Crypto Vol

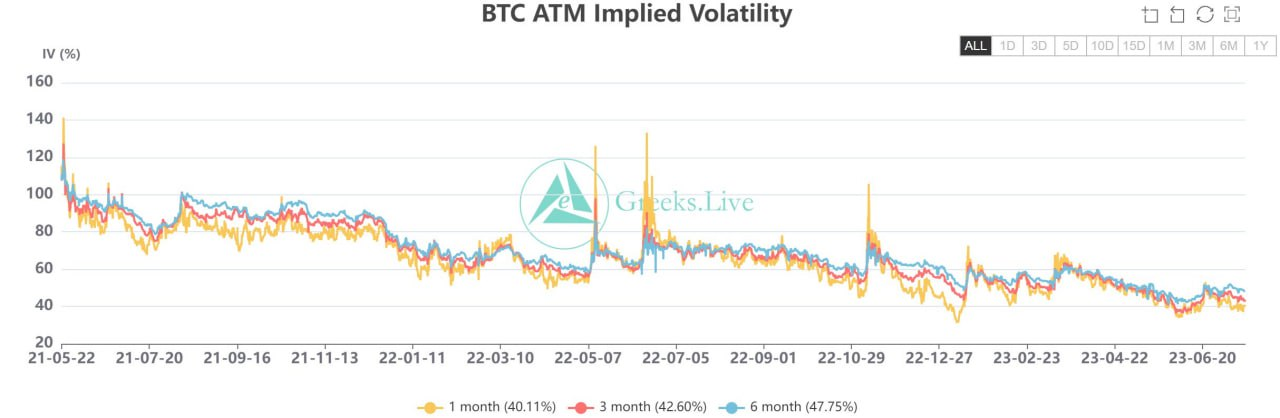

The current one-year RVs(realized volatility)for Bitcoin and Ether are 52% and 67%.

Looking back to the beginning of 2023, the one-year RVs for Bitcoin and Ether are still 65% and 88%;

Looking back to 2022, the one-year RVs for Bitcoin and Ether are as high as 81% and 106%;

Going back to the most volatile year, 2020, the one-year RVs for Bitcoin and Ether are as high as 92% and 113%;

Far back in 2014, Bitcoin's one-year RV was over 155%, when Ether was just being born.

It is an indisputable fact that the overall volatility of cryptocurrencies is declining, which will inevitably force the implied volatility of cryptocurrencies to keep going to new lows.

Paradigm's Week In Review(17July - 23July)

Paradigm’s Week In Review (17July - 23July) @GenesisVol 🧵

Bullish flows early in the week in BTC options, traders bought fresh upside and rolled their upside positions out. Spot chops through range as summer lull continues.

BTC -1% / NDX -1.25% / ETH -2%

🌊BTC

Notable follow-thru interest in longer dated tenors from weeks past:

840x 29-Dec-23 34000/45000 Call Spread bought

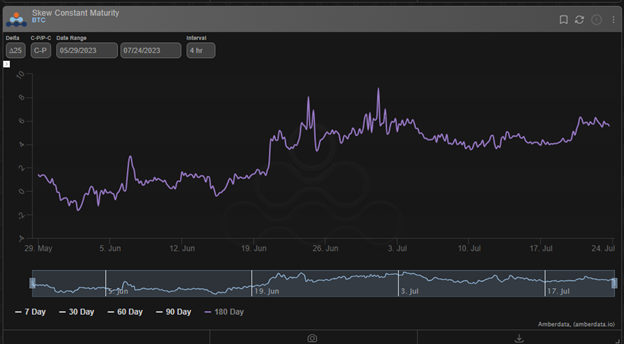

Remember the Dec flows in the past 6 weeks, 180d 25d skew below.

5k 29-Dec-23 40000 Call bot

2200x 29-Dec-23 35000/45000 CSpd bot

Pretty clear that options block volumes are highly correlated to spot's position in it's local range.

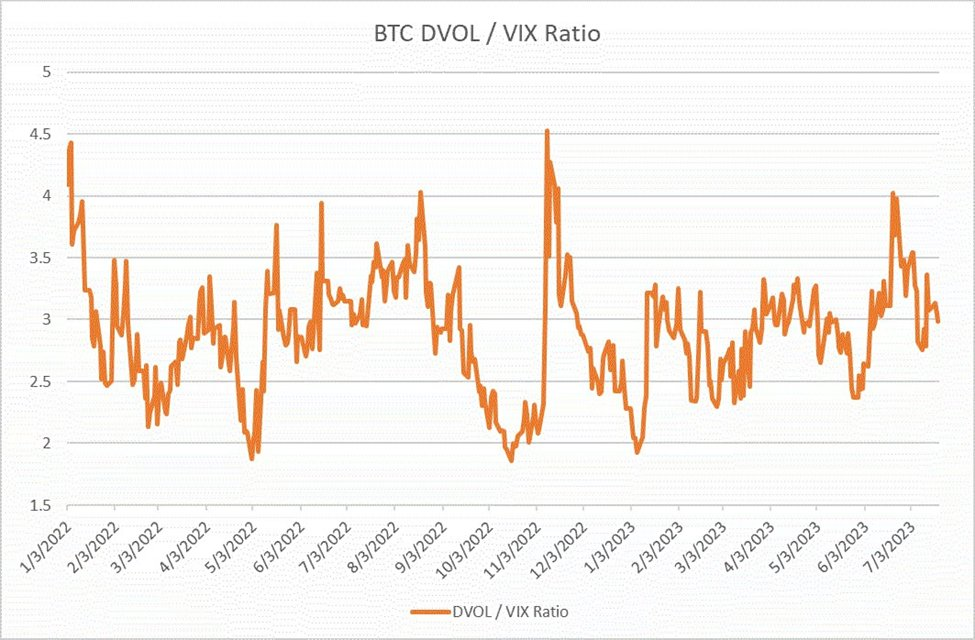

BTC 1M ATM vols approaching 35v, but with VIX ~13, not like BTC vols look low on a relative basis...everything is low. BTC 7d realized ~24.4v, vol sellers rejoice.

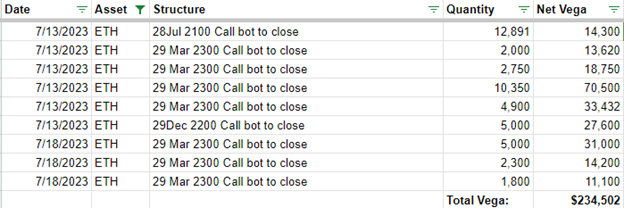

Mixed ETH flows on Paradigm, continuation of Deribit-direct Mar vega buying blocks printed..

Total flows noted below. We discuss these flows on the new #TBP coming tomorrow 🙏

6k Dec 1600/2400 Strangle bought

5k Aug 1900/2200 Call Spread sold

4k Sep 2200 Call bought

Check out the new Macro Pulse. We get into China, XRP, ETH/BTC flows and more!

Another @davidbrickell80 masterpiece 👇

Finding Unique Alphas

I think a pretty good portfolio that assumes you aren't incredible at finding unique alphas would go along the following:

- Carrywhoring:

- basis arbs. Not great capacity on the juciest ones, but probably the best Sharpe of all with decent capacity if you really get good at it.

- Seasonal Effects

- Just play around with the well-known ones across quite a few markets, and you'll end up finding some dummy stupid opportunities like some options expiry effect in Polish stocks (random example). Be careful with these because you can overfit since not much data, but some commods for example have clear day of week, week of month, day of month, etc effects.

- Momentum + Trend

- Run this shit on every asset imagine-able. Forget trying to make the best possible strategy here because the rule of the game is just to diversify to living fuck when it comes to momentum. Absolute or relative??? Both.

- Random alphas you find along the way:

- If you spend enough time poking around, you'll find one egregiously simple + profitable effect every year or so that you can just milk to death.

- Special situation arbs:

- Build a fucking scanner because sometimes someone does something silly, and you get a big fat arb that exists for maybe a day and can make a year's return in equities in that day. Honestly, with the addition that I'd probably want to execute w/ limit orders so have a bot for that + save time automating transfers, the selection of the arbs is mostly discretionary for special cases. Example: LUNA/UST, depeg arbs (from various past depegs), ETH merge arb (shitty exchange vs. large exchange arbs got to like 10% on ETH lol), and so on.

Systematic Positioning Index

The Systematic Positioning Index is one of many new models we've developed over the past year. It tracks equity exposure across the most prominent Quant fund strategies in the market today.

In a modern market, it's Flows >Fundamentals.

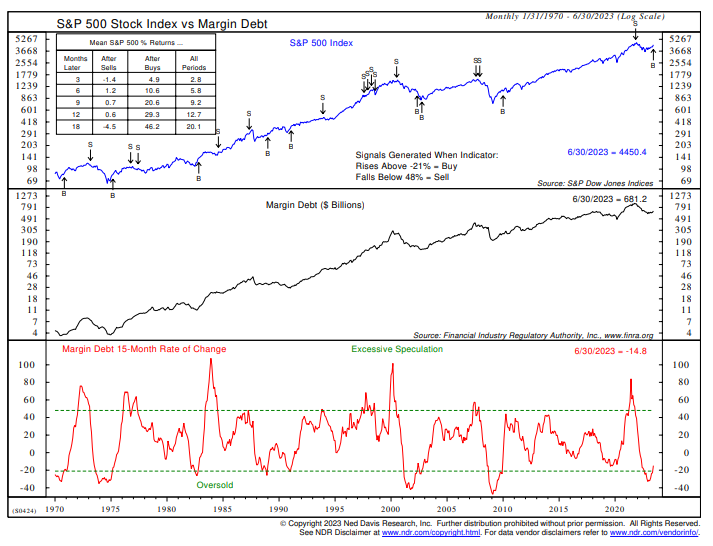

Margin Debt

Some good news for the bulls. Margin debt has started to recover from very oversold levels, generating a relatively rare buy signal. Debt remains about $250 billion below the 2021 peak.

Euro

Most Expensive #Euro on Record Has Traders Braced for Declines - Bloomberg

Source Tweet - Christophe Barraud

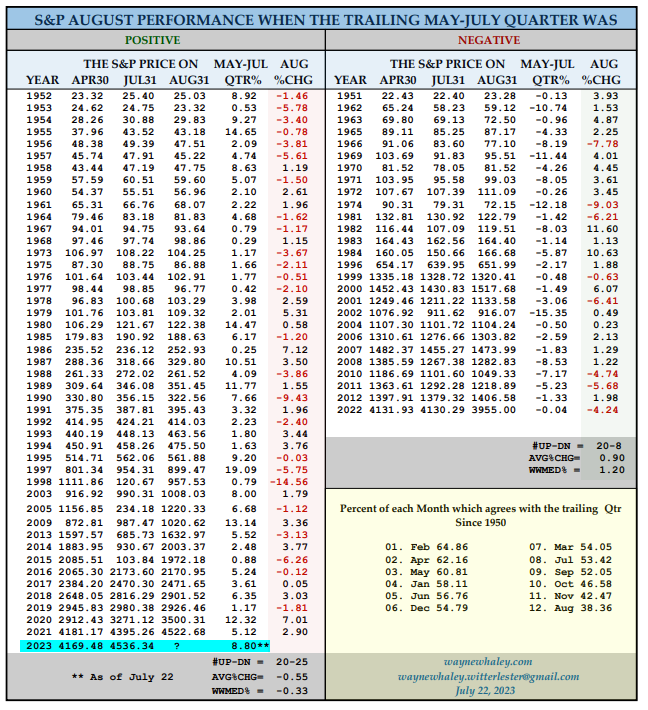

Seasonality

AUGUST IS THE KING MONTH OF COUNTER TRENDINESS... The trend is truly the friend of most months but since 1950, August has gone against the direction of the trailing Qtr in 45 of those 73 (61.6%) years. On the other hand, February has followed the Qtr trend in 65% of years.

