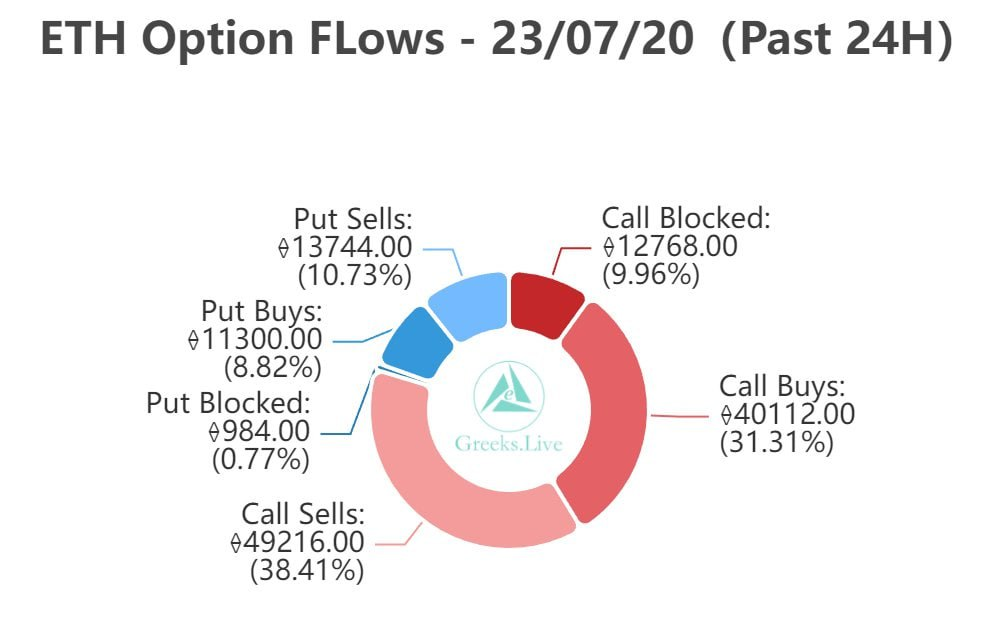

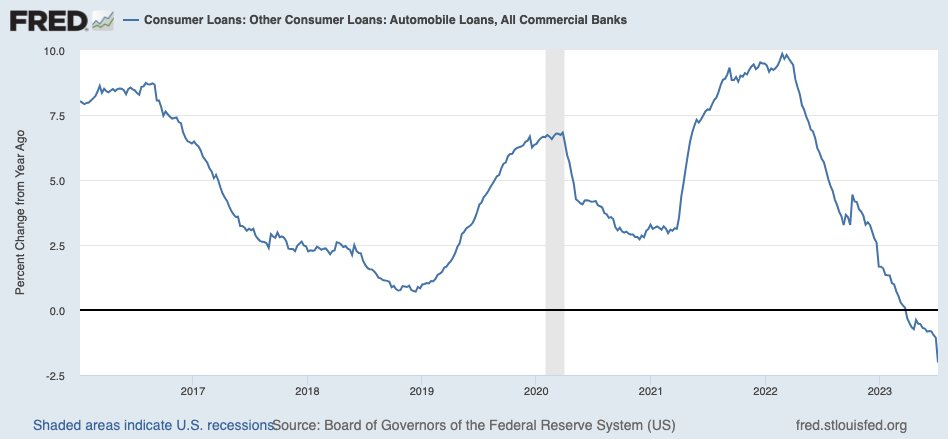

BTC ETH Options

Prices of BTC/ETH are falling and the options market is ramping up to sell calls.

The main focus of trading this week has been on July calls, with more than 70% of daily trades being contributed by calls, and a whopping 20% of July OTM(10% around the price) calls traded.

The strong Call selling atmosphere in the options market this week is continuing to depress short-term IVs, with IVs for weekly options now falling again to extreme lows of 30%.

Contrary to the large number of analysts who are bearish on the long term trend, institutions are going almost all out to short the short term market.

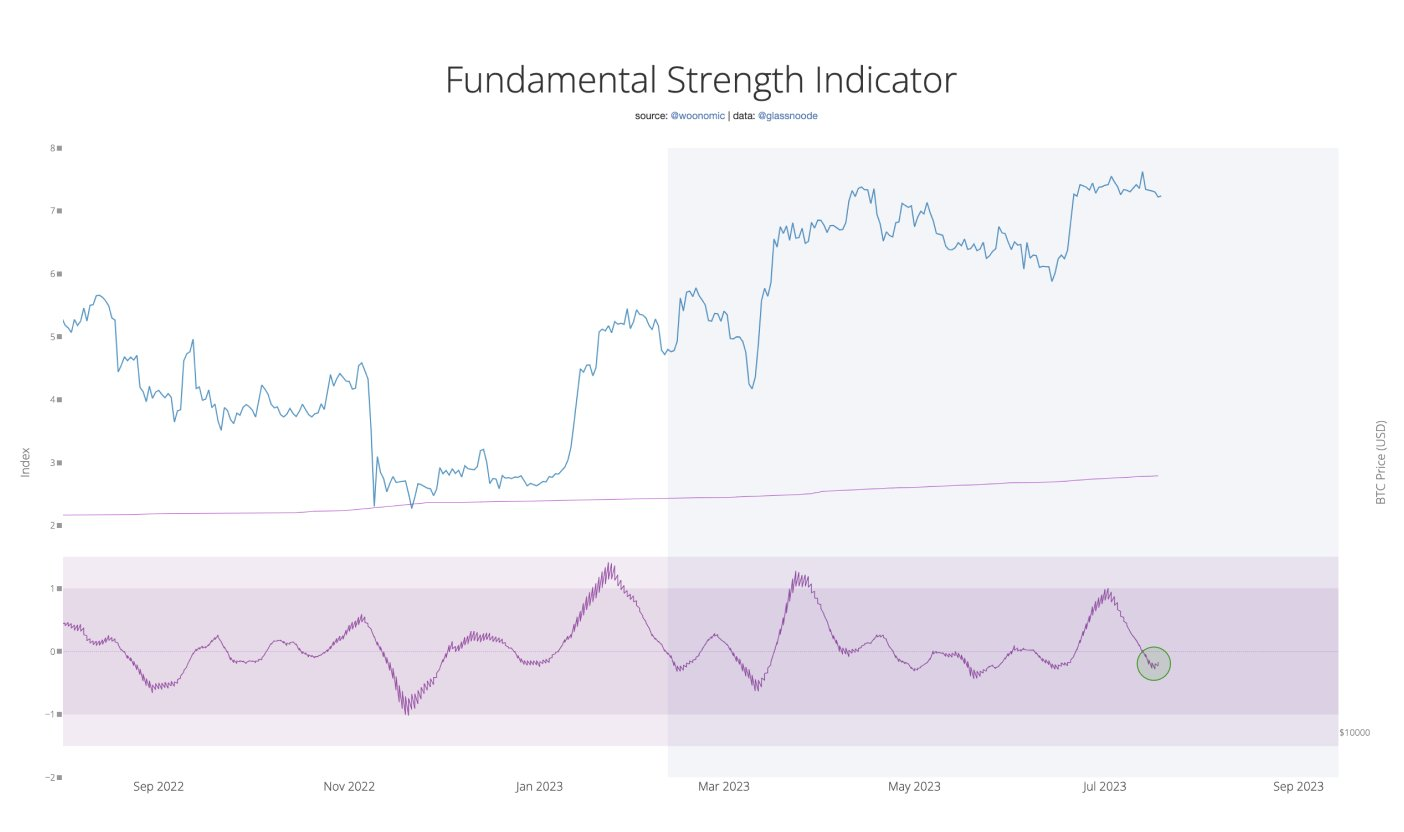

BTC Consolidation

Early signs that BTC consolidation is nearing completion (FSI chart below).

Futures demand is currently moving the market, this demand has been climbing against sideways price action (this is bullish).

Volatility dynamics also signalling a larger move is probable.

UK Gambling Law

The U.K.’s @hmtreasury says gambling law wouldn’t work for crypto, despite lawmaker concerns that plans to apply rules broadly similar to those for TradFi treats the sector too softly.

