ETH

Crypto Options Market

ETH option interest is back!

ETH finally leading the way higher on the heels of XRP ruling w/ ETH +6% vs. BTC +3%.

Eyewatering performance out of crypto equities with COIN +25%, MARA +15%, MSTR +12%.

Let's get into it 😎

For maybe the first time since Shapella, ETH Deribit volumes have outdone BTC, with Jul 2ks quite active on Paradigm.

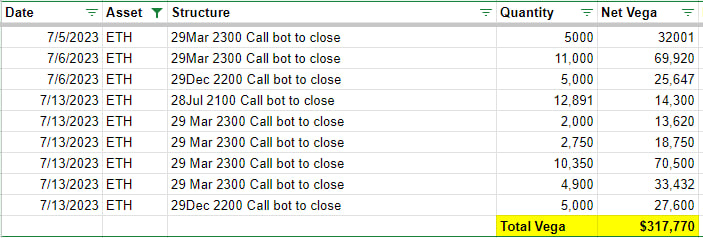

A good amount of today's Paradigm flow felt connected to the elusive overwriter who hastily covered large outstanding short positions in the wake of the rally.

The most covering activity we've seen yet...evident through significant OI decreases across their active strikes. Note this entity does not trade on Paradigm, some prints below:

20k 29-Mar-24 2300 Call bought

13k 28-Jul-23 2100 Call bought

5k 29-Dec-23 2200 Call bought

Considering the enormous size of their trades (which are a lot smaller after today), we're a bit surprised by the entity's strong reaction to market-to-market swings and their quickness to cover risk on spot/vol moves still pretty mild compared to crypto history

Top BTC Structures on Paradigm:

1. 500x 28-Jul-23 32000 Call bought

2. 372x 25-Aug-23 32000 Straddle bought

3. 200x 29-Sep-23 50000 Call bought

Top ETH Structures on Paradigm:

1. 10000x 25-Aug-23 2000 / 29-Dec-23 2100 Call Calendar sold

2. 9250x 21-Jul-23 2000 Call bought

3. 8000x 28-Jul-23 2000 Call bought

4. 7625x 25-Aug-23 1800/2200 Bull Risk Reversal bought

5. 7000x 29-Sep-23 1700/2300 Strangle bought

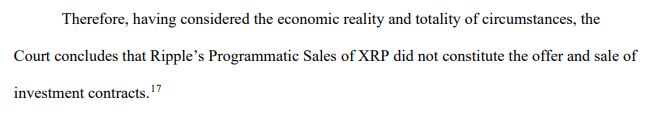

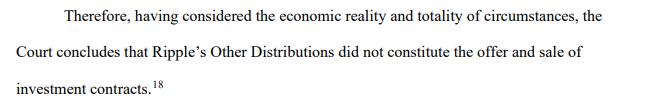

XRP Good/Bad

Ripple case, here is the good and the bad.

But it is mostly VERY good for all alts, and a surprisingly big win for XRP.

First Judge did decide institutional sales/fundraising was securities.

But, that the programmatic sale on exchanges didn't meet third prong of Howey.

So sales to users via exchanges was fine, as long as it was through orderbook and not ICO/IEO/Launchpad like things.

Bounties, investments in others using XRP, grants using XRP, and transfers to execs in XRP not considered securities

Overall a huge win.

XRP is one of the more centralized foundations, with a key figure head, who had standard sales via exchanges, and formal distribution programs.

If those aren't securities, nearly nothing sold via exchanges is.

Moral:

-Don't do institutional private rounds/OTC

-Sell via exchanges

-Distribute via protocol natively

-Fuck you Gensler.

Win.

PS - If XRP isn't a security, clearly BTC and ETH are not either.

Good luck on stopping the ETF now Gensler. 🖕

One huge fucking winner here is exchanges.

If institutional sales, OTC, and direct token sale raises are securities, then all selling is going to flow through public order books again.

No more billions in convertible funding rounds early on.

Now tbf remember this is on the summary judgement and so you can have this go further to trial and appeal etc. It doesn't mean case closed but it's a HUGE fucking win and well reasoned.

Coinbase XRP Re-Enable

Source Tweet - Coinbase Assets

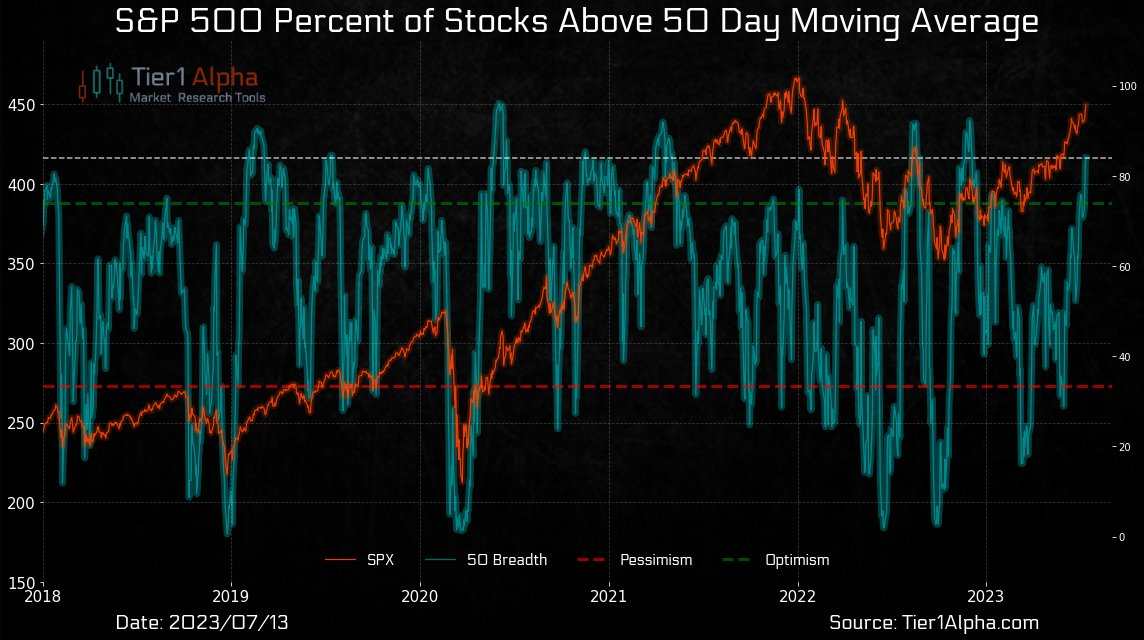

SPX 50DMA

Breadth is back with a vengeance. 83% of $SPX components are trading above their 50-day moving averages.

That's a 97%ile reading over a ten-year period.

SPX Vol

1 month realized volatility in SPX is <10 for the first time since Nov '21.

This drops the floor for implied volatility, which dropped after CPI.

We're looking for another 5 or 6 days of relative quiet before VIX exp/OPEX loosen things up.