Thiw Week Earnings

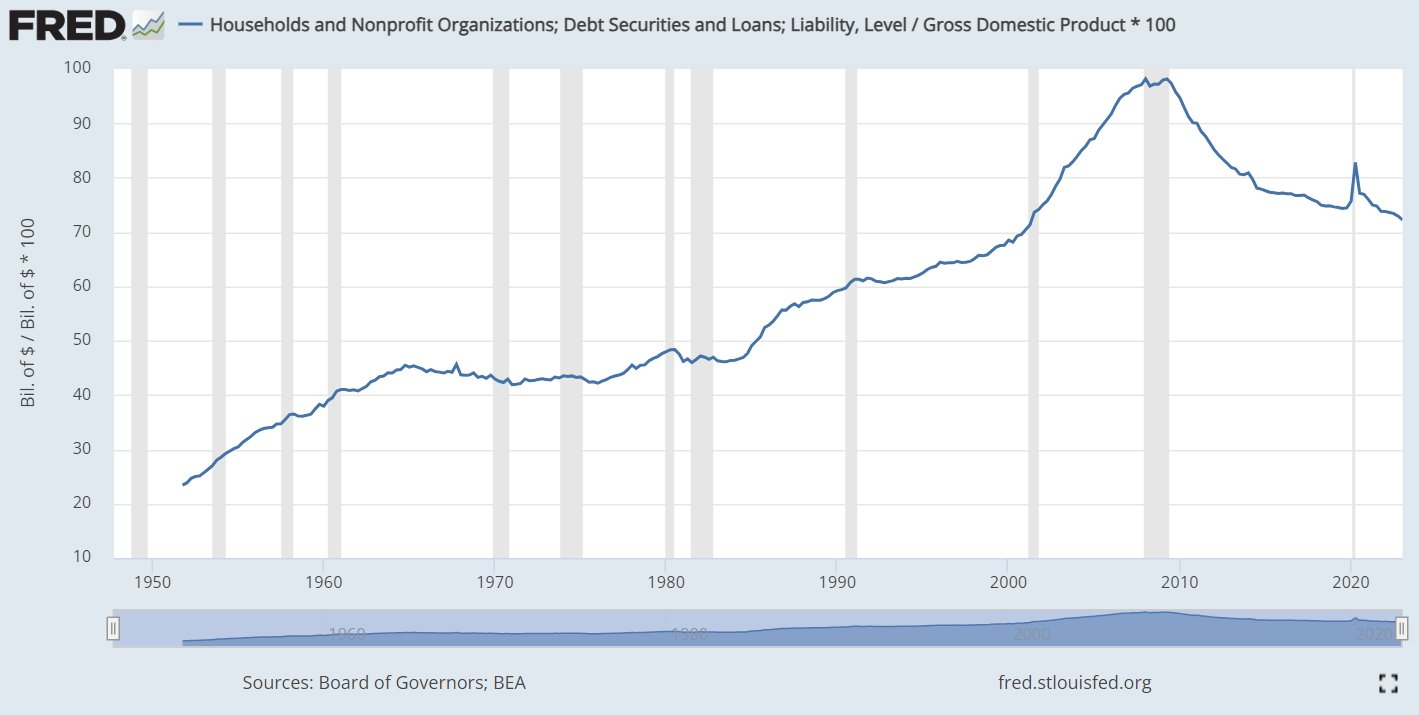

Real Yields

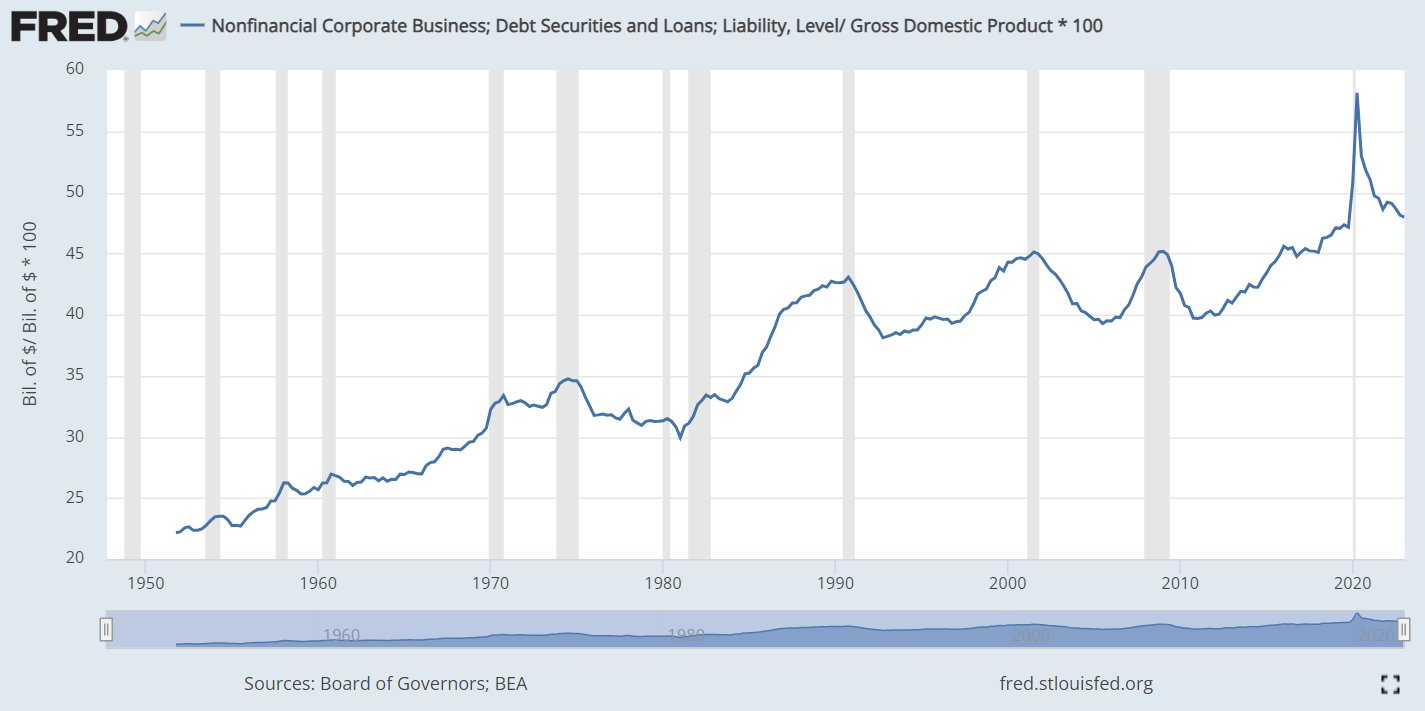

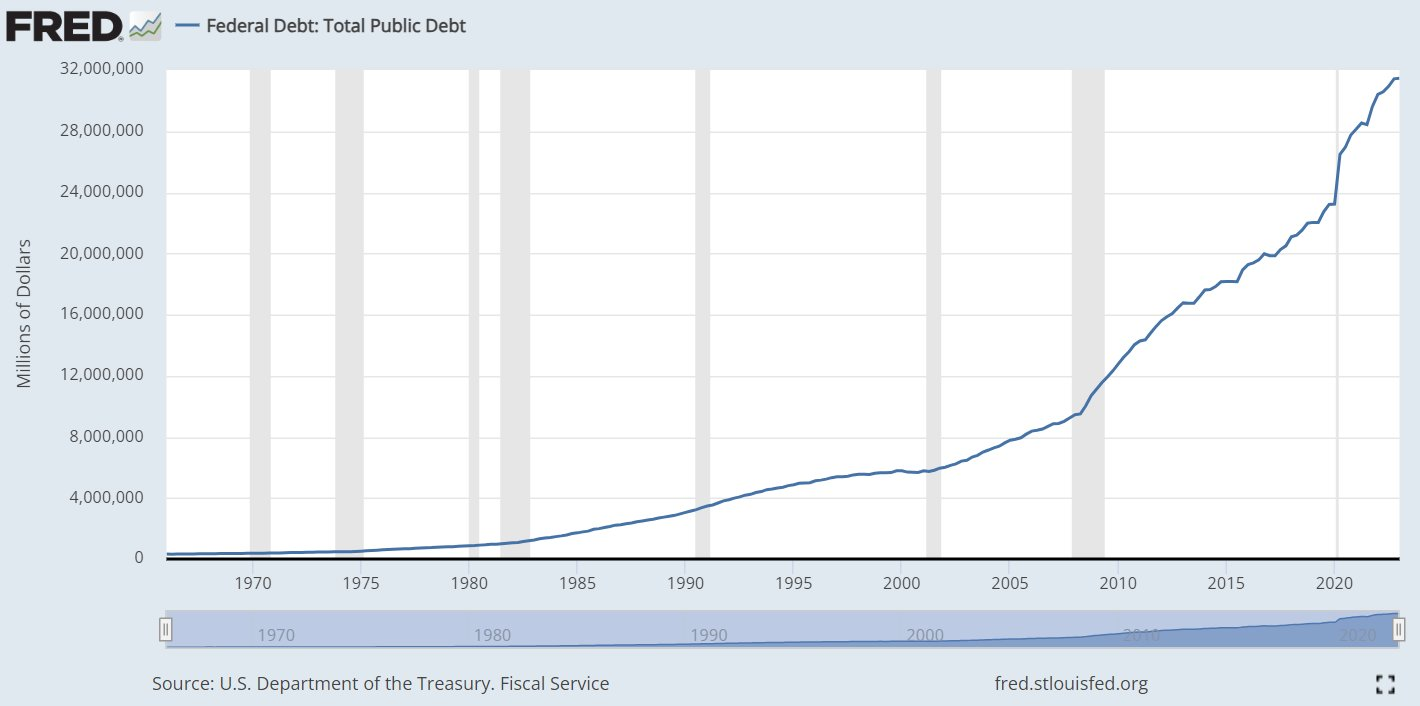

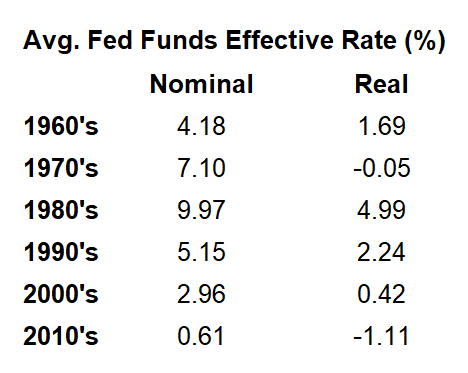

Real yields don't really matter anymore, if they ever did.

The only relevant marginal borrower is the govt...

...and they borrow more to make up for a deficit in private debt expansion.

The govt has been responsible for nearly all the incremental new debt since the GFC.

Hholds have continued to reduce their borrowing (% of GDP) at roughly the same pace when reals avg'd <0.5% in the late 2010's, and still less than pre-GFC pace when reals were higher.

Corp debt has grown, but not by much at all since the prior cyclical highs.

Note that corp debt grew fastest in the 80s, when real yields were sky high.

Then you have govt.

No correlation between reals and borrowing.

It has accelerated when in all periods, accelerating fastest when household debt growth has reversed (80s and today).

Households struggled lifting debt in the 80s, when reals were high.

However they also can't lift debt/GDP when reals are negative.

What are the factors that drive it then? Politics has a lot to say for it.

If real yields had an effect on marginal debt growth its not clear from these numbers.

There are sectors in which real yields REALLY matter, such as borrowing against inflation linked revenues.

In these cases however it isn't growth that's affected, but asset prices.

In economies where there is a large amount of variable debt the effect might seem to be larger but evidence is scant there as well.

This phenomena is why I tongue-in-cheek named my blog "macro is dead".

The notion of "restrictive" interest rate policy is meaningless (if it ever really was).

If high real yields don't stop debt expansion then what economic theory is available to the Fed?

If the Fed ignores the deficit then they will be no different to Arthur Burns when he was (unfairly) blamed the effects of LBJ's massive spending in the late 60s.

I don't think the Fed has a winning choice at all, and shows how powerful debt growth is over monetary policy.

If the Fed ignores the effect of interest cost deficit expansion on the economy, it may as well limit its job to just financial stability.

If inflation falls, they will be bailed out for now. If it rebounds...well everyone is in a bit of trouble.

Looking at reals (or r* for that matter) seems odd.

If moving these figures doesn't achieve an outcome, then why would we bother anchoring anything to them?

Is r* an undefined number, or one that only exists with an input of budget politics and the productivity of debt?

USD/China

USD/China - The Donkey Kong Dollar Peg.

Why CNH/CNY will continue to weaken and why HKD is also vulnerable.

Like many kids who grew up in the 70’s and 80’s, I was an arcade game junkie. One of the games I invested countless quarters in was Donkey Kong, in which a lovestruck Mario braves numerous challenges to rescue the Princess from Donkey Kong, who has taken her captive.

If Mario is nimble enough and is able to dodge all the obstacles thrown his way, he can finally knock out the pegs of support for Donkey Kong, causing him to crash on his head.

The Donkey Kong Dollar Peg

Today, I extend this analogy to another Kong — the Hong Kong Dollar (HKD) specifically and its bigger cousin CNY. I’ll address this amalgam as the Donkey Kong Dollar Peg.

The gorilla Donkey Kong in this case symbolizes the CNY Soft Peg and HKD Hard Peg and the monetary authorities behind defending it — the PBOC (People’s Bank of China) and the HKMA (Hong Kong Monetary Authority).

