Chapter 2. Simple Linear Regression

Regression Analysis

Study a functional relationship between variables

- response variable y(dependent variable)

- explanatory variable x(independent variable)

Simple linear regression model

- When is a linear function of parameters, the models is called a linear statistical model.

- Simple linear regression model :

Method of estimation

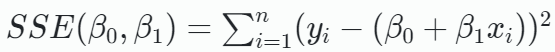

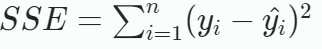

Sum of squares for error(SSE)

- The least squares estimators and are the estimators of and that minimize the sum of squares for error

Method of inference

-

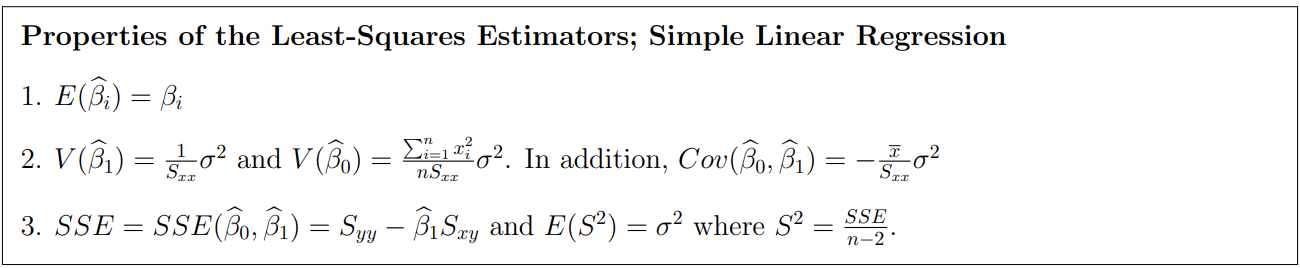

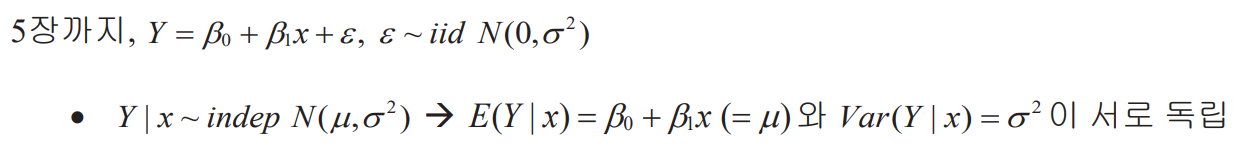

Consider a simple linear regression model :

-

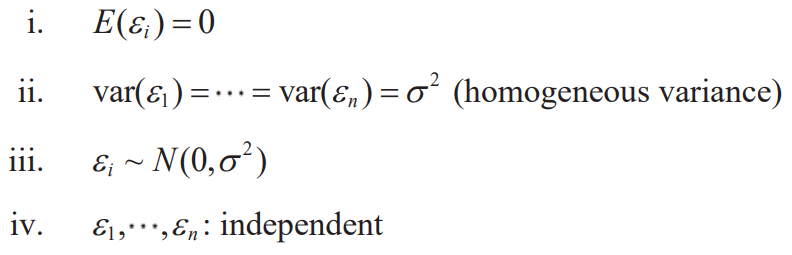

Assumption

- that does not depend on

- Suppose independent observations are to be made on this model

:

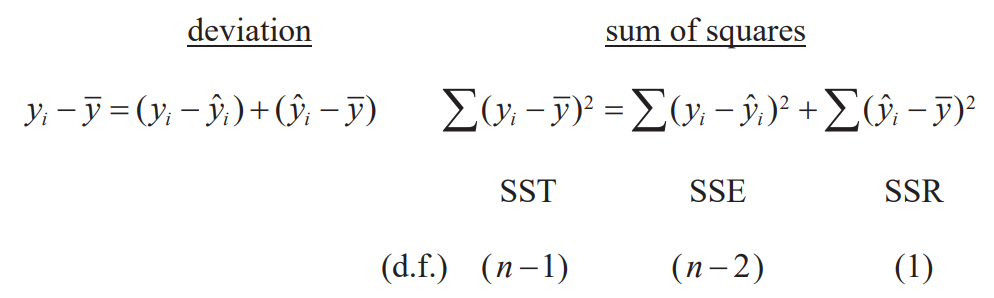

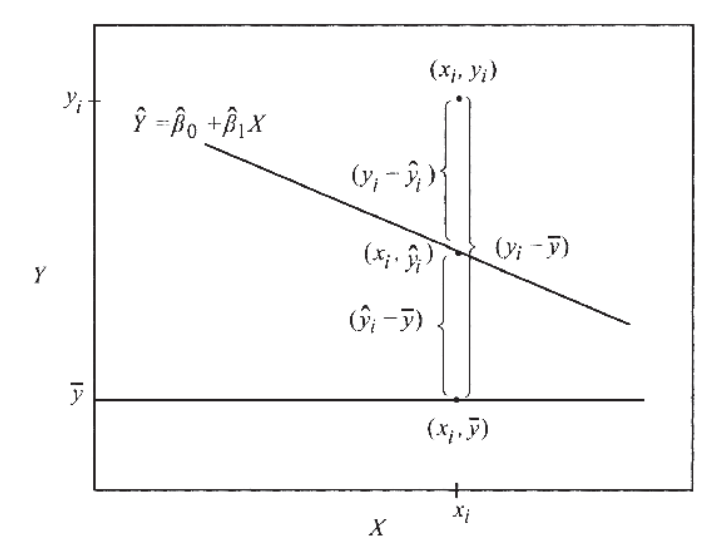

Measuring the quality of fit

Decomposition of Sum of Squares

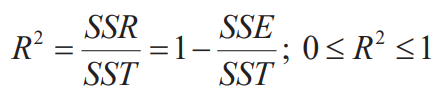

Coefficient of determination

- : Proportion of variation of y explained by x

Chapter 3. Multiple Linear Regression

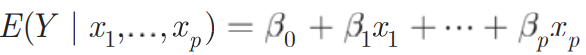

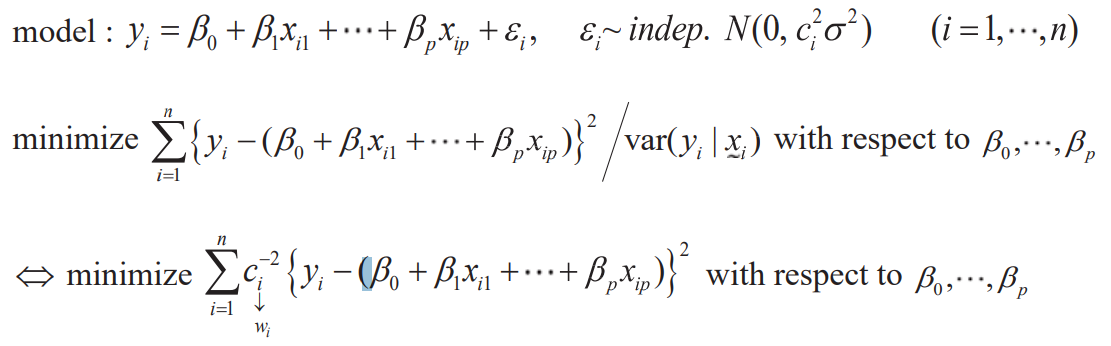

- Multiple linear regression model :

