Valkyrie BTC ETF

Final piece of the #Bitcoin ETF puzzle for now. @ValkyrieFunds added to the federal register today as expected. Next date to watch is the 8/13/23 deadline for Ark/21Shares'. We expect it to be DELAYED.

(It's possible the Grayscale vs SEC court decision comes before that though)

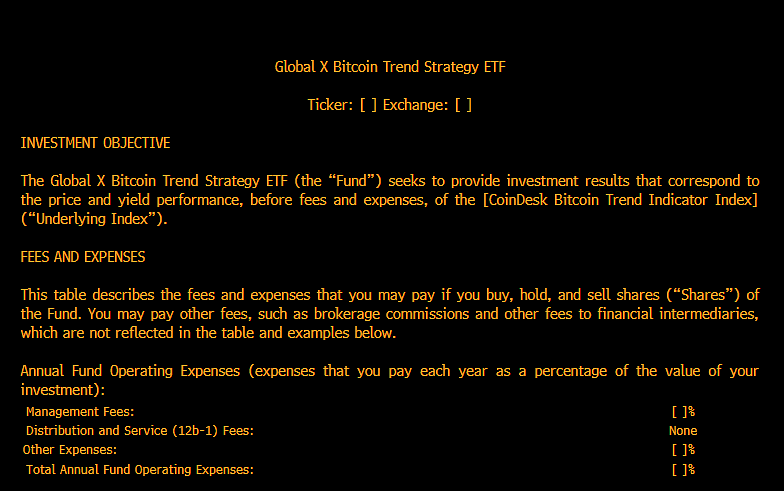

New BTC Future ETF

Looks like @GlobalXETFs has partnered up with @CoinDesk indices to file for a Bitcoin Trend Strategy ETF. Will use trend following indicators to be tactical/dynamic in with Bitcoin futures.

Potential effective date = ~10/3/2024

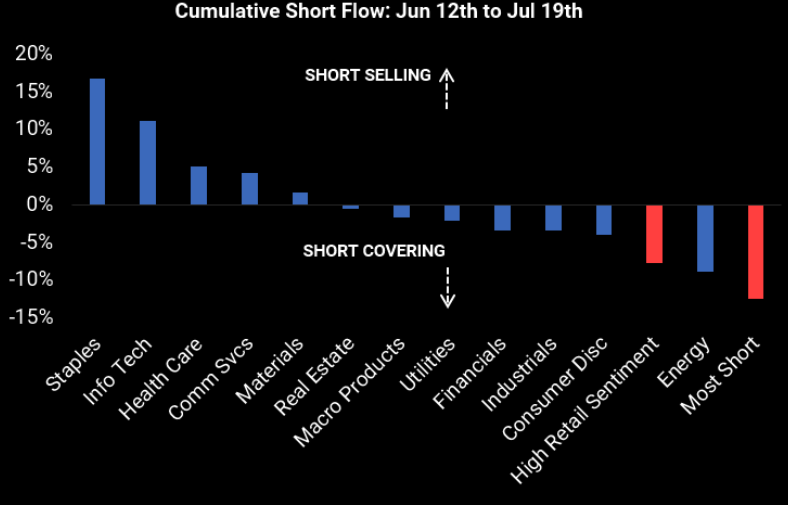

Short Covering

This is where there has been a lot of short covering. Energy has been one of the main ones as it was extremely short. Current price action is really a technical move based on that short covering

Source: GS

Spotify

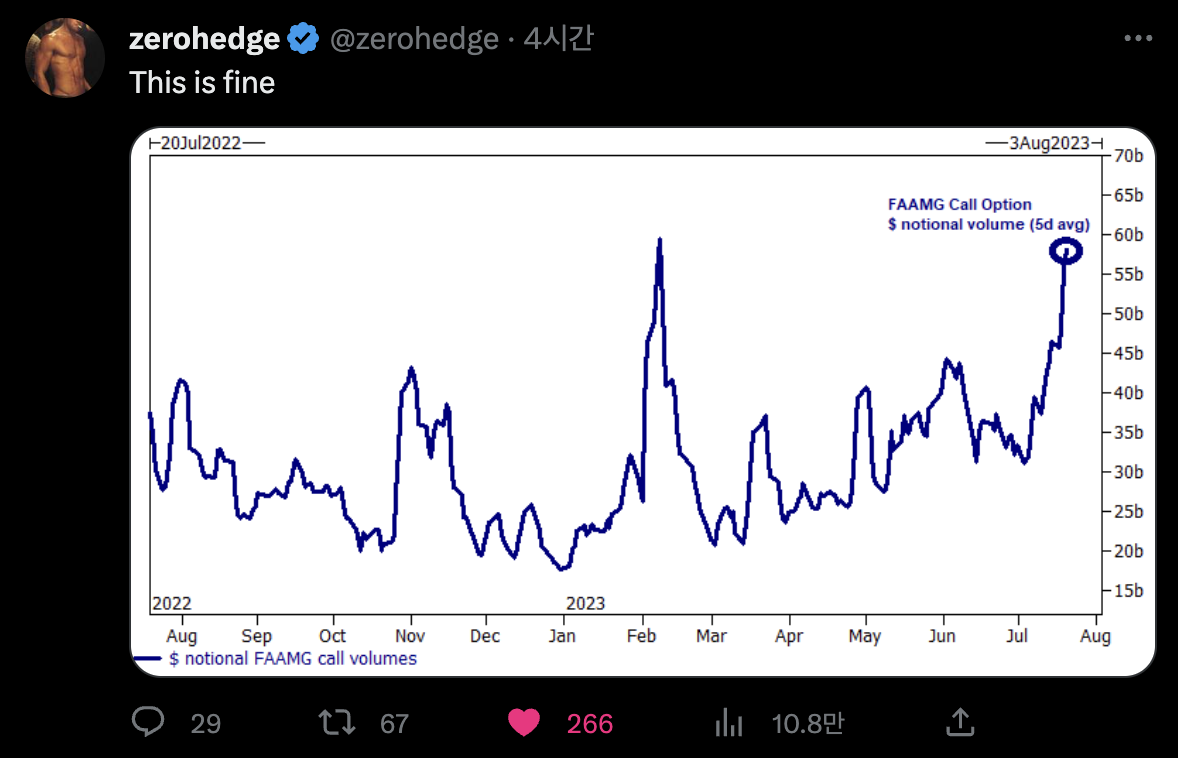

FAAMG Call Option

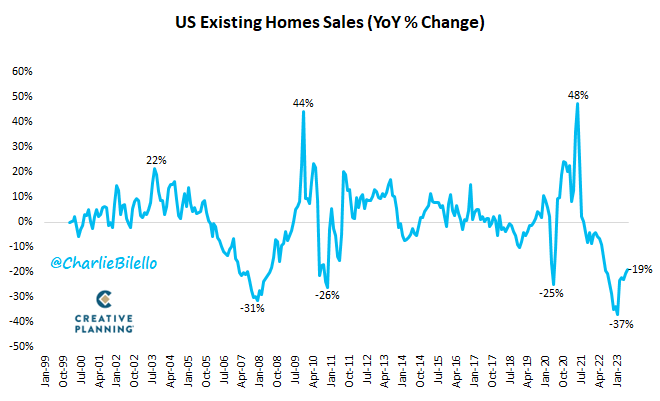

US Existing Home Sales

US Existing Home Sales fell 19% over the last year, the 22nd consecutive YoY decline. That's the longest down streak since 2007-2009.

