DVOL 35?

The market is entering the delivery week and both BTC and ETH are currently close to their maxpain points at $29,000 and $1,850.

The continued downturn has caused sold calls to make up the majority of volume, which has pushed skew negative, meaning that calls will be cheaper.

The Dvol Volatility Index is likely to fall below 35% for the first time in history if there are no fluctuations in the next few days, especially if it fails to bring volatility to the cryptocurrency scene around the rate hike.

Fidelity Report BTC

From a Fidelity report on the case for Bitcoin:

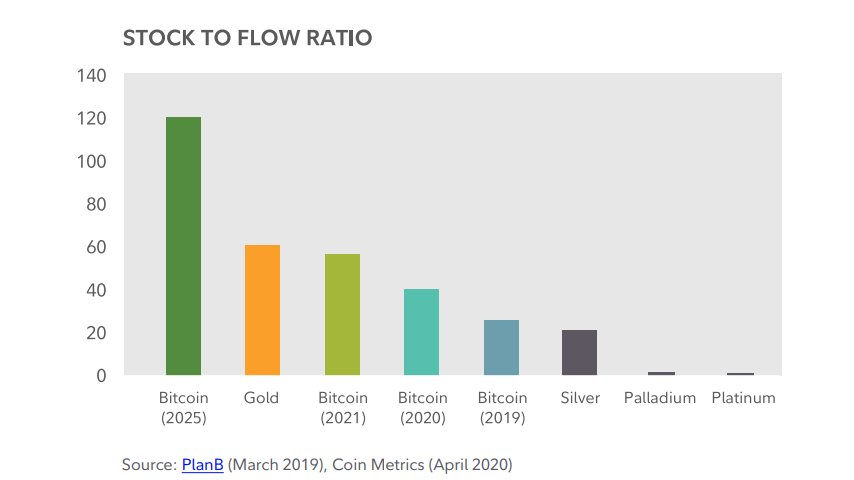

After the upcoming halving in ~8 months, Bitcoin will have a higher stock to flow ratio than Gold

Source Tweet - Will Clemente

Fidelity - BITCOIN INVESTMENT THESIS

BlackRock Report BTC

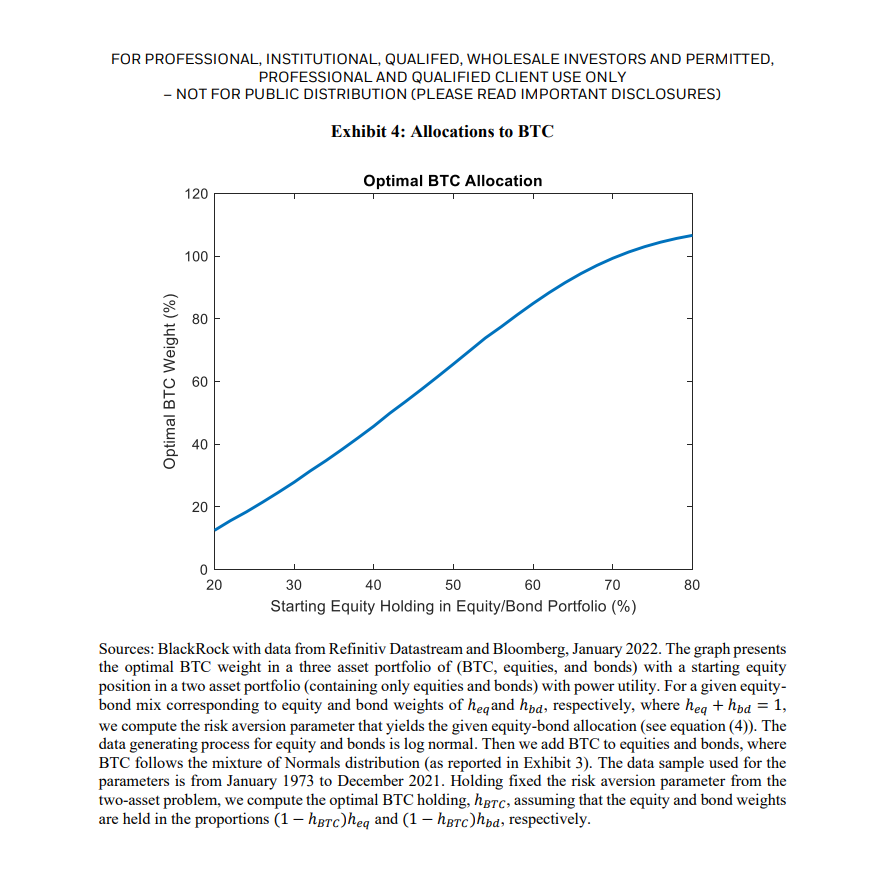

Great chart published by @BlackRock (link below).

Investors with long time horizons should hold overweight equity portfolios.

However, now that #Bitcoin exists as a superior form of money and savings technology, investors should consider an optimal BTC allocation of 80-100%.

Source Tweet - Joe Burnett

Asset Allocation with Crypto: Application of Preferences for Positive Skewness

Thoughts On The Crypto

1) Stablecoin total market cap keep decreasing, no new money entering #crypto

Actually the opposite with liquidity rugs like $WLD entering the market and sucking out retail money into the hands of VCs

2) Money is on-chain

CEXes like Binance keep hitting new ATL in volume

DEX volumes keeping pretty stable

3) People are bored. No new money is entering the space with few new narratives being formed (TG bots, aggregators..)

New meme coins launching with extremely low liquidity so they can be pumped easier.

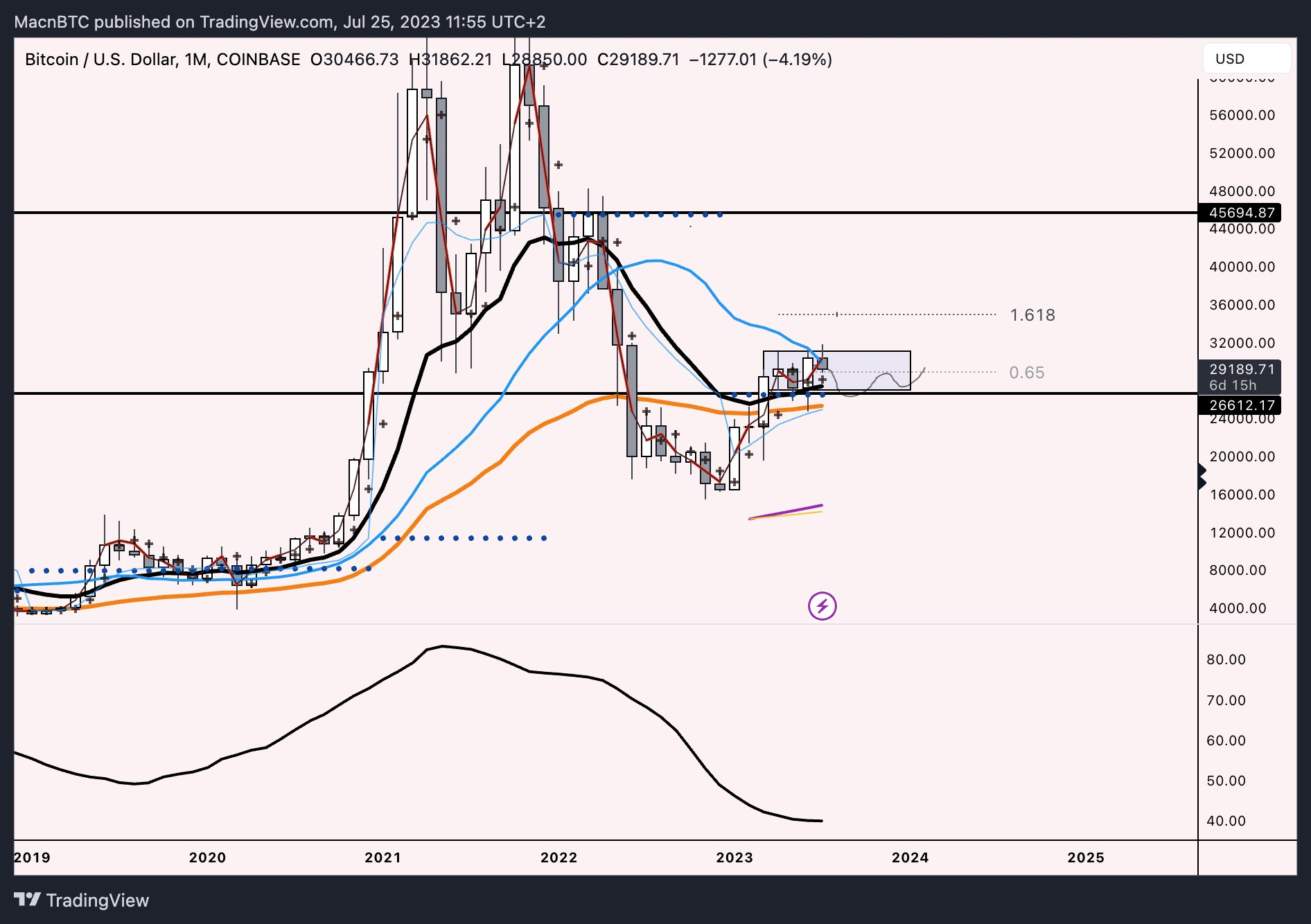

4) We have had major positive news and $BTC still could not break $30k

Stocks are close to ATH and $BTC is lagging hard.

5) So when does the market turn around?

from a TA perspective I think we still have a couple of months sideways before MAs flatten and BTC will break out of this range

6) From a FA perspective it will be important to watch two events.

$BTC Blackrock etc ETF approval (many legal experts expect mid/late Aug which IMO is early)

Binance lawsuit settlement. Binance will likely have to pay one of the largest fines in history, this is one to watch

7) No matter how long all of this takes I'm bullish for the future, I'm bullish on human greed and humans always wanting to gamble on internet money to break out of the 9-5 matrix.

8) It's important to preserve capital and not get chopped until market properly reverses

Congress/Crypto

This week in Congress and crypto: This is the week. Nearly 5 years after a various group of bipartisan lawmakers got together to work on a regulatory framework for crypto, we are now at the cusp of Congress moving various crypto regulatory bills. Here's what's on deck:

Bill #1: Clarity for Payment Stablecoins Act of 2023. An effort that started with the scrutiny of Libra and spearheaded by @RepMaxineWaters in 2022. The problems it is seeking to solve: Terra implosion, Tether reserves and FTX/Binance's commingling of customer funds.

The hangup still remains the role of state vs federal regulators. On this fight we see state regulators with stablecoin frameworks like NYDFS vs banks, which has split the Ds it seems. Interesting note is CA is working on their own stablecoin regime. Reference 1

Bill #2: Financial Innovation and Technology for the 21st Century Act. This market structure bill is based off several previous bipartisan bills like Token Taxonomy and Securities Clarity. It is also unprecedented since it involves two Committees. These are rare bills.

For this fight it is the crypto industry vs the skeptics. It is by no means a giveaway to the crypto industry as it has bright line rules for where the SEC is involved and the CFTC. It puts new rules for token issuance, VCs, accounting standards, and spot market regulation.

A common pushback for this bill has been the complexity of the legislation. However this hasn't stopped other G-7 nations (the EU in particular) from passing similar rules. There is a distinct undertone that regulating crypto will make it be seen as a "legitimate" asset class.

Bill #3: Blockchain Regulatory Certainty Act. A bipartisan bill from @GOPMajorityWhip and @RepDarrenSoto that provides safe harbor for validators, software developers, and other service providers from any registry as a money services business (the opposite of Warren/Marshall).

Bill #4: Keep Your Coins Act. An effort to protect user's rights to self custody that has been led by @WarrenDavidson. Self custody has come under scrutiny in both the Trump and Biden Administration. Self custody's protection became important in wake of collapses like FTX.

Bill #5: Financial Technology Protection Act. An effort spearheaded by now Senator @SenTedBuddNC and now being carried by @ZachNunn and @jahimes. Bill creates a taskforce to tackle best ways to deter illicit activity via crypto by organizing relative law enforcement experts.

The votes this week are just at the committee level meaning these are the Members of Congress who have spent hours in hearings, briefings and dialogue on these issues. The next step after these bills pass will be a vote on the House floor where all members will vote on them.

Will these bills pass the committees? Yes. The question is how bipartisan it will be. Given it is a split Congress, Rs need Ds to give these bills a chance in the Senate. That is tough in a hyperpartisan climate which will only get worse as the 2024 election approaches.

This is why @PatrickMcHenry has been so gun-ho with a record number of crypto hearings this year. The regulators missed many of the frauds in 2022 and the enforcement cases they have pursued sometimes conflict with another regulator. The courts have added further confusion.

Only Congress can provide the rules for what businesses can or can't do. Many Rs and Ds have called for regulating the industry and it has become apparent that the SEC's talking points that securities laws are clear hasn't held up in the courts nor in practice.

The hold outs for supporting these bills range in their arguments. For some it is substance, others it is pure politics. The good news is that the first set of bills 5 years ago started on a bipartisan basis and it seems they will keep that base line of support this week.

Without these clear rules, bad actors will continue to exploit the regulatory gaps to harm consumers and enrich themselves. FTX, Binance, Terra and several others are clear examples of that. The question remains: who will support rules and who will support the status quo?

