ⓒ Michael Roberts

마이클 로버트의 글 요약

마이클 로버트는 최근 미국의 경제 상황과 트럼프 대통령의 관세정책이 세계 경제에 미치는 영향을 분석하며, 겉으로 드러나는 낙관적 경제 지표 뒤에 숨겨진 문제들을 지적한다. 주요 내용은 다음과 같다:

-

빅테크 기업의 실적과 주식 시장 호황:

- '매그니피센트 세븐(Magnificent Seven)'으로 불리는 주요 기술 기업들은 최근 분기 실적에서 높은 수익을 보고하며 미국 경제가 호황이라는 트럼프의 주장을 뒷받침했다. 미국 주식 시장은 사상 최고치 근처를 유지하고 있다.

- 하지만 이 실적은 인공지능(AI) 투자보다는 기존 인터넷 및 소셜미디어 서비스(예: 메타의 광고 수익)에서 비롯된 것으로, AI 투자로 인한 수익은 아직 미미하다.

-

AI 투자 열풍과 비용 증가:

- 메타, 마이크로소프트 등 빅테크 기업들은 AI 데이터센터와 인프라에 막대한 투자를 하고 있다. 예를 들어, 메타는 2025년 자본 지출을 660억~720억 달러로 늘리고, 마이크로소프트는 2026년 데이터센터 지출을 1200억 달러로 확대할 계획이다.

- 그러나 AI에서 발생하는 수익은 아직 미미하며, AI 앱 사용자(예: Copilot, Gemini, ChatGPT)의 3%만이 유료 서비스를 이용한다. 기업들은 현금 흐름을 소진하거나 민간 신용(Private Credit)을 통해 자금을 조달하며, 이는 규제가 약한 신용 시장의 리스크를 증가시킨다.

-

미국 경제의 이면:

- 미국의 2분기 실질 GDP 성장률은 연율 3.0%로 발표되었으나, 이는 관세로 인한 수입 감소(-30%)로 인해 순수출이 GDP에 기여한 결과다. 수입을 제외한 민간 내수 판매는 1.2% 성장에 그쳤다.

- 투자 성장률은 1분기 7.6%에서 2분기 0.4%로 급감했으며, 제조업 일자리는 지난 1년간 11.6만 개 감소했다. 2025년 상반기 실질 GDP 성장률은 연율 1.2%로, 2024년에 비해 크게 둔화되었다.

- 고용 시장은 7월에 7.3만 명의 일자리만 증가하며 팬데믹 이후 최악의 상황을 기록했고, 실업률은 상승했다. 기술 부문도 2022년 정점 대비 일자리 감소가 두드러졌다.

-

관세정책의 영향:

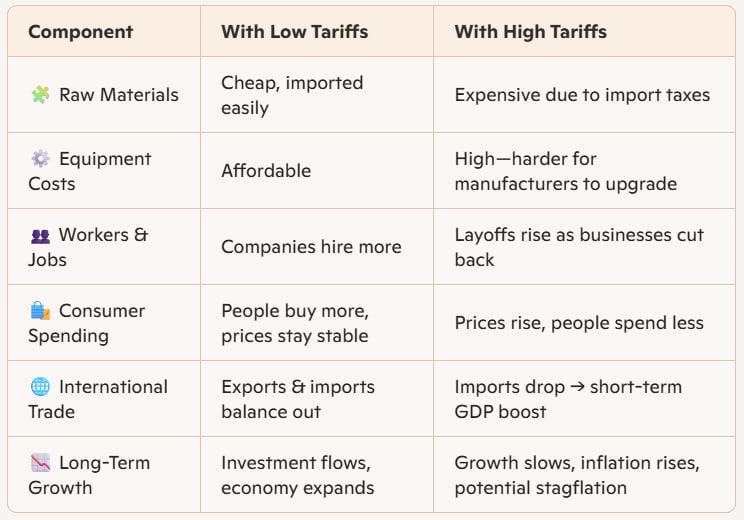

- 트럼프의 관세정책으로 미국의 평균 관세율은 18.2%로, 거의 100년 만에 최고 수준이다. 이는 정부 재정 적자(약 GDP의 6%)를 메우기 위한 추가 수익을 창출하지만, 경제 성장 둔화와 무역 적자 확대(작년 대비 50% 증가)로 상쇄된다.