Mario represents the Free Market, willing to brave the obstacles thrown his way to thwart him from helping his Princess escape an opaque, overleveraged prison.

Although CNY and HKD are technically two different currencies with different monetary authorities and policies, the two are joined at the hip ultimately, and pressure on one exerts pressure on the other.

In March, I wrote a piece expressing my bearishness on CNY and why a CNY Devaluation would prove to be a strong Disinflationary force in the near-term for the world.

Even if you don’t trade Currencies or Commodities, the strong Disinflationary pulse coming from this is something everyone should be concerned about.

That piece was entitled "Re: Geopolitics/Inflation/USD-Ball In A China Shop" and can be found on my website.

The following two charts show you the difference in price action between CNH (offshore CNY, which is soft-pegged to the USD) and the HKD (which is hard-pegged to the USD — for now).

For full disclosure, I personally went long USD/short CNH in March after writing my post at 6.88, took profit at 7.27 and 7.16, and then recently re-shorted at 7.15. I am also long USD/short HKD just below 7.85.

As you can see, the Devaluation Thesis has panned out thus far in CNH/CNY (despite overall weakness in DXY), and I think we are likely to see new lows in CNH/CNY before this is over, despite recent PBOC interventions to stymie the weakening.

HKD has been hard-pegged to a tight band of 7.75 to 7.85 to the USD since 1983, so the price gyrations you see are overexaggerated, but the recent moves off the upper band also suggest HKMA interventions to stymie the Mario speculators from crashing the Donkey Kong HKD peg.

Why China Needs To Devalue

@Brad_Setser recently opined that China may have $3T more in Shadow Reserves over and above its publicly disclosed $3T of FX Reserves.

There is healthy debate over what kind of assets constitute these Shadow Reserves and how liquid they are, but to me the matter is moot.

Two observations come to mind:

-

The fact that they have a closed capital account and the fact that they have such opacity that makes us guess at this number in the first place is a problem of trust in and of itself.

-

It doesn’t matter how much firepower PBOC/HKMA have to defend CNY or HKD when the real question is: Do they want to?

In short, I think China has a big economic problem and its monetary authorities, the PBOC and the HKMA, are grappling with impossible dilemmas. The unwinnable Kobayash Maru simulation that Captain Kirk had to play in “Star Trek II: The Wrath of Khan” comes to mind.

I won’t rehash what I wrote in March, but I explained the PBOC’s policy dilemma with the classic Homer myth about Odysseus needing to steer a precarious course between the Scylla of Weak CNY and the Charybdis of Strong CNY.

I followed up with my reasoning for why the PBOC would likely steer towards the Scylla of Weak CNY, given the collapse in Oil prices (not to mention China’s significant SPR stocking at our expense): Reference 1

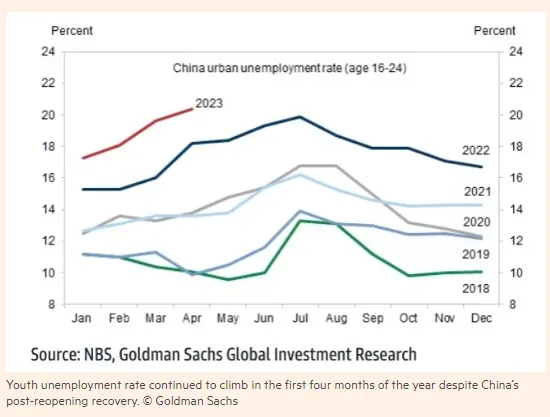

Indeed, the parade of deplorable economic data has been relentless out of China, and I think the tepid attempts at stimulus thus far have done little to nothing to shore up consumer confidence.

As a Geopolitical aside, the chart above from this FT article should make you wonder what the CCP will do with a restive young (and mostly male) population that is unable to find work.

Another example: Reference 2

The reason why many got the Chinese Re-Opening wrong was because they extrapolated the US Re-Opening when in fact the Chinese response was almost diametrically opposite to the US response.

Think about what would have happened in the US if we:

Locked down for another 18 months

Did not flood the system with both Monetary AND Fiscal Stimulus

That’s where China is today: Reference 3

China’s centrally-directed, government investment-led, debt-fueled growth boom appears to be coming to a screeching halt given the distortions and wasteful capital misallocations created in the economy, now exacerbated by an aggressive Fed that is hell-bent on fighting Inflation.

China’s centrally-directed, government investment-led, debt-fueled growth boom appears to be coming to a screeching halt given the distortions and wasteful capital misallocations created in the economy, now exacerbated by an aggressive Fed that is hell-bent on fighting Inflation.

If anything, the CCP’s Three Red Lines restrictions to curb property speculation have worked too well and have gutted household balance sheets which store as much as 70% of its wealth in real estate.

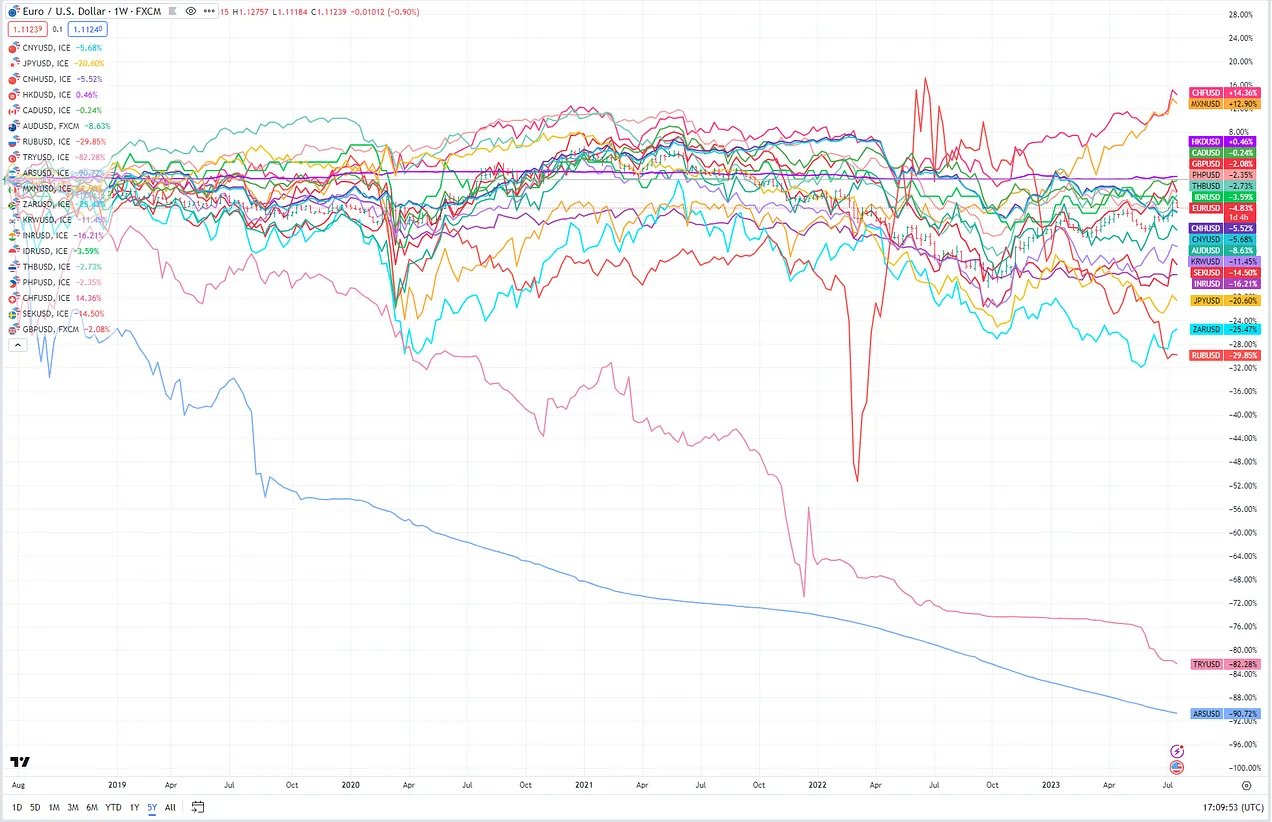

Absent a healthy consumer, absent more Bridges To Nowhere, China’s only game is to Export its way out, but how will it do that without a significantly weaker CNY — especially when the the rest of the world has significantly devalued against USD?

I could easily extend my Scylla/Charybdis Analogy to the HKMA, which also faces an impossible policy choice:

-

Defend the HKD Peg and further pressure Real Estate, given that 97% of Hong Kong mortgages are HIBOR Floaters (see chart of HIBOR in my Tweet below), according to this article: Hong Kong Mortgage Costs Spike With 97% on Floating Rates

-

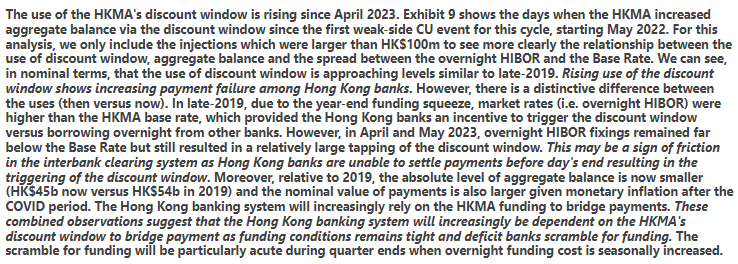

Let the Peg go the way of Donkey Kong and end a 40-year old, anachronistic HKD Hard-Peg regime. Reference 4

And this is just the Cyclical part of the equation that China is grappling with.

Imagine what happens if China’s Cyclical downturn actually coincides with a much longer-term Structural/Demographic downturn? Reference 5

China’s Smoldering Crater Scenario comes about if there is Constructive Interference between Short-Term and Long-Term Cycles, to borrow a Mental Model from physics/engineering that I wrote about last year, entitled "Destructive/Constructive Interference In Econ Cycles."

As it turns out, Richard Koo, who has studied Japan’s Lost Decades extensively, recently made some points that make me believe that Constructive Interference between short-term and long-term cyclical downturns could be a real possibility for China: Reference 6

Richard’s recent interview on Odd Lots is a must-listen, in my opinion. Richard Koo on China’s Risk of a Japan-Style Balance Sheet Recession

What Is The PBOC/HKMA Afraid Of?

Despite all of these reasons for why China would want a weaker CNY/HKD, why has both the PBOC and HKMA been defending CNY and HKD, respectively?

The PBOC, on the evening of 7/19/23 intervened particularly aggressively, by fixing CNY at ~7.15 when CNH was trading ~7.22, directing state banks to sell USD/buy CNY, and adjusting some “macro-prudential” parameters to encourage more foreign inflows. Reference 7

To put this into perspective, the PBOC has not been this aggressive in its interventions in about a year since CNY nearly hit 7.40.

Weston Nakamura gives an excellent overview and puts this recent bout of intervention into context: China Pushes Yuan Aggressively Higher As Dollar Junk Bonds Implode

Weston believes these actions were meant to stymie default risks in USD-denominated bonds of Chinese property developers.

Maybe, but as @Jkylebass points out in his recent address at the Hudson Institute, there might actually be Geopolitical reasons behind the much higher 65% default rate of USD-denominated bonds vs. the 21% default rate of onshore bonds of the same Property Developer credits.

Regardless of underlying motivations, these actions don’t appear to be coming from a position of strength and smack of desperation to me.

What is the PBOC afraid of?

I believe that China needs a weaker CNY but fears losing control of the situation and is desperately trying to manage the optics against a Disorderly Devaluation.

Similarly, the raison d’etre for the HKD Hard Peg no longer exists, but the PBOC/HKMA fear the repercussions of breaking the peg.

In other words, The Donkey Kong Dollar Peg looks wobbly.