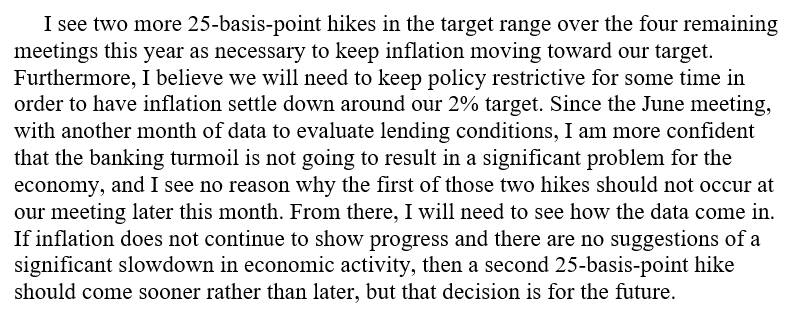

Fed July Hike

Fed governor Chris Waller signals he’s all-in for a July hike

He says he’d be prepared to hike again “sooner rather than later” (i.e., in September) “if inflation does not continue to show progress” and if “there are no suggestions of a significant slowdown in economic activity”

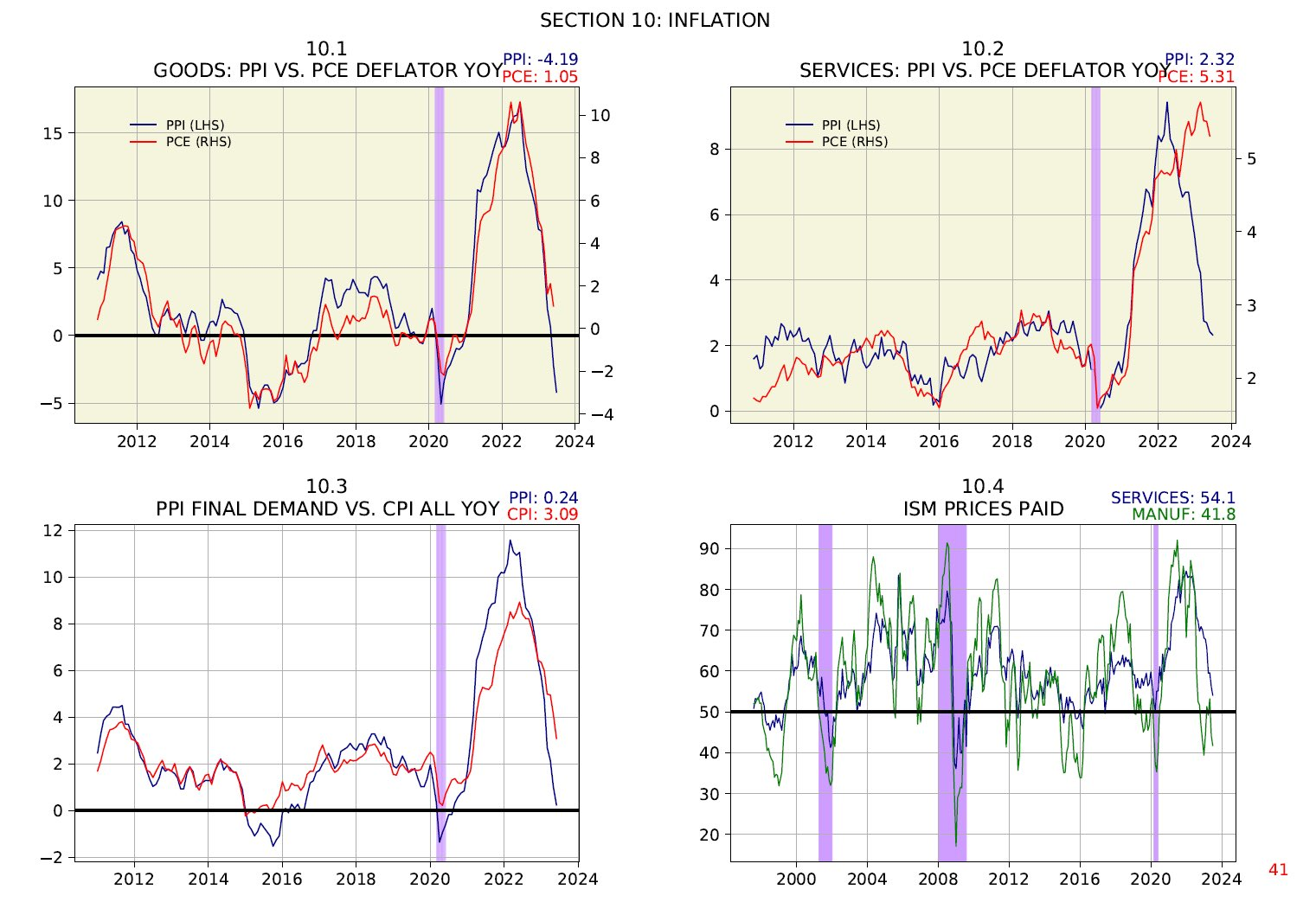

PPI

Producer Price Index (PPI) Has Plummeted Like a Brick

Good: -4.2%

Services: 2.3%

All: .24%

Disinflation and even deflation.

PPI peaked 9 months after excess real money supply peaked, whereas CPI peaked at 11 months. PPI doesn’t have the problem of imputed (made up and lagging) shelter like CPI.

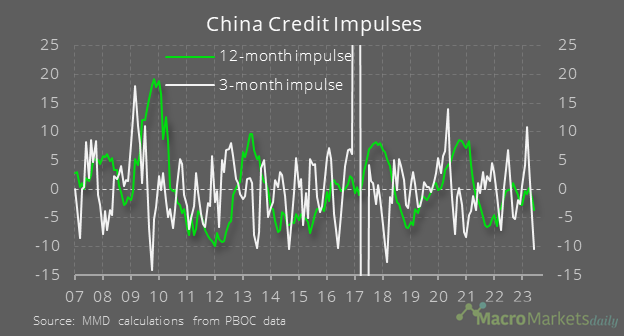

China Credit Impluse

Looking at China's credit impulse on a three-month basis shows a big contraction up to June, the largest since early 2018 and underscoring the disappointing nature of China's recovery

