BTC ETH DVOL 37

The Dvol (Volatility Index) for BTC and ETH fell to 37%, the lowest level in history since two years ago, and the current Implied Volatility level, as projected by Dvol's algorithm, has fallen to the lowest level in crypto's history.

Continued low liquidity has severely depressed IV levels, and today's rapid decline to a new short-term low of $29,000 failed to pull IV up, with almost all term IVs not moving up, and the market remaining dead.

The low liquidity market has seen more spikes and drops, with daily options price up 7x today, and this will only increase in subsequent markets.

SNX

DeFi tokens that are showing signs of a turnaround, part two - $SNX

The biggest opportunity in DeFi

Firstly, Synthetix is involved in the most profitable businesses in crypto – perps. It caters to a prime use case in crypto: leveraged betting on asset prices.

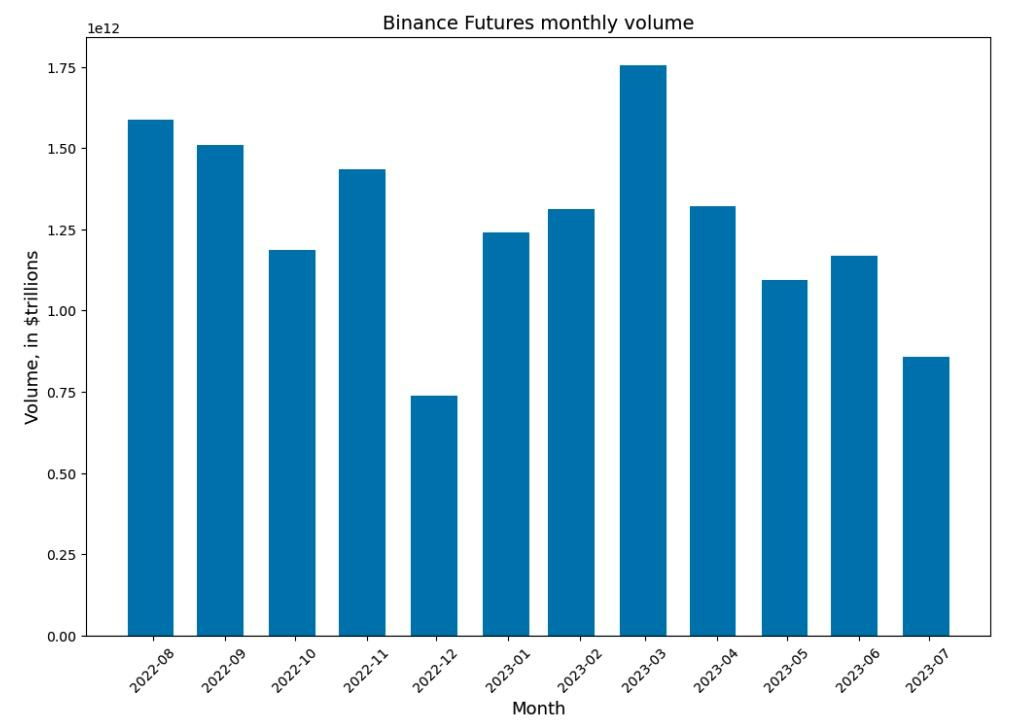

Binance futures consistently doing >$1tn in monthly volume. With 4 bps capture, it f $400m of monthly revs.

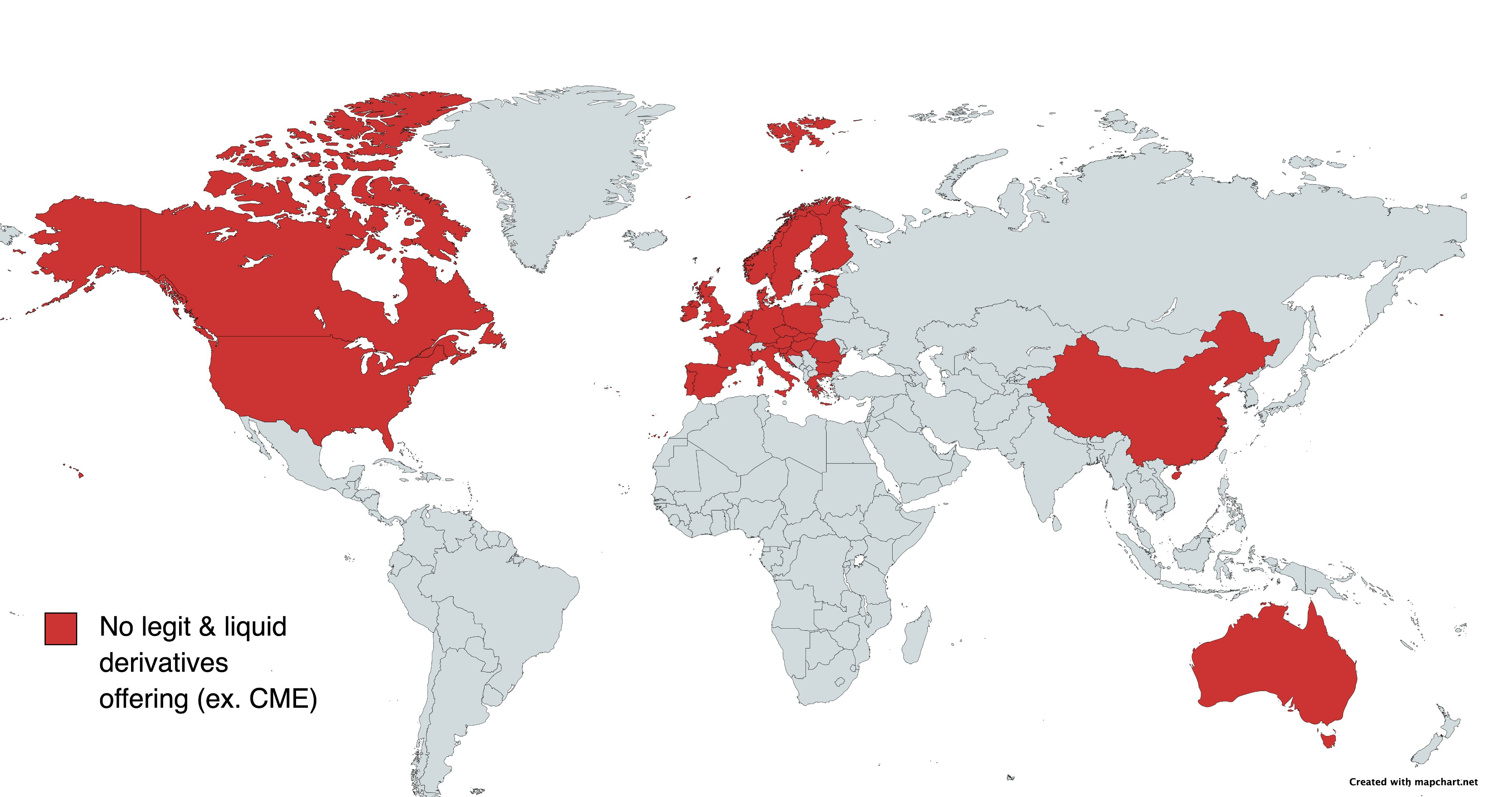

This lucrative business is banned in nearly all DMs.

The US has long enforced this, but THIS year futures were banned in the EU, Australia and other jurisdictions. In most Western countries, you can't access legit CEX perps.

Currently, perp DEXes are competing with third-tier CEXes that market themselves as 'no KYC' exchanges.