- 관세는 수입업체가 부담하며, 현재 절반 정도가 내부적으로 비용을 흡수하고 있지만, 결국 소비자 가격에 전가될 가능성이 크다. 예일대 Budget Lab은 관세로 인해 미국 소비자 물가가 1.8% 상승하고, 가구당 평균 2,400달러의 소득 손실이 발생할 것으로 추정한다.

- 관세는 국내 제조업체의 부품 수입 비용을 증가시켜 투자와 수익 마진을 압박하며, 경제 성장을 0.6%포인트 감소시킬 가능성이 있다. 이는 2026년까지 GDP 성장률을 1% 아래로 떨어뜨릴 수 있다.

-

스태그플레이션 우려:

- 미국 경제는 성장 둔화와 고용 감소에도 불구하고 인플레이션이 3% 수준에서 고착화되며, 연준의 목표 2%를 상회한다. 팬데믹 이후 20%의 물가 상승과 3%로 둔화된 임금 상승으로 실질 소득은 정체되었다.

- 연준은 기준금리를 4.25%로 동결하며, 인플레이션 억제와 경제 지원 간 딜레마에 직면했다. 금리 인하는 인플레이션을 악화시킬 수 있고, 금리 유지 또는 인상은 기업과 가계의 차입 비용을 증가시켜 경제 성장을 더욱 억제할 수 있다.

- 관세의 본격적 영향이 아직 반영되지 않은 상황에서, 미국 경제는 성장 정체와 인플레이션 상승이 공존하는 스태그플레이션에 직면할 가능성이 크다.

분석

마이클 로버트의 글은 미국 경제의 겉과 속을 대비하며, 트럼프의 관세정책과 AI 투자 열풍이 단기적 호황 뒤에 장기적 위험을 초래할 수 있음을 경고한다. 주요 분석 포인트는 다음과 같다:

-

빅테크의 실적과 AI 투자:

- 빅테크 기업들의 높은 실적은 주식 시장과 경제 낙관론을 부추기지만, 이는 AI가 아닌 기존 사업에서 나온 결과다. AI 투자는 막대한 비용을 요구하지만, 단기적으로 수익 창출이 미미해 기업들의 재무 건전성에 부담을 준다.

- 민간 신용을 통한 자금 조달은 규제가 약한 신용 시장의 불안정성을 높이며, AI 버블 붕괴 시 신용 위기로 이어질 가능성이 있다.

-

관세정책의 경제적 영향:

- 트럼프의 관세정책은 단기적으로 정부 수입을 늘리고 GDP 성장률을 부풀렸지만, 이는 수입 감소로 인한 착시효과다. 실제 내수와 투자는 둔화되고 있으며, 제조업 일자리 감소와 무역 적자 확대는 경제의 취약성을 드러낸다.

- 관세로 인한 비용은 결국 소비자에게 전가되며, 물가 상승과 소득 손실로 이어질 가능성이 크다. 이는 스태그플레이션(성장 정체 + 인플레이션)을 가속화할 수 있다.

-

경제 전망과 연준의 딜레마:

- 미국 경제는 2025년 상반기 저성장(연율 1.2%)과 고용 부진으로 취약한 상태다. 인플레이션이 연준 목표를 상회하며, 금리 정책은 인플레이션 억제와 경제 부양 간 균형을 맞추기 어려운 상황이다.

- 트럼프의 정치적 압력(금리 인하 요구, 연준 의장 해임 위협 등)은 연준의 독립성을 위협하며, 정책 결정의 불확실성을 높인다.

-

스태그플레이션과 글로벌 영향:

- 미국 경제의 스태그플레이션은 글로벌 경제에도 영향을 미칠 수 있다. 관세로 인한 수입 감소는 글로벌 공급망을 교란시키고, 특히 유럽(0.1% 성장)과 일본 등 저성장 국가들에 추가적 압박을 가할 가능성이 있다. 반면 중국(4% 이상 성장 추정)은 상대적으로 견조한 성장을 유지하고 있다.