Source Tweet - MacroMarketsDaily

12 Interesting Charts

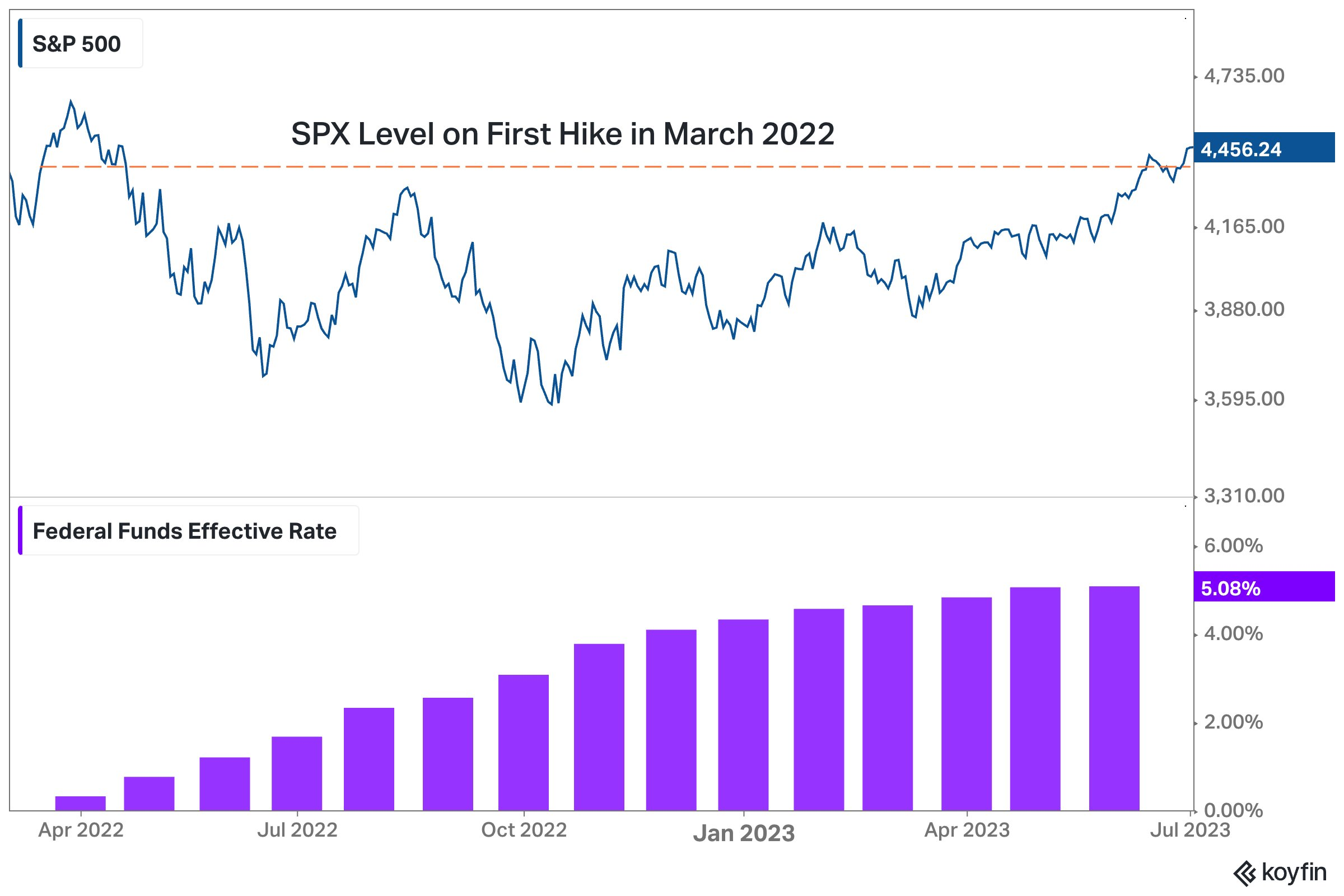

1/ The Equites detox was one hell of a ride.

The S&P 500 has now surpassed the level it traded at when the Federal Reserve initiated the current rate hike cycle back in Q1 of 2022.

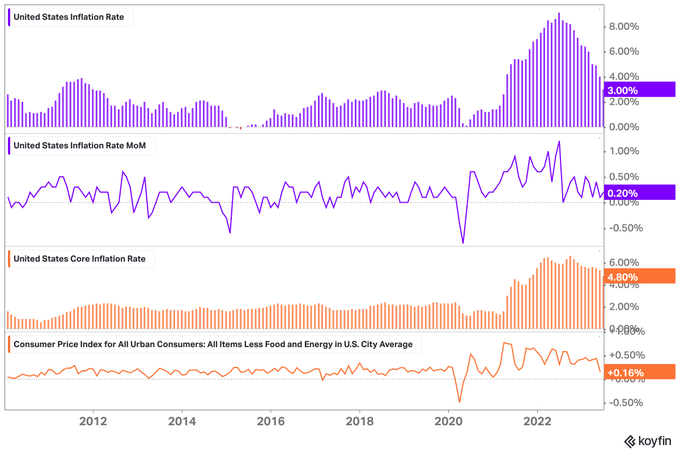

2/ Some are saying "we are so back" after June's US CPI data came in nice and cool.

• CPI MoM: 0.2% (vs 0.3% exp)

• CPI YoY: 3.0% (vs 3.1% exp)

• Core CPI MoM: 0.2% (vs 0.3% exp)

• Core CPI YoY: 4.8% (vs 5.0% exp)

Others are saying pay attention to core CPI.

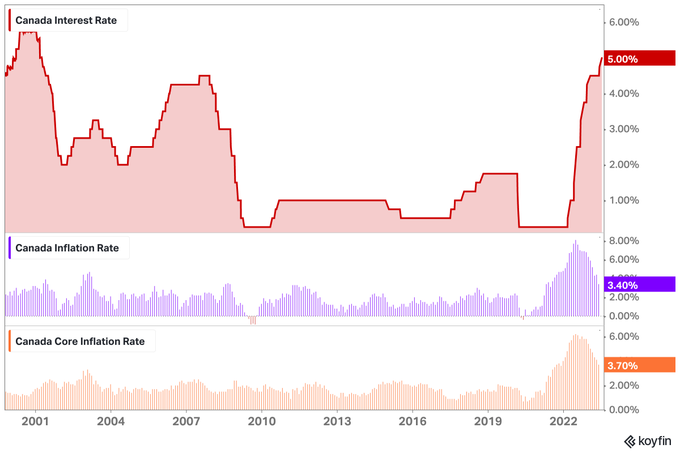

3/ Meanwhile, in Canada, the BOC raised rates again yesterday.

The 25bps hike takes the rate up to 5.0%; the highest level in over 20 years.

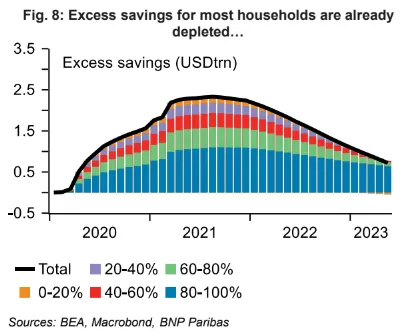

4/ BNP Paribas shows that household excess savings are depleting.

“We estimate the top income quintile currently holds just over 80% of excess savings. The 0-20% and 20-40% quintiles have already depleted their excess savings balances".

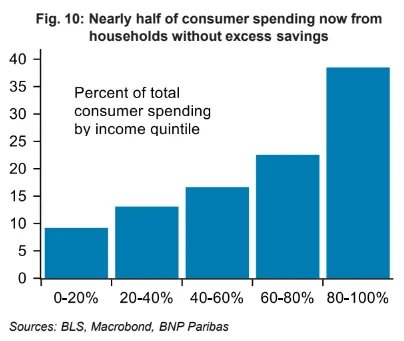

5/ More from BNP on excess savings:

"The 40-60% quintile will likely follow in the next month or so. Spending by all income quintiles excluding the top one covers about 65% of total consumption".

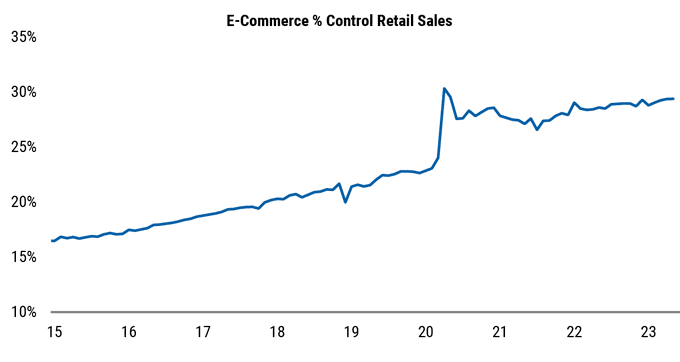

6/ Remember the "e-commerce pull forward" narrative?