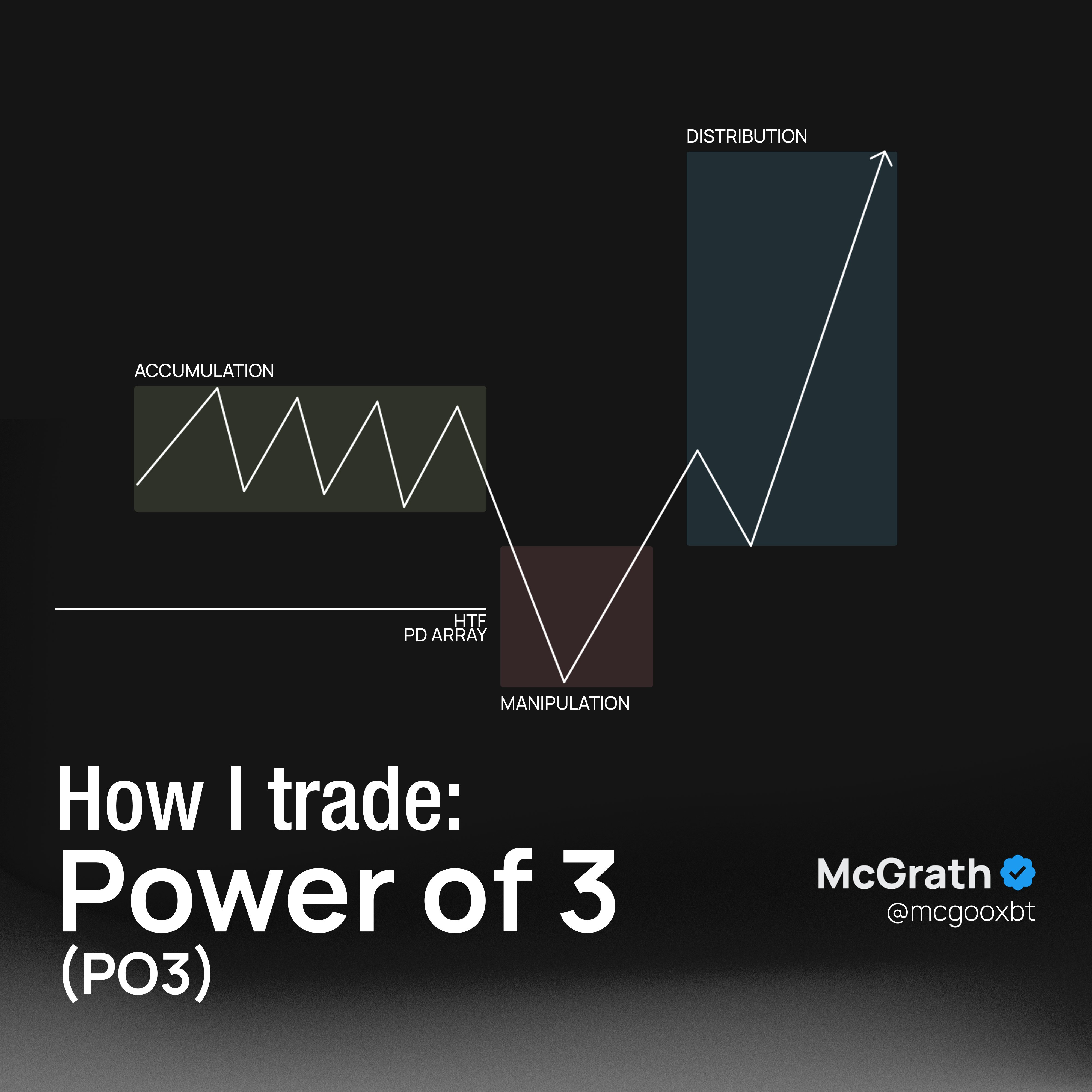

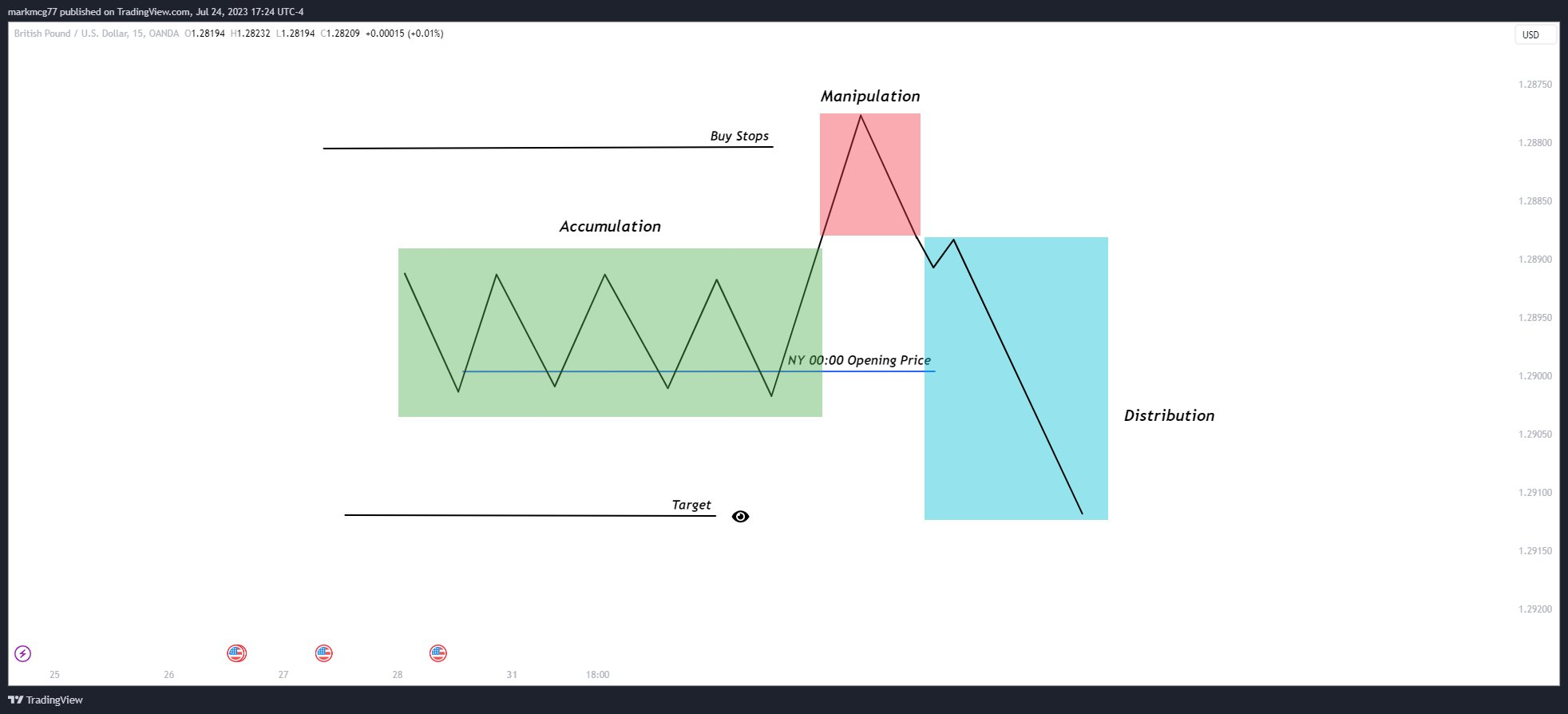

How I Trade Power Of 3 (PO3)

Hello all, I decided to write this thread as I feel the integration of PO3 into your trading can provide nice confluences to add to your trading arsenal

I will give a breakdown of what The Power Of 3 is, also 2 real trade examples, where I analyse a Weekly PO3 and a Daily PO3

Having a bias is key for trading PO3 reasonings being which I will discuss later in this thread

For this annotated breakdown I will be analysing a bullish daily scenario but as always the same principles would apply inversely if my bias was bearish.

What is PO3

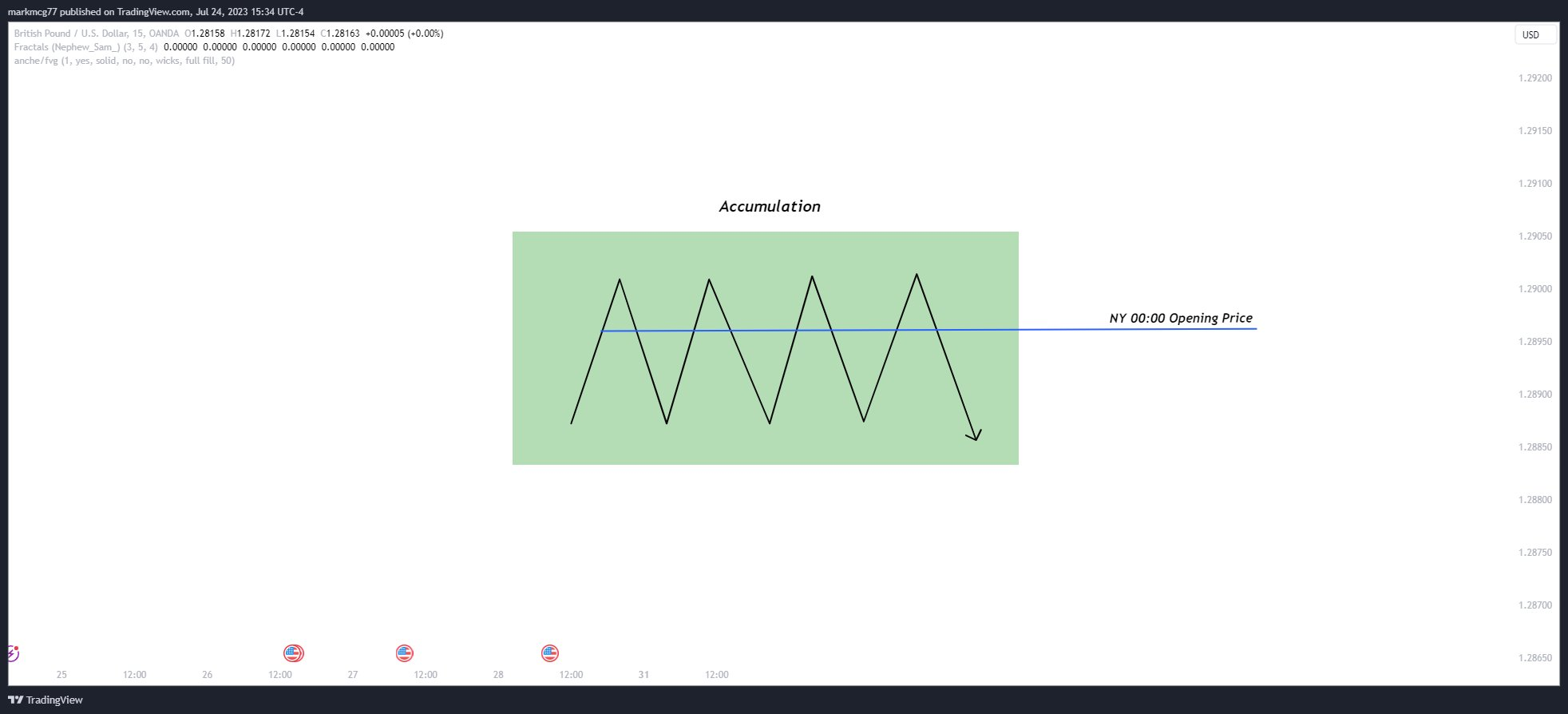

Accumulation

Accumulation refers to the phase in where smart money or large institutions accumulate positions. If we have a bullish daily bias we would want to see accumulation below or around the NY Midnight Opening price (Daily Open).

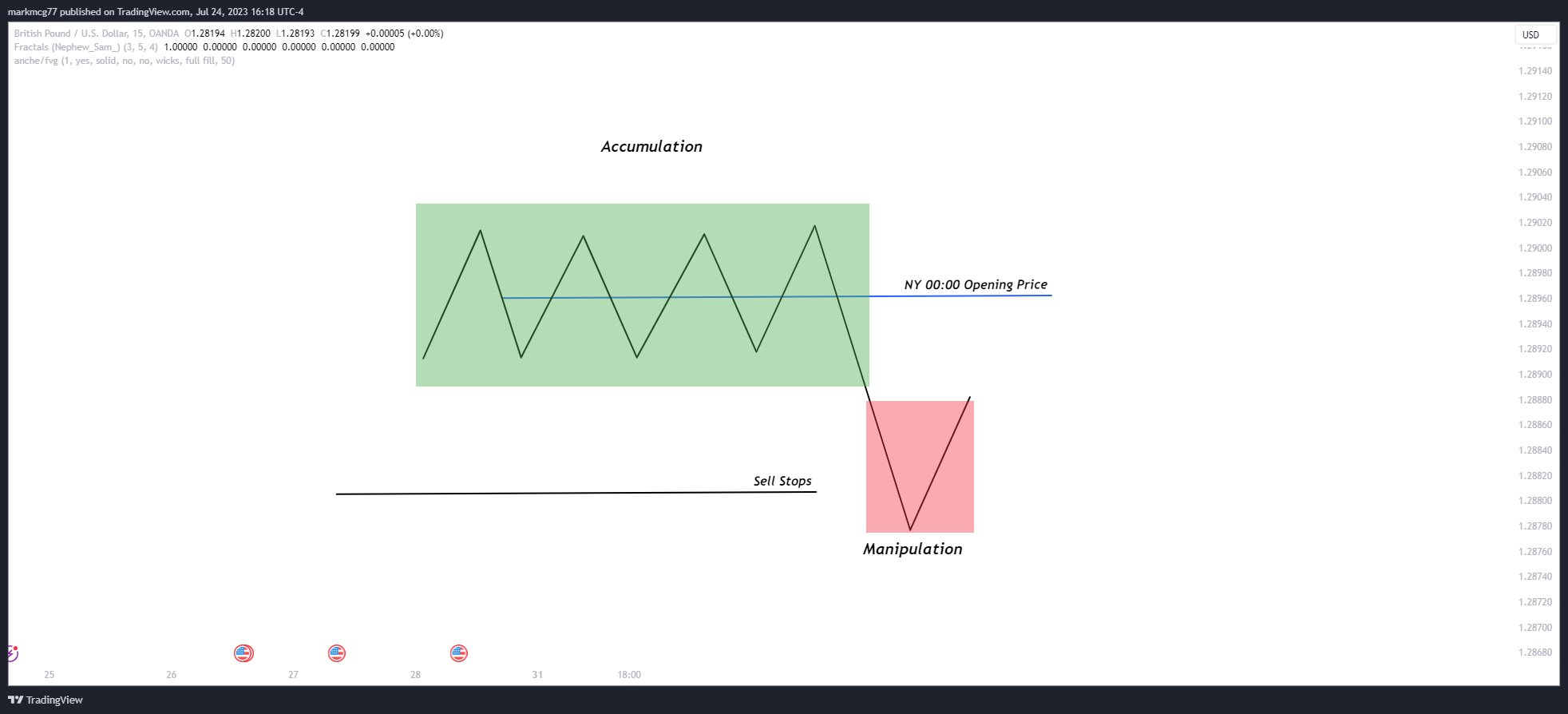

Manipulation

This phase is a false move, where smart money influences retail traders into thinking price is breaking down, to then,

in which they engineer liquidity by taking stops before expanding in the opposing direction.

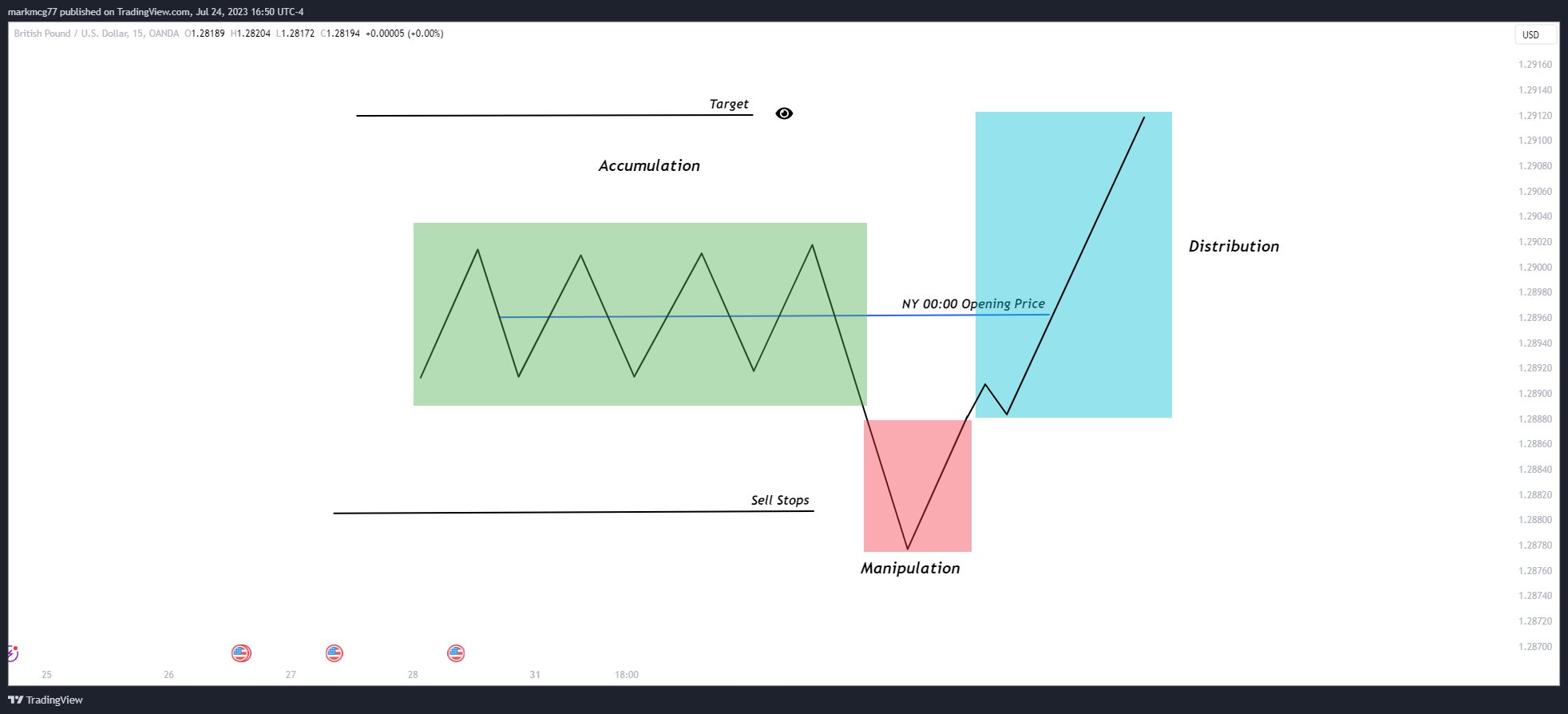

Distribution

The final phase of PO3 is expansion / distribution, in which smart money distributes their positions, this move should take out a targeted level in accordance to our daily bias.

Here is also a bearish example for reference,

Just to note.

If bias is bearish; Look for accumulation ABOVE or around opening price

If bias is bullish : Look for accumulation BELOW or around opening price

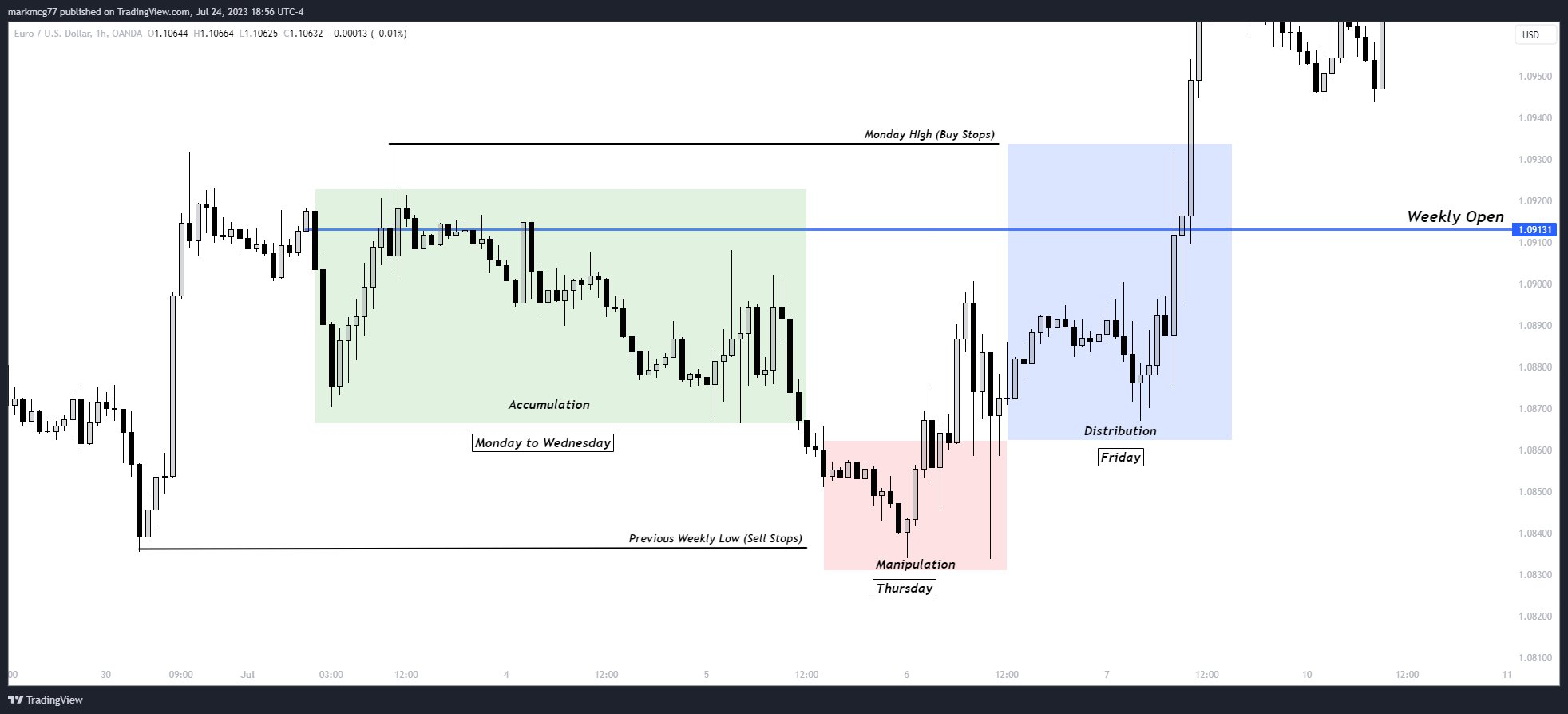

Weekly PO3

Mon to Wed: We had the accumulation phase below the weekly open, where smart money are accumulating their long orders