Source Tweet - Charlie Bilello

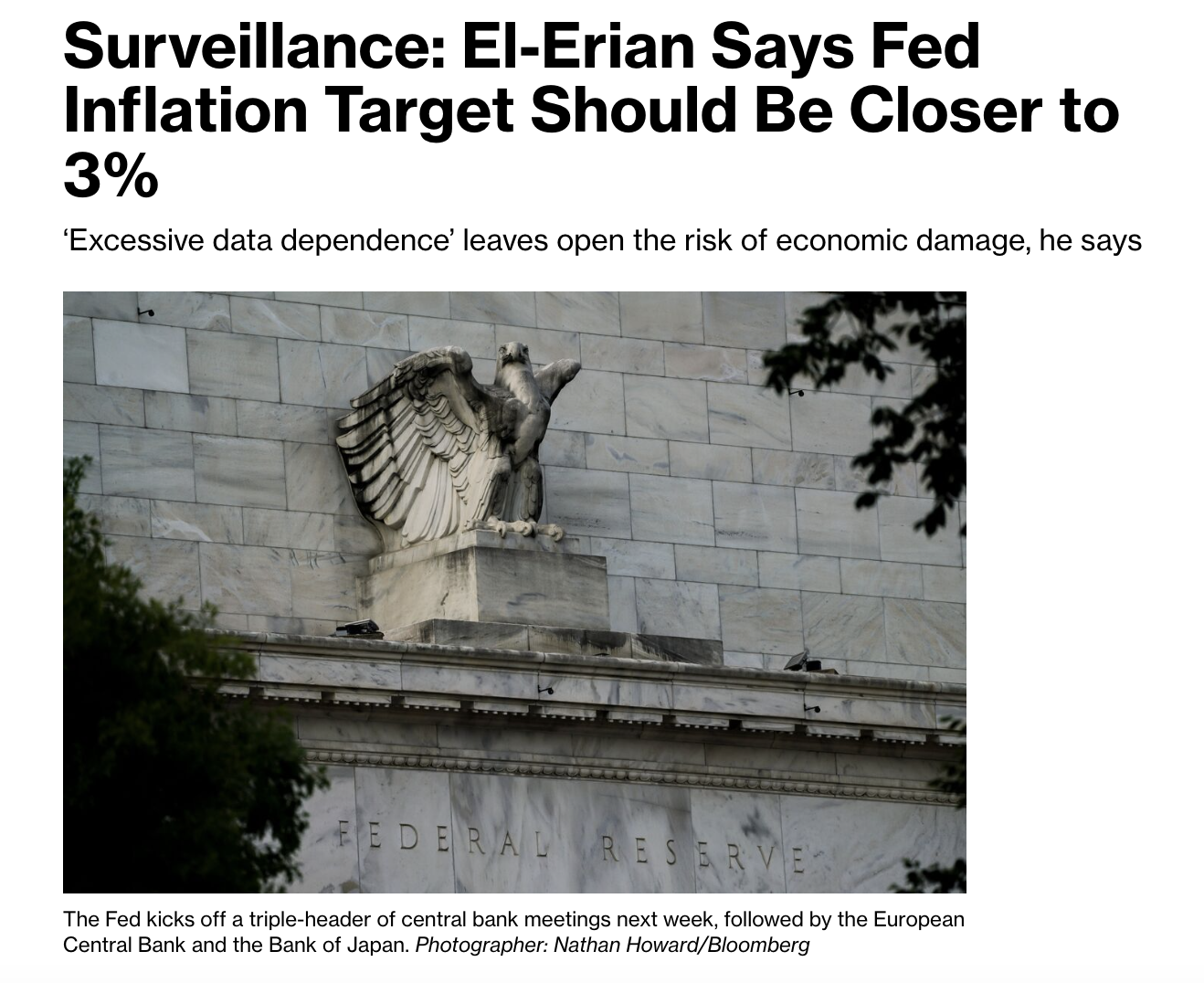

Fed Infaltion Target 3%

Bloomberg - Surveillance: El-Erian Says Fed Inflation Target Should Be Closer to 3%