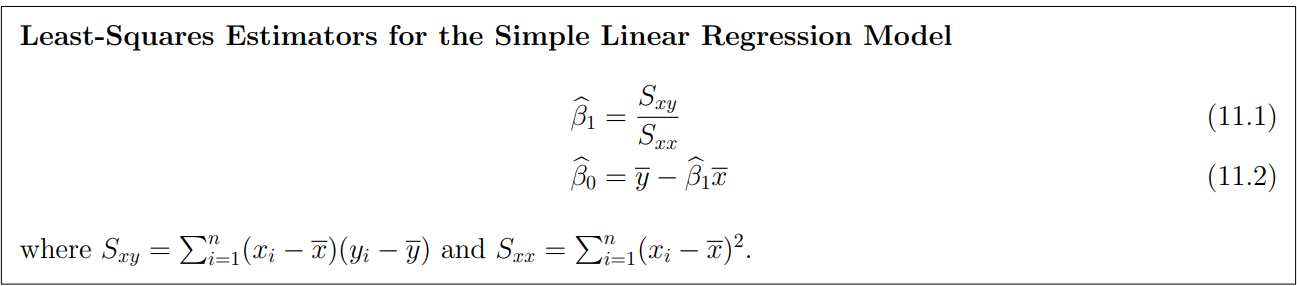

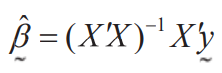

Least squares estimates

- minimize

- normal equation :

- estimate of :

Matrix approach

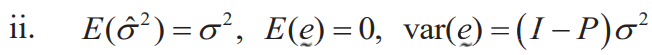

Method of inference

Properties of estimates

Recall that

Measuring the quality of fit

Decomposition of sum of squares

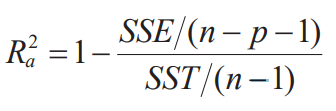

Multiple correlation coefficient(MCC) & Adjusted MCC

- means that determination of y by linear combination of x becomes larger or proportion of variation of y explained by x1,...,xp

- As the number of explanatory variables increases, always increases and unconditionally decreases.

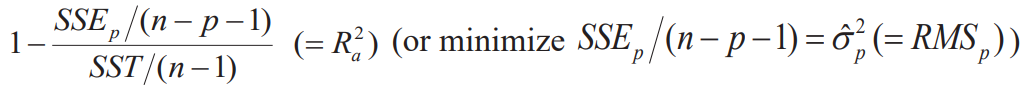

- is inappropriate for comparing the fitness between models with different numbers of explanatory variables. Therefore, consider the following adjusted

Interpretations of regression coefficients

- (constant coef.) : the value of y when

- (regression coef.) : the change of y corresponding to a unit change in when 's are hold constant(fixed)

Chapter 4. Regression Diagnostics: Detection of Model Violations

Validity of model assumption

,

Linearity assumption

graphical methods(scatter plot for simple linear regression)

Error distribution assumption

graphical methods based on residuals

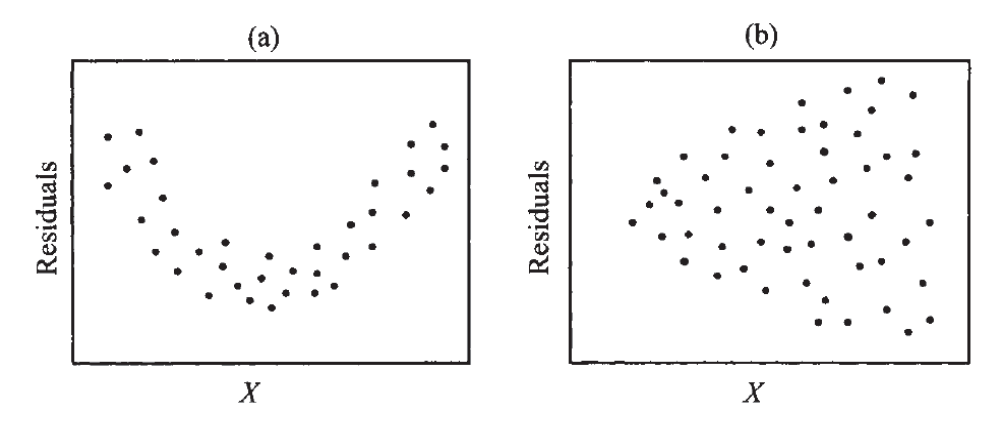

Assumptions about explanatory variables

graphical methods or correlation matrices

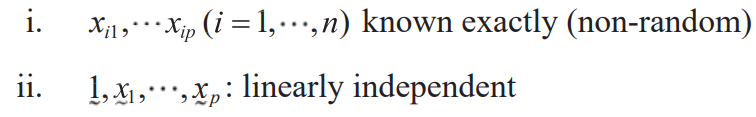

Residuals

- If a regression equation is obtained from the population, the difference between the predicted value and the actual observed value obtained through the regression equation is error

