Thanks!

📢 Weekly Trading Update 📈

For the period of July 10th to July 16th, Greeks.Live has achieved a significant nominal trading volume of $50,945,065 ($50.9 million) through block trades.

As of July 16th, the cumulative nominal trading volume for this month in block trades has reached $126,051,594 ($126 million).

Thanks for your supports.

Crypto Weekly Review

Paradigm’s Week In Review (10July - 16July) @GenesisVol

Strong outperformance by ETH (+4%) on the XRP (+55%) ruling, BTC (+.8%).

Up only options flow and resurgence of ETH options!

Large ETH overwriter shorts being covered.

Giddy up!

XRP had been accused of selling unregistered securities and this week the SEC ruled partially in Ripple’s favor on programmatic sales on exchanges but against them for institutional sales.

XRP and Crypto stonks mooned:

XRP +60% | COIN +34% | RIOT +22%

🌊BTC

Bullish flow expressed in outrights and risk reversals in July and Sep.

Traders took advantage of the midweek pullback from 31k to 30k:

1000x 29-Sep 27k/32k Bull RR bought

649x 28-Jul 28k/33k Bull RR bought

625x 21-Jul 32k Call bought

525x 28-Jul 32k Call bought

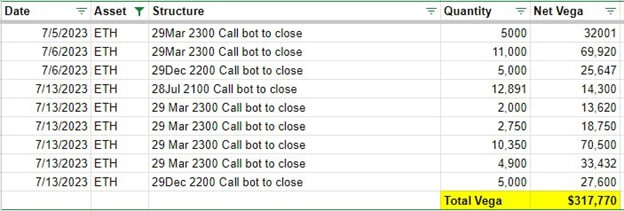

On 7/13, ETH options volumes outdone BTC for the first time in 2 months.

This was due to the $300,000 of short vega covered this week as ETH rallied. T

his underwriting flow has historically kept volatility well supplied.

As the possibility of the “elusive” flow no longer weighing down the curve, we saw significant outright topside vega and gamma being lifted this week.

29k 28-Jul 2100 Call bought

27k 28-Jul 2200 Call bought

13k 21-Jul 2000 Call bought

9k 28-Jul 2000 Call bought

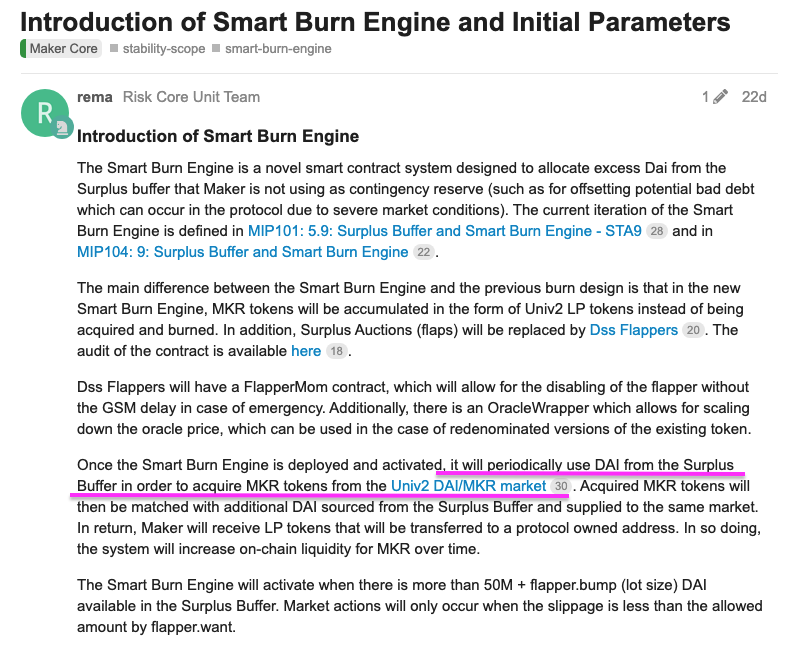

MKR

Lately, there've been signs of a potential bottom in the 3-year-long DeFi bear market. Starting with $MKR, I'm sharing the tokens I'm buying.

I believe $MKR will end up being one of the most obvious capitulations in hindsight.

The last two US-based VCs have capitulated.

Paradigm unloaded their bags 4 months ago, and a16z is in the process of liquidating right now. Interestingly, they're even using the same desk to execute. Total disbelief.

Polychain and Dragonfly offloaded all their $MKR years ago

Meanwhile, Rune, already the largest holder, is buying even more $MKR. He might be the only founder in crypto who's ever purchased their own token.

As a de facto decision-maker, at least his decisions align with holders, and he's clearly committed

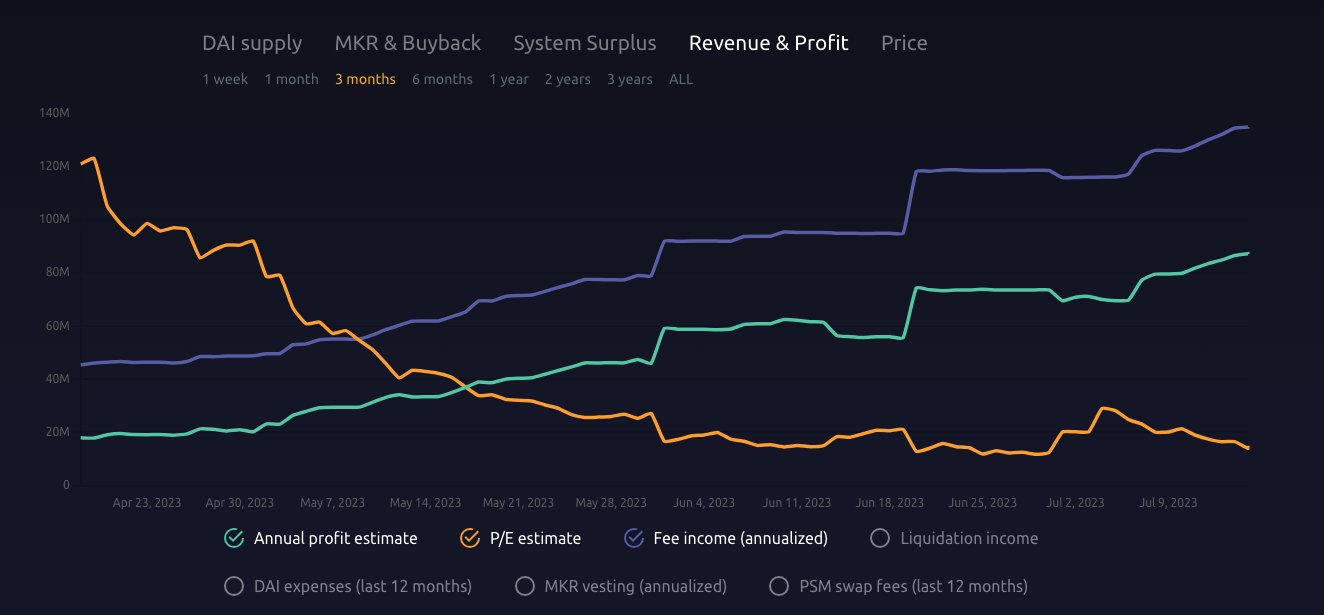

In the last 3 months, Maker has been smashing it in terms of revenues.

By reducing USDC on its book from over 50% to a mere 9% and replacing it with yield-generating RWA, Maker has managed to quadruple its earnings.

$MKR is currently trading at 9.2x earnings.

