Crypto Options Vol - Chang

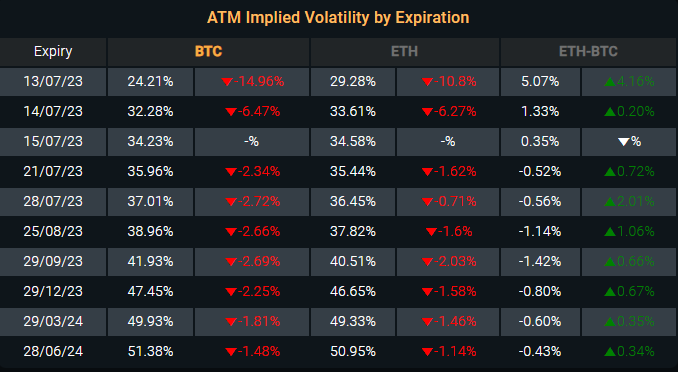

Crypto options vol has fallen sharply over the entire period since the CPI event. Short-term options bleed more. However, it is a kind of "pattern" that has always been repeated. Vol rose before the CPI or FOMC and fell right after, unless there were special cases. And there was always no change in the price of the underlying asset.

The crypto market currently has little correlation with other assets and is exhibiting independent movements. Recently, there has been little price change at the 30k level, and as a result, sellers are generating stable profits even in a low Vol environment. See Greekslive's comment in this regard.

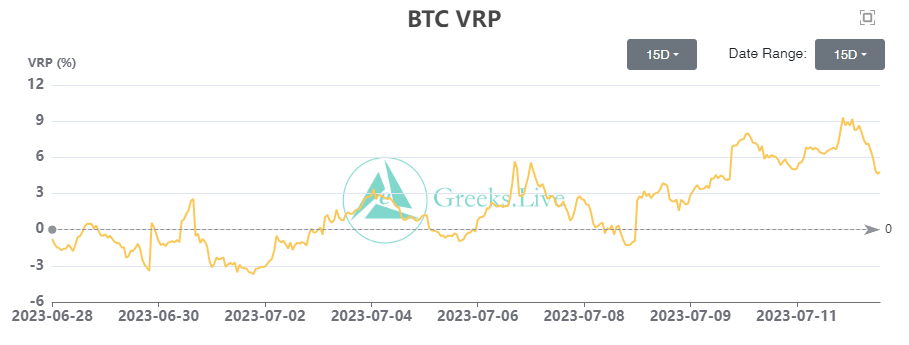

"CPI data is just around the corner, but the current macro data has had limited impact on crypto, with none of the short-term option IVs showing gains this week. The data of note is that short-term VRPs continue to rise, with the BTC 15D VRP already up 9% and ETH 15D VRP back in positive, while long-term VRPs are flattening out after last month's big rally, with all major VRPs above their annual averages. Sellers have been able to continue to profit in such a low IV environment at the moment, thanks to very low volatility levels of late." - Greekslive

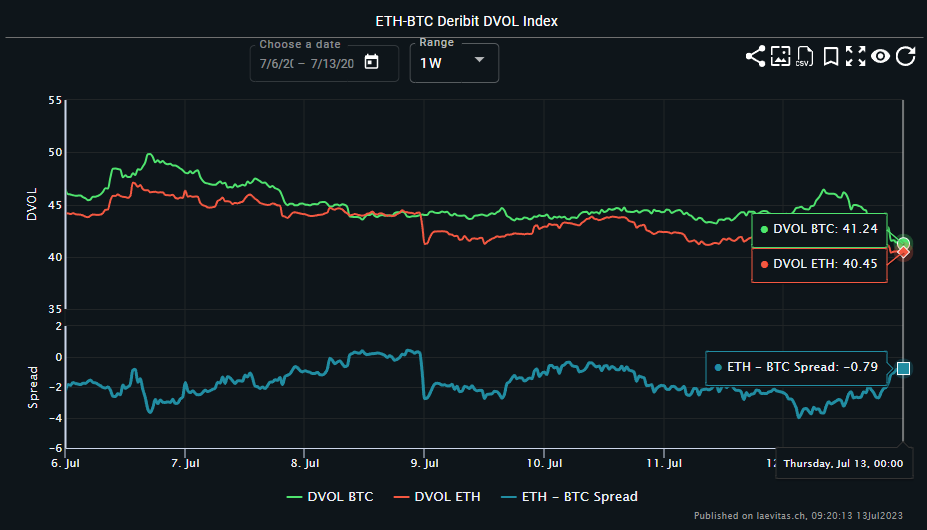

BTC, ETH DVOL are both near their lows. ETH is still Vol lower than BTC. The spread gap has narrowed more than before.

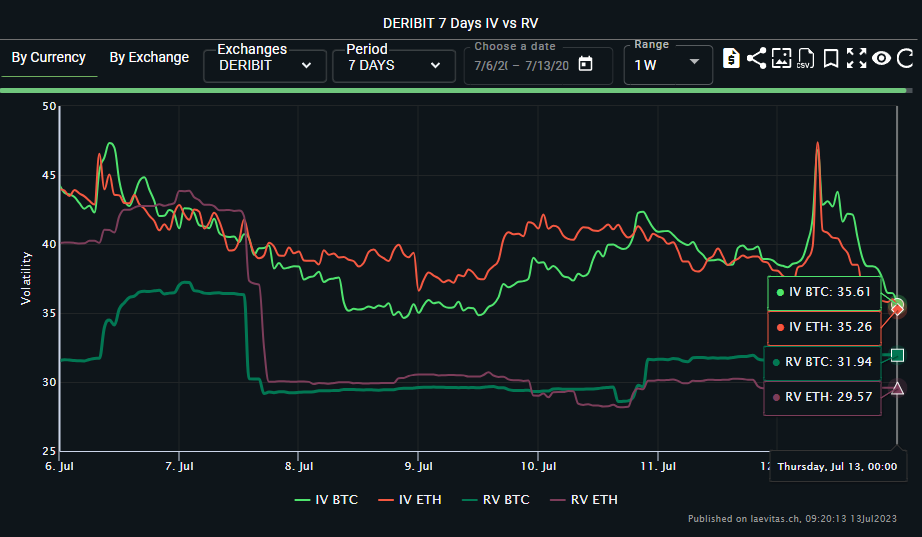

The RV-IV spread is also narrower than before. In most situations, it is highly likely to maintain a low Vol state continuously. But sometimes there will be opportunities for buyers.