Thursday: Manipulation occurred where smart money fake a move down taking out retail sell stops

Friday: Expansion to target being Monday High

Here is a bearish Daily PO3 example on EU

Asia: Accumulation in the Asian session

London: Manipulation in the London session to take out buy stops

NY: Expansion to the downside in the NY session

Just for reference,

If you were able to identify this daily PO3 above in the London session, you would of caught a nice short in the expansion phase during NY

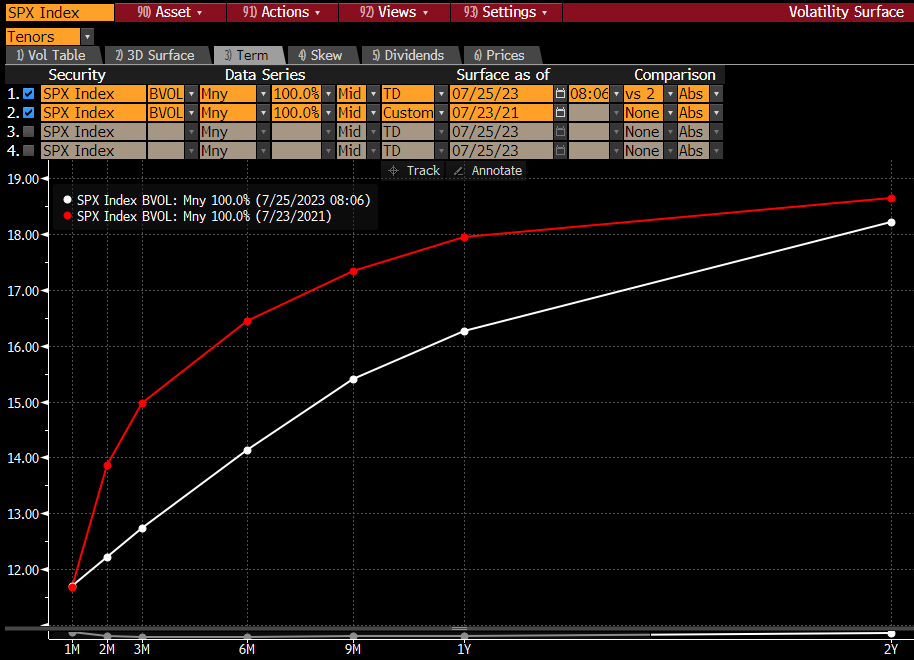

SPX Vol

Crazy, or should we say lazy, eights...SPX 1m realized vol at 8.88...There's just one pain trade in markets and that is the sputtering of the "earnings engine" for long vol strategies when realized vol declines and stays low. 1m realized is in the 6th %ile over the last 3 years.

When realized is so low, the termstructure is bound to be pretty far in contango as the feedback from low realized to p/l on owning vol hits the front hardest. While 3m SPX implied > 1m, the spread isn't as high as you'd expect. I see that part of the TS at just 1 vol.

For comparison, check out the SPX implied vol TS now vs. 2 years ago (a time of comparably low realized vol). Same 1m but much higher 3m back then.

The point is that 3m implied looks especially interesting right now to own.

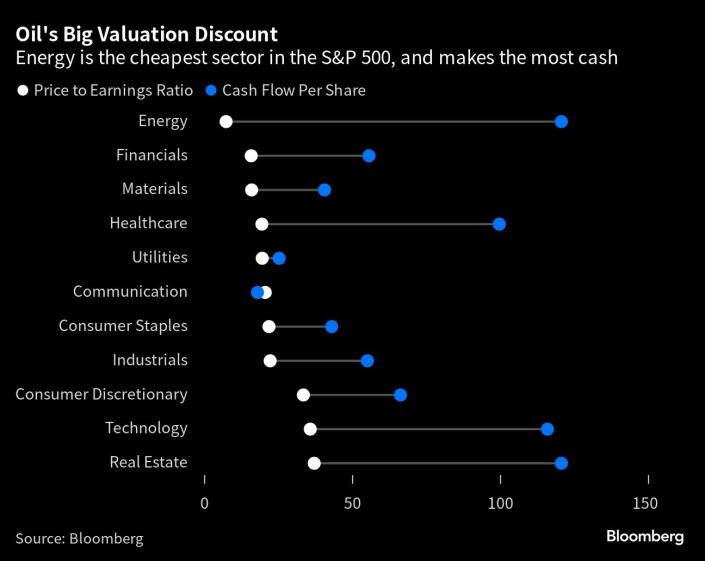

Berkshire Hathaway

Berkshire Hathaway Inc. is using this year’s dip in commodity prices to load up on some of Buffett’s favorite oil and gas investments, showing that history’s most famous investor sees opportunity in a sector long disfavored due to its volatility and effects on the climate. --Bloomberg

M2/Inflation

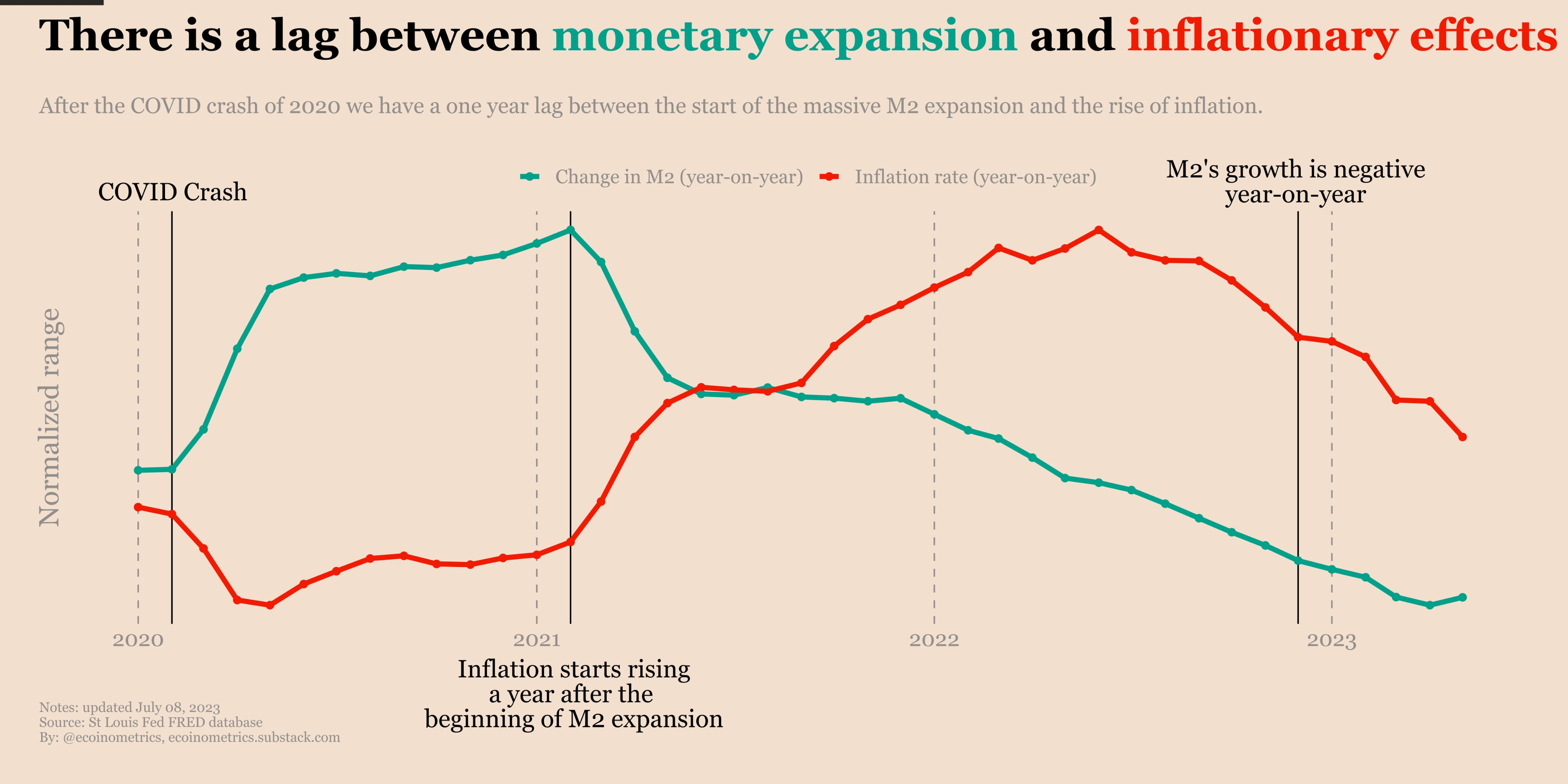

There was a whole year between the COVID crash and the first signs that inflation could get out of control.

Anyone who has bough Bitcoin during this period still managed to get positive real returns despite the bar market.

Next time the money printer goes out of control you know what you have to do.

Surge Transportation Bankruptcy

BREAKING NEWS: Surge Transportation, a digital freight brokerage, has filed for Chapter 11 bankruptcy protection in the Central District of Florida, according to filings. Thirteen of its top 20 creditors are factoring companies that pay small carriers.

Freightwaves - Freight broker Surge Transportation files for Chapter 11 bankruptcy

M2/GDP

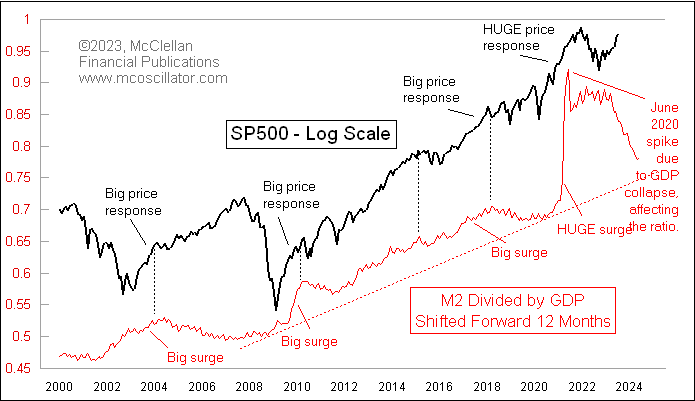

Latest M2 data just out, tiny uptick in M2 (not seasonally adjusted) in June. We have never seen a drop like this one in M2/GDP, so it is hard to say exactly what it means. We know that big rises in M2/GDP lead to big stock market gains 1 year later. But it is extrapolation not yet supported by history to say that a decline in M2/GDP means a drop a year later for stocks.

Equity Trading by Segment: Retail has become a much bigger presence & its implications

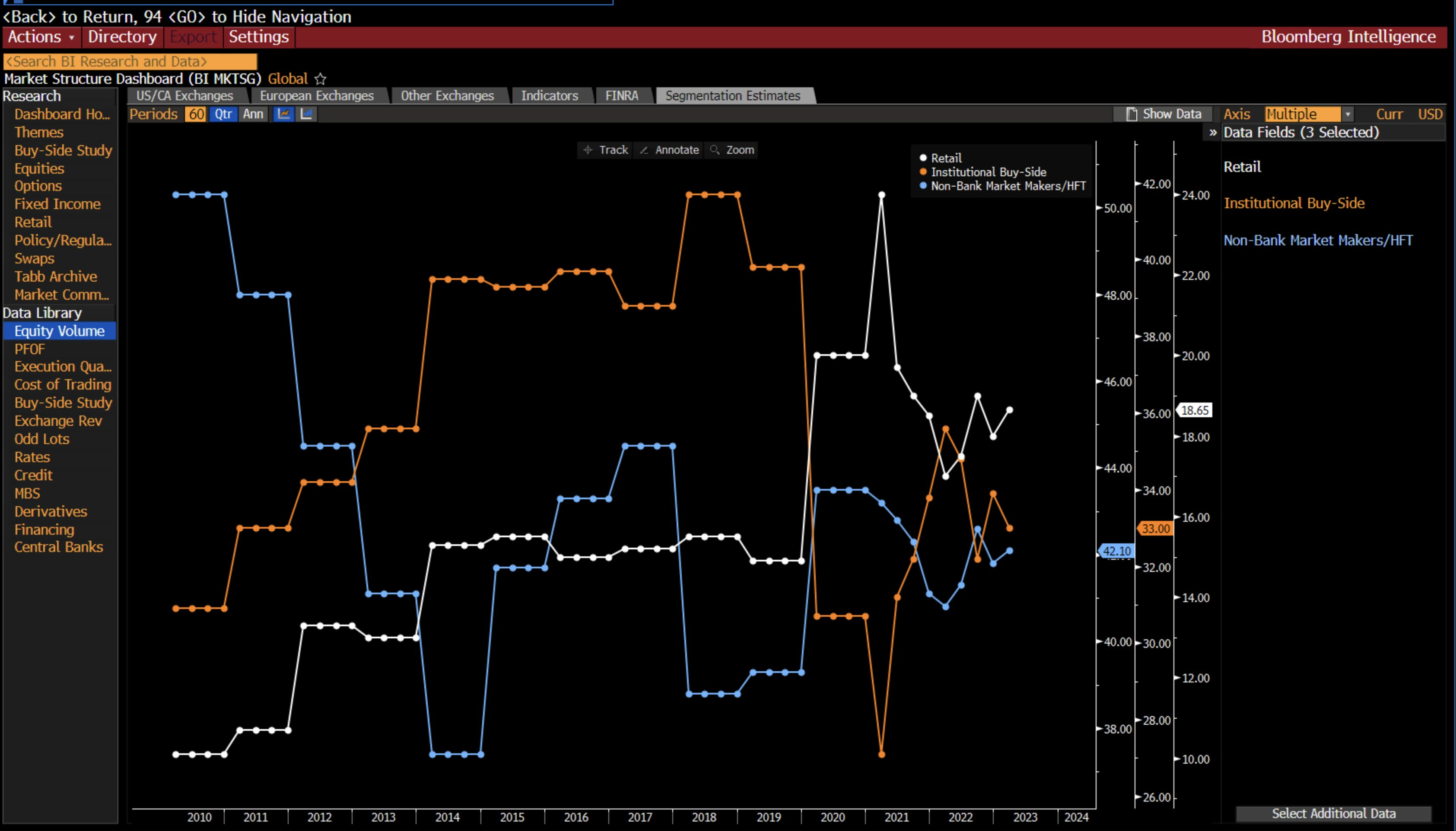

Share of trading by retail investors (white) has increased from 10% in 2010 to a high of 24% (2021 Q1). I think this makes it hard for institutional investors to read the market correctly, compared to a decade ago.

The reason is because retail traders inject more uncertainty in the market which affects both volatility and price-on-price feedback (momentum). For this reason, institutional investors need to pay more attention to the behavioral aspects of investing rather than just focus on fundamentals.

