Direxion BTC ETH ETF

Direxion just filed for a Bitcoin + Ether Futures ETF

SEC Now Ready ETH ETF?

SEC now ready to consider ETH futures ETFs, sources say — but what’s changed?

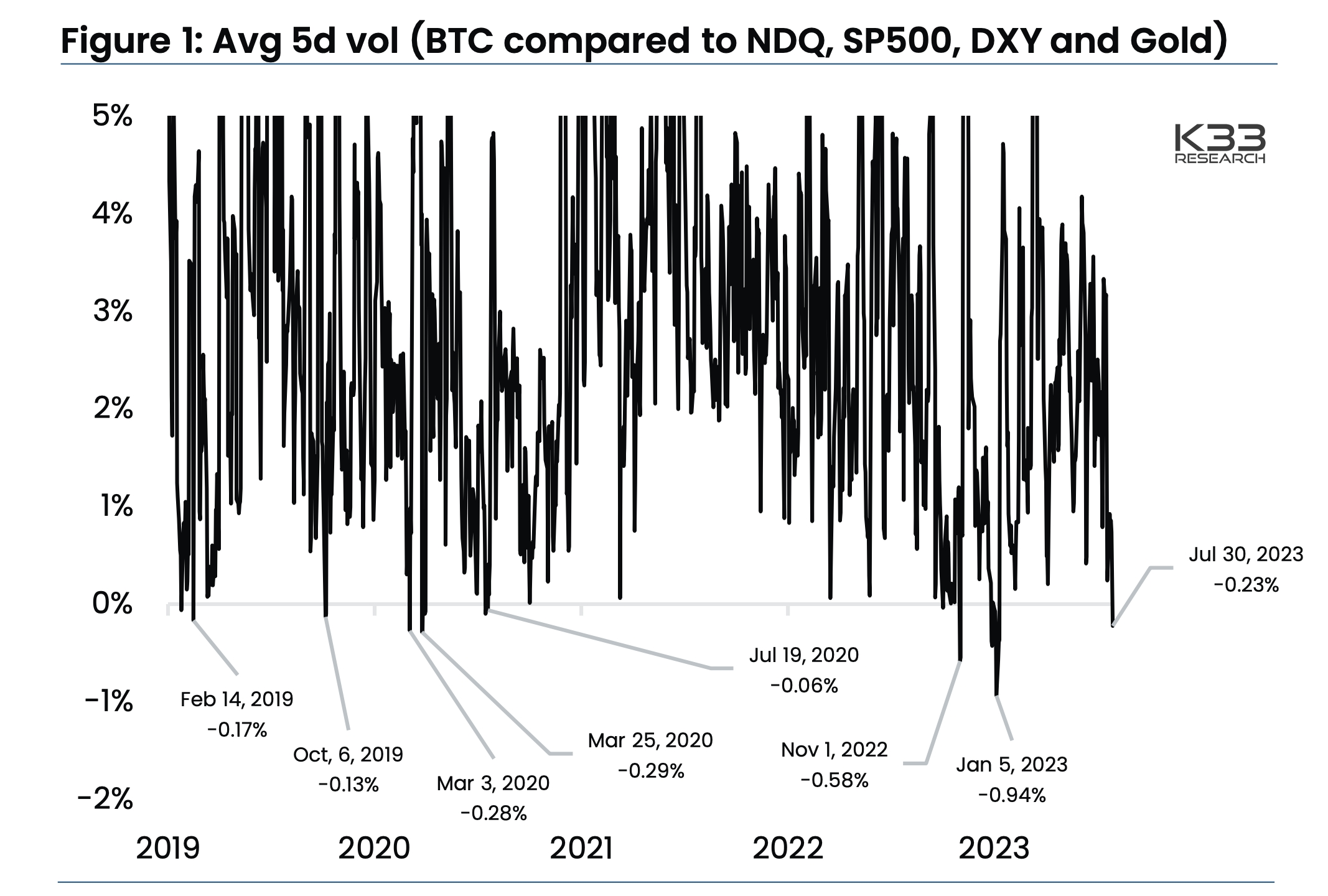

BTC 5day Volatility

Bitcoin’s current 5-day volatility is below that of major traditional assets like Nasdaq, S&P 500 and gold

