Crypto Opitons

Block trades continue to maintain high levels of turnover, with BTC and ETH's block trades maintaining a 40%+ share of turnover today.

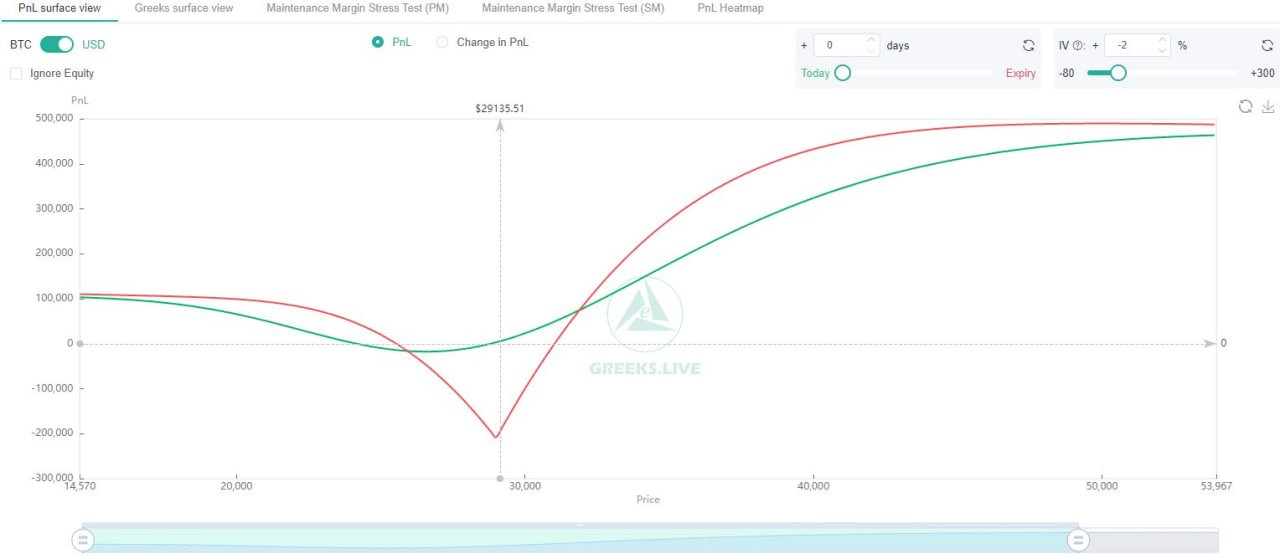

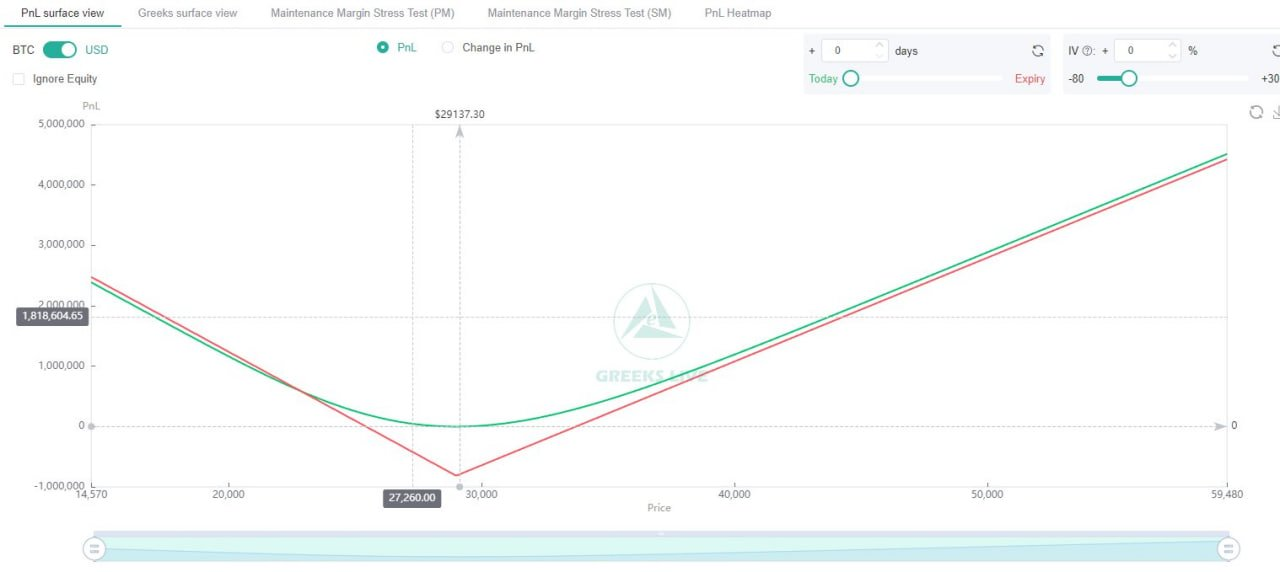

Most of today's block trades were very regular and look to be the same whale in action, selling wide straddles such as BTC-29DEC23-36000C/28000P and using that premium to buy straddles from recent months such as BTC-27OCT23-29000C/29000P.