Morgan Stanley thinks "It does look like the pandemic may have kicked e-commerce into a sustained higher gear".

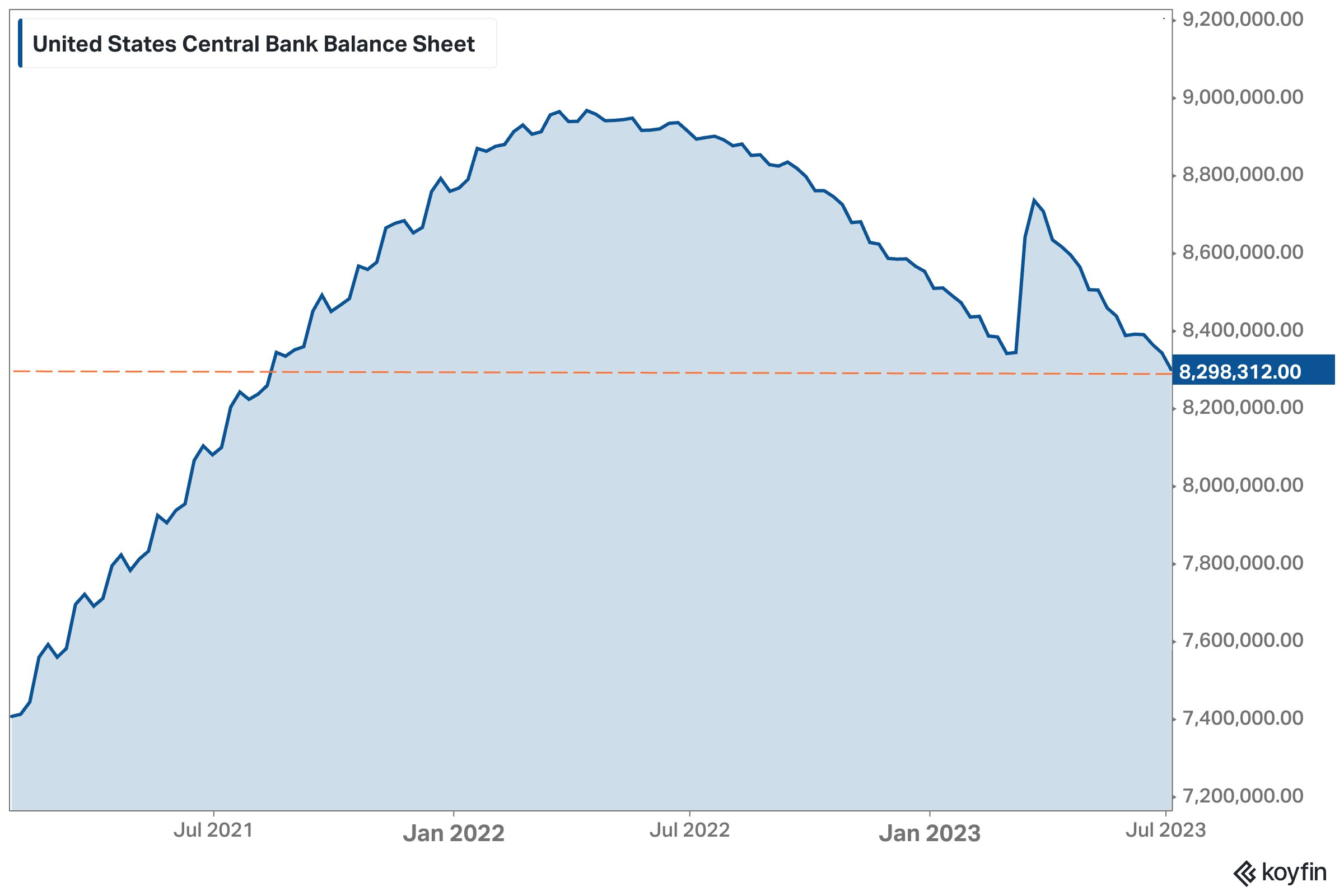

7/ The Fed's banking stress spike has been erased.

"Worth noting that thru last week, spike in Fed's balance sheet (which coincided with banking stress earlier this year) has been completely undone - total assets now at lowest since mid-2021".

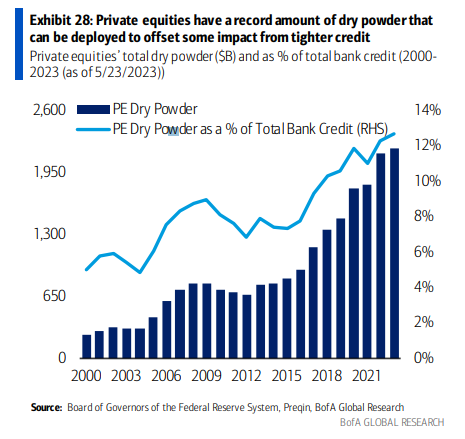

8/ Private equity has been saving?

"Private equity has a record amount of dry powder" sitting ready to deploy in the face of tighter credit conditions.