- AI 투자 붐은 글로벌 기술 경쟁을 심화시키지만, 수익성 없는 과잉 투자는 자본 시장의 불안정성을 키울 수 있다.

결론

마이클 로버트는 미국 경제의 호황이 빅테크와 관세정책에 의해 과장되었다고 비판하며, 실질적인 경제 지표는 둔화와 불균형을 보여준다고 지적한다. 트럼프의 관세정책은 단기적 이익을 가져오지만, 장기적으로 물가 상승, 투자 감소, 경제 성장 둔화를 초래할 가능성이 크다. AI 투자 열풍은 새로운 성장 동력으로 기대되지만, 현재로서는 수익 없이 비용만 증가시키며 금융 리스크를 키우고 있다. 미국 경제는 스태그플레이션에 직면할 가능성이 높으며, 이는 연준의 정책 결정과 글로벌 경제에 중대한 영향을 미칠 것이다.

ⓒ Michael Roberts

Michael Roberts

Tariffs and the US economy

By michael roberts on August 4, 2025

Last week, the mega tech companies – the so-called Magnificent Seven – presented their latest earnings results. They appeared to be ‘blockbuster’. They painted a picture of a booming economy, supporting President Trump’s assertion that America “is the hottest country anywhere in the world”. (He was not referring to global warming). At the same time, Trump announced his latest round of tariff measures on goods exports from other countries into the US. The US stock market continued to stay near a record high.

The financial media lauded the tech results and even went along with the Trump administration’s claims that all the fears about the hit to US economic growth and inflation from Trump’s tariff measures had been proved wrong.

But the more you look at the data below the stock market hype and Trump’s claims, the reality is much less rosy. Below the surface, large parts of corporate America are grappling with slowing profits and the uncertainty generated by Trump’s aggressive trade war. With almost two-thirds of S&P 500 companies having reported second-quarter results, earnings for consumer staples and materials companies are down 0.1 per cent and 5 per cent year on year, according to FactSet data. Indeed, 52 per cent of those S&P 500 companies to have posted results, have reported declining profit margins, according to Société Générale.

A graph of a graph showing the growth of a company

AI-generated content may be incorrect.

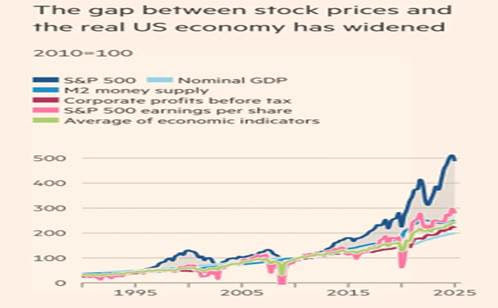

The 10 biggest stocks on the S&P 500 account for one-third of overall profits across the index, with tech and financials reporting year-on-year quarterly earnings growth of 41 per cent and 12.8 per cent, respectively.

And when we delve into the earnings results of the Magnificent Seven, we find, contrary to the views of the financial media, that their earnings rises are not due to revenues and profits accrued from the huge investments in AI made by these companies, but from existing services created from the previous tech boom in the internet and social media. Meta’s (Facebook) shares jumped more than 11 per cent on their results adding more than $150bn to its market value. But the rise in earnings came from increased advertising revenues in existing services, not AI.

Meta's Zuckerberg proclaimed that he is investing ever more in AI data centers and energy sources. “We are making all these investments because we have conviction that superintelligence is going to improve every aspect of what we do from a business perspective,” Zuckerberg said on a call with investors. However, Meta's finance officer Susan Li said Meta was not anticipating “meaningful” revenue from its generative AI push this year or in 2026. And the company cautioned that the costs of building the infrastructure needed to underpin its AI ambitions were growing. Meta raised the lower end of its 2025 capital expenditures forecast to between $66bn and $72bn. It said that it expected its 2026 year-over-year expense growth to be higher than its 2025 growth rate, citing higher infrastructure costs and growth in employee compensation due to its AI efforts.