DOJ

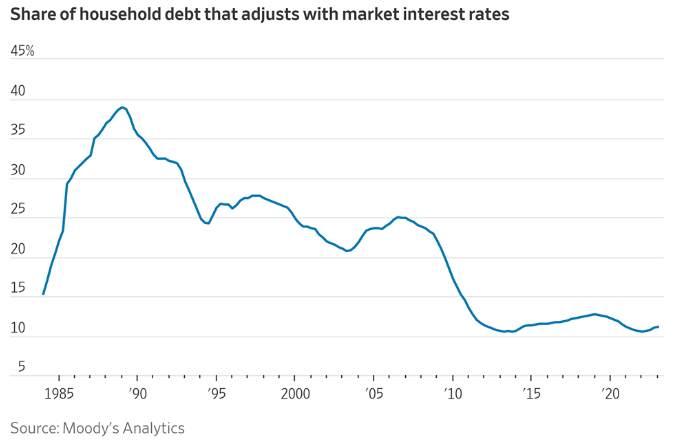

US Household Debt

Only 11% of US household debt has an adjustable interest rate, down from nearly 40% in the late 1980s. The many Americans locked into low fixed mortgage rates have not been impacted by the Fed's 11 rate hikes.

Source Tweet - Charlie Bilello

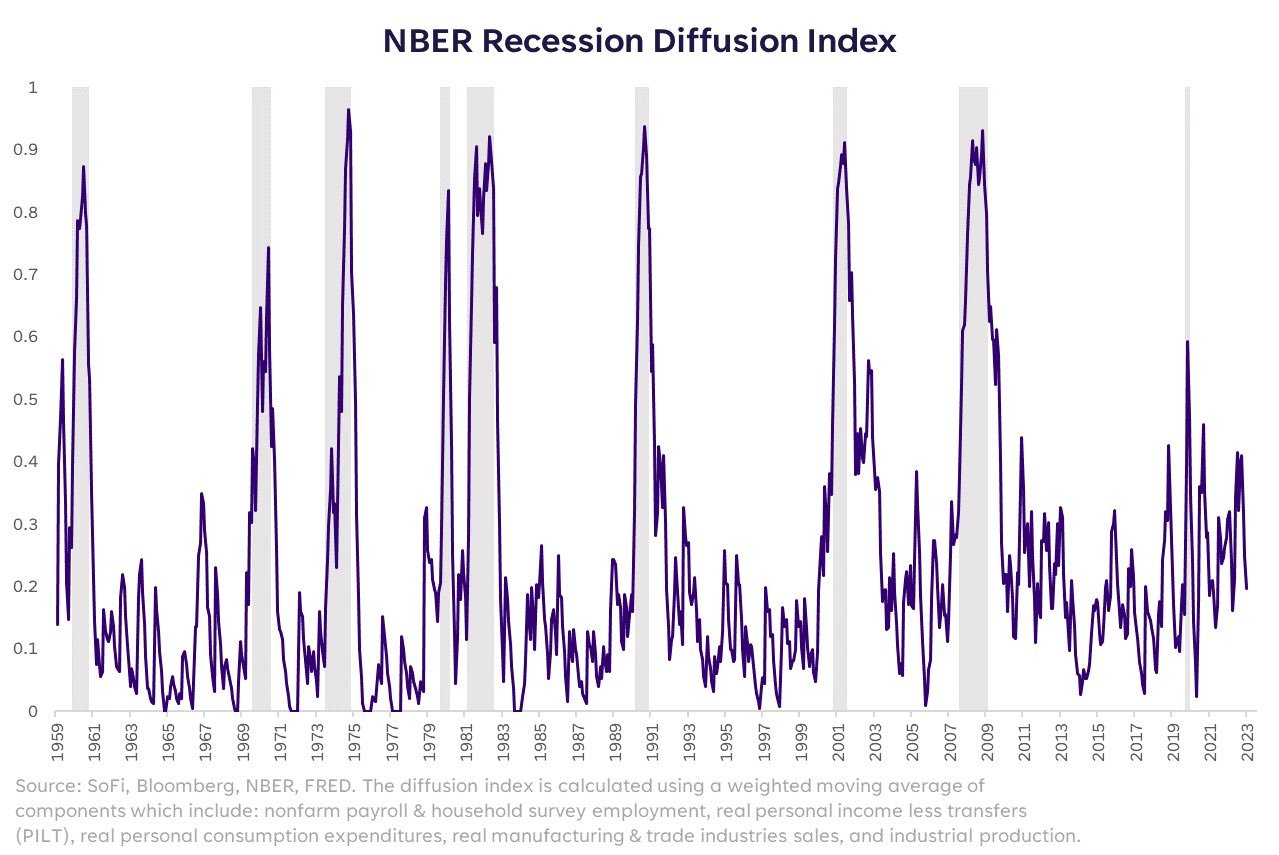

NBER Recession

A composite of variables that the NBER uses to make recession calls has improved over the last few months. Moreover, it never really got to the heights we've seen in most recessions (ex-Covid). It was a yellow light, currently leaning yellow-ish green? Time will tell🚦