Coindesk - UK Government Rejects Lawmaker Plan to Regulate Crypto as Gambling

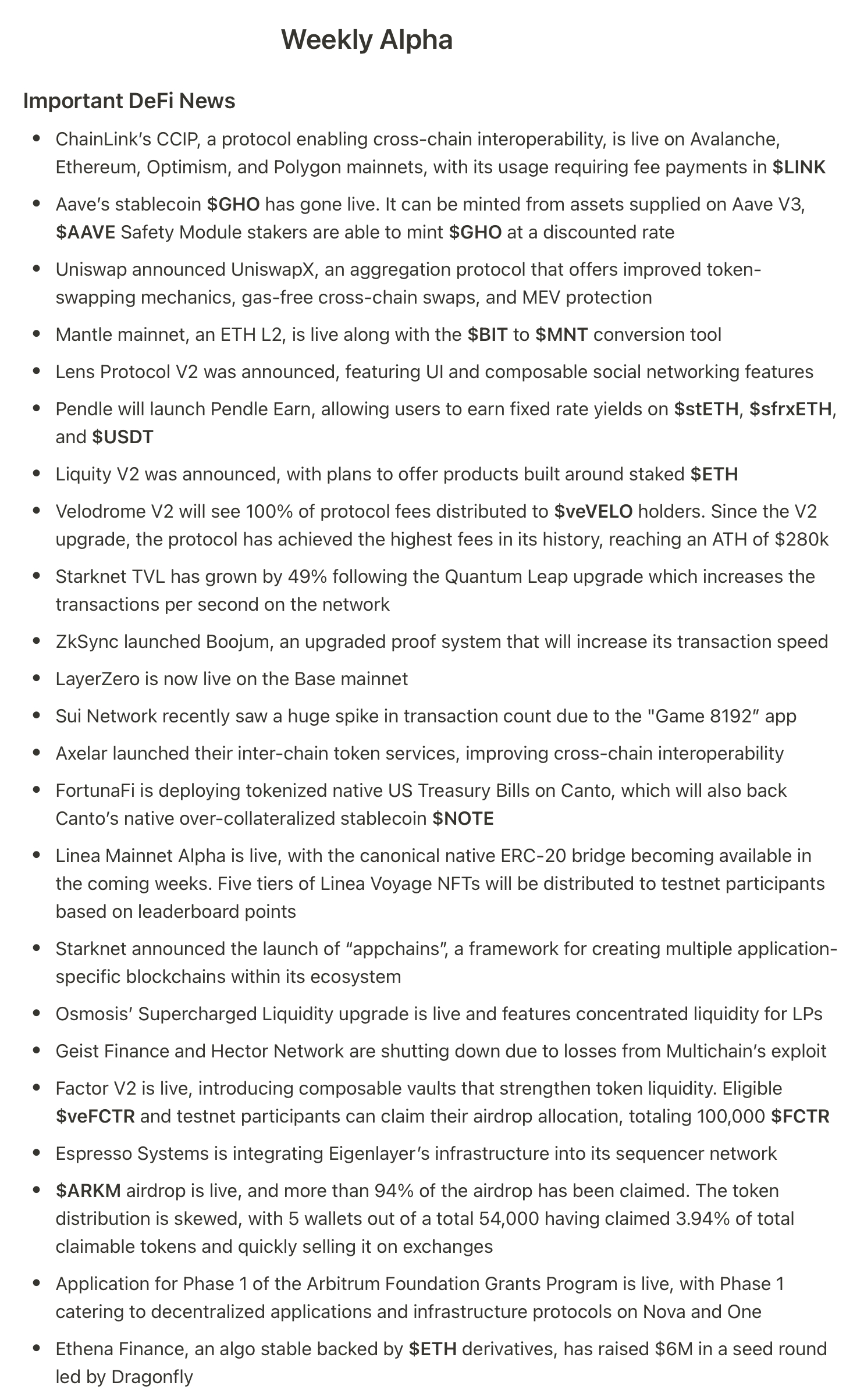

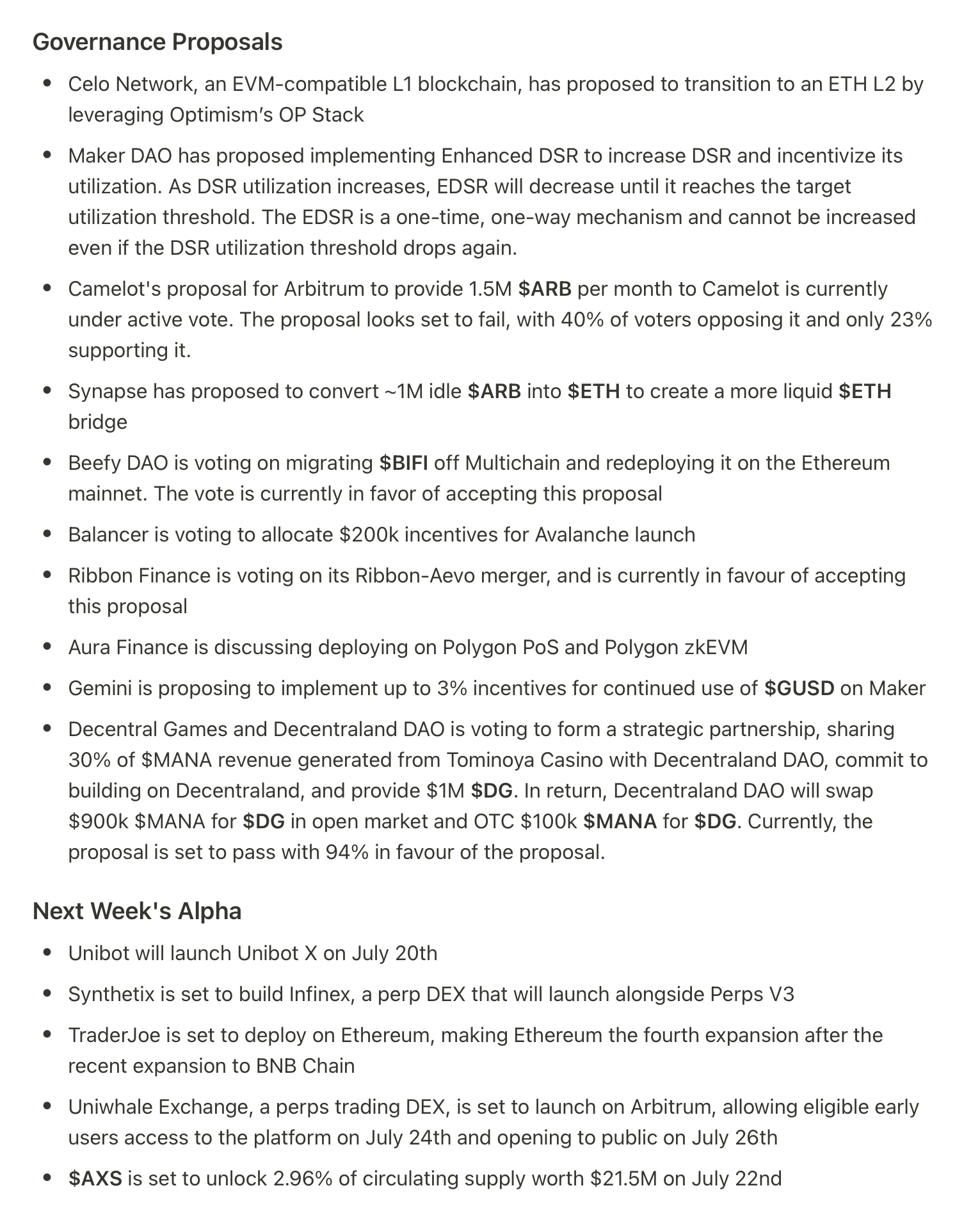

Weekly Alpha

Source Tweet - An Ape's Prologue

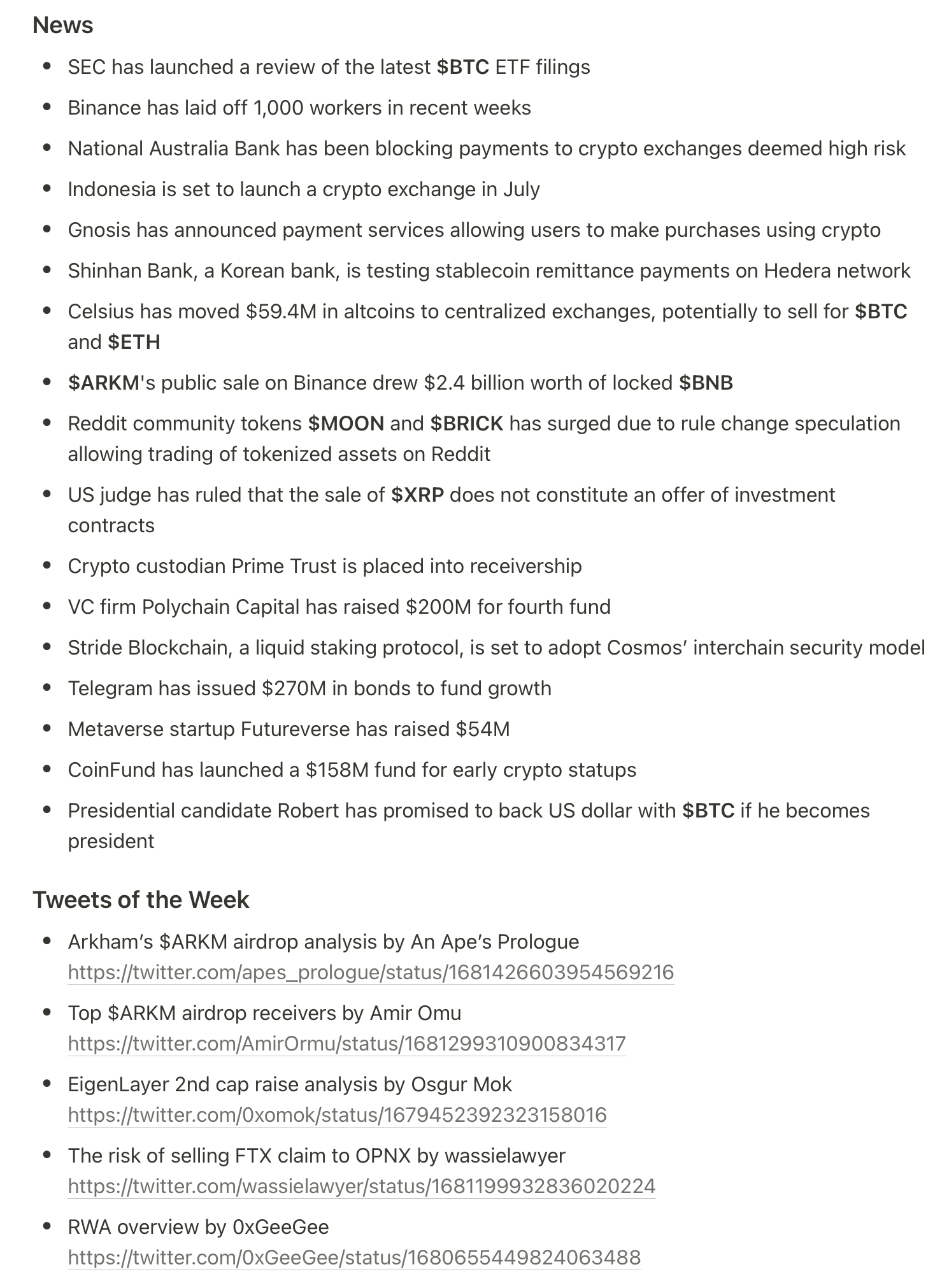

Interest Payments

The US, which spends more on its military than the next 10 countries combined, is now spending more on interest payments than defense spending 👀😮

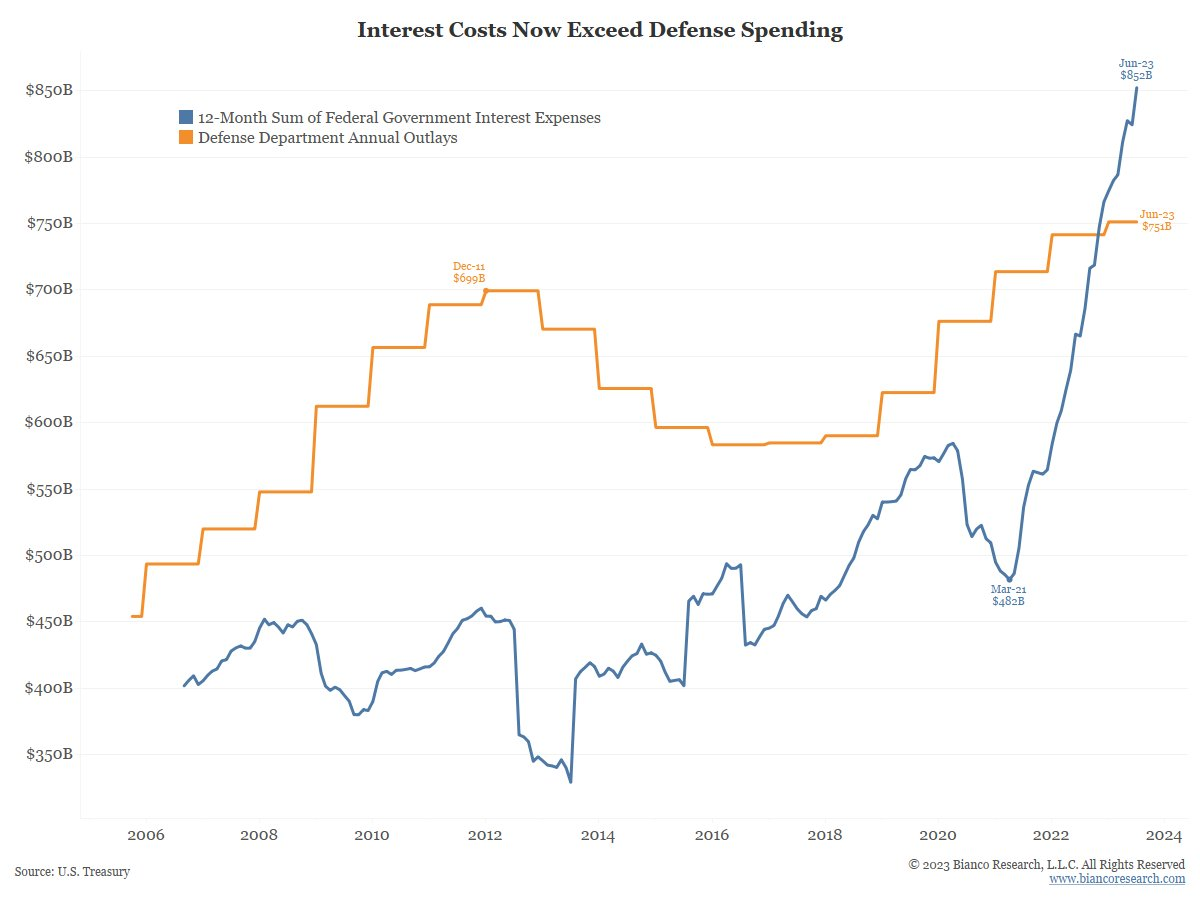

Chinese Flights

Chinese domestic flights are already at pre-pandemic levels, with international flights slowly catching up.