Latest Euro Area Bank Lending Survey

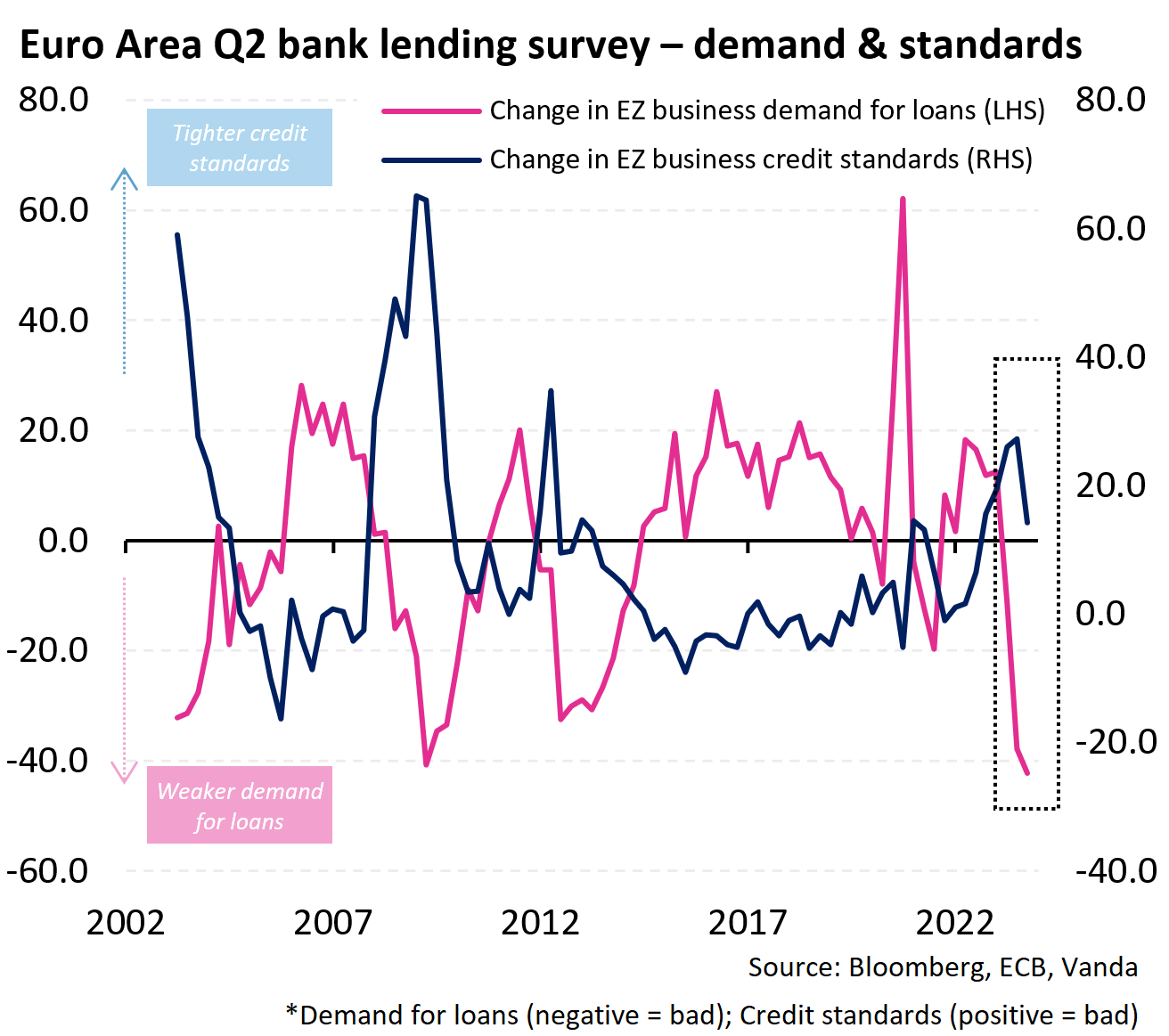

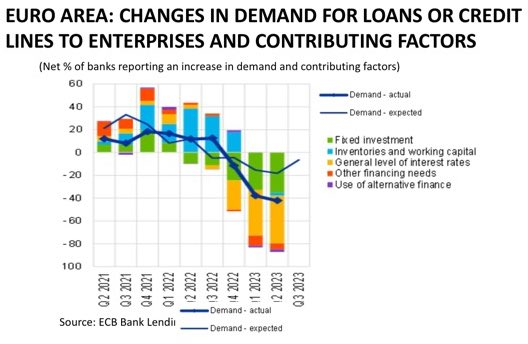

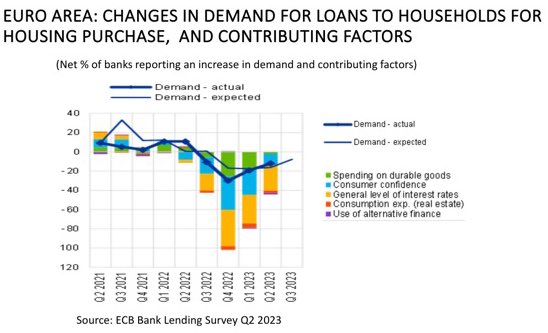

⚠️ Latest Euro Area bank lending survey might have improved from a credit standards perspective. But don't be fooled... demand for business loans fell to a new low. This is recession-like sentiment in European cyclicality. $EUR & European equities running into big headwinds

EU BLS

News from the possible recession in the EA: the ECB’s Bank Lending Survey (BLS) show that firm’s demand for credit continues to tumble; down 42% in Q2 to the lowest value in 20 years, (since 2003). Factors: high interest rates and lower fixed investment

For Households the BLS says: “The net decrease in demand for housing loans remained strong in the second quarter of 2023 but was lower than the sharp net decrease in the previous two quarters (net percentage of banks of -47%, after -72% in the first quarter of 2023…)”

Source Tweet - Vitor Constancio

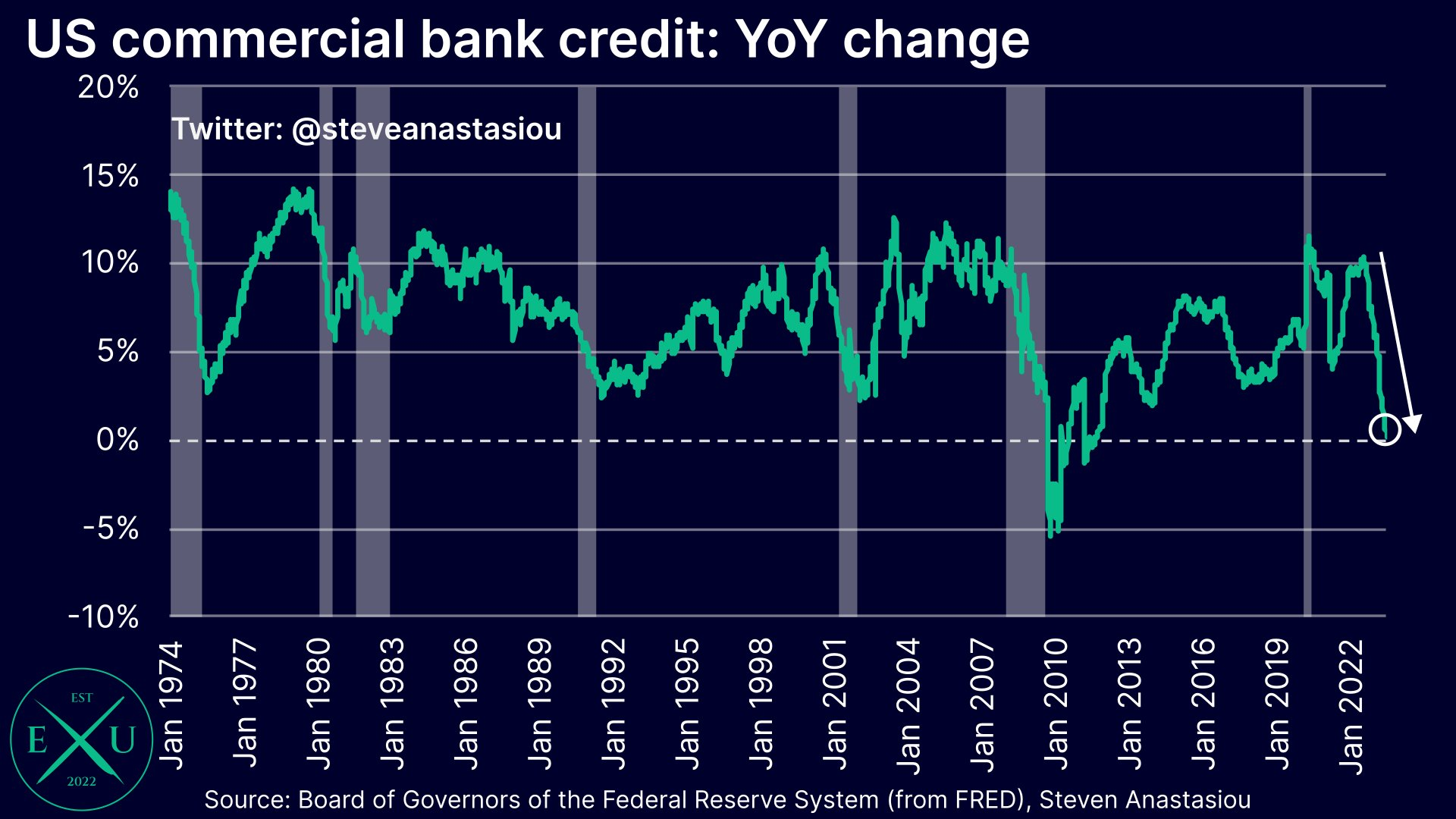

US Commercial Back Credit

Whoever thinks that the Fed’s tightening isn’t having a big impact, and that it needs to ramp up its tightening even further, hasn’t been looking at bank credit, which is on the verge of turning YoY negative.

After seeing YoY growth of above 10% in August 2022, it has fallen to just 0.1% today.

The moderation comes amidst a major decline in security holdings by commercial banks, which are down over 10% YoY as banks act to raise cash to fund deposit outflows.

At the same time, the Fed’s aggressive tightening is encouraging debt deleveraging. Total loan & lease growth has fallen from 12.5% YoY in December 2022, to 5.4% today. With the Fed expected to deliver another rate rise this week, expect loan & lease growth to moderate further over the weeks and months ahead.

Source Tweet - Steven Anastasiou

PACW

PacWest Bancorp, which has been selling assets to shore up its balance sheet, is in talks to be sold to Banc of California.

Both companies were scheduled to report quarterly earnings Tuesday afternoon

Source Tweet - Nick Timiraos

WSJ - Banc of California Agrees to Buy PacWest as Regional Lenders Seek Strength Together

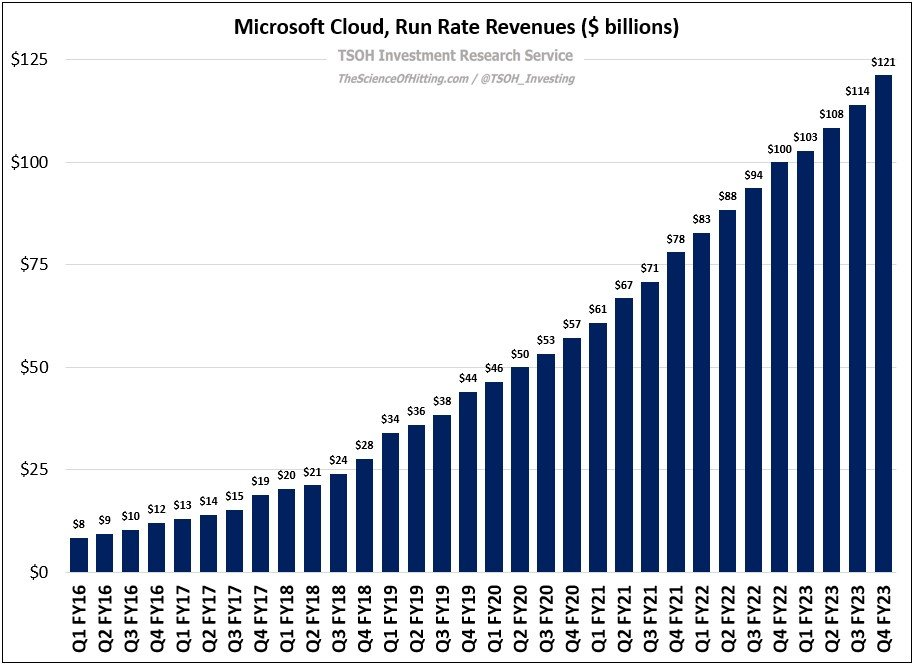

MSFT Earning

A live thread with key quotes from $MSFT Q4 23 call:

- CEO @satyanadella starts us off as usual:

"We had a solid close to our fiscal year, the Microsoft cloud surpassed $110B in annual revenue up 27% in constant currency with Azure, all up accounting for more than 50% of the total for the first time"

- On LinkedIn:

"Linkedin revenue surpassed $15B for the first time this fiscal year & membership growth has now accelerated for 8 quarters in a row, a testament to how mission critical the platform has become to help 950M+ members connect loan sell and get hired"- $MSFT CEO

- On trends in the cloud:

"I think overall in the cloud you do see new project starts and then those are project starts to get optimized and then you sort of time series all of that and that's sort of what you see in the normal course" - $MSFT CEO

- On Azure outlook:

"...We see the demand signals quite strong. It remains strong" - $MSFT CFO

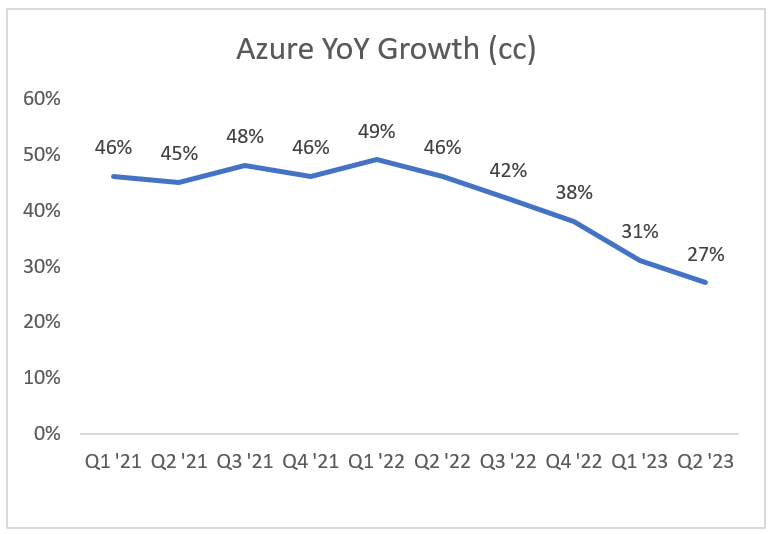

[Chart: @jaminball]

- On data and AI:

"for the analytics workloads, we brought together compute storage governance with a very disruptive business model. I mean to give you a flavor for it right. So you have your data in an Azure data Lake, you can bring SQL to it you can bring Spark to it you can bring Azure AI or Azure open AI to it right?"