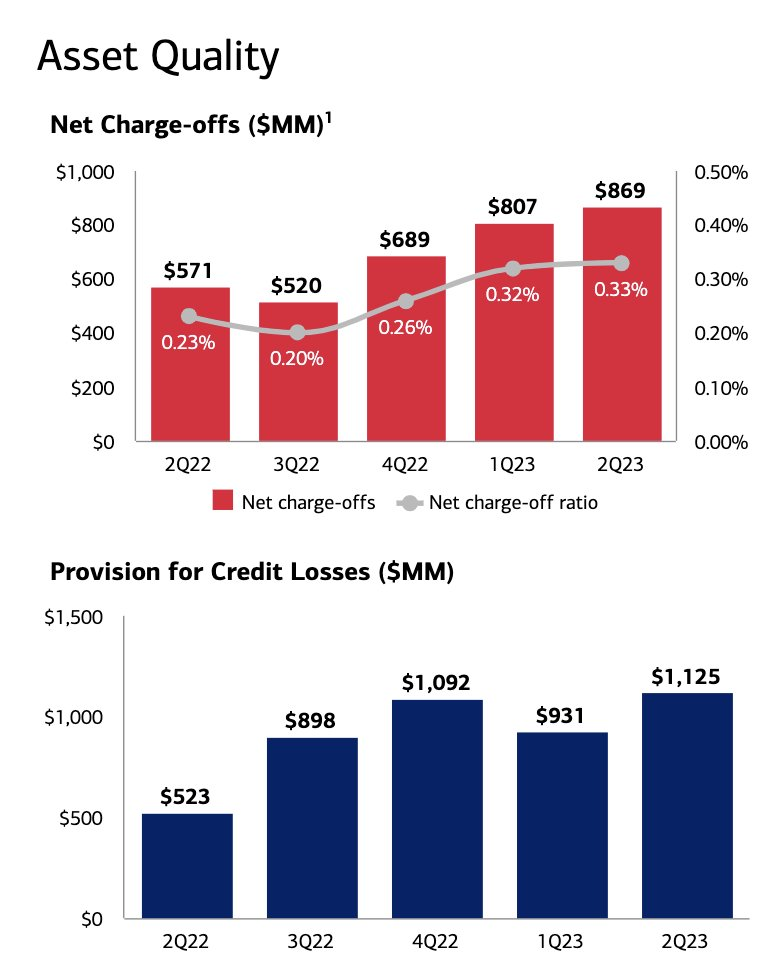

On the HKD side of things, one of my eagle-eyed Substack subscribers found this excerpt from a recent BofA report, italics mine

The HKMA’s ceding of monetary authority to the Fed by dint of its HKD Peg is creating fractures in its banking system, as this article explains. Interbank rates soar past 5pc as HKMA injects $3.8b

Here are some quotes from my aforementioned “Ball In A China Shop” piece from March, specifically about the HKD peg

If push came to shove for the HKMA, I would guess that the PBOC would have to make a choice on whether or not it steps in.

And that leads us back to the question of not whether it can (potentially bolstered by Setser’s Shadow Reserves thesis) but whether it truly wants to, given the strong simultaneous short-term Cyclical headwinds superimposed upon long-term Structural/Demographic headwinds.

Conclusion

In addition to the Macro data I have been tracking, the anecdotal gut-checks from friends on the ground in China indicate that things are bad. Reference 8

Another friend in the Real Estate business corroborated this and said that even folks who are very “pro-CCP” are not making money, implying that even the well-connected are not exempt.

The same friend said that he is once again seeing scared Chinese money (that has somehow circumvented China’s official $50k/household outflow caps) bidding for Single Family Homes in SoCal.

What a strange, distorted Macro environment, where mostly Deflationary forces emanating out China are somehow exerting some Inflationary forces in certain pockets of the US economy!

Alas, I am not so sanguine on the impact on global Oil/Commodities demand.

This is the reason why I continue to hold short positions in both CNH and HKD as “Chicken Hedges” against my Long-Term Oil PE exposure, which I explained in this interview: The Chinese Yuan "Doom Loop" & The Oil-Dollar Wrecking Ball | Michael Kao & Alexander Stahel

Don't forget about the CNY/Oil Doom Loop: Reference 9

Bottom Line

The outlook for the Donkey Kong Dollar Peg (CNY, CNH, HKD) looks asymmetrically bad, and I don’t mind jumping over a couple barrels to reach the Princess. If Donkey Kong crashes, the reverberations will be felt in every Asset Class in every corner of the world.

Chart & Quotes Thread for Week29

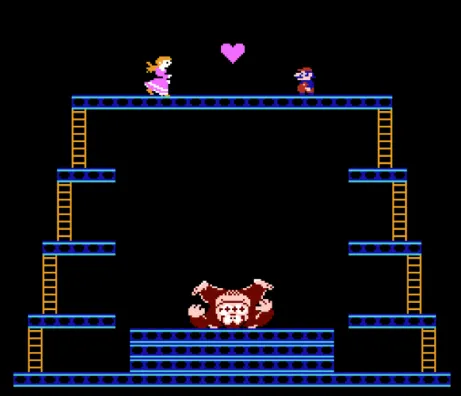

- Blackstone hit the $1T mark in AUM.

"Total AUM increased 6% YoY to $1 trillion" - $BX CFO

"...Blackstone, started by Pete Peterson and Steve Schwarzman in 1985 with $400,000 and a dream..." - $BX COO

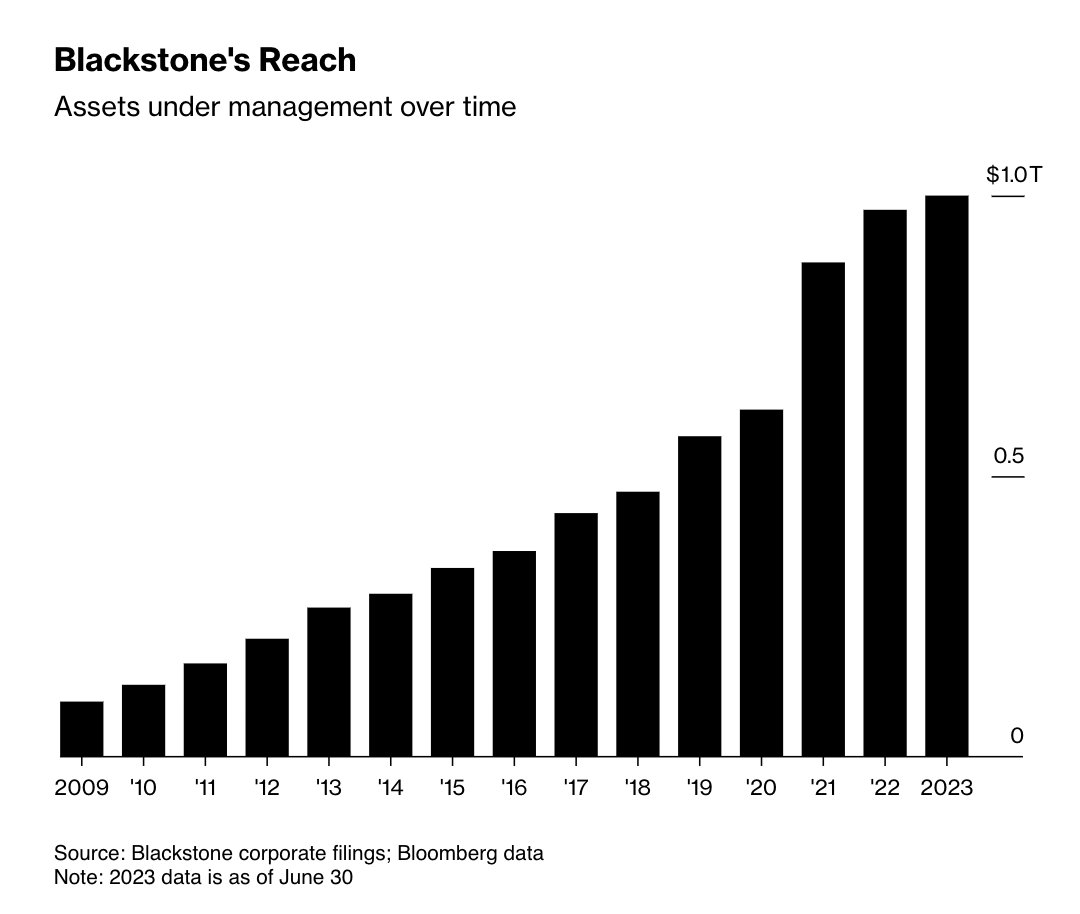

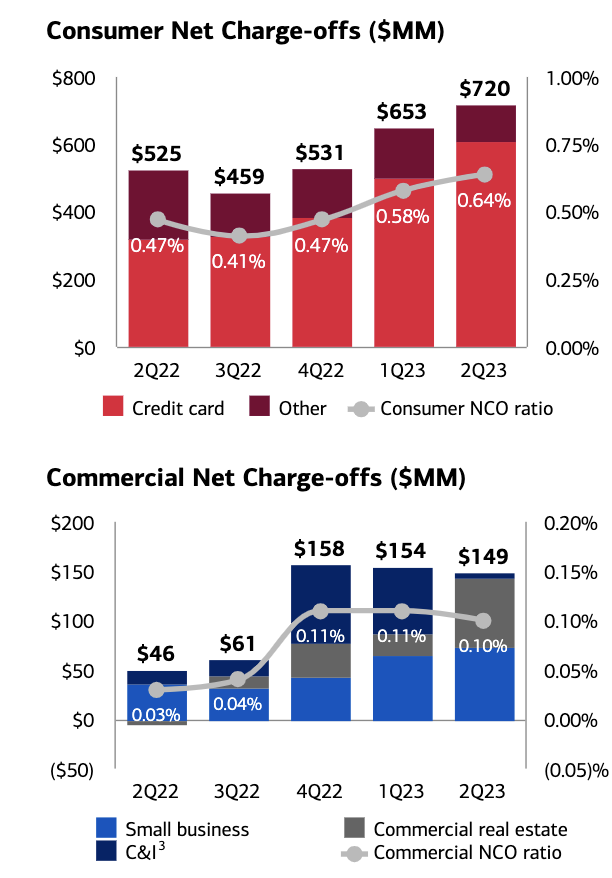

- Credit quality is normalizing:

"On consumer, we note we continue to see asset quality metrics come off the bottom and they remain below historical averages" - $BAC