Weather and Inflation

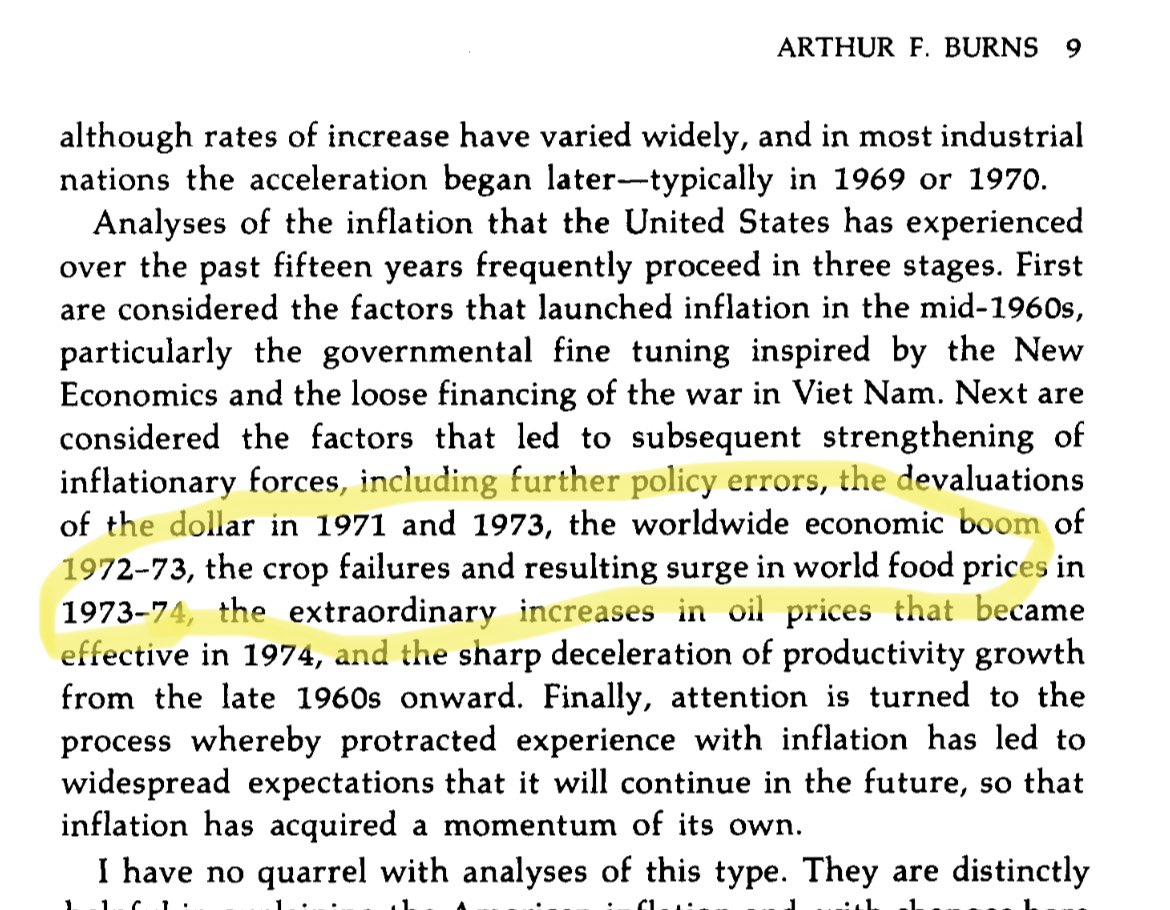

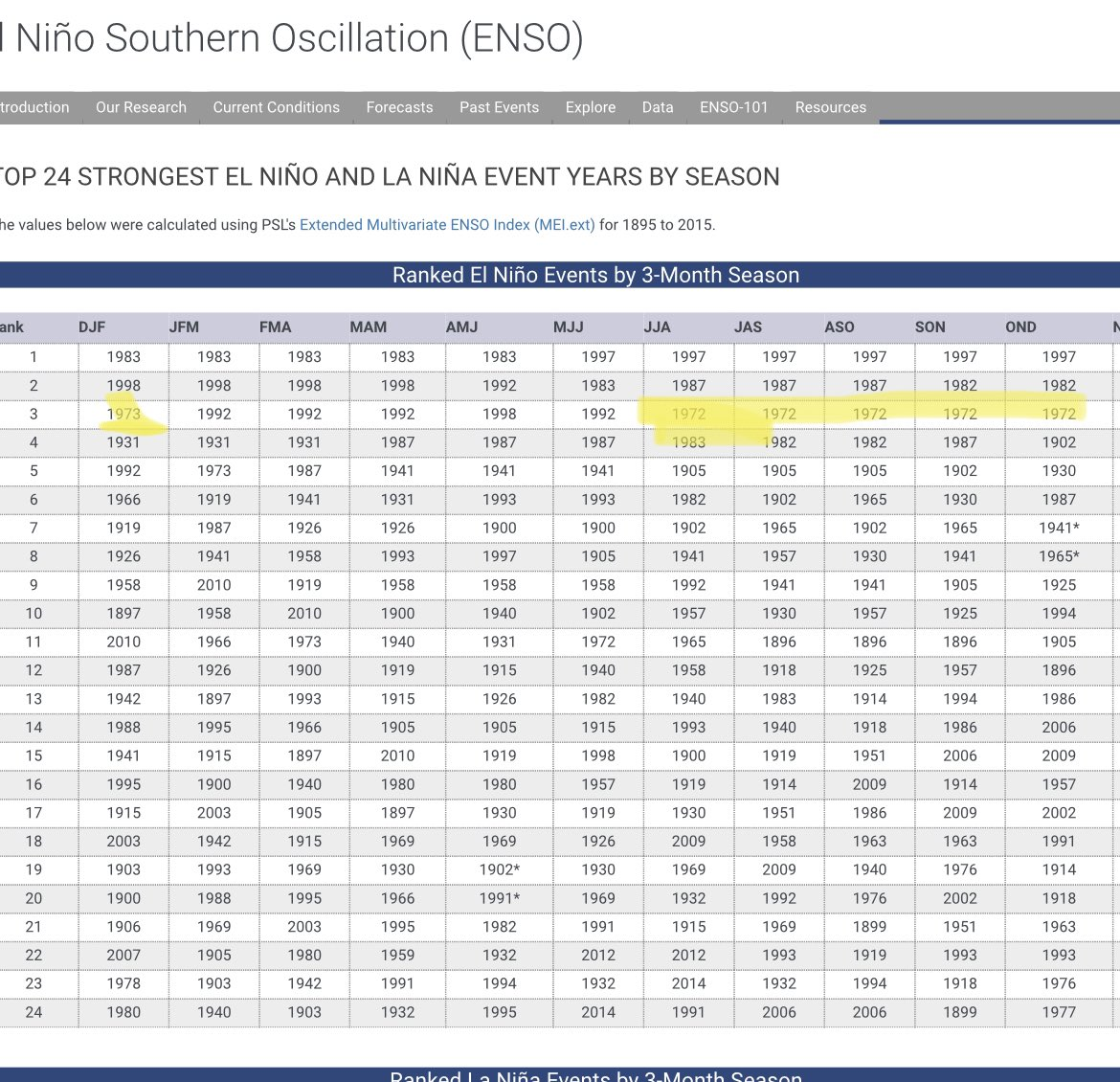

A 🧵 on weather and inflation. While we’re more optimistic about core inflation lately, progress on headline is worrisome. One of the key risk I see: el nino. A little known fact: Arthur Burns indirectly blamed El Niño on contributing to out of control good prices.

1972-1973 the third strongest El Niño from 1895-2015. Summer drought in europe, grains crop failure in Asia, a Soviet grain deal with US that went awry key contributor to global crop failure and food prices surge then.

Fast forward to today. Noaa says 81% of moderate to strong El Niño this fall to next year and 20% chance of a “historically strong” El Niño. Drought and extreme heat worsening crops in parts of Asia, contributing to government actions like the following.

If this does turns put to be a major El Niño, my guess is that the reversal of global food price decline will happen next year. Add to that of Russia backing out of the Grain Deal with Ukraine, a 2x whammy on food prices. A complicating situation for the Fed next year.