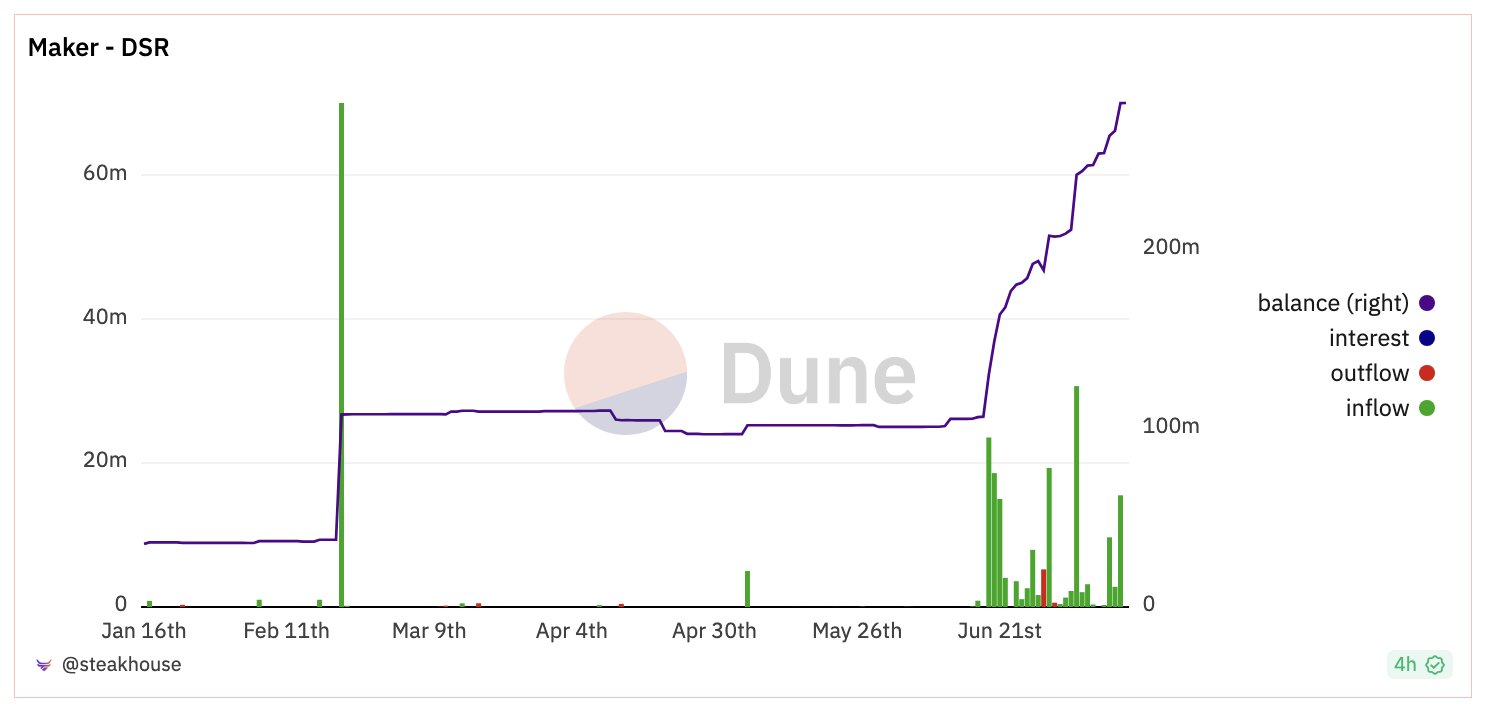

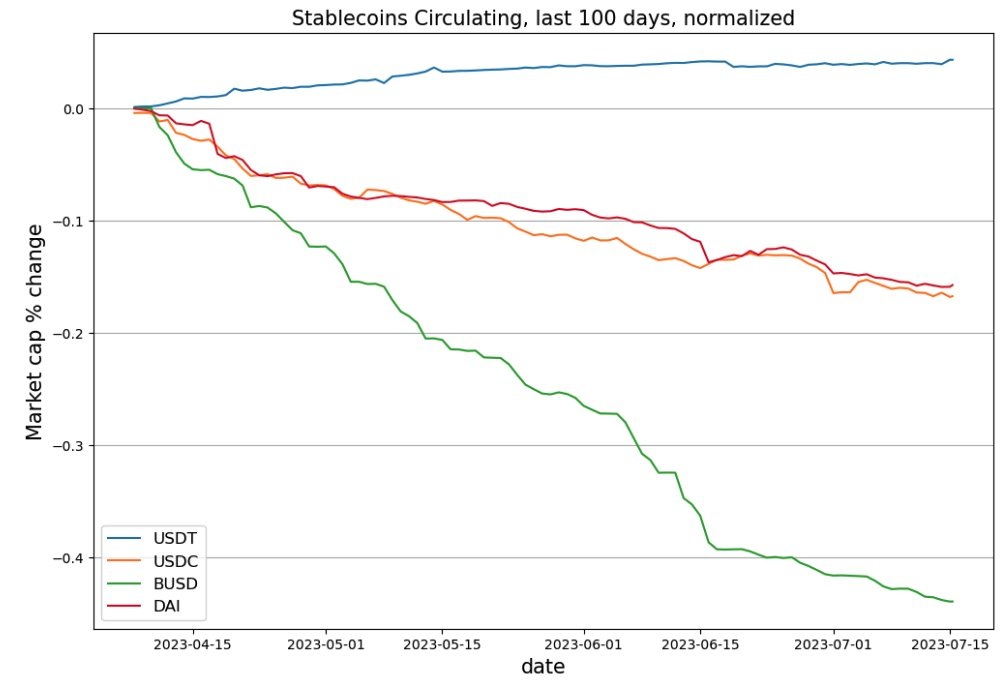

DAI is the only stable that passes yield to its holders by hiking the DAI savings rate. Last month, the DSR contract saw inflows of $170m, which is roughly a 170% increase.

Meanwhile, there are billions of stagnant capital in money markets earning less.

So far, the hike in DSR hasn't been sufficient to reverse the trend for the DAI supply, though it's managed to stop the bleeding.

DAI supply is the driving force behind Maker revenues. If the DAI supply starts to trend upwards, expect Maker revenues to follow suit.

Everyone was hating on Maker for their stupid burn mechanism. Well, now it's about to get smart. They'll periodically buy MKR from the market, pair it with DAI, and LP.

Endgame...

Not too certain about the timeline here, but the new farms and rebranding should stir up some hype around Maker. Think it's a net positive in the long run.

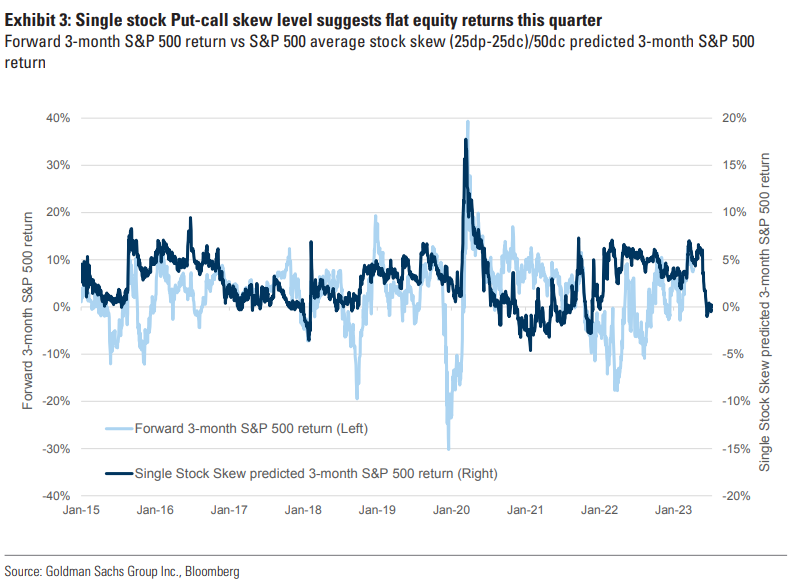

Skew

Worth a read from GS "Single stock Put-call skew is the most consistently useful options market indicator for predicting forward equity returns. When put-skew is high, it shows there is elevated potential for a relief rally"

"When calls are well-bid, investors are already positioned for upside, equity returns tend to be below average. As July earnings season kicks off, put-call skew is at a 1Y low. Current option market positioning is consistent with flat equity returns over the next three months"

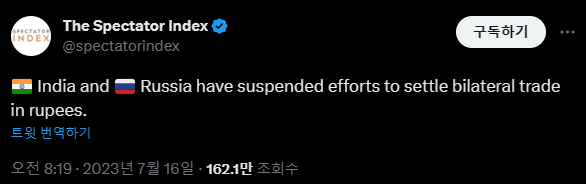

Rupees Settle

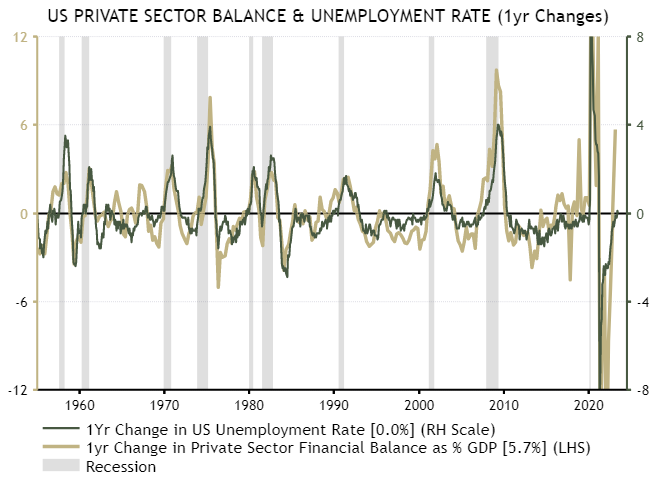

Unemployment

It might be tempting to capitulate on a bearish macro and markets view...but this chart that we sent to our @asr_london clients last week points to higher unemployment ahead... households and corporates are building surpluses - a sign of reduced investment or increased saving...

Taiwan Chip Exports

Taiwan's chip exports just fell the most in 14 years, down 20.8%

-

This was the sixth consecutive month of falling exports on slowing demand

-

Shipments to mainland China and Hong Kong, which account for over 50% of Taiwan's chip exports, fell for an eighth month

Source Tweet - Markets & Mayhem

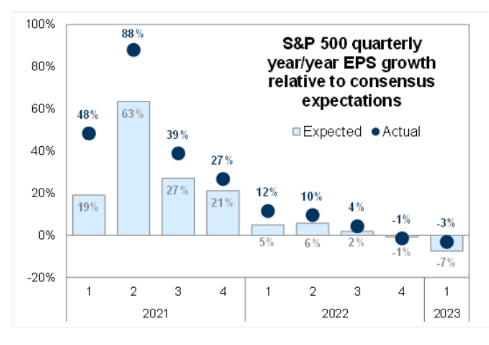

S&P YoY EPS

"In the 9 quarters since the start of 2021 actual S&P YoY EPS growth has beat consensus expectations in 8 of the last 9 quarters (by an avg of ~10% each quarter). S&P 500 firms should be able to exceed the low bar set for 2Q (again)."