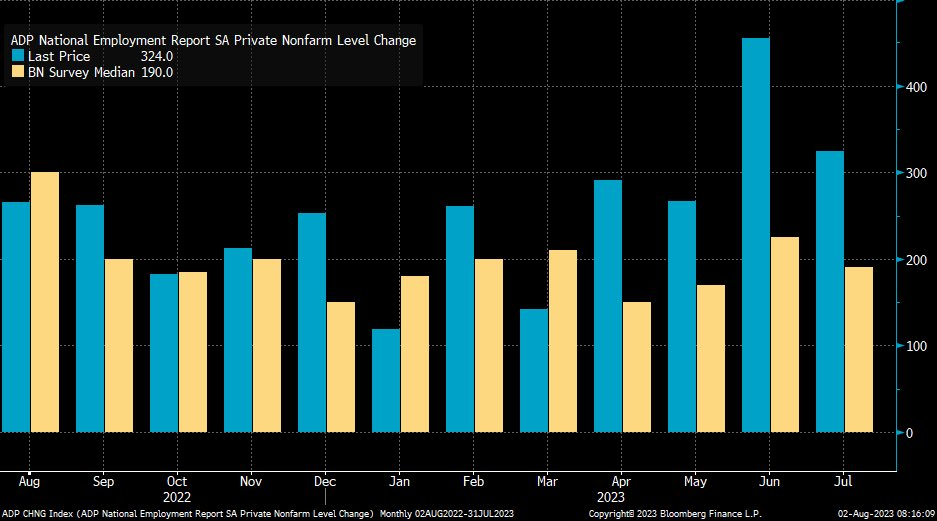

ADP

The ADP report says US firms added 324k jobs in July, a notable upside surprise from the est of 190k. While this hasn't tracked well with the official government jobs numbers, it's ADP's second-largest jobs added number in over a year.

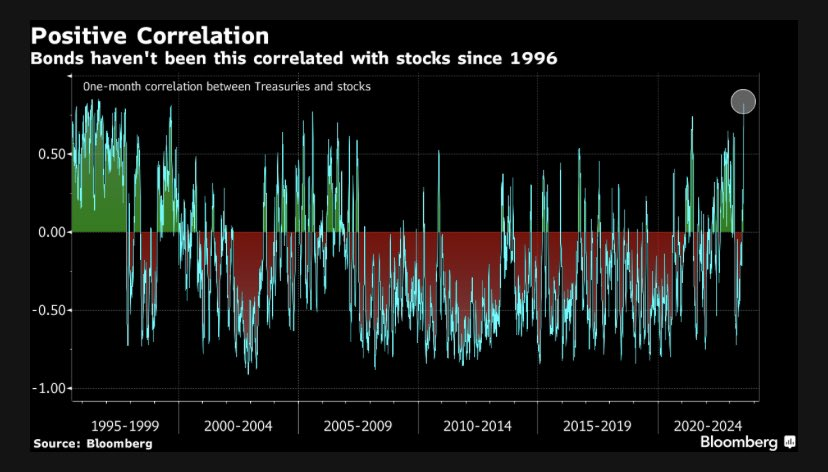

Treasuries/Stock

Treasuries haven’t been this ineffective as a stock hedge since the 1990s. The one-month correlation between the two assets is now at its highest reading since 1996.