Source Tweet - Longview Economics

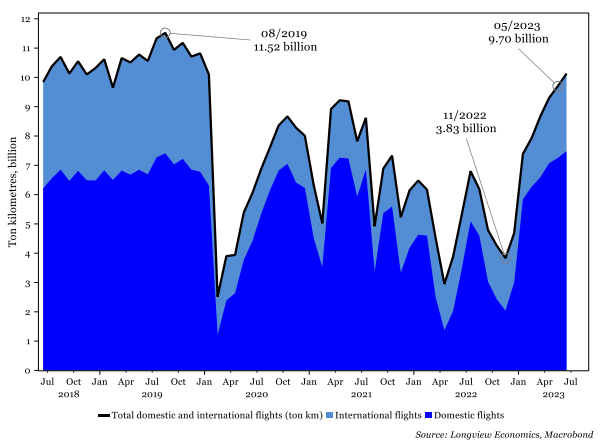

Auto Loans

Percent change in auto loans by banks dropped in the beginning of July and is negative for the first time since the pandemic. Combination of higher prices, higher interest rates and tightening bank credit likely generate slower sales later this year.

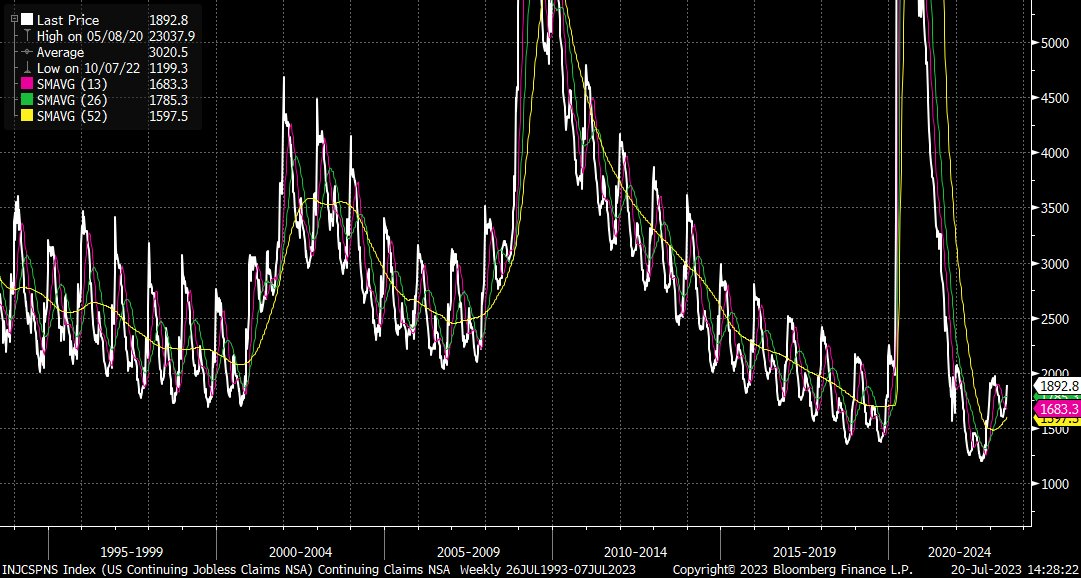

Continuing Claims

Continuing Claims – A Rare Divergence from Normal

With Covid the BLS deployed a new seasonal adjustment methodology, eventually scraping it earlier this year.

Whether the situation is, now, properly measured is a reasonable conversation.

Using the non-adjusted data one can see the usual seasonal patterns. Claims peak in January, fall back sharply to the June, bounce a bit and then generally bottom in Sept/Oct.

However, 2023 is looking different. Continuing claims, for the week to 7 July, are not far off their January levels.

The only time, in the past 30 years, that continuing claims exceeded the January level was 2001.