- On the other hand, if a regression equation was obtained from the sample group, the difference between the predicted value and the actual observed value obtained through the regression equation is the residual

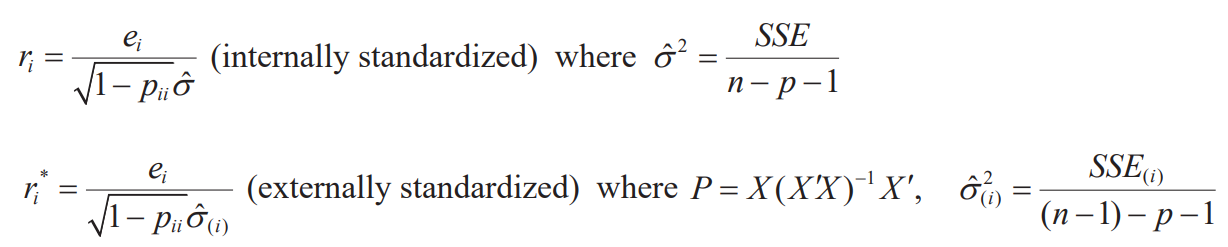

Residual plot

plot

- If the assumptions hold, this should be a random scatter plot

- Tools for checking non-linearity / non-homogeneous variance

Scatter plot

- for linearity assumption

- for linear independence(multicollinearity)

Leverage, Influence and Outliers

- Leverage : Checking outliers in explanatory variables

- Measures of influence : Cook's distance, Difference in Fits, Hadi's measure & Potential-Residual Plot

- Outliers : Leverage(outliers in the predictors), Standardized(studentized) residual(outliers in the response variable)

Chapter 5. Qualitative Variable as Predictors

- Sometimes, it is necessary to use qualitative(or categorical) variable in a regression through indicator(dummy) variables

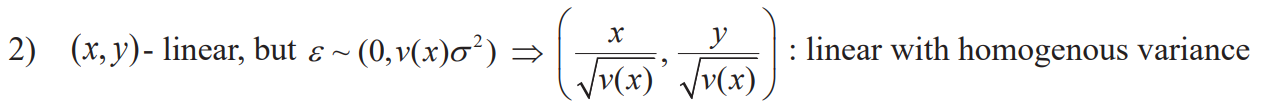

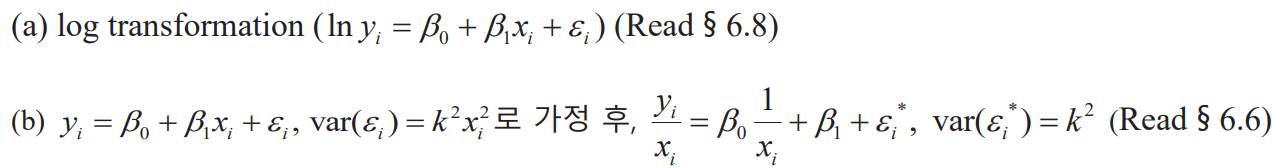

Chapter 6. Transformation of Variables

- Use transformation to achieve linearity and/or homoscedasticity

Variance stabilization transformation

- The distribution of may not be a normal distribution.

- Therefore, and may have a functional relationship with each other. Example: Poisson distribution, binomial distribution, negative binomial distribution

- When the distribution of or the functional relationship between and can be known, a special transformation can satisfy the assumption of the normal distribution and eliminate the functional relationship.

- Log transformation is typically used a lot to reduce variance

Chapter 7. Weighted Least Squares(WLS)

Residual plot shows the empirical evidence of heteroscedasticity(이분산성)

Strategies for treating heteroskedasticity

- Transformation of variable

- WLS

- (b) of Transformation of variables gives the same result as WLS, but it is difficult to interpret the result.