- Goldman Sachs

Source Tweet - Daily Chartbook

Charts & Quotes Thread for Week 28

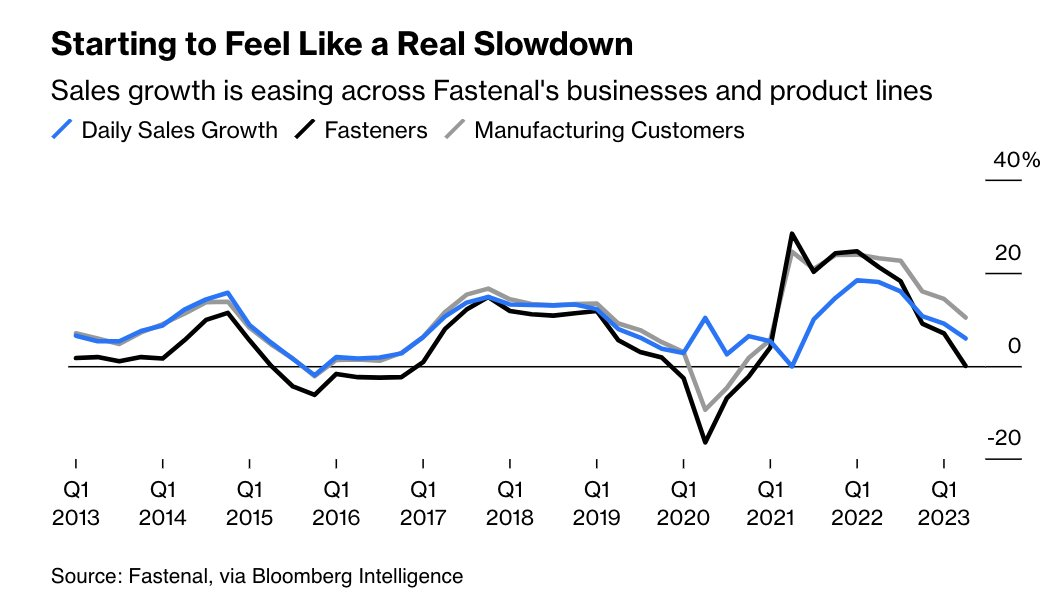

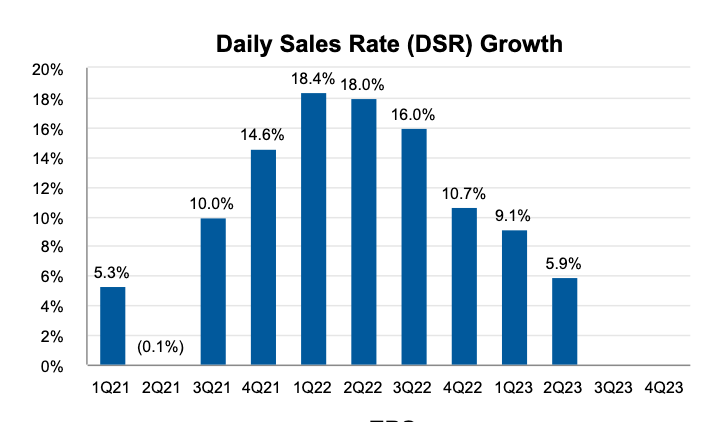

Fastenal warns of slowing down industrial demand in H2 2023

"We're going to experience something we have experienced for a number of years, and that's a slowing economy" - $FAST CEO

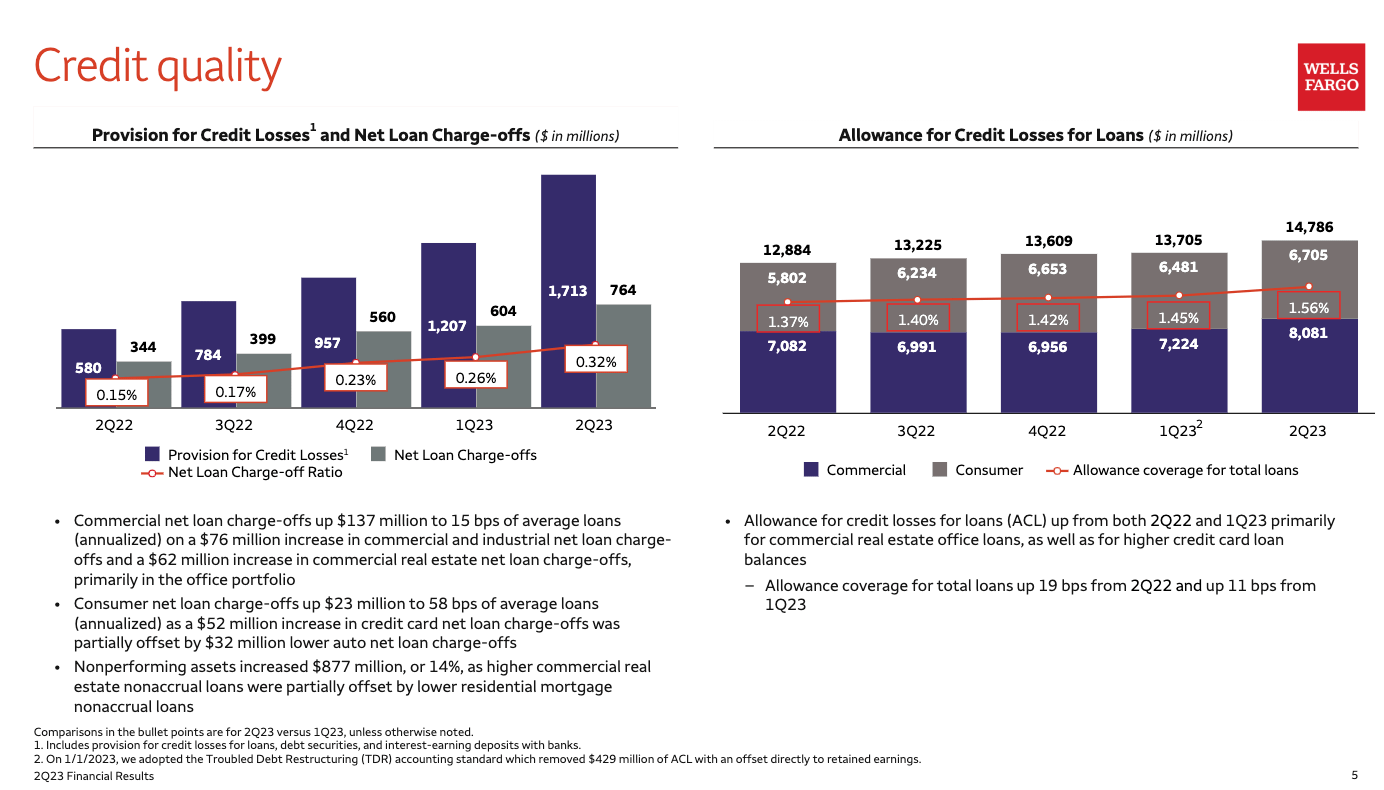

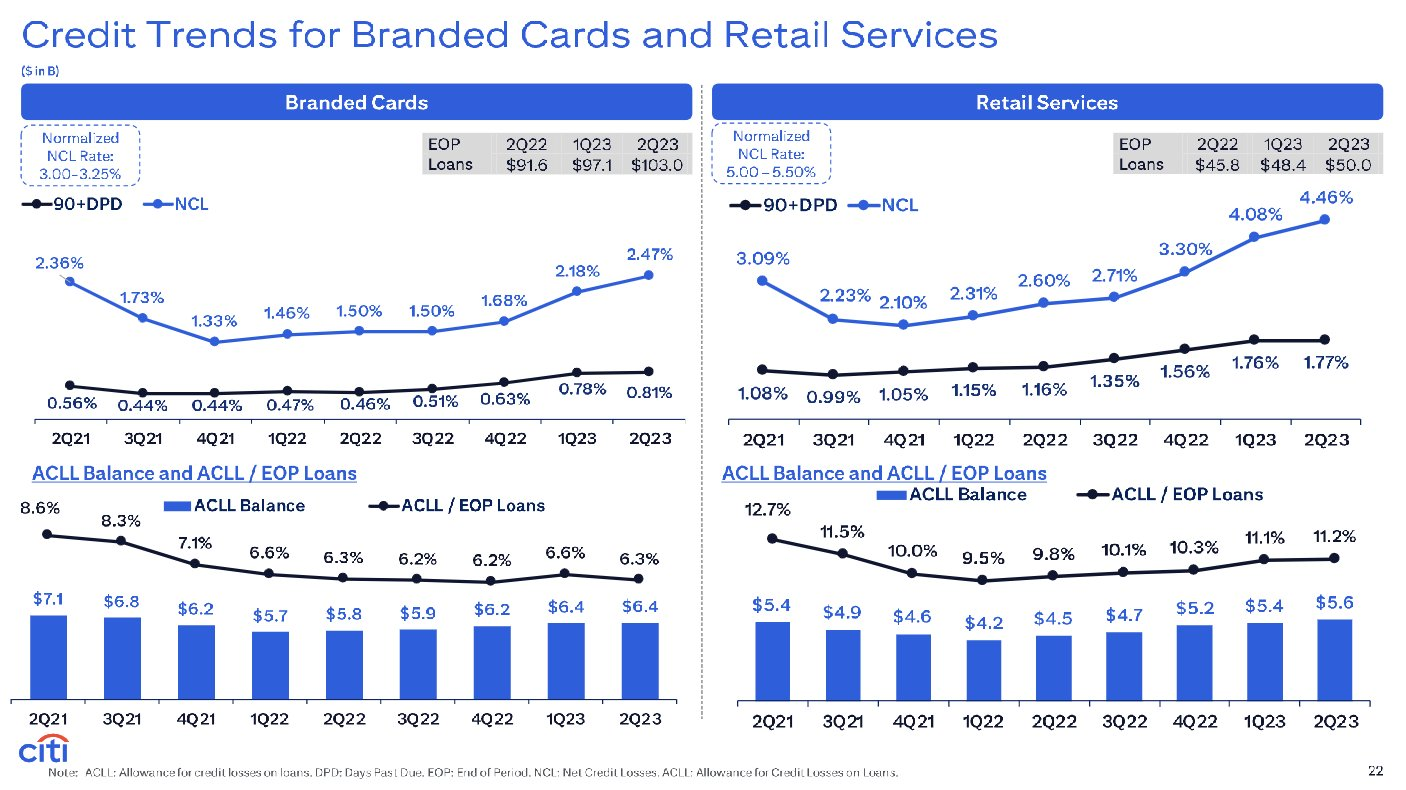

Credit quality is normalizing:

".We still see this as a normalization, not deterioration story" - $JPM

"Net charge-offs have continued to increase from historical lows but overall credit quality was strong" - $WFC

