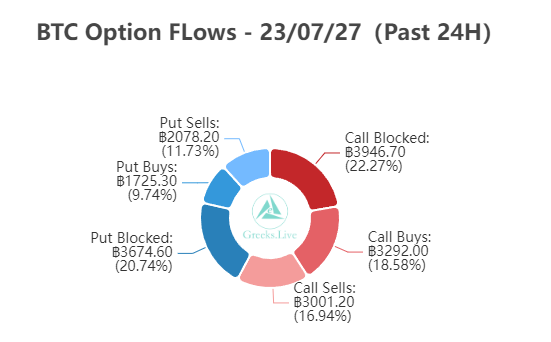

Crypto Options Market

Monthly delivery is just around the corner and volatility has fallen to historic lows this month with Dvol already approaching 35%.

Every summer is a relatively low volatility time frame and this year is no exception, but the historical trend suggests that the current low volatility levels won't last much longer and that the market is always finding new hot spots.

Buyers of forward options have recently begun to enter the market, with calls and puts being traded in some volume, and the movement of large investors is worth keeping an eye on.

Market Expecting 2% Move

To give you an idea of how listless and boring Bitcoin has been, just take a look at DVOL.

In equities we can use the "Rule of 16". Take the current implied volatility and divide it by 16 to get an idea of the expected daily move.

[We arrive to 16 by taking the square root of the total trading days. 252 for NYSE]

It is 365 in crypto, which leaves us with a a square root of 19. So with a DVOL of 39, the market is expecting sub 2% moves.

Gensler on BBTV

Gensler on BBTV re spot ETF filings: "Those filings come up to a 5 member commission so can't comment but.. crypto is highly speculative, no protections of sec laws, no fair and truthful disclosure, platforms get away w things that NYSE couldn't, rife with fraud and hucksters."

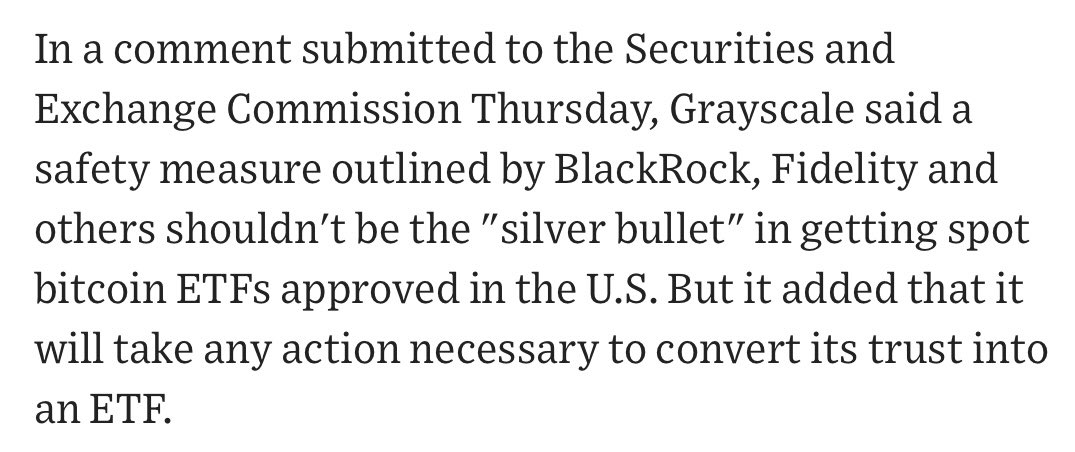

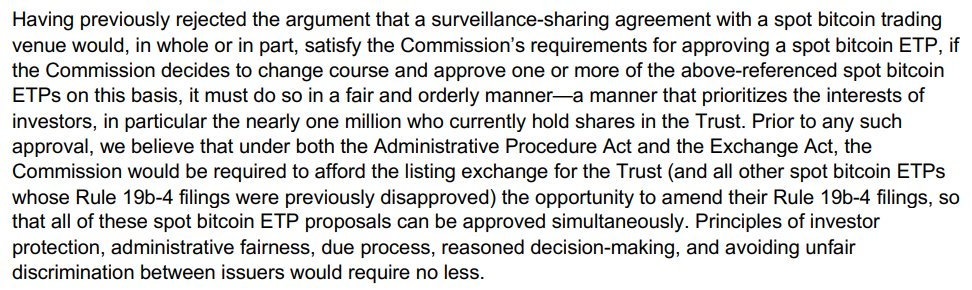

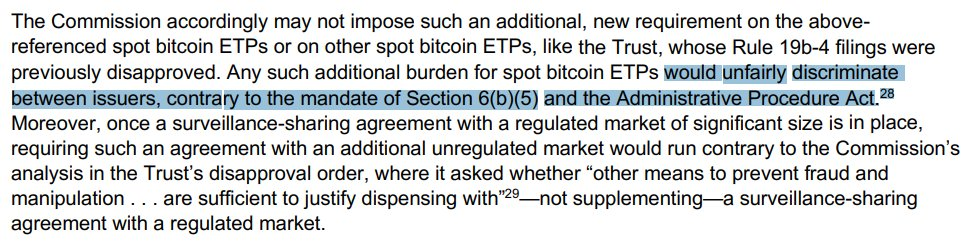

Grayscale

Very interesting comments by Grayscale submitted to SEC today…

Said surveillance sharing agreement w/ Coinbase wouldn’t be sufficient to get spot bitcoin ETFs approved.

via @Vlajournaliste

Here's the full letter...

Think comes down to this: Grayscale wants to ensure fair process for spot bitcoin ETF approval.

Imagine if Grayscale sues the SEC again for another potential APA violation...

Wild.

To summarize, Grayscale is basically saying that if SSA w/ COIN is the magic game changer for spot btc ETF approval, then that would run counter to SEC’s previous denials & put Grayscale at an unfair disadvantage…

Have to read this as bullish for spot btc approval overall tho.

Adding comments from Grayscale's Chief Legal Officer...

"The SEC should not pick winners and losers."

Again, they're clearly concerned the SEC might allow other spot btc ETFs to come to market prior to GBTC conversion.

Grayscale’s Latest GBTC Comment Letter

Sequoia Cuts Crypto Fund

Sequoia Cuts Crypto Fund to $200 Million From $585 Million -- WSJ

Sequoia Also Pares Back Ecosystem Fund By Half -- WSJ

Sequoia Cuts Funds Amid Broader Startup Downturn -- WSJ

Source Tweet - Walter Bloomberg

Sequoia Capital Slashes Crypto Fund as It Downsizes Amid Startup Crunch

Yellow

Yellow exec tells sales staff company will file bankruptcy Monday

Truckers

Watch the truckers: if Yellow liquidates, BofA analysts see up to 40% earnings upside potential on average for nonunion pure-play LTL carriers, like XPO, SAIA and Old Dominion Freight Line. Plus these are extremely shorted stocks.

July Trucking Market Update

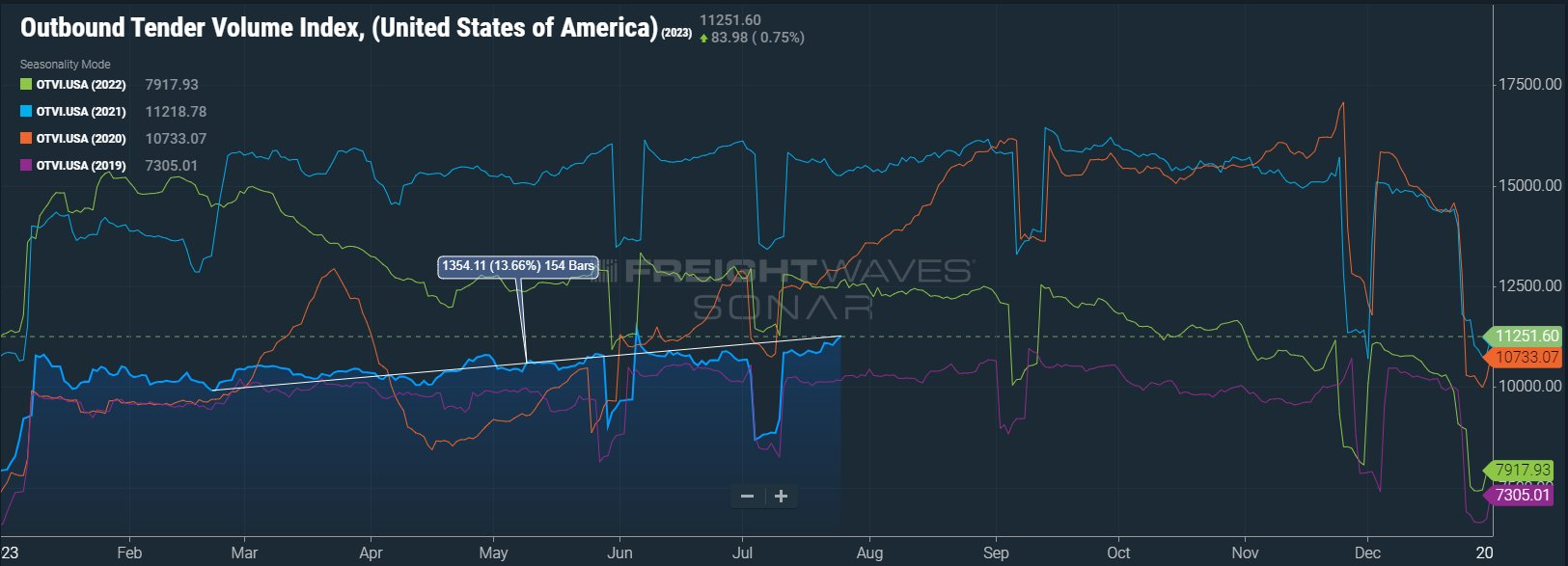

Outbound Truckload Demand showing signs of life after a 9 month stretch of practically flatlining. OTVI crossed above 11,250 today on the @SONAR_FW index, 14% increase since February. We have not seen these levels since Nov 22'.

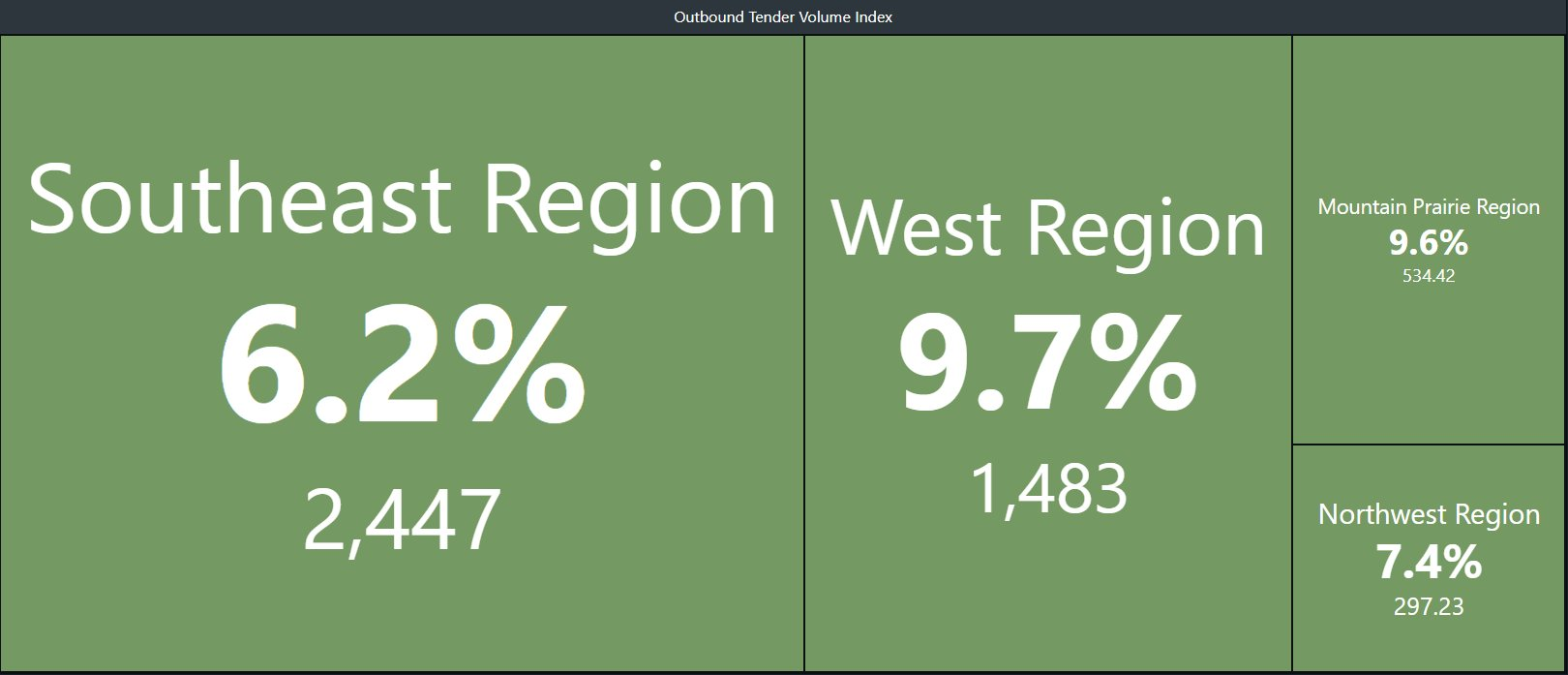

In the last month most of the gains are coming from the Southeast and West Regions, with LAX and PHX leading the way for the west and MEM and ATL leading the way for the southeast.