Source Tweet - Lisa Abramowicz

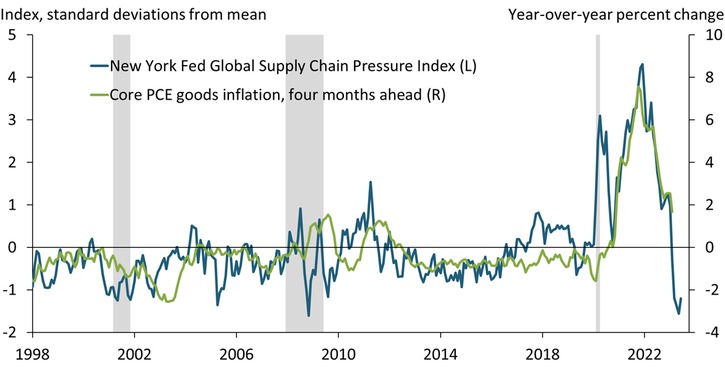

Goods Deflation

NEW: Research from the Kansas City Fed shows a tight relationship between the NY Fed's supply chain pressure index and core goods inflation

Changes in the supply index lead core goods inflation by 4 months

This implies additional goods deflation ahead

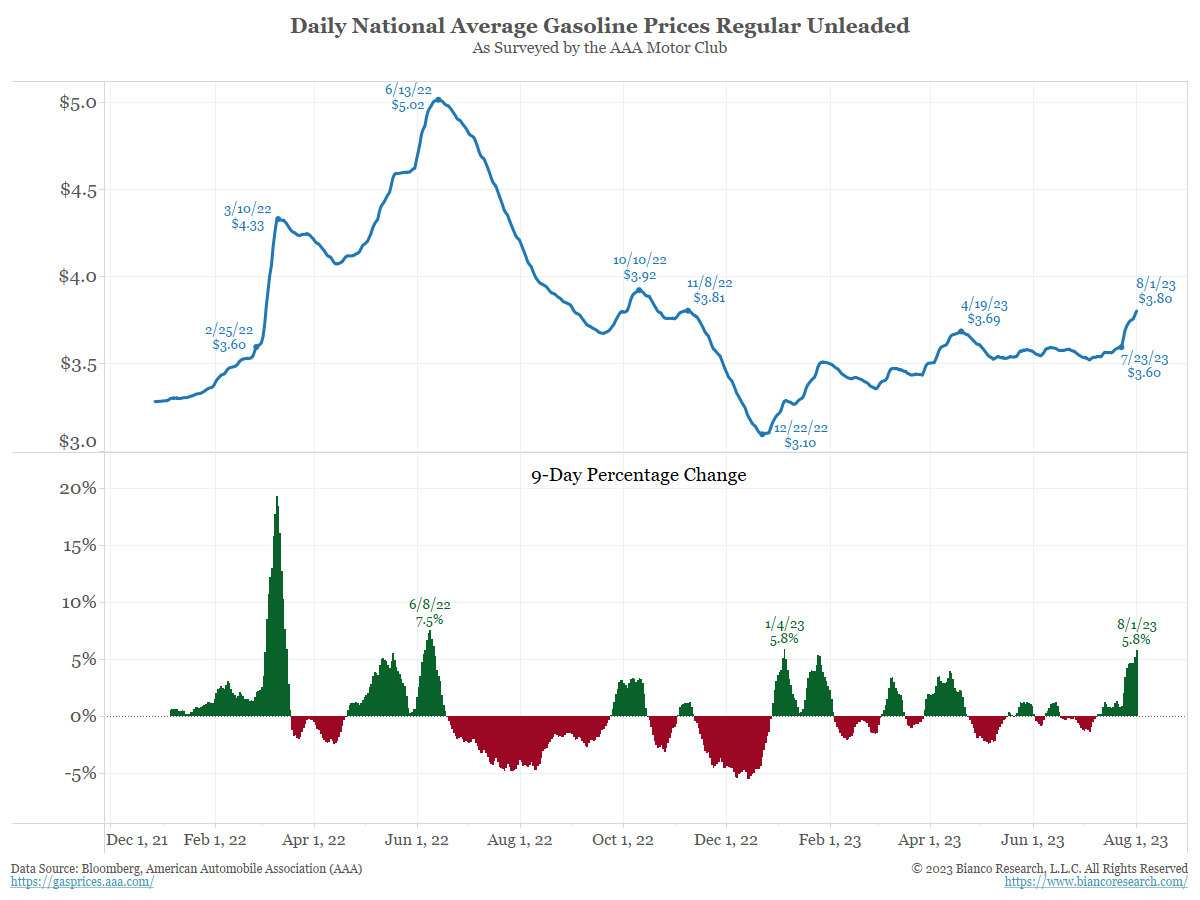

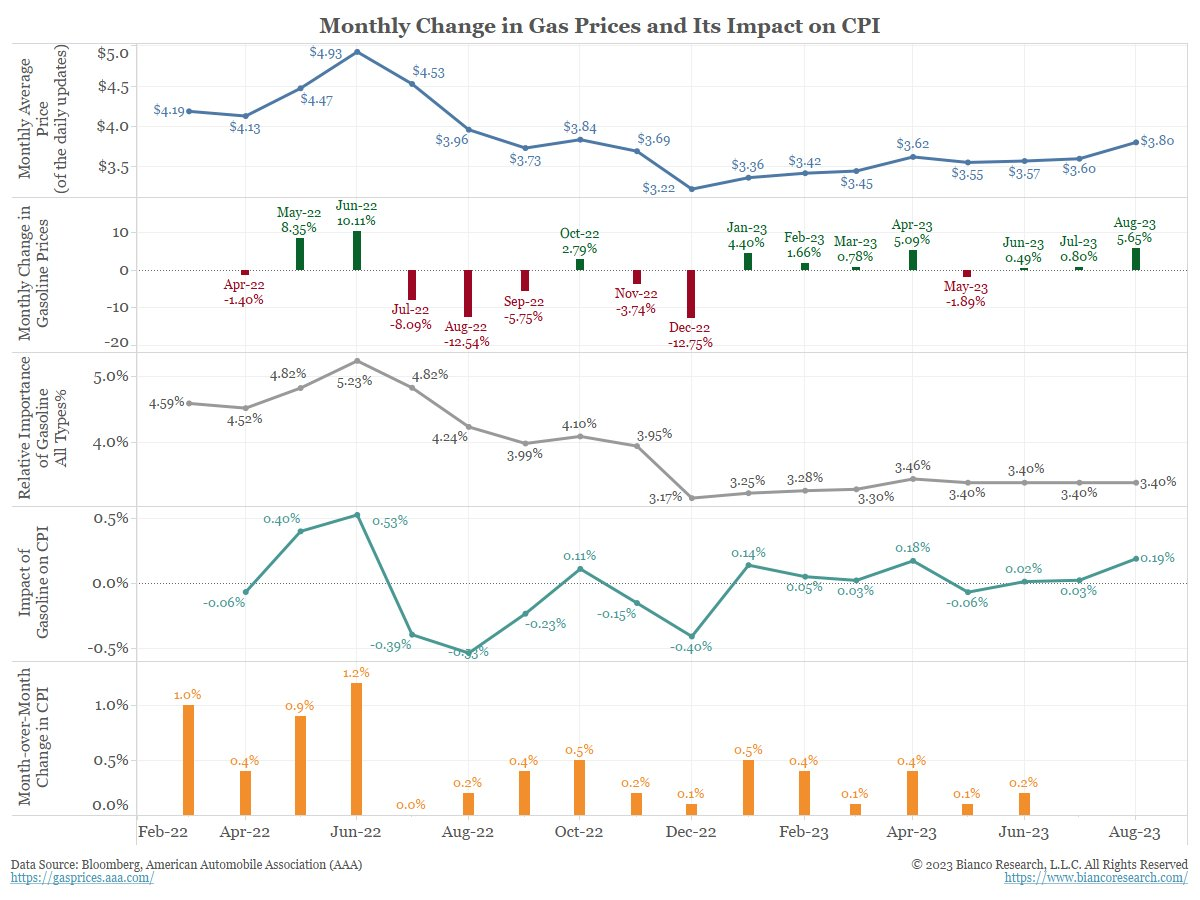

Gasoline CPI Impact

The national average of gasoline prices jumped another two cents yesterday to $3.80/gallon.

Over the last nine days, prices have jumped 5.8%. Equaling the January pop higher for the biggest such move since last November.

CPI impact?