"continued normalization in cards net credit losses" - $C

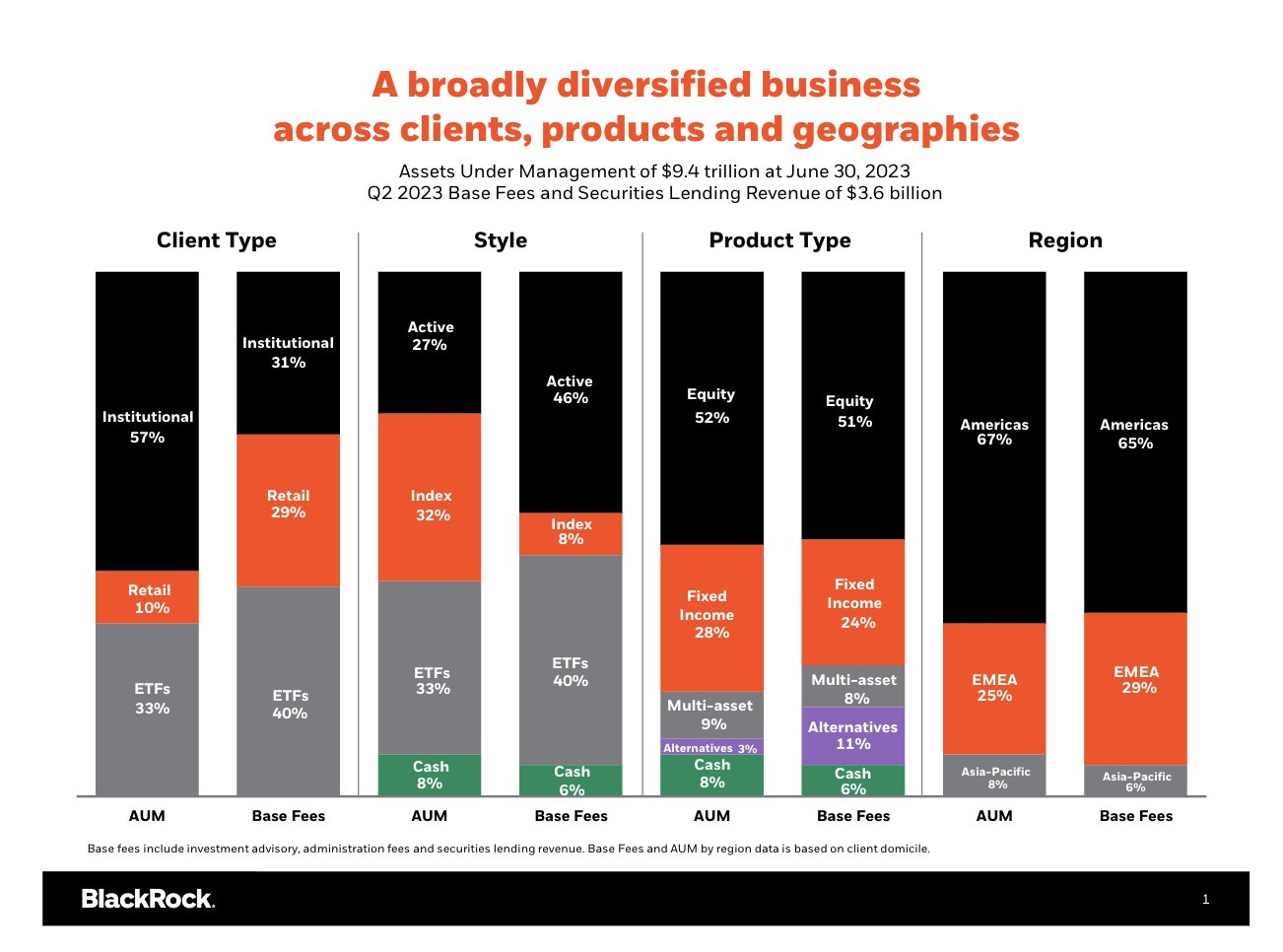

BlackRock keeps growing:

"Clients entrusted BlackRock with an industry-leading $190 billion of net inflows in the first half of 2023. Our 9.4 trillion in assets, 9.4 trillion units of trust are up over $830 billion since year-end" - $BLK CFO

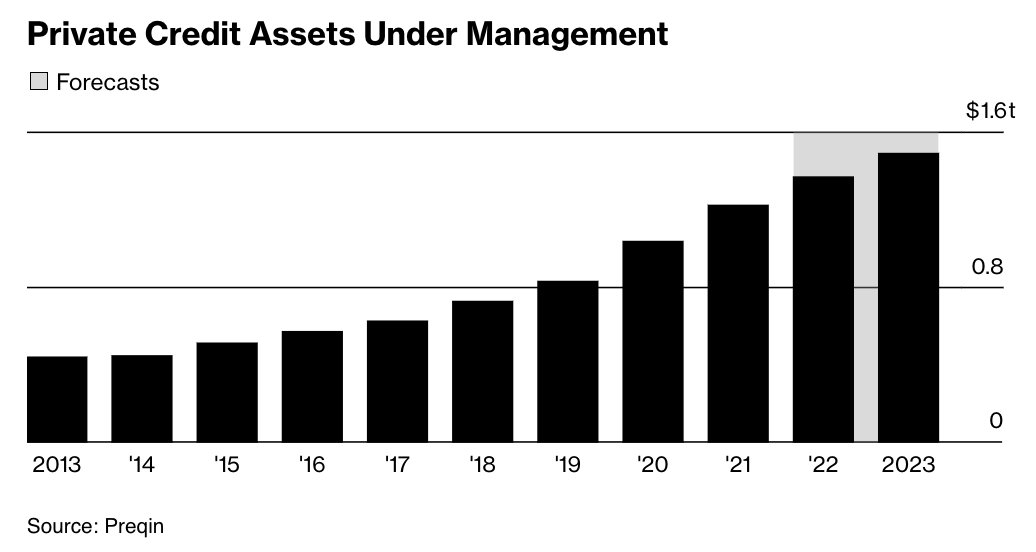

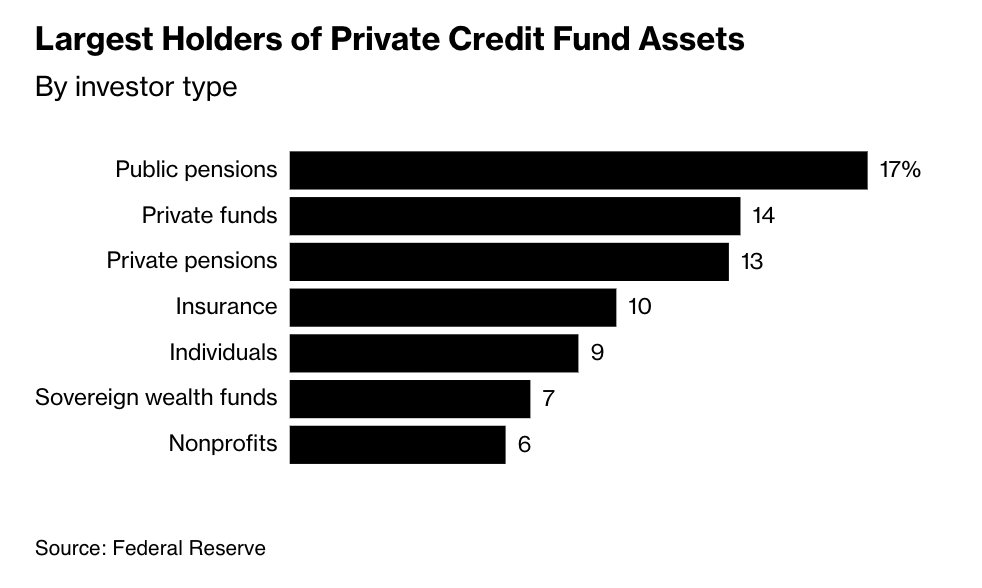

With potentially tougher banking regulations, private credit will be the winner:

"I think that's what it is, is great news for hedge funds, private equity, private credit, Apollo, Blackstone. And they're dancing in the streets" - $JPM CEO