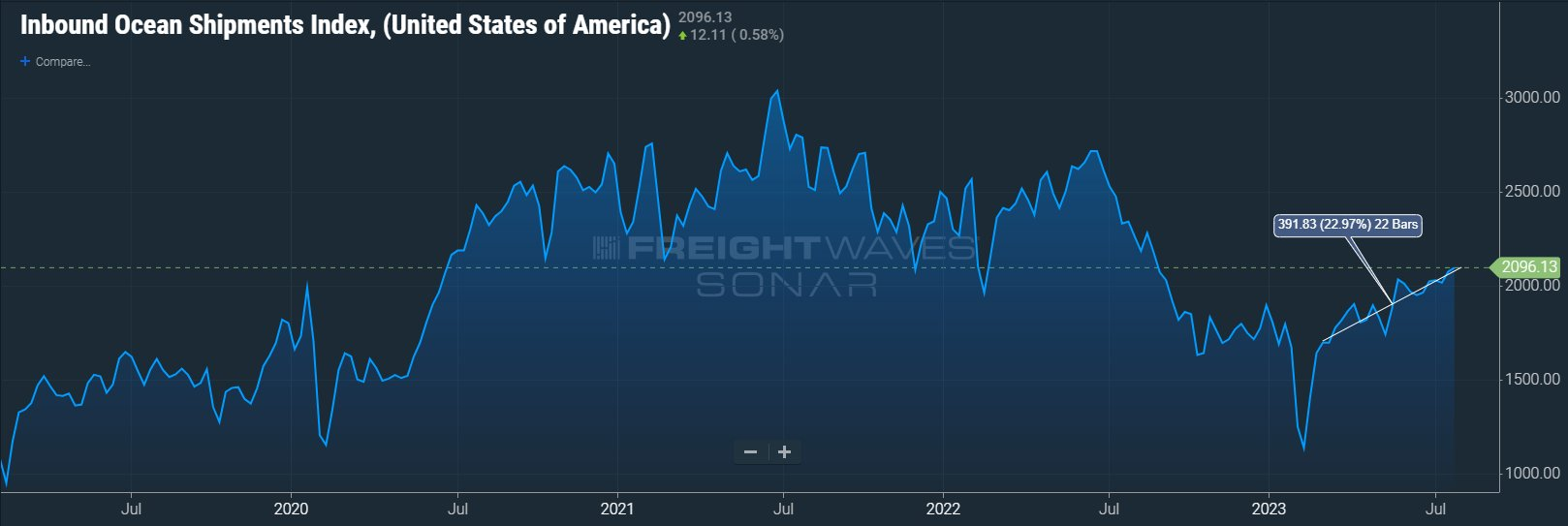

Likely due to the recent small uptick in the rejection rates we have seen in the west from the spark of spot freight, causing shippers to have to tender a load more then once. But I also think a part of it is due to the 20%+ increase we have seen in Total Inbound Ocean Shipments.

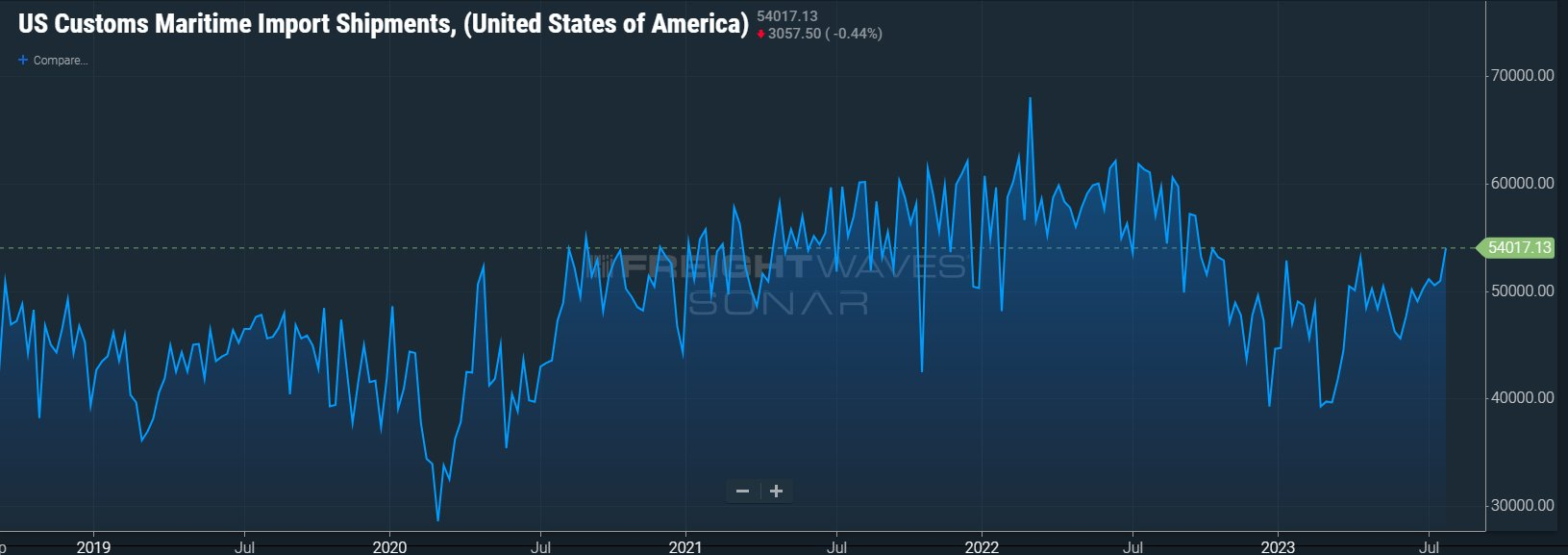

The increase in Inbound Ocean shipments has led to more BOL's hitting the ports recently, climbing back towards that 55,000-60,000 daily average we saw over the last few years. Some of this will convert to truckload, having a impact on OTVI.

Truckload Rejections are the first place we go to tell us where the market is trending, but rejections just cant seem to make up its mind. We have been at a 3.17% average since Jan 29th. That's a fairly long stint for a data set that historically doesn't like to stand still.

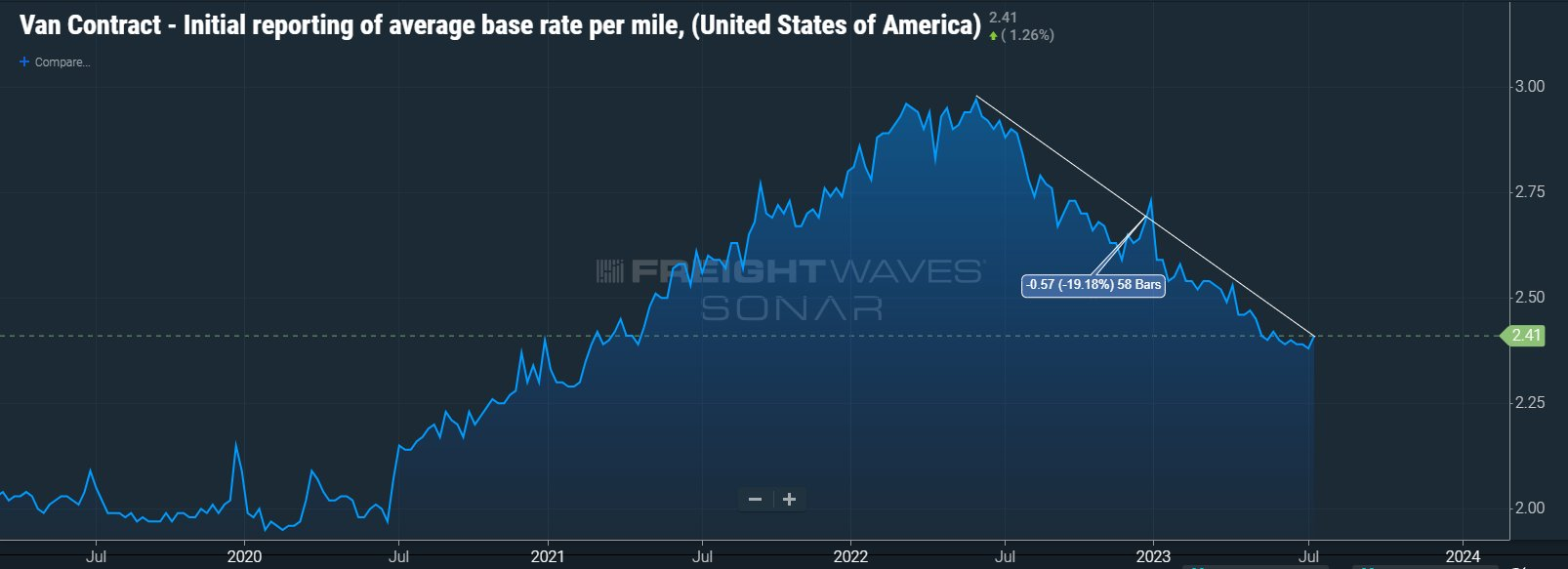

With rejections so low for a extended period of time, carriers are pressured to lower long term rates to retain business. Making it increasingly difficult to sell on service. Line Haul Rates have fallen close to 20% since their peak in May 2022, but still up 22% since Pre Covid.

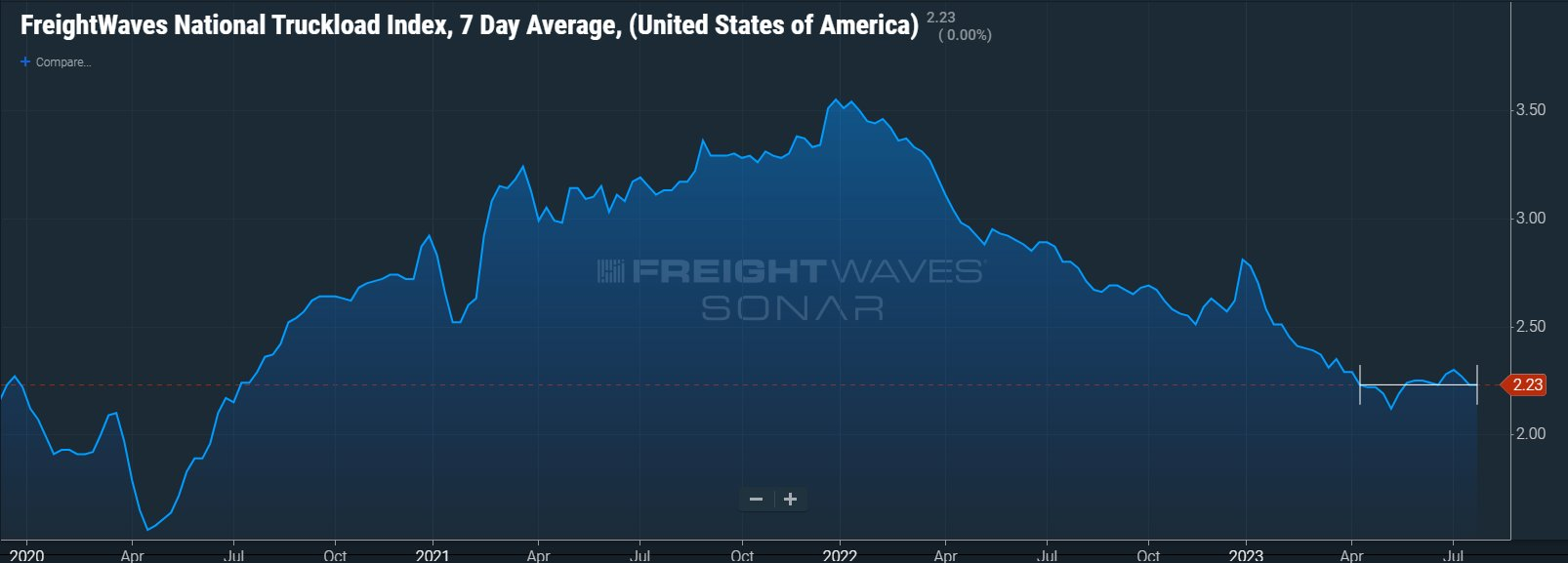

On the other side of the fence, Truckload Spot Rates seem to have found a floor for the time being. Holding a $2.23 average since April 9th, with a low of $2.12 and a high of $2.30 during that time. Hard to tell where this one is going with rejections not moving.

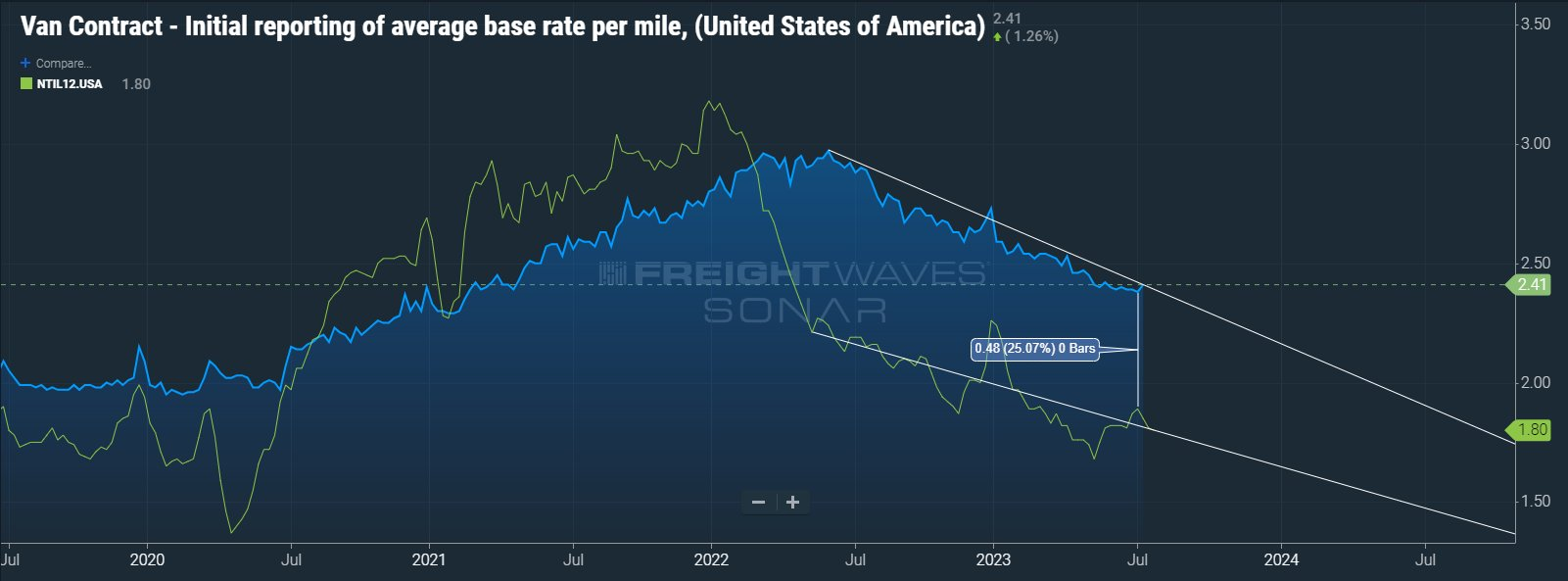

Gap between Contract and Spot Rates tells us a lot about where we are in a market cycle. This gap as you can see is slowly contracting. We would be looking for a $.20-30 Gap to lead us into the next cycle. That Gap got as close as $.48 on July 2nd before expanding back out a bit.

@FreightWaves National level data is a great start, but its crucial to understand where that split is in the market between Contract and Spot Rates on your own lanes. Without @SONAR_FW to dive into them individually, you are missing the details on the ground.

Interest Costs

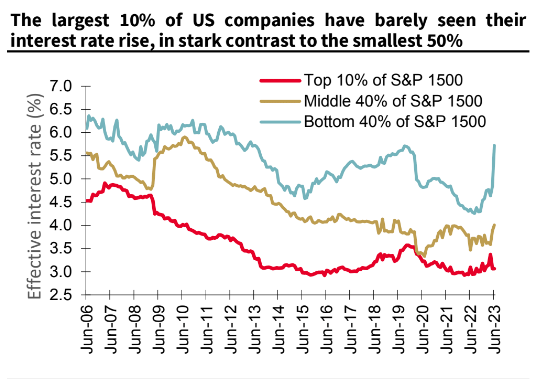

"The top 10% ex-financial companies by market cap haven't seen interest costs rise, while the bottom 40% have seen a significant rise."