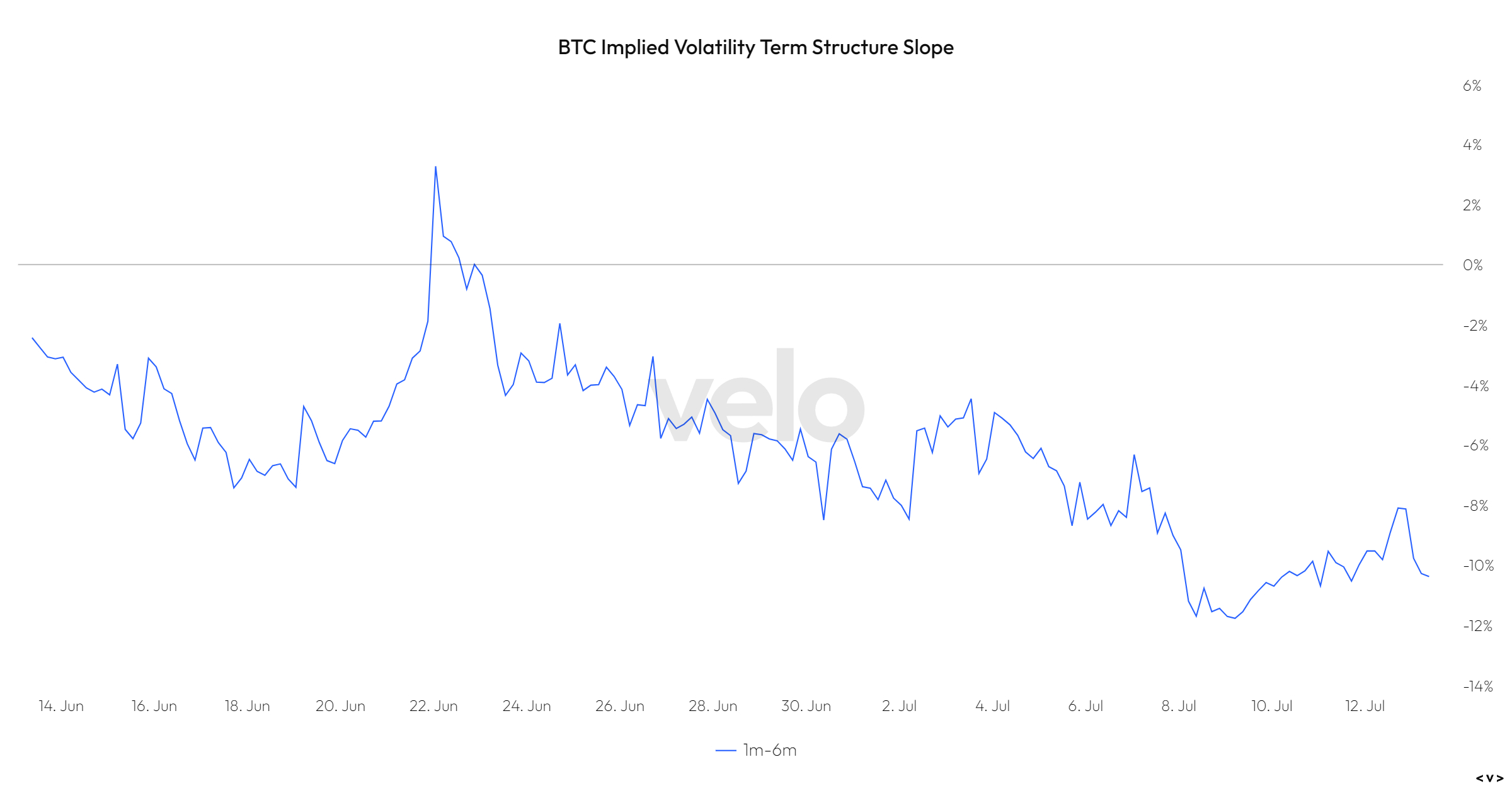

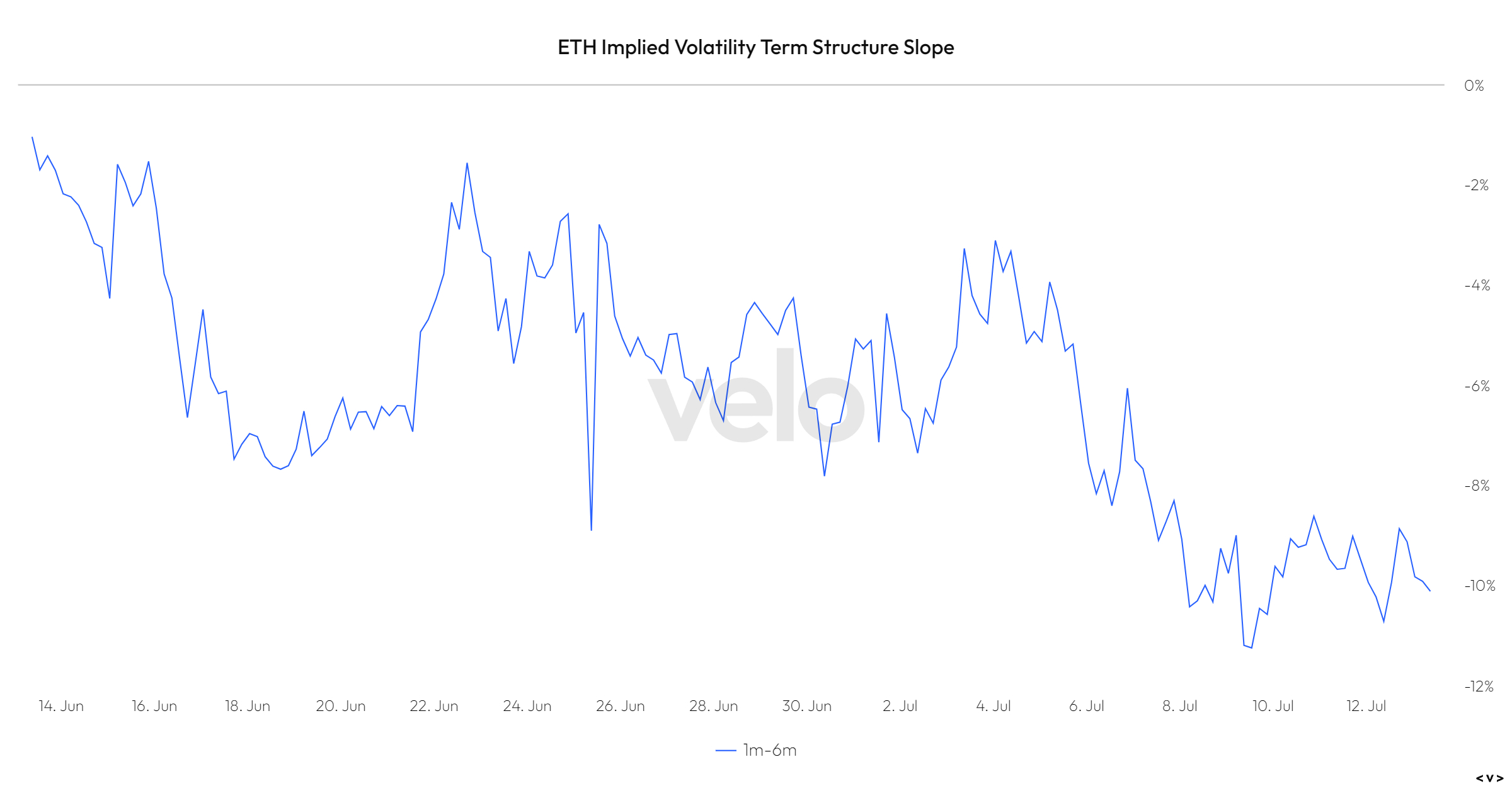

Historical volatility continues to move lower, with VRP returning to positive premiums. However, the implied volatility started to diverge, with the short-term IV falling rapidly to new lows since last month's rally, while the long-term IV has maintained its uptrend and is now at a two-month high. The main reasons for this situation are:

1) Interest rate and arbitrage strategies are more crowded due to fewer hot spots in the overall market at the moment, and as low IVs have persisted for a longer period of time, sellers have mainly focused on the short term, pushing down short IVs sharply.

2) As the market moved into the second half of the year and the halving of BTC approached, there were whales betting on the year end market, which pushed the forward IV up.

This has created a divergence between the short and long term options and it is now more effective to buy calendar spreads. - Greekslive