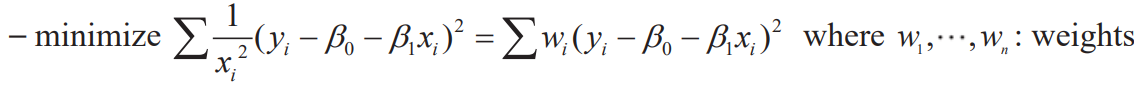

Weighted Least Squares(WLS)

- We use WLS when we suspect an equally distributed assumption of error.

- It is used when you want to create a regression model that is less affected by outliers.

- Idea

- Incorrect observations adjust the weight to have less effect on the min of SSE

- If , the observation is excluded from the estimation and is the same as OLS if all are equal.

Sums of Squares Decomposition in WLS

Chapter 8. The Problem of Correlated Errors

- Assumption of independence in the regression model: the error terms and are not correlated with each other.

- Autocorrelation

- The correlation when the observations have a natural sequential order- Adjacent residuals tend to be similar in both temporal and spatial diemensions(economic time series)

Effect of Autocorrelation of Errors on Regression Analysis

- The efficiency of LSE for regression coefficients is poor(unbiased but no minimum variance)

- or the s.e. of the regression coefficient may be underestimated. In other words, the significance of the regression coefficient is overestimated

- Commonly used confidence intervals or significance tests are no longer valid

Two types of the autocorrelation problem

- Type 1: autocorrelation in appearance(omission of a variable that should be in the model)

Once this variable is uncovered, the problem is resolved - Type 2: pure autocorrelation

involving a transformation of the data

How to detect the correlated errors?

- residuals plot(index plot) : a particular pattern

- runs test, Durbin-Watson test

What to do with correlated errors?

- Type 1: consider another variables if possible

- Type 2: consider AR model to the error reduce to a model with uncorrelated error

Numerical evidences of correlated errors

Runs test

- uses signs(+,-) of residuals

- Run: repeated occurrence of the same sign

- NR: # of runs

- Idea: NR if negative corr, NR if positive corr

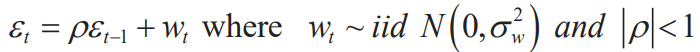

Durbin-Watson test(a popular test of autocorrelation in regression analysis)

- Use it under the assumption called as AutoRegressive model of order 1(AR1)

- Durbin-Watson's statistic & Estimator of autocorrelation

- Idea: small values of is positive correlation & large values of is negative correlation

Chapter 9. Analysis of Collinear Data

- Interpretation of the multiple regression equation depends implicitly on the assumption that the predictor variables are not strongly interrelated

- If the predictors are so strongly interrelated, the regression results are ambiguous : problem of collinear data or multicollinearity

Multicollinearity(다중공선성)

- Regression assumption: rank(X)=p+1

- Multicollinearity is not found through residual analysis.

- The cause of multicollinearity may be a lack of observation or the uniqueness of the independent variables to be analyzed

- The multicollinearity problem is considered after regression diagnosis including residual analysis

Symptom of multicollinearity

- Model is significant byt some of are not significant

- Estimation of are unstable and drastic change of by adding or deleting a variable