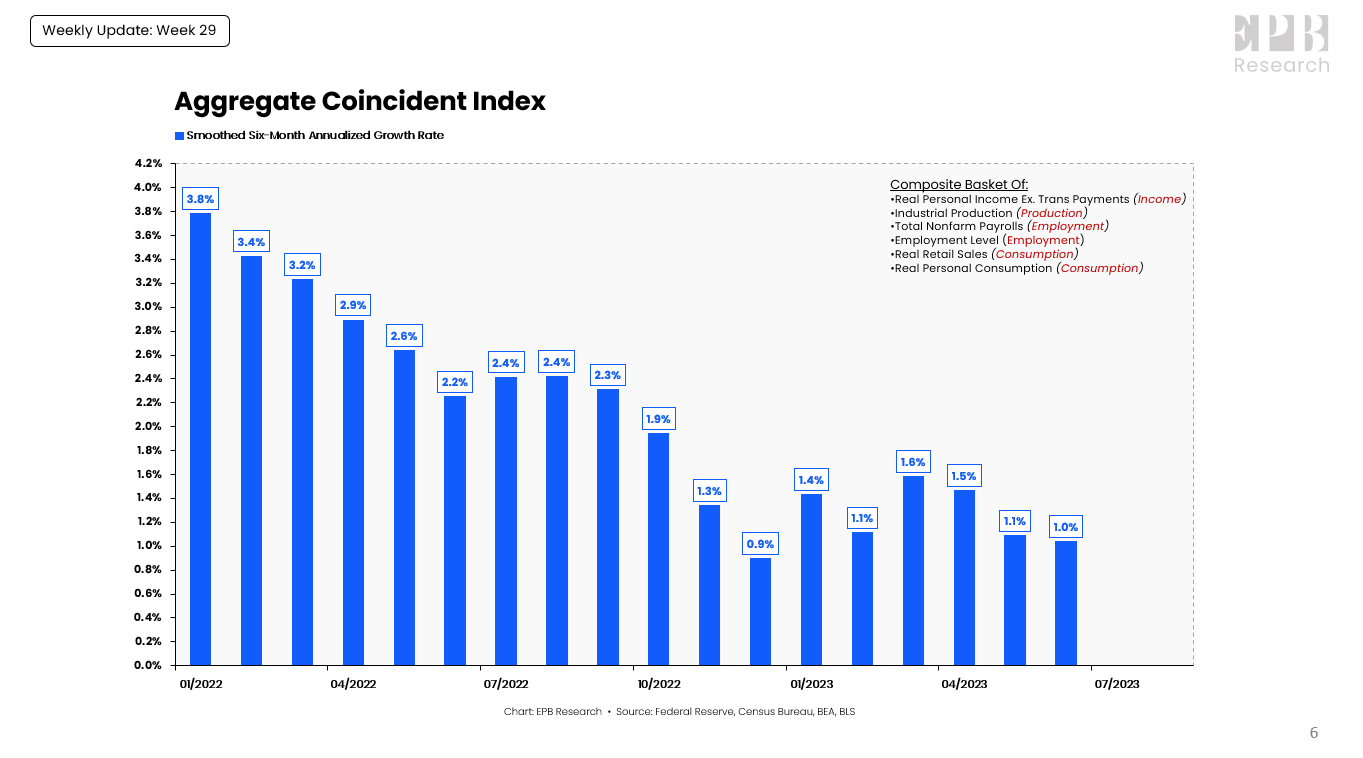

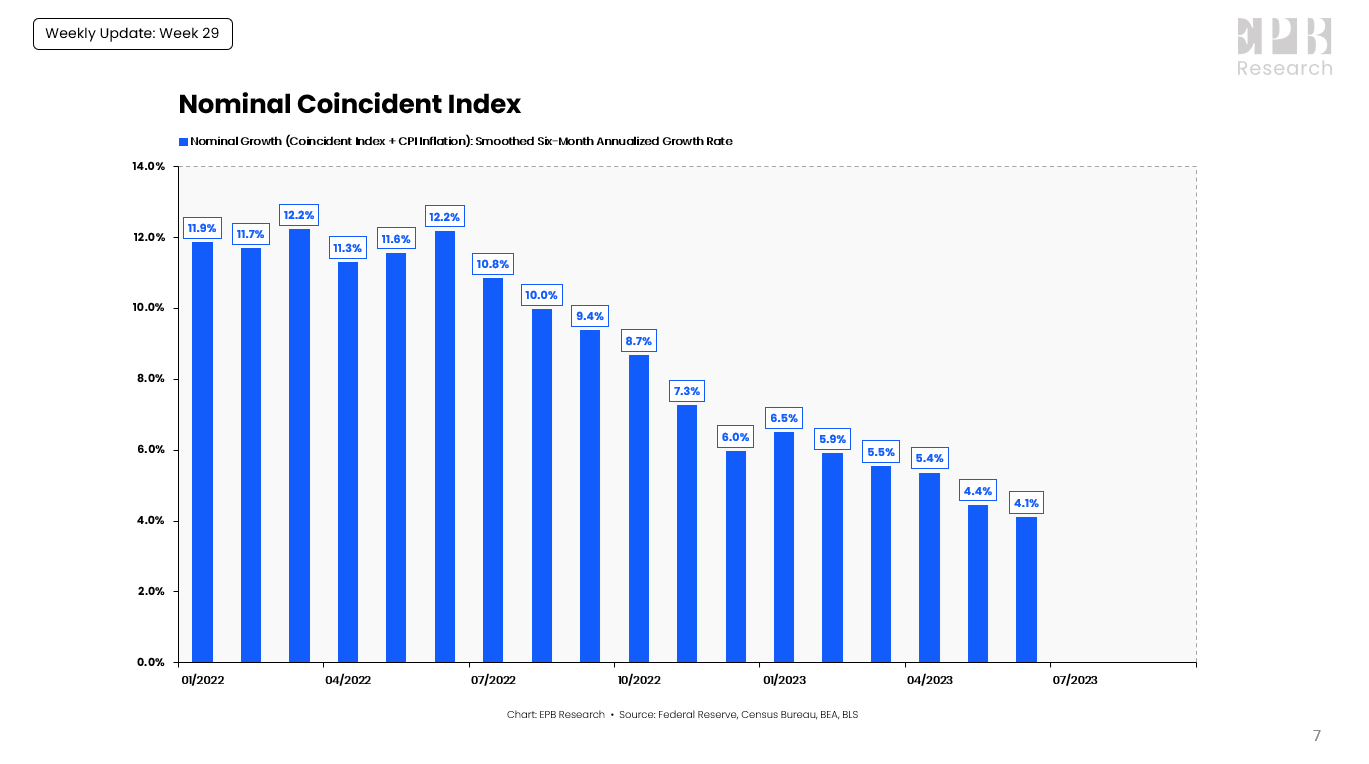

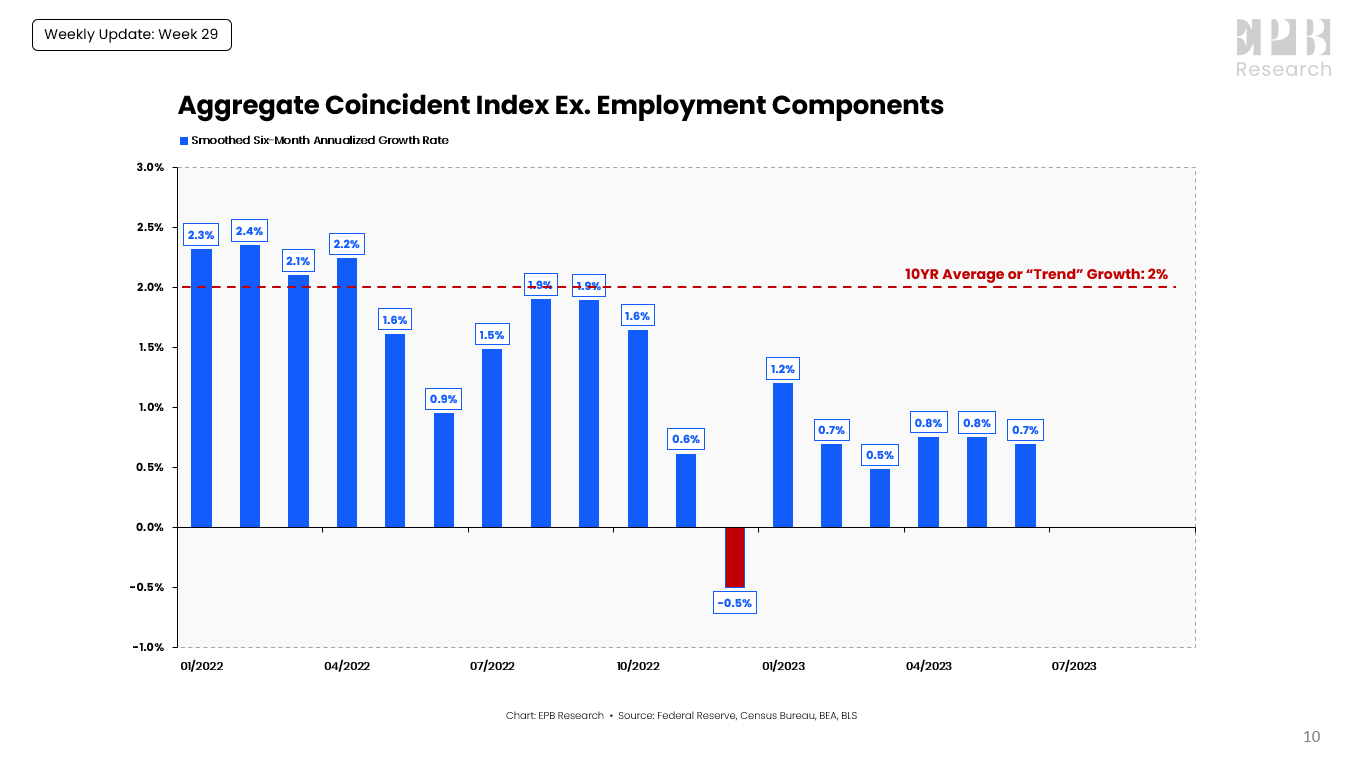

Aggregate Economic Activity

Despite the narratives created by market momentum, Aggregate Economic Activity continues to cool (slowly).

After the retail sales and industrial production data, the most objective measure of real growth shows just a 1.0% trend.

On a six-month basis, inflation has declined to 3.1%.

So our Nominal Coincident Index is showing a 4.1% growth rate as of June.

This is the lowest nominal growth rate of the cycle and below the 10YR average of 4.4%.

Nominal growth is no longer above trend.

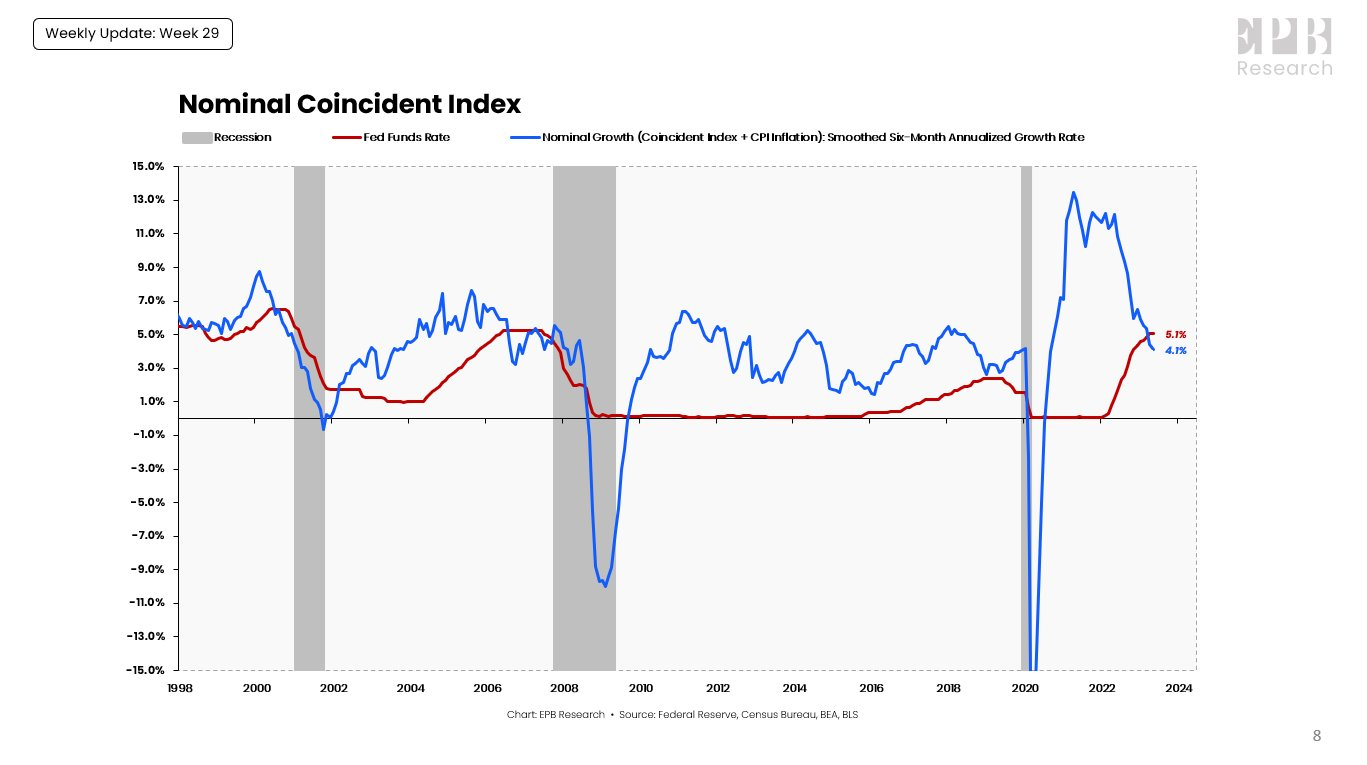

The Fed has raised short-term rates to 5.1%, soon to be ~5.3%.

So the Fed has short-term rates above current and trending nominal growth, a condition that historically doesn't last very long.

Aggregate Economic Growth is also overstated by employment growth.

Our Aggregate Coincident Index of six NBER variables contains two employment components.

Excluding employment, Aggregate Economic Activity is just 0.7%.

If employment growth is running above sales and production growth, then worker productivity declines, margins compress, and employers have to make adjustments.

These dynamics are all captured in a well-formed Leading Employment Index.

Similar to the chart on nominal growth, the risk is that monetary policy gets incrementally tighter even without further rate hikes as inflation/nominal growth declines.