Over at Microsoft, quarterly profits soared from record revenues in its cloud computing division. But it too is looking to make future money from its massive investment in artificial intelligence. Finance officer Amy Hood said Microsoft spending on data centres would rise to $120bn in 2026 up from $88.2bn in 2025 and almost quadruple the $32bn in 2023. “We are going through a generational tech shift with AI . . . We lead the AI infrastructure wave and took share every quarter this year, we continue to scale our own data centre capacity faster than any other competitor.” But little or no revenue comes from AI so far. Copilot AI apps now had 100mn monthly users, Google’s Gemini with 450mn users and market leader ChatGPT, with more than 600mn. But only 3% actually pay for AI.

Already Microsoft and Meta capital expenditure is more than a third of their total sales. Indeed, capex spending for AI contributed more to growth in the US economy in the past two quarters than all of consumer spending.

And there is no end yet to the AI investment boom. US data center construction hit another record high in June, exceeding $40bn annualized for the first time. That's up 28% from this time last year and up 190% since the launch of ChatGPT nearly three years ago.

But this boom in the stock market, driven by AI hype, is increasingly out of line with the rest of the US economy.

Take the latest US real GDP figures. After the data showed that the Eurozone grew only 0.1% in Q2 2025, the US data showed a rise in real GDP of 0.7%, which translated into an annualised rate of 3.0%, more than forecast. Trump hailed the result. But the headline growth rate was mainly due to a sharp fall in imports of goods into the US (-30%) as the tariff rises began to bite. The fall in imports meant that net trade (that’s exports minus imports) rose sharply, adding to GDP. Excluding trade and the impact of the tariffs, real final sales to private domestic purchasers, the sum of domestic consumer spending and gross private fixed investment, slowed to a rise of just 1.2% compared to 1.9% in Q1.

Indeed, investment growth dropped back in Q2, up only 0.4% vs 7.6% in Q1. Investment in equipment grew only 4.8% compared to the huge 23.7% rise in Q1, while investment in new structures (factories, data centres and offices) fell 10.3% in Q2, having also fallen 2.4% in Q1. Looking through all these volatile changes, the overall picture is that the US economy rose 2.0% in real terms in Q2 2025 over the same period in 2024, at the same rate as in Q1. The US economy is still doing better than the Eurozone and Japan, but at less than half the rate of China.

Source: BEA

Mainstream economist Jason Furman points out that US real GDP growth for the first half of 2025 averaged just a 1.2% annual rate, well below the pace in 2024. So the current 2% a year rate as above is likely to slip further.

Source: Jason Furman

And then there is employment. The latest release on jobs growth in the US was ugly. The US Bureau of Labor Statistics said there was only a tiny 73k increase in July and previous May and June data were revised down sharply, while the unemployment rate rose. Indeed, only 106,000 jobs have been added from May to July, down sharply from the 380,000 added in the previous three months.

This is now the worst job market in the US since the end of pandemic slump. Layoffs are at their highest level with nearly 750k job cuts in H1 2025. Even the high flying tech sector has seen a loss of jobs. Across all subsectors, jobs growth remains well below the peak tech era of 2022 or even the pre-COVID era.

Blame the messenger. On the news of July jobs figures, Trump claimed the US economy had never been stronger; the figures had been rigged and so he sacked the longstanding head of Bureau of Labor stats. It’s true that the jobs statistics are volatile and the Bureau finds it difficult to reconcile different measures of employment growth, but the irony in Trump’s move is that the Bureau’s estimates of payroll employment have got more, not less, accurate over time.

The reality is that the US economy has been slowing down for some time and with it, employment growth. Indeed, America has lost 116k manufacturing jobs over the last year—that's the fastest pace of job loss since the early COVID era and worse than any period from 2011-2019. Big drops in the transportation (-49k) & electronics (-32k) industries have driven most of the decline.

And then there is inflation. Far from inflation rates heading down as the economy slows, the official rates are staying stubbornly closer to 3% a year, instead of the target rate set by the US Federal Reserve of 2% a year.

Source: Furman

You might say, what difference does one percentage point make? But remember American consumers have suffered an average 20% rise in prices since the end of the pandemic slump and with average wage growth now slowing towards 3% a year, any real gains in living standards have disappeared.