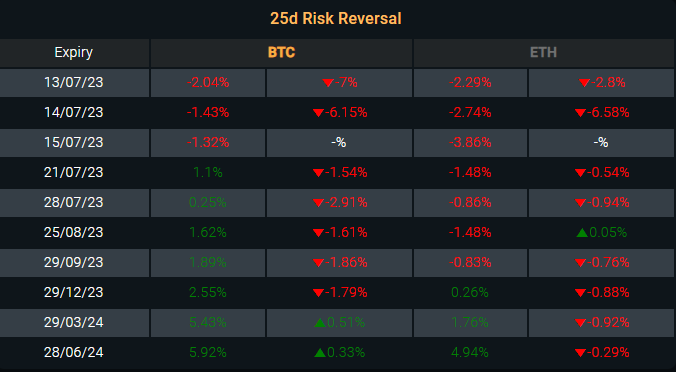

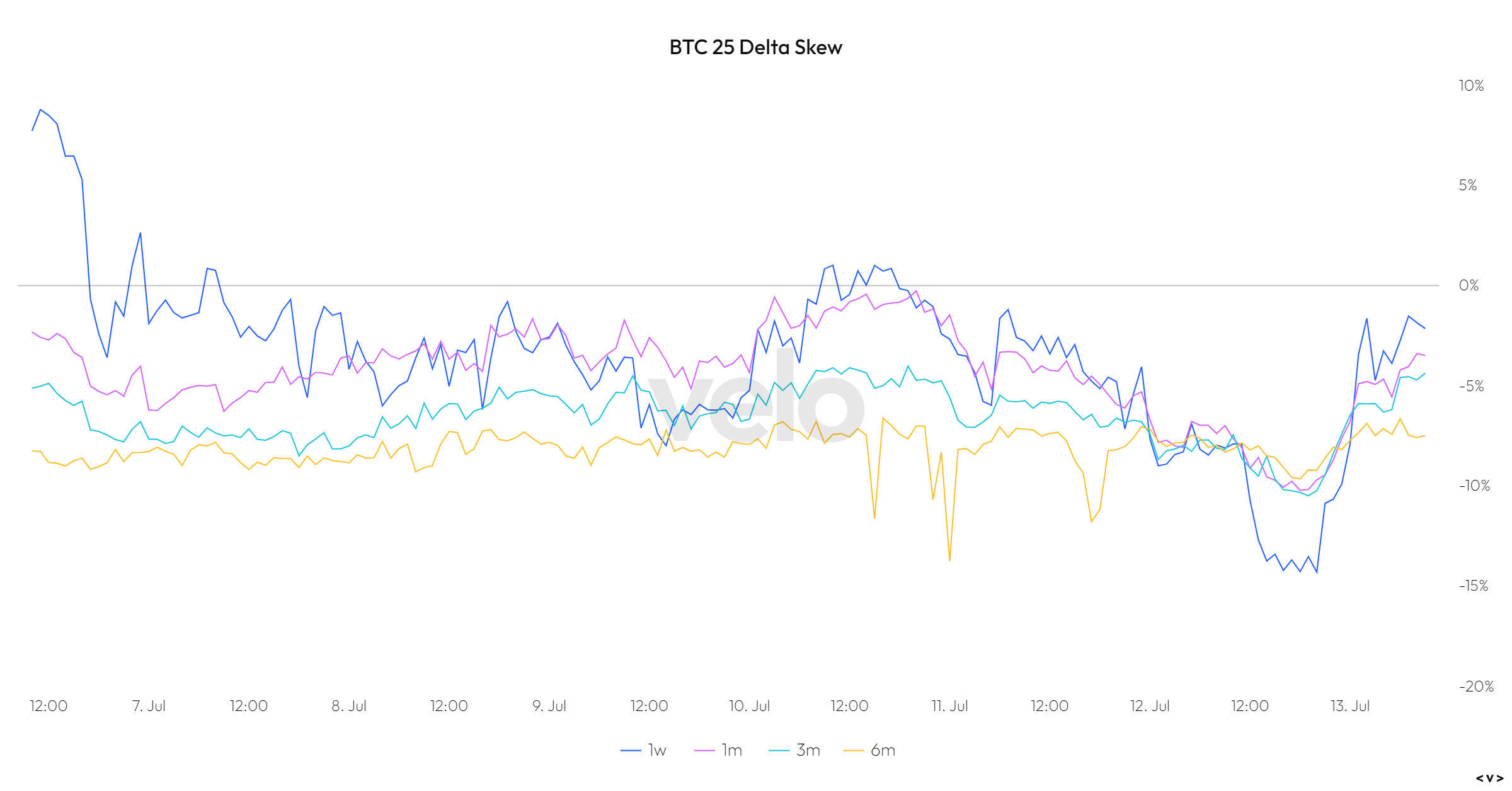

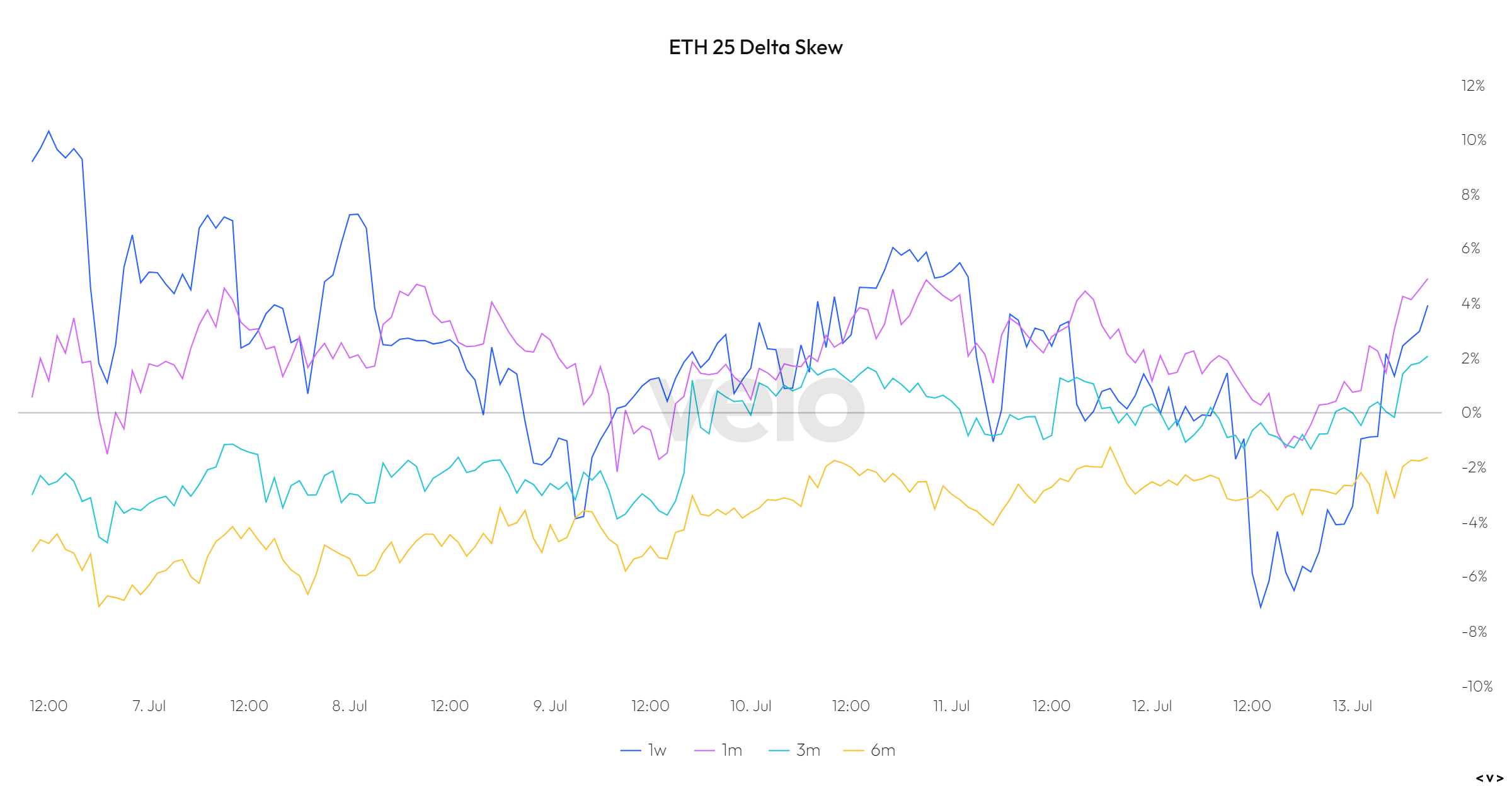

It seems that sentiment is gradually cooling in the options market. The BTC skew is still more focused on calls, but sentiment seems to be weaker than before. ETH is more negative right now than BTC.

