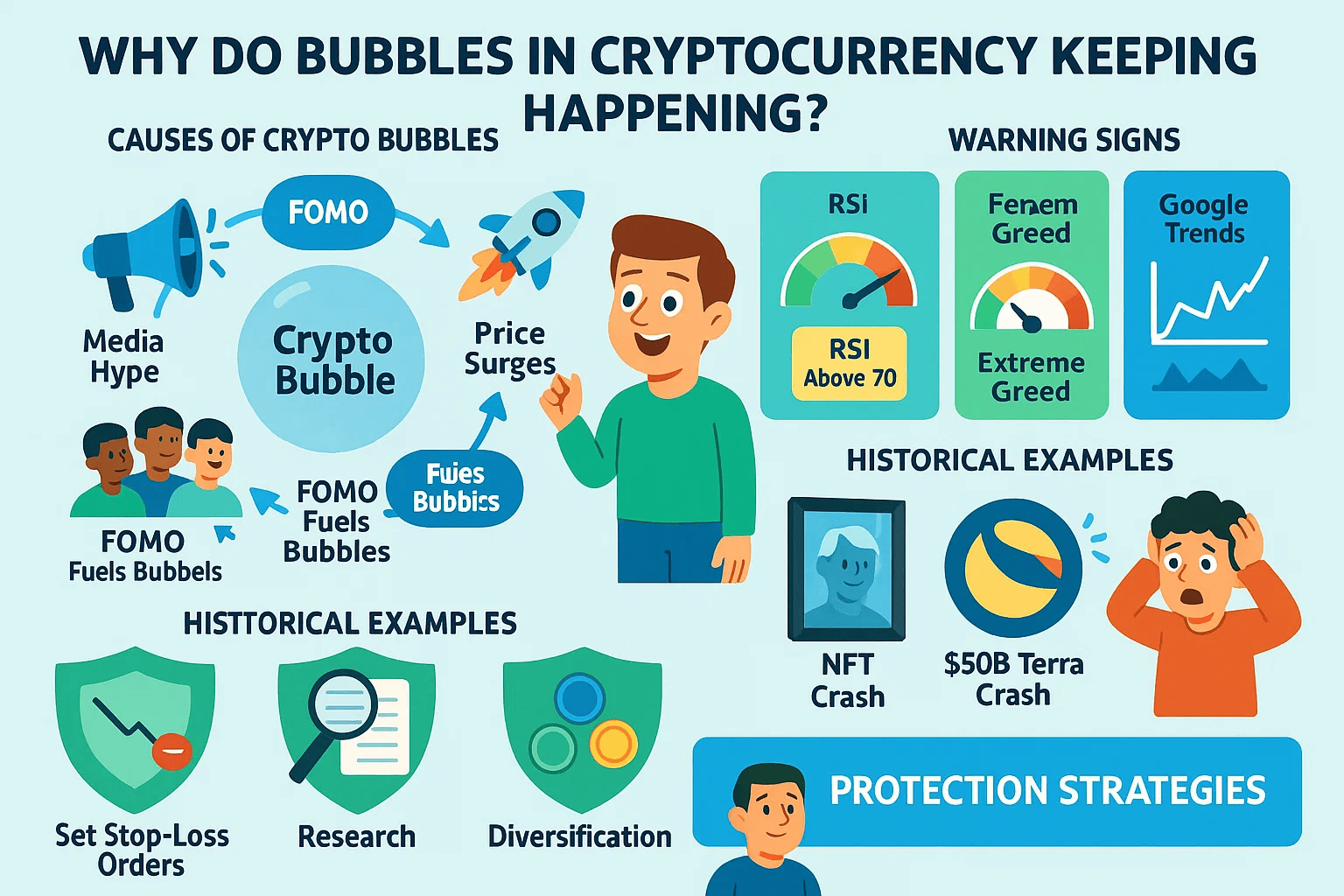

Cryptocurrency markets are infamous for their wild swings—from meteoric rises to catastrophic crashes. If you’ve ever wondered, “Why do bubbles in cryptocurrency keep happening?” you’re not alone. These cycles of euphoria and despair are rooted in human psychology, speculative frenzy, and the unique nature of blockchain technology.

In this guide, we’ll explore:

- The core causes of crypto bubbles

- Historical examples of explosive growth and collapse

- Warning signs to spot before a crash

- Strategies to protect your investments

Whether you’re a seasoned trader or a curious newcomer, understanding these patterns is critical to navigating the volatile world of digital assets.