It looks like the whale is adjusting its positions, and the above positions as a whole are profitable when prices move more sharply and implied volatility IV falls.

With the market extremely depressed, the whale is starting to get out and long price volatility using monthly options, but is not bullish on IV rising. This move is likely based on an adjustment to the whale's current position for a prolonged period of low volatility.

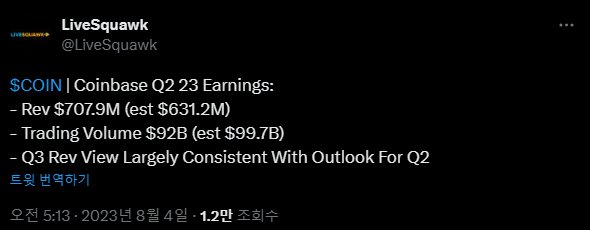

Coinbase Earnings

ETH Futures ETF 11

UPDATE: Another one.... 11 ETFs Filed... Proshares filed for a 4th ETF with Ethereum futures. This one is an equal weight #Bitcoin & #Ethereum ETF just like Bitwise's filing which dropped an hour ago.

Base Layer 2

Coindesk - Coinbase Sets Public Launch of ‘Base’ Layer 2 Blockchain for Next Week

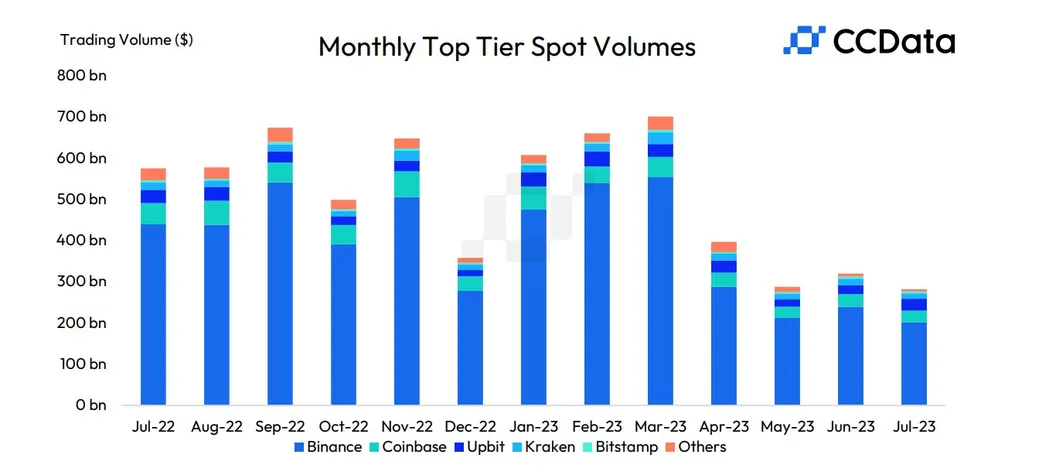

Upbit Volume

Weekly Alpha

Source Tweet - An Ape's Prologue

Negative Gamma

Today the market is in negative gamma as it broke below the HighVolLevel. What does that mean? Even if it's a topic we touched a lot in the past, let's re-cover this quickly before the next trading session. Quick thread 🧵

The HighVolLevel is the border between positive&negative gamma. In +gamma the market is less volatile because the market maker is long gamma. Meaning that, he goes short the market when the price goes up, and goes long when the market goes down. This keeps the market in ranges

The contrary happens when we go below the HighVolLevel in negative gamma. When we are in this red box volatility is higher and daily ranges are higher, market moves faster

This happens because to stay delta hedged the marker maker goes short when the market falls and goes long when the market goes up accentuating intra day movements

A trader can take advantage using spreads. You can use the levels to place the strikes of your option spreads. Knowing in which box you are helps you understand if you will be in a high or low volatility environment. There is a lot of free material on our website on this topic