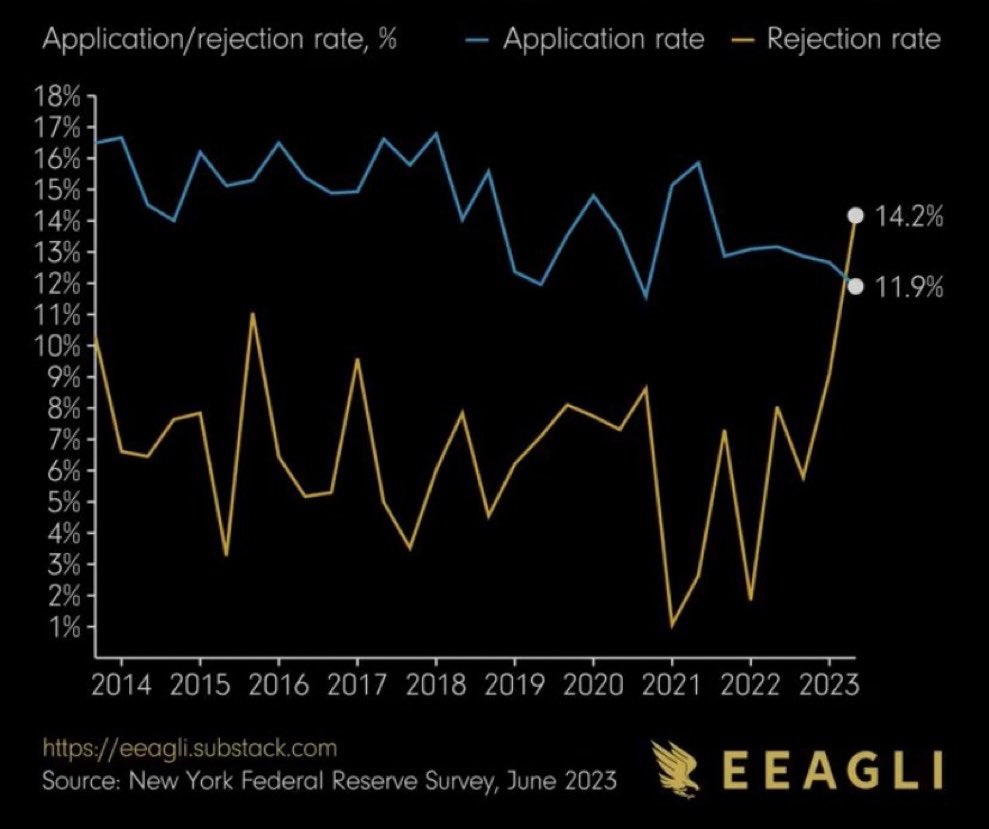

US Auto Loan Rejections

U.S. auto loan rejections have surged 📈

Basically, unlike the past couple of years, it’s a rough time to be a car shopper if you don’t have decent credit and/or some money down.

Have good credit and/or some money down? You’re fine.

I’m closely watching what happens next.

Source Tweet - CarDealershipGuy

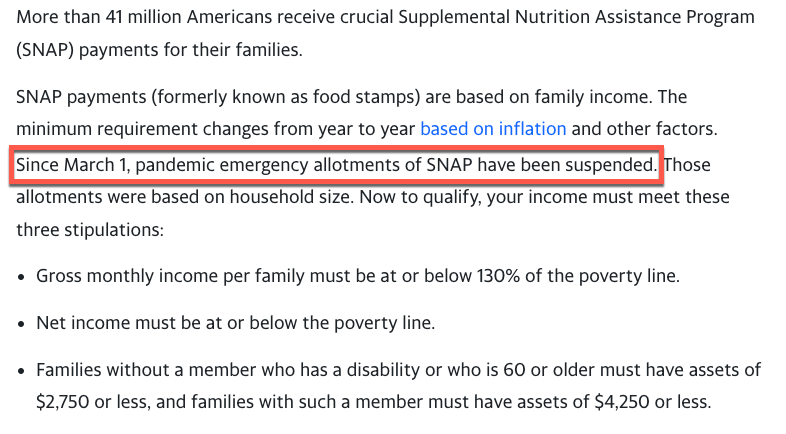

Conagra and General Mills

Conagra and General Mills reported a slowing of demand in Q2.

Freight cos that haul food have talked about how soft conditions for food & beverage freight have been.

People still gotta eat. What gives?

Pandemic-related SNAP payments ended on March 1.

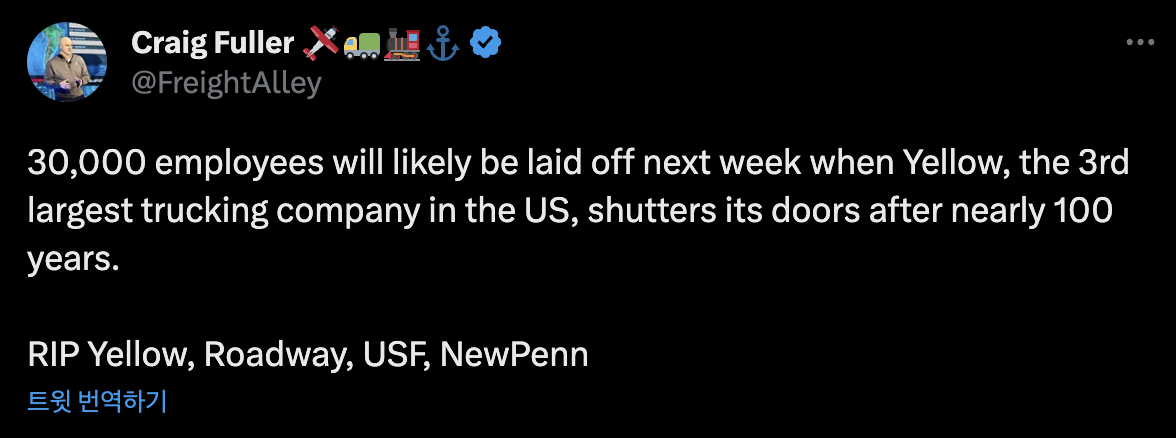

Yellow

BREAKING NEWS: The U.S. District Court for the District of Kansas ruled Friday against less-than-truckload carrier Yellow Corp.’s request for an injunction, which would have kept its Teamsters employees from engaging in a work stoppage.

FreightWaves - Yellow loses attempt to stop strike

Disinflation/Real Rates

The Bond Market Is Keeping It Real, (yo!).

Traders and speculators may wonder if now is a good time to go long the long end of the curve – specifically the 10-yr tenor.

The two main reasons for a speculative long are a disinflationary impulse, or a slowdown in economic growth.

On the growth front, we’re just not there. The Atlanta Fed’s Q2 estimate is currently at 2.4%.

Obvi these numbers ebb and flow, but the bottom line is 2-handle GDP prints are the not the stuff growth slowdowns are made of.

If anything, we are seeing the cyclical acceleration I anticipated earlier this year. The kicker is an uptick in real residential investment growth, which is now positive.