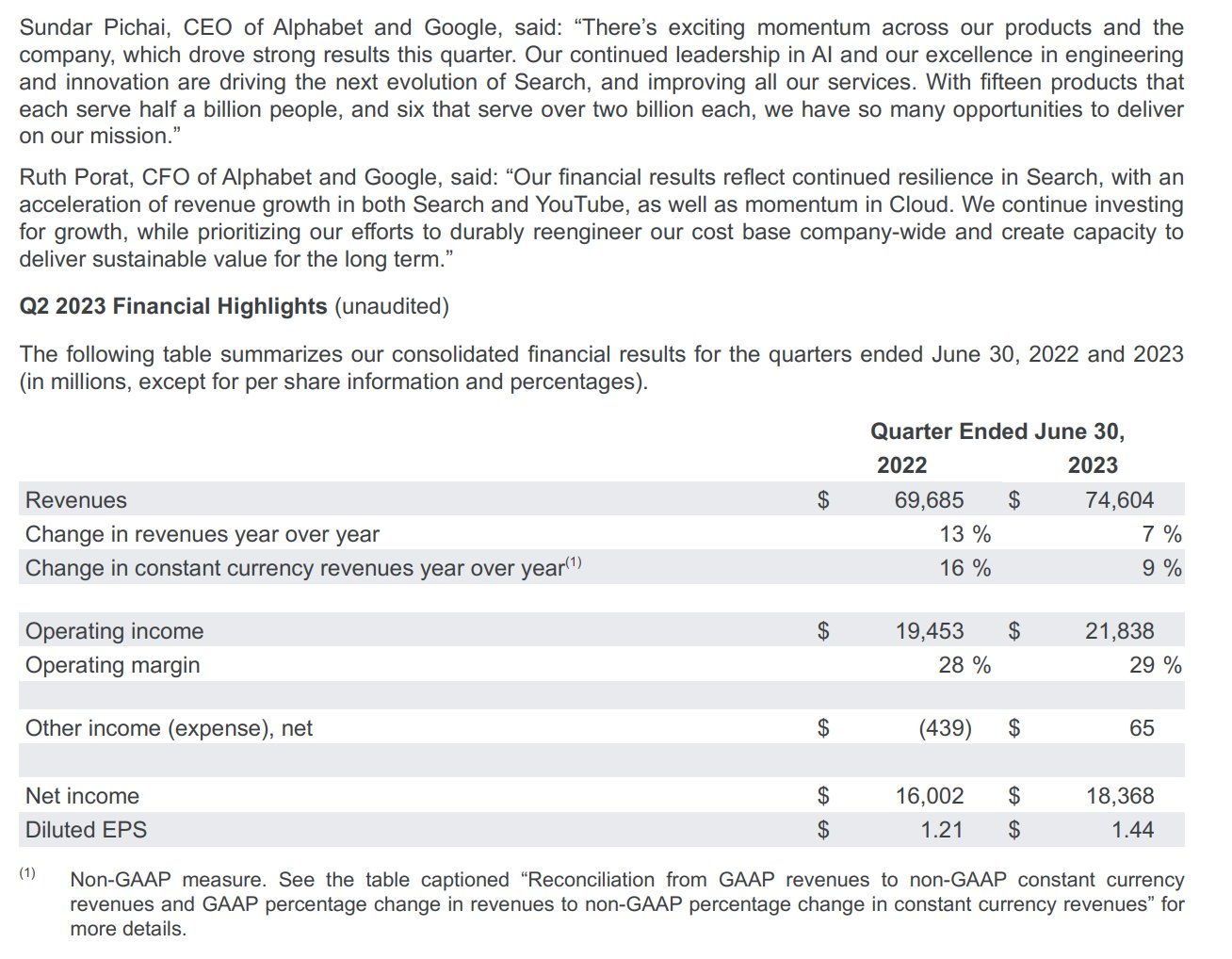

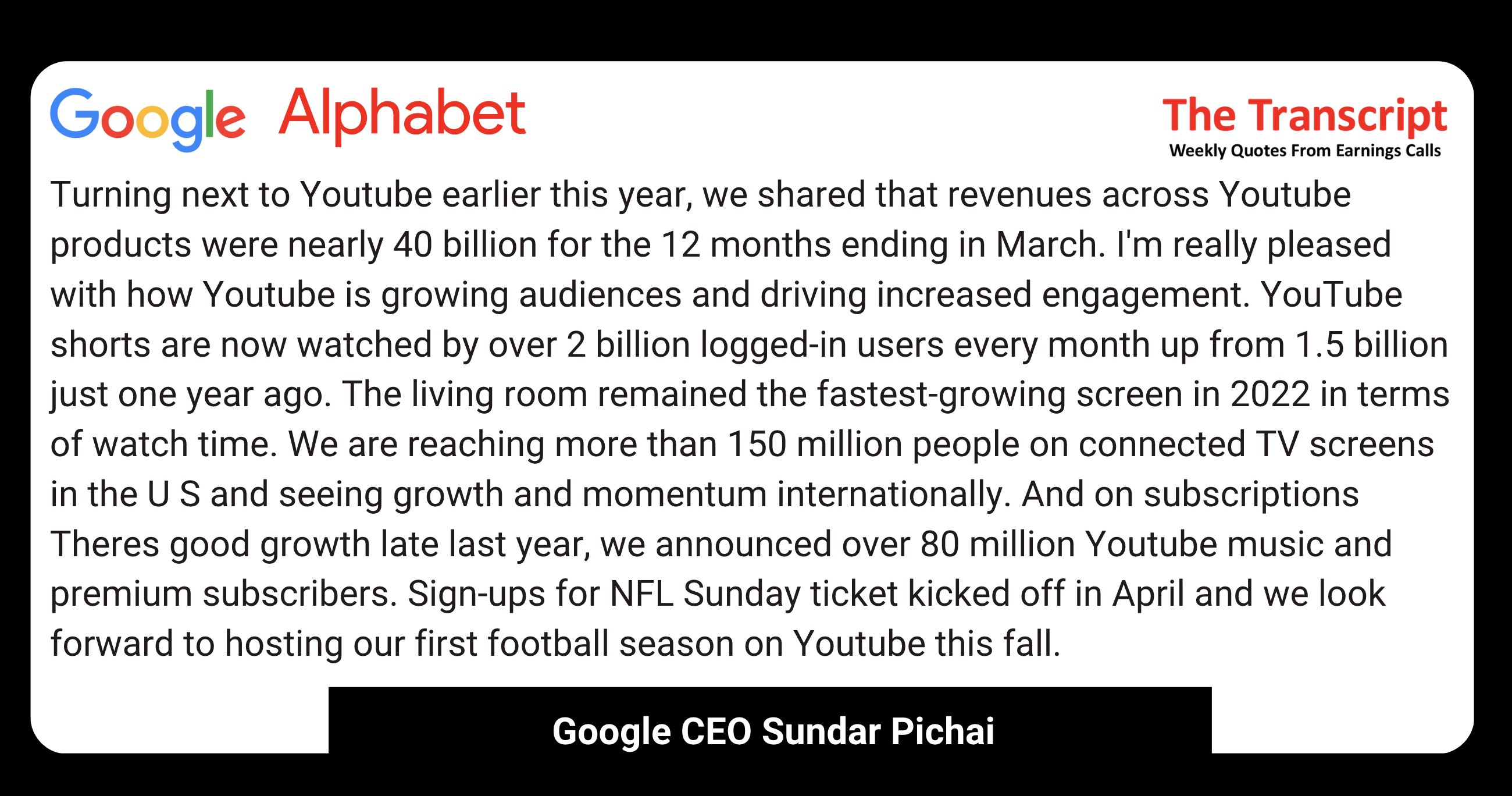

Alphabet Earning

Some key live quotes from the Alphabet Q2 23 earnings call:

- A solid quarter for Alphabet:

"The momentum across the company drove our results this quarter. We delivered solid performance in search and Youtube and ongoing strong growth in Cloud." - $GOOGL CEO @sundarpichai

- On Google Cloud:

"We see continued growth with Q2 revenue of $8B up 28% and operating profit of $395M. Our AI-optimized infrastructure is the leading platform for training and serving generative AI models"

- On YouTube :

"I'm really pleased with how Youtube is growing audiences and driving increased engagement. YouTube shorts are now watched by over 2 billion logged-in users every month up from 1.5 billion just one year ago" - CEO

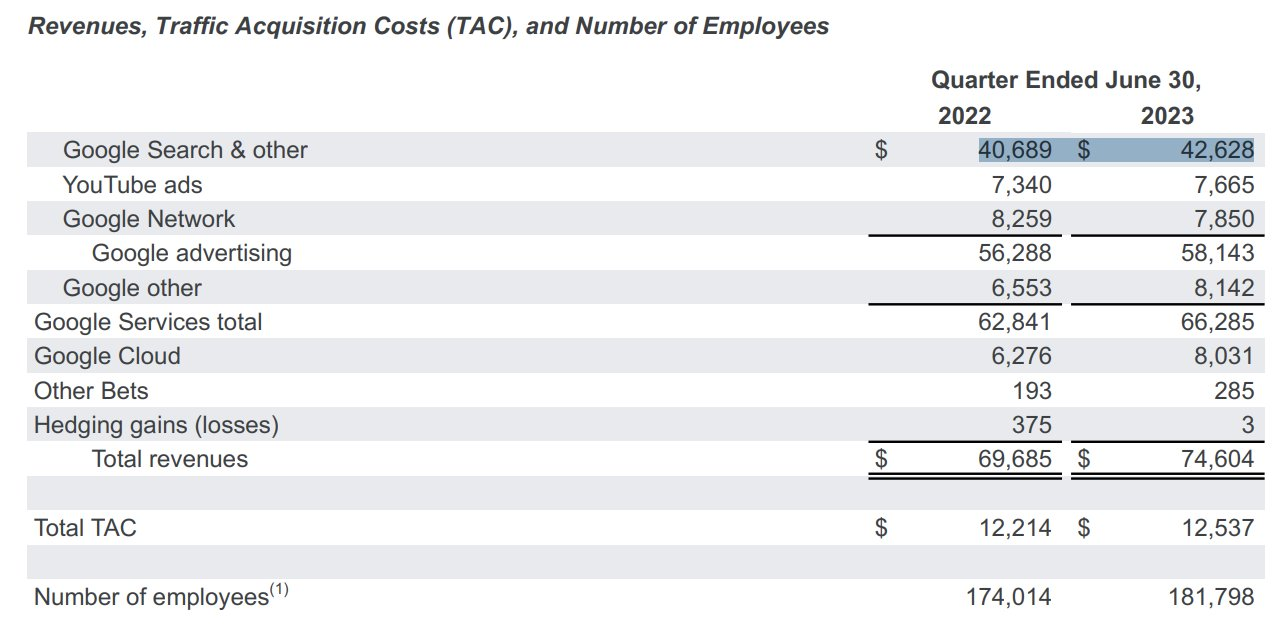

- Alphabet Q2 2023 breakdown:

—Google total services revenues: +5% YoY to 66.3B

—Search & other revenues: +5% YoY to 42.6B

—Youtube ads revenues: +4% YoY to 7.7B

—Network revenues: -5% YoY to 8.9B

—Other revenue: +24% YoY to 8.1B (driven by YouTube Subs]

- On Google Cloud customers:

"We are particularly excited about the customer interest in our AI-optimized infrastructure..At the same time, we continued to experience headwinds in the second quarter for moderation in consumption growth as customers optimize their spend" - CFO

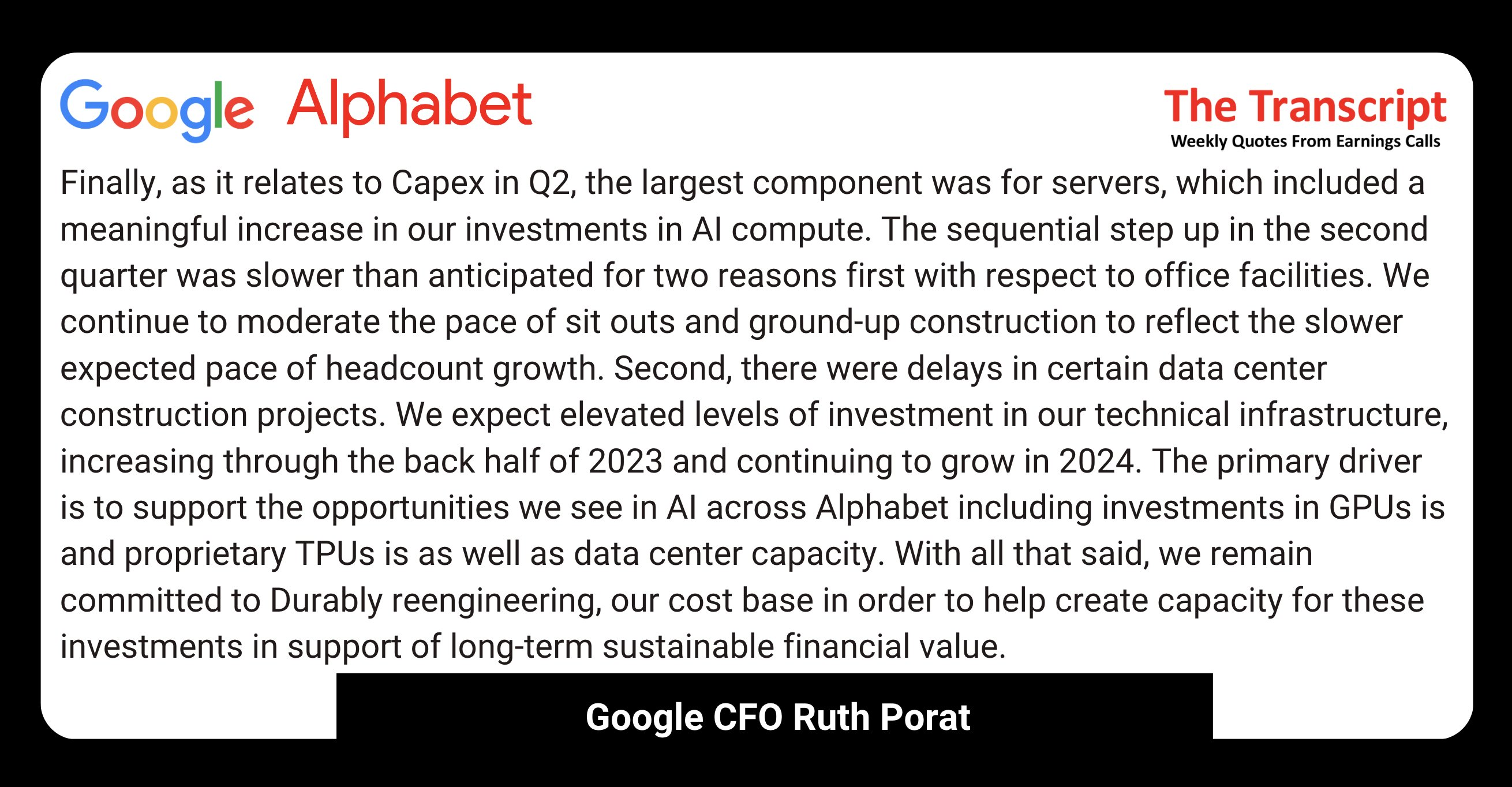

- On capex:

"We expect elevated levels of investment in our technical infrastructure, increasing through the back half of 2023 and continuing to grow in 2024. The primary driver is to support the opportunities we see in AI across Alphabet..." - $GOOG CFO

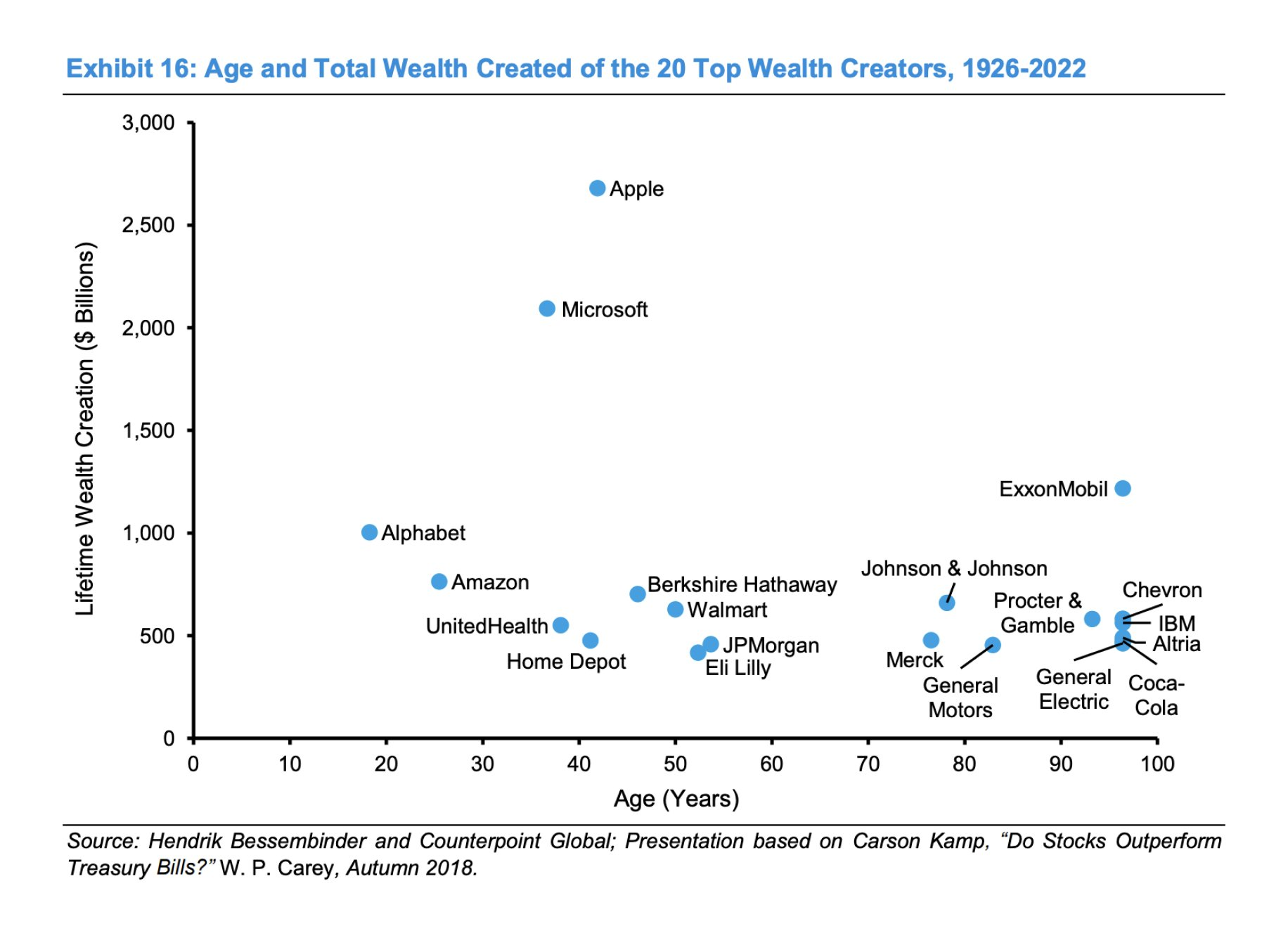

Birth, Death, and Wealth Creation

Michael Mauboussin's brand new research paper "Birth, Death, and Wealth Creation" is packed with incredible charts and insights.

Here are 10 highlights 🧵

- The Top 20 Wealth Creators among 28,000+ US-listed companies since 1926 and their age as public

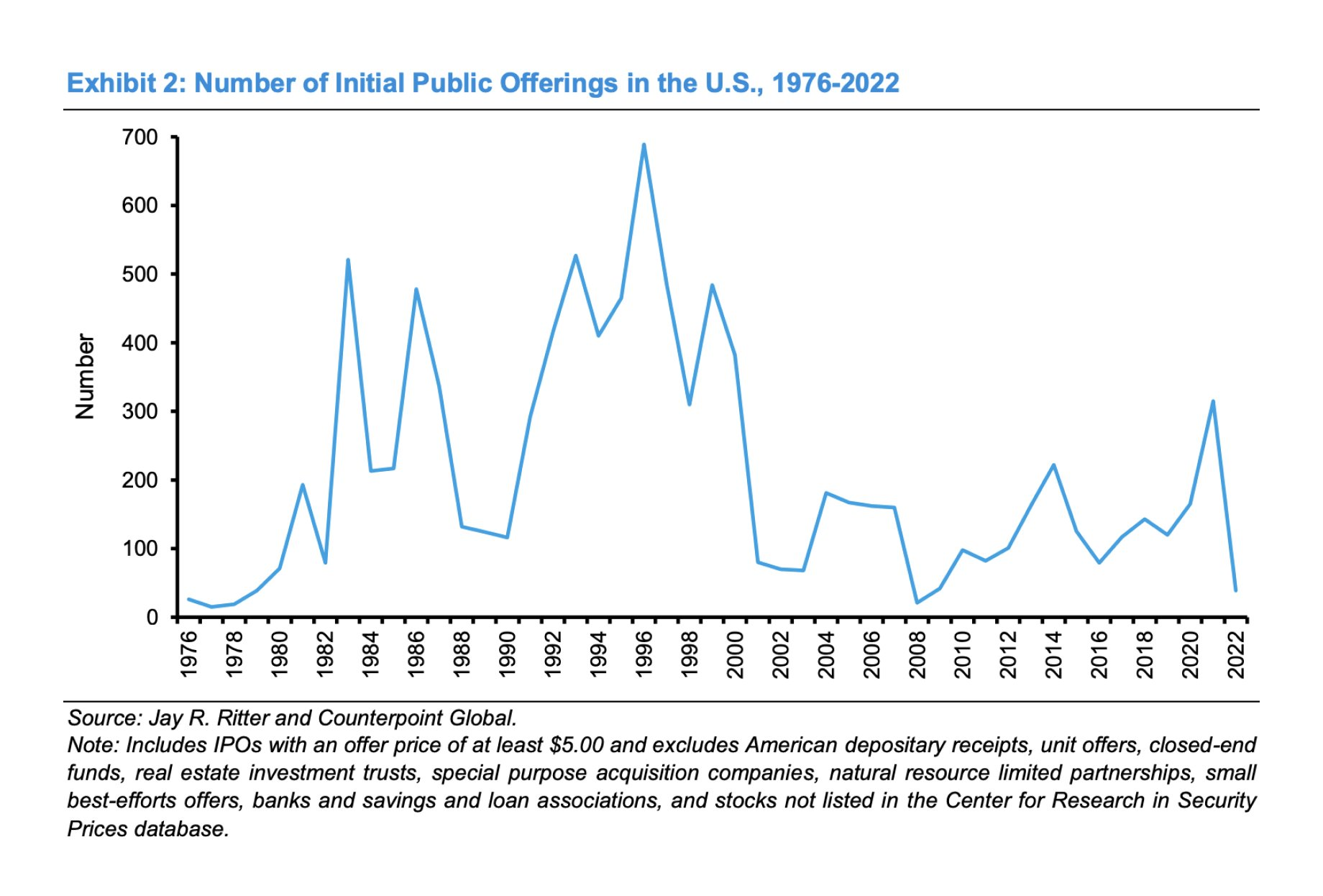

"Ritter’s data show only 39 IPOs in 2022, the fewest since 2008 when the economy was in the throes of the Great Recession."