Saudi Oil Cut

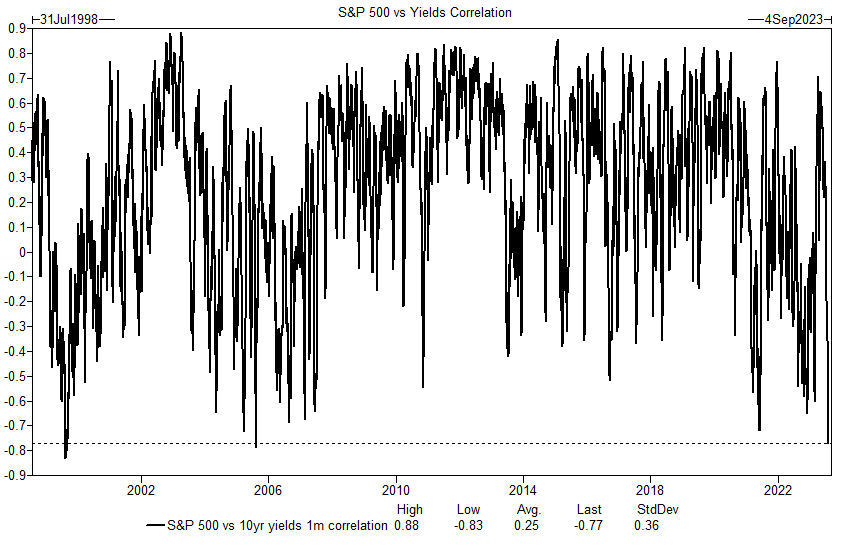

SPX/10Y Yields

SPX correlation to 10y yields is now at its most negative level in 18 years.

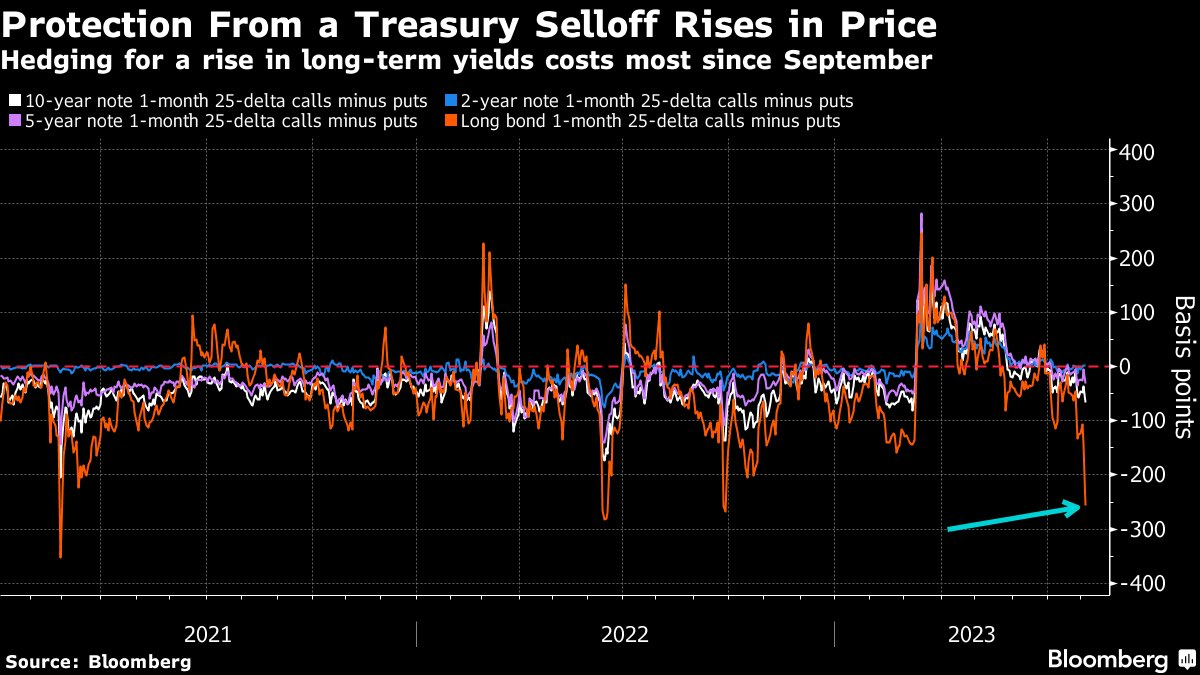

Interest Rate Options

Interest rate option traders are paying up for protection against more rally in long term maturity Treasury yield. In red 25delta calls vs puts, puts dominating bringing the ratio down

30Y

The 30-year is up 30 bps in the last 48 hours.

(For those not deep into the bond market … this is a huge move.)