Source: Atlanta Fed

Average real weekly earnings for full-time employees are now at the same level as just before pandemic, some five years ago.

All this is well before Trump’s tariffs begin to hit the US economy and consumers. As Fed chair Jay Powell put it: "American businesses have been absorbing Trump’s tariffs so far, but eventually the burden will be shifted on to American consumers.” Trump's latest tariff measures are a mess with no rhyme or reason. He has raised high tariffs on some countries and in some sectors, but not in others. Since Trump took office, the average effective US tariff rate on all goods from overseas has now soared to its highest level in almost a century: 18.2%, according to the Budget Lab at Yale.

A graph of a graph showing the average of goods

AI-generated content may be incorrect.

Source: The Budget Lab

Trump says increased import tariffs are bringing in billions in extra revenue for a government that is running a huge budget deficit of about 6% of GDP a year. But the extra billions are tiny compared to the deficit and revenue is being lost from Trump’s cuts to corporate profits taxes and above all from the slowdown in the economy. Meanwhile, the US trade deficit is running about 50 per cent above last year and will end up higher for 2025 as a whole, while GDP growth will be weaker.

Tariffs are typically paid by the importer of the product affected. If the tariff on that product suddenly goes from 0% to 15%, the importer will try to pass it on. So far, many have resisted and tried to absorb the extra cost. Some 50% say they are “absorbing cost increases internally.” But eventually, the tariff rises will feed into consumer prices. The Budget Lab at Yale estimates the short-term impact of Trump’s tariffs will be a 1.8% rise in US prices, equivalent to an average income loss of $2,400 per US household.

But the tariffs will also lead to less investment at home as US manufacturers find the costs of importing components from abroad rising significantly, and domestic substitutes (if they exist) will be pricier. Profit margins will be squeezed even if prices are raised to compensate. That will add to downward pressure on US economic growth. The Yale Budget Lab reckons if they stay as they are now, Trump’s tariffs will reduce GDP growth by 0.6% pts through the rest of this year and next year (that means the current growth rate of under 2% could fall below 1% by end 2026). As I have argued before, the US economy would then enter a period of stagflation, where economic growth stutters to a near halt, while unemployment rises along with inflation.

This puts the US Federal Reserve in a serious dilemma. Last week, the Fed’s monetary policy committee decided not to lower its policy interest rate. The Fed's policy rate, which sets the floor for all borrowing rates in the US and often globally, was held at 4.25% for the fifth straight meeting. This was despite threatening noises from President Donald Trump who wants a huge cut and says he will remove Fed Chair Powell if he does not get it. But if the Fed cuts rates, that will weaken its ability (such as it is) to control inflation and meet the 2% target. On the other hand, if it continues to hold rates up, then it will add to the borrowing costs of companies and households and so force further cuts in investment and employment.

Now I have argued in the past that Fed monetary policy has little effect on the economy: what matters are profits and their effect on investment. But the Fed’s dilemma between rising inflation and rising unemployment sums up the growing stagflationary environment in the US. And the impact of Trump's trade tariffs has yet to be fully felt. So the Fed faces the prospect of a stagflationary economy.

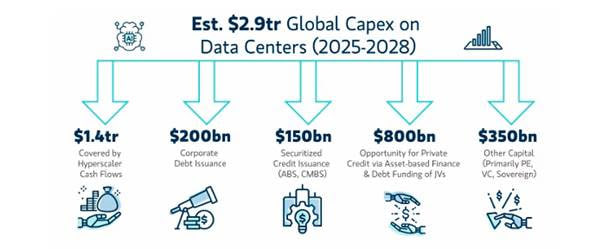

Meanwhile the AI capacity spending boom accelerates. The Magnificent Seven of mega tech companies are paying for this by running down their cash reserves and borrowing more. Of the planned investment in AI data centers of near $3trn by 2028, half will have come from using up cash flows and increasingly nearly another third from what is called 'private credit'.