- The numbers of U.S. IPOs since 1976

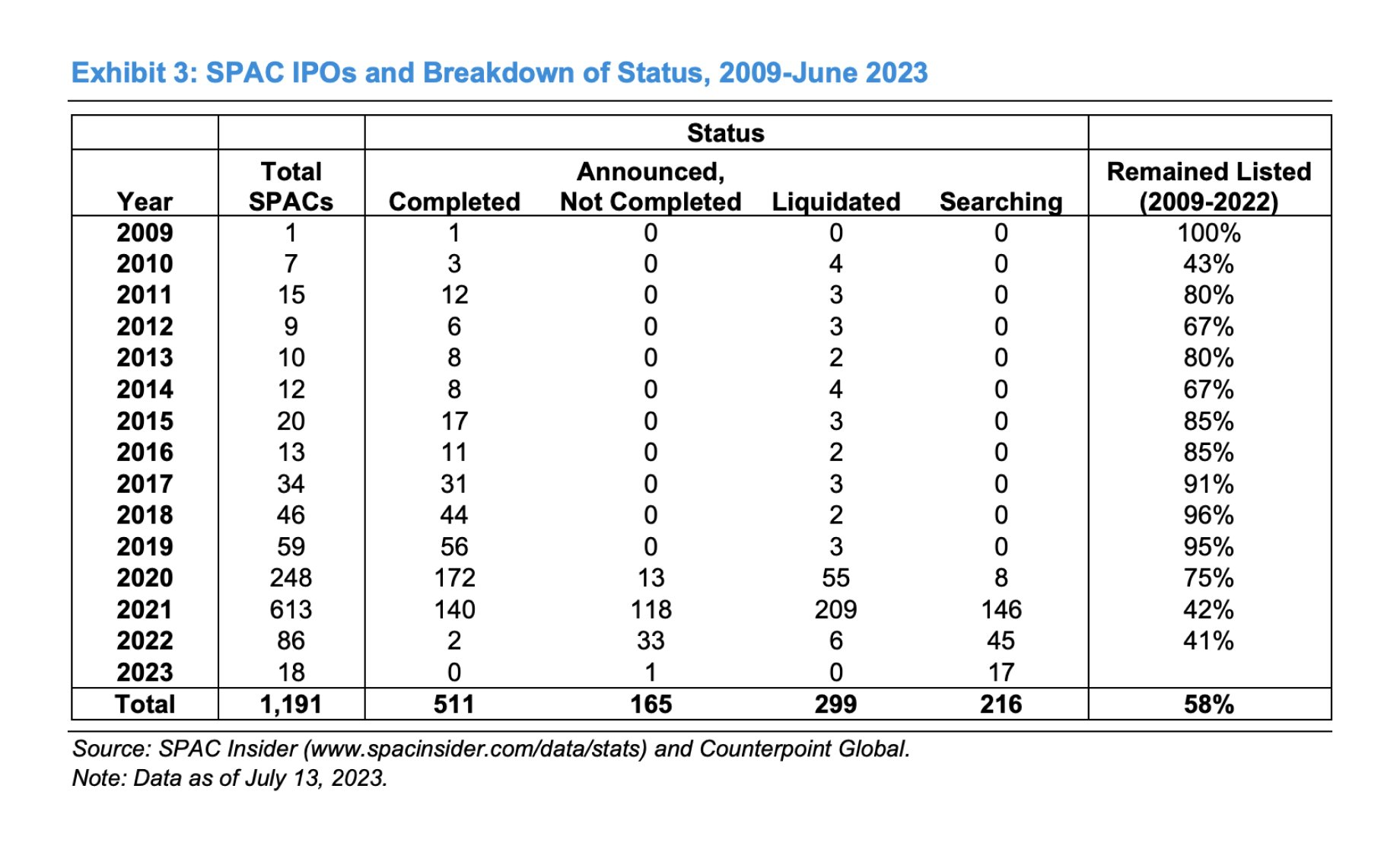

- This in insane. The numbers of U.S. SPACs in 2020 and 2021 account for roughly 2/3 of all SPACs ever issued

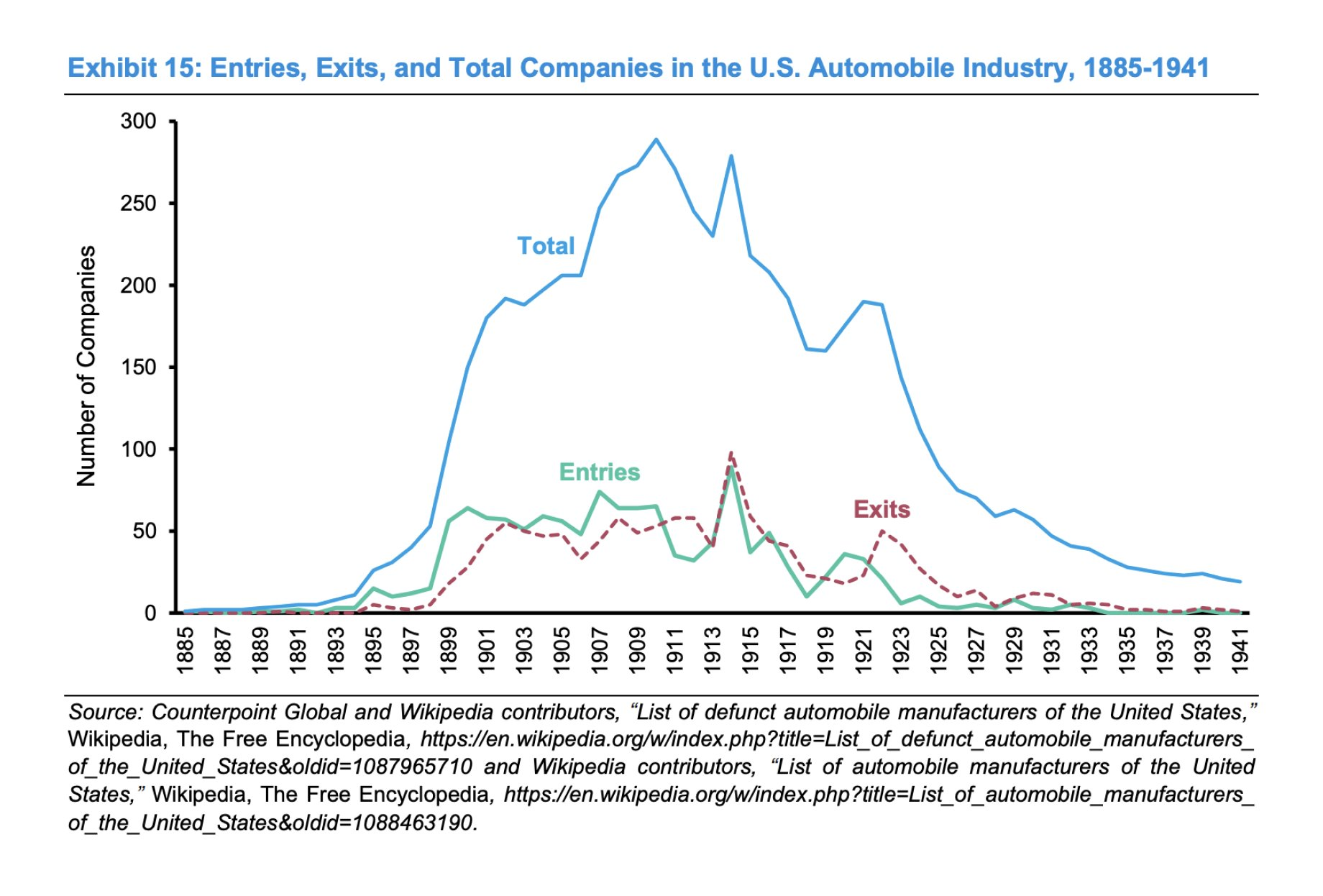

"The combination of technological revolutions and financial capital in public markets can lead to large booms and busts. [...] Each marked an epoch of substantial birth followed by sweeping death."

- The Automobile Boom & Bust of 1885-1941

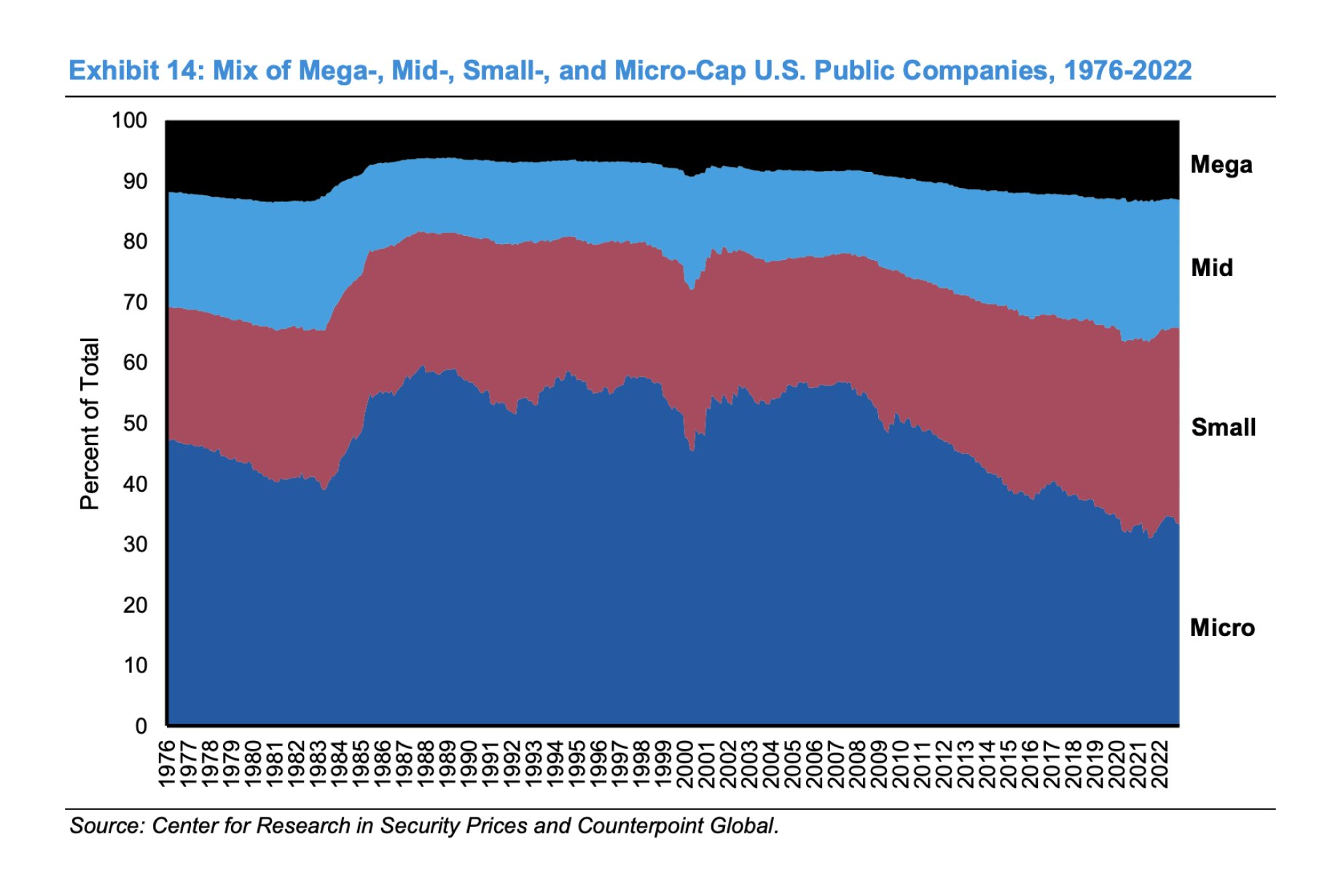

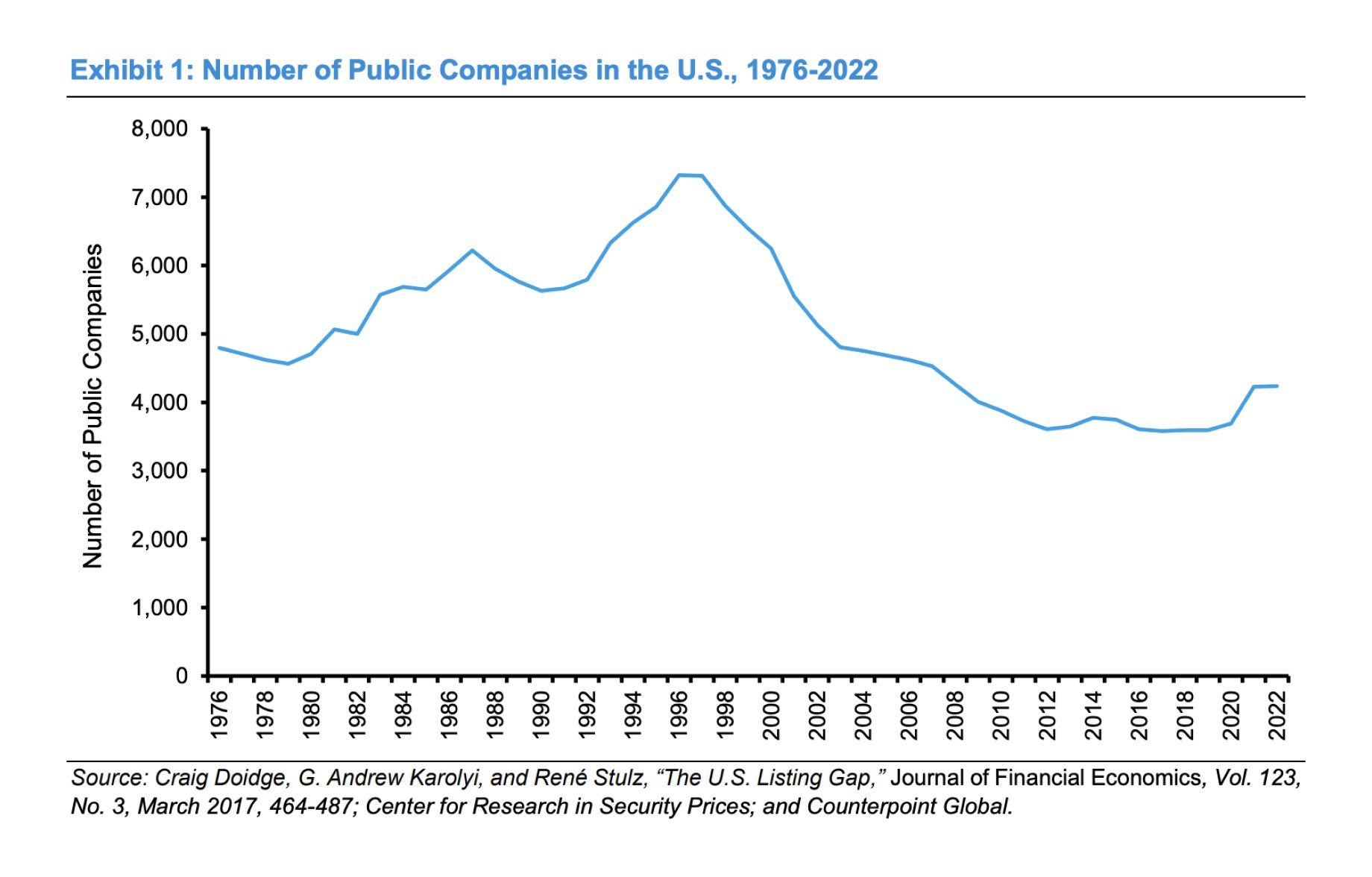

"Mega cap companies were 7%, and Micro cap 56%, of the total number of public companies at the peak in 1996. In 2022, Mega stocks were 13% and Micro stocks just 33% of the total."