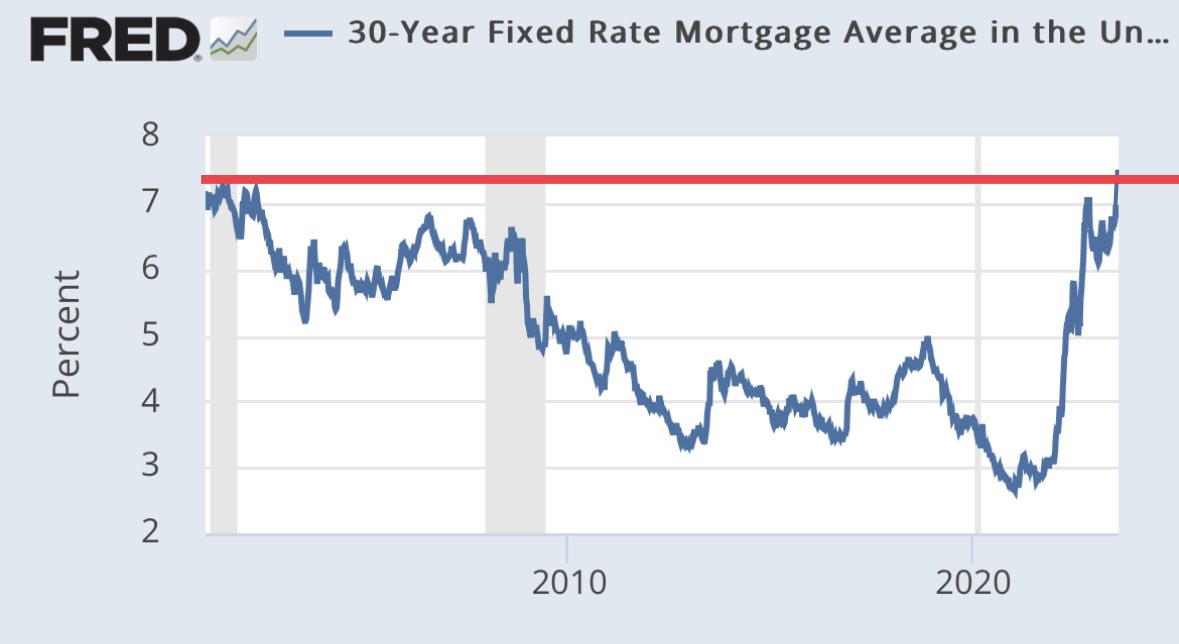

30Y Mortgage Rates

🚨BREAKING🚨

30 year Mortgage rates hit a NEW 23 year high of 7.20% 🚀

A monthly payment on a $500k loan at 7.2% rate with $100k down (20%) excluding taxes, insurance & utilities is

$2,900 😳

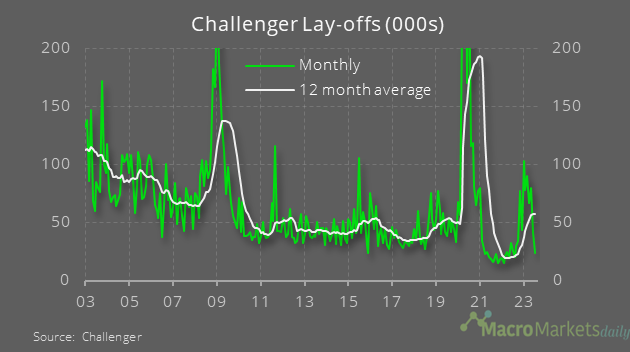

Challenger Lay-Offs

Challenger lay-offs back down sharply in July and initial jobless claims still relatively low, so no sign of the labour market cracking in those data sets