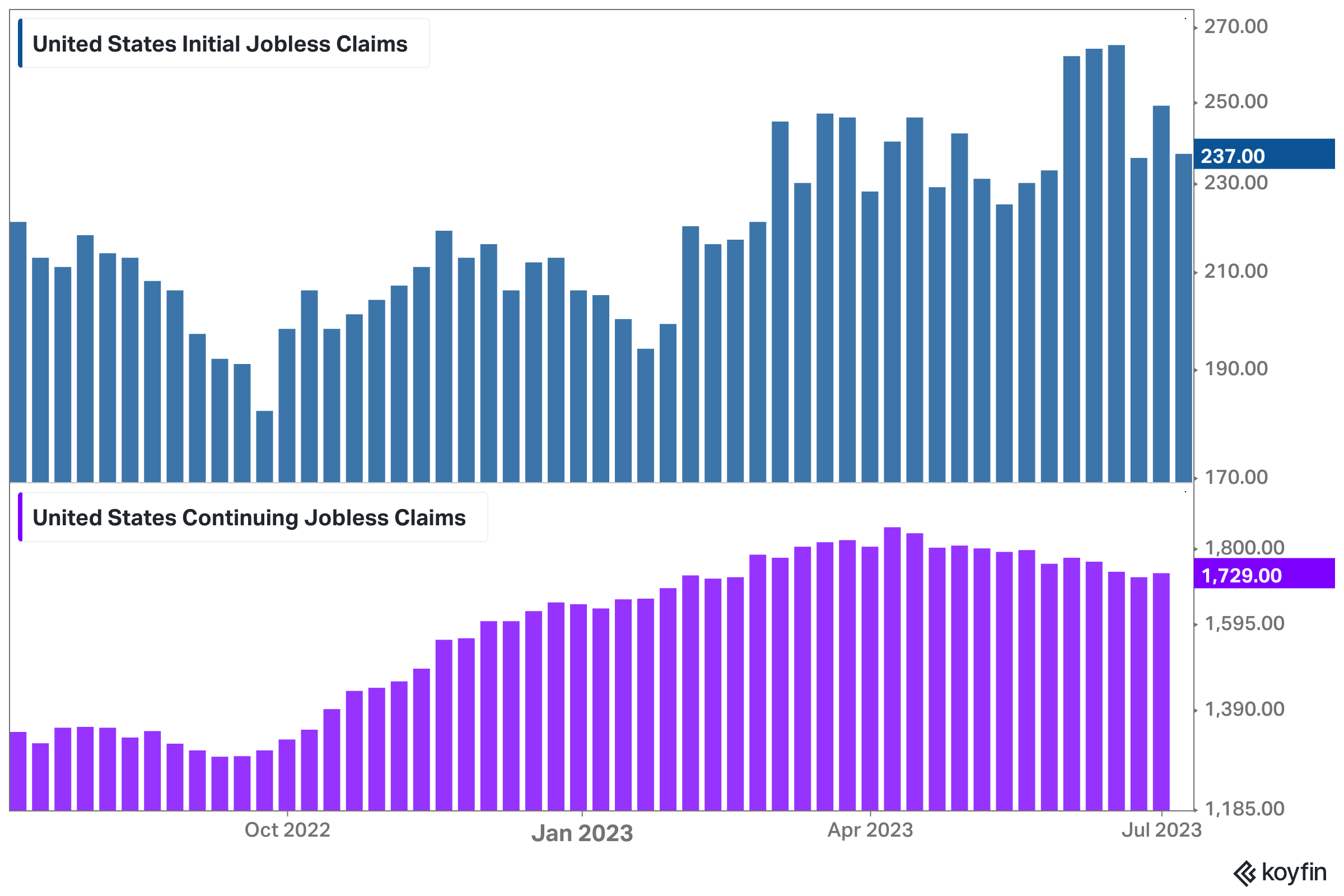

9/ US Initial Jobless Claims come in lower than expected at 237k (vs 250k exp), while continuing claims are marginally above expectations at 1.729m (vs 1.723m exp).

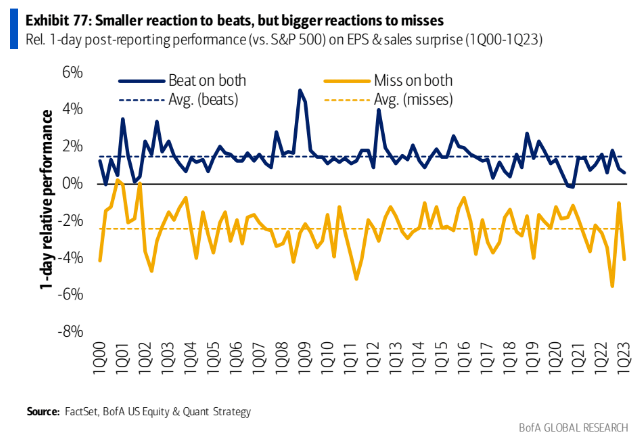

10/ BofA show that companies who missed estimates were punished considerably more than the reward companies who reported beats were given.

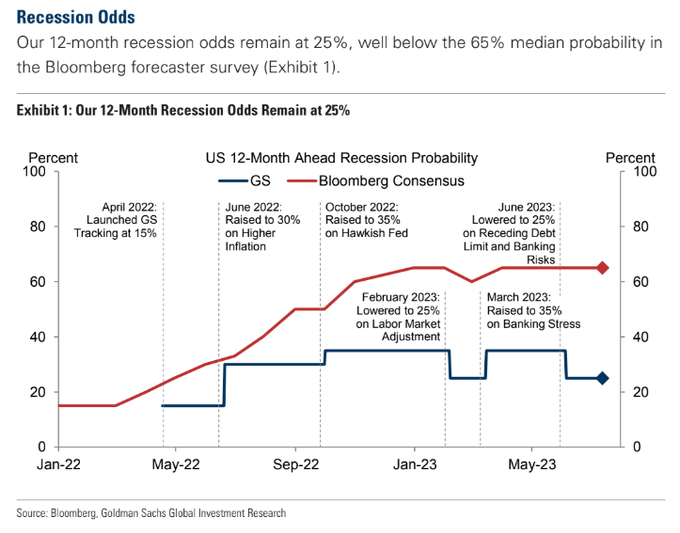

11/ Just nine months after Bloomberg's economic projected a "100% of recession in the next 12 months", the consensus at Bloomberg now sits at 65%; according to the forecaster survey.

Goldman, suggests the 12-month recession odds are closer to 25%.

12/ Closing thought from @bespokeinvest

Maybe we are "so back"?

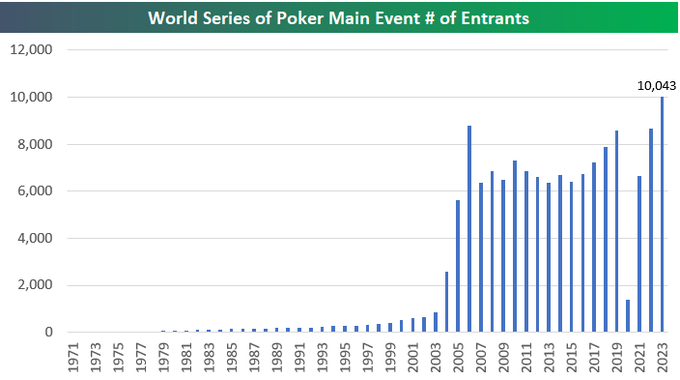

"Not recessionary: The World Series of Poker Main Event ($10k buy-in) drew a record number of entrants this year at 10,043, eclipsing the prior high from 2006".