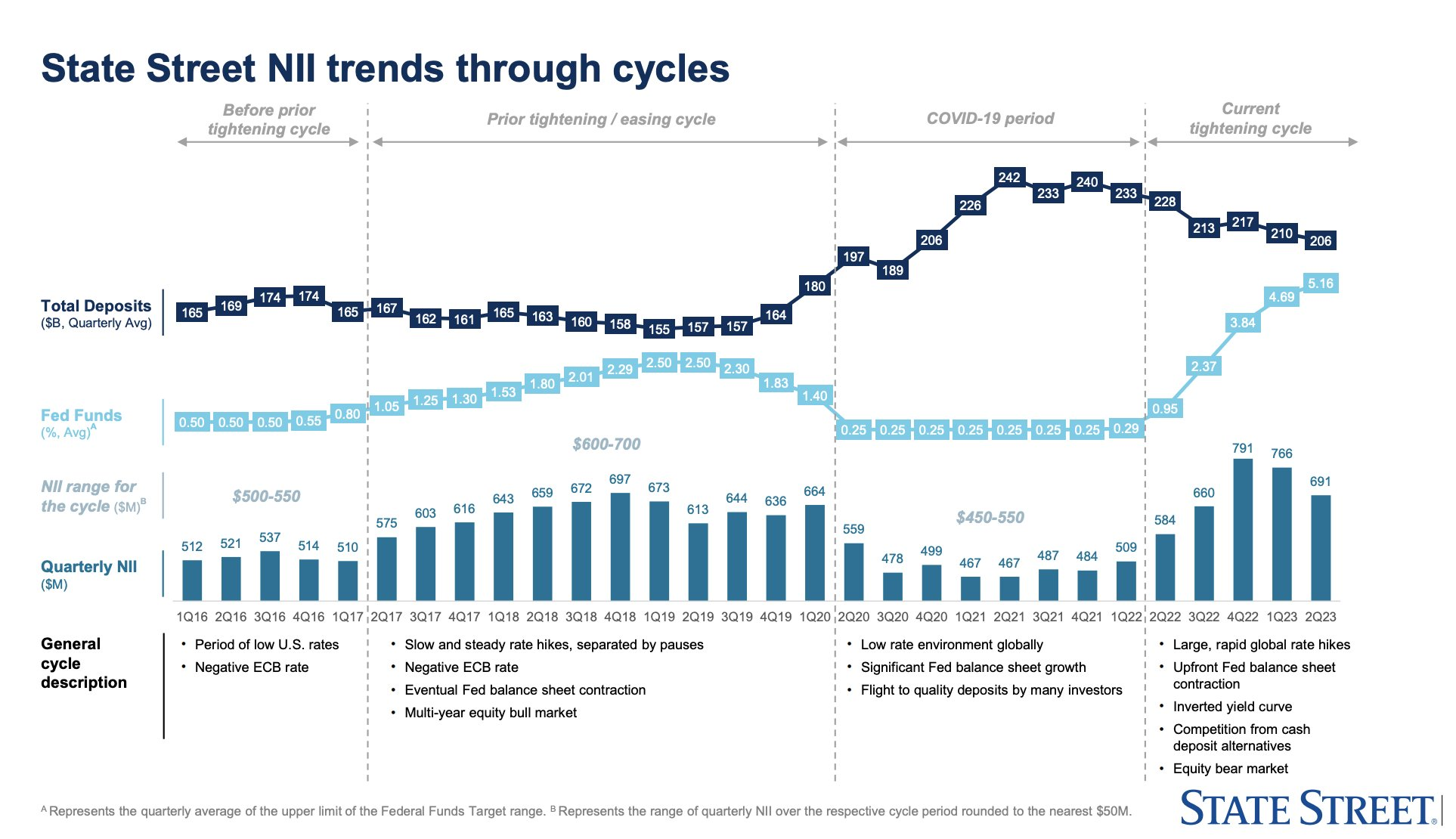

Here is State Street's NII trends through the cycle:

"You can see...that our recent quarters have come with a much higher than usual level of NII and we are now normalizing to a more typical level of NII that is inherent in our business activities" - $STT CFO

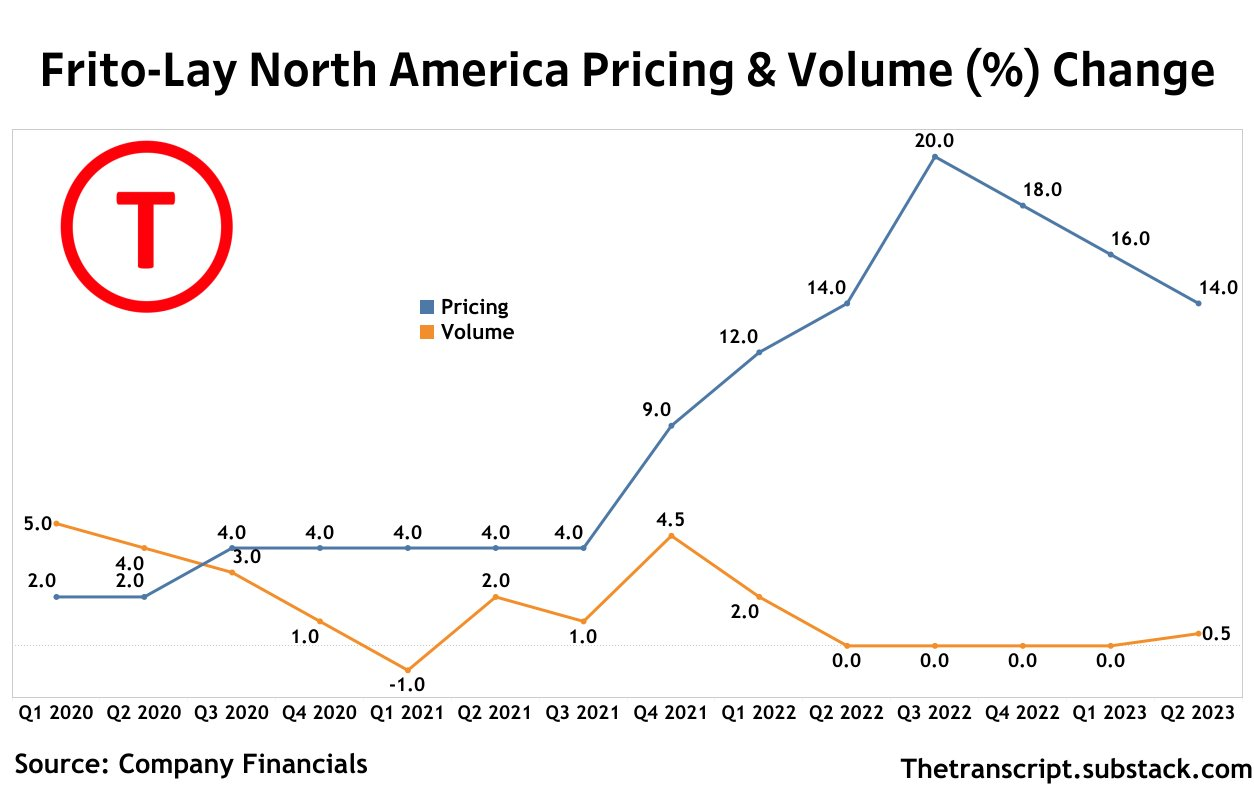

Pricing is strong at Frito-Lay with little impact on volumes:

"The Frito-Lay is having a tremendous year again on top of a very good ’22" - $PEP CEO

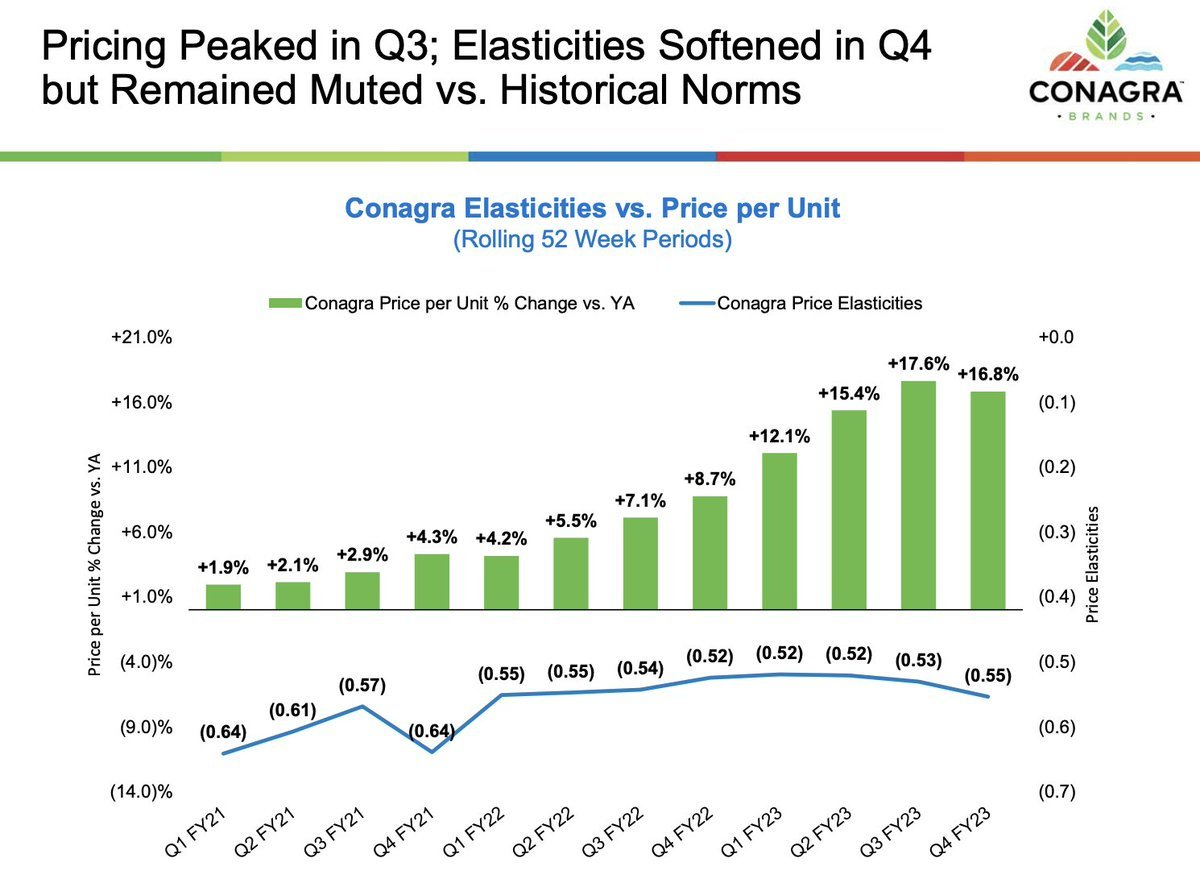

Conagra is past peak in pricing:

"pricing peaked in Q3, but remains almost 17% above the prior year...During Q4, elasticities did soften a bit, but remain fairly consistent well below historical norms & in line or better than competitors" - $CAG CEO

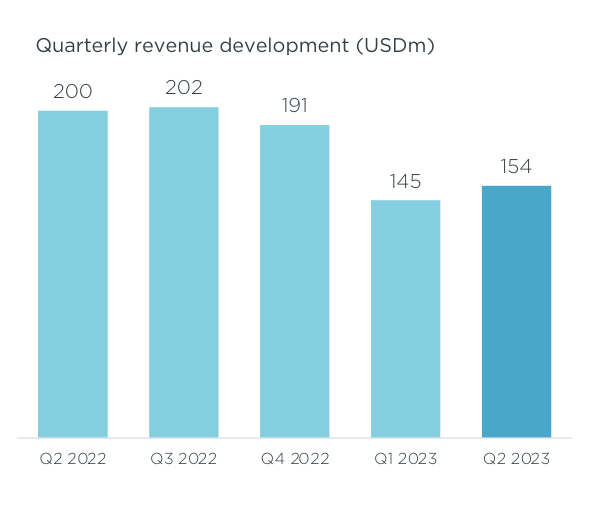

Nordic Semiconductor having a challenging time:

"After several years of strong growth, we see a challenging market out there with worries about economy in general and consumer spending in particular...Revenue was down 23% year-on-year, but up 6% from Q1"

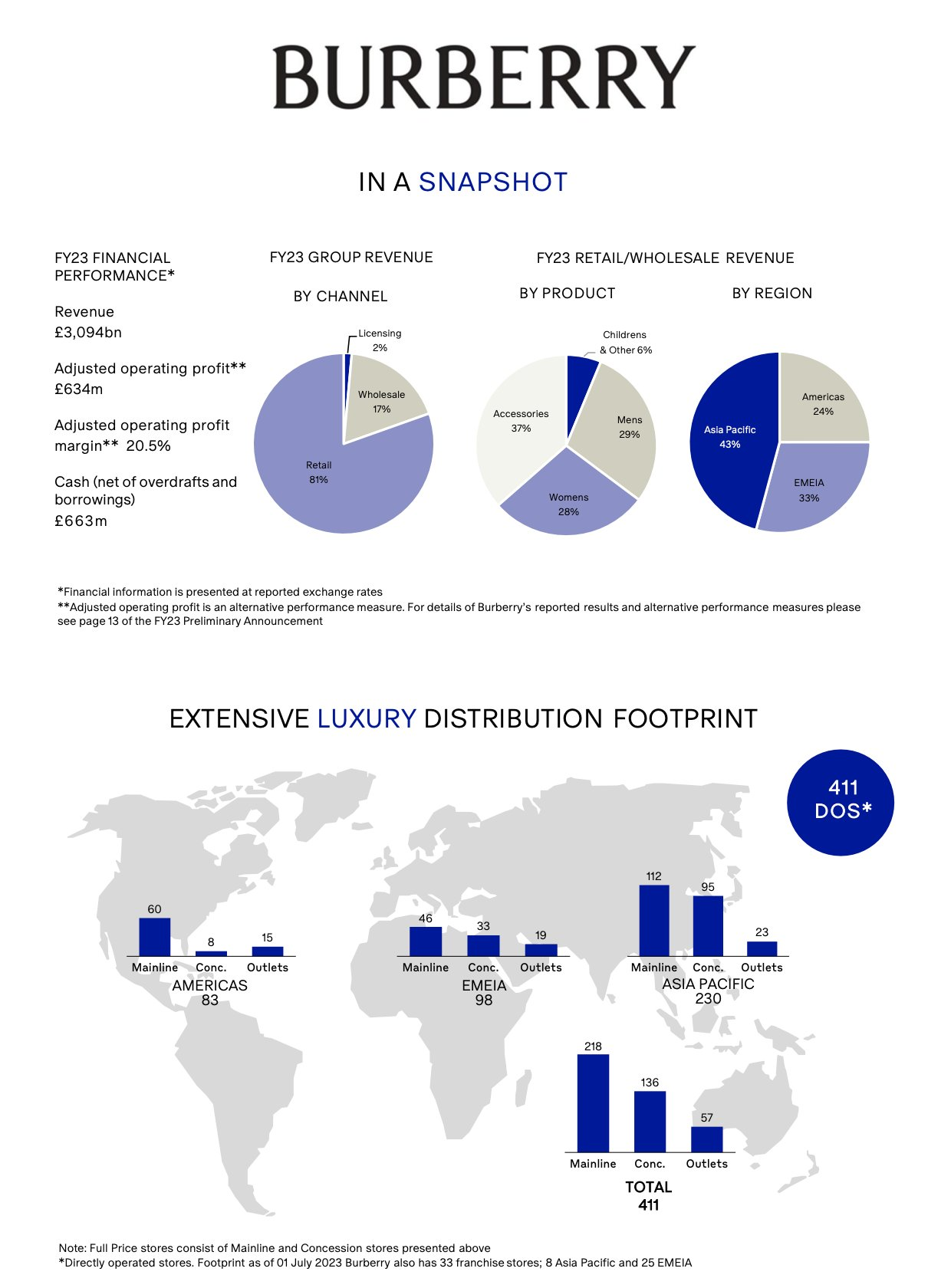

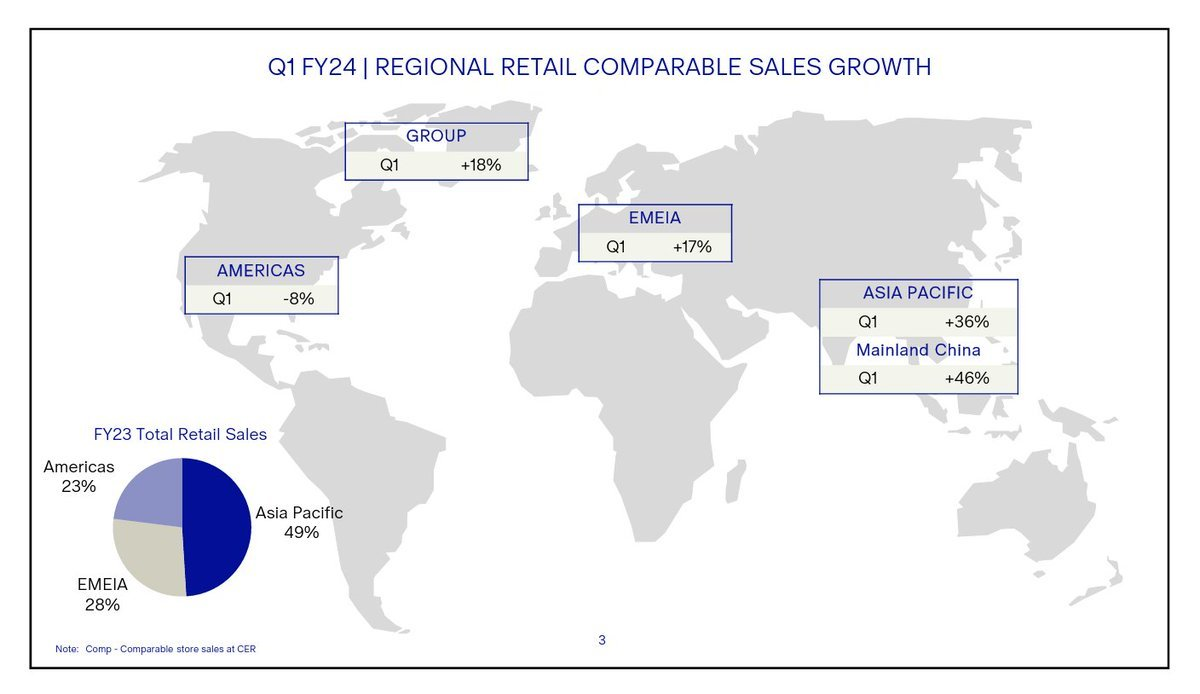

Burberry with a strong quarter:

"Comparable store sales grew by 18% with robust recovery in Mainland China, up 46%....We continue to see a good underlying performance from our core product categories with outerwear seeing growth of 36%s" - CEO

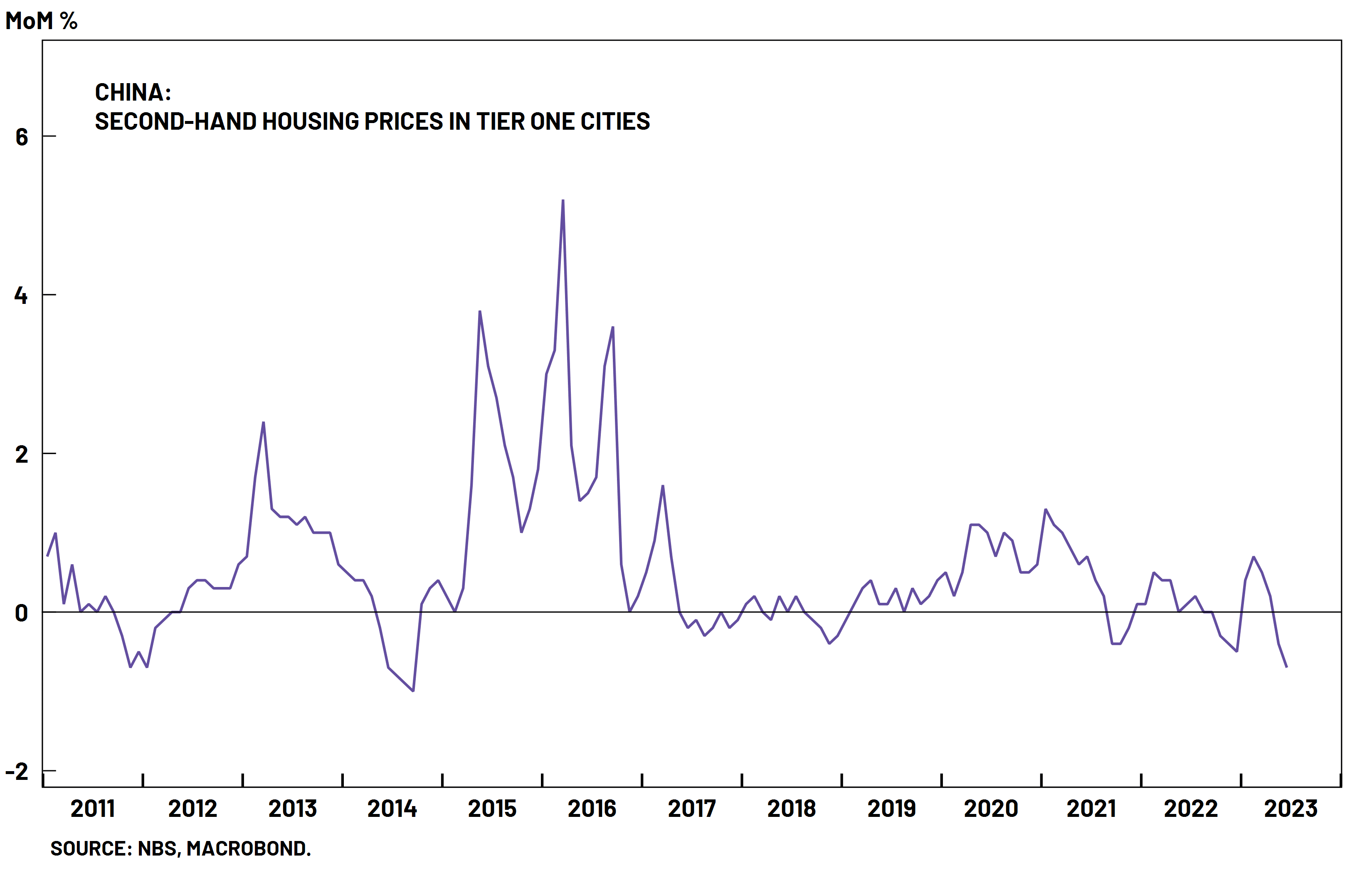

China Second-hand Residential Property Prices

Second-hand residential property prices in China's Tier One cities fell 0.7% in June on a month-over-month basis, the largest decrease since Sep. 2014. If there is one thing that could really open the Pandora's box in China, it's falling property prices. Period.