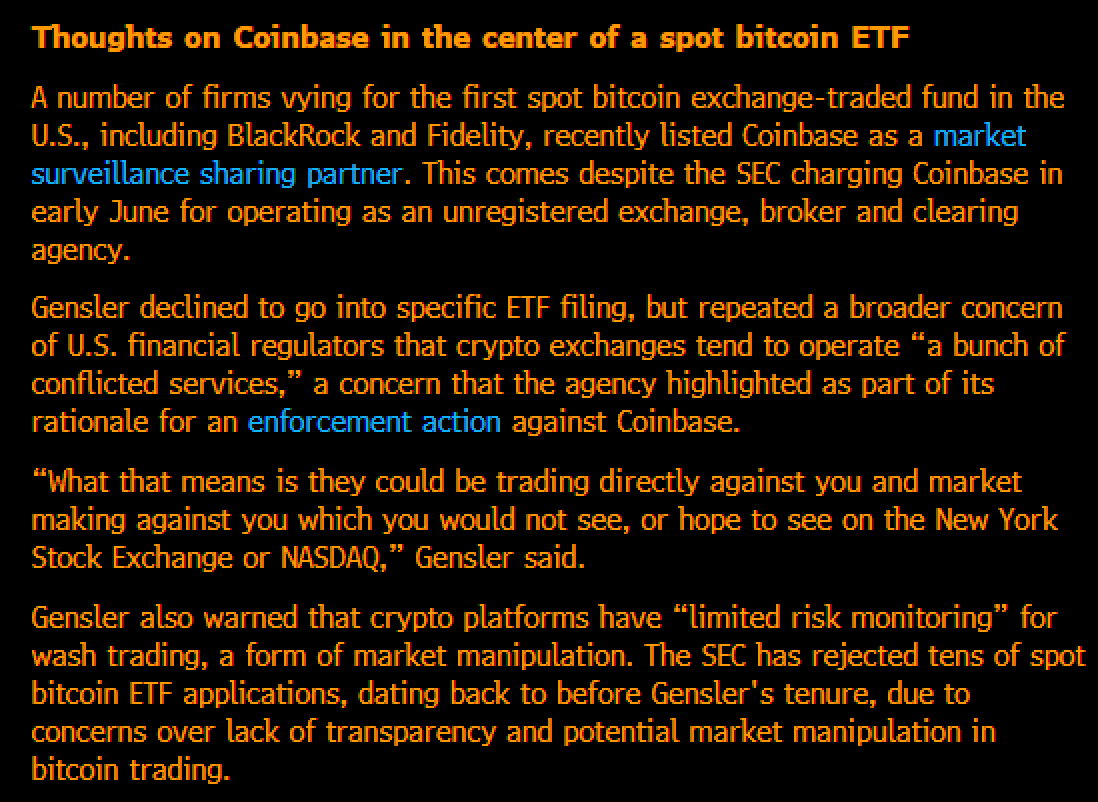

Gensler Comment

Gensler was asked today in a webinar about Coinbase being at center of ETF filings. He couldn't comment on the filings but went pretty negative on crypto exchanges saying they operate "conflicting services" and have "limited risk monitoring" Here's full quote via @TheBlock

Initial reaction: seems like a bit of cold water (bc in the futures ETF filing race which we predicted right, Genz's words proved imp clues). This makes seem like SSA could be pointless if this is problem for him? (but that would be moving goal posts bc no mentioned in denials)

Once again tho, Nasdaq and BlackRock both knew he had these kinds of problems w exch. Very poss they working with Coinbase to address all this, which means the SEC using ETF approval as leverage to clean all this up (which is largely our theory on why approval IS very poss).

GS Desk

“.. The $SPX is now ~3% higher than where it was when the Fed started hiking .. For first time in 2023 we are currently being asked by multiple clients if we think the S&P 500 is now on track to clock an ATH before year end. I am going with a yes on this..”