The 4th panel shows the monthly price change (2nd panel) times the weight (3rd panel). If $3.80/g holds for the month, it adds 0.19% to CPI.

The bottom panel shows the monthly CPI. When gasoline adds at least 0.10% to CPI, headline CPI prints at least 0.4%.

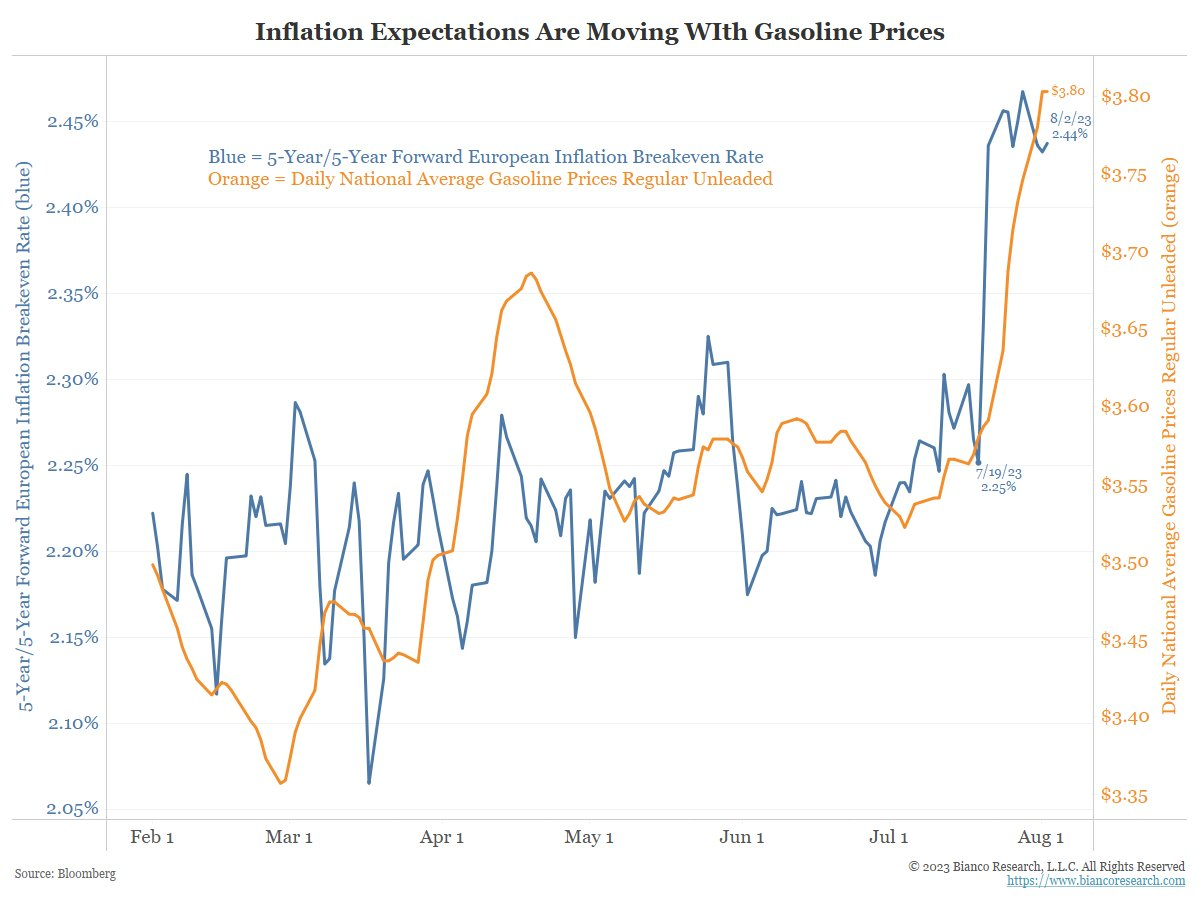

Have the markets noticed? Yes!