Source Tweet - MacroMarketsDaily

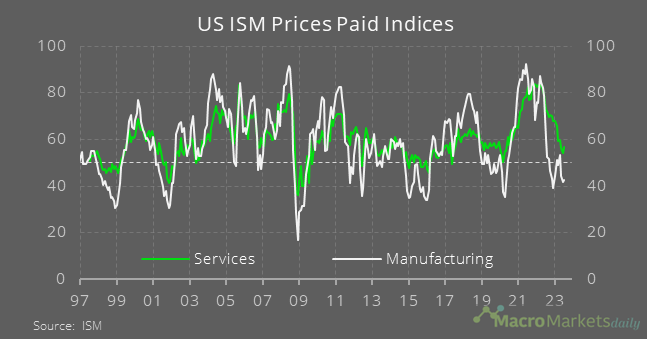

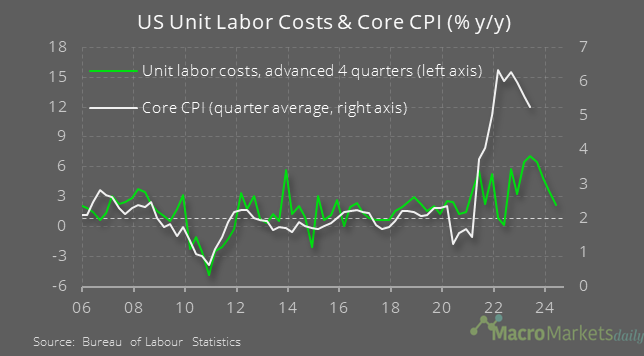

ISM/Unit Labor Costs

Uh oh...while only a small move in the grand scheme of things, the rebound in the prices paid index of the ISM service gauge is bad news for the Fed, particularly following the signs of robust labour demand so far this week

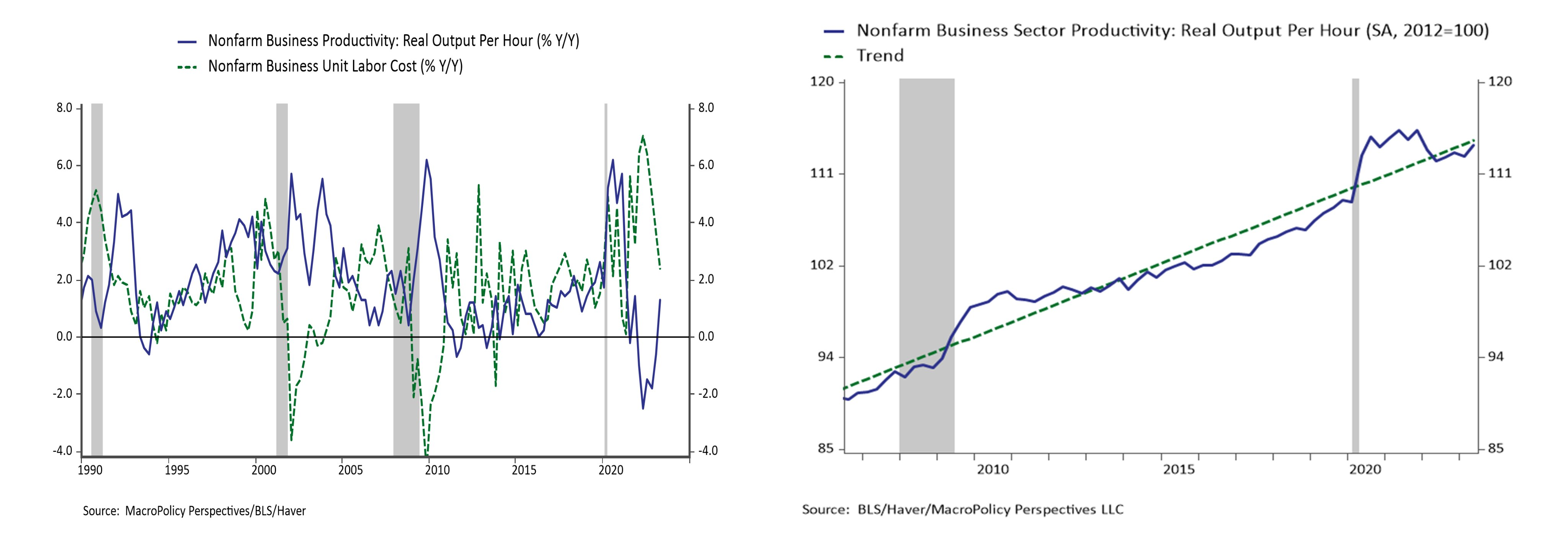

That being said, the productivity data also released today were more positive and show unit labor costs growth is back at a level normally consistent with core inflation of close to 2%

Source Tweet - MacroMarketsDaily

Yield Curve/Financial Conditions

What is happening at the long end of the yield curve is now tightening financial conditions more than any other single development so far this year (including the Fed’s rate decisions). When this hits home, longs in Mag7 will get nailed.