- The Revenge of Mega and the Decrease of Micro

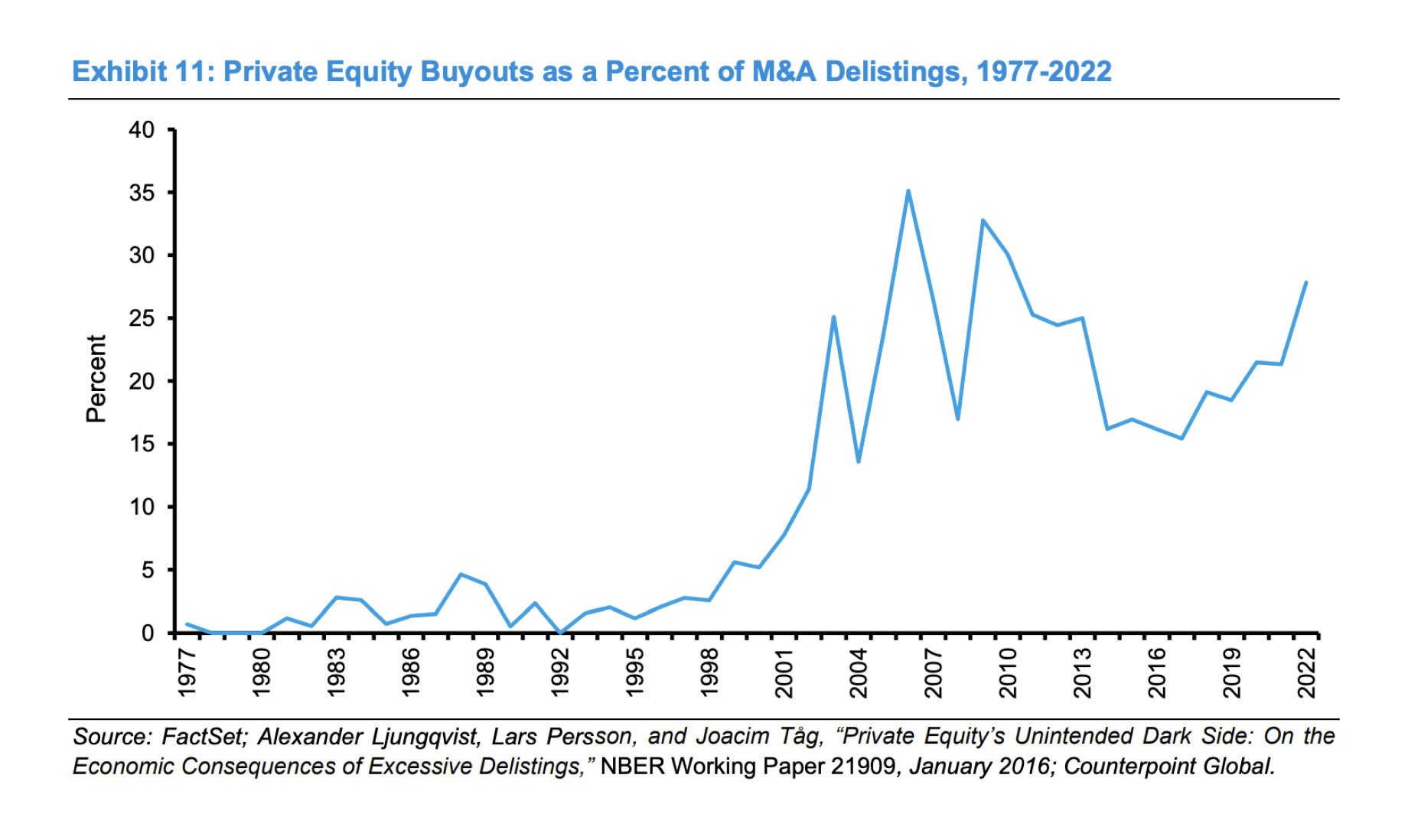

"Buyouts were less than 2% of M&A delistings from 1977 to 2000 but have been more than 20% since then."

- Private Equity buyouts are ramping up

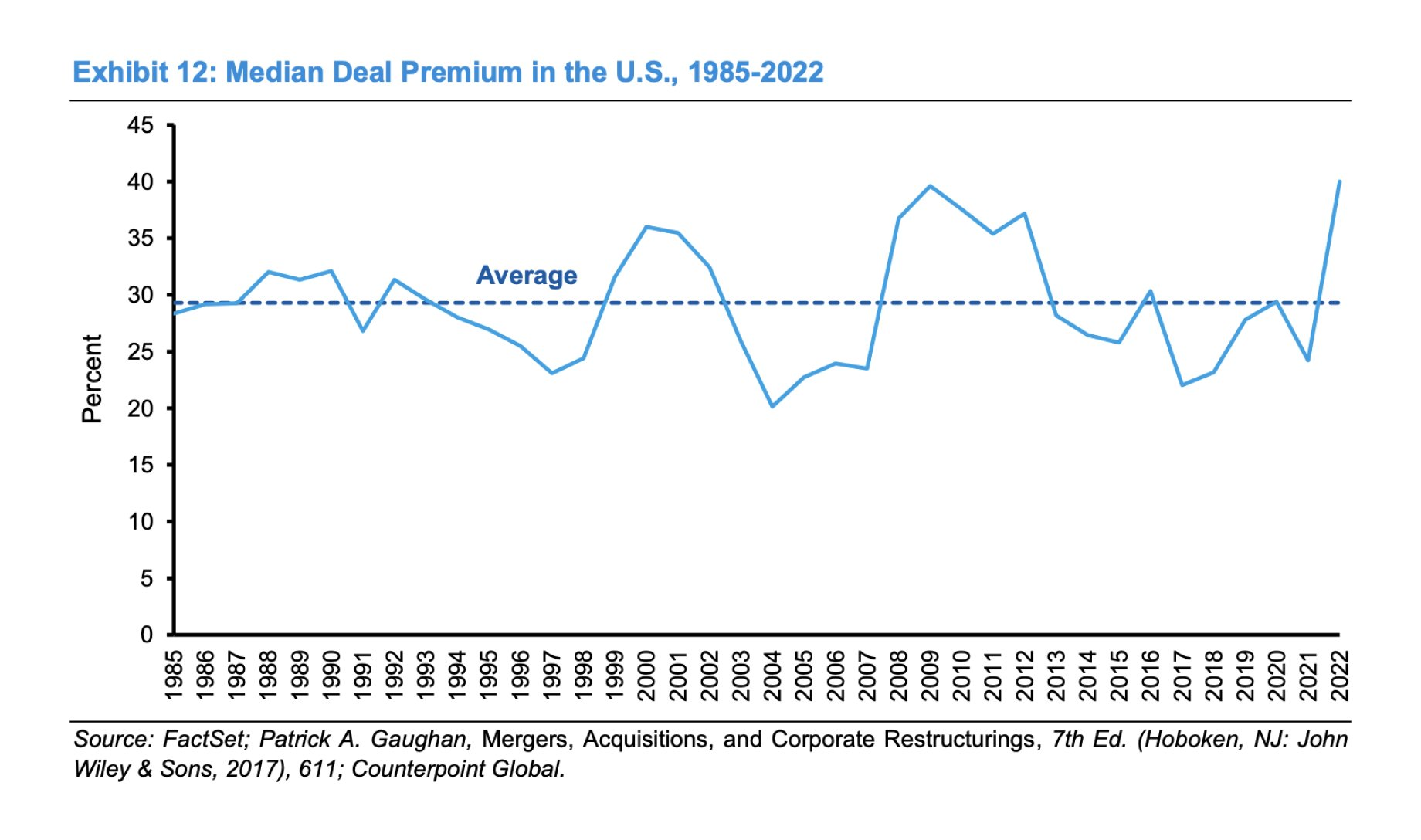

- Median buyout deal premiums are back to the GFC highs

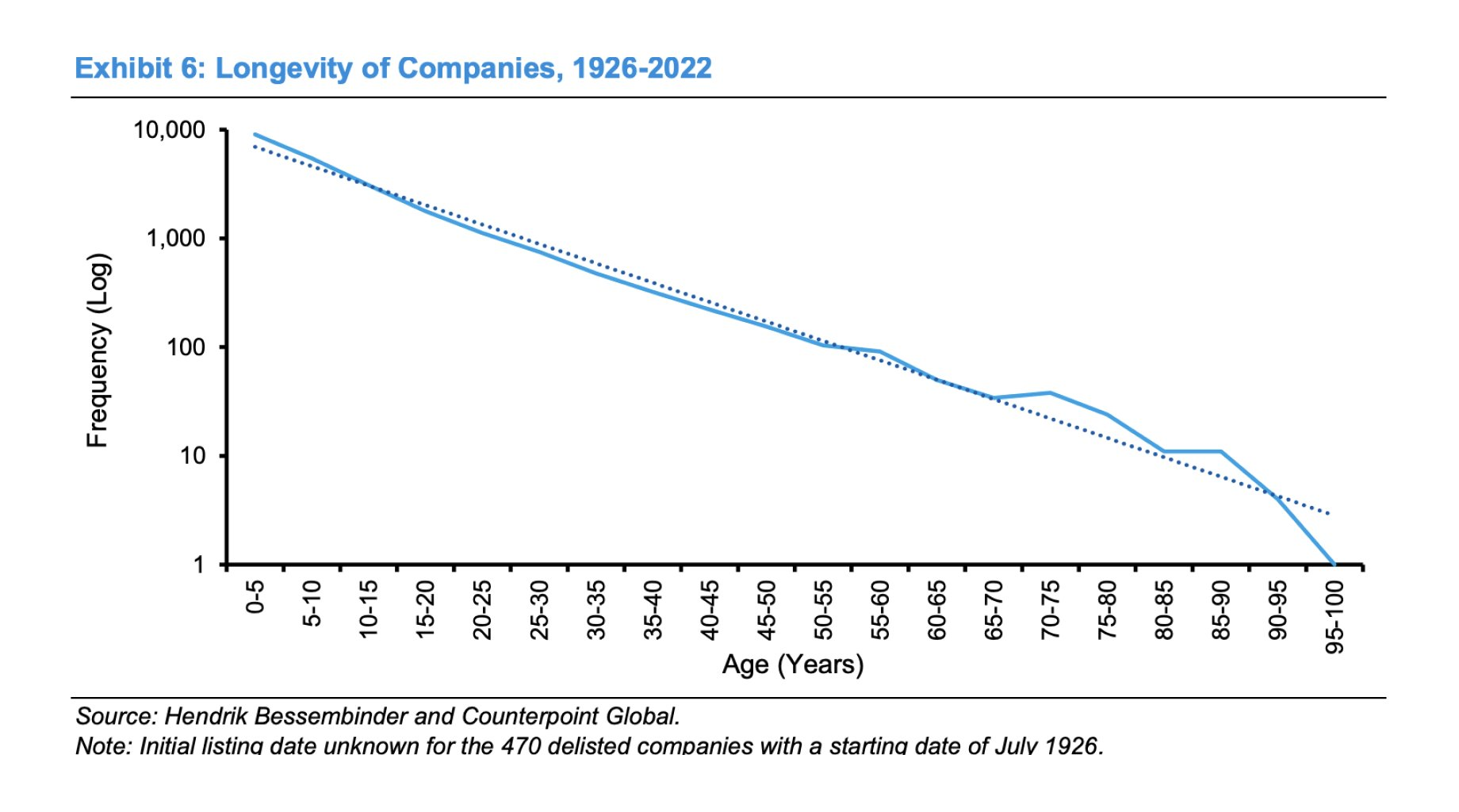

"If anything, the longevity of public companies has lengthened in the 2000s and 2010s relative to the 1980s and 1990s."

- About 5% of the publicly traded companies at the beginning of 2023 are more than 50 years old

"The combined sales of the top 100 public companies were nearly 7 times those of the top 100 private companies in 2021"

- The numbers of publicly traded companies in the U.S. over the last five decades

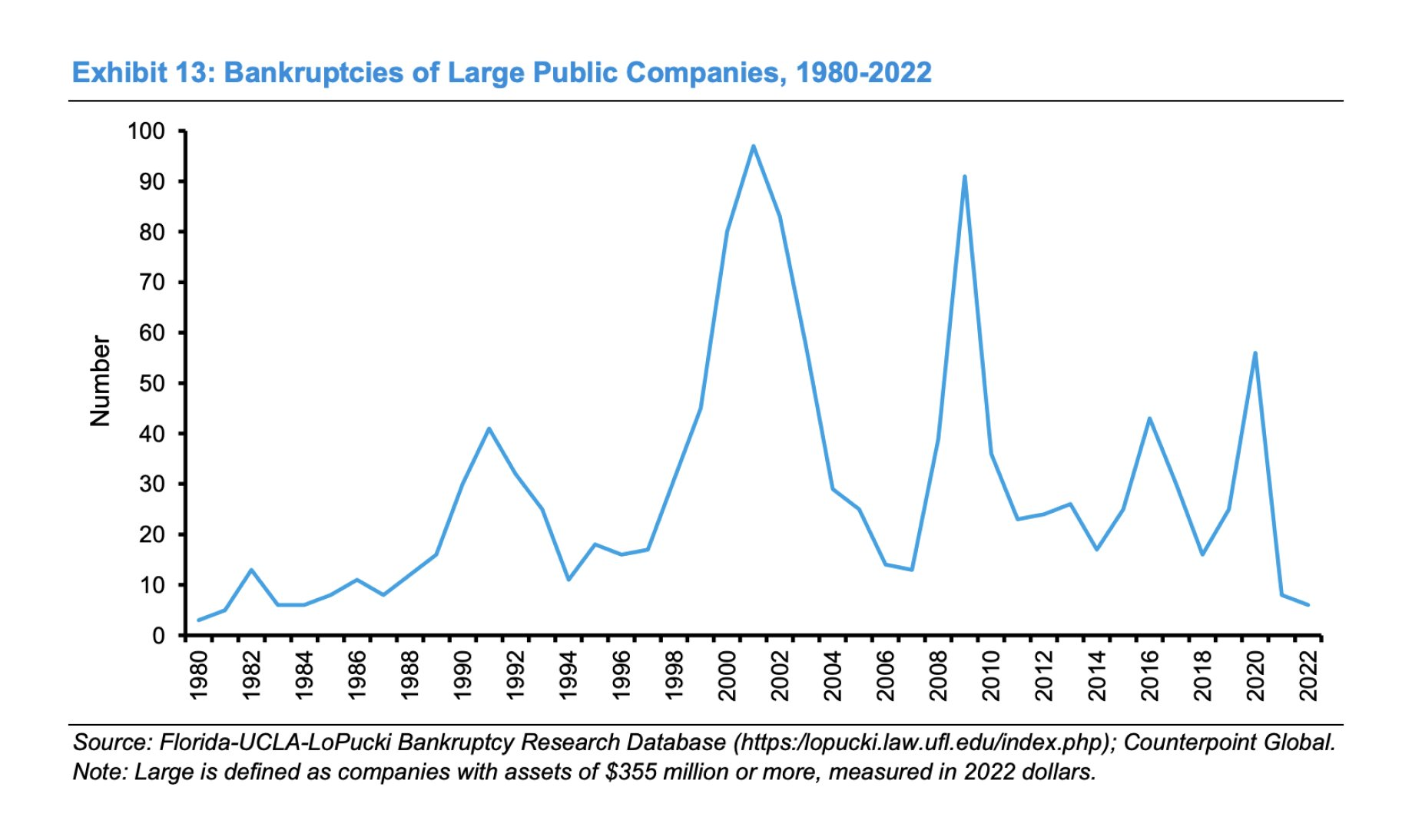

- Bankruptcies among large companies (definition: >$355m in assets) are at very low levels when looking back over the last three decades

Monetary Plumbing

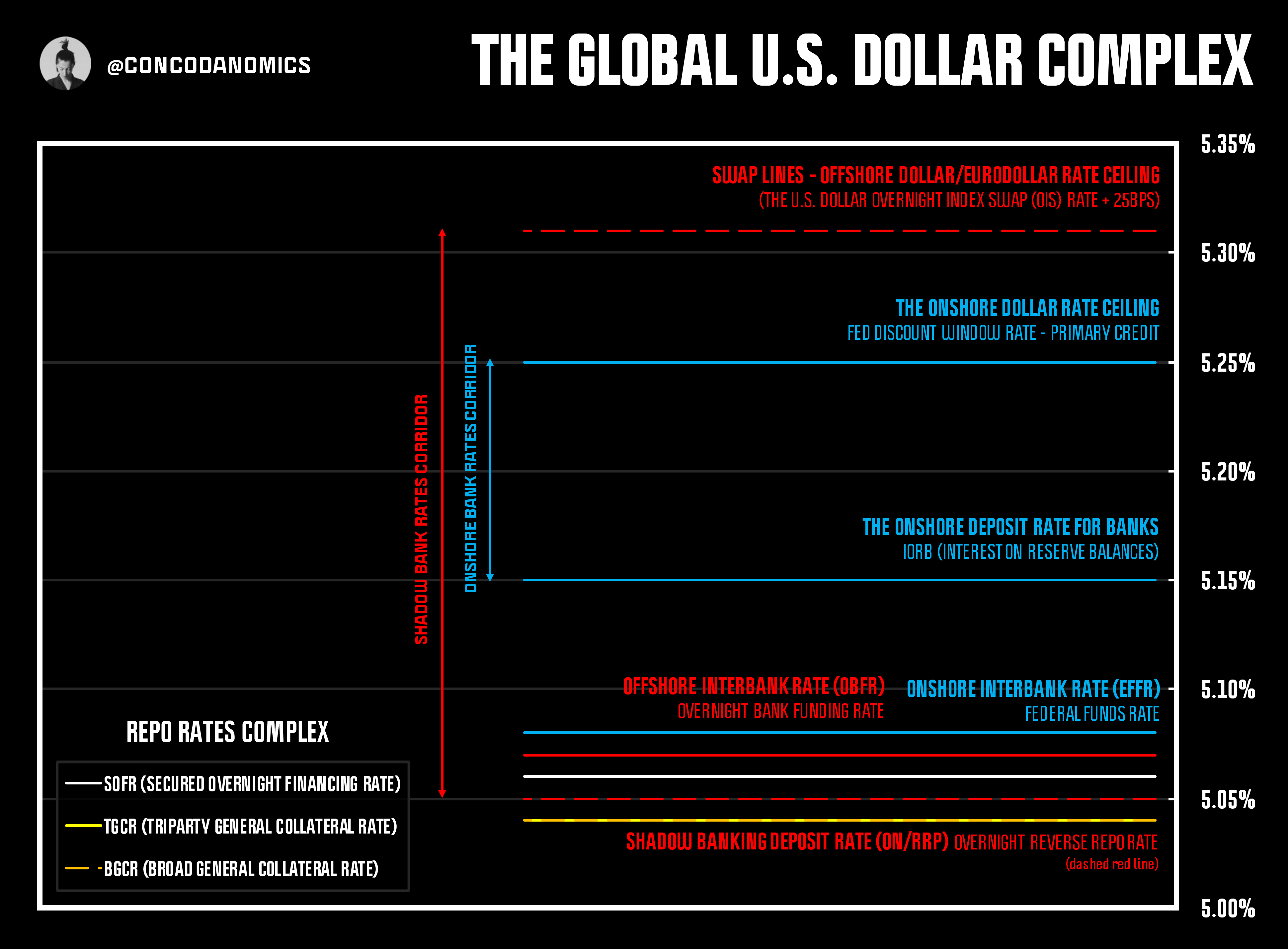

Monetary leaders are about to uncover the inner workings of an obscure $2 trillion market, the most opaque ecosystem within the U.S. dollar funding complex. This, however, is not the much-hyped Eurodollar system. The Repo Market Blindspot™ is about to be unveiled...