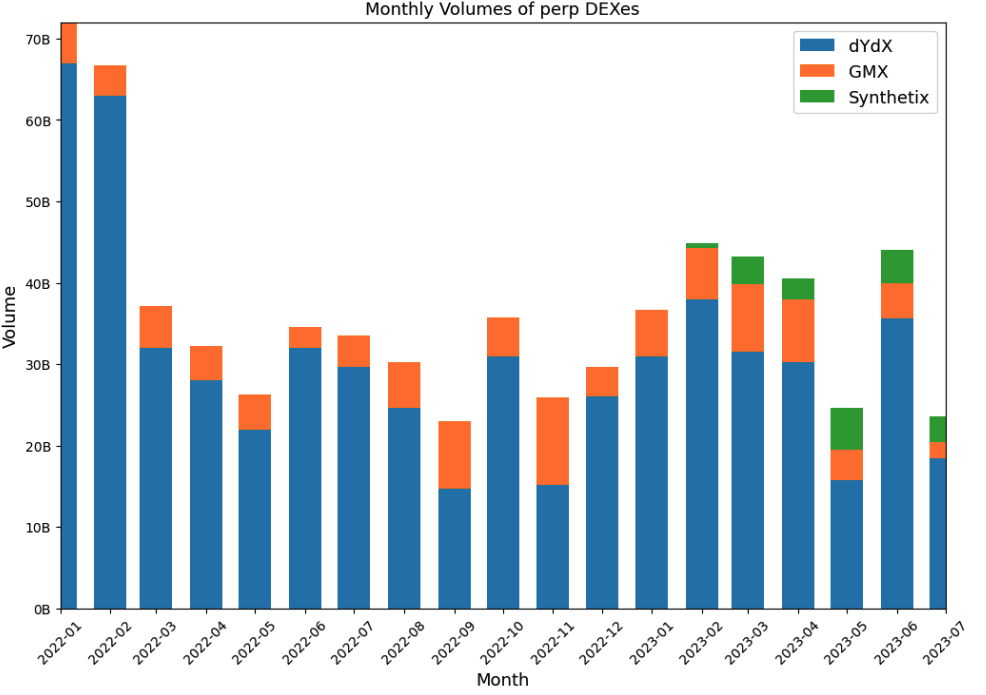

The top three DEXes generate just 2%-4% of Binance's earnings, and over 80% of that is subsidized through token rebates.

Anyone who trades perps knows that the user experience is subpar. The tradeoffs vary by DEX, but none are particularly impressive.

The good news is that it's being solved. And if we have Uniswap > CB moment for perps, we're looking at a potential 50x+ Reference 1

You almost have to have some exposure to that.

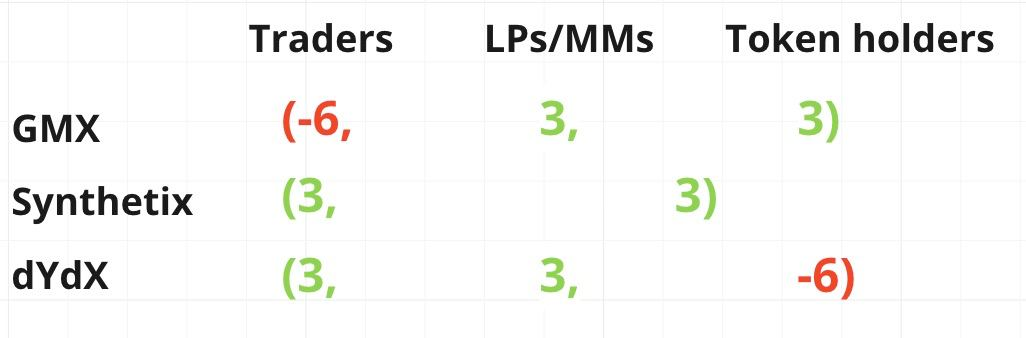

Typically, DEXes have three stakeholders: traders, MMs/LPs, and token holders.

For sustained success, an exchange must treat them well and keep balance. Which is what most DEXes fail at.

On dYdX, token holders are the ones left holding the bag. They get nothing and face dilution of more than 50% per year.

On GMX, it's the traders who are getting screwed. For more on this, check out the thread I wrote back in December

In the current version of Synthetix, $SNX stakers ARE the liquidity providers. Thus, Synthetix only has to balance between two stakeholders and directs 100% of revenue to $SNX stakers.

This is in contrast to $GMX's 30% and $DYDX's 0%.

The main innovation that allows Synthetix to scale to over 40 markets and OI caps that are more than 4x its working capital, while having 8 bps roundtrip fees, is its funding & pricing mechanism that keeps the skew balanced. Reference 2

As far as I know, $SNX is the most productive DeFi blue-chip.

$SNX stakers capture 100% of trading fees and inflation of $SNX as compensation for taking on the risk of being the counterparty, which has significantly reduced with the shift to perps v2.

Meaning comparing SNX to other cryptos isn't exactly an apples-to-apples comparison.

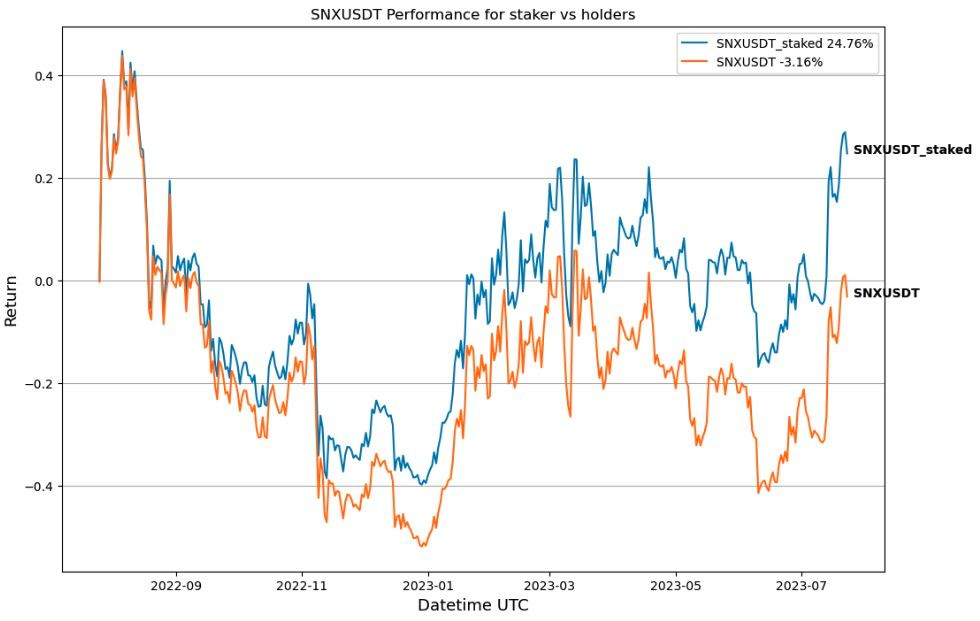

In the chart, I've plotted the returns for stakers vs. holders who don't stake over the past year, factoring in sUSD and escrowed SNX rewards discounted by 50%.

note: inflation is lower now

Even after this recent pump, SNX is trading at 25x earnings (30d lookback), which is hardly expensive given the growth potential

Two major factors holding Synthetix back are Optimism and sUSD, as acknowledged by Kain in a recent blogpost.

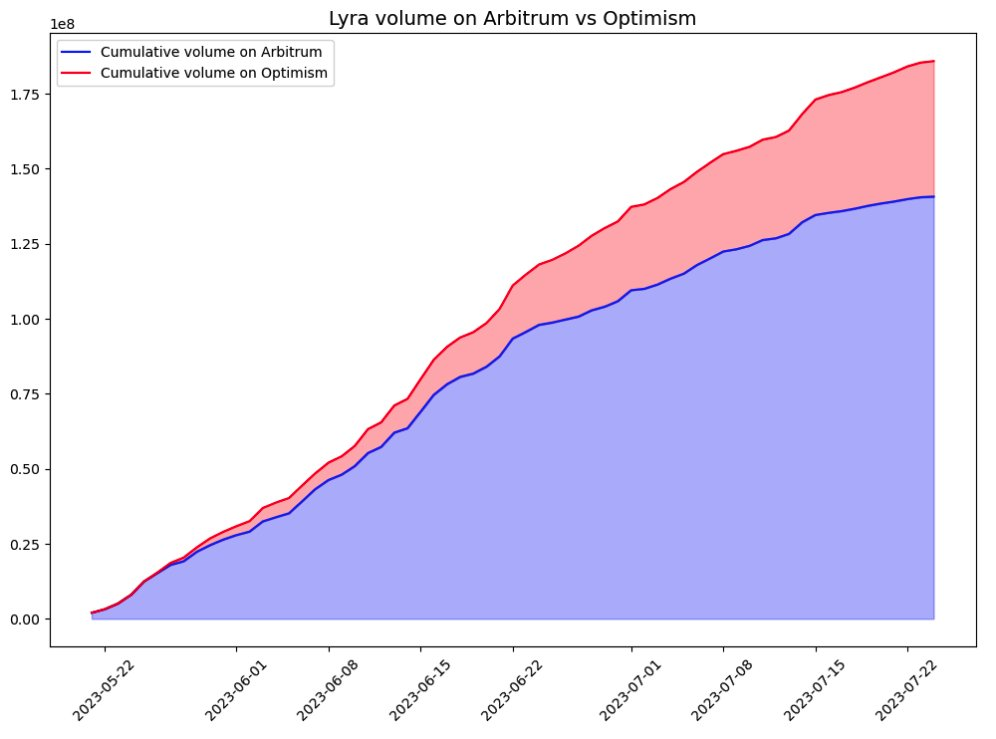

This is best shown by Lyra, which despite being OP-native and offering more markets, is doing over 3x the volume on Arbitrum.