Now anything can happen, but the2023 recession is now looking like a low probability event that would be associated with the economic meteor of a sudden stop.

While it’s a little early to declare mission accomplished on the inflation front, significant progress has been made towards the Fed’s goals.

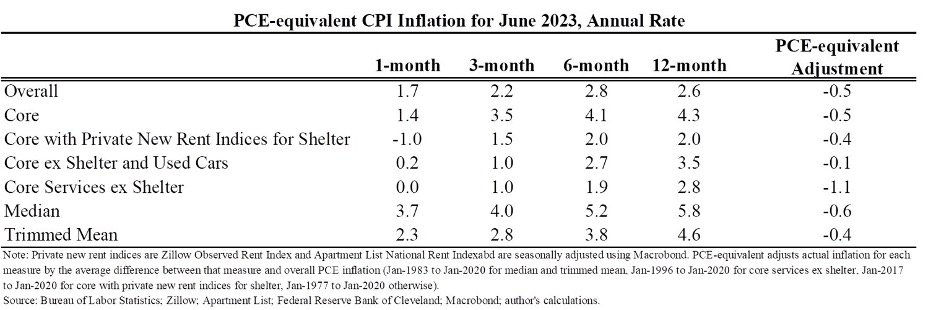

Here is a nice chart that I cribbed from @jasonfurman

The growth slowdown isn’t there. And while inflation has not been fully put out, it’s not looking like that 70’s show all over again.

This may or may not cause some tears for the inflation super nova crowd that’s been crowing since QE was initiated after the GFC.

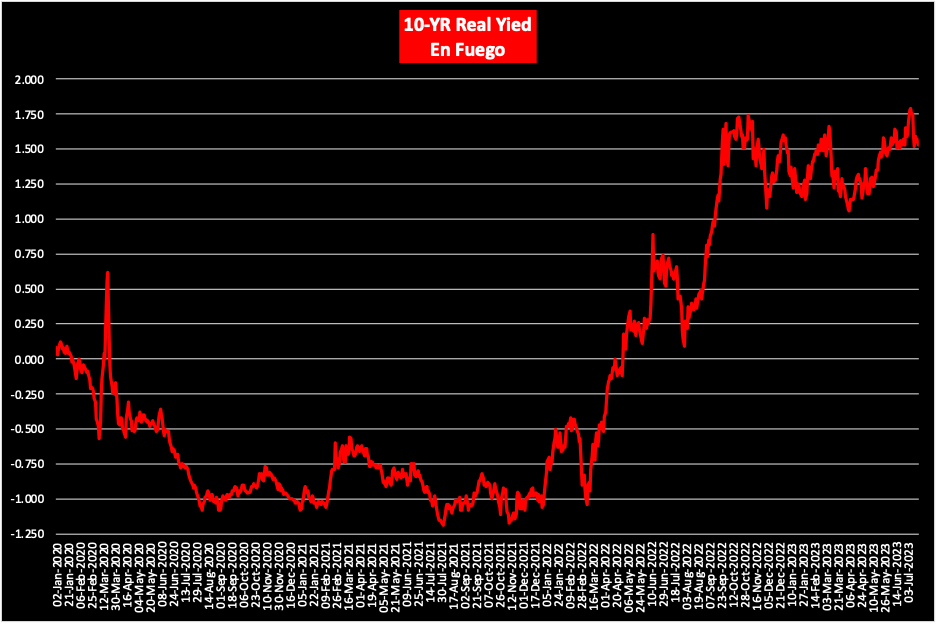

All clear to go long the 10-yr? Check out real yields first. They are in the driver’s seat, and they are on fire to the upside.

Real yields are near post pandemic highs. In fact, reals have not seen these levels since April 2010.

The unfortunate reality of bond math is that inflation expectations can continue to decline and bond investors can still lose money if reals continue to climb.

The consensus around the rise in yields is that the market is pricing in higher levels of Treasury debt issuance to fund post pandemic deficits, along with the Fed’s QT program.

@dampedspring has spilled gallons of digital ink on both topics so I won’t repeat them, mainly bc he is way better at this than I am.

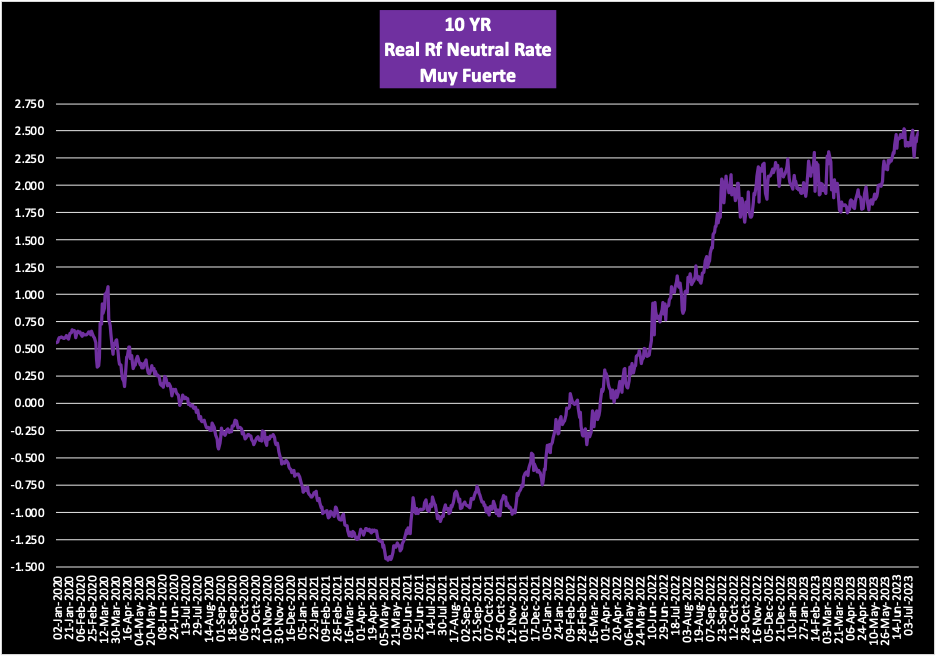

But here is something else to consider: the real risk-free neutral rate.

The real risk-free neutral rate is the real rate stripped of its risk premium. It offers one of the cleanest looks into the rates complex.

Recall that long-term interest rates can be broken down as follows:

Long-term interest rate = average expected real short-term interest rate over the long-term horizon + average expected inflation over same horizon + term premium.