Shades of a August 1998 Moment in here…

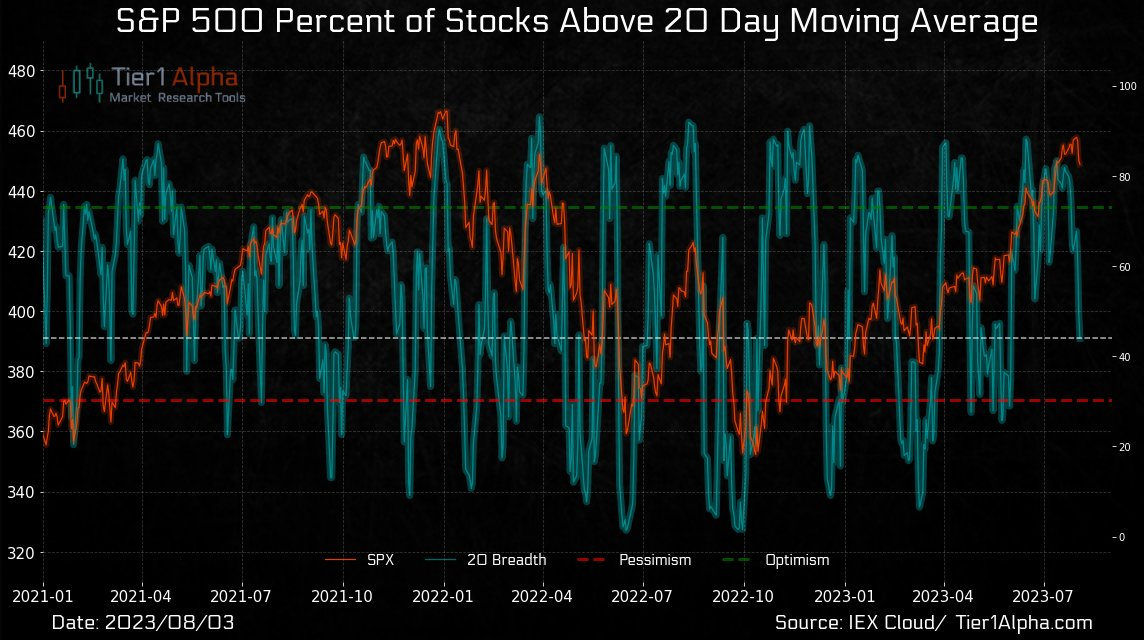

SPX Percent of Stocks 20D MA

Short-term breadth took another huge hit today. Let see if tech earnings can juice some index correlations. Otherwise, not a great sign for $SPX.

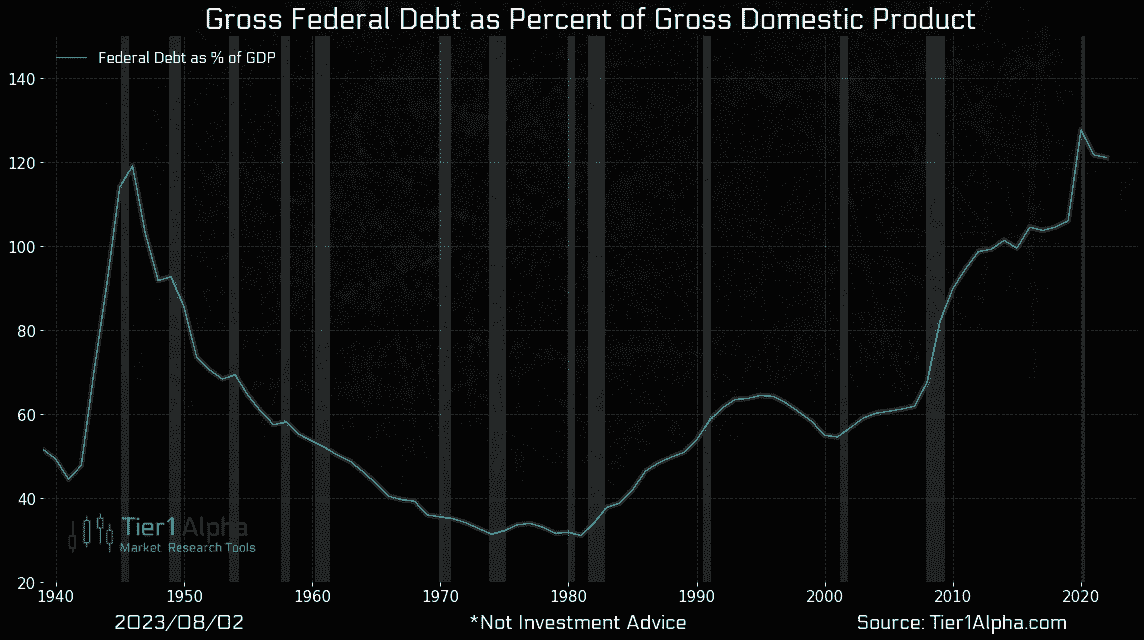

Gross Domestic Product

We try to be as apolitical as humanly possible. Still, the latest surge in government spending was an effort to ward off an imminent recession within sight of a presidential campaign. 😠

In our recent observations, we've noted a significant shift in financial dynamics. Government spending has largely supplanted the Federal Reserve's balance sheet contraction. We will show you that chart (Fed liquidity vs. SP500) tomorrow; it's getting more interesting by the day.