CCIP (released this week) solves this

I believe that the moment Synthetix IS available on Arbitrum, volume (and thus revenues) will double overnight, driven by DeFi natives alone.

Infinex, which aims to onboard the wider public, is promising, considering there's not much choice anyways.

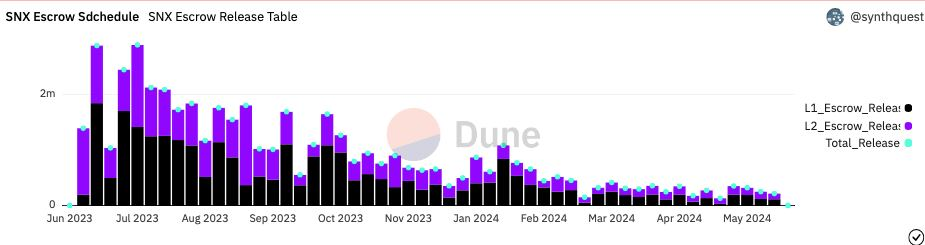

Summer is the period when the most $SNX gets vested, sometimes exceeding 2m per week.

Going forward, the amount of newly vested supply will reduce significantly, reflecting the lower inflation rates

v3. LaaS or generalized liquidity layers is a new meta, and a few teams are working on this in parallel. Synthetix, having this vision for a long time and having already built a decent ecosystem, is probably best positioned to bring this vision to life

USDT/USDC

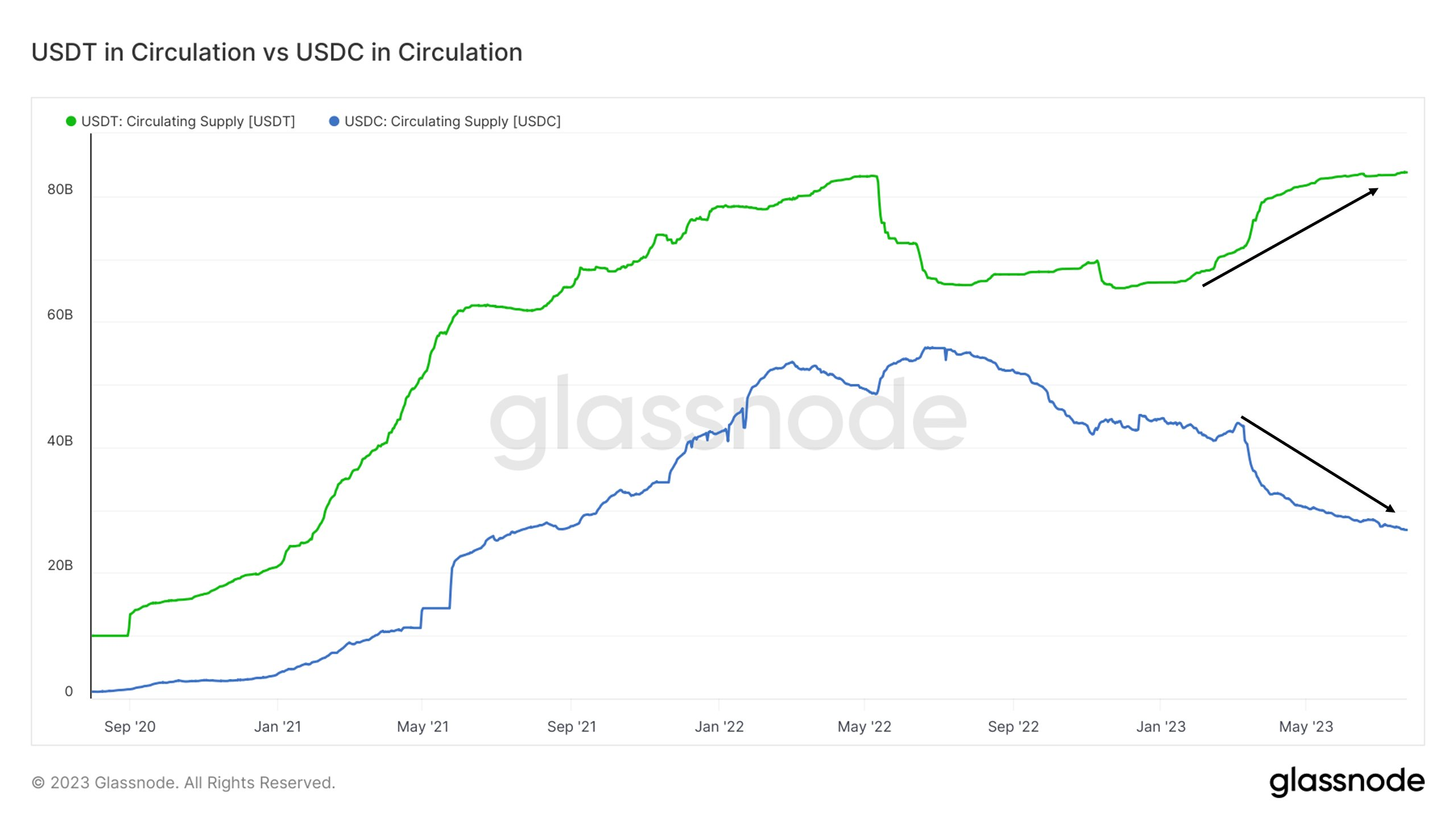

Ever since the banking crisis, there has been a clear divergence between USDC and USDT in circulation.

Tether's market share continues to grow as Circle's market share continues to decline.

Source Tweet - Reflexivity Research

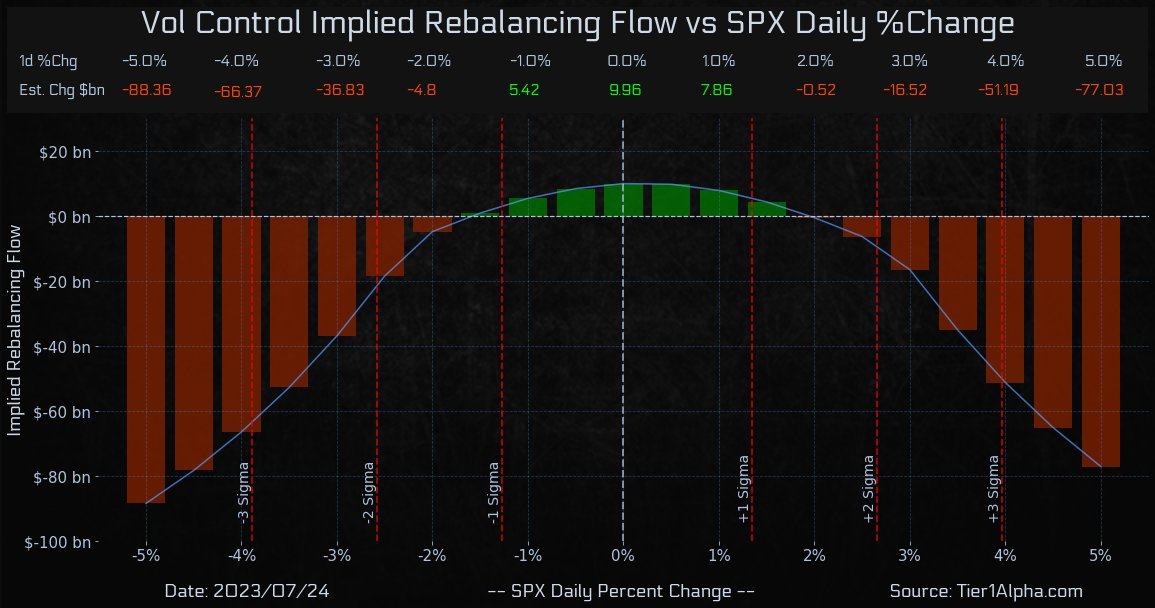

Vol Control Flows

We could see some huge Vol control flows hit the tape tomorrow with a possible $10 billion in added equity exposure.