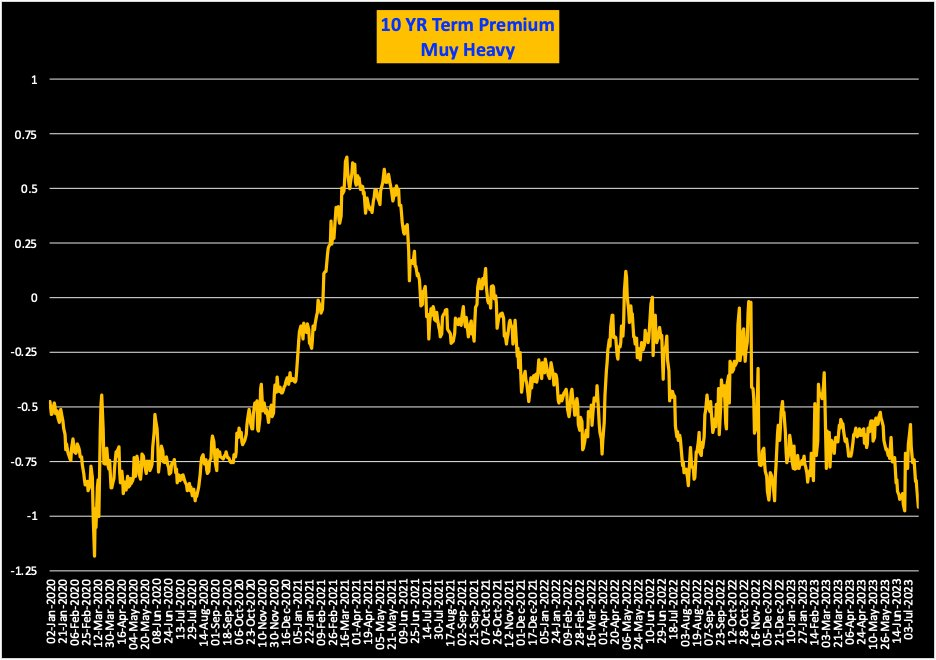

The term premium is the added compensation (i.e., extra yield) investors require for the risk of holding long-term treasuries over short-term ones.

For folks more familiar with equity investing, think of the term premium as the risk-adjusted discount of a stock: the wider the risk premium, the cheaper the stock relative to its intrinsic value.

Similarly, the more narrow the risk premium, the more expensive the stock relative to its intrinsic value.

Now, bond term premiums can be negative, as they are now. Meaning investors are paying a premium over and above the intrinsic value of a discounted stream of cash flows.

I like to use the real risk -free neutral rate as a proxy for tracking the fundamentals of the economy.

@davidbeckworth has stated that the real risk-free neutral rate tracks the natural interest rate (aka r*).

Although the real risk-free neutral rate stalled during the growth scare of H2 2022, it’s been on consistent tear since mid-2021, and has continued up after making a local bottom in H1 2023.

This is the noise.

The signal comes squaring the deeply negative term premiums with the strong economic fundamentals suggested by the real risk-free neutral rate.

Recall the no-recession premise I’ve been carping on for 9-month’s now.

Recall the increased issuance I mentioned earlier in this thread.

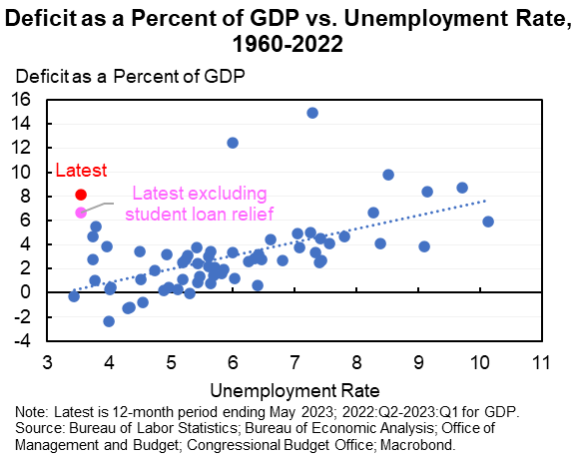

We are currently running 8% (6% ex-student loan relief) primary budget deficits while U3 has been averaging 3.6%.

Historically this low of a U3 is associated with a balanced budget. (h/t @jasonfurman)

What this means is fuel is being poured on a red-hot labor market. Investors bidding 10-yr term premiums to cyclical lows are either front-running tomorrow’s recession or over-paying for 10-yr paper.

Given the growth impulse we are seeing, I’d reckon it’s the latter.

The risk is, 10-yr bulls will have a look at the receipts and discover they overpaid for paper.

Dedicated real money will hold for structural reasons (asset-liability management). Leveraged cash that is watching its DV01?

Yea not so much.

I don’t think this is necessarily a bad thing for equities, provided real growth keeps nominal GDP elevated despite a decline in inflation.

The pain trade is therefore for higher long yields, driven by real yields that offset declining inflation, and higher NGDP which provides a floor to equities.

Happy Friday folks. I missed you.