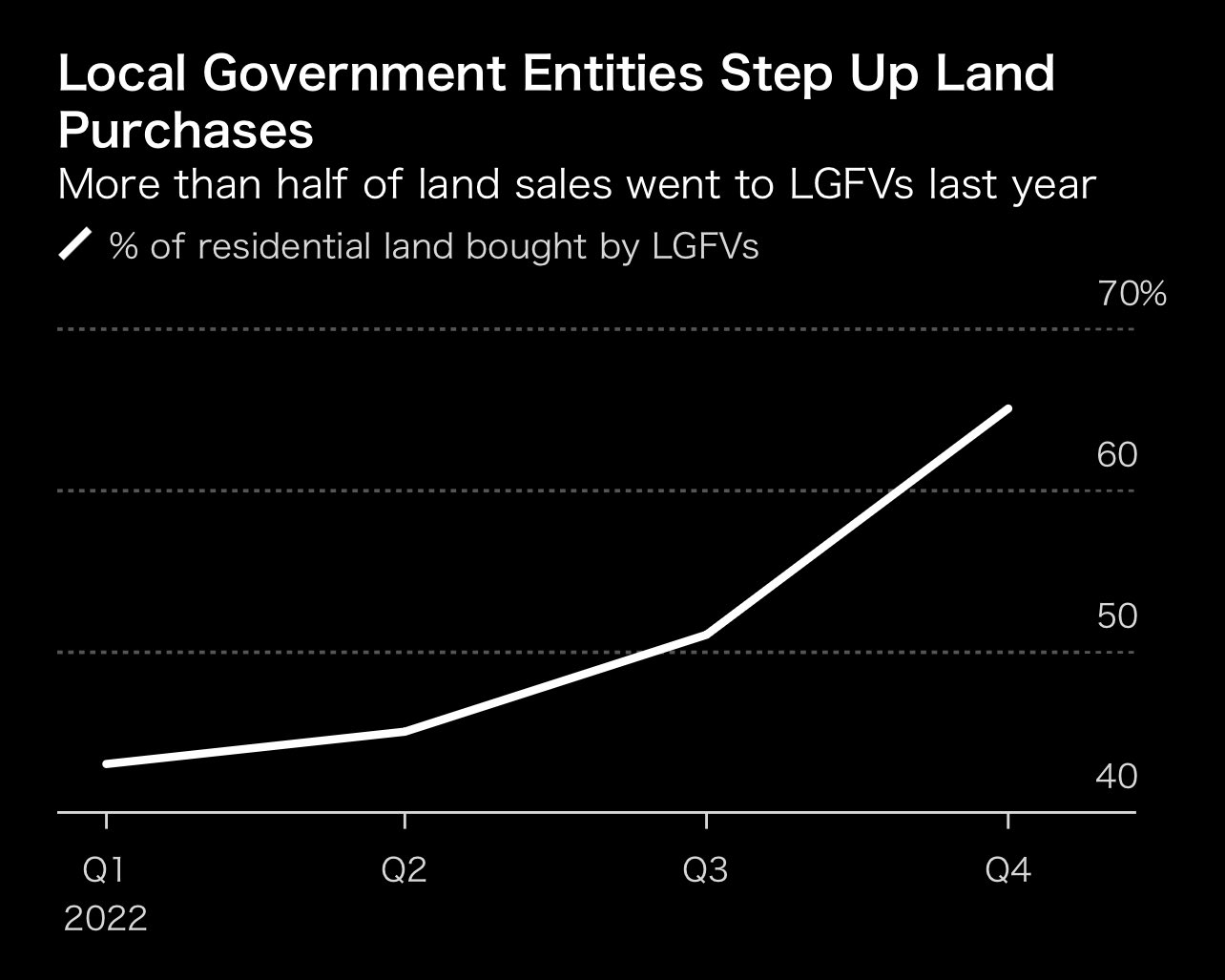

China Property

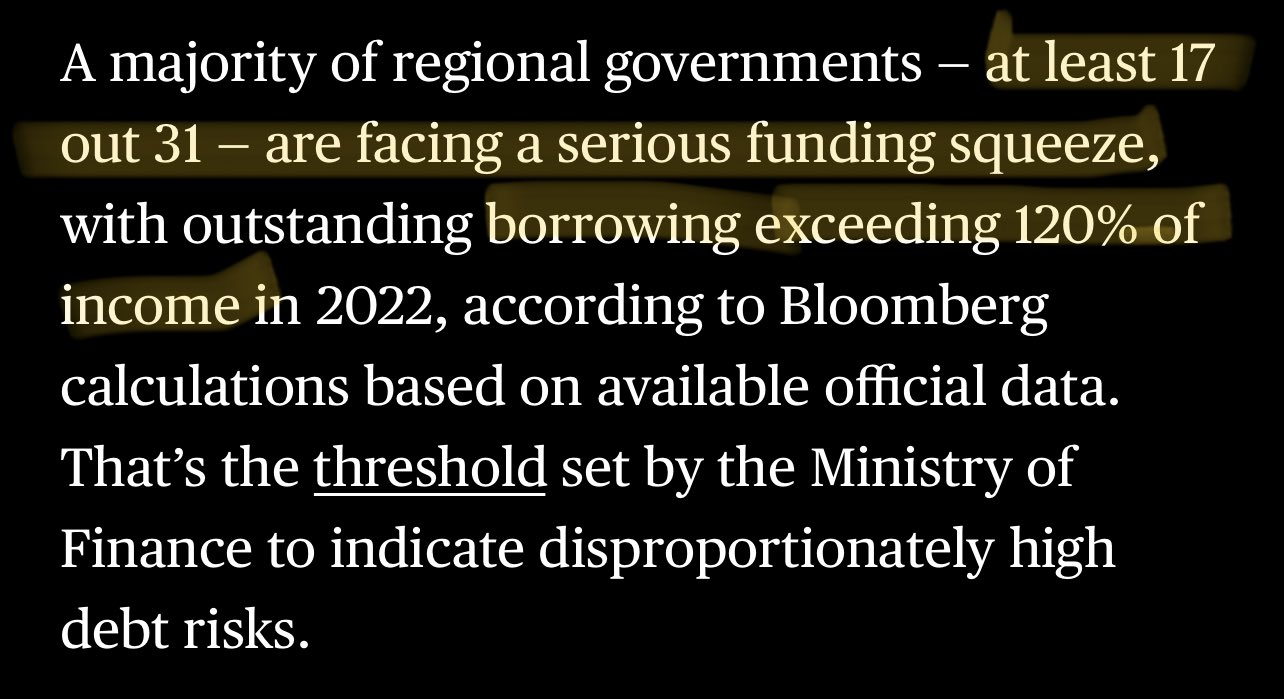

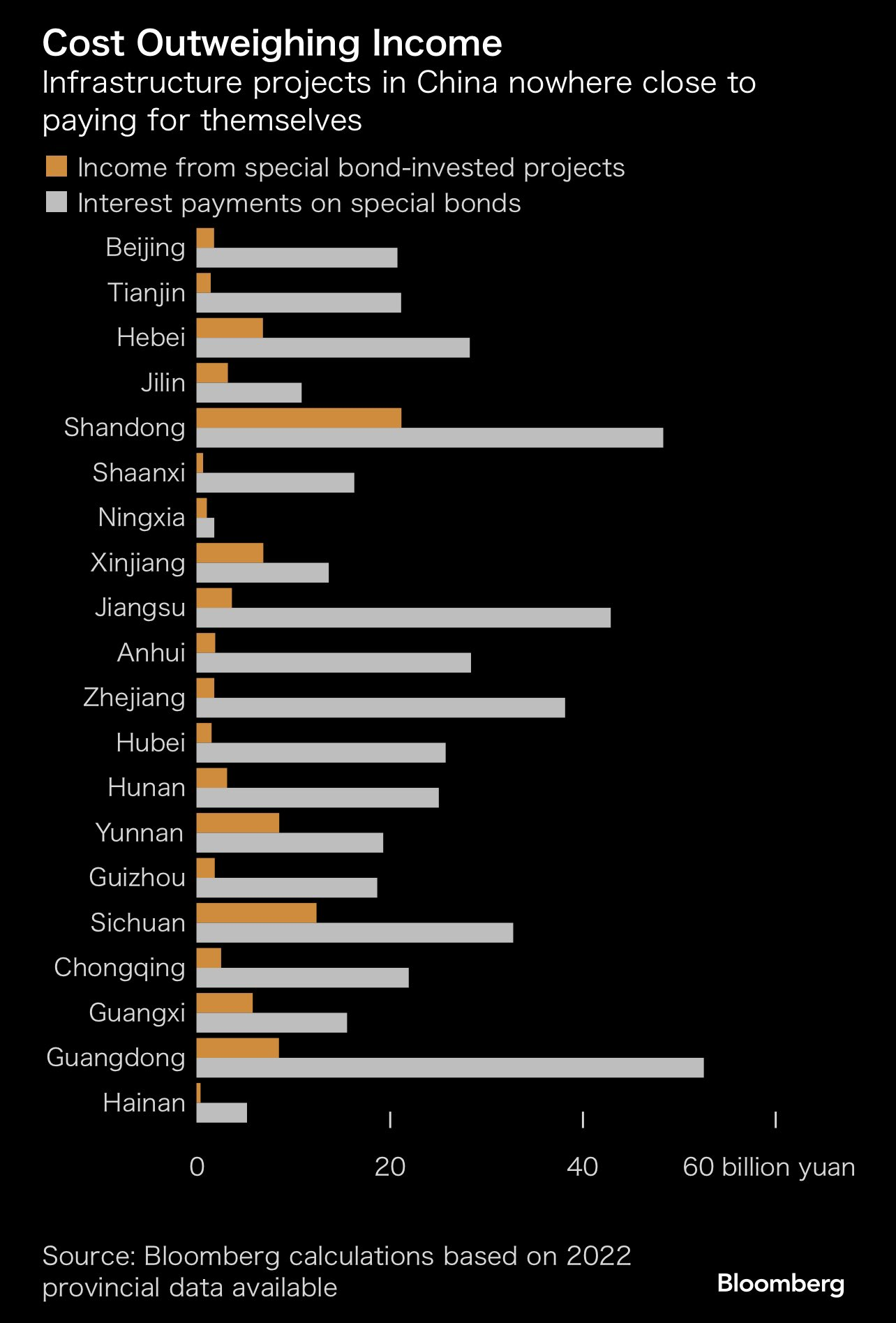

China is doing everything it can to avoid falling property prices. As private developers have pulled back on land purchases for new developments, provincial governments have stepped in with off-balance sheet borrowings to scoop up properties, called Local Government Funding Vehicles (LGFV)

LGFVs became common after the GFC, helping to lubricate China's epic infrastructure projects, and their role in the market increased as the private market softened. These entities bought over 50% of new land sales in 2022. Cities were essentially selling land to themselves at reserve prices simply to avoid lower bids.