Source Tweet - Carl Quintanilla

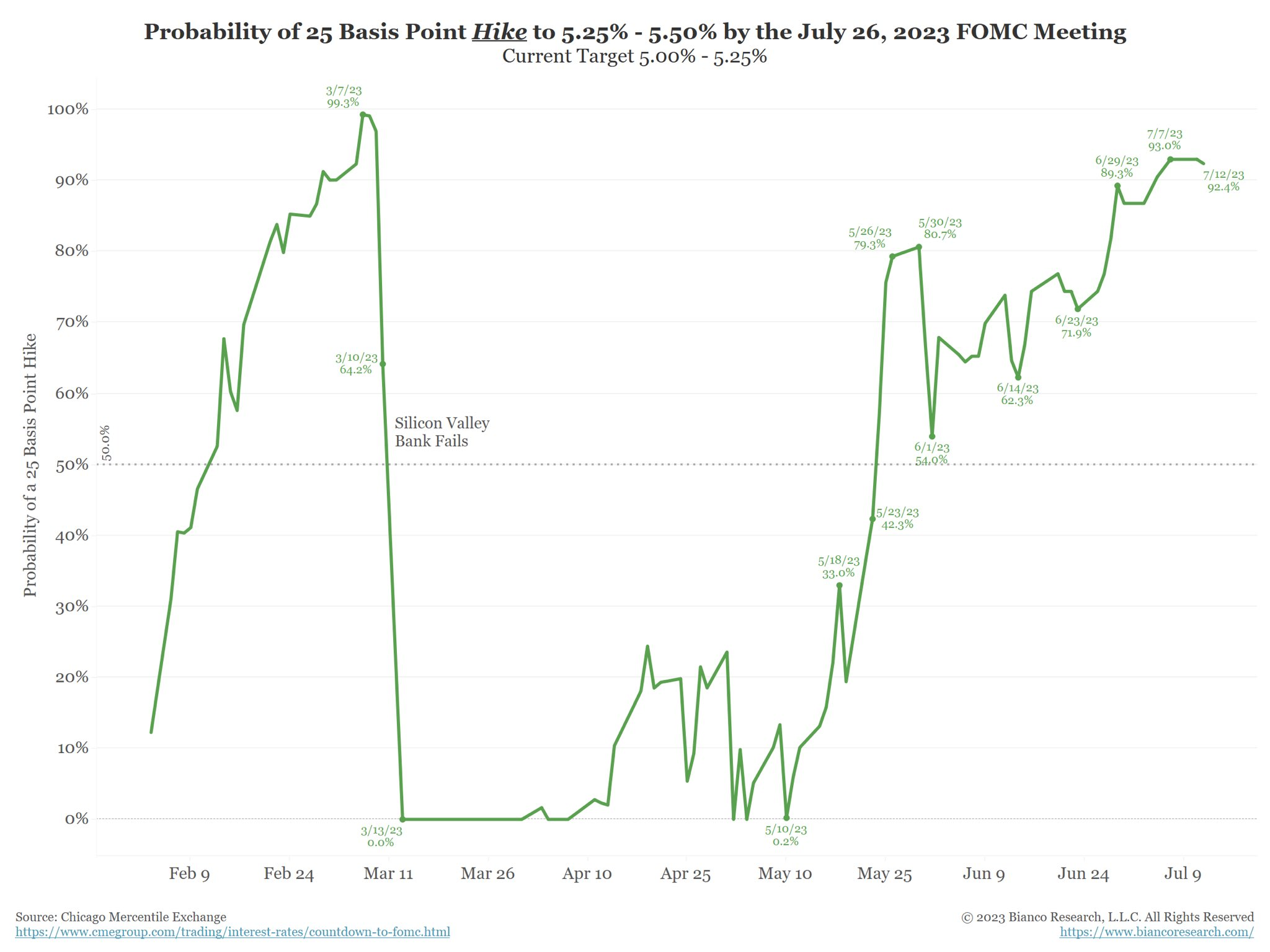

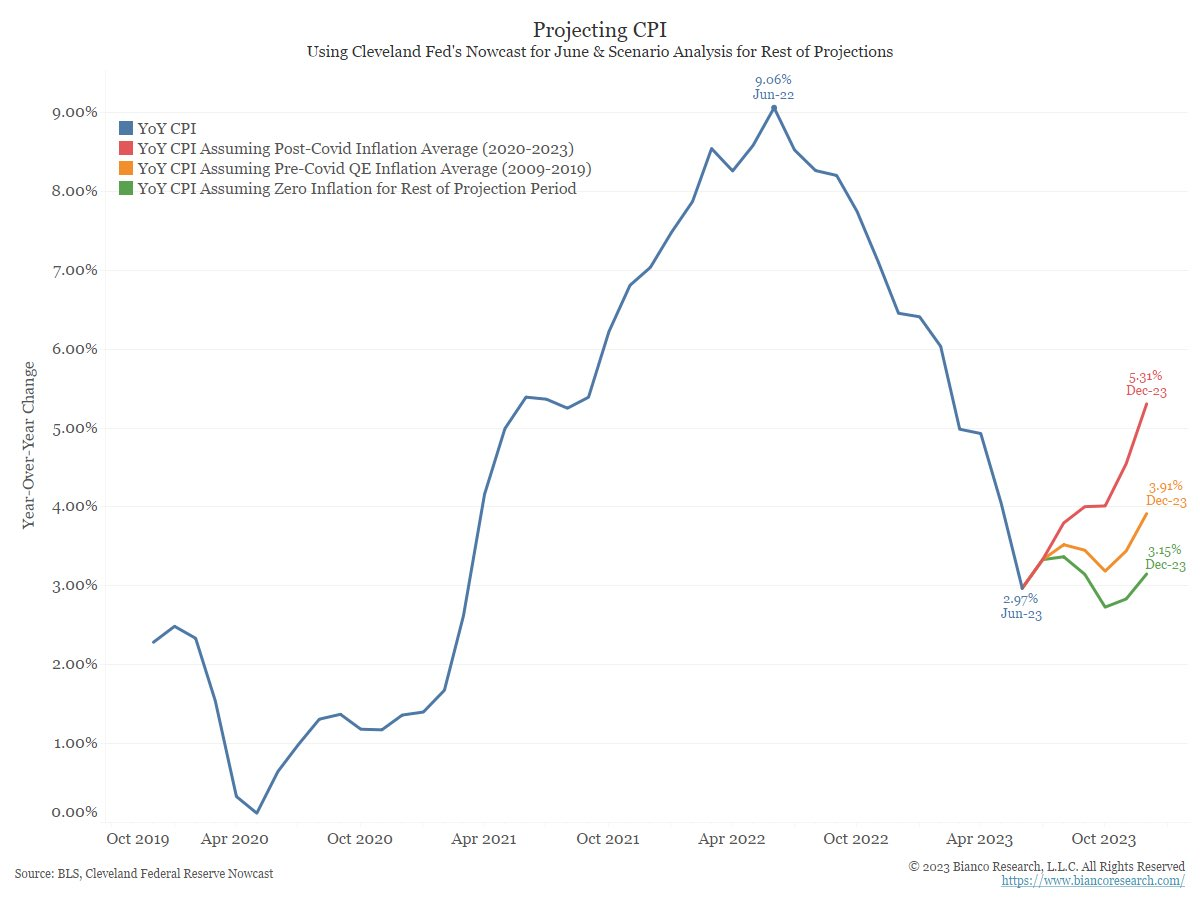

CPI

Despite the better-than-expected CPI report today, the probability of a July 26 rate of 25 basis points to 5.25% to 5.50% barely moved.

The market is strongly expecting a hike in two weeks.