Source Tweet - David Cervantes

China

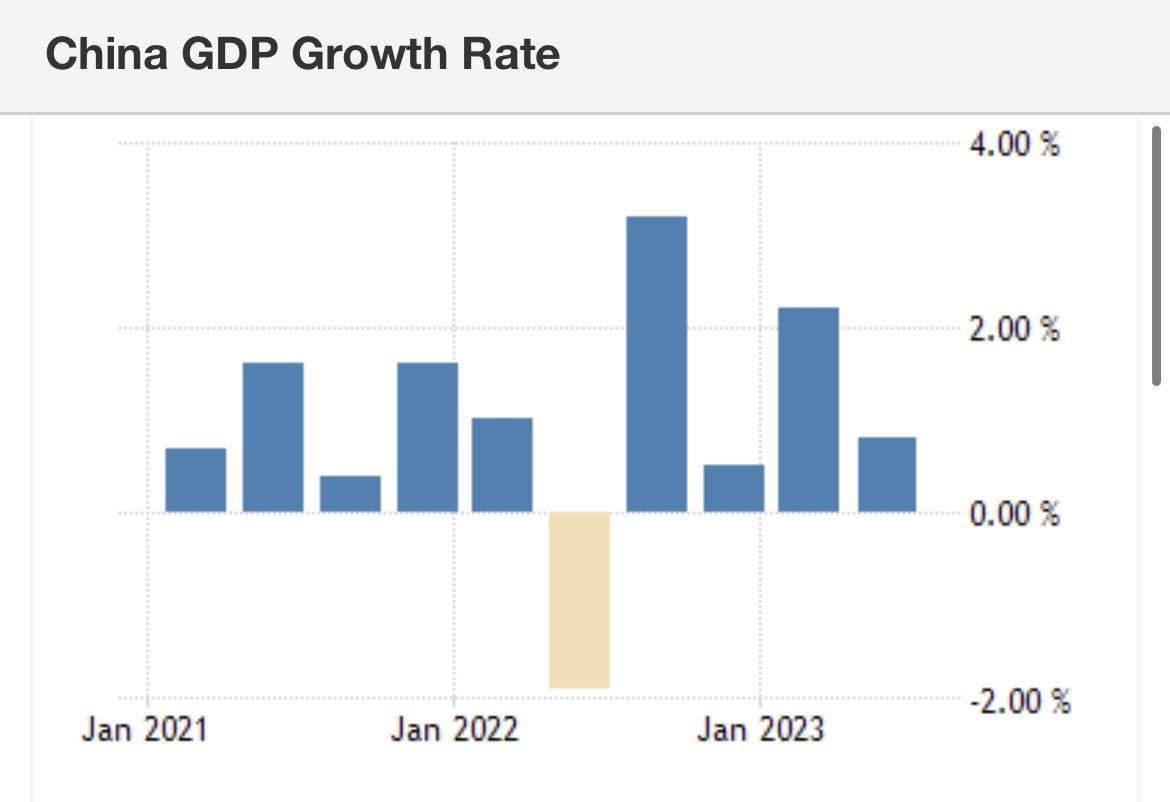

China weakness is either b/c they are stuck figuring out how to stimulate or they have chosen to accept mediocrity.

Given most outstanding debts are in their own FX and they have the ability (and track record) to direct stimulus, it seems this low growth path is a choice

Those who have followed China’s progression for decades know that they have at times exerted substantial force behind stimulating the economy when growth has flagged.

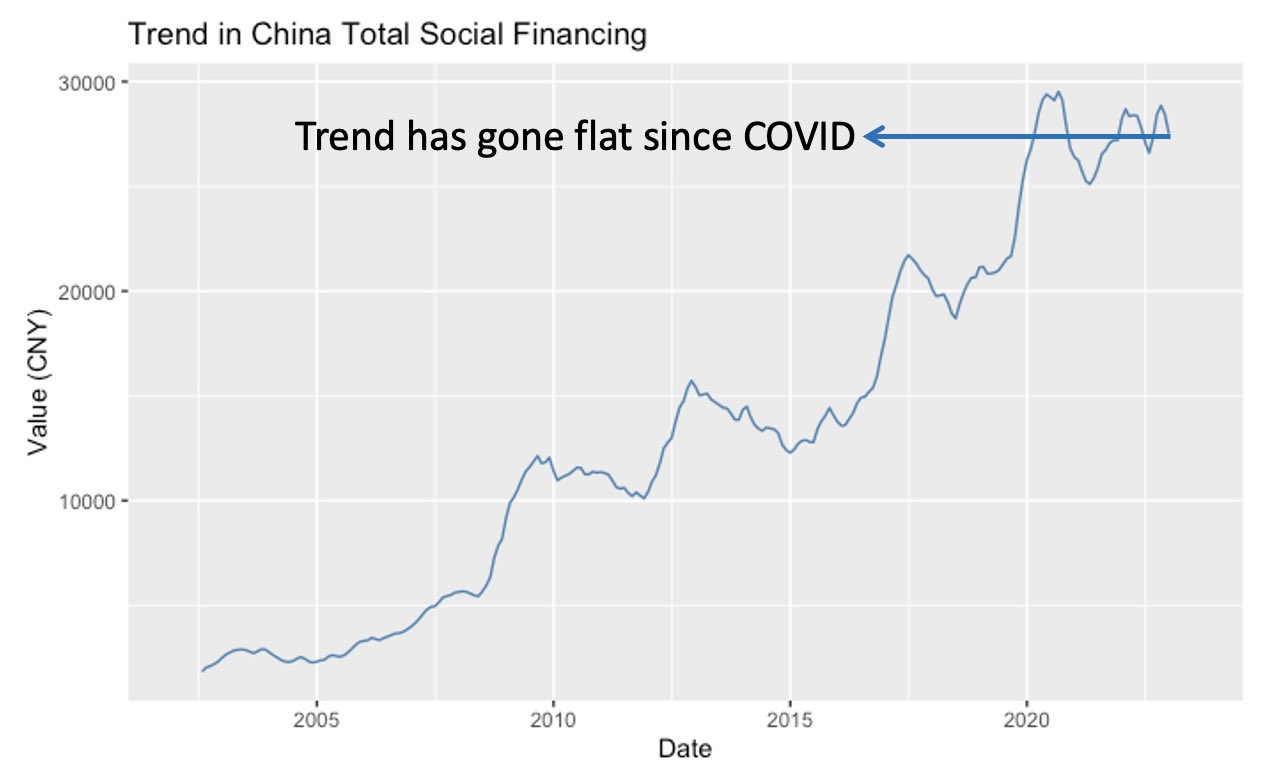

GFC, ‘16 ‘crisis’, covid we’re all times when the Chinese accelerated capital into the economy. Not this time.

Of course any economy that pursues domestic stimulation is primarily limited by domestic inflation (none) or the exchange rate. Too much stimulus and the fx declines too much.

And while the CNY has fallen vs the CFETS basket over the last year it’s not anything concerning.

And over any longer time frame the CNY is actually pretty strong even with the recent decline.