"Credit losses are increasing" - $COF

"Credit normalization is happening faster in retail services" - $C

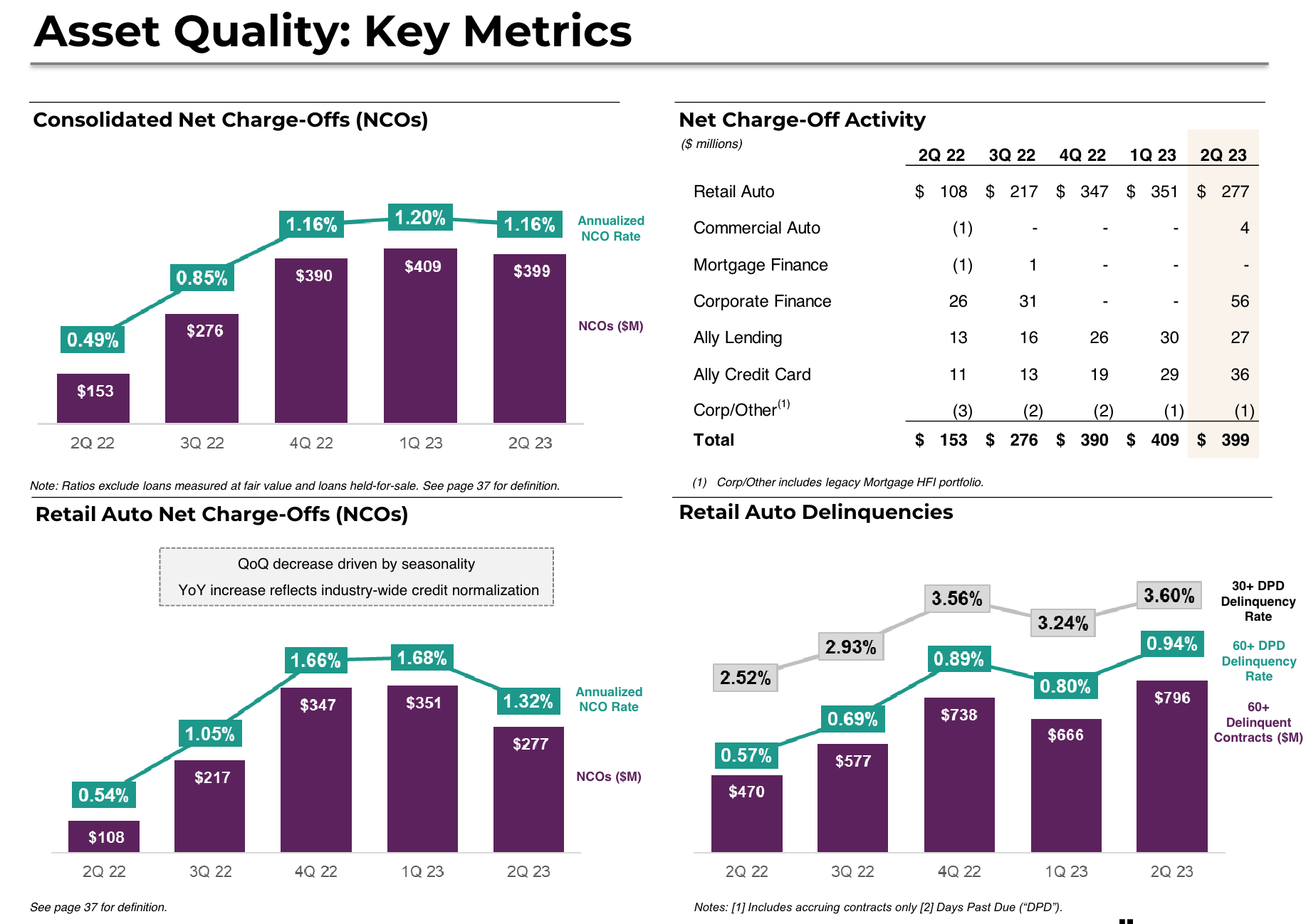

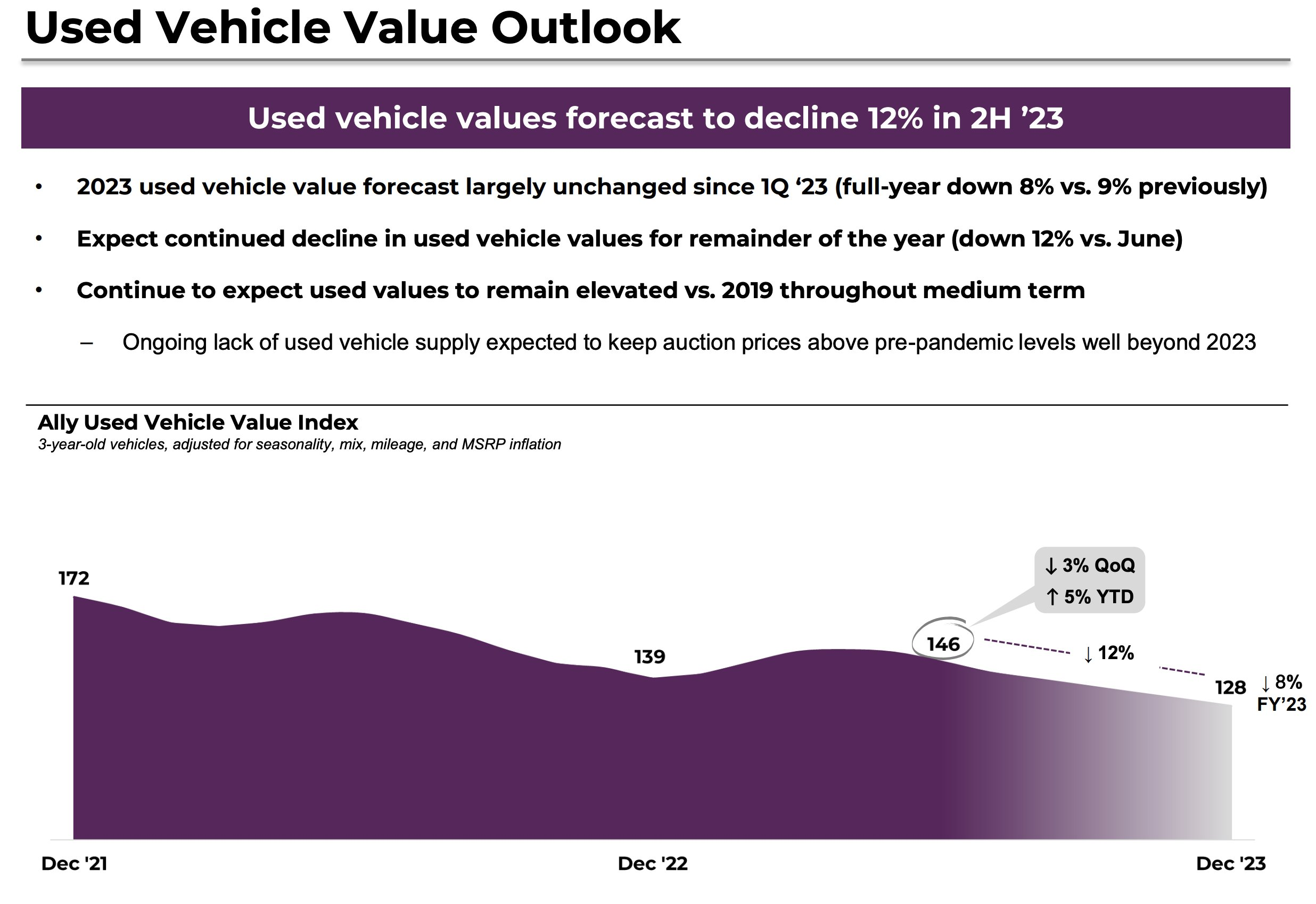

- Auto credit quality remains a worry though:

"Delinquencies remain a watch item and remain elevated entering the second half of the year. And consistent with prior guidance, we assume a meaningful step down in used vehicle values for the remainder of the year" - $ALLY CEO

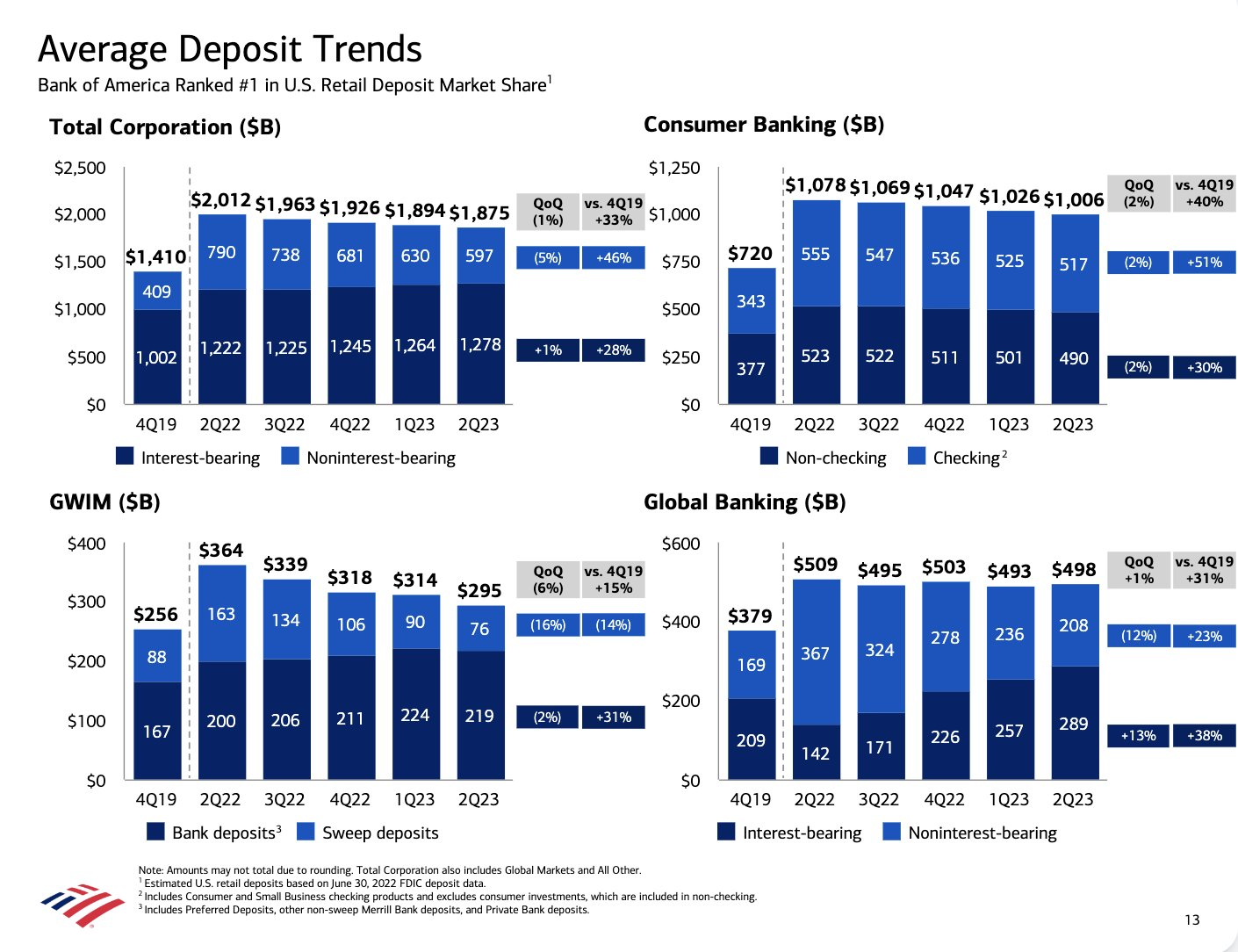

- Deposits have stabilized:

"We ended Q2 at $1.88T, down 1.7%, with several elements of our deposits seeming to find stability" - $BAC CFO

"Throughout the quarter, customer deposit balances continue to normalize & we observed relatively stable trends since mid-May" - $CMA CEO