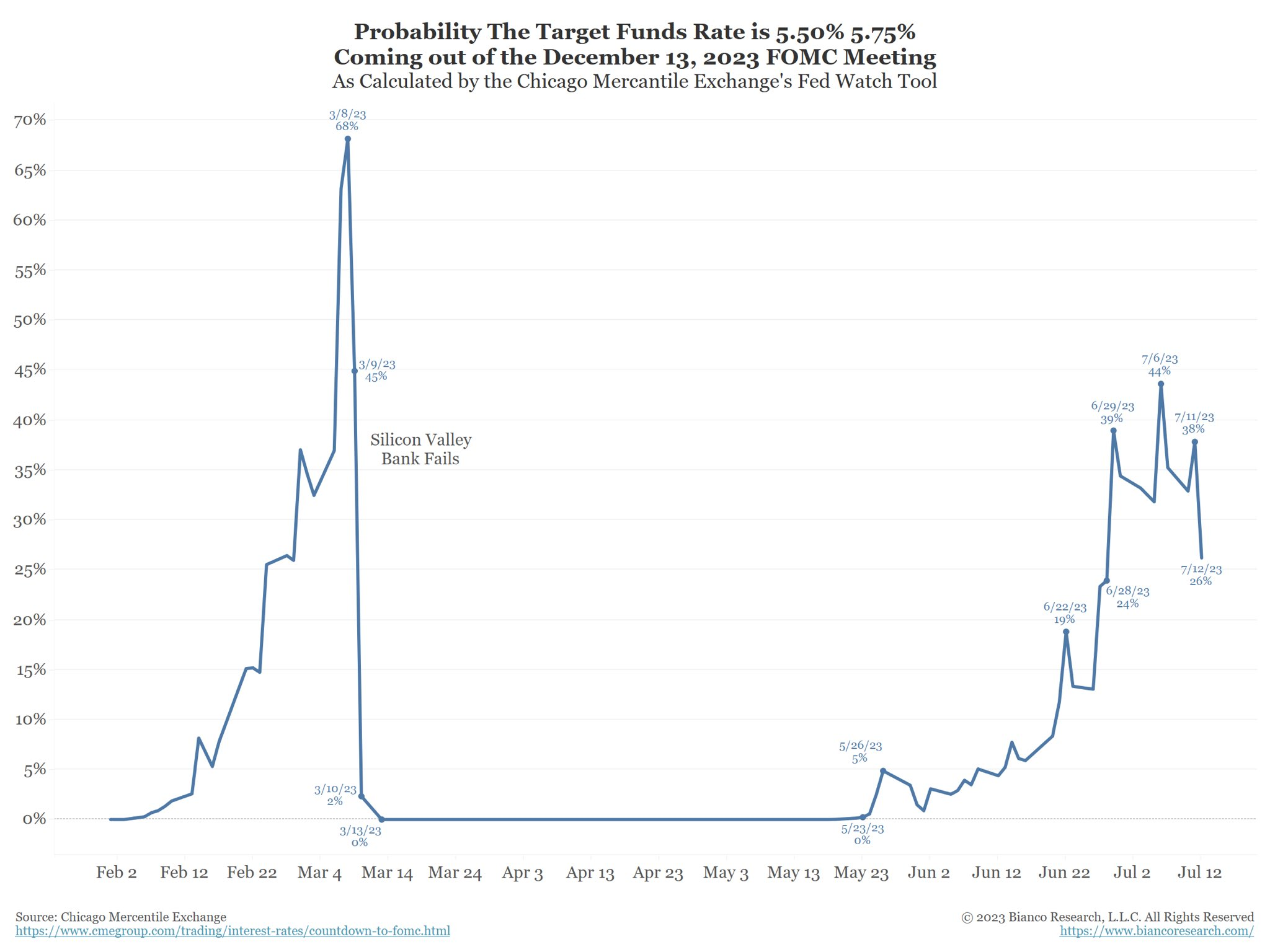

But will we get the second 25 bps hike the Fed dot plot signaled for later this year?

Below the probability of another 25 bps hike by December (assuming a 25 bps hike on July 26).

Note this probability has yet to get above 50% (post-SVB). And now it has declined to 26%.

Remember, for the last 18 months the market has consistently underestimated the Fed at every step.

Words like “pause,” “pivot,” “step-down,” and “skip” were used to explain why the Fed will soon stop.

So the talk of July beimg the last hike is not new.

July 2022 CPI was 0.0%, and August 2022 was 0.2%.

It will be much easier for the July 2023 and August 2023 CPI numbers to “jump over” these numbers so year-over-year CPI is poised to rise for the rest of the summer.