While Wednesday's Fed presents its own challenges, these bullish flows should provide a supportive backdrop for $SPX heading into the event.

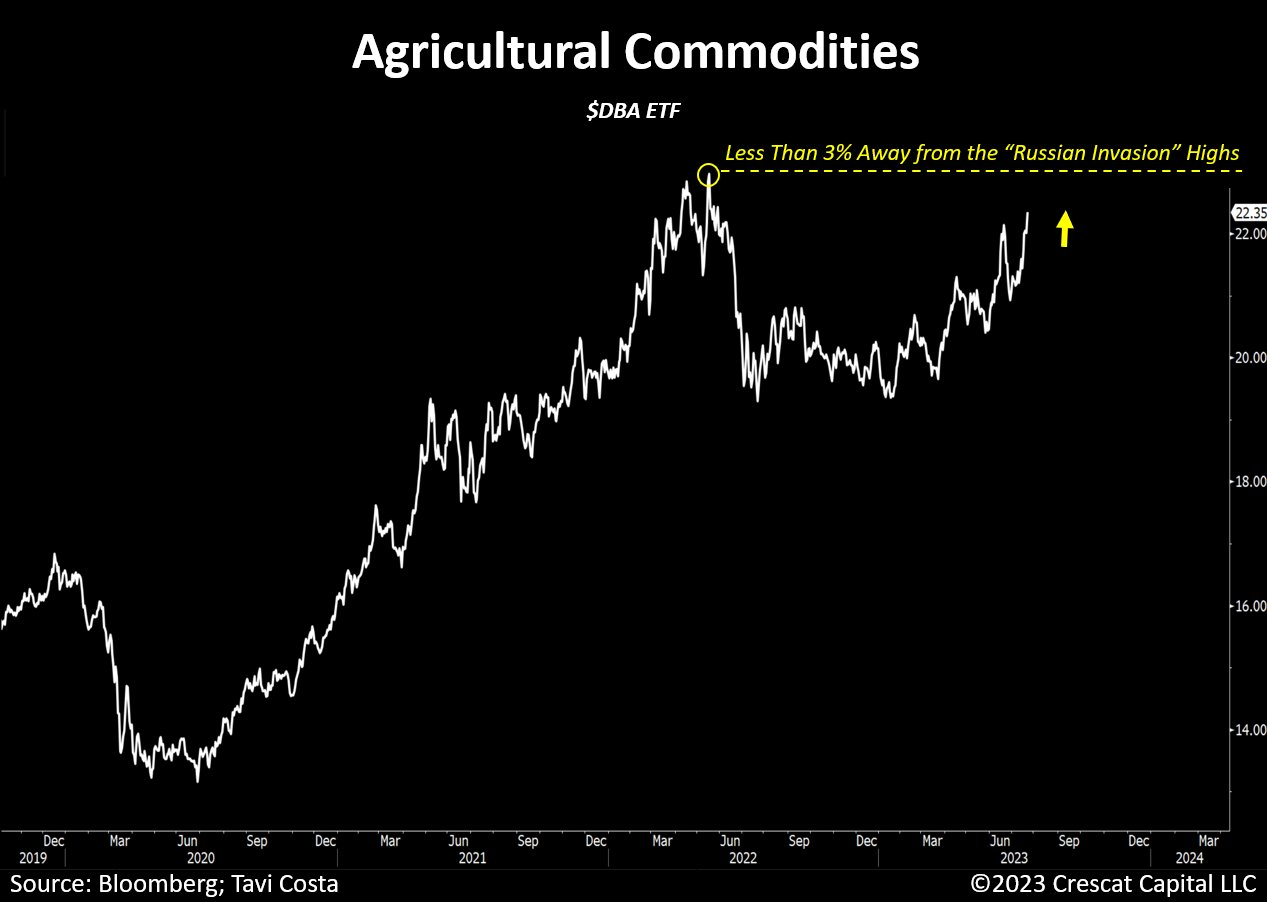

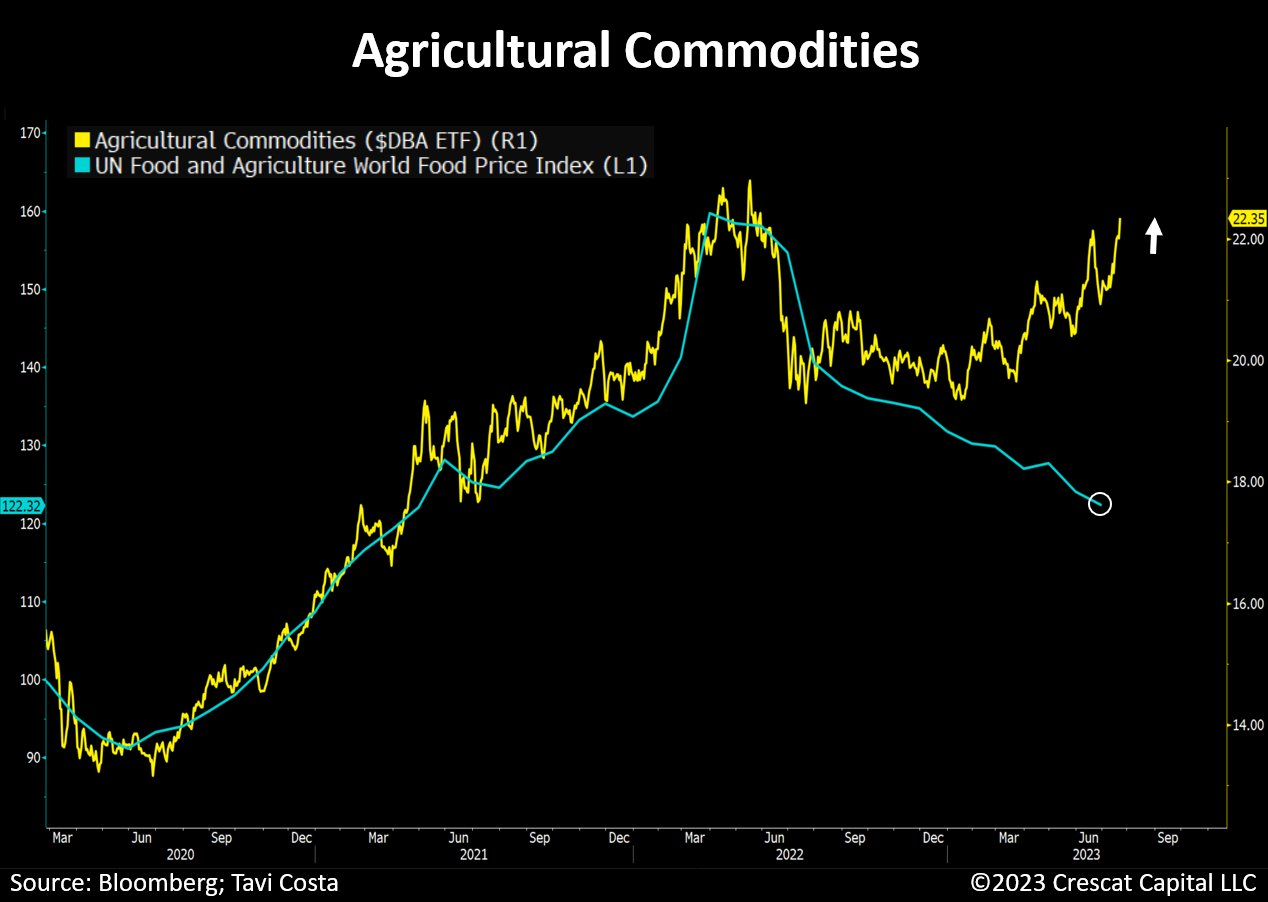

Agricultural Commodities

Meanwhile:

Agricultural commodities are less than 3% away from reaching the highs seen during the "Russian Invasion."