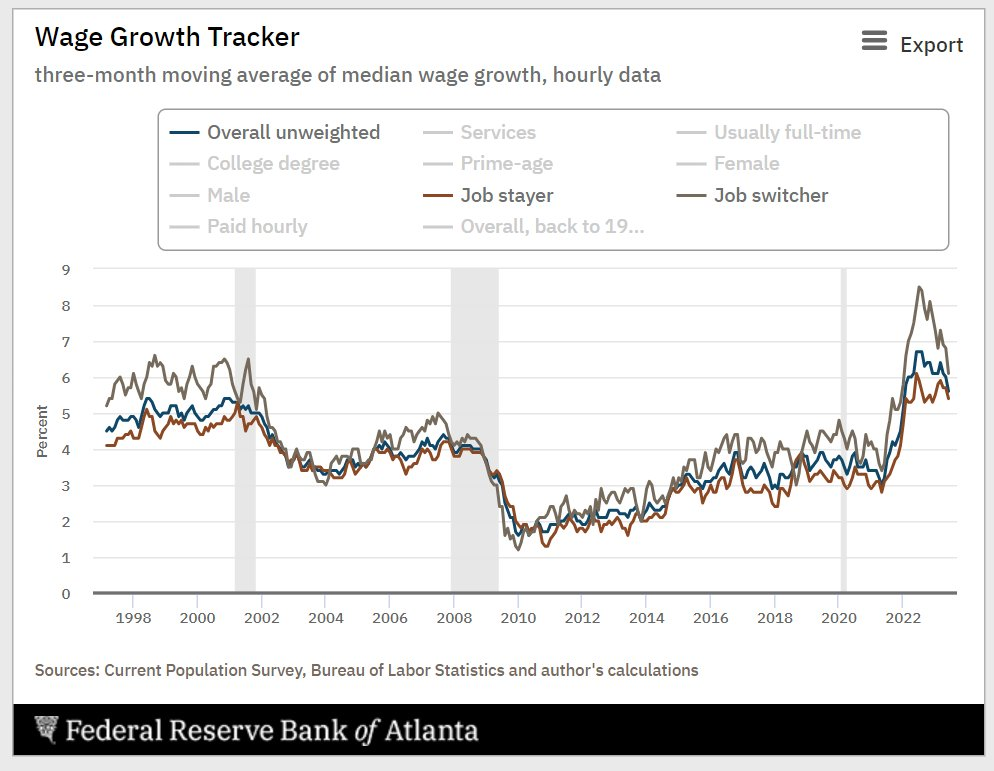

Wage Growth Tracker

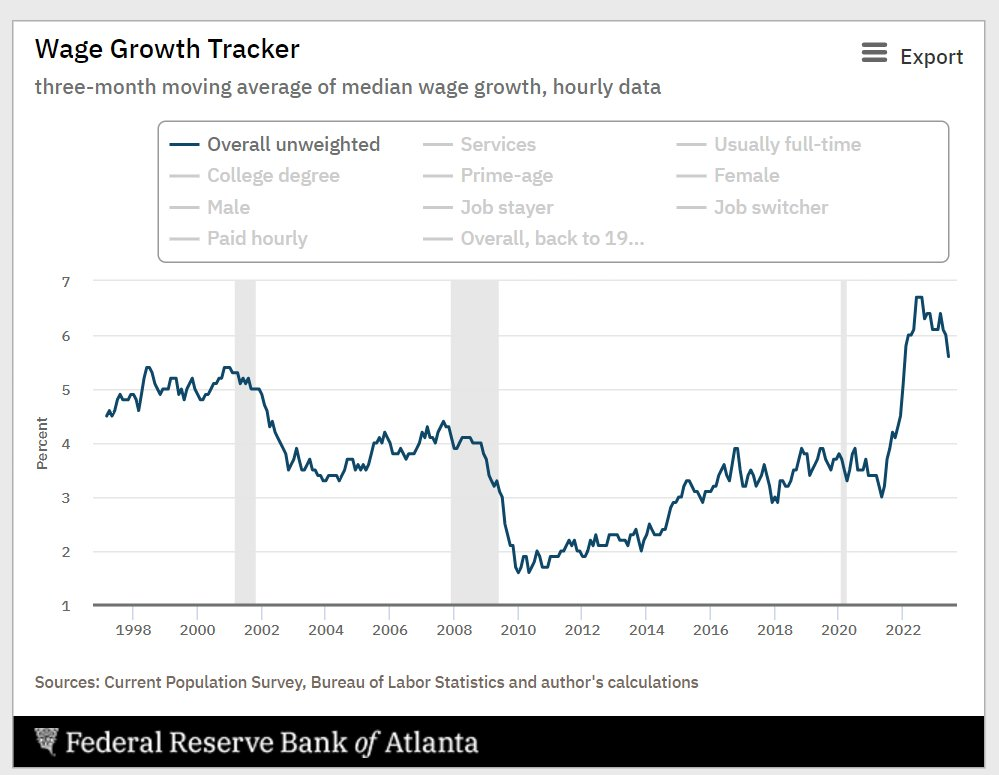

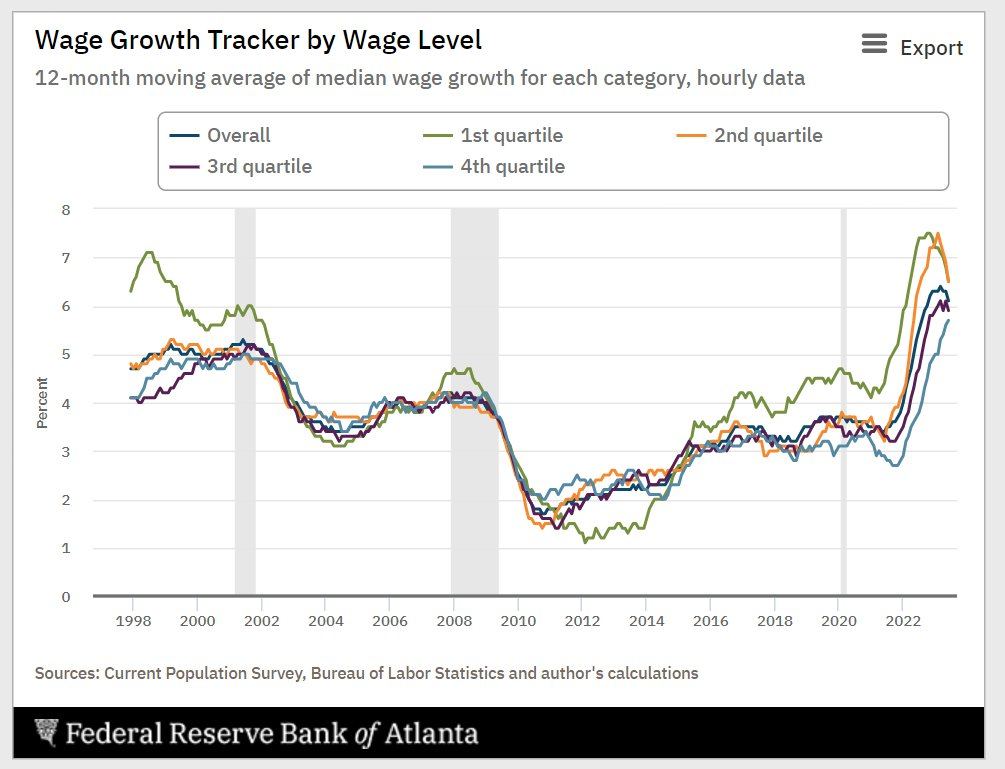

The @AtlantaFed Wage Growth Tracker slip to 5.6% in June from 6.0% in May -- lowest since January 2022

Wage growth at the lower end of the wage spectrum is now visibly cooling -- notable declines for the bottom 2 quartiles -- but still elevated year-on-year pressures for the top half of wage earners

Moderation in wage growth premium for 'job switchers' which is now much closer to pre-pandemic (3-mo basis)

Likely to start seeing overall, stayer & switcher wage growth moderate + rapidly amidst a cooling labor market where execs are focused on cost moderation

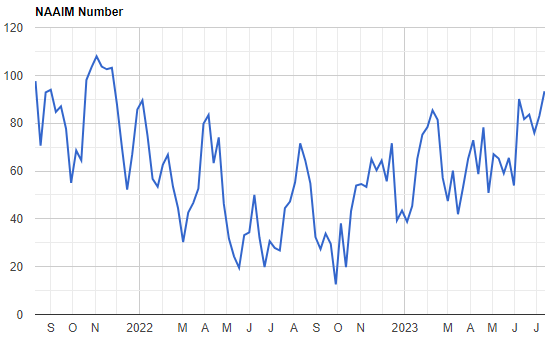

NAAIM Exposure

Active managers increased their exposure to equities over the last week.