The tech companies are borrowing less in the traditional form of corporate bond issuance or bank loans and instead opting for getting credit from private credit companies that raise money from hedge funds, pension funds and other institutions and then lend it on. These credit vehicles are not regulated like the bond markets or the banks. So if things go wrong in the AI bubble, there could a rapid reaction in credit markets.

The US has a record high stock market, unlimited spending on AI capacity by the tech giants, along with sharply increased borrowing to pay for it; but no sign yet of any significant revenues or profits from AI – and alongside that: a slowing rest of the economy, a widening trade deficit in goods and increasing unemployment and prices. All this as we go into the second half of 2025.

https://thenextrecession.wordpress.com/2025/08/04/tariffs-and-the-us-economy/

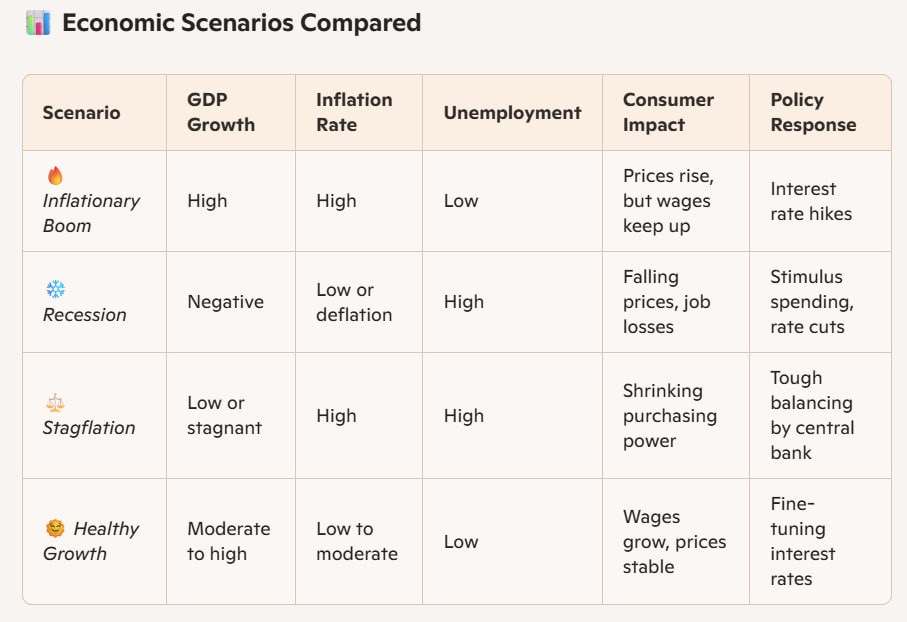

Key Takeaway

In the short term, falling imports (due to tariffs) can inflate GDP artificially, giving the appearance of strength.

In the long run, tariffs raise costs, reduce investment, and risk triggering stagflation—which is when inflation stays high, but economic growth and jobs dry up.

🧠 Origins of the Term

Coined in the 1970s during a turbulent economic period, particularly in the U.S. and UK.

Standard economic theory at the time—Keynesian economics—assumed inflation and unemployment moved in opposite directions. Stagflation broke that mold.

🔬 Economic Theories Explaining Stagflation

1. Supply Shock Theory

Major disruptions in supply chains (like oil embargoes) raise input costs.

Businesses respond by hiking prices → inflation.

At the same time, production slows, leading to layoffs → unemployment.

- Structuralist View

Long-term rigidities in labor markets, resource allocation, or industrial policies trap economies in inefficiency.

These bottlenecks stifle productivity, while prices continue to climb.

- Monetarist Critique

Argues that excessive money supply growth caused inflation.

Central banks tried to stimulate growth with low interest rates but triggered rising prices instead.

If they tighten too late, the economy slows and unemployment rises.

- Cost-Push Inflation

Wages and input prices rise faster than productivity.

Companies raise prices to maintain margins → cost-push inflation.

Consumers reduce spending due to high prices, dampening growth.

⚠️ Why It’s So Hard to Manage

Inflation-fighting tools (e.g., high interest rates) slow down the economy.

Growth-stimulating tools (e.g., rate cuts) stoke inflation.

Central banks must make tough trade-offs, often choosing between price stability or job growth.