This is not the time to be pounding the table saying that inflation is over.

Food prices are primed to follow suit

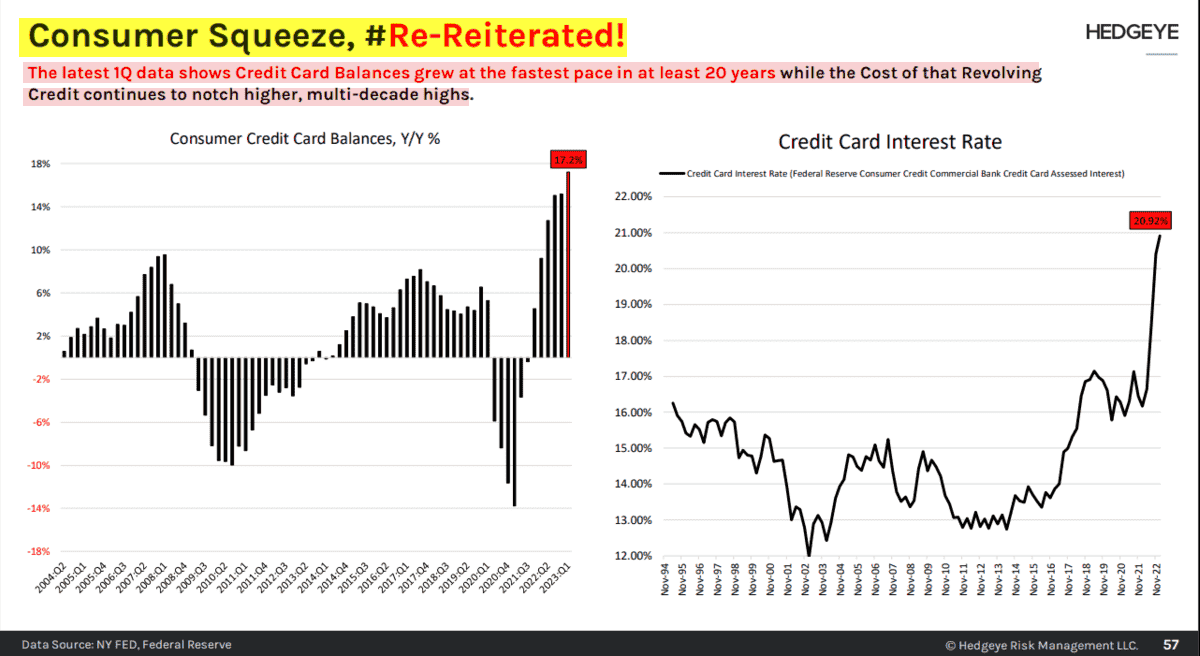

Credit Card Balances

FACT: U.S. Consumers are in bad shape. Credit card balances in America are at 20-year highs as interest rates skyrocket ⚠️

Many people still don’t “see” clear evidence of the U.S. economy slowing. Set aside the fact that Industrial Production went negative last week. Set aside that Retail Sales is flirting with Dr. Zero.

“People can't pay their credit card balances," explains @KeithMcCullough. "This is the America you live in. It's a huge problem.”

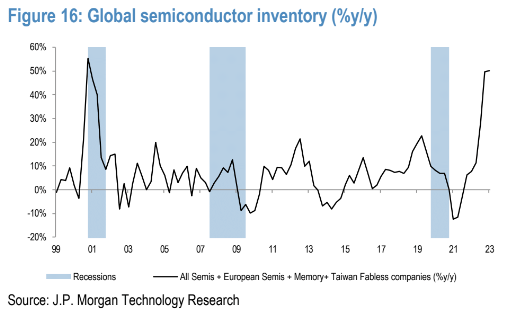

Semis Inventory

"Semis inventory is at the highest levels since 2001."

-JPMorgan

Source Tweet - Daily Chartbook

Digital Ruble

Inflation/Rate Hikes

Former NY Fed executive Brian Sack: “The view that we would need two additional rate hikes rested in part on their frustration that inflation had not moderated more substantially. That’s now changing.”

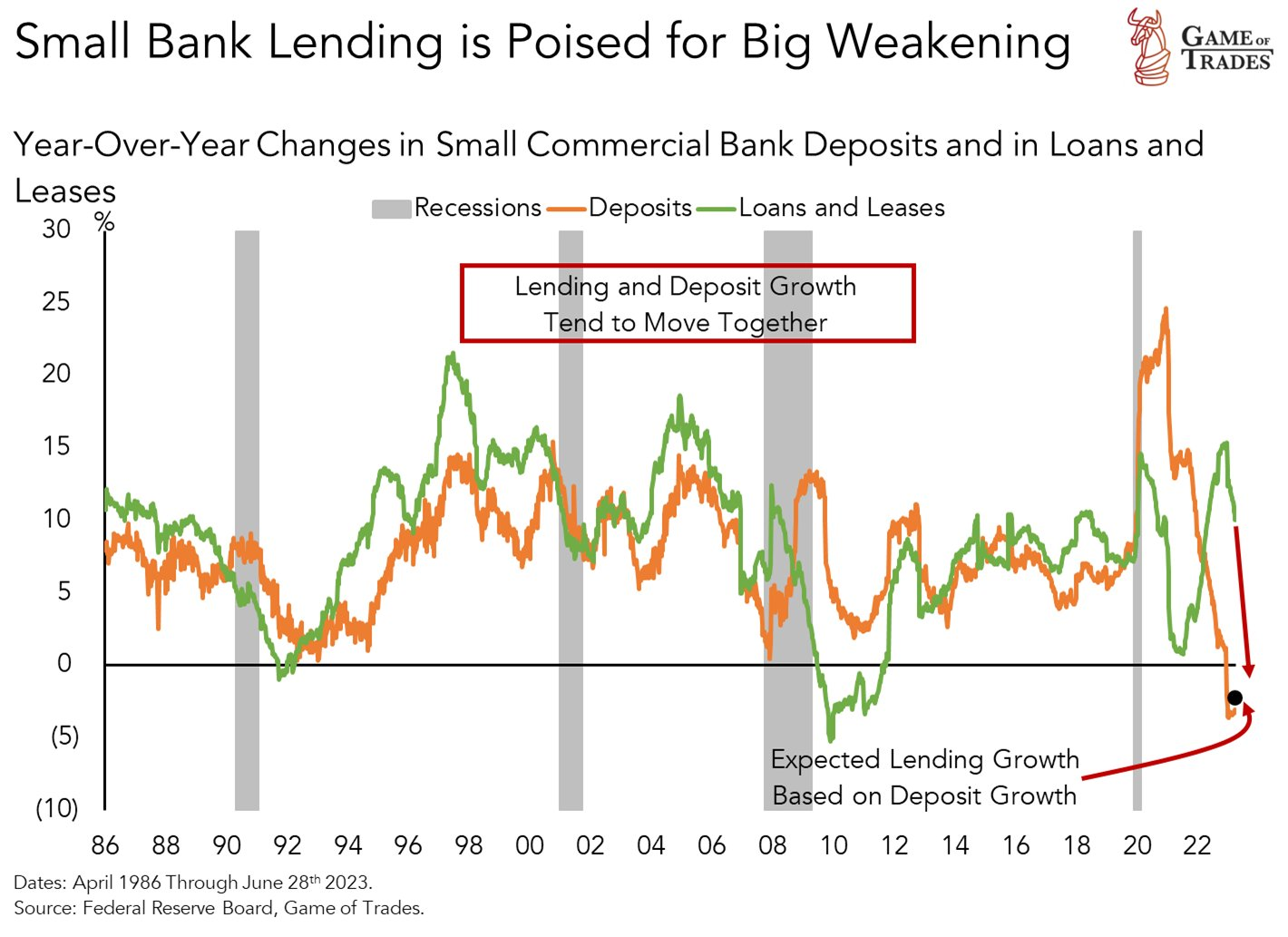

Credit Conditions

Credit conditions are likely to get worse in H2 2023

Commercial bank deposit growth has been contracting sharply, pointing to a decline in lending