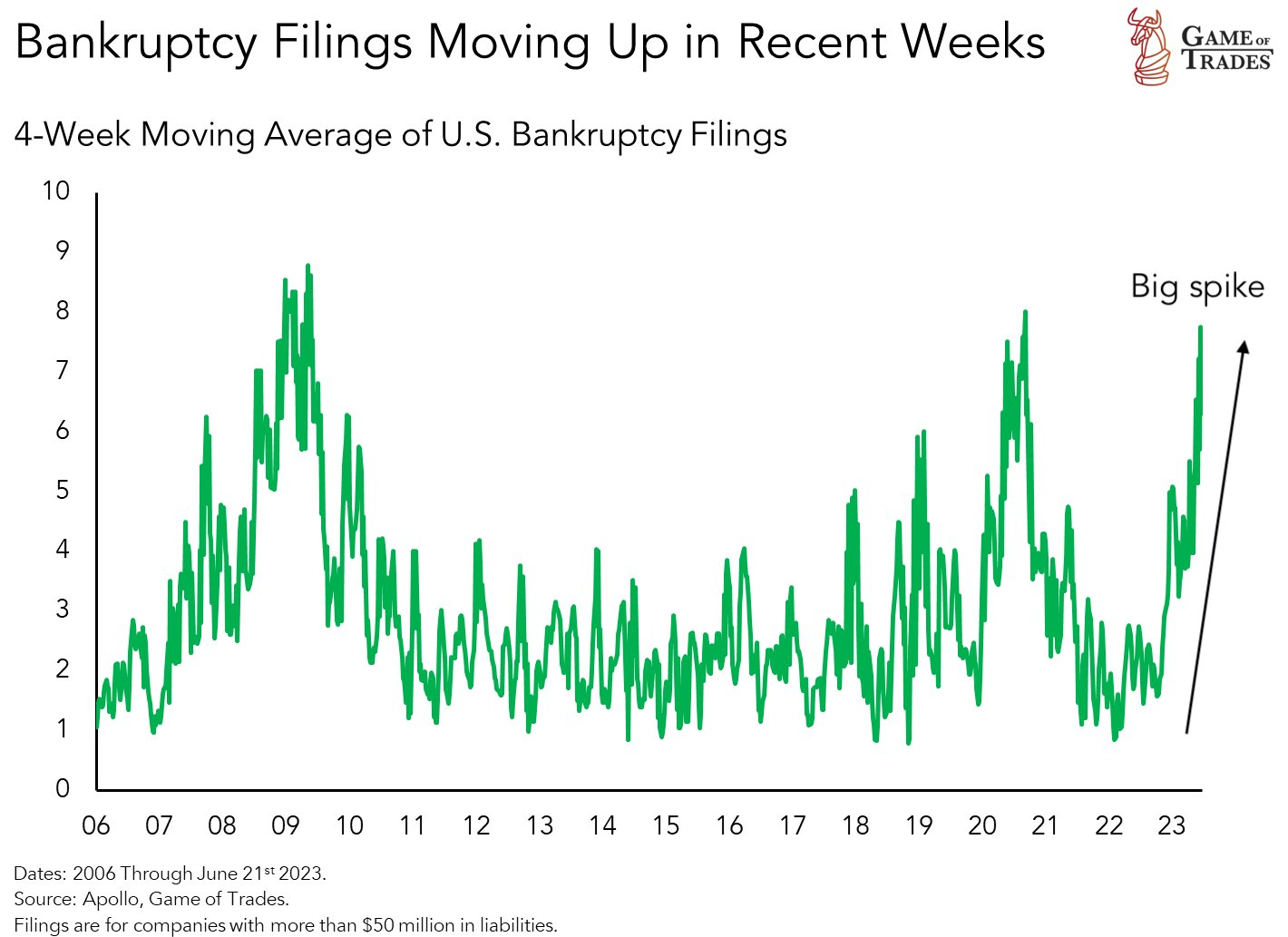

Corporate Bankruptcies

Corporate bankruptcies have been spiking in recent weeks

Let's take a look at why and the market implications

An important thread

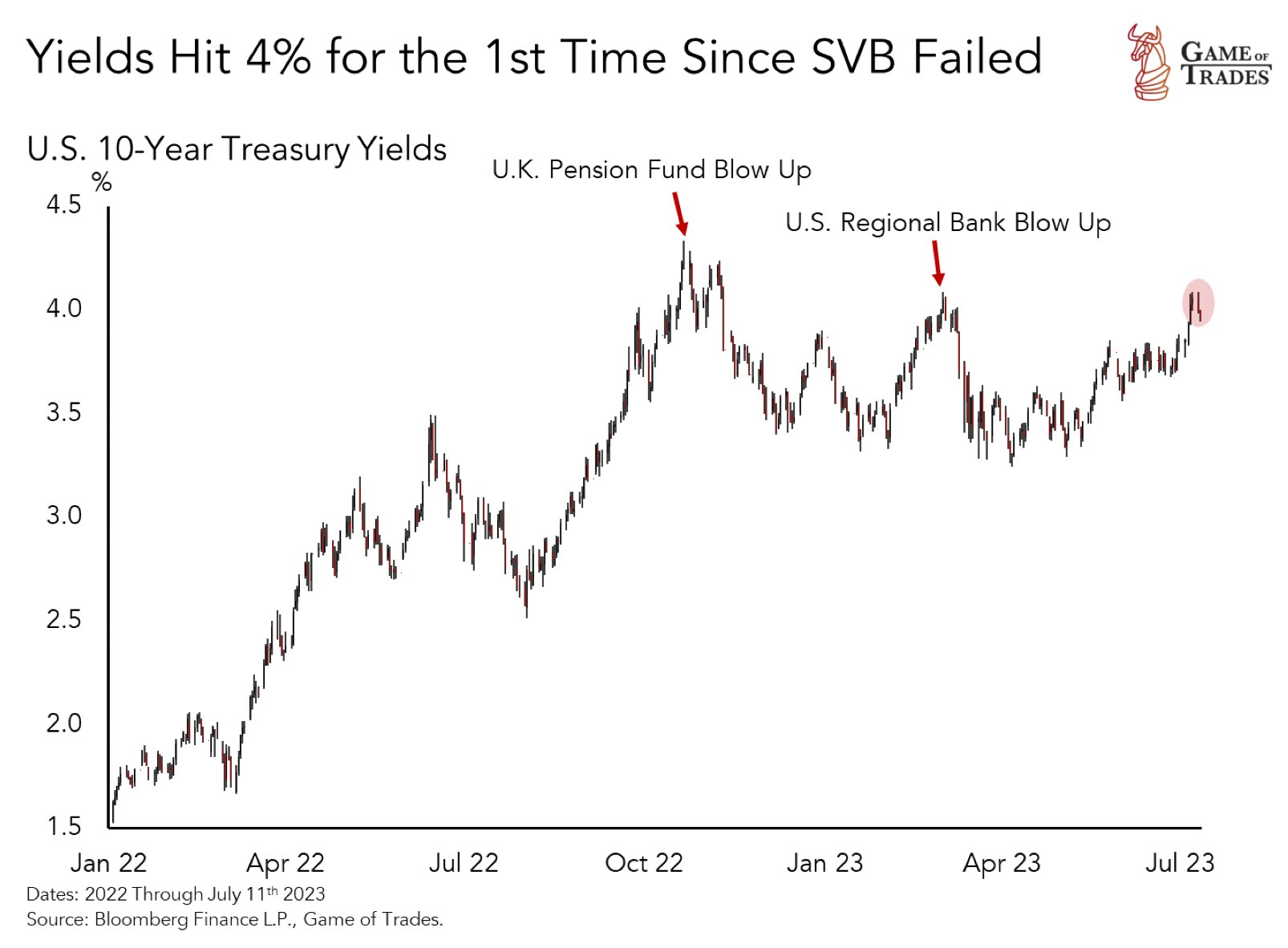

Rising bankruptcies coincides with bond yields hitting 4%, a level previously associated with the Silicon Valley Bank collapse and UK pension fund crisis

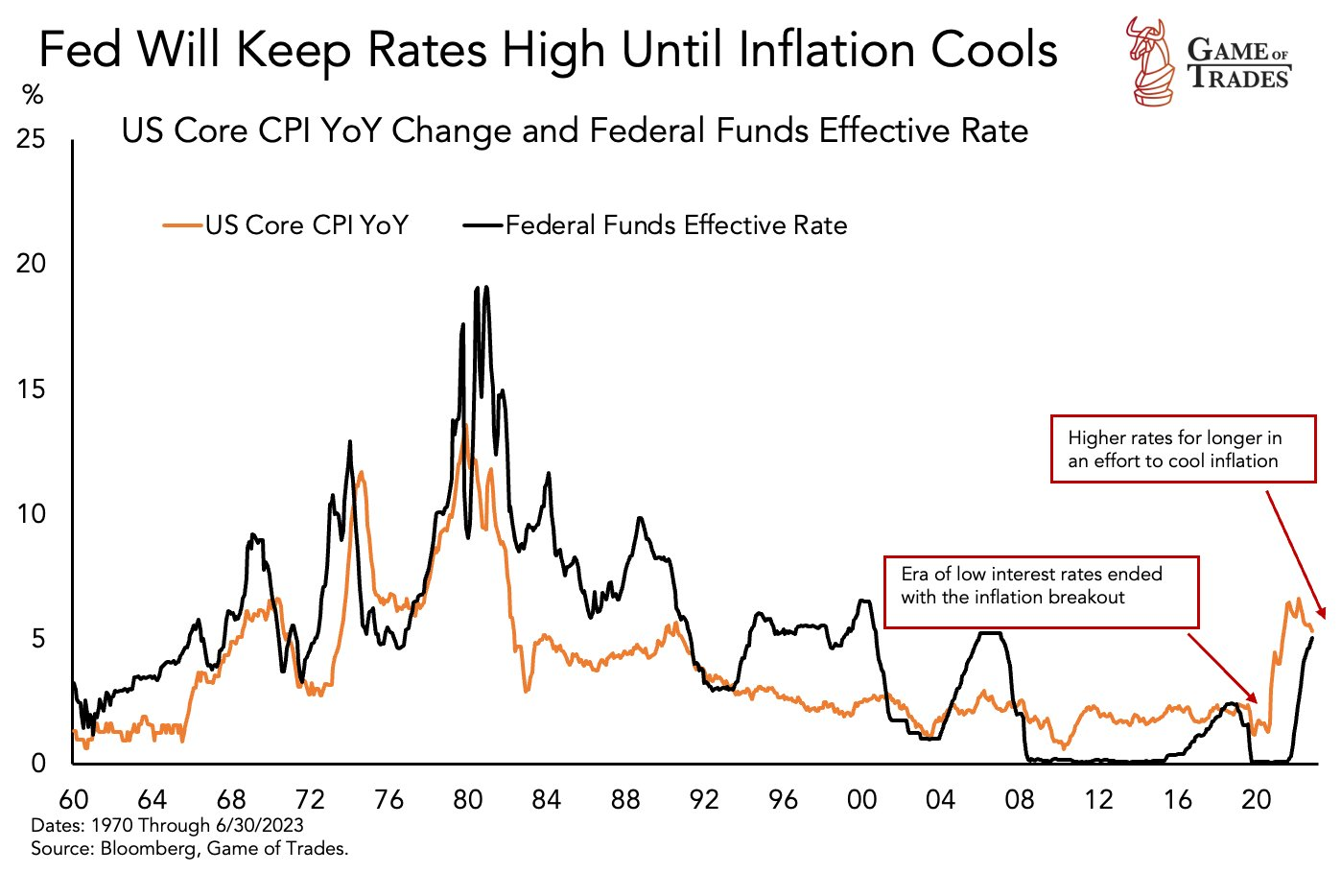

Despite escalating financial stress, the Fed maintains a 'higher for longer' stance to curb inflation

This is amidst a U.S core CPI inflation rate persistently above 5% and the Fed funds rate