Today’s CPI release does not appear to have changed the markets view of the Fed in July. They will hike 25 basis points to a fed funds rate of 5.25% to 5.50%.

After that, this release does not matter as more data will be released before the September meeting.

If this red headline holds, expect ever higher CPI.

*BRENT CRUDE RISES ABOVE $80 A BARREL FOR FIRST TIME SINCE MAY

If YOY CPI bottoms at 3% this month and starts creeping higher, we don’t believe the Fed declares victory. Expect at least one more hike after July 26.

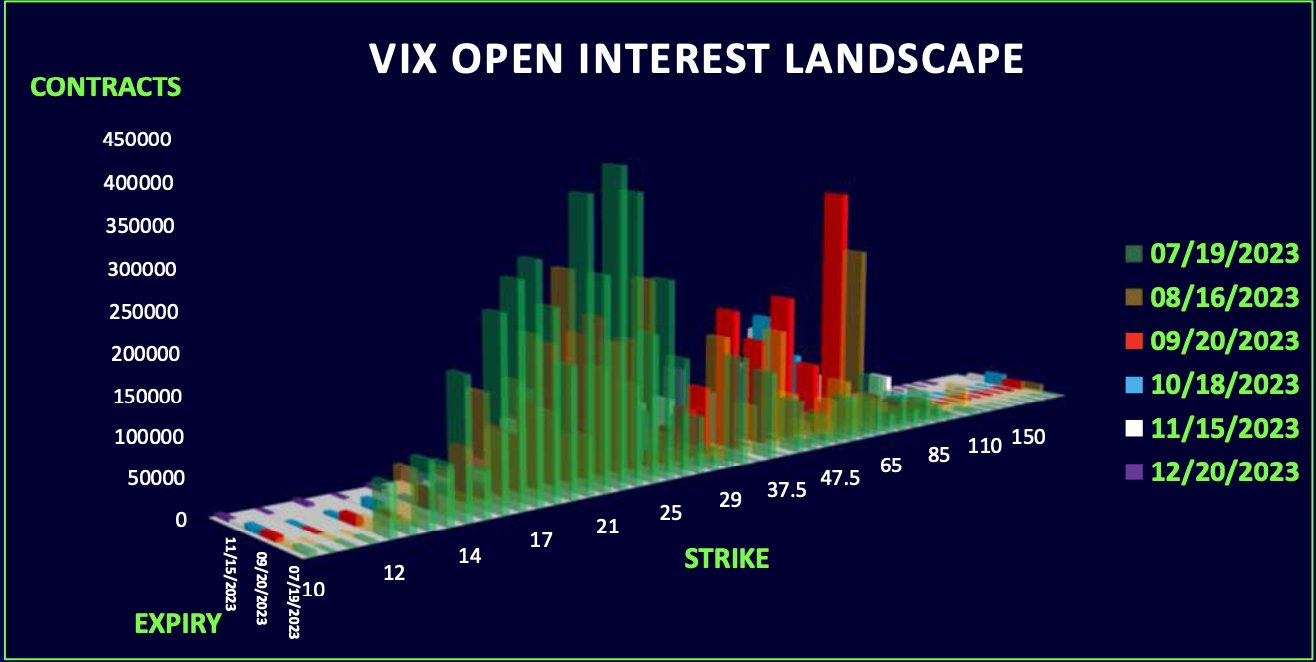

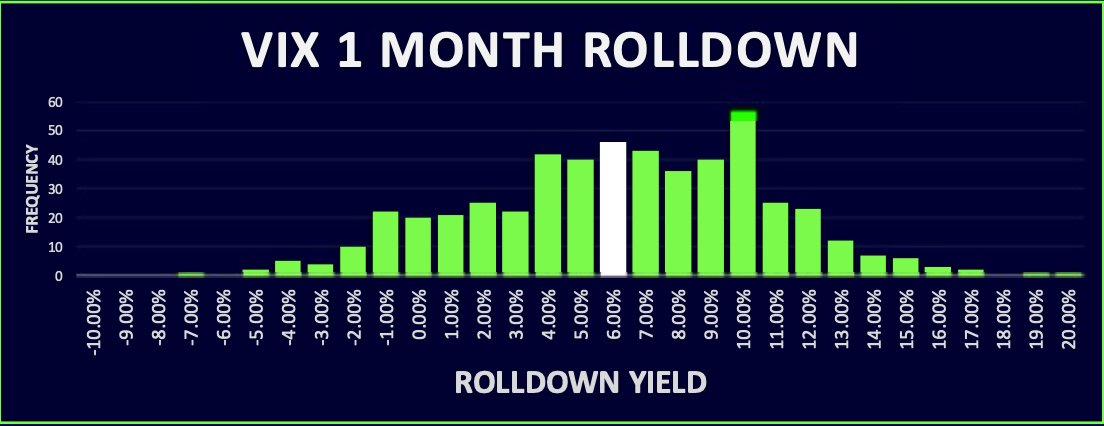

VIX

Now that CPI is out...