Loan

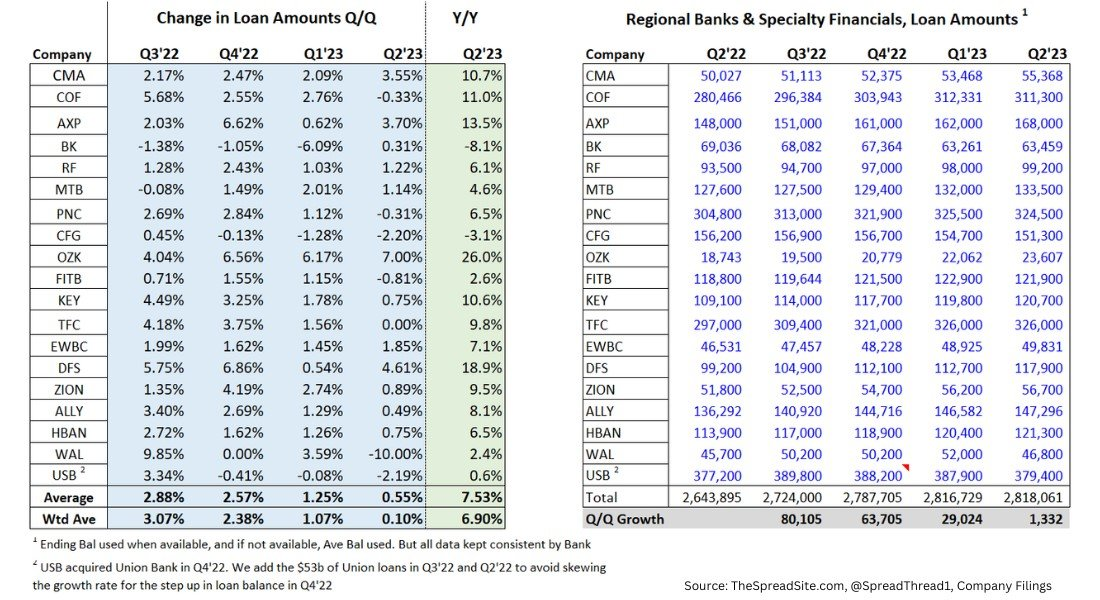

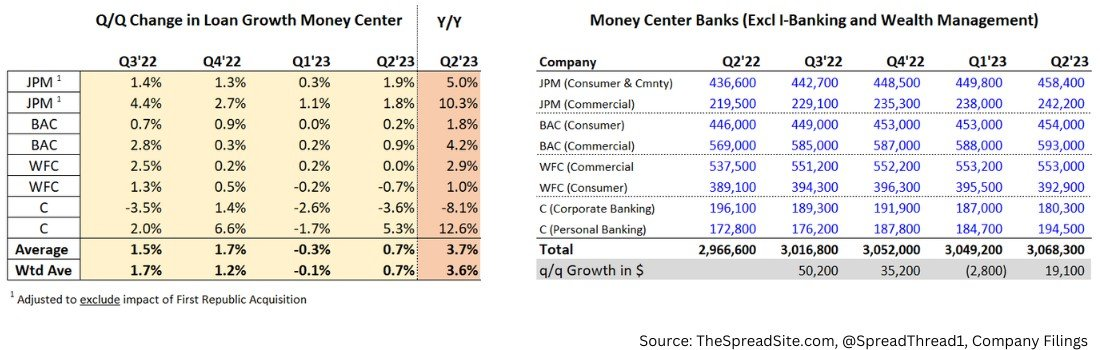

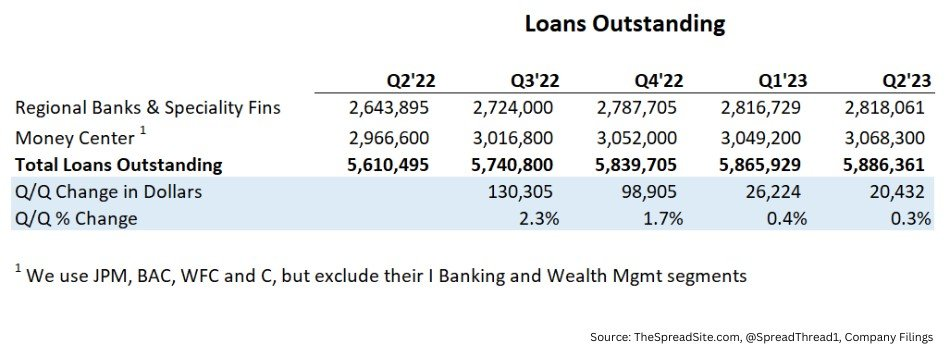

With bank earnings mostly done, we compiled loan growth name-by-name, shown below. In short, at a single-name level, lending for the regional banks has decelerated for the past several quarters, with roughly zero loan growth (Q/Q wtd avg) in 2Q23.

The money center banks have offset some of the slowdown, with a modest pickup in loan growth this past quarter, though mainly from JPM (ex First Republic), and still up just 0.7% Q/Q.

Finally, here is the summary data for all banks we tracked, with total loan growth of 0.3% Q/Q in 2Q23.