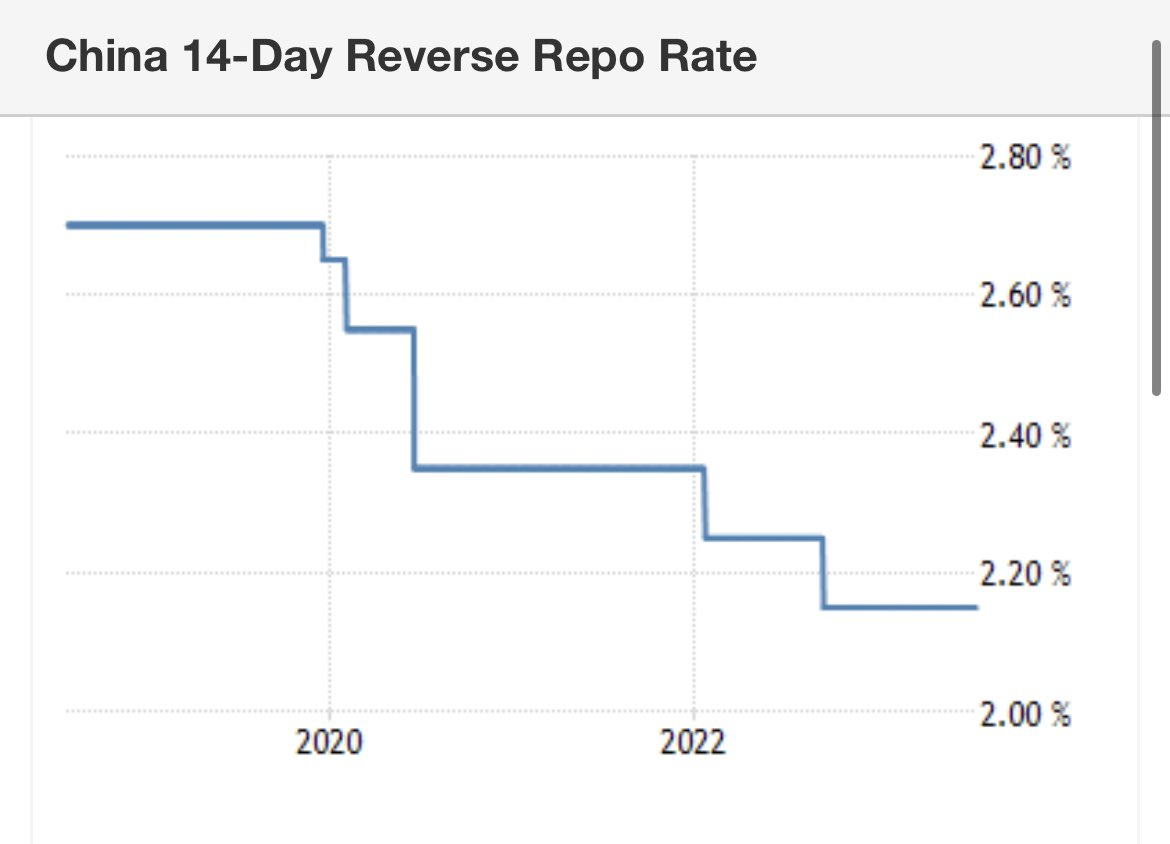

Instead what we are seeing is very limited actions taken by the central bank and central government authorities.

Use whatever rate you want, but short term rates haven’t moved much. Could certainly decline more

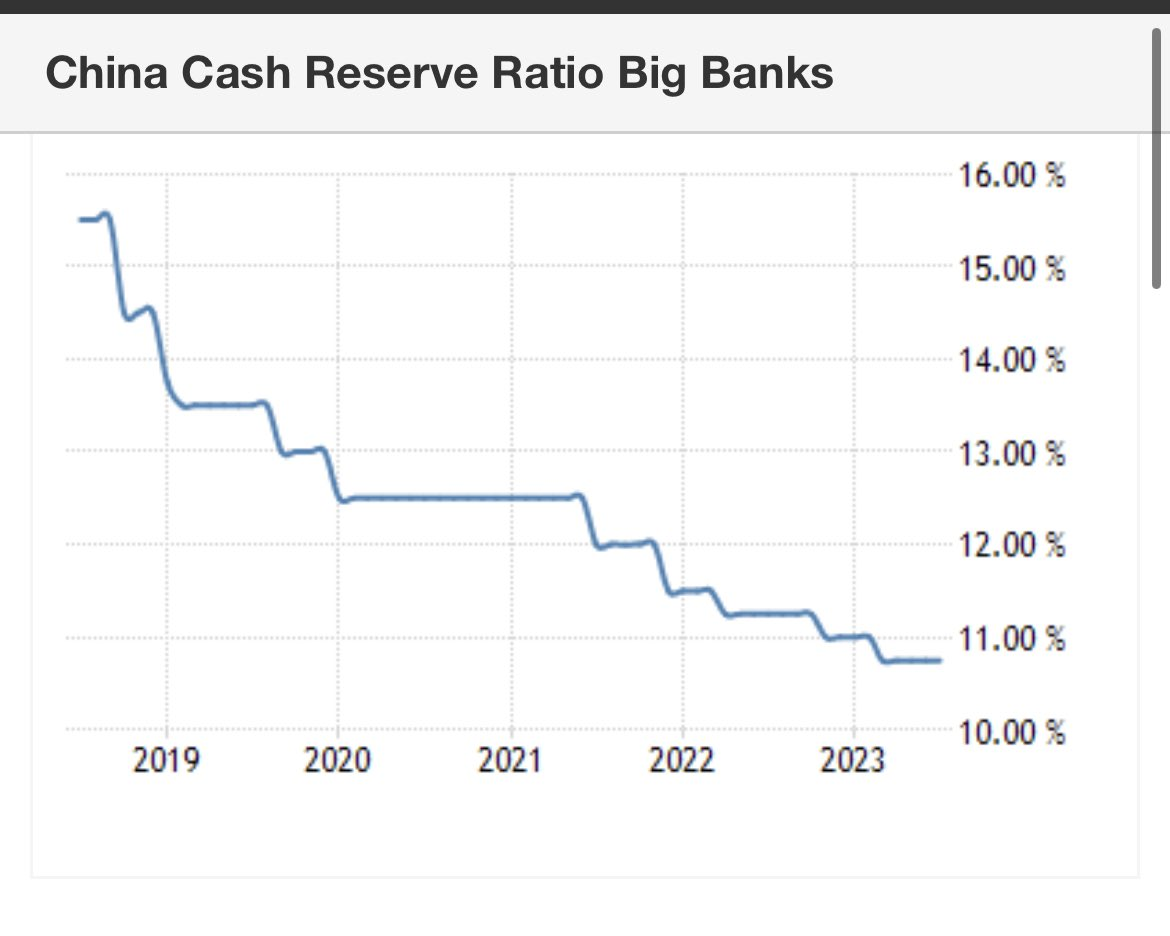

Reserve requirements also haven’t come down all that much in the post covid period considering the malaise.

The long end hasn’t moved much either relative to what would be needed to significantly stimulate.

And whatever they are doing in terms of their announced policies to get the economy going, it’s certainly not seen as being a substantial stimulus to the real economy.

After deglobalization fears and reopening hope, stocks have just languished at half their peak levels.

Put together it looks like the Chinese have the means and room to stimulate more but they just aren’t pulling the levers enough to get the economy moving.

Now some have said it’s like Japan in the 90s or a typical middle income trap dynamic. That they are ‘stuck’ here.

Those don’t resonate for me given there is lots more room as I note above (not Japan in 90s) and the debts are domestic (not typical middle income trap).

So it must be a choice.

And as all economic choices in China are political in nature, the question becomes has the leadership abandoned its desire to achieve pretty good economic growth? And if they have, why?

I’m just a macro guy and Chinese politics is way above my pay grade.

But I can tell when there is an ability to do more that is not being used. And that’s what’s going on here.

As the second biggest world economy, it’s critical to understand how they are likely to manage their economy.

If the reality is they shifted to accept (or even target) mediocrity, then that has huge implications across asset markets and other economies for years to come.

Analysis Articles

Ben Lilly - The Dollar Is Hurting. Can Devs Do Something?

TheSpreadThread - A Late-Cycle Melt Up

Greg Magadini - Macro State of Crypto – Where It Has Been and What's Next