However, the impact of deficits can be elusive until they suddenly matter profoundly. We began the year with federal interest payments on government debt constituting 2.5% of GDP, a figure that's on track to hit 4% within a mere 9-month span.

During the fiscal year (FY) 2022, the federal government generated $5.0 trillion in revenue, equating to $15,098 per capita, while it spent $6.5 trillion or $19,434 per person. This outlay included funds channeled to the states. Federal revenue saw a 14.3% hike in FY 2022, bolstered by an increase in personal income taxes, social security taxes, and revenue from the auctioning of spectrum for commercial wireless and broadcast use.

Meanwhile, federal spending dipped by 12.4% in FY 2022, after stagnating in FY 2021. However, the government still spent 28.7% more than it collected in FY 2022, which led to a $1.45 trillion deficit. As a result, the national debt soared to $30.9 trillion by the close of the last fiscal year.

Whoever the next president of the US will be, they will face a debt mountain to rival developing economies. This is obviously coinciding with the refinancing debt crises facing commercial real estate over the next 24 months. Roughly 2 trillion dollars that needs to be refinanced from interest rates as low as 1% or even lower to 8% and above.

But never fear. As always, we will have a stiff drink🍸 and follow the flows.

(This is a brief excerpt from today’s "Market Situation Report" written by our brilliant friends at Tier1 Alpha. Make sure to follow them @t1alpha).

Productivity

Productivity is the secret sauce of noninflationary growth & a soft landing and it surged in Q2. Reduced supply chain frictions & declining labor turnover likely points to a productivity tailwind for a few quarters or more if tech transformation gives us a better trend