Source Tweet - The Spread Thread

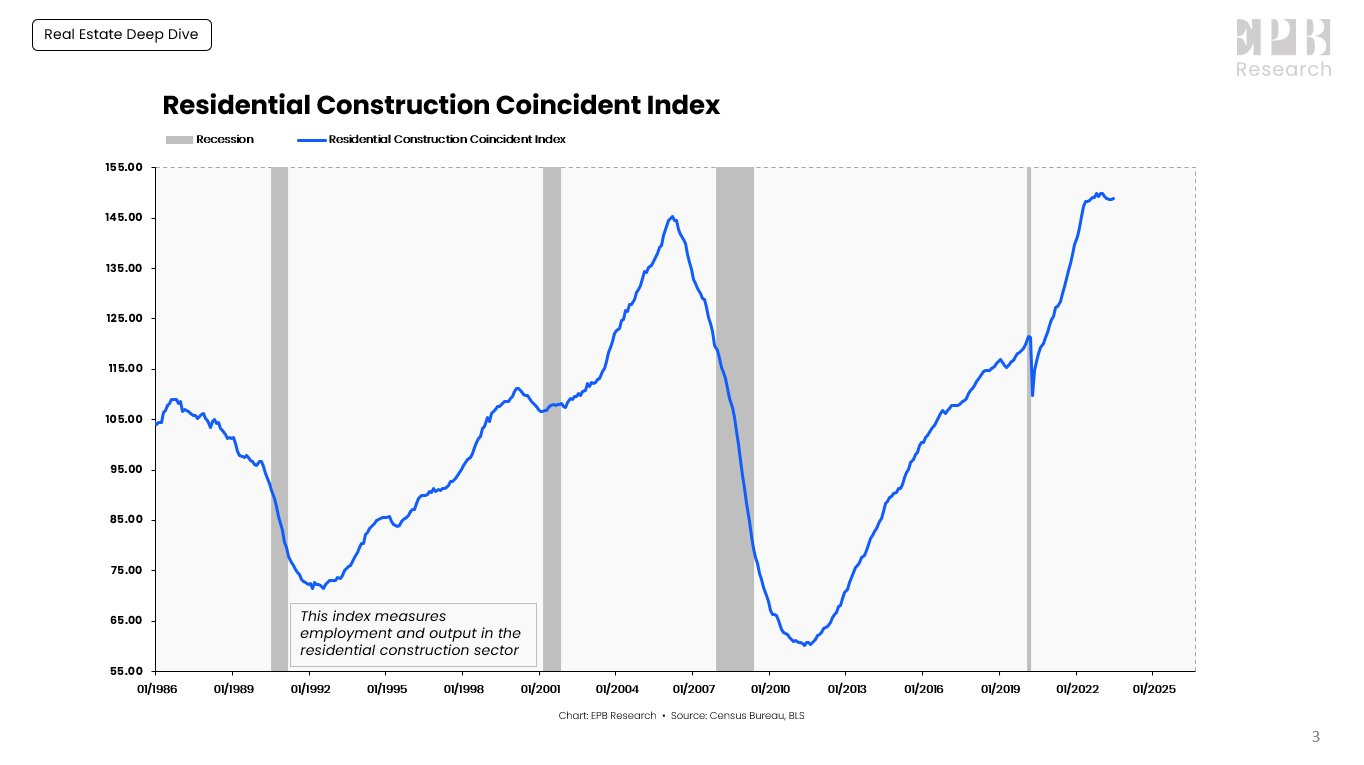

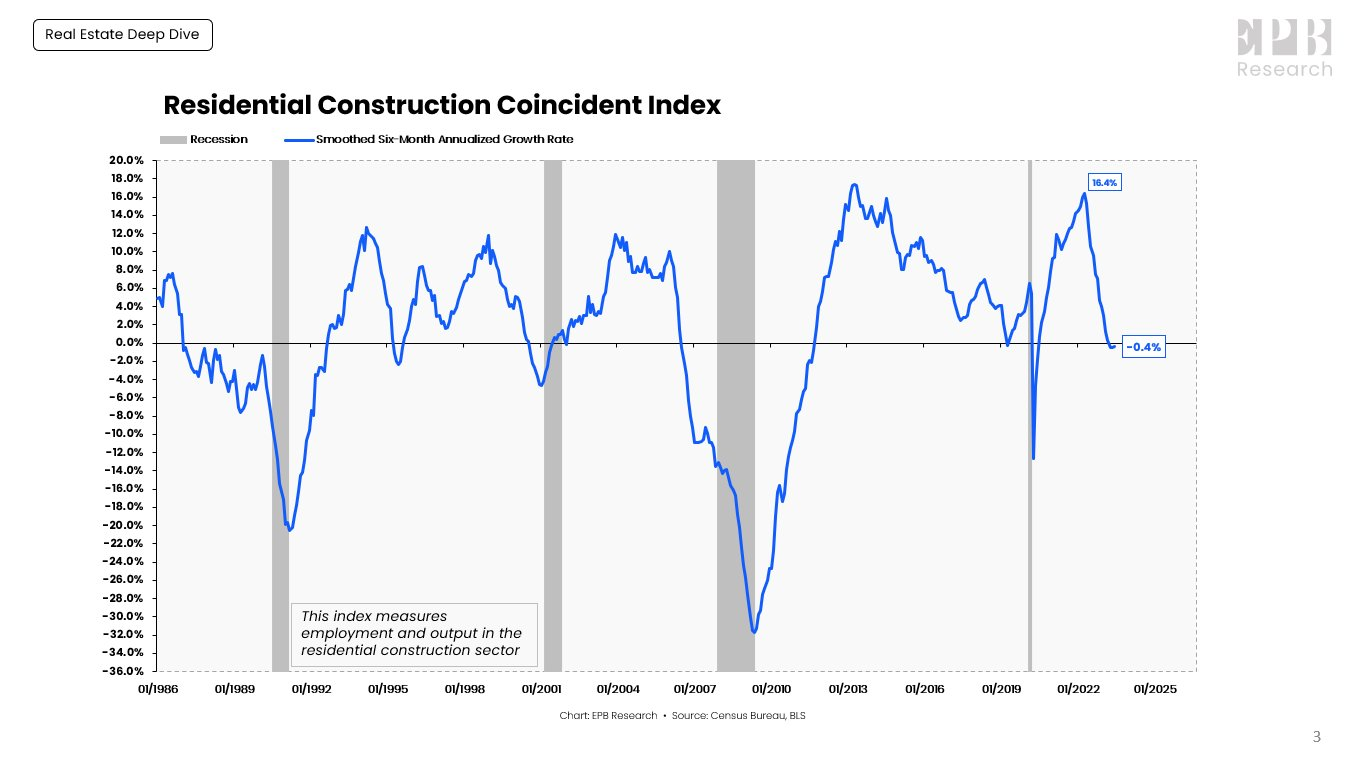

Residential Construction

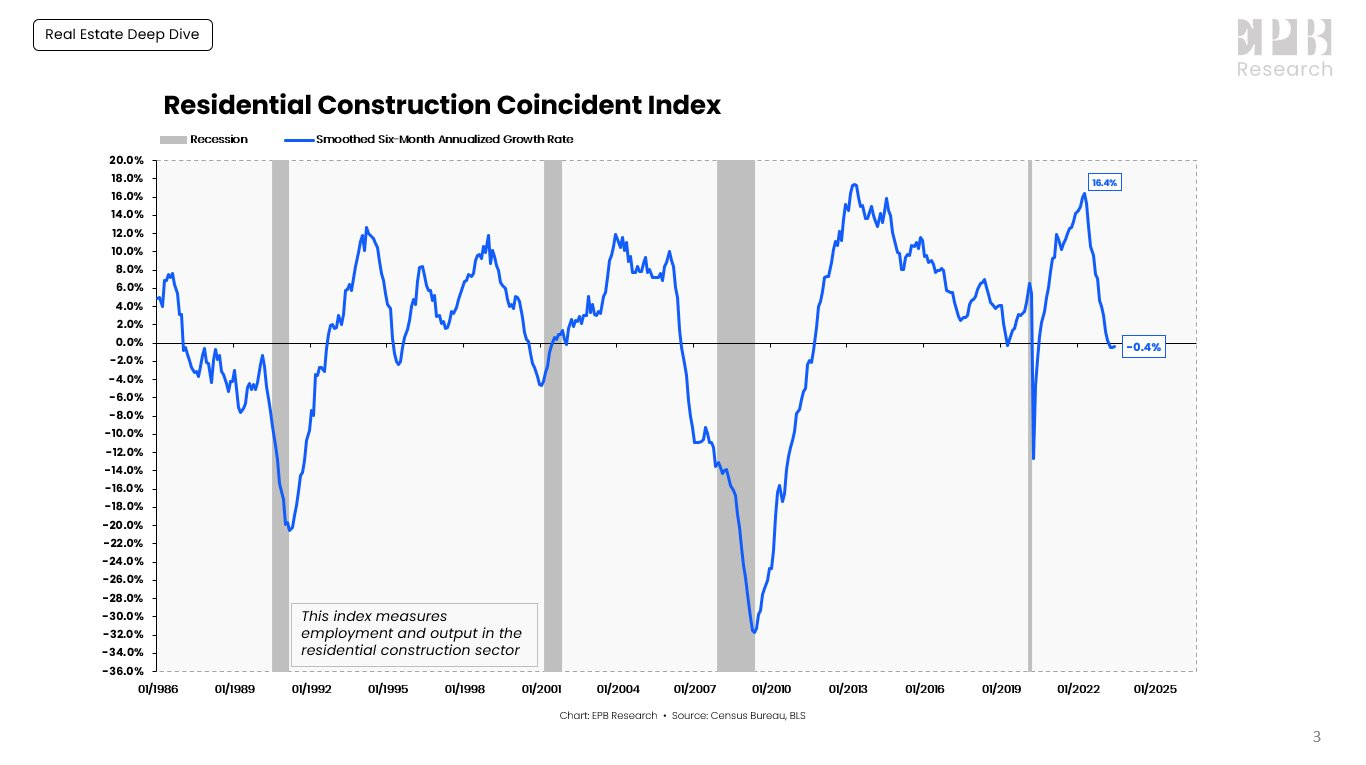

Employment and output in the residential construction sector has cooled from a near-record 16% annualized growth rate to a mild contraction.

The hard or soft landing question will largely come down to where this index goes from here.

Activity in the residential construction sector exploded in 2020/2021 and flattened out at peak levels almost immediately after monetary tightening began.

Employment and output in the residential construction sector boomed for most of the last 13 years.

Much of this activity came in the form of multi-family apartment construction.