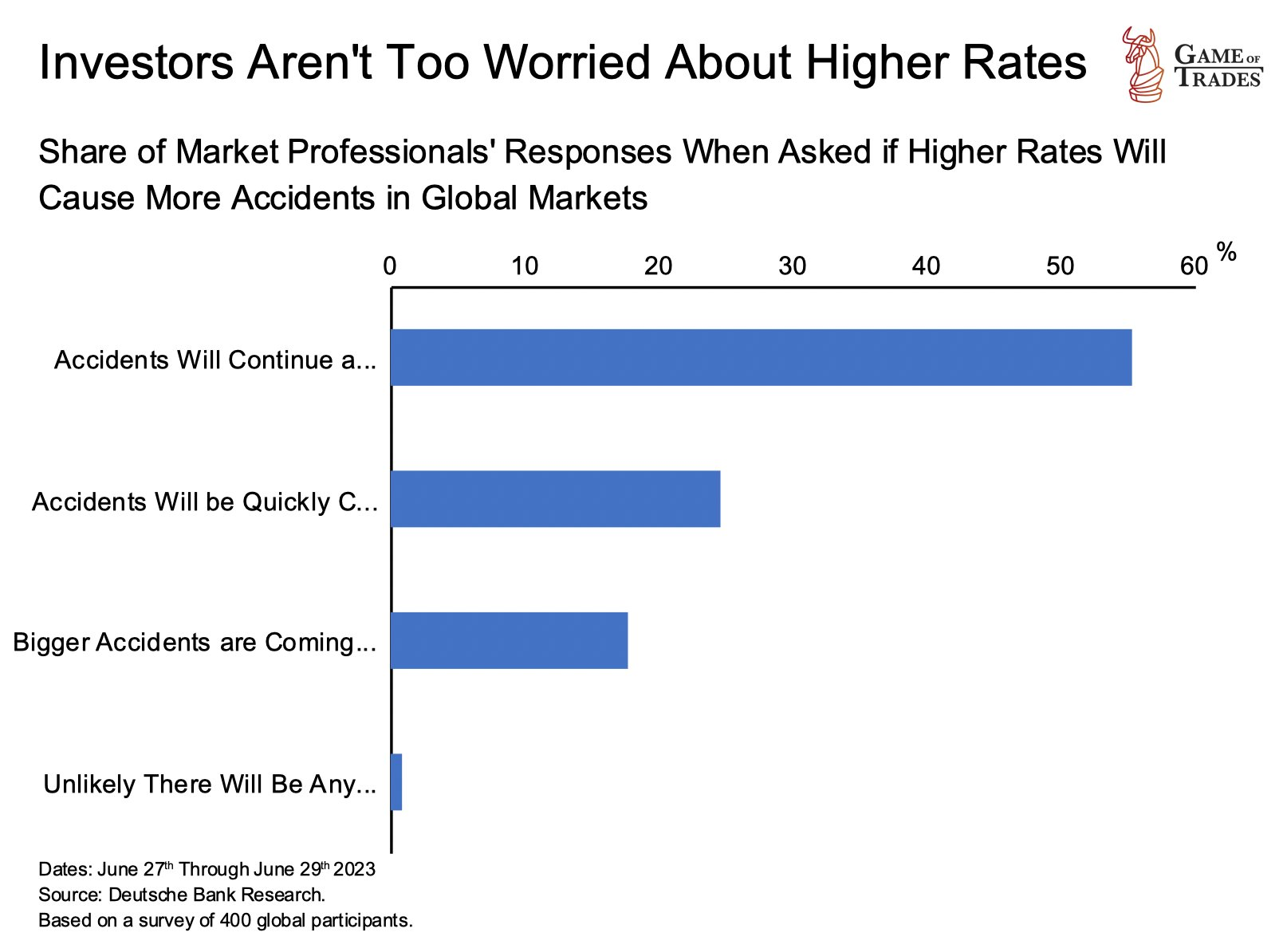

A Deutsche Bank survey indicates that over half of market professionals anticipate market stress due to higher rates

While 20% foresee minimal impact, and approximately 17% warn of potential severe financial stress

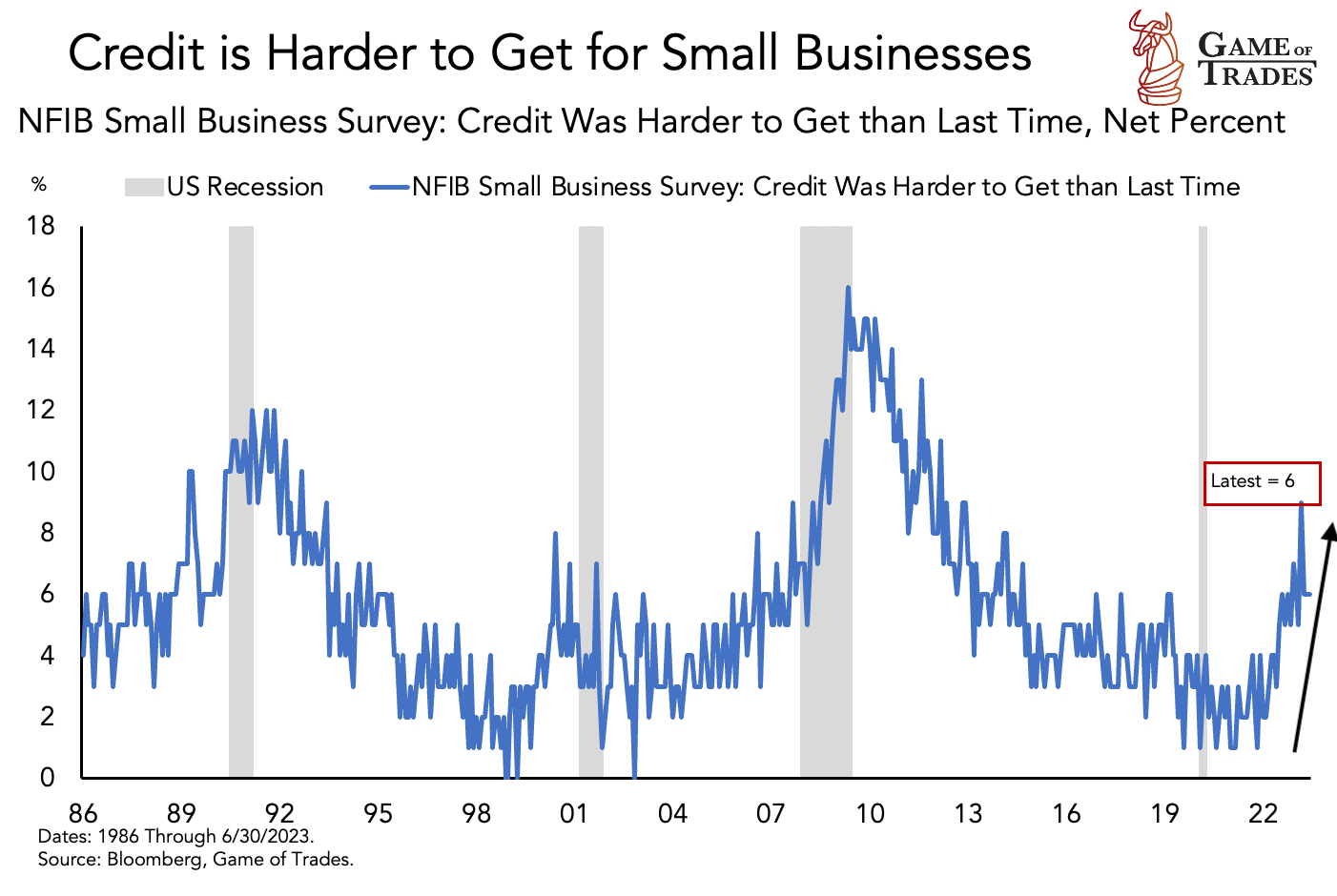

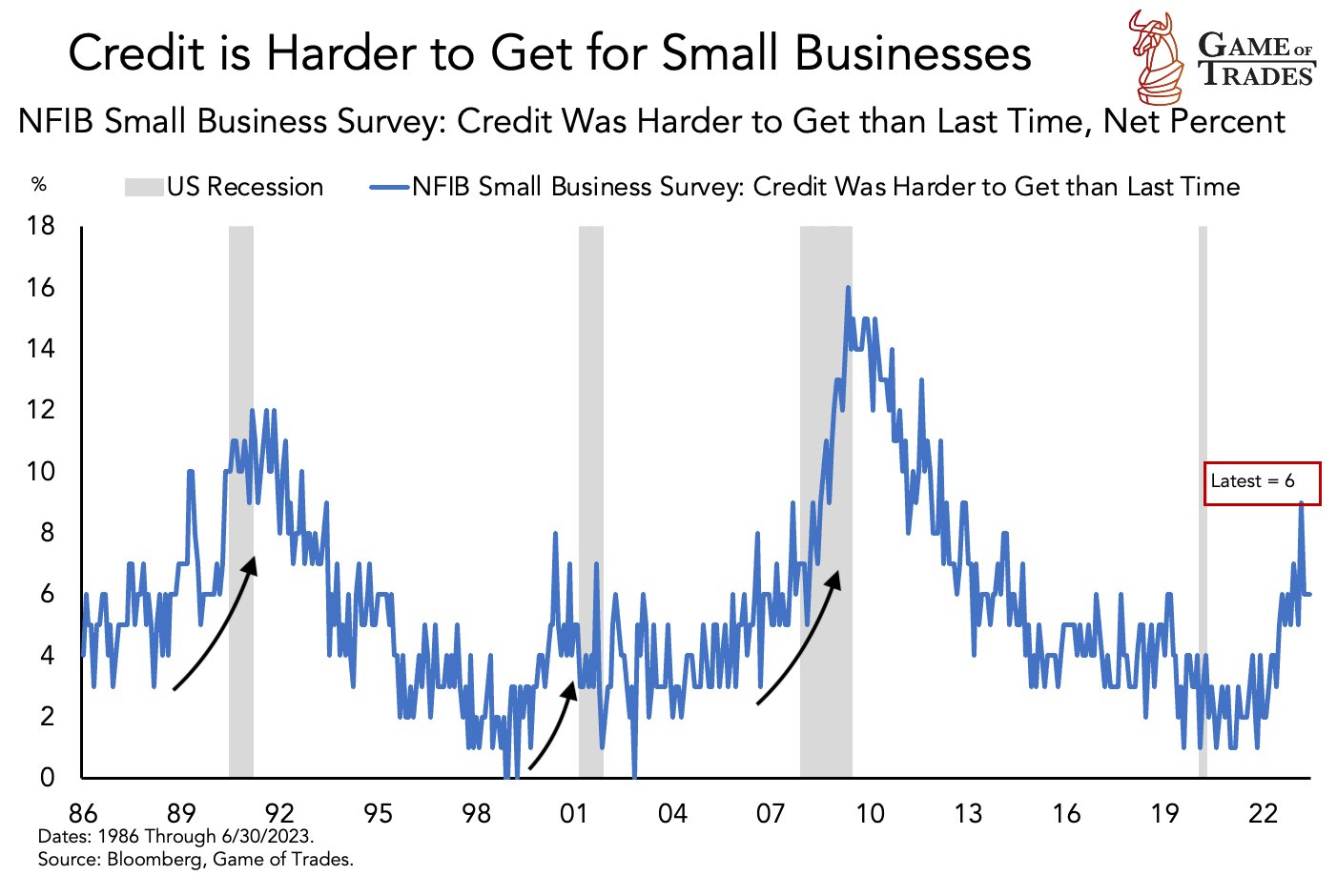

Businesses are finding it increasingly challenging to secure loans due to stricter credit standards, a consequence of higher rates

Historically, tighter lending standards precede recessions, as evidenced in:

- 1989

- 1999

- 2007

In each case, the Fed was in a tightening cycle

The stricter credit standards aligns with the rise in bankruptcy filings, as per Apollo research