-SocGen

Source Tweet - Daily Chartbook

GDP

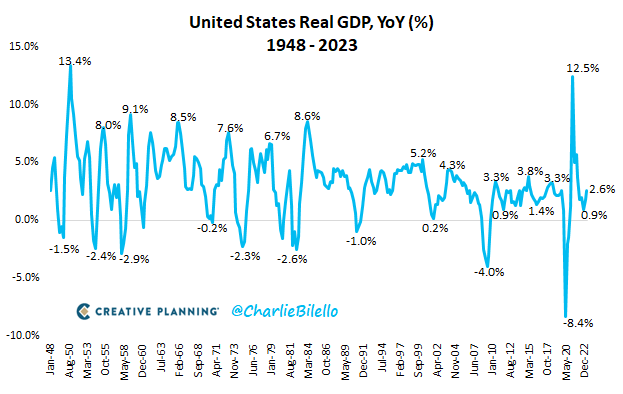

The first report on US economic growth during the 2nd quarter was a good one with Real GDP rising 2.6% YoY, well above expectations.

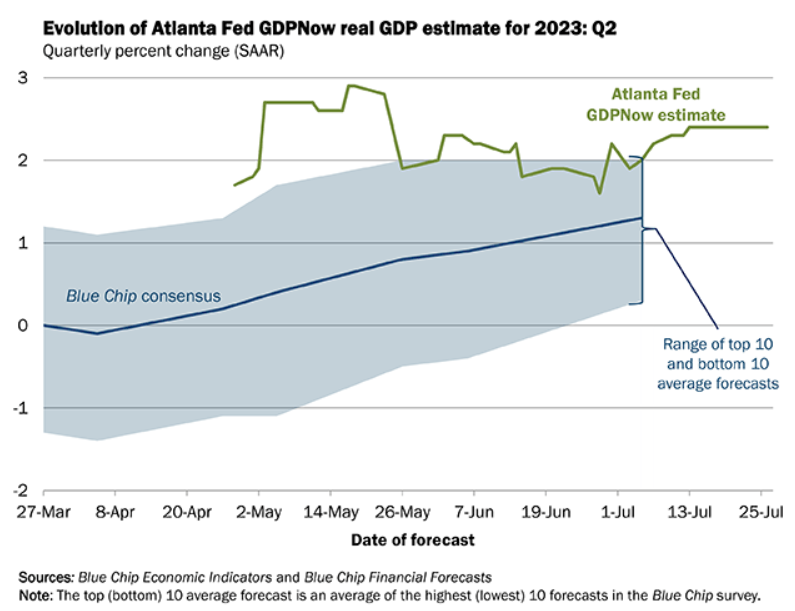

The Atlanta Fed's 2.4% estimate for annualized real growth during Q2 was right on the money while Wall Street estimates (Blue Chip consensus) were too bearish.

Source Tweet - Charlie Bilello

Strengthen Capital Requirements

"Bank regulatory agencies today requested comment on a proposal to increase the strength and resilience of the banking system. The proposal would modify large bank capital requirements to better reflect underlying risks...."

Source Tweet - The Transcript

Agencies request comment on proposed rules to strengthen capital requirements for large banks

BOJ YCC

BREAKING NEWS: The Bank of Japan will discuss tweaking its yield curve control policy at a policy board meeting Friday to let long-term interest rates rise beyond its cap of 0.5% by a certain degree, Nikkei has learned.

BOJ to discuss yield curve control tweak to allow rates over 0.5%

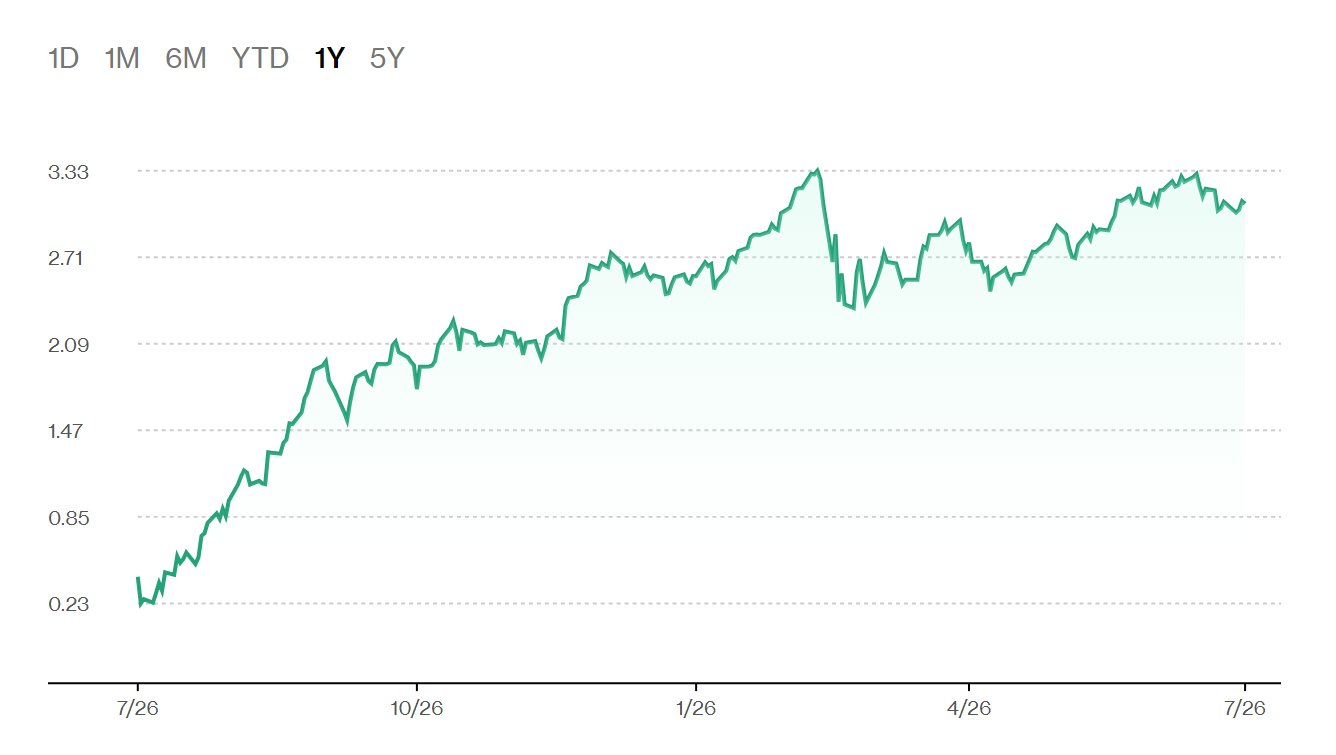

YCC/US Mortgage

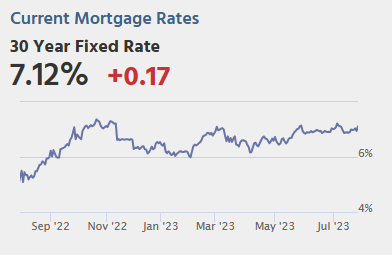

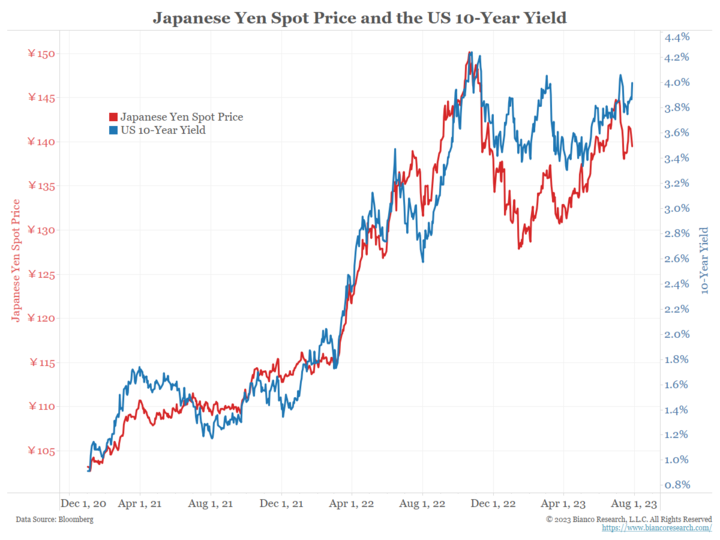

The Nikkei news report that Japan might tweak its policy stance on yield curve control sent up U.S. mortgage rates today

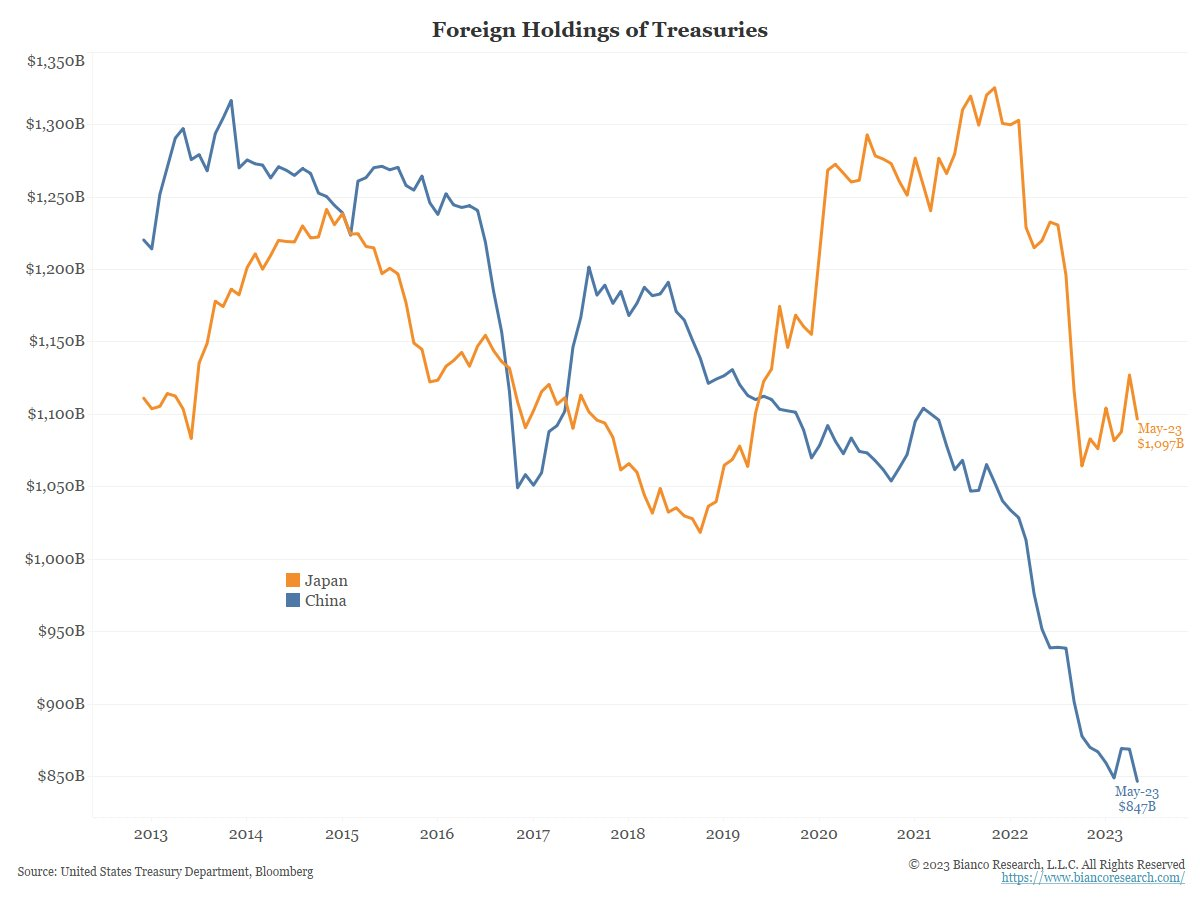

Japan is the largest foreign holder of US Treasurys, so higher rates in Japan could lead to less demand for US debt

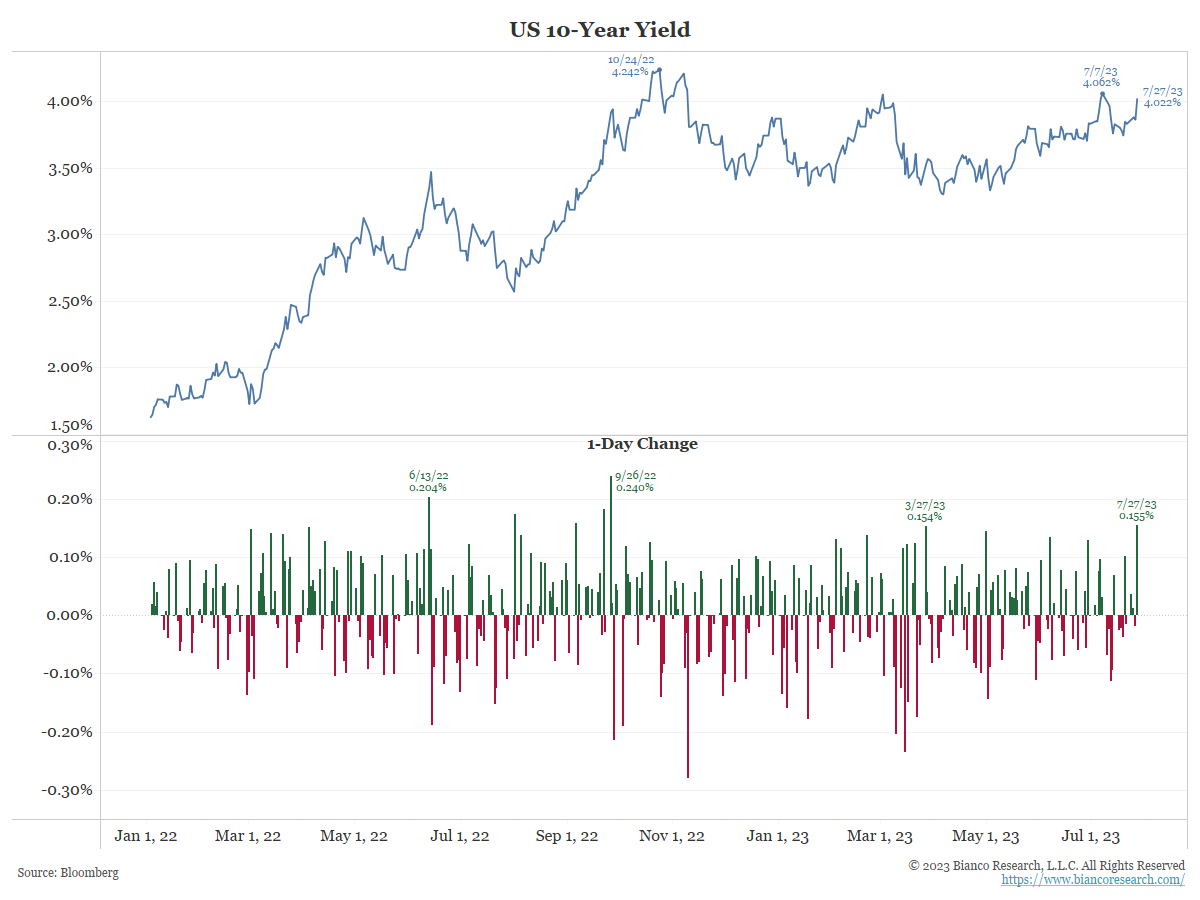

Bond Yields

*US TREASURY 10-YEAR YIELD RISES 15 BASIS POINTS ON DAY

If this holds, it will be the biggest one-day rise on 10-year yields this year.

Why is this happening?

Several things.

First, the Bank of Japan will meet tonight (US time). Will they expand their Yield Curve Control (YCC) Cap?

Why does it matter to the UST yields should the BoJ raise its YCC Cap?

Japan is the largest foreigner holder of the Tsys, even larger than China.

Raising the cap makes JGBs relatively more attractive when than UST. So, in theory, this should sap demand from UST to JGBs.

Higher JGB yields should make the Yen relatively more attractive than the $$ (red line)

If the red line should go up. Notice its relationship to the blue line (the US 10-year yield).

The Yen is not rising, but the YCC Cap has yet to be expanded.

We'll find out tonight.

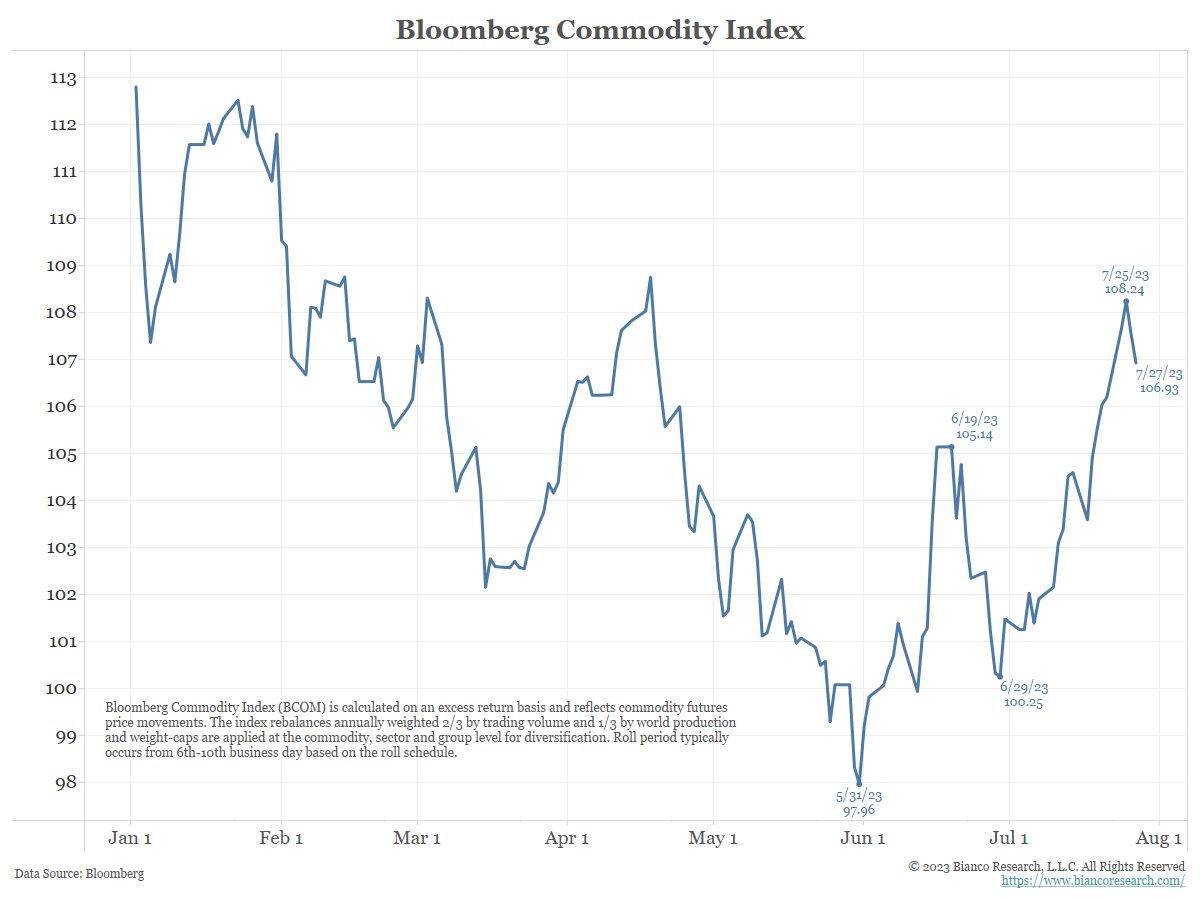

Another reason US yields are surging is commodity prices are surging. This is fueling inflation worries.

The Bloomberg Commodity Index is up ~7% in July.

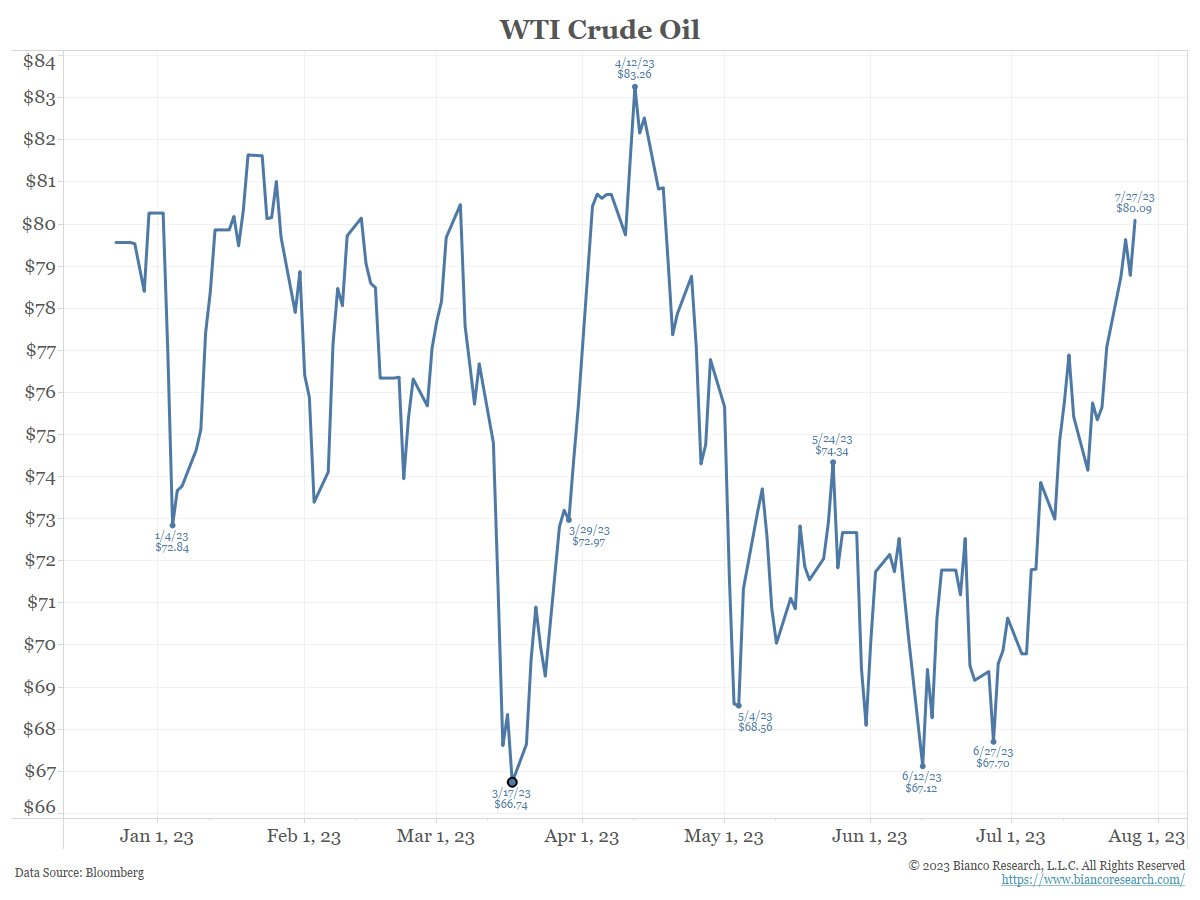

And Crude oil has awoken from its slumber. WTI is back above $80 for the first time since April.

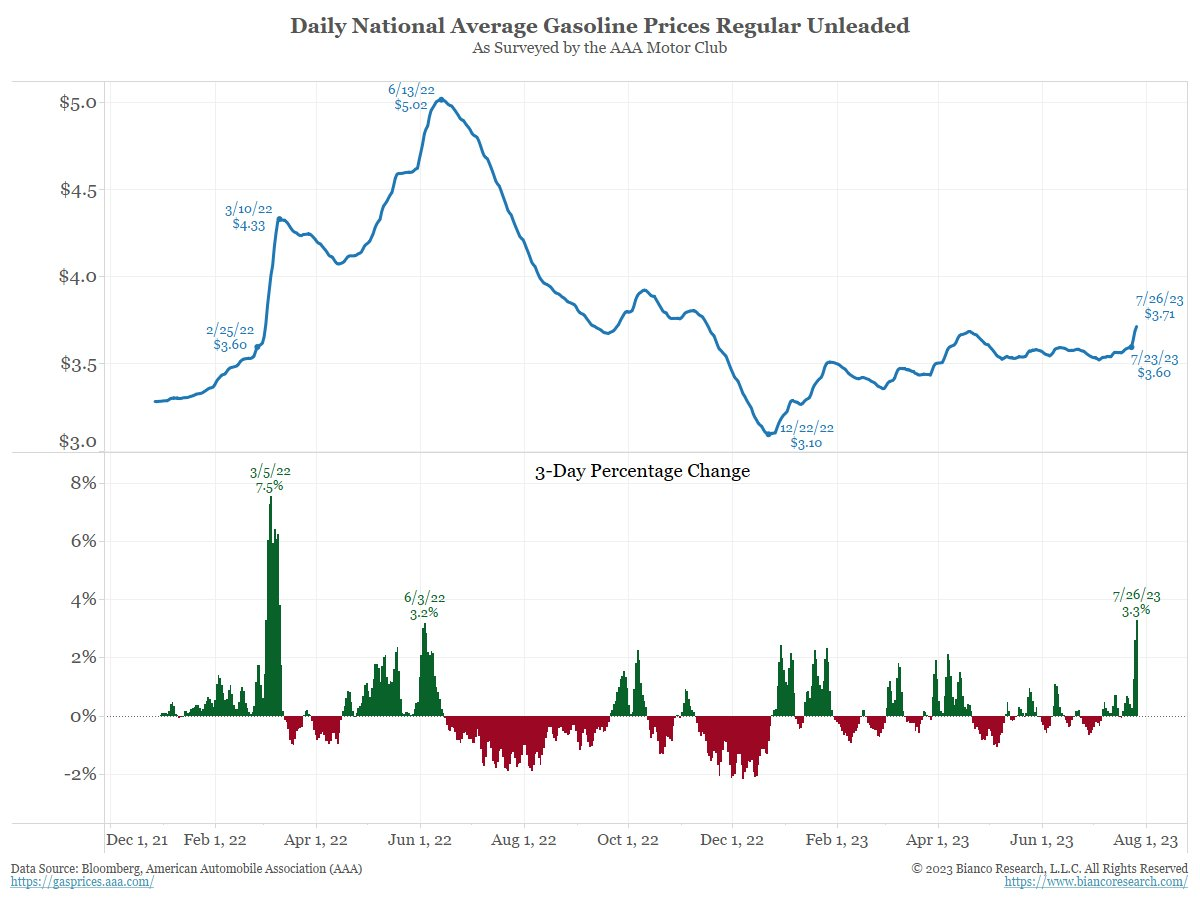

And, what has to be causing ingestion in both the White House and Fed. The nat'l avg of gas prices has surged by 11 cents, or 3.3%, IN THE LAST 3 DAYS.

This is the biggest 3-day percentage rise in gasoline prices since March 2022 ... the month after the Ukraine war began.

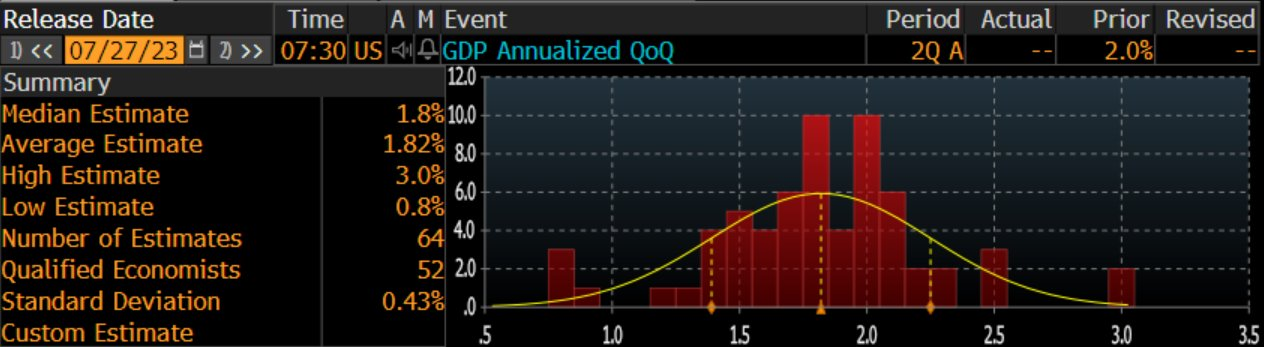

Finally, on the economic front, Q2 GDP handily beat the 1.8% consensus guess with a 2.4% reading.

Of 52 economist estimates, 2.4% was higher than all but five.

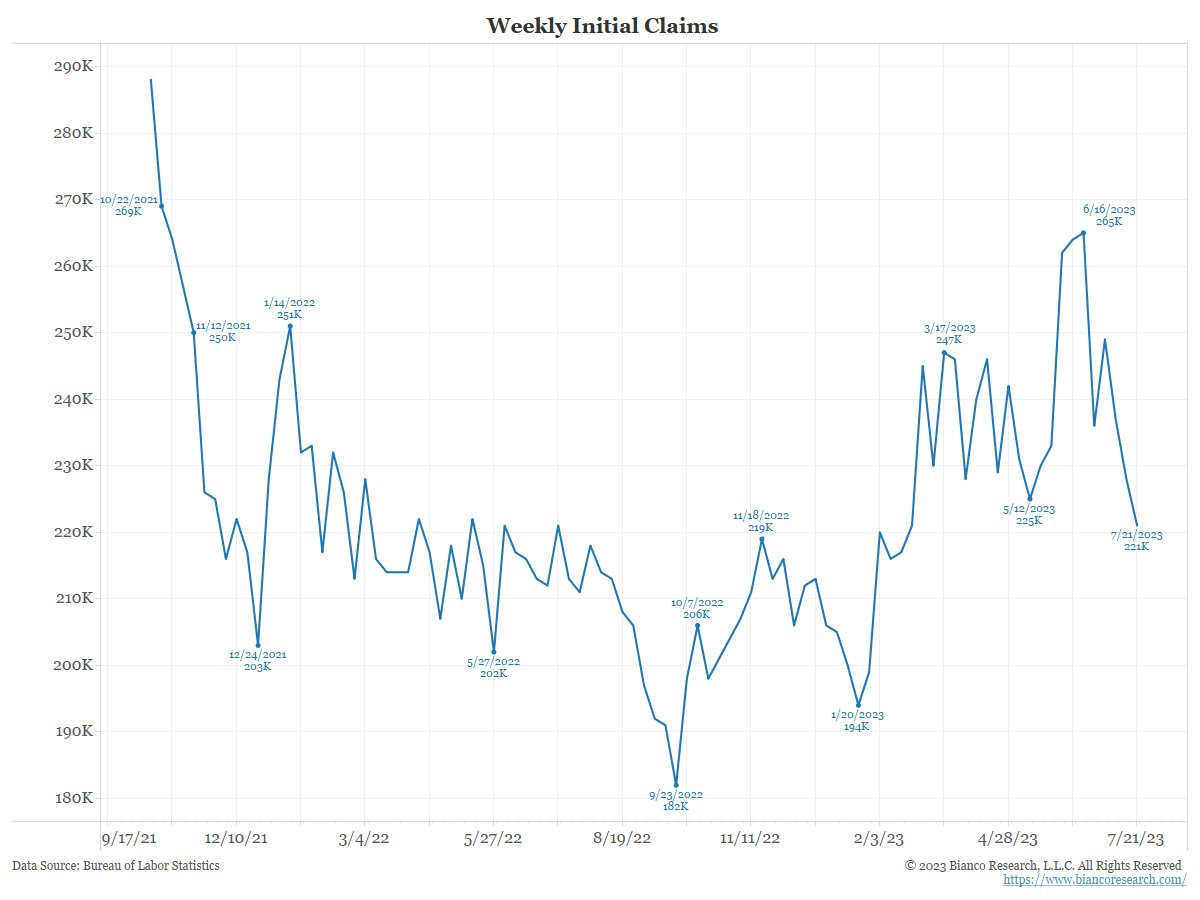

And initial claims for jobless benefits fell more than expected to 221k.

Claims are now at their lowest level since February.

This looks more like a booming labor market, not one about to roll into a recession.

In sum, Treasury Yields are looking less attractive for the largest foreign buyer, commodities are surging, gas prices a popping higher, the economy is beating, and it looks like more growth and not recession for jobs.

Bond yields are responding appropriately. 🚀

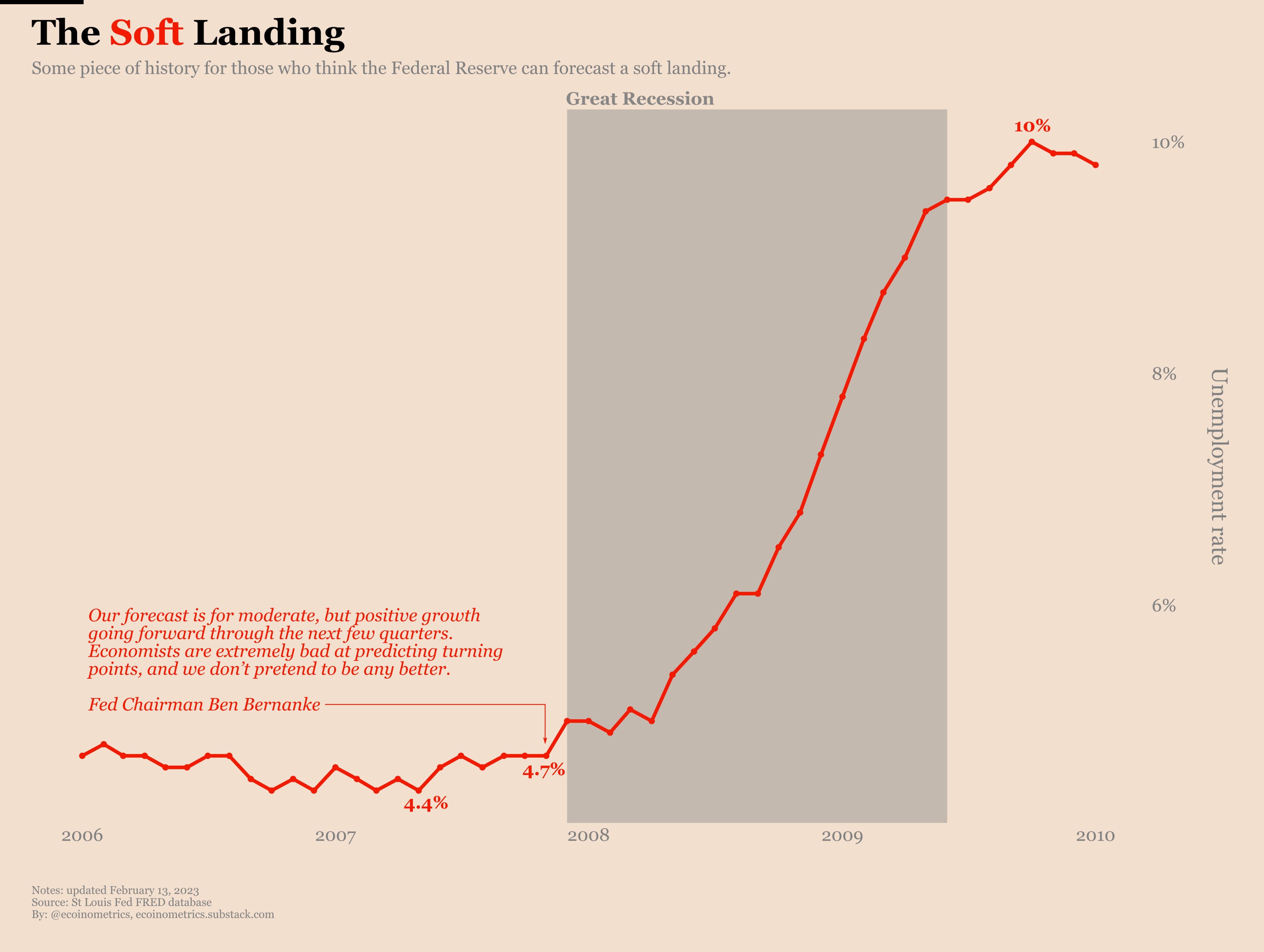

Soft Landing

“The Fed’s Staff believes the US will avoid a recession in 2023.”

Fed Chair Jerome Powell, July 2023

“Our forecast is for moderate, but positive growth going forward through the next few quarters.”

Fed Chair Ben Bernanke, December 2007

Oil

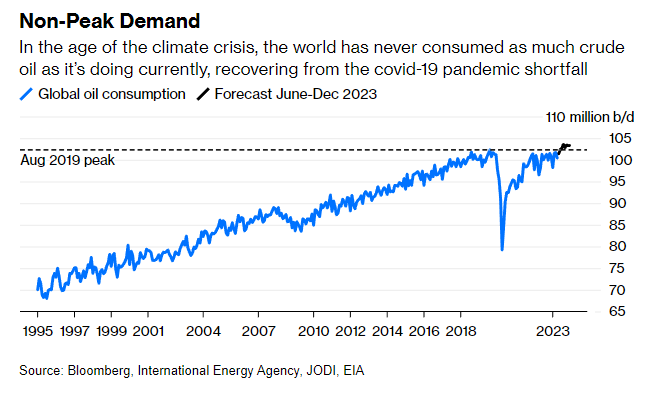

The world is consuming a record amount of crude, despite talk of shifting away from the fuel. "We use enough crude to fill about 6,500 Olympic-size swimming pools every day"

Source Tweet - Lisa Abramowicz

Bloomberg - The Harsh Truth: We're Using More Oil Than Ever

Russia Oil

Fantastic report by Reuters on Russia's new trading arms delivering🛢️oil around the world through an opaque logistic involving as much as 3 different traders for just one cargo.

Between March and June, at least 40 middlemen, including companies with no prior record of involvement in the business, handled Russian oil. These new players allowed Moscow to keep crude and refined products exports around 6-8 million barrels per day (bpd) on average in 2023

In March-June 23, the top traders who bought russia 🛢️were:

UAE-based

Petroruss

Voliton

Demex Trading

Nestor Trading

Orion Energy

Hong Kong-based

Guron Trading

Bellatrix Energy

Covart Energy

Singapore-based

Patera

The emerging companies have played a key role in keeping russia oil exports moving, allowing leading crude producers such as Rosneft, Lukoil, Surgutneftegaz and Gazprom Neft to divert increasing volumes of oil to India and China.

Source Tweet - Francesco Sassi

Insight: Obscure traders ship half Russia's oil exports to India, China after sanctions

Coal

And another harsh truth: global coal demand rose to an all-time high in 2022, and it's likely to rise further in 2023, setting a fresh record high (via today's @IEA update)

Source Tweet - Javier Blas

Global coal demand set to remain at record levels in 2023

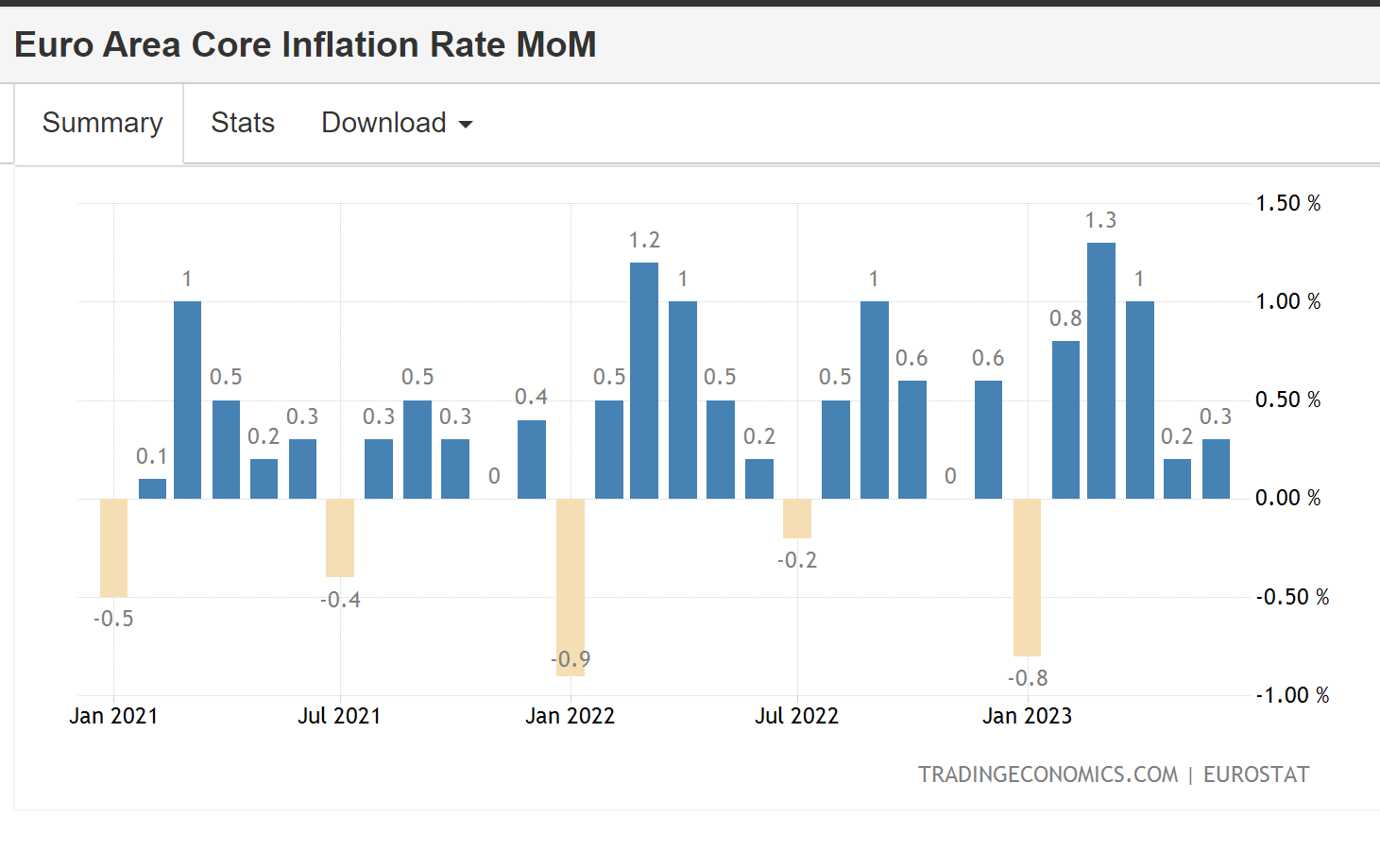

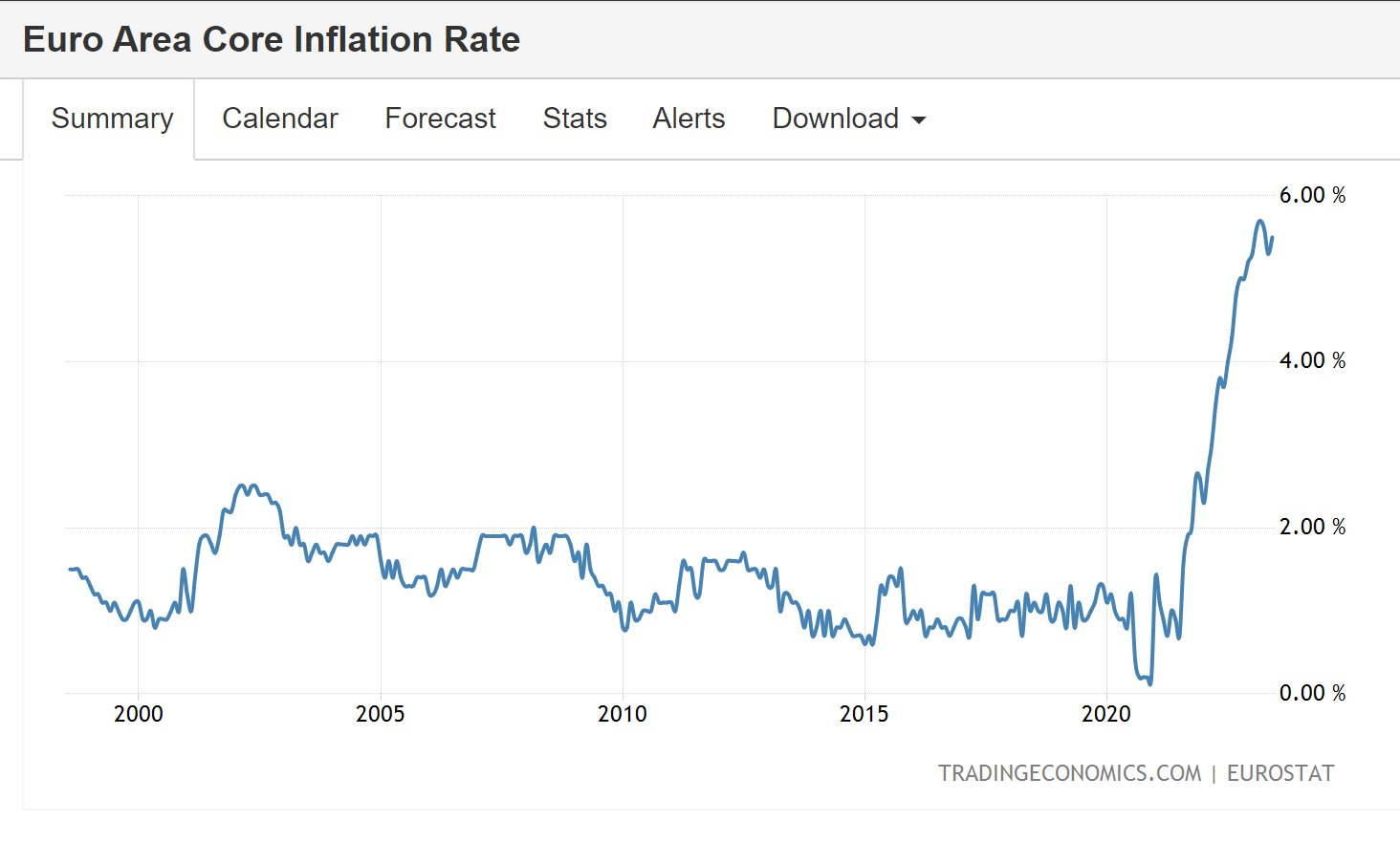

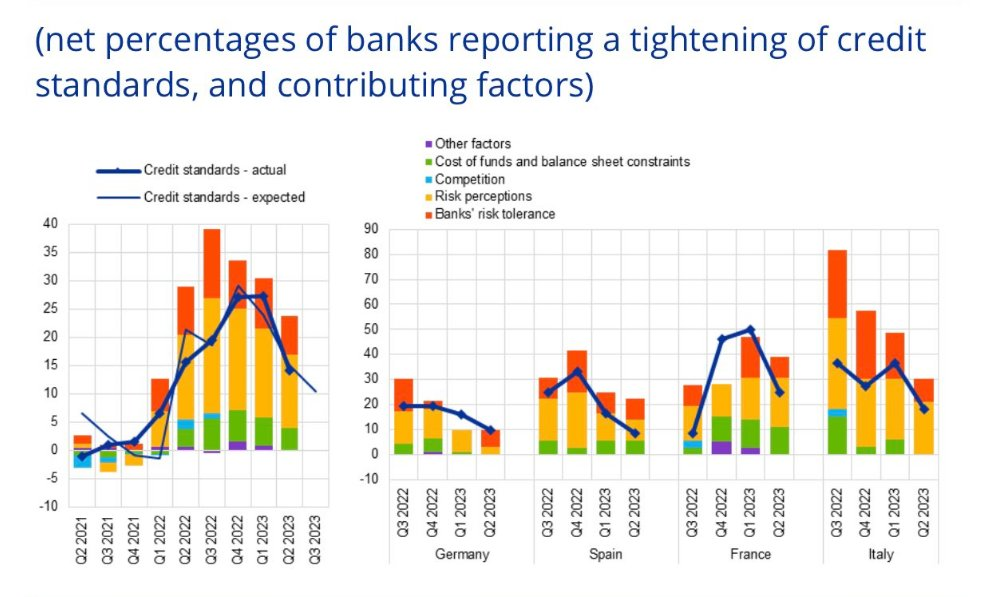

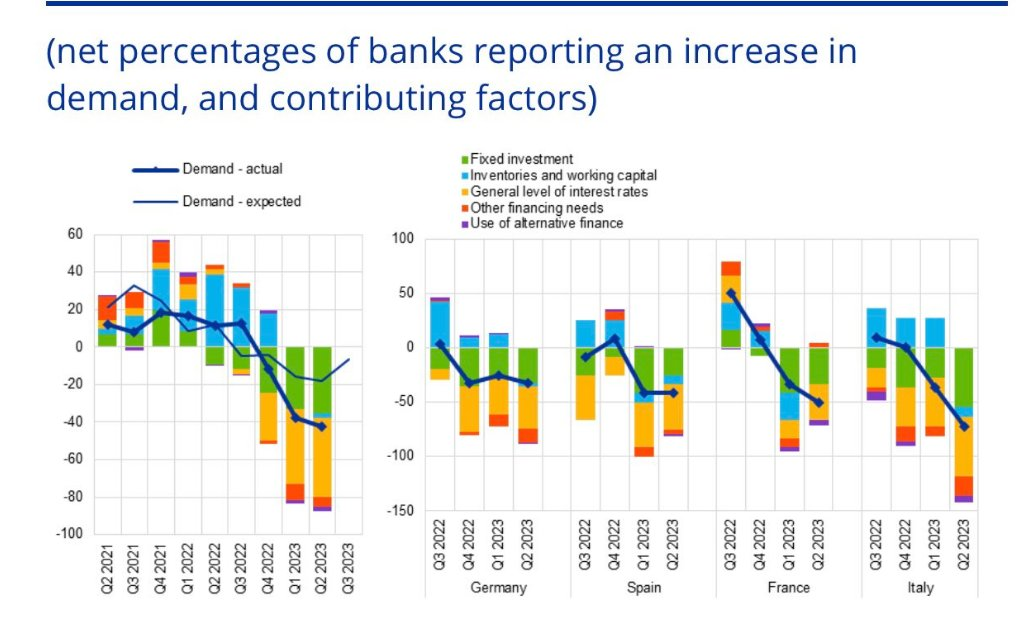

ECB

The ECB in many ways is ahead of the Fed with the efforts made now slowing growth across the region.

The question is whether it is soft enough to bring inflation down to target soon. So far, not all that much progress.

Monthly core not showing stability at high levels

While the ECB may point to progress slowing aspects of the region's economy their mandate is inflation durably at 2%.

Right now its running in the 5s and not clearly trending down.

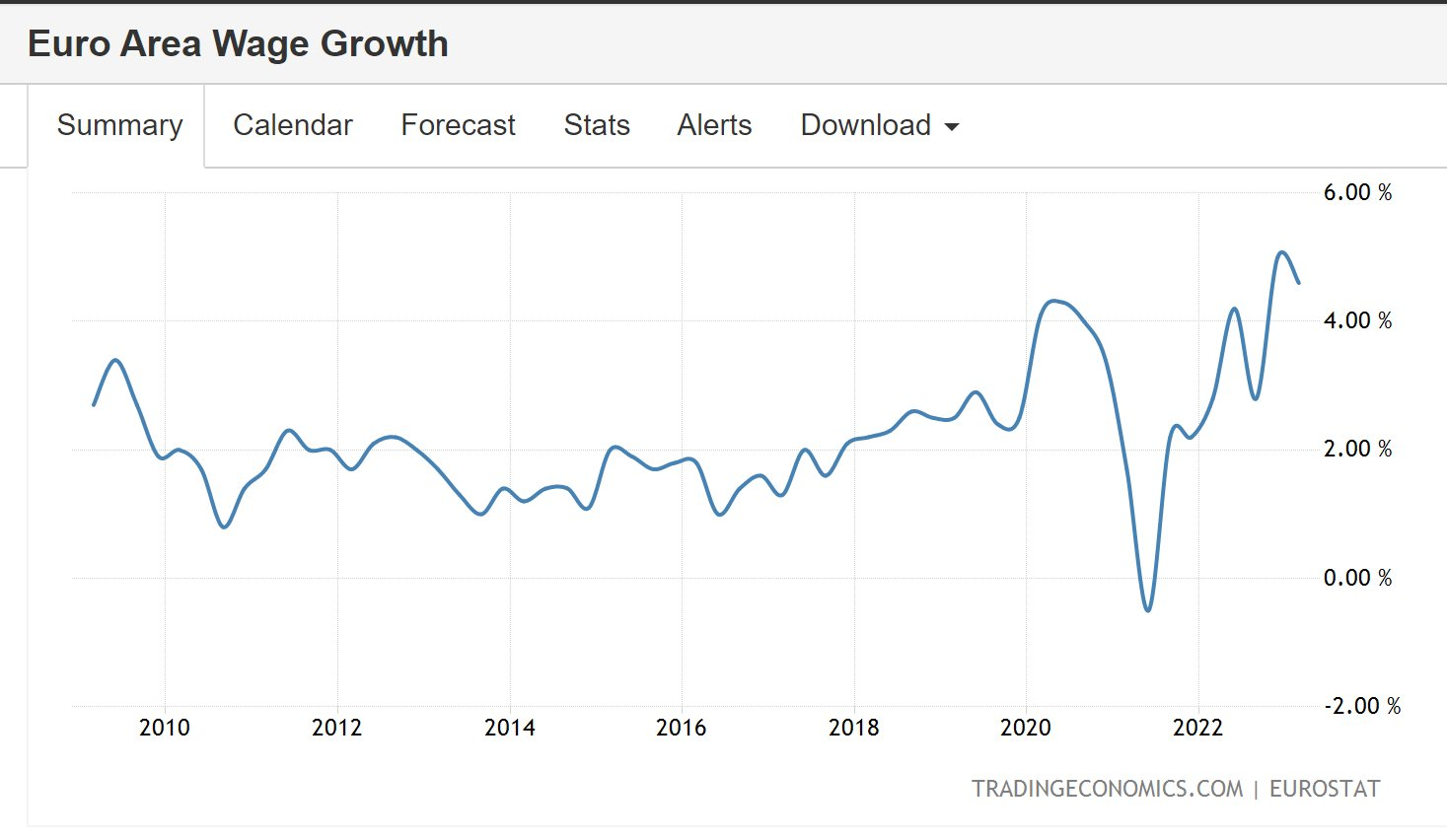

While there is a lot of focus on the credit side with the credit survey, etc. the thing that is driving continued inflation in the eurozone is elevated wage growth which is running around 5%. Its a little out of date but havent seen labor market deterioration since.

That persists because unemployment continues to be at secular lows

If the ECB stops here they are putting a lot of hope on the slowing of credit creating a compounding drag on the economy that is enough to soften labor markets fast.

But what is driving it is important, standards on the margin are getting better, not worse

Credit is slowing because demand for credit is slowing. And demand for credit can be soft when income growth is doing ok because demand & investment can be financed by elevated nominal incomes (for HH and biz).

Of course credit slowing will have some drag on the economy, thats not a question. The question is how fast will it be able to slow economic conditions.

Standards have been tight for a year and demand has been weak for a couple quarters. But no dent on the labor market.

Cutting against that is the fact that each month that passes wage growth and inflation becomes more entrenched.

Its a race to slow down the economy to slow inflation vs that entrenchment. And the ECB is not winning with core inflation running stable in the 5% level.

Of course this meeting was a given. The question is will it be one more and done. Touching a terminal rate of 4.5% and then a swift shift to cuts? [Reference 1]

And longer out German 2s continue to sit at right around 3% suggesting pretty soft policy ahead.

The hope of a pause in the eurozone is even more unlikely than the Fed. The ECB has one mandate - bring inflation durably to 2%.

Core inflation is 5%. Labor markets are secularly tight. Real short-rates are negative. There is a lot more work to do and that is not px in.

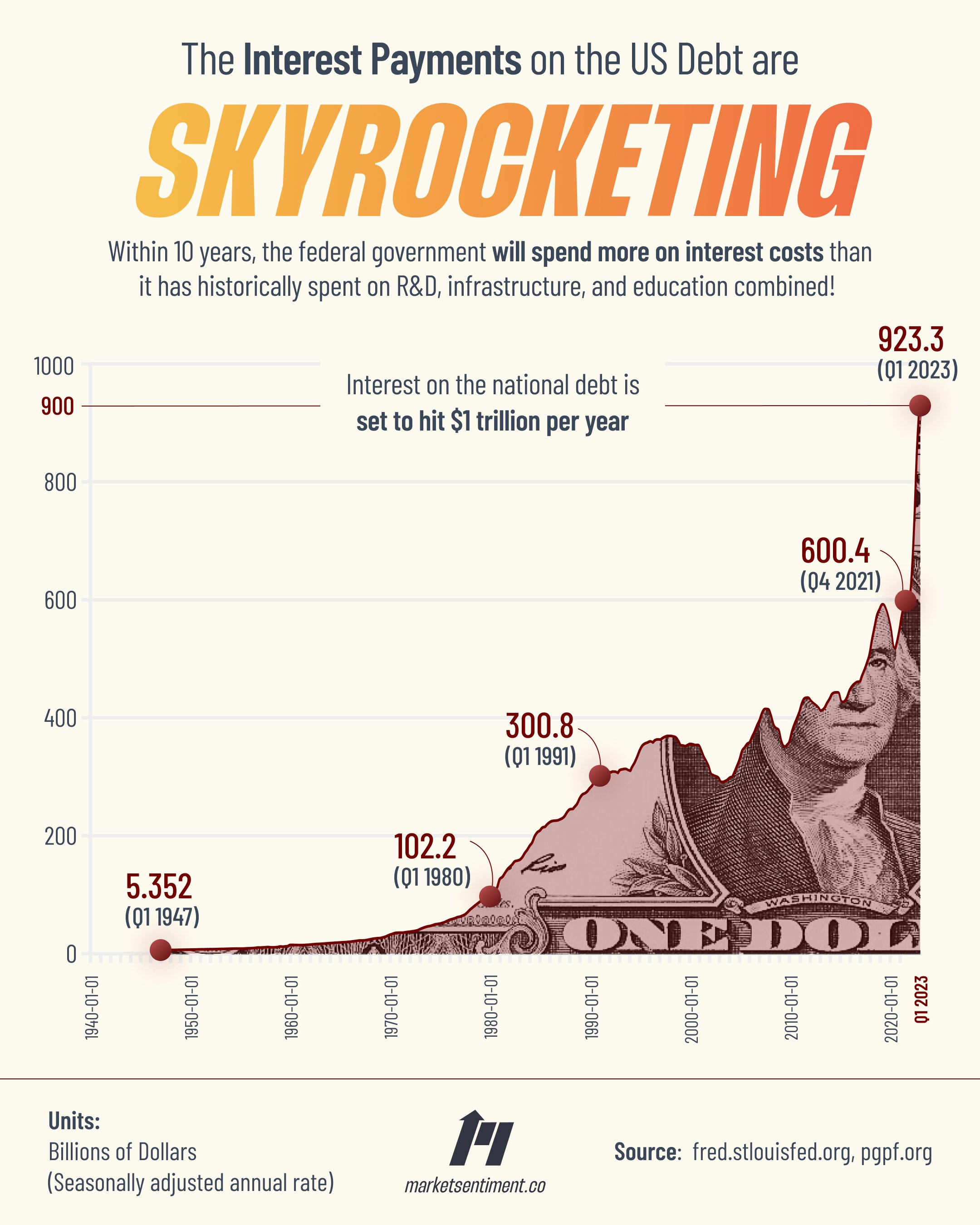

Debt

The Fed has approved yet another interest rate hike and we are now at the highest level in 2 decades.

Most are missing the real crisis that comes with increasing interest rates:

The interest on the national debt is set to hit $1 trillion annually (~$7,500 per household)

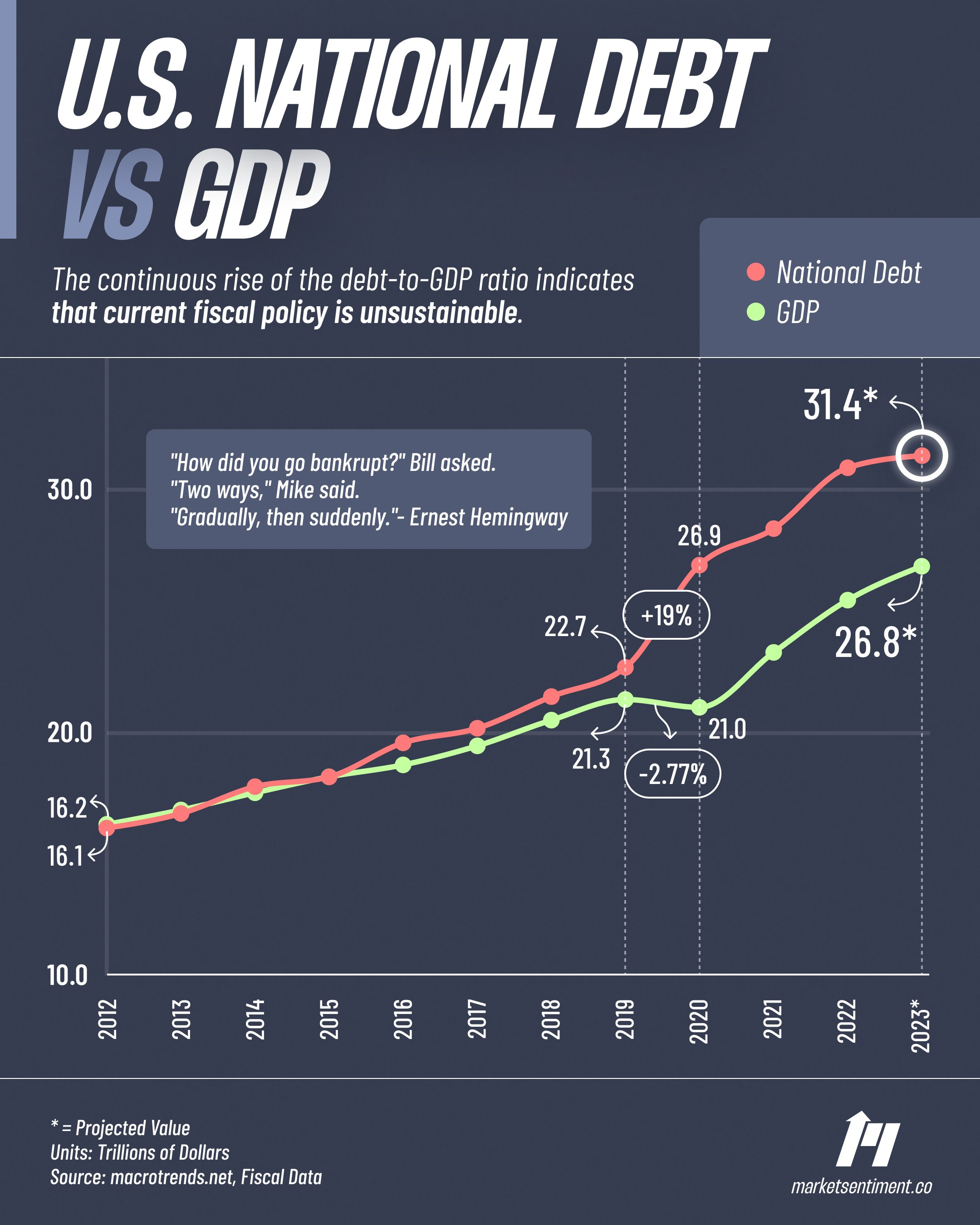

Adding fuel to this fire is the ever-increasing national debt.

It has outpaced the GDP growth for the past few years.

It's not the deficit that's the issue.

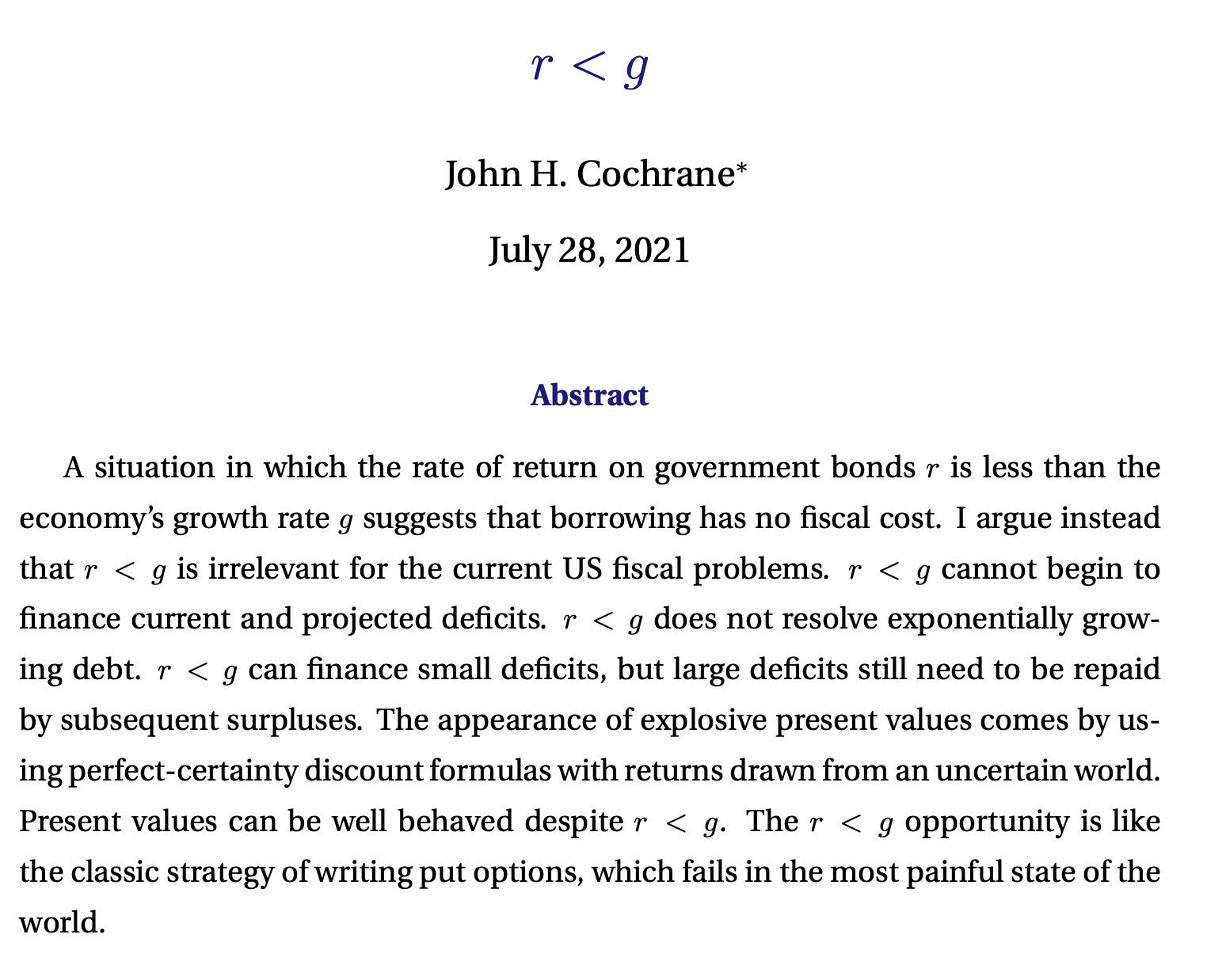

If the country is growing at 5% and the rate of return on Bonds is only 2%, then the country can run a 3% deficit forever without increasing the debt/GDP ratio.

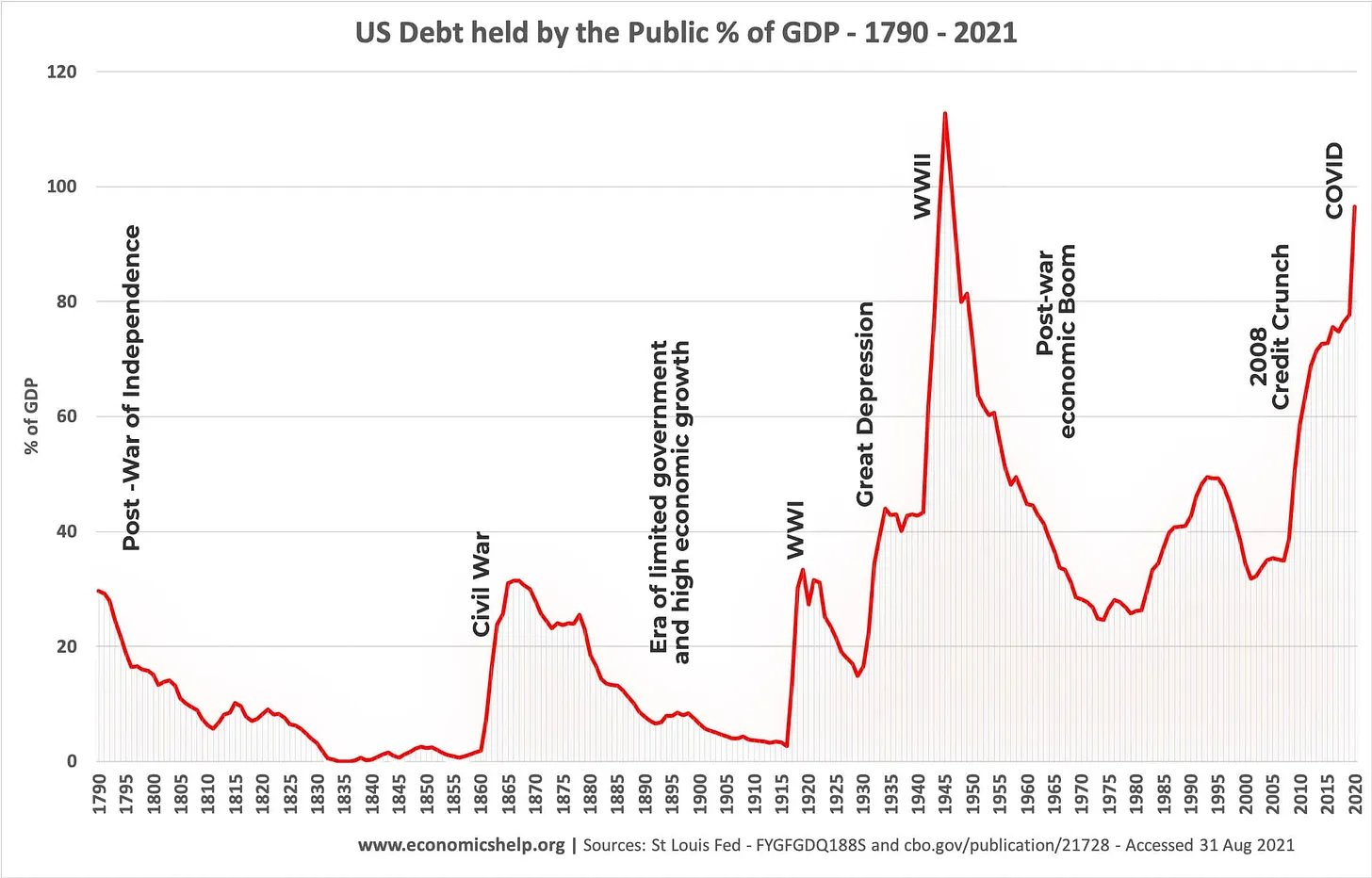

The U.S. was a classic example when it was successfully able to reduce the debt even while running a deficit just after World War 2 with extremely high tax rates and a massive post-war growth boom that accelerated our GDP.

The problem with this approach is that it only works when everything is going well.

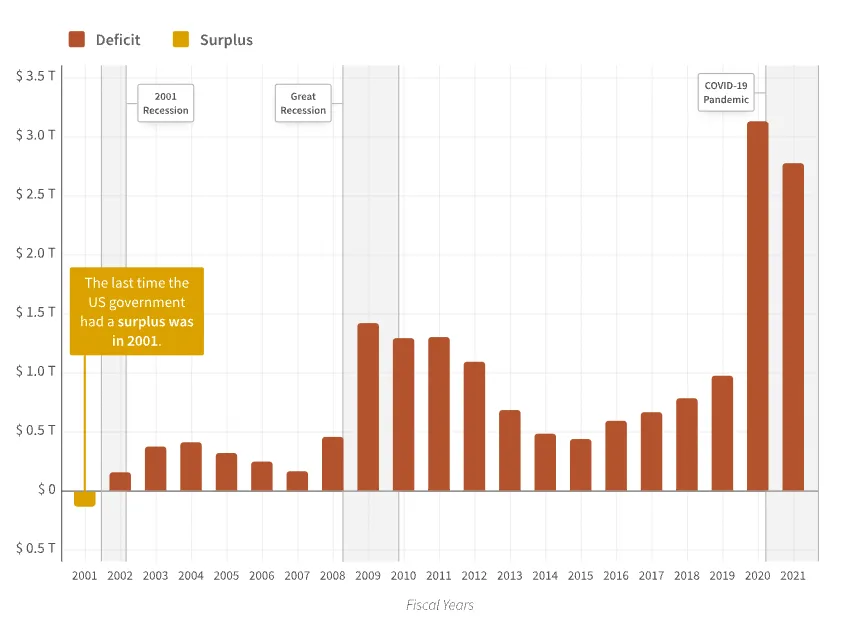

In the last 2 decades, the US has never run a surplus (even in the good times) and when a recession inevitably occurs, we have to run more deficits to stimulate spending.

With the Fed hiking interest rates, we are increasing the rate of return of the bonds, which will cause overall interest payments on our debt to rise.

This is pushing us into a debt crisis where we have to prioritize interest payments over Infrastructure, SS, Healthcare, etc.

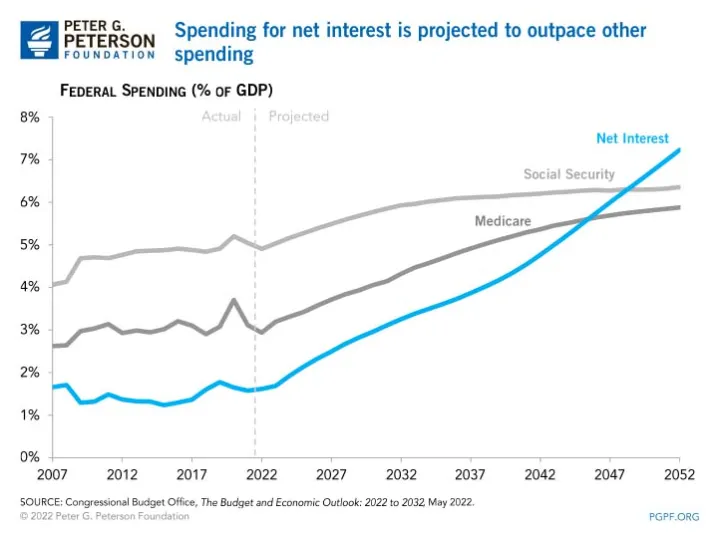

This exact scenario is currently projected by the Congressional Budget Office.

Interest payment on the debt is projected to surpass both Medicare and Social Security by 2049.

Here's @RayDalio warning us that if we continue on the current debt growth, eventually there would be no more buyers for the U.S. Debt. [Video]

Source Tweet - Market Sentiment

Gold

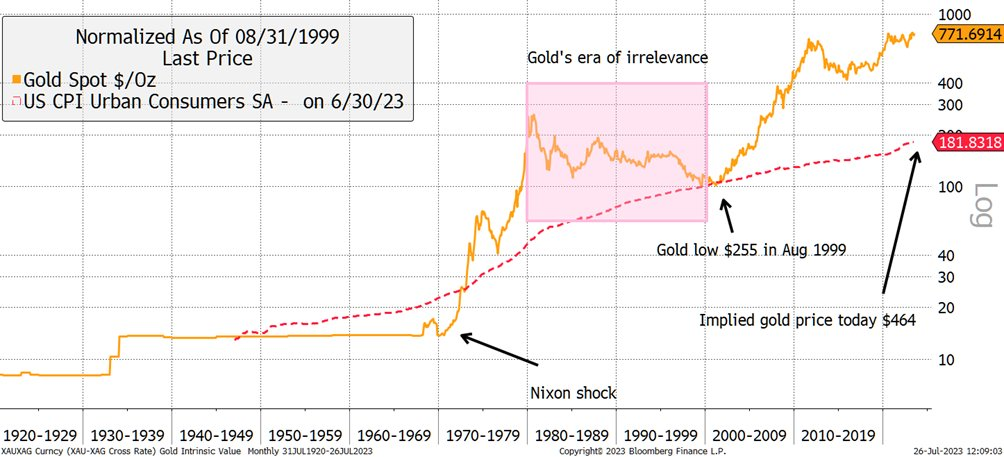

Since it's a rare commodity, #gold has intrinsic value. But even if it wasn't rare, it would still have intrinsic value, just less than it currently does.

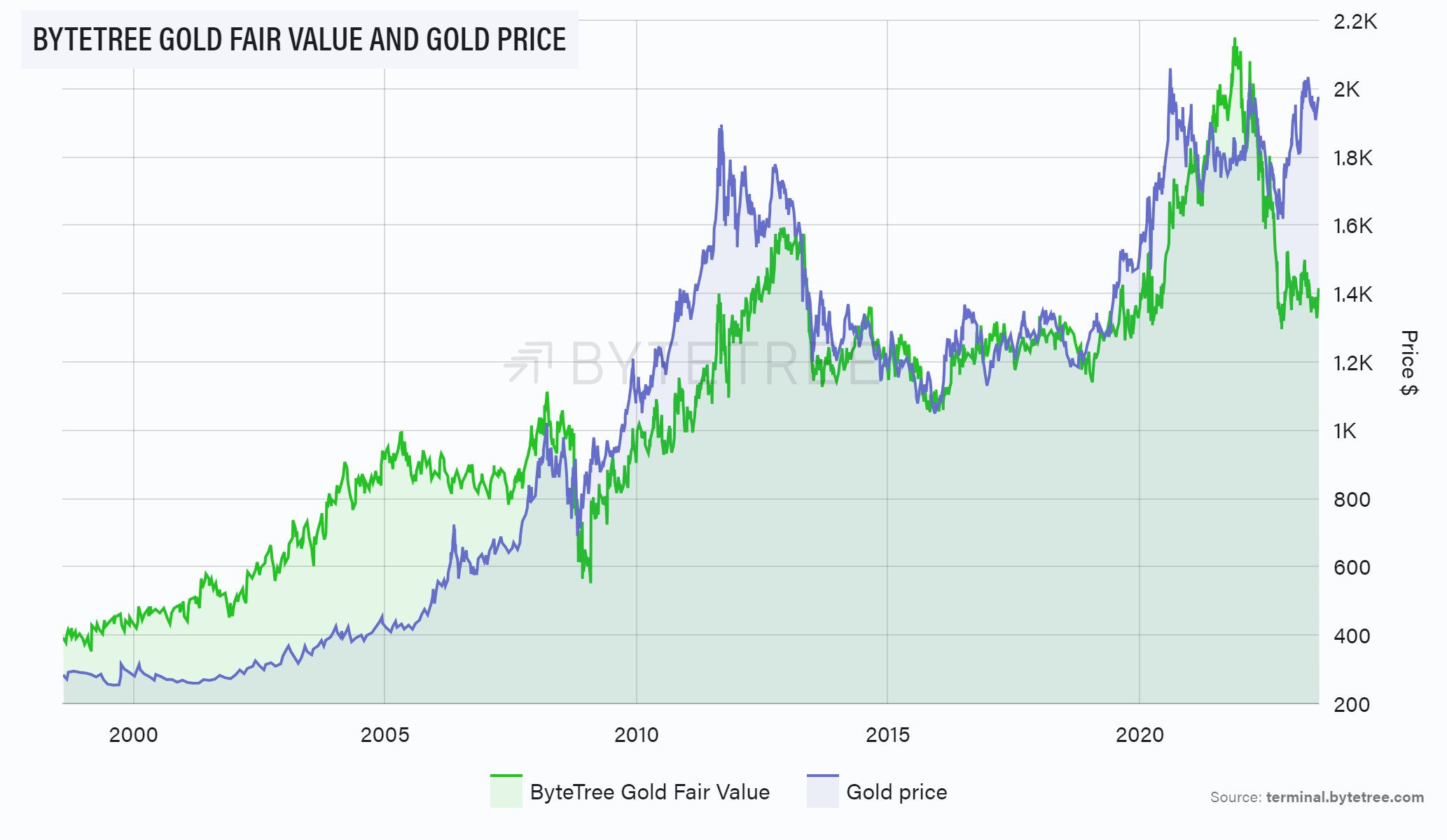

So that begs the question, how much of the #goldprice reflects its intrinsic value, and how much is something else?

I believe the #goldprice is made up of parts, one of which is the intrinsic value of the metal, probably linked to #commodities, while there is an additional monetary value sitting on top.

This is derived from gold’s global role as a financial backstop and the vast liquidity that goes with the territory. #Gold provides insurance against the failure of the financial system, which just so happens to be an #inflation hedge to boot.

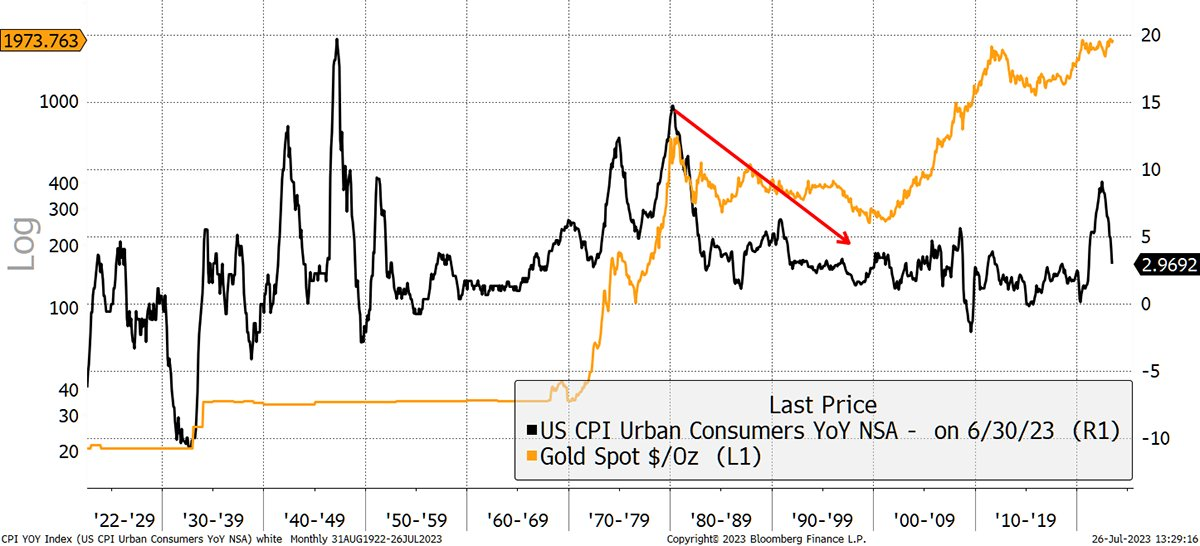

Prior to 1971, as you all know, #gold had a formal role in the financial system for centuries. Then in 1971, as modern communication technology enabled, Nixon took the dollar off the gold standard, paving the way for the system of fiat currencies that followed.

In 1971, gold was significantly undervalued as the price vs the dollar hadn’t been adjusted since the 1930s while #inflation marched on. The price soared, buoyed by the bursts of inflation throughout the 1970s. By 1980, inflation had peaked, and gold’s job was done.

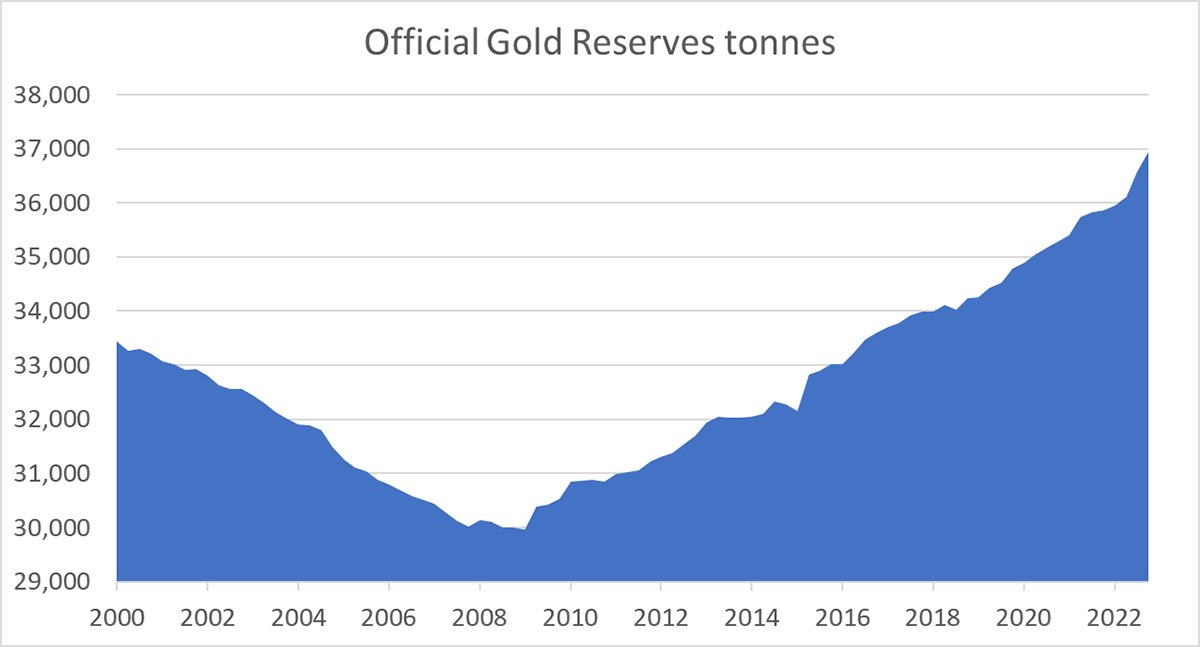

For the next two decades, the #fiat monetary system seemed to work well, at least in the developed world. #Gold spent the period in irrelevance. The central banks were queuing up to sell their gold in a somewhat orderly fashion.

This carried on until 2009, when mainly non-OECD nations restarted their #gold purchases in the aftermath of the global financial crisis. Since then, the central banks have been increasing their holdings and never more so since the Russian invasion of Ukraine.

The remarkable thing is that the gold standard withered in the 1970s, and other than the recent rumors surrounding a gold-backed BRICS currency, there has been no official need for central banks to own #gold. They do so out of choice.

Gold is once again relevant.

#Gold is a liquid inflation hedge, making it much more valuable than its simple physical form. There is a need for a lasting and growing monetary asset in an uncertain world, especially since 2008, when we discovered that banks were no longer a reliable choice for the economy.

If you agree that #gold has intrinsic value, with additional monetary value on top, then understanding why #Bitcoin has value becomes a whole lot clearer. Satoshi Nakamoto skipped the intrinsic bit and created a valuable network, which is a lasting moat.

ByteTree - Understanding Gold’s Intrinsic Value

Amazing summary in one Collection. A lot of effort each day to make something like this. Keep it up mate! Greetings from Europe from MiniMe!