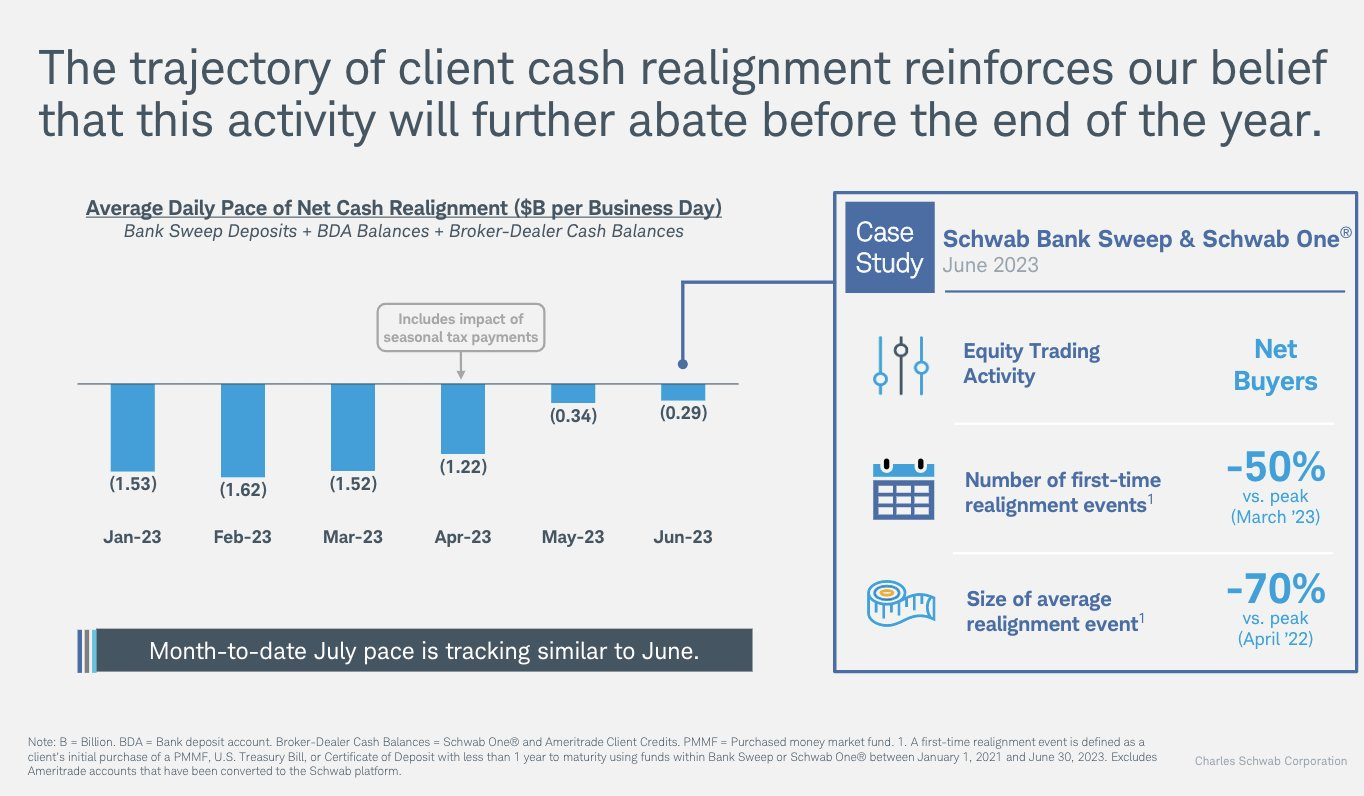

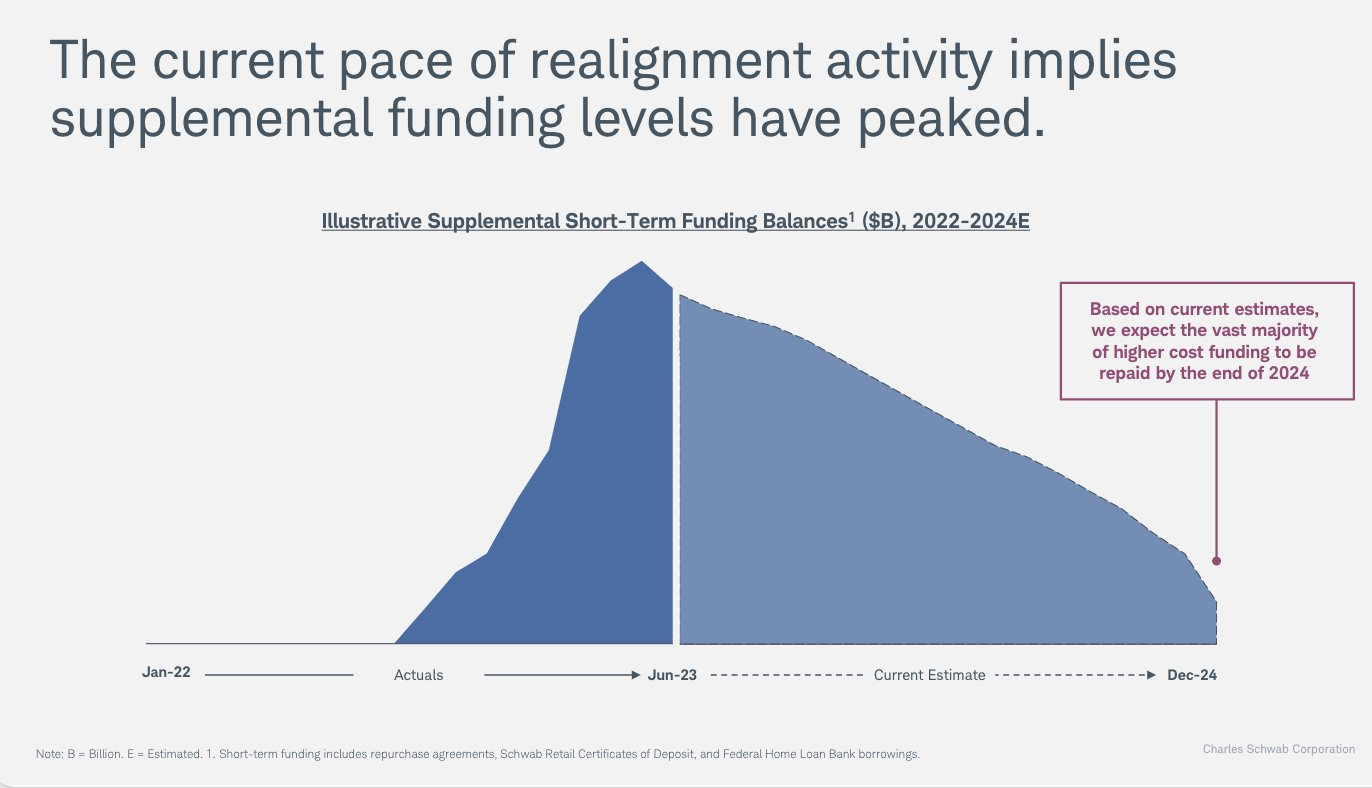

- The pace of cash realignment is slowing down:

"And as client cash realignment continues to slow and eventually reverses, we'd expect those supplemental funding balances to continue to decline over the next 18 months and be mostly paid off by the end of 2024." - $SCHW CF

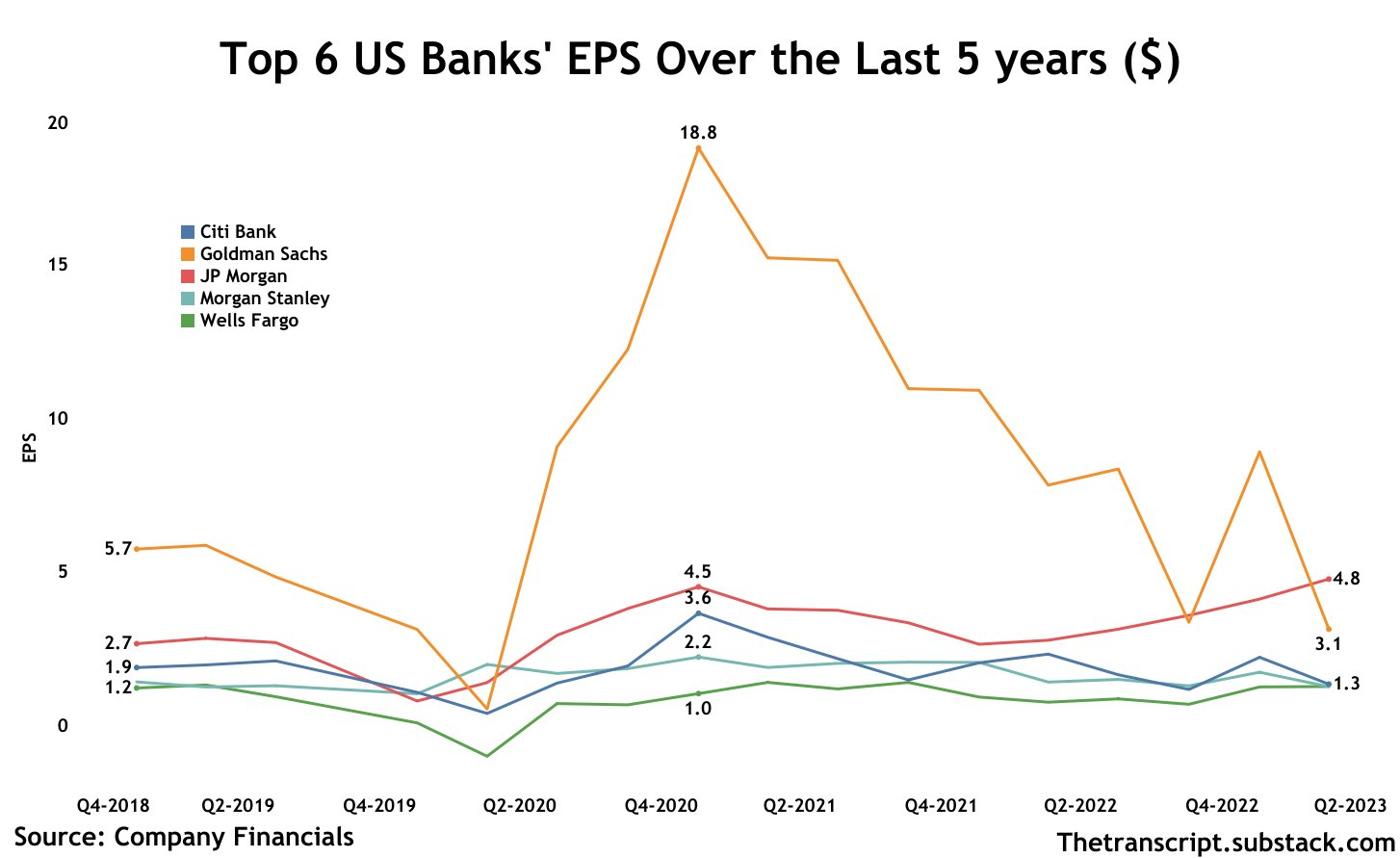

- This is the trajectory of bank earnings:

"The investment banking returns right now are at a very, very significant low" - $GS CEO

"Reported results include severance charges of approximately $300 million. This reduced EPS by $0.14" - $MS CFO

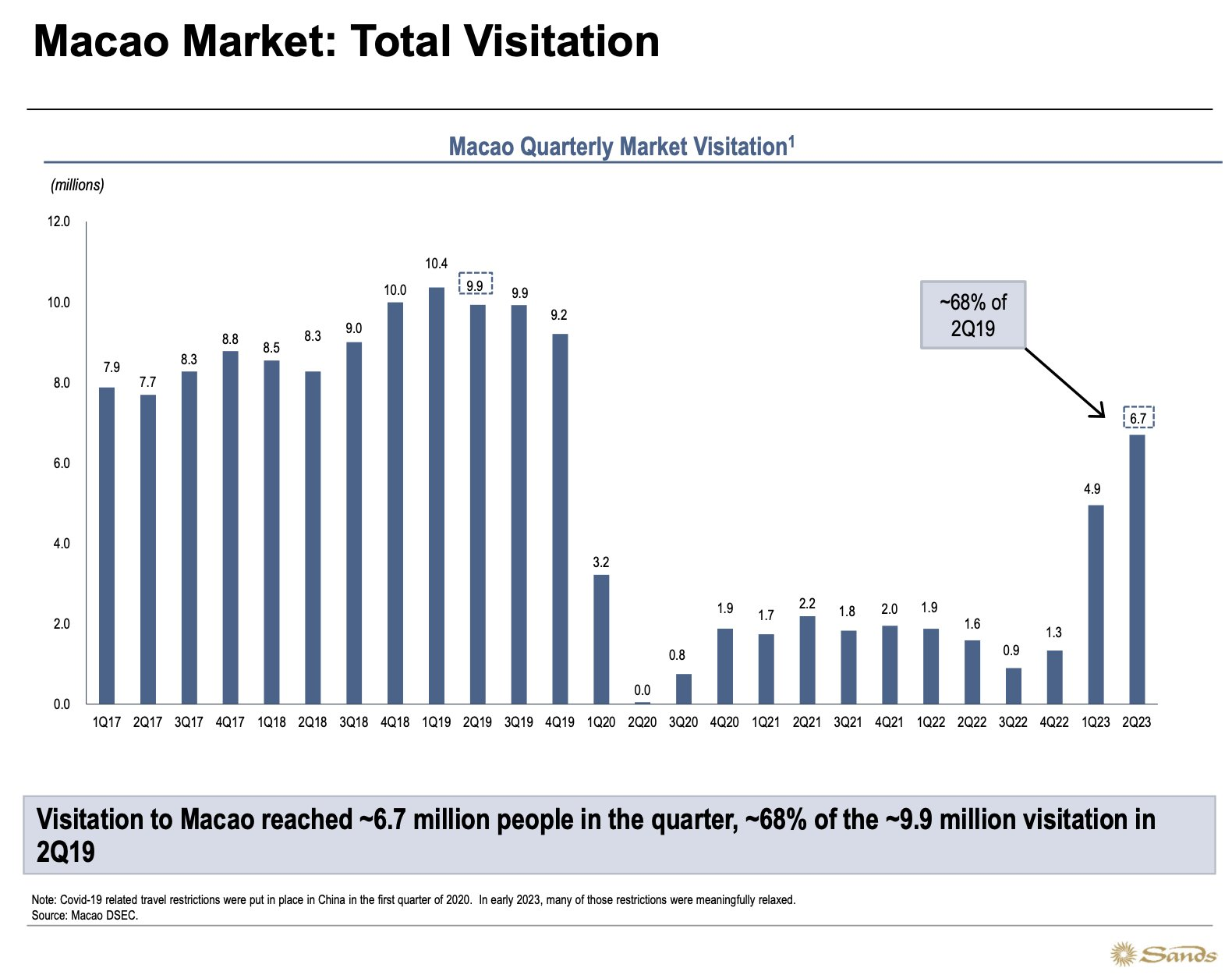

- Macao visitations have recovered:

"We saw underlying visitation recovery, obviously. Macao visitation recovering to almost 70% of 2019. And all of our key volume metrics were up significantly against April and May" - Las Vegas Sands COO