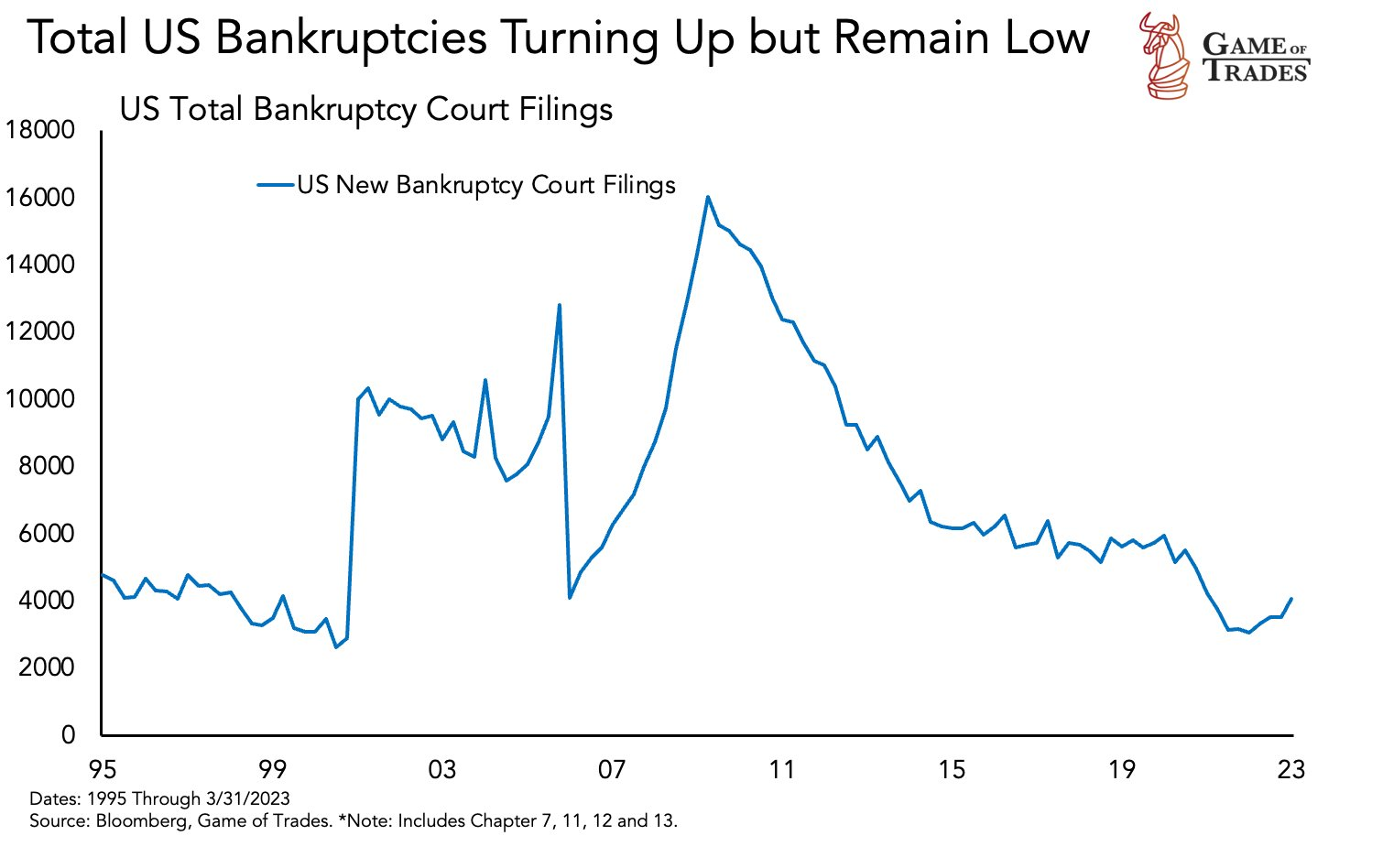

It’s important to note that the bankruptcy filings are from companies with liabilities exceeding $50 million, a specific sample

A broader view of total U.S. bankruptcy court filings from a different dataset presents a different narrative

Bankruptcy filings remain low on a relative basis, but have been trending higher

The current default rate is merely the beginning

As the Fed sustains high rates, bankruptcy figures are set to worsen

While 2023 sees limited debt maturing, refinancing concerns escalate from 2024 onwards

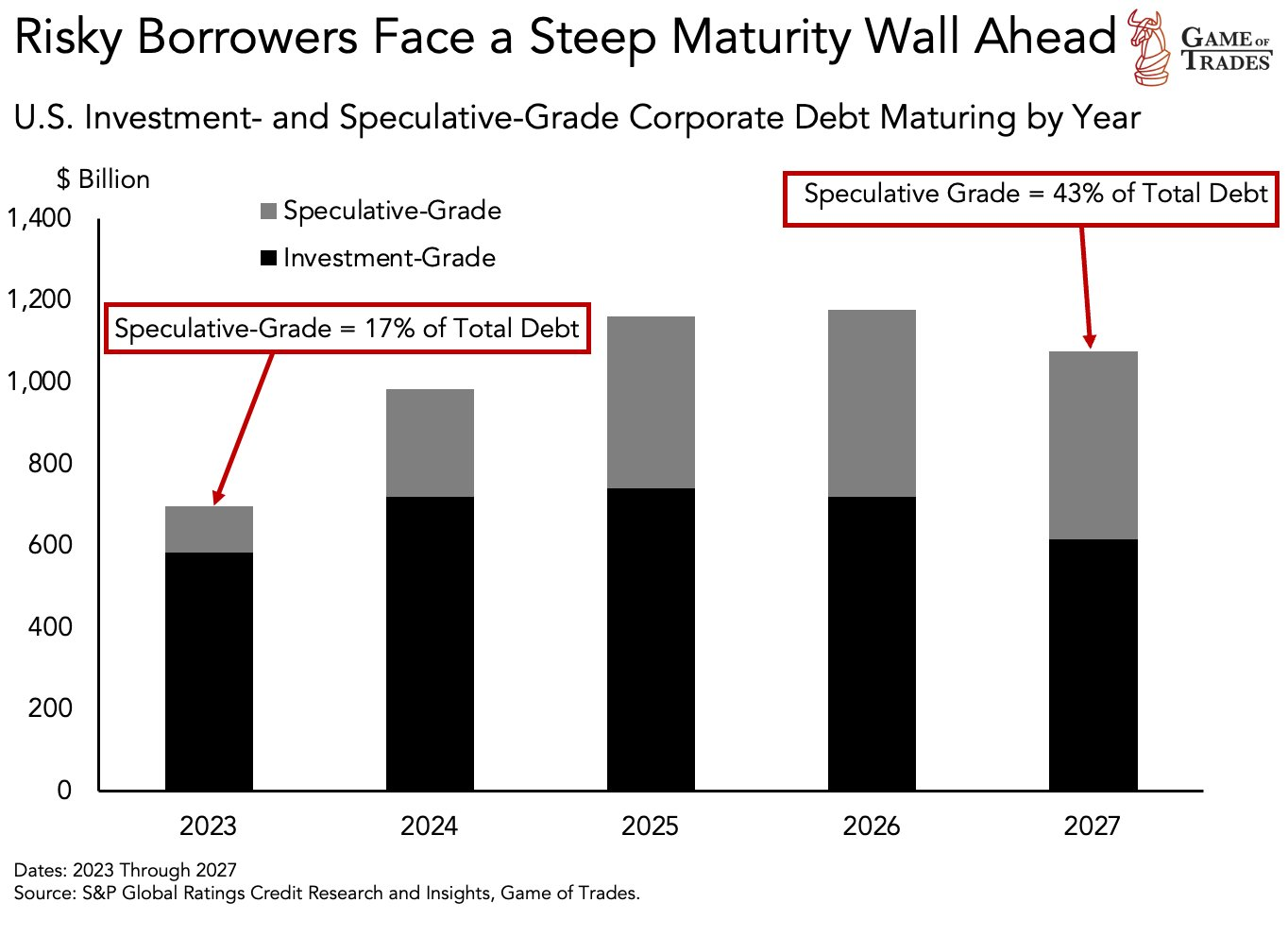

The chart below illustrates annual debt maturity and the breakdown of speculative vs investment-grade debt maturing

In 2023, approximately $700 billion of debt matures, sparing businesses that refinanced at low rates in 2020/21 from higher rate environments

However, in 2024, debt maturity is expected to surge to $1 trillion, and in 2025, it is expected to reach $1.2 trillion

The market's current lack of concern stems from the economy's delayed response to interest rate hikes since 2022