Many of these projects return far less than initial rosy projections, and Bloomberg now estimates that 17 of 31 Chinese provinces are facing debt burdens in excess of 120% of their revenues. They're looking to the PBOC for help.

China's urgency to reopen early in 2023 and make everyone forget their demonization of covid makes a lot more sense when seen through the lens of these mounting debt problems.

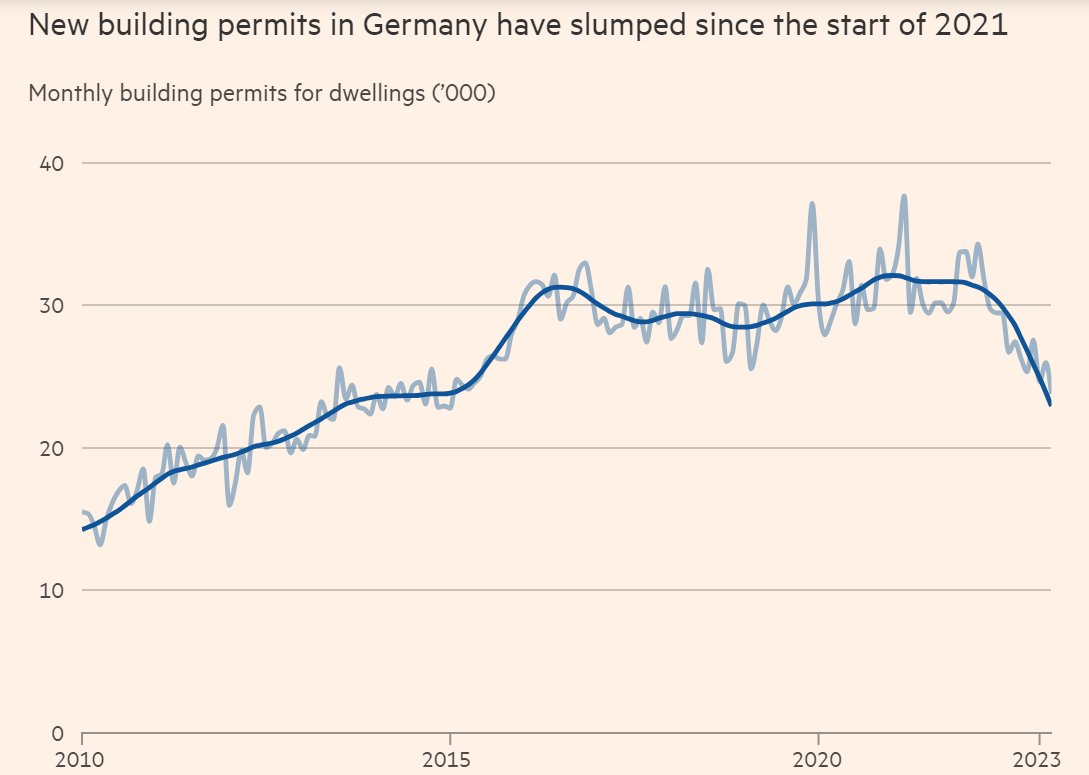

German Construction

FT: ‘Catastrophic’ outlook for German construction adds to Olaf Scholz’s woes.

Developers are scrapping plans to build homes amid rising inflation, high interest rates and labor shortages

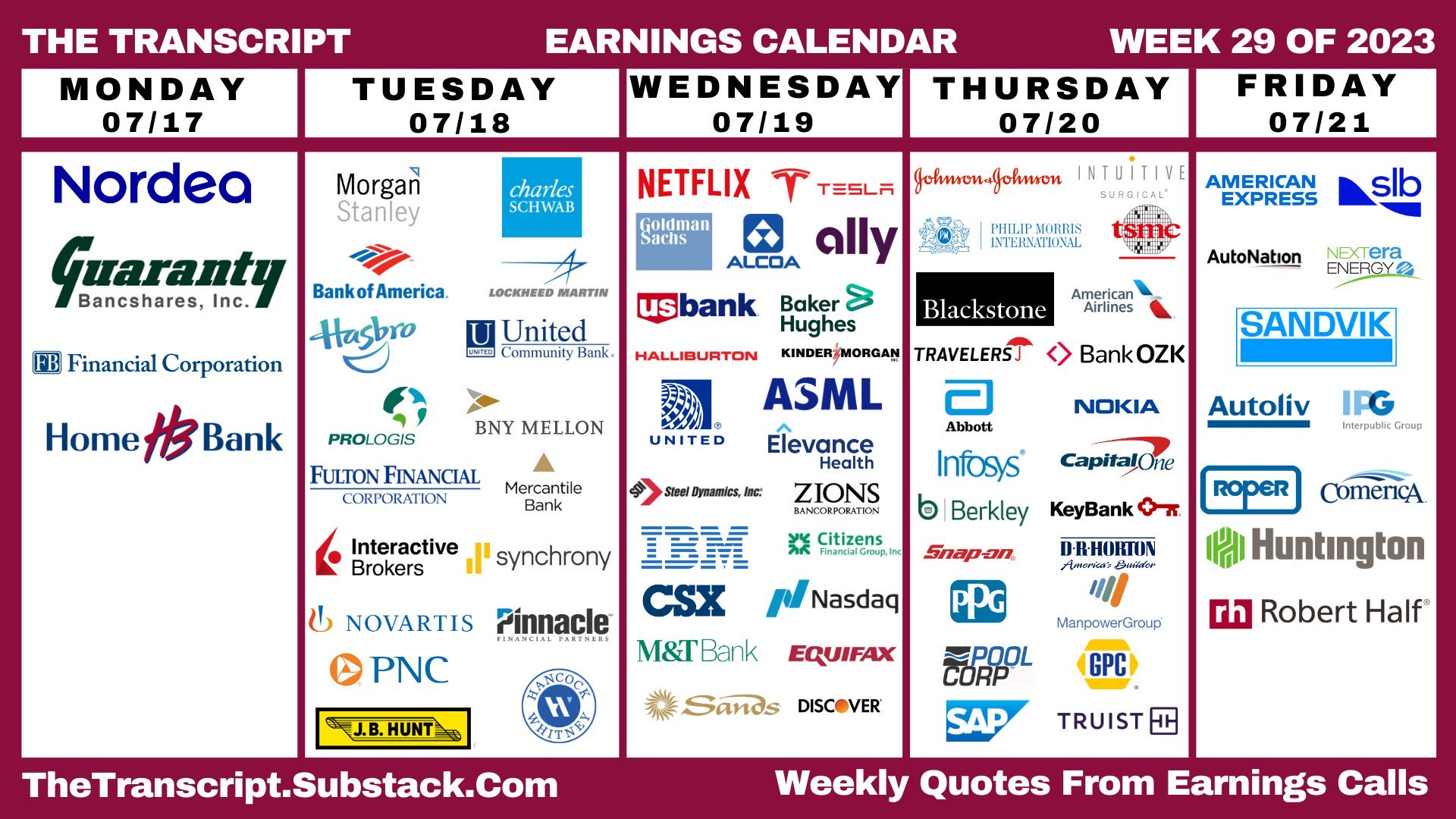

This Week Earnings

Analysis Articles

TheSpreadThread - Everyone's Starting a Multifamily

Cpital Flows - Macro Report/Insights: Maintain and Adaptive Mindset

Cameron Dawson - Second Half 2023 Outlook: The Imagination for Reality

저도 개발자인데 같이 교류 많이 해봐요 ㅎㅎ! 서로 화이팅합시다!