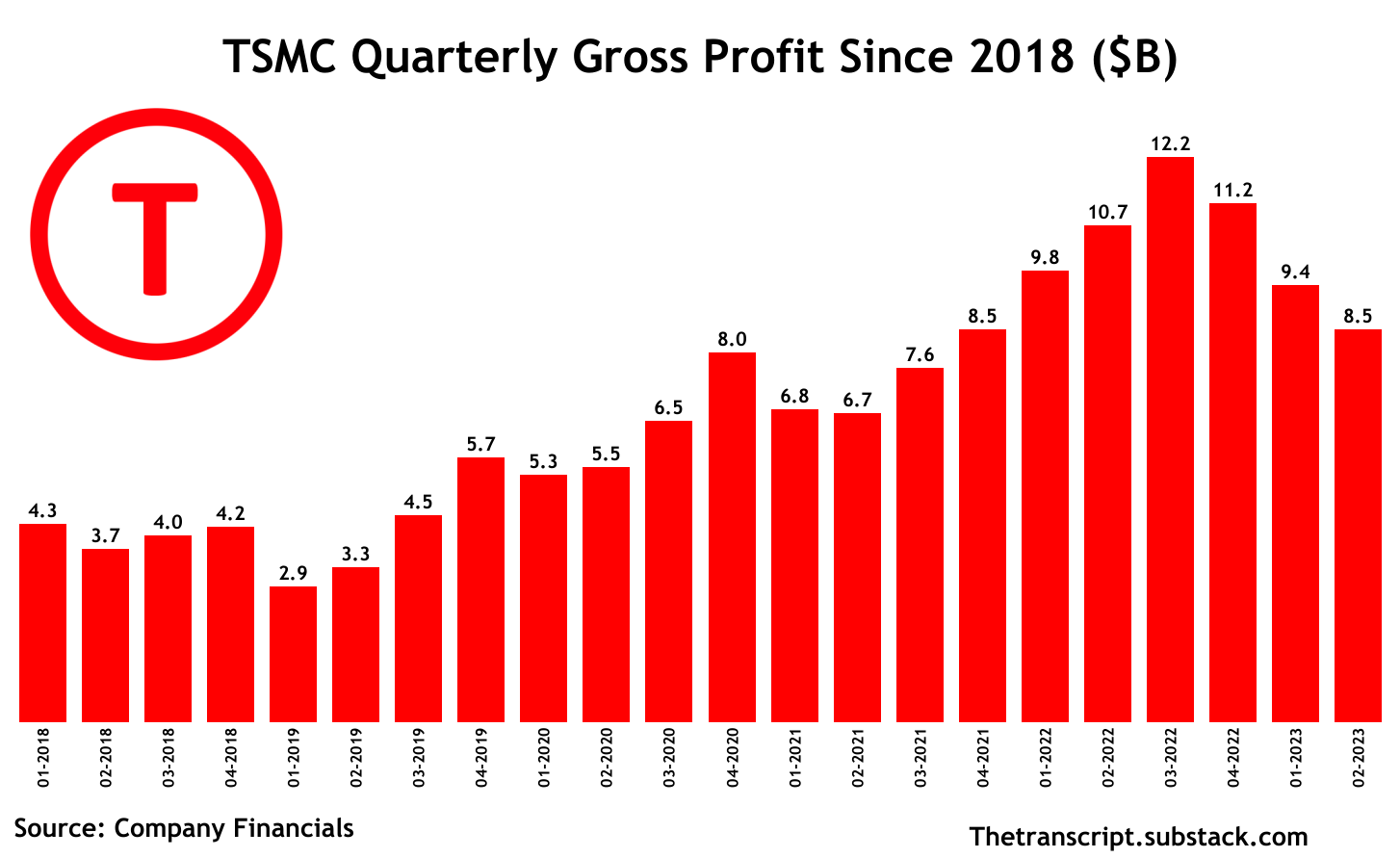

- TSMC's revenues to decline 10% in FY 2023:

"We now expect the foundry industry to decline mid-teens and our full year 2023 revenue to decline around 10% in U.S. dollar term" - $TSM CEO C. C. Wei

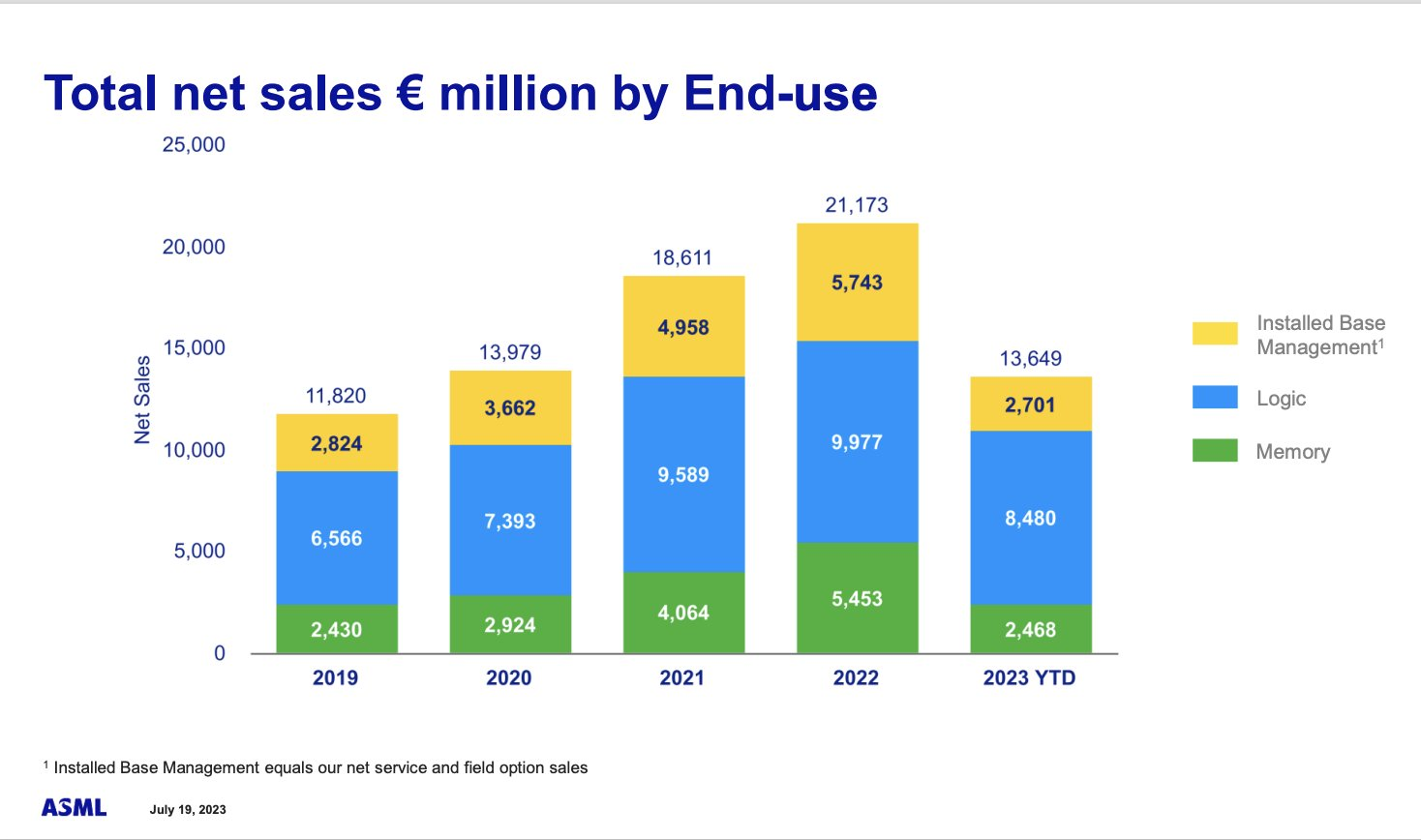

- ASML raised FY 23 guidance on the back of strong demand in China:

"Due to strong DUV revenue and despite the increased uncertainties, ASML expects strong growth for 2023 with a net sales increase towards 30% and a slight improvement in gross margin, relative to 2022" - $ASML

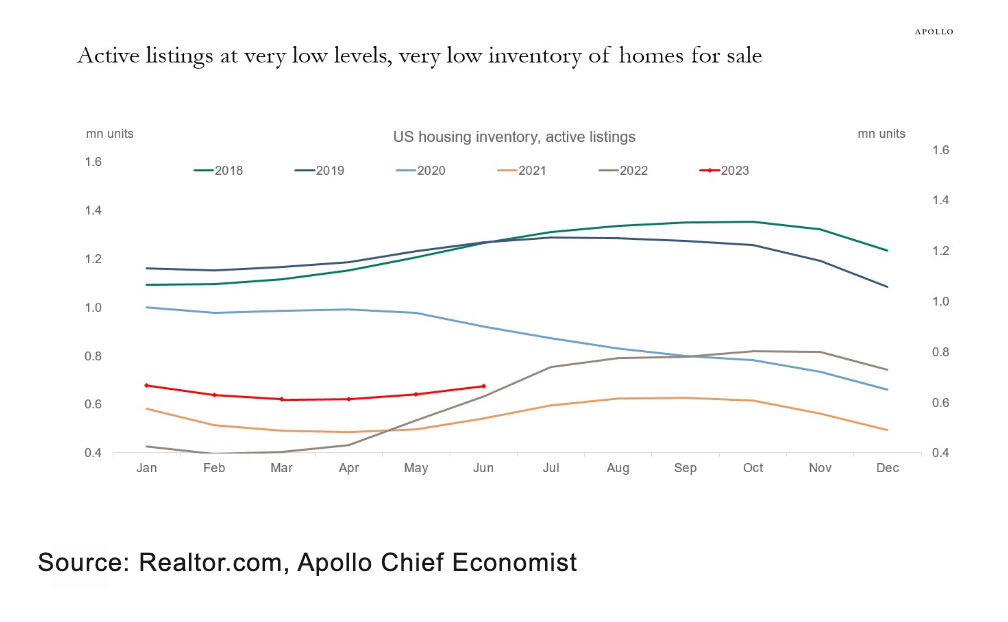

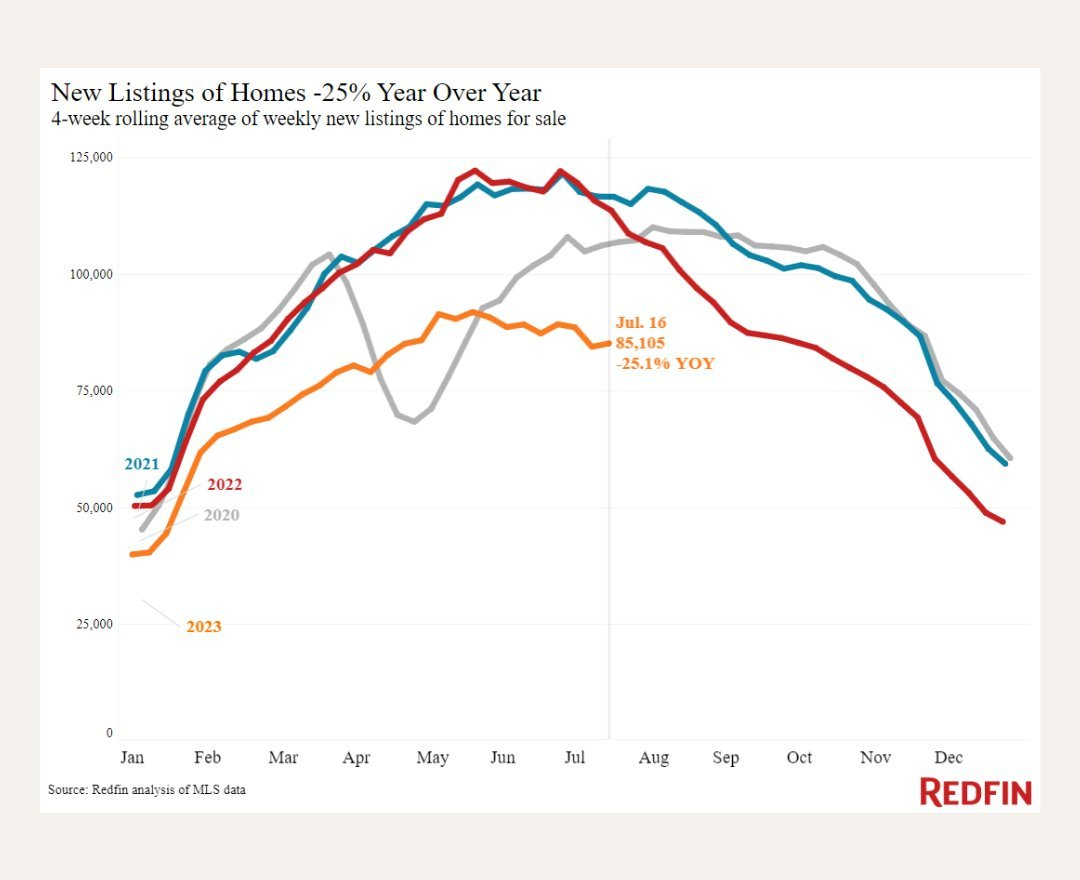

- New homes listings remain below 2020, 2021, and 2022 levels:

"Demand is low, but inventory is even lower" - $RDFN CEO

"As for current market conditions, the supply of new and existing homes at affordable price points remains limited" - $FOR COO