- Estimation result contrary to the common sense

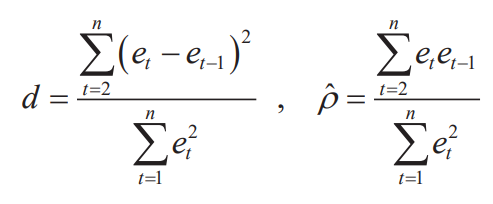

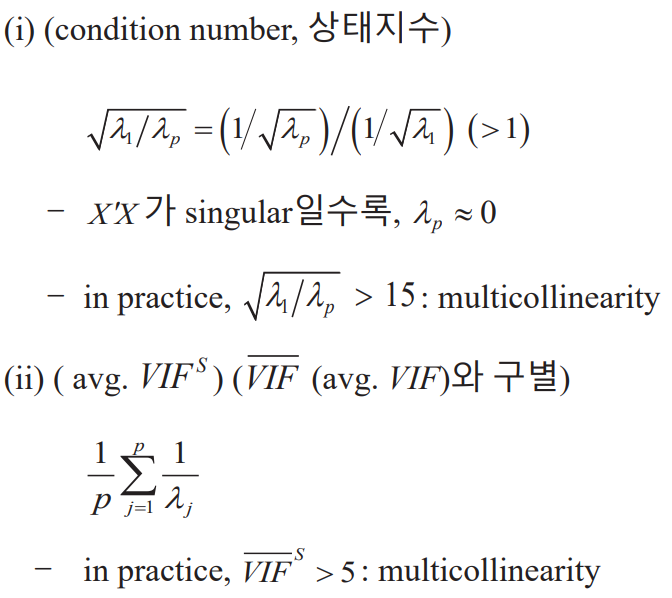

Numerical measure of multicollinearity

Correlation coefficients of and

- Pairwise linear relation but can't detect linear relation among 3 or more variables

Variance Inflation Factor(VIF)

- VIF>10 evidence of multicollinearity

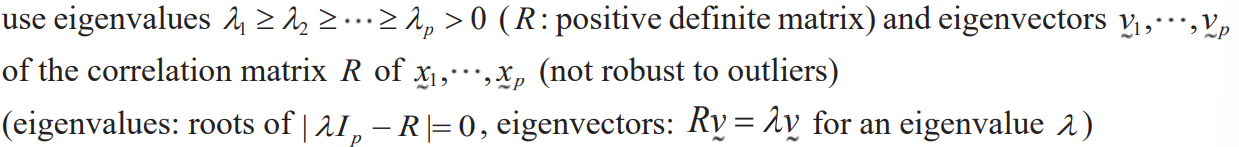

Principal components

- Overall measure of multicollinearity

What to do with multicollinearity data

- (Experimental situation) : design an experiment so that multicollinearity does not occur

- (Observational situation) : reduce the model(essentially reduce the variables) using the information from the PC's, Ridge regression

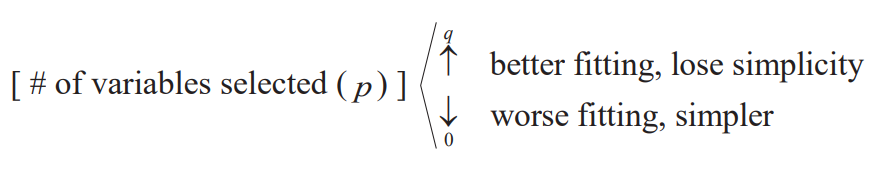

Chapter 11. Variable Selection

- Goal: to explain the response with the smallest number of explanatory variables

- Balancing between goodness of fit and simplicity

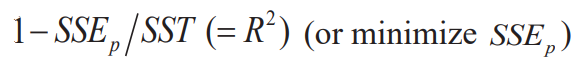

Statictics used in Variable Selection

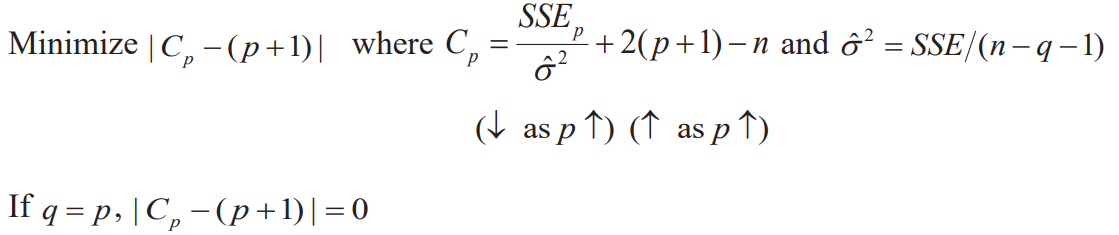

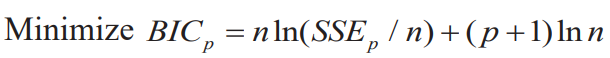

- To decide that one subset is better than another, we need some criteria for subset selection