Focus will shift to earnings and VIX likely to grind lower.

Loads of July upside calls on VIX that will decay away over the next week.

Dealers are clearly short these which is why VVIX is so elevated relative to VIX. CHARM effect will make them sell July VIX futures.

The roll down in the VIX term structure is quite flat given the level of vols down here. Normally would be much steeper into VIX expiry.

Fed Reverse Repo

SEC BTC ETF

UPDATE: have confirmed with several firms that there is NOT a collective #Bitcoin ETF meeting with the SEC today.

**no coordinated effort, and no formal ‘grand bargain’ meeting occurring in DC today.

**each firm is aware of their current standing and keeping SEC lines of communication open and fresh.

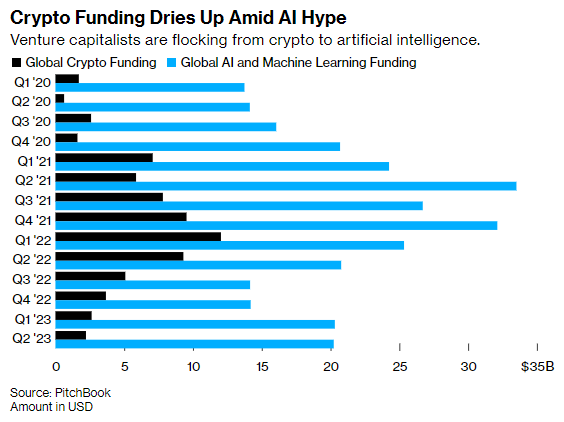

VC Spent

"In the most recent quarter, VCs spent less on crypto and digital asset companies than at any point since 2020...At the same time, the total global value of investments in AI for the April-June period was higher than crypto even at its peak."

Source Tweet - Daily Chartbook

Tomorrow Earnings

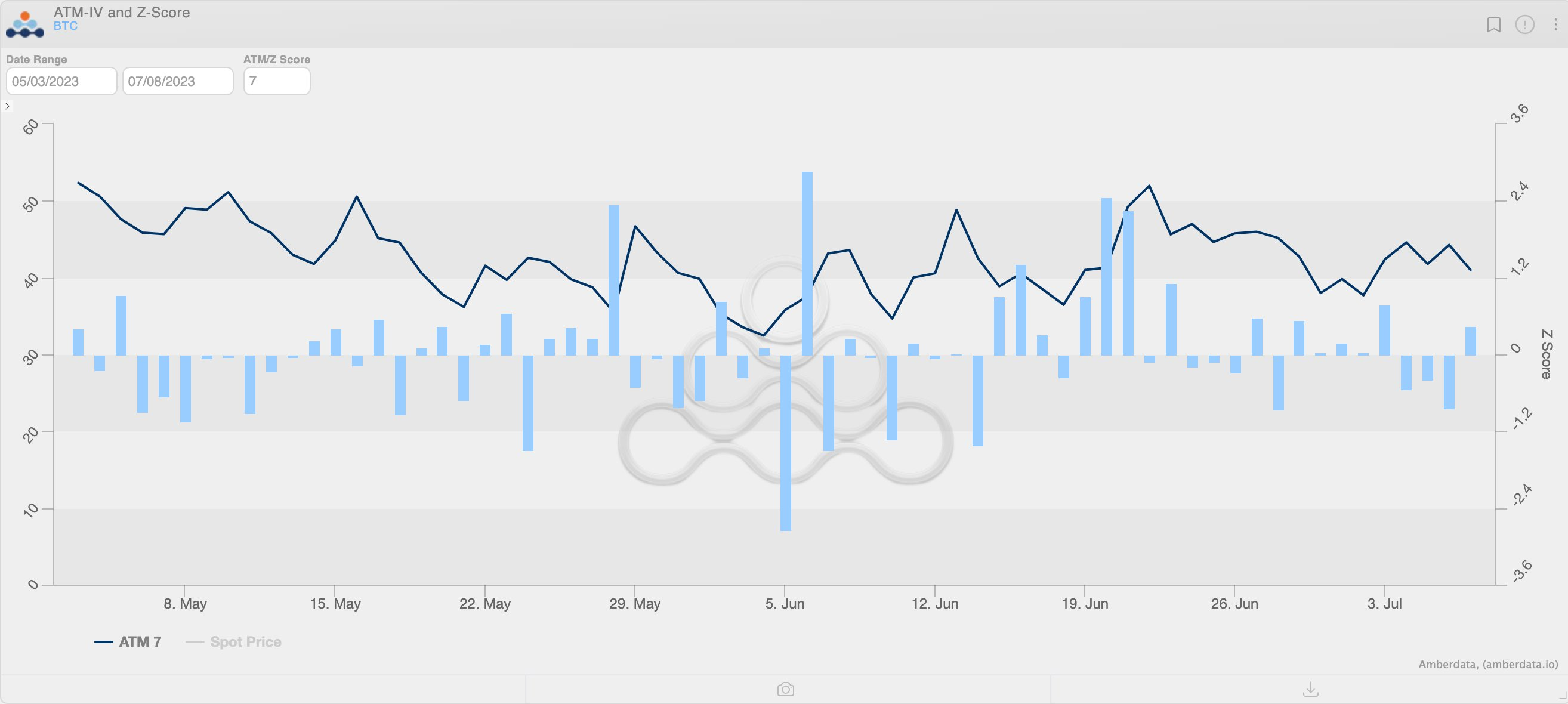

Amberdata Options New Feature

Fresh New Feature: ATM-IV and Z-Score

This endpoint compares the daily implied move from ATM-IV versus the close-to-close log-normal return witnessed.

We, therefore, get the size (in standard deviations) of the daily price return. IV is the "Opening" value at the timestamp time. While LN and close, represent the closing return and closing price respectively.

This chart gives users a clear visual representation of the magnitude of the daily return and the subsequent response in ATM-IV.

You can view instruments, risk management tools, and crypto options activity on the Amberdata Derivatives App: Amberdata.io

Analysis Articles

Kaico Research - Q2 Liquidity Ranking for Crypto Assets

Paradgim - The Macro Pulse | Bond Bloodbath: What does this mean for Crypto?

ASGARD Markets - The Fabric of Interest Rates