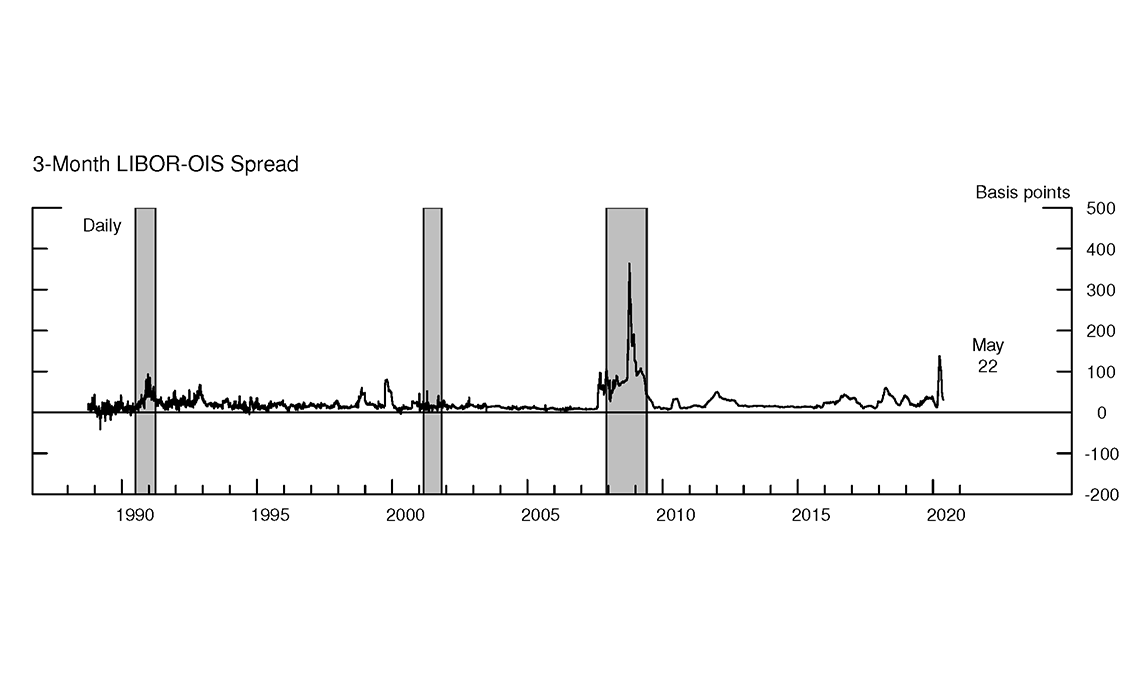

In the midst of the 2008 crisis, the Fed and the U.S. Treasury received an abrupt wake-up call. The failure of Lehman Brothers started a run in every major market for dollars, from FX swaps to money market funds to commercial paper, not only onshore but globally...

The illusion that onshore dollars and offshore dollars were equivalent had been obliterated. The rate to borrow (real) onshore dollars, Federal Funds, disconnected from LIBOR, the now defunct rate to borrow unsecured dollars offshore. “Eurodollars” were in short supply...

Faced with unrivaled monetary complexity, leaders had little choice but to not only inject billions into — what had become — global Wall Street banks but quell a global dollar shortage by firing up its swap lines...

By supplying as many dollars as needed via its funding facilities, the Fed preserved the stability of the global dollar paradigm. The major players and participants in finance then deemed this as a pledge from authorities to provide enough liquidity to stem any future shortage...

A permanent bridge between onshore and offshore dollars had been constructed. Ever since the GFC (global financial crisis), the implicit promise from authorities to make onshore and offshore dollars fungible persisted, no matter the cost...

By delivering endless dollar liquidity through FX swap lines and a cluster of other programs, the Fed had solidified its “global jaws”. But even this became a sideshow. In the decade after the subprime crash, global regulators set out to transform the system entirely...

Slowly but surely, leaders chose to drive systemic risk away from banks and park it elsewhere. Through a series of ever more stringent regulatory actions, banks were prohibited from taking on too much risk and leverage, so the shadow banks assumed the banks’ riskier duties...

Using U.S. Treasuries and agency MBS (mortgage-backed securities) to secure most of their trades, money market funds and dealers — the new plumbers of the monetary system — happily absorbed new hazards, assuming they were backed by U.S. authorities’ willingness to intervene...

Using U.S. Treasuries and agency MBS (mortgage-backed securities) to secure most of their trades, money market funds and dealers — the new plumbers of the monetary system — happily absorbed new hazards, assuming they were backed by U.S. authorities’ willingness to intervene...

Sensing victory, authorities have made it their number-one mission to stamp out all remaining chokepoints in the system. One particularly obscure market has been flagged as a blindspot: NCCBR (non-centrally cleared bilateral repo”), the uncleared market for secured cash loans... Reference 1

NCCBR is the primary market for hedge funds to obtain enormous amounts of leverage at a very low cost. But not only has it grown into the most obscure segment of the repo market. It has become the largest, sporting an estimated $2 trillion in outstanding agreements... Reference 2

Authorities are now moving in to subdue the rising risk of instability in this obscure ecosystem. But as we’ll shortly discover, it’s not that straightforward...

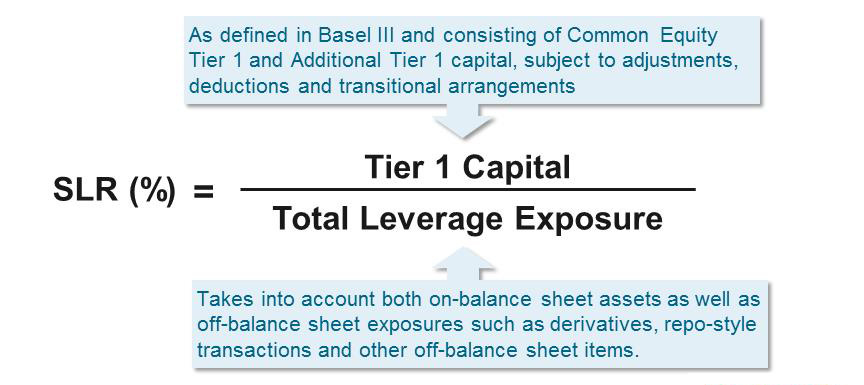

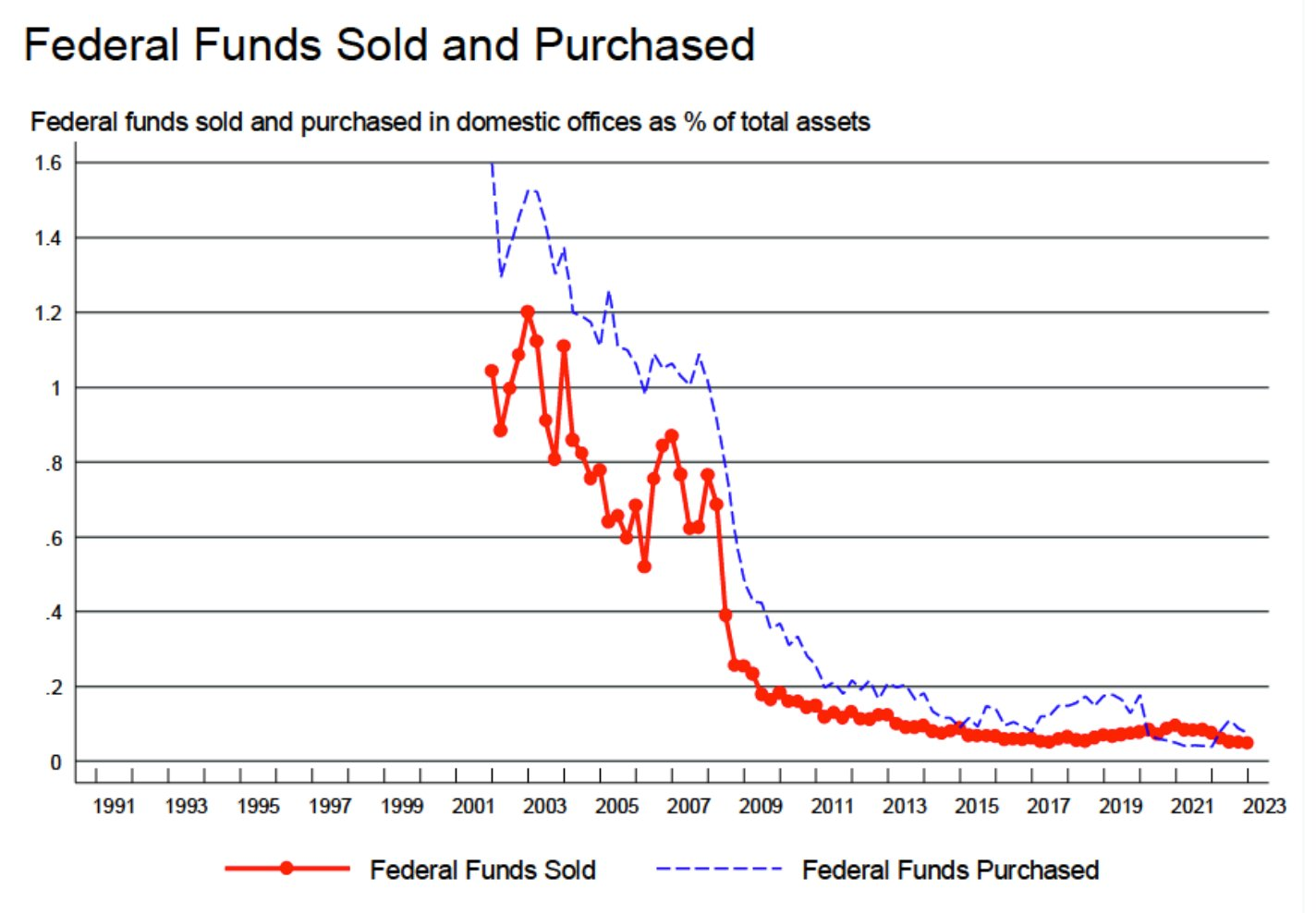

The biggest shift caused by regulators’ obsession with removing systemic risk was a move from “bank-based” to “market-based” finance. With regulations like the SLR and LCR in place, the ability of Wall Street banks to not only make markets but lend to one another was inhibited...

Global financial players started to transition away from unsecured lending almost entirely onto a secured standard, where repo — the secured cash loans market — began to play a dominant role. As trillions in secured lending took place daily, leaders started to declare victory...

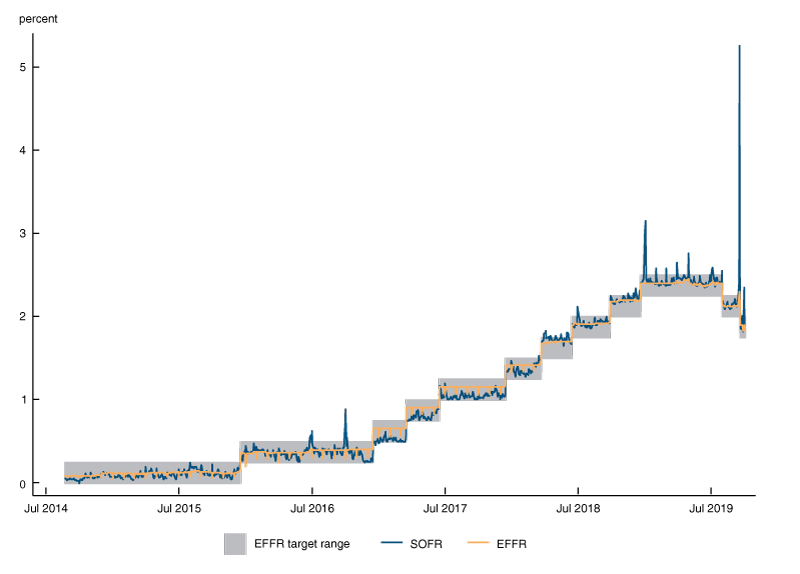

Reality, however, quickly demonstrated that even the secured standard was not enough to eliminate market disruptions. In September 2019, the “repocalypse" struck. Repo rates shot above the Fed’s target range, destroying the illusion of resilience in the new secured era...

The most common explanation was a sea of corporate tax payments and Treasury issuance sucking too many reserves out of the system. Yet despite all the financial players involved knowing the liquidity drain was coming, repo market turmoil still ensued. Something else was afoot...

The sheer complexity and opaqueness of the repo markets made the causality impossible to diagnose, even today. The Fed had no option but to intervene. The repocalypse, however, wasn’t the only episode of instability in repo markets...

Fast forward to the COVID-19 market meltdown, and repo markets once again started to break down. Economic and political indecision surrounding the pandemic, combined with very restraints regulators had imposed on monetary plumbers, led to severe disruptions...

A global “dash for U.S. dollars” caused dealers’ Treasury inventories to expand enough to hit their balance sheet limits, impeding their ability to make markets. Meanwhile, hedge funds started to unwind popular trades, exacerbating the repo turmoil...

To subdue the distress, the Fed expanded its operations by offering to lend up to $500 billion dollars daily via its repo facilities. Market players perceived this as the Fed willing to provide as much liquidity as was needed to regain stability... Reference 3

Subsequently, rates and volatility rapidly decreased. Disaster had been averted. But even though the secured standard had proven shaky, monetary leaders persisted. Having already committed to a system overhaul for over a decade, the unsecured age of global finance was over...

Though delicate, the secured standard has arguably proven to be more stable than its predecessor. But like the unsecured standard, monetary leaders will once more try to paint over weaknesses in the new paradigm, with uncleared bilateral repo at the top of their agenda...

The COVID-19 repo turmoil has attracted the gaze of the regulatory establishment, as hedge funds continue to use high amounts of leverage on trades they don’t have to report to regulators. Measures are set to be introduced that will review activities in the NCCBR market...

In January 2023, six months after gathering NCCBR data from prominent securities dealers, the Office of Financial Research (OFR) announced it was introducing a regular NCCBR data collection. Until then, no central source on the most opaque corner of funding markets had existed... Reference 4

The initial release revealed a potential $2 trillion — $1.19 trillion in reverse repos and $0.94 trillion in repos — in outstanding repo agreements. The U.S. Treasury responded with proposed standards to liberate the inner workings of this obscure market...

Still, mandating NCCBR participants like hedge funds to report highly leveraged trading activities may fail to increase financial stability. The dynamics of the NCCBR market are intricate...

The ultimatum by regulators will be to persuade the hedge fund community to exit from dubious uncleared markets and transition toward the “central clearing” complex, run by the sole CCP (central counterparty) in repo: the FICC (Fixed Income Clearing Corporation)...

With centrally cleared trades, a central counterparty takes both sides, known as netting, which reduces counterparty risk and balance sheet constraints for dealers... Reference 5

But as regulators dive into the particulars, they will discover central clearing will seem unappealing for the very hedge funds they’re trying to convince...

In uncleared bilateral repo, dealers make markets for hedge funds with lower “haircuts” on collateral, meaning they obtain more cash for the securities they pledge, hence obtaining higher leverage. This is key to executing popular trades, like the Treasury-Futures basis... Reference 6

Moreover, cleared repo markets only support the pledging of Treasuries and agency securities, whereas participants in NCCBR like to pledge a wider range of collateral — even equities. With few benefits, data clarity and the move onto central clearing will have little impact...

When turmoil inevitably erupts, the only tool that can save the day is Fed's monetary alchemy. Even without opaqueness, the complexity of the NCCBR dooms the Fed into intervening. The U.S. central bank’s “volatility suppressor” will, once again, come to the rescue.