- The criteria is minimizing a modified

Adjusted multiple correlation coefficient

- For fixed p, maximize among possible choices of p variables

- For different p's, maximize

Mallow's

AIC

BIC

Partial F-test statistics for testing

Variable Selection

- Evaluating all possible equations

- Variable selection precedures(Partial F-test)

- Forward selection

- Backward elimination

- Stepwise selection

Chapter 12.Logistic Regression

- Dependent variable:Quanlitative & Independent variables:Quantitative or Qualitative

Modeling Qualitative Data

- Rather than predicting these two values of the binary response variable, try to model the probabilities that the response takes one of these two values

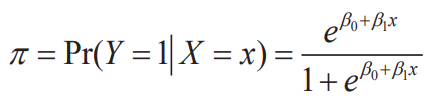

- Let denote the probability that Y=1 when X=x

- Logistic model

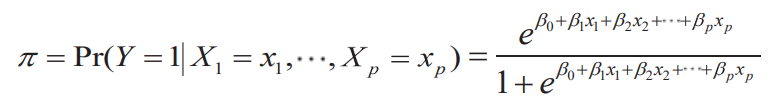

- Logistic regression function(logistic model for multiple regression)

- Nonlinear in the paramters but it can be linearized by the logit transformation

- Odds : Indicates how many times the probability of success is that of failure

- Logit

- Modeling and estimating the logistic regression model

- Maximum likelihood estimation- No closed-form expression exists for the estimates of the parameters. To fit a logistic regression in practice a computer program is essential

- Information criteria as AIC and BIC can be used for model selection

- Instead of SSE, the logarithm of the likelihood for the fitted model is used

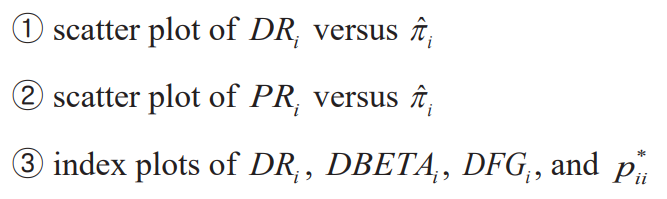

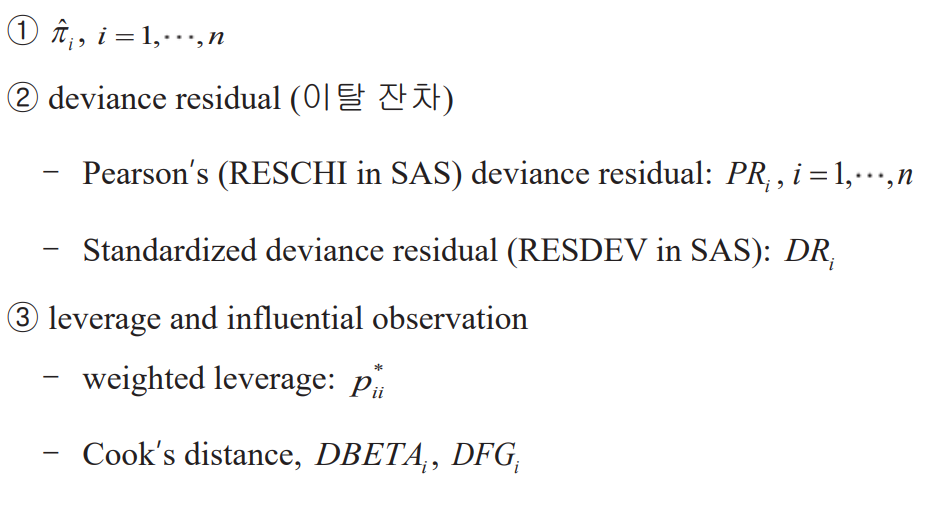

Diagnostics in logistic regression

- Diagnostic measures

- How to use the measures: same way as the corresponding ones from a linear regression