BoE

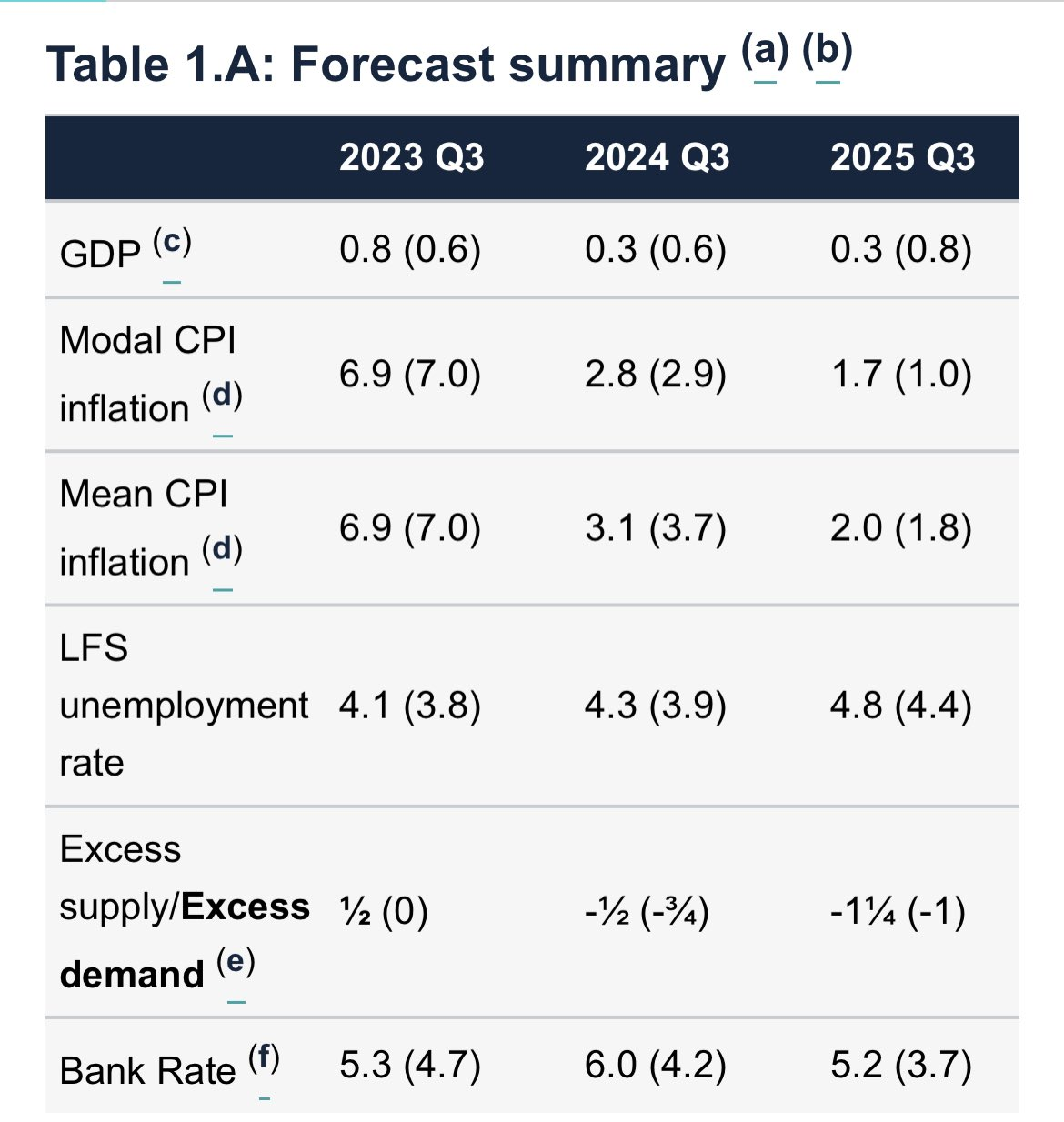

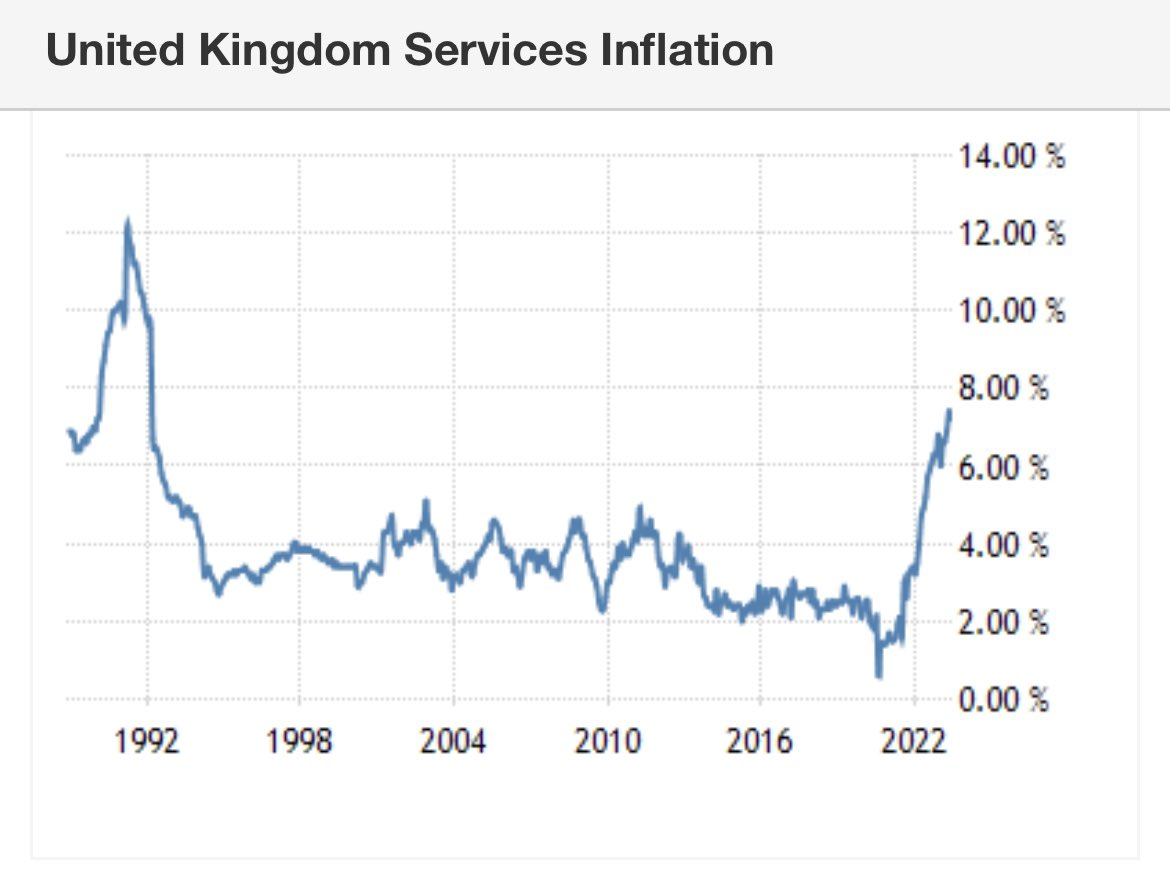

BoE remains a case study in the consequences of remaining behind the curve.