NAAIM Exposure Index up to 93.3 from 83.1.

Source Tweet - Daily Chartbook

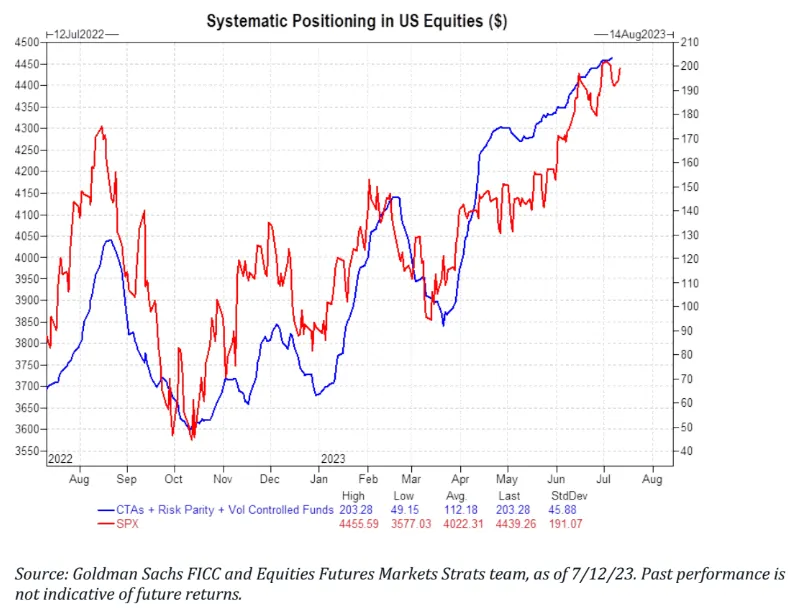

CTA Positioning

"Systematic strategies, across CTA, vol-control, and risk-parity, have been re-leveraging and this flow dynamic remains positive correlated with equity indices.”

- Goldman Sachs

Source Tweet - Daily Chartbook

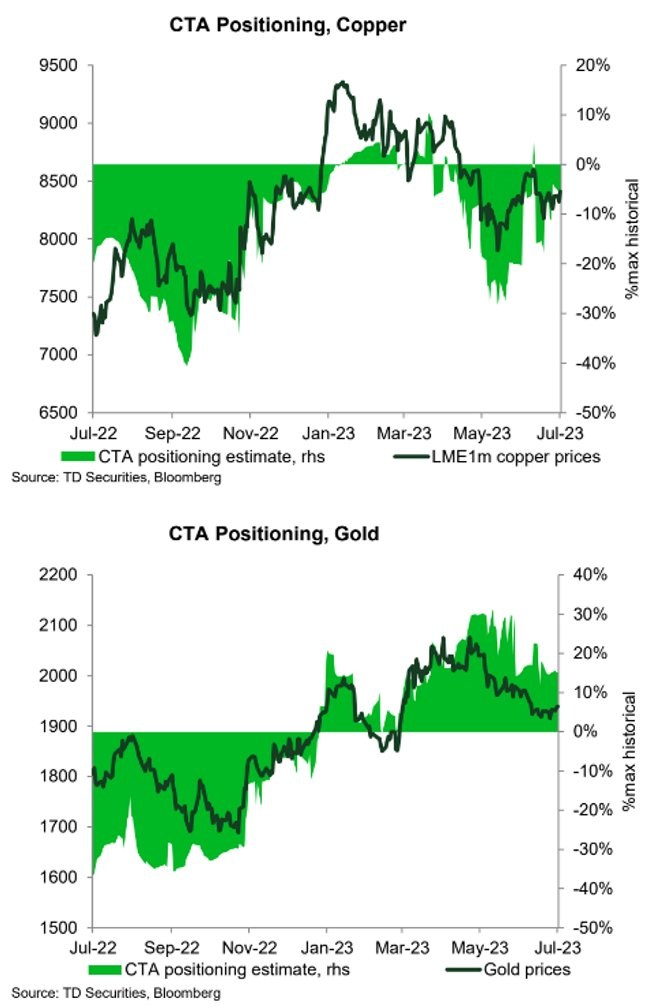

CTA - Copper/Gold

CTAs are short copper and long gold.