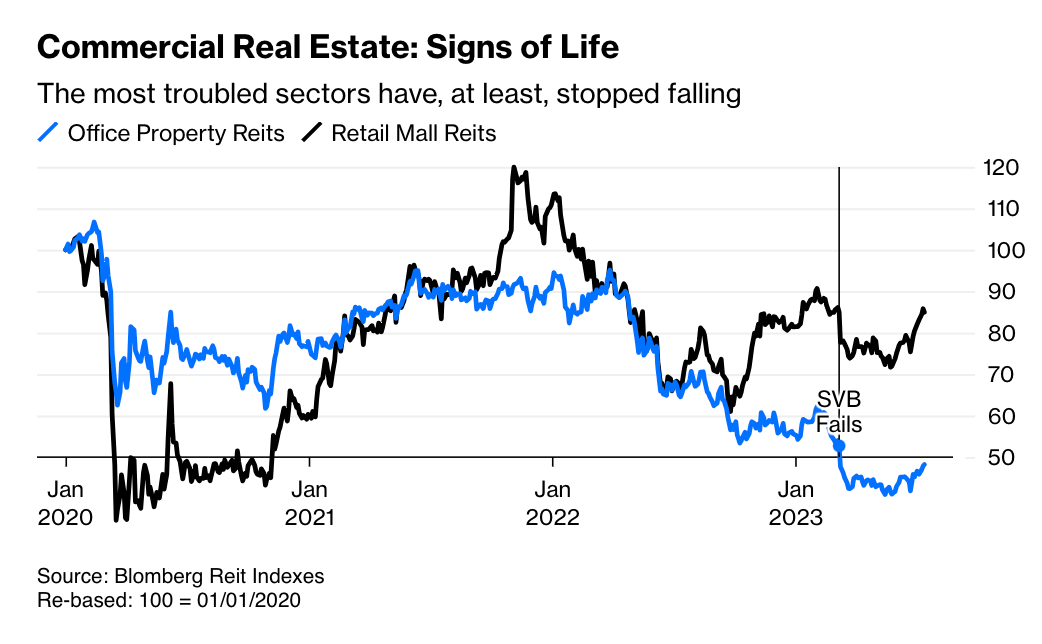

- Some signs of life in Commercial Real Estate:

"looking forward, the positives are rates are coming down or at least are no longer going up at the short end like they were in the long end seem to have stabilized & that is helpful for commercial real estate values" - $BX COO

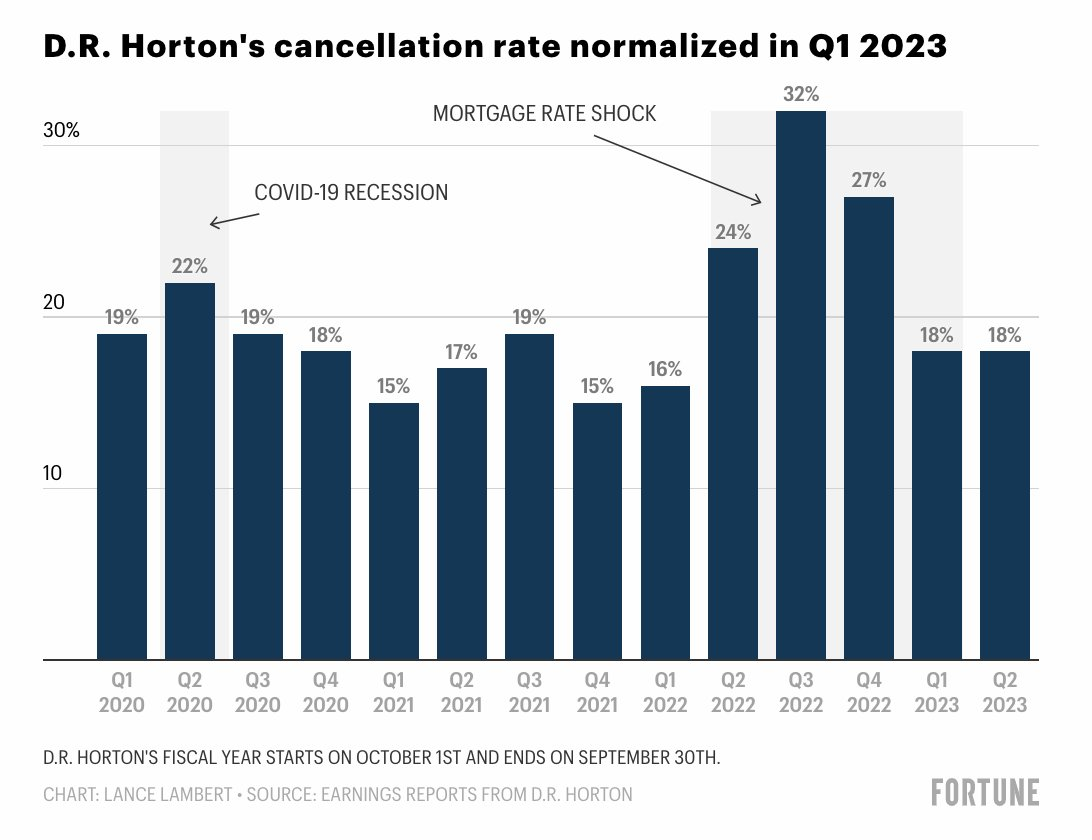

- Cancellation rates at D.R. Horton are normalizing:

"Net sales orders for Q3 increased 37% to 22,879 homes and 26% in value to $8.7B...cancellation rate (cancelled sales orders divided by gross sales orders) for Q3 23 was 18% compared to 24% in the prior year quarter" - $DHI

- Used-vehicle prices projected to decline in H2 23:

"We are currently forecasting a 12% decline in values across the back half of 2023, which would result in a full year decline of 8%, roughly in line with what we shared last quarter" -$ALLY CFO

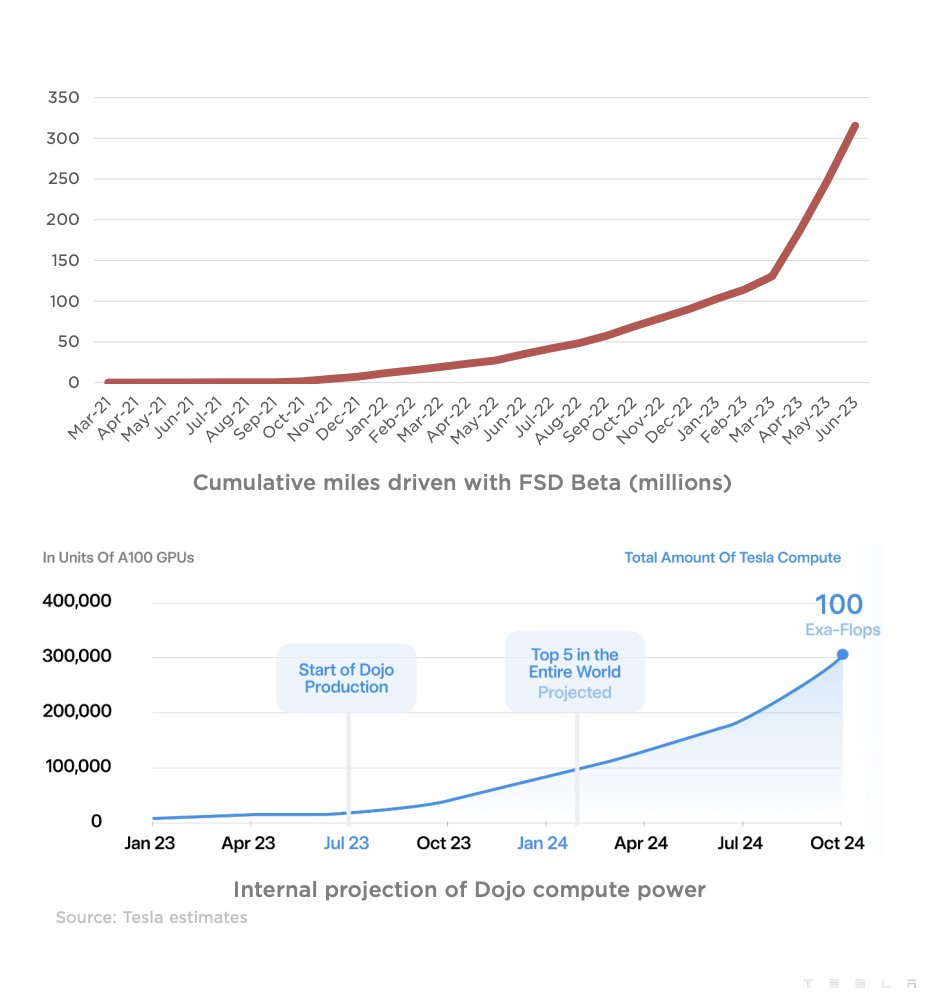

- Tesla's FSD is making progress:

"So today, over 300 million miles have been driven using FSD Beta...It will soon be billions of miles, tens of billions of miles...We see a clear path to full self-driving being 10x safer than the average human driver" - $TSLA CEO

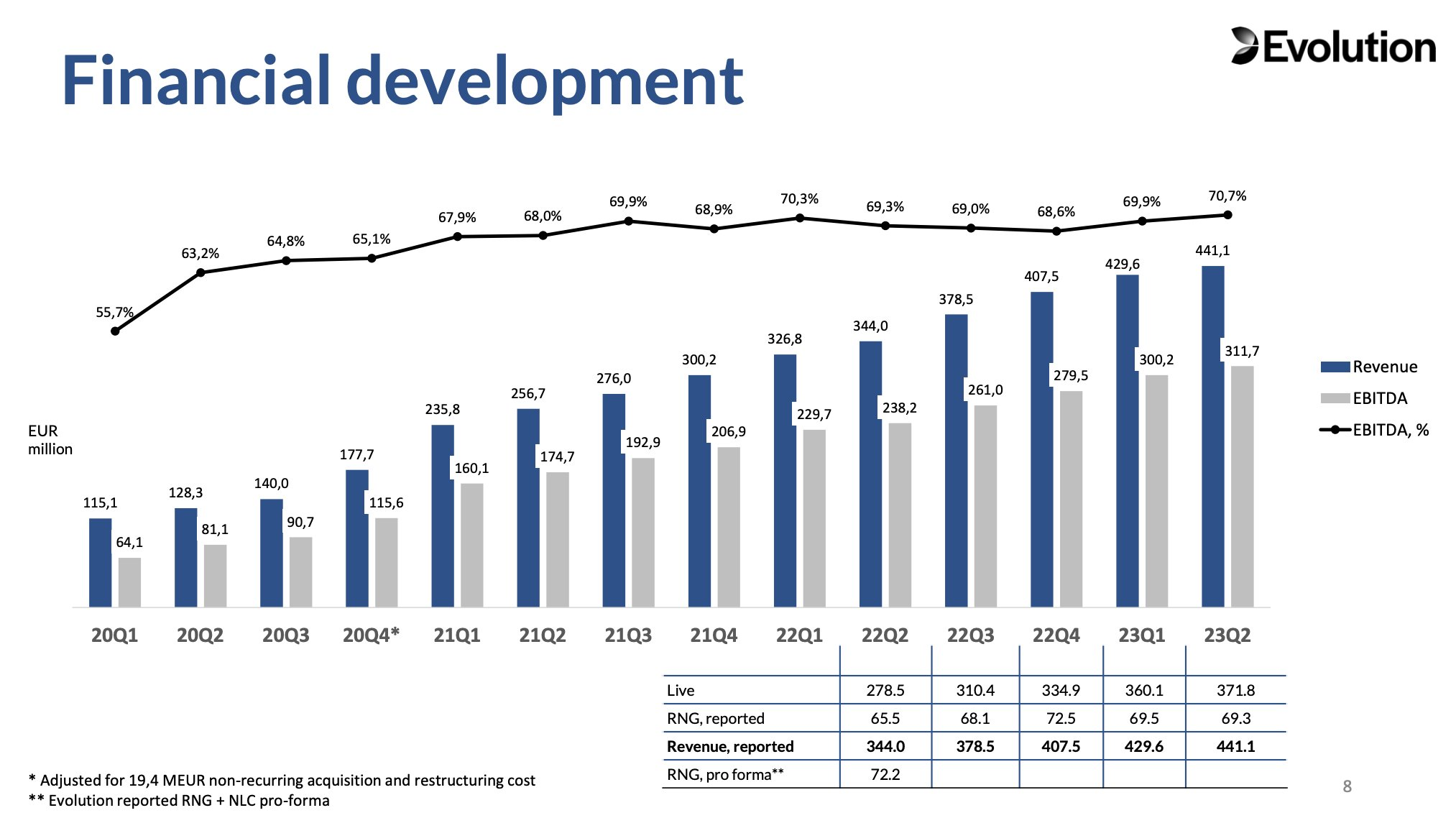

- Evolution Gaming just keeps growing:

"After a strong Q1, I'm satisfied to report yet another financially a solid quarter...Revenues in the quarter increased by 28.2% to EUR 441M...EBITDA in the quarter increased by 30.8% to EUR 311.7M, corresponding to a margin of 70.7%"