What Causes Crypto Bubbles?

At their core, crypto bubbles form when prices surge far beyond an asset’s intrinsic value, driven by speculation rather than fundamentals. Several factors contribute to this recurring phenomenon:

1. FOMO (Fear of Missing Out)

Social media hype and influencer endorsements create a herd mentality. When retail investors see others making quick profits, they rush to buy, fearing they’ll miss out on gains. This self-reinforcing cycle inflates prices unsustainably.

2. Technological Hype and Misunderstanding

Terms like “blockchain,” “DeFi,” and “NFTs” often overshadow real-world utility. Newcomers may mistake buzzwords for innovation, investing in projects without understanding their viability. For example, the 2021 NFT bubble saw digital art sell for millions, only to lose value when the trend faded.

3. Inexperienced Retail Investors

Rookie traders dominate crypto markets, often relying on flashy headlines instead of fundamentals. Their lack of risk awareness amplifies volatility.

4. Media and Celebrity Influence

Positive coverage from mainstream media or celebrities (e.g., Elon Musk’s tweets) can trigger massive buying frenzies. Conversely, negative news spreads FUD (“fear, uncertainty, doubt”), accelerating sell-offs.

5. Leverage and Overconfidence

Traders using borrowed funds to amplify gains increase market fragility. When prices dip, margin calls force mass liquidations, worsening crashes.

Secondary Keywords: crypto bubble causes, why crypto crashes, FOMO in crypto

Historical Examples of Crypto Bubbles

1. The ICO Bubble (2017–2018)

Initial Coin Offerings (ICOs) became a speculative gold rush. Projects promised groundbreaking tech but often delivered scams. By 2019, the market cap plummeted from $830 billion to $100 billion, with 80% of ICOs exposed as fraud.

2. The NFT Bubble (2021–2022)

Celebrity endorsements (e.g., Snoop Dogg) fueled demand for NFTs, with sales peaking at $6 billion monthly on OpenSea. When interest waned, prices collapsed, leaving many holders with devalued assets.

3. Terra Luna Collapse (2022)

Terraform Labs’ algorithmic stablecoin UST lost its peg due to flawed mechanics, wiping out $50 billion. This disaster highlighted risks in overengineered protocols and overreliance on incentives.

LSI Keywords: ICO bubble, NFT market crash, Terra Luna collapse

Warning Signs of an Impending Bubble Burst

Recognizing red flags can help you exit before prices crater:

- Extreme Public Interest: Skyrocketing Google Trends searches or trading volumes signal overheating.

- Unrealistic Price Predictions: Influencers hyping moonshots without citing tokenomics are a red flag.

- Overbought RSI Scores: A Relative Strength Index (RSI) above 70 for weeks indicates unsustainable momentum.

- Crypto Fear & Greed Index: Extreme greed (scores near 100) precedes most crashes.

- Excessive Leverage: High open interest in futures markets often precedes sharp corrections.

PAA Question: How do you know when a crypto bubble is about to burst?

How to Protect Yourself During a Crypto Bubble

1. Develop a Clear Investment Strategy

Focus on fundamentals like tokenomics, use cases, and team credibility. Avoid chasing trends without research.

2. Use Stop-Loss and Take-Profit Orders

Automated tools limit losses and lock in gains during volatility.

3. Diversify Your Portfolio

Spread investments across asset classes (e.g., Bitcoin, Ethereum, stablecoins) to reduce risk.

4. Avoid Leverage Until Experienced

Borrowed funds magnify losses—stick to capital you can afford to lose.

5. Stay Informed via Reliable Sources

Follow reputable analysts and on-chain metrics instead of social media hype.

LSI Keywords: avoiding crypto bubbles, crypto investment strategy, stop-loss orders

Conclusion

Crypto bubbles persist because human psychology and speculative incentives remain unchanged. While innovation drives adoption, unchecked hype creates instability. By understanding the mechanics behind these cycles, you can make informed decisions and avoid joining the ranks of those burned by collapses.

Remember: Not all crypto projects are scams. Bitcoin and Ethereum have survived multiple bubbles, proving their resilience. The key is to separate genuine value from speculation.

Ready to dive deeper into cryptocurrency basics? Explore our guide to what is cryptocurrency to build a solid foundation for your journey.