Source Tweet - Daily Chartbook

Fidelity 2nd BTC ETF

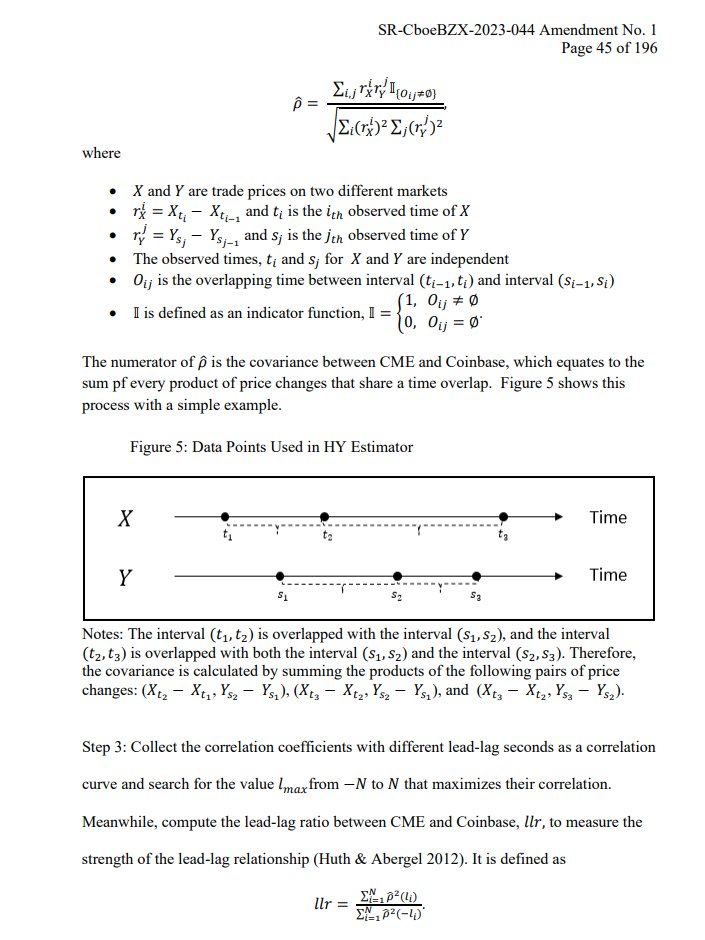

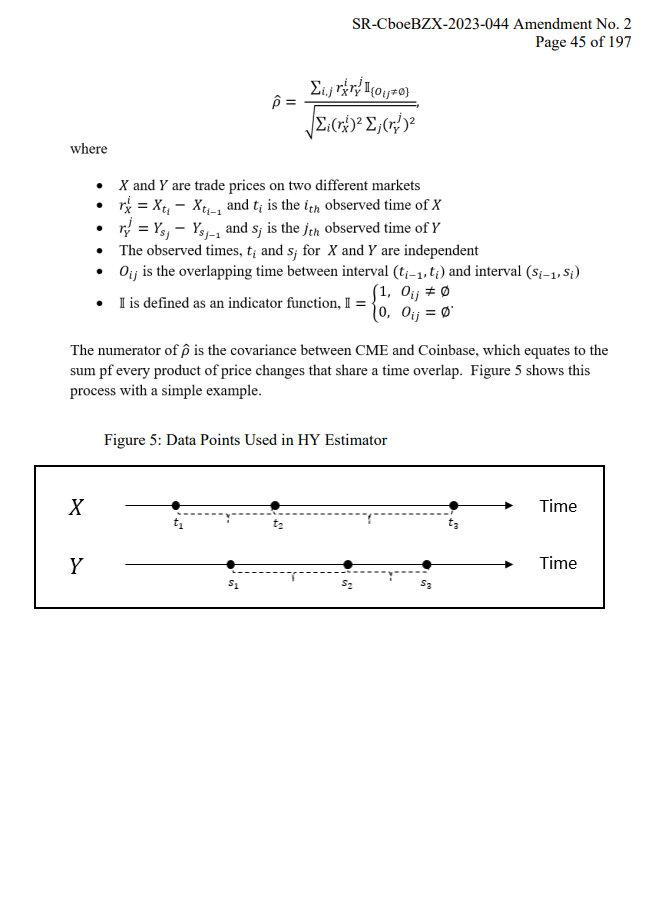

UPDATE: @Fidelity filed a 2nd amendment to their spot #Bitcoin application. I couldn't find anything materially different between the two. The only thing i can find is formatting changes... Which i guess is possible because the SEC is notoriously finicky about formatting?

These things are almost 200 pages long. So its entirely plausible I've missed something here. But @EricBalchunas, @VildanaHajric and I dug through it and couldn't find any material differences.

Bitwise BTC ETF

UPDATE: @BitwiseInvest had it's Spot #Bitcoin application acknowledged by the SEC just now. This essentially starts the clock for them. Will be interesting to see if others are acknowledged today or if SEC waits until tomorrow.

To be clear. This is just a step in the process and would happen even if Gensler/SEC were planning to deny them next month. Basically just a formality. But gives us better idea of timing.

Lot of people asking about timing in addition to what it means (doesn't mean all that much tbh). This estimate of timing still looks fairly accurate though: Everything you need to know about the spot bitcoin ETF race in one beautiful table

Europe First Spot BTC ETF

Europe approved its first spot #Bitcoin ETF in October 2021, but the SEC has denied all spot Bitcoin ETFs. However, in 2023, several institutional giants, like BlackRock and Fidelity, have filed new spot ETF applications, hoping to be the first U.S. approved spot #BTC ETF.

The asset manager told the Financial Times that it has decided to launch the #ETF now because it has seen a gradual shift in demand compared with 2022. The asset manager told Cointelegraph that it is still assessing the launch and will share a date soon.

Europe’s first spot Bitcoin ETF eyes 2023 debut after year-long delay

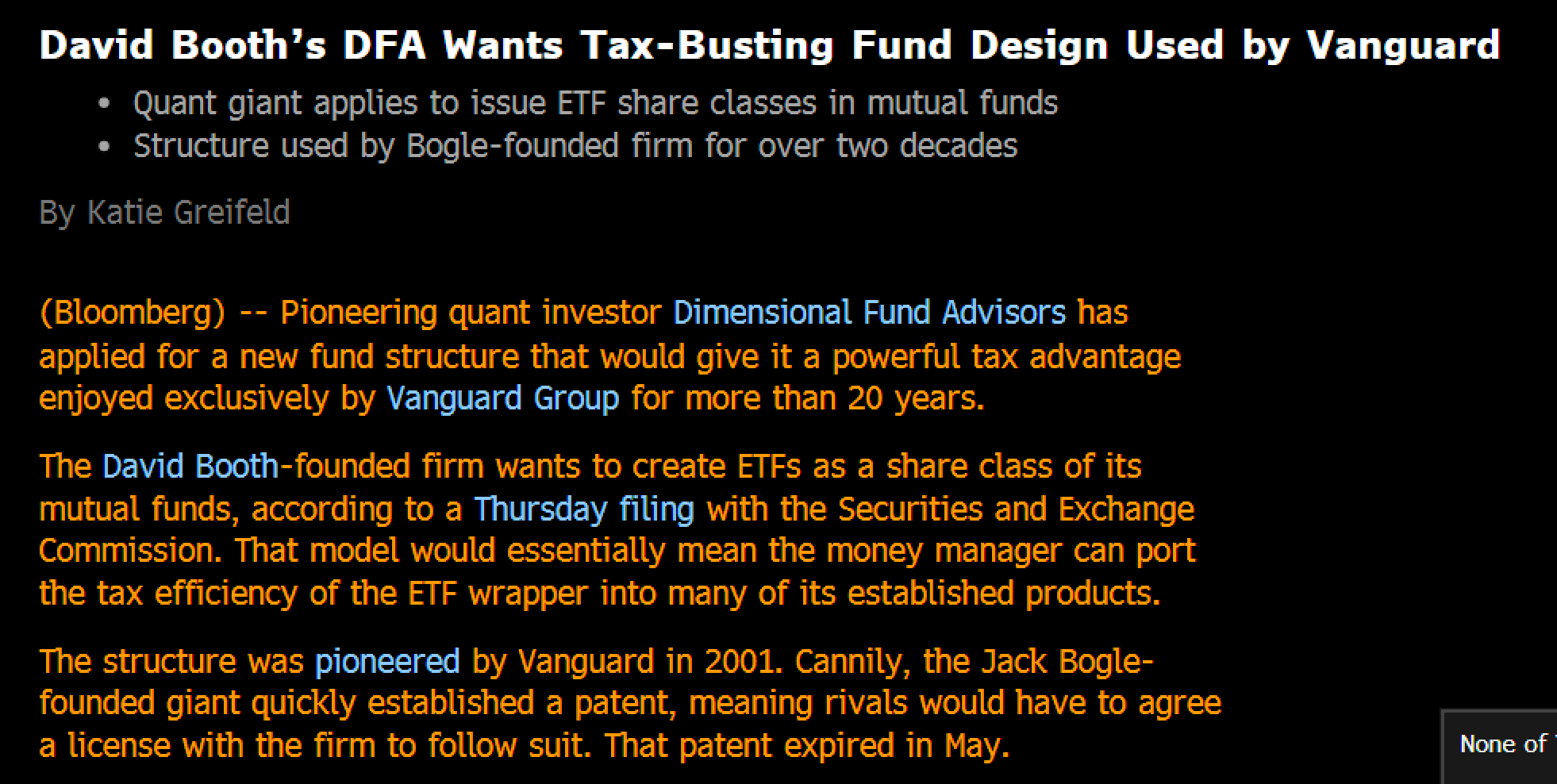

DFA Files to launch ETF share classes on their mutual funds

WHOA: DFA wants to use Vangaurd's ETF share class structure for its mutual funds, the patent for which recently expired. They filed today for this, story/scoop via @kgreifeld

Weekly Alpha

Source Tweet - An Ape's Prologue

Analysis Articles

Kaico Research - The State of Stablecoins

Deribit Insight - ETH Is Building Enough Liquidity For A Breakout