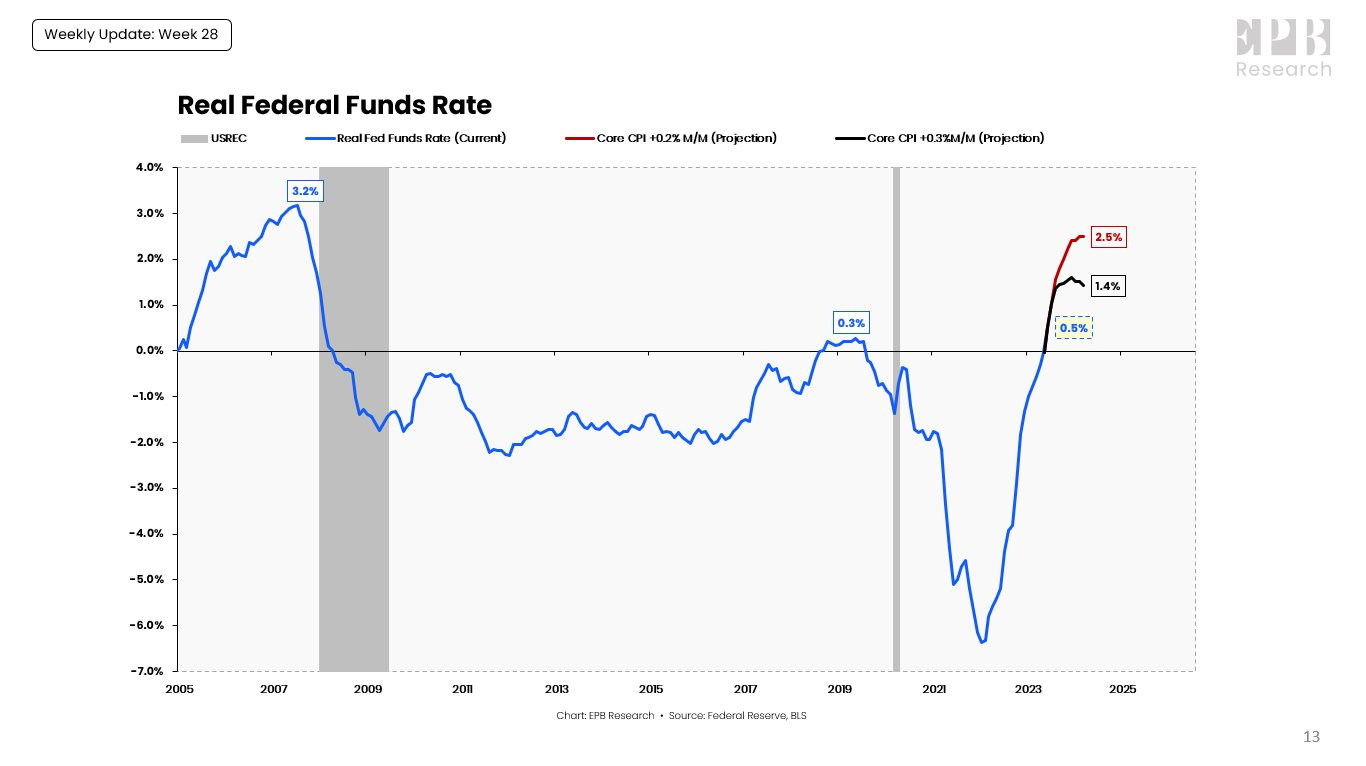

Activity over the last 13 years, however, was accomplished with perpetually negative real interest rates.

Soft landing optimism is centered around levels of activity stabilizing with significantly positive real interest rates for the first time since 2007.

Services Economy

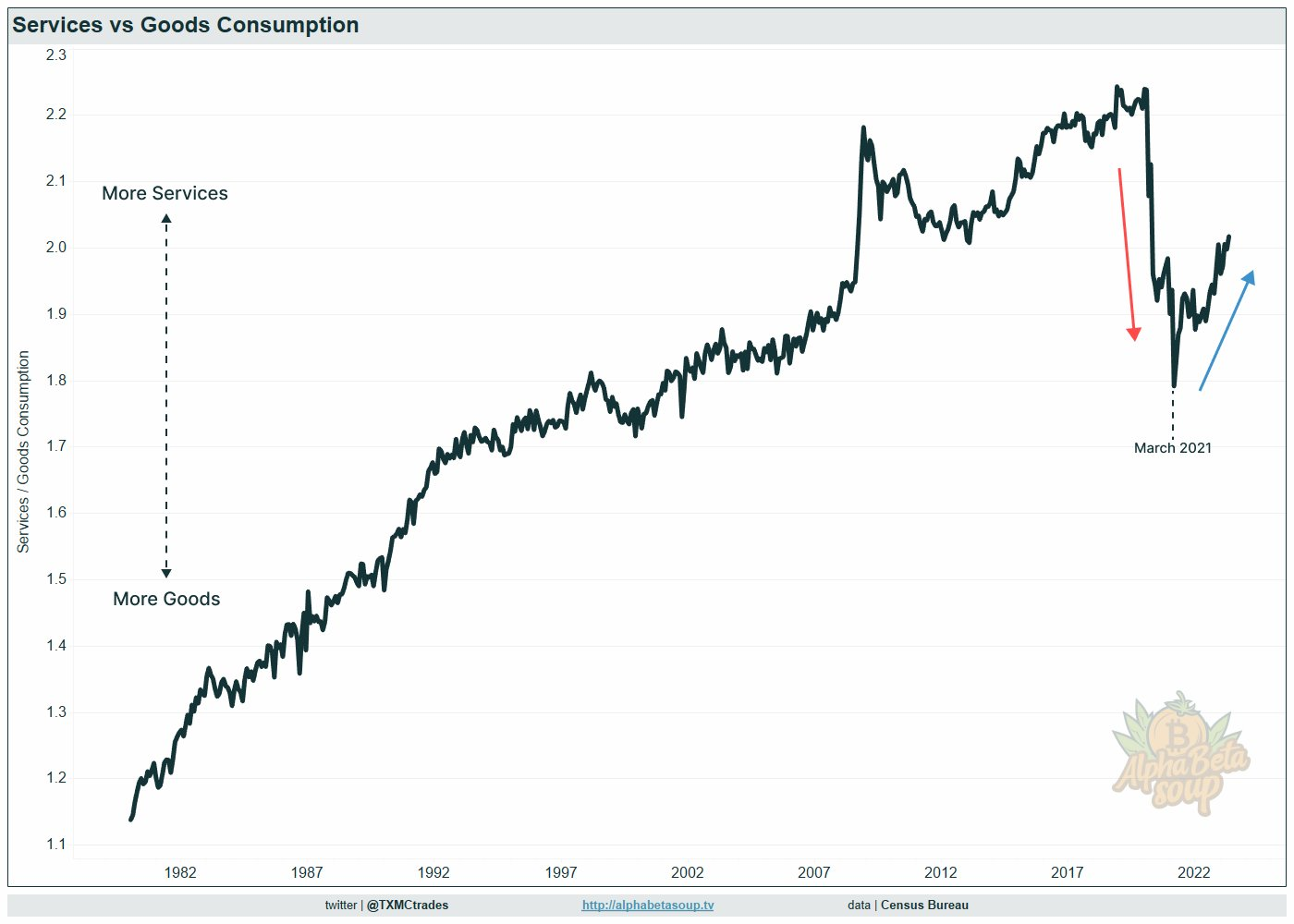

The pandemic shock caused a dramatic one-time shift in the balance of goods vs services spending, with multi-year effects that have complicated analysis (to say nothing of inflation):

-

Present goods consumption is relatively weak due partly to demand pulled forward in 2020-21 while services were shuttered, so PMIs and retail look historically anemic today as many people are simply shopping for less "stuff".

-

Services spending has stayed sticky as consumers make up for lost time and pay for experiences, juiced by 40yr highs in wage growth (services are more labor intensive).

This imbalance remains below the post-GFC range, and suggests the services economy still has a ways to climb simply to catch up to where it was.

Video

- Marty's Creepy Discontinued Hat Business

- How he caught the Volatility Crash

- Panic in ETH Overwrite Market

- Crypto Vibe in Brazil

Paradigm x Marty - TBP | Marty Talks Running a $20M Crypto Short Vol Fund. -Ep. 31

개발자로서 성장하는 데 큰 도움이 된 글이었습니다. 감사합니다.