Since gasoline prices (orange) started popping higher on July 19, so has the 5-year/5-year inflation breakeven rate (blue).

The 5-year/5-year rate is what the Fed looks at as they believe it best measures inflation expectations.

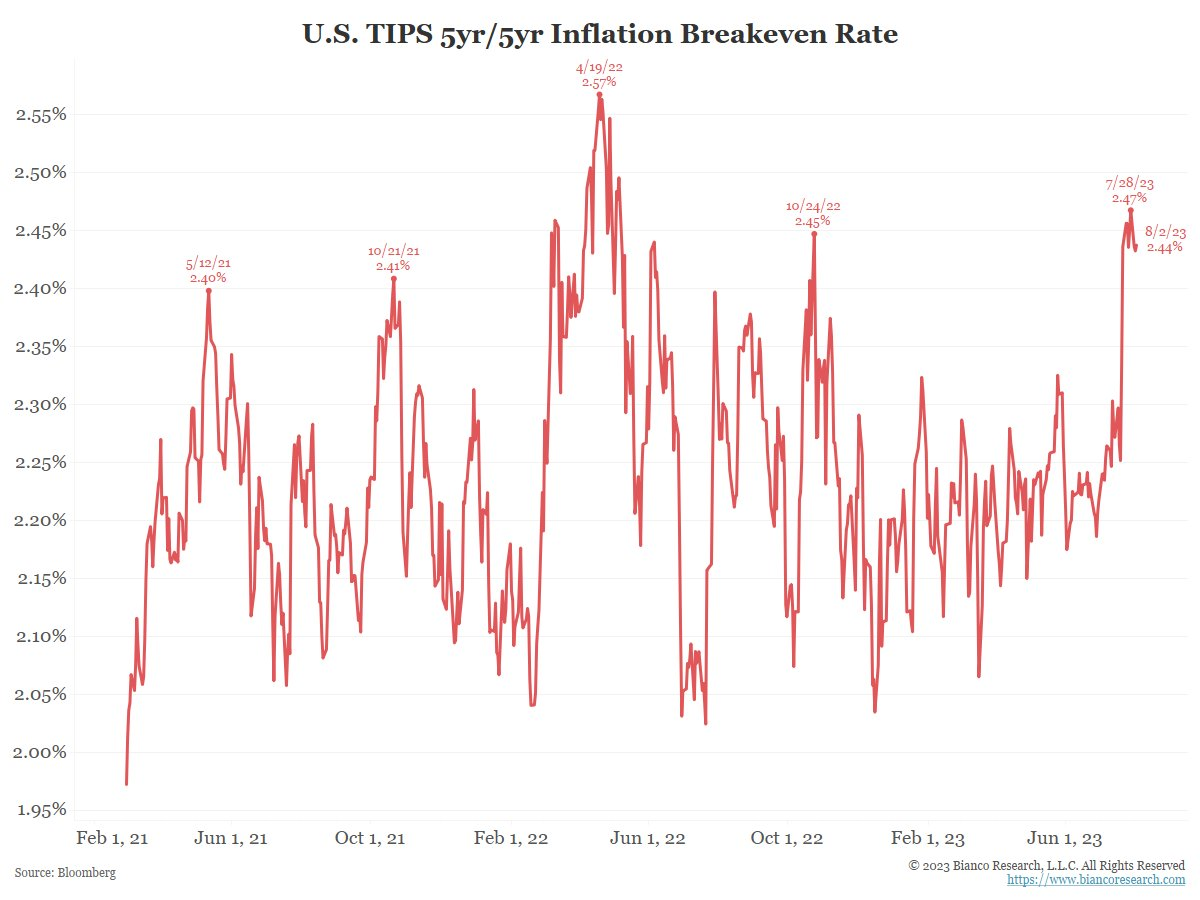

And it is surging to the highest level in over a year.