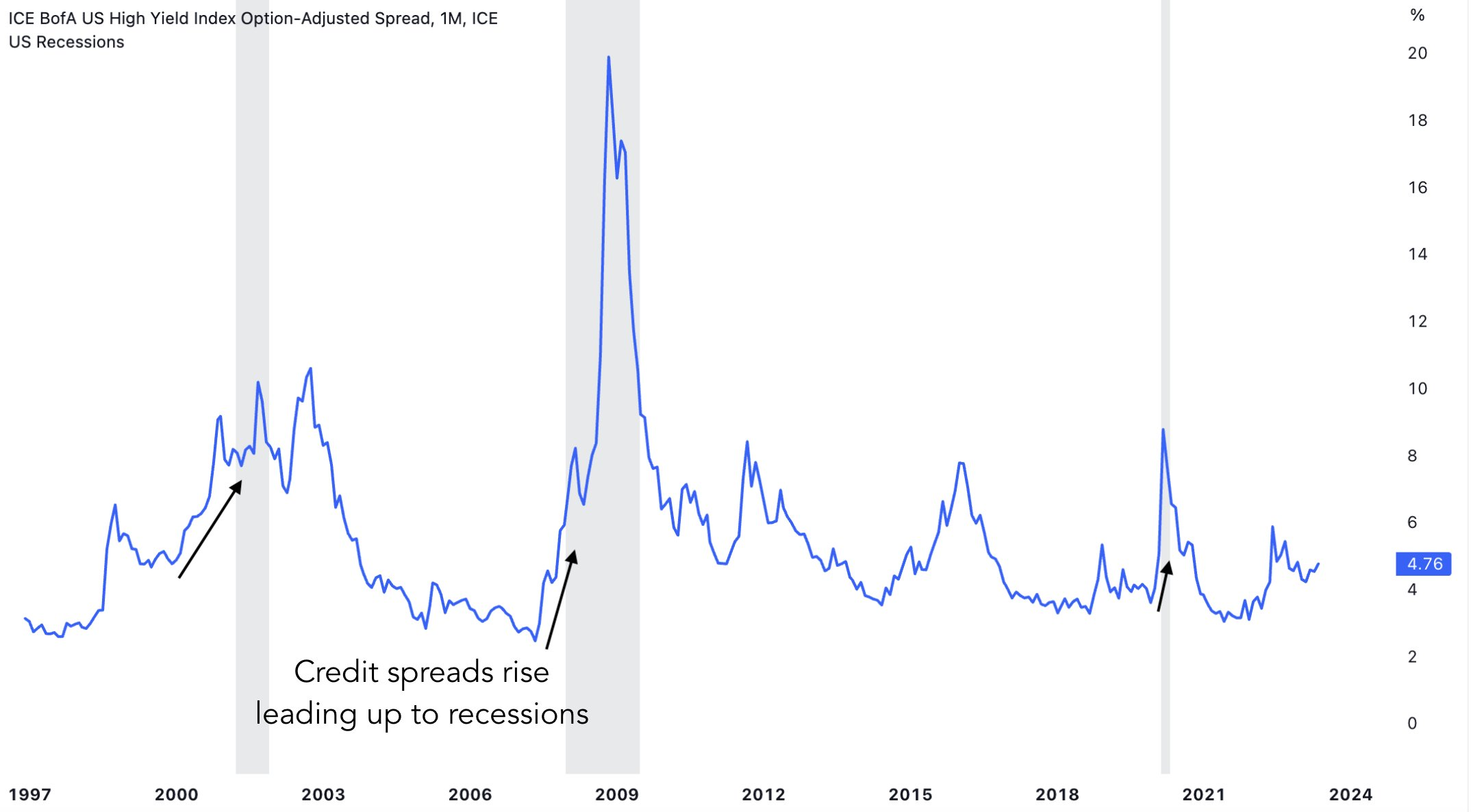

Which also explains the persistently low credit spreads

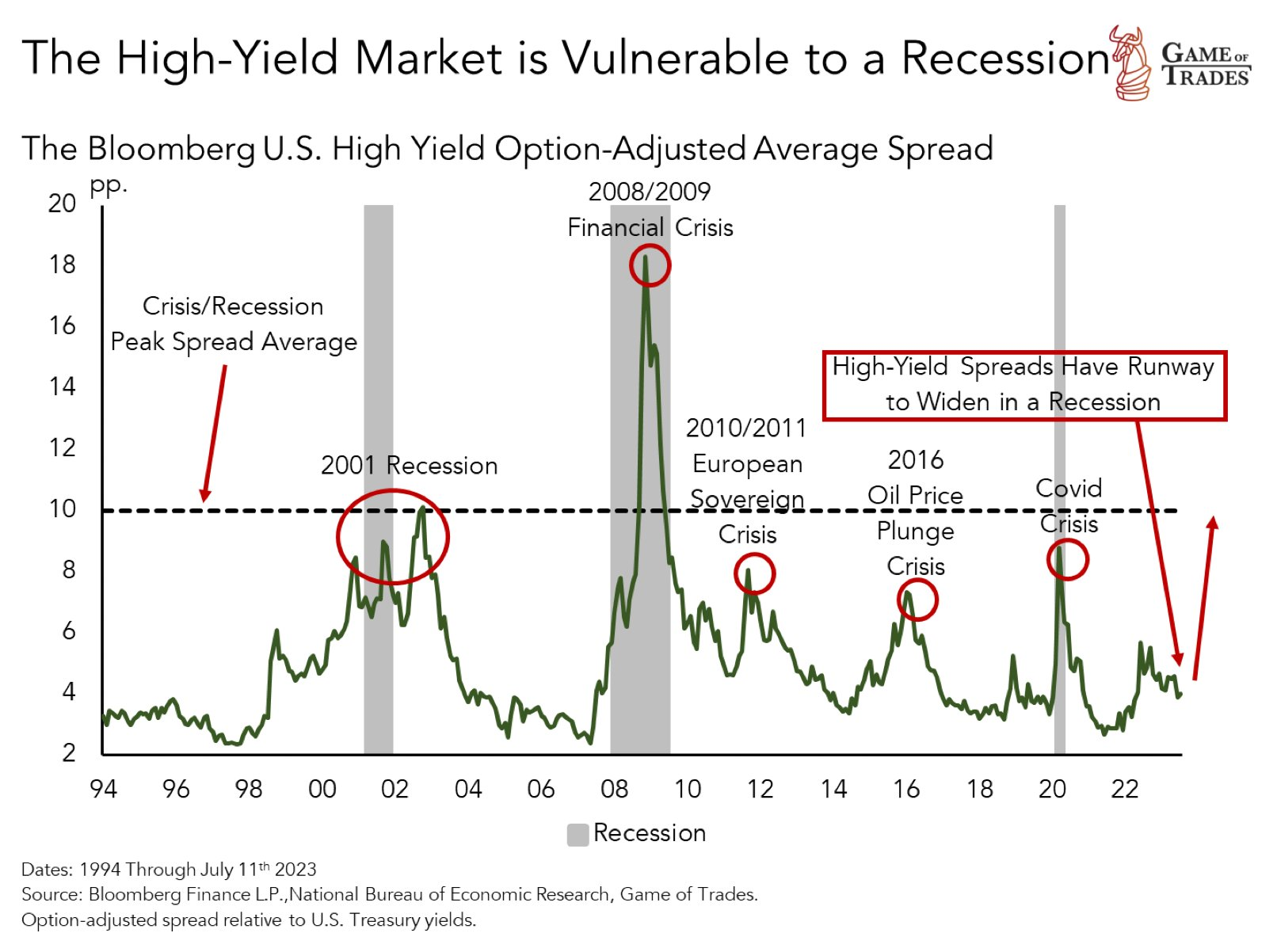

Credit spreads, indicative of credit risk pricing in financial markets, typically rise ahead of recessions, as seen in 2001, 2008 and 2020

Despite recent bankruptcies, credit spreads remain stable due to 2 factors:

-

Most companies have yet to refinance their debt

-

The economy has not yet entered a recession

As the Fed persists with restrictive rates, the market is likely to price in more risk as bankruptcies increase

This could lead to wider credit spreads and lower stock prices, with the peak panic occurring during the recession

TSLA

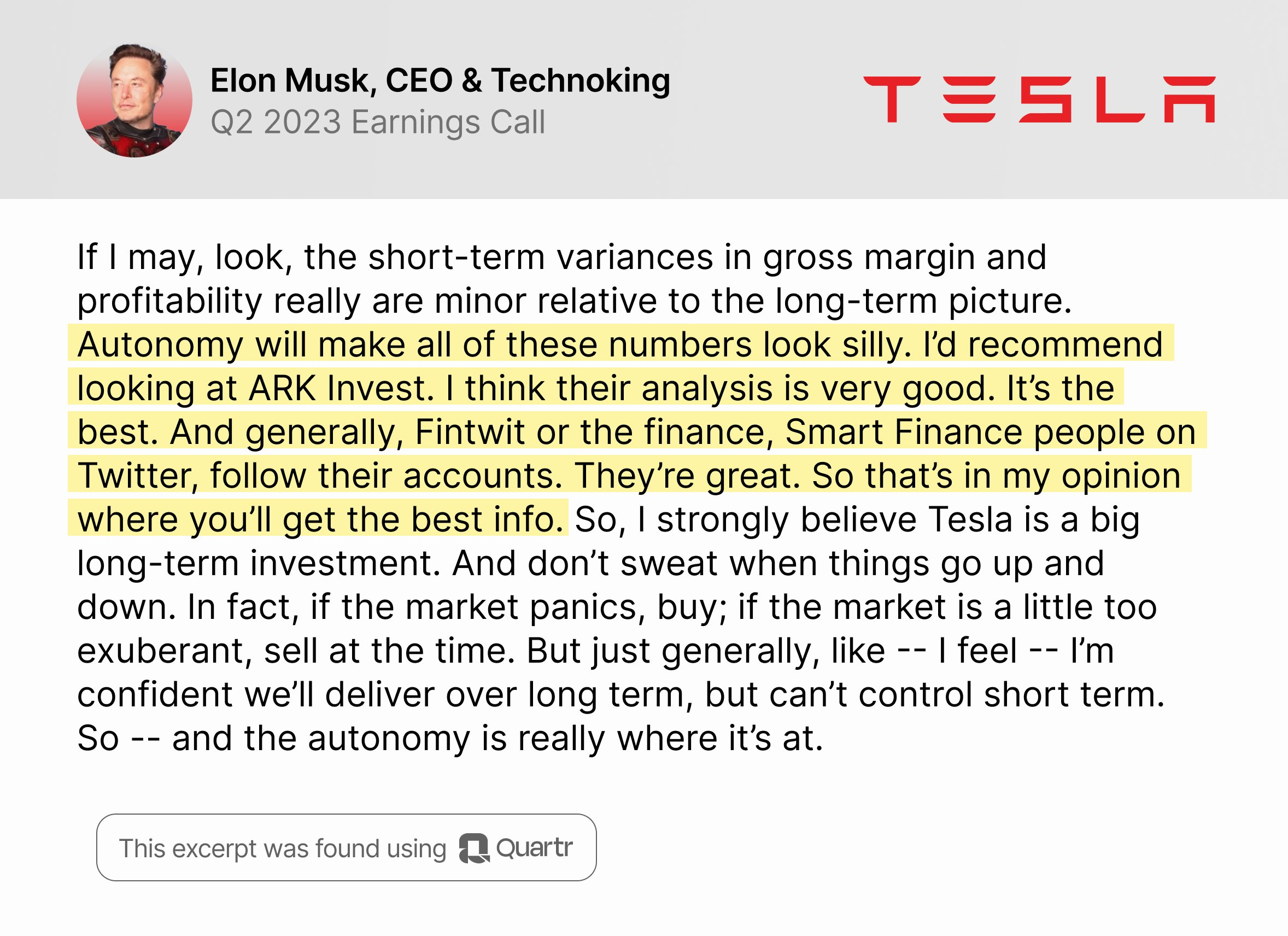

Yesterday's $TSLA earnings call was wild.

Elon gave investing advice, cited Benjamin Graham and claimed Tesla could 10x from here ($9+ trillion).

You will find all the highlights in this thread 🧵

- Elonmusk recommends ARK Invest, calling their research "the best"

"I care a lot about the sort of small shareholders [...]. I love you, guys."

- The outrageous 10x, or $9 trillion, remark, plus a reminder to "buy and hold"

- Elon recommends buying stocks in companies who make products you love, then he goes on citing Benjamin Graham

- Apparently, $TSLA's Model Y became the best selling vehicle of any kind globally in Q1

- Elon says he thinks it's "ridiculous" that $TSLA has positive FCF

Not your regular corporate jargon 😂

- Elon claims $TSLA's robotaxi products will "drive volume through the ceiling, next level", and that demand is "quasi-infinite"

- $TSLA's full self-driving will be 10 times safer than the average human driver, according to Musk

- And he says $TSLA's advantage in self-driving is in their unique data

- He then for some reason starts talking about Nerualink and building robot arms and legs

- $TSLA's Supercharging network has now surpassed 50,000 and the connected open source protocol is now called the North American Charging Standard

Analysis Articles

Amberdata - Decoding Option Flows: Q2 2023

3개의 댓글

In the vast expanse of the online gambling world, there exists a figure known only as the High Stakes Player. Their reputation precedes them, whispered in hushed tones among the most seasoned of gamblers. With nerves of steel and a mind sharp as a razor, they navigate the treacherous waters of online casinos with unmatched https://fastpaycasino-au.com/ confidence and precision.

잘 봤습니다. 좋은 글 감사합니다.