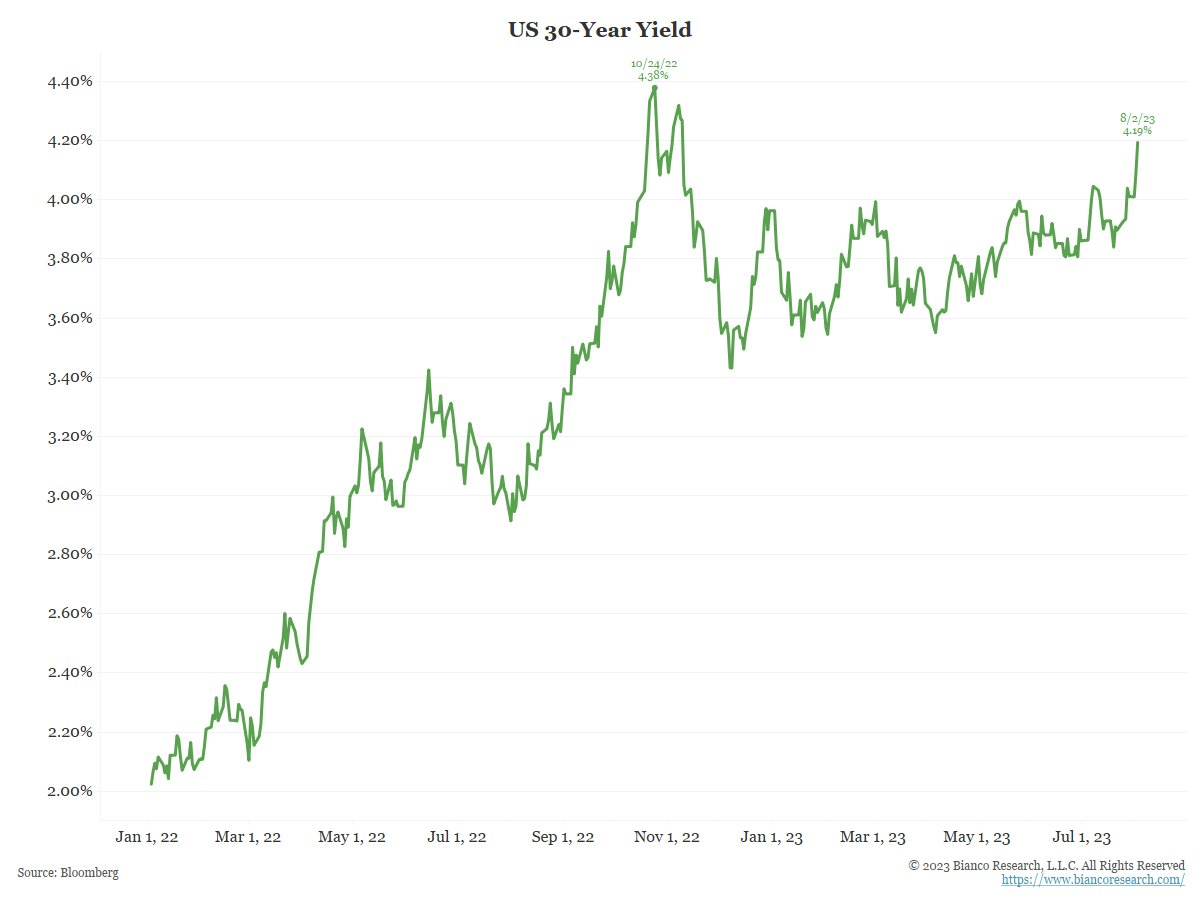

The 30-year push out to 4.19% as higher gasoline prices, greater inflation expectations, and more Treasury supply are coming.

*US TREASURY 30-YEAR YIELD RISES 10 BASIS POINTS ON DAY TO 4.19%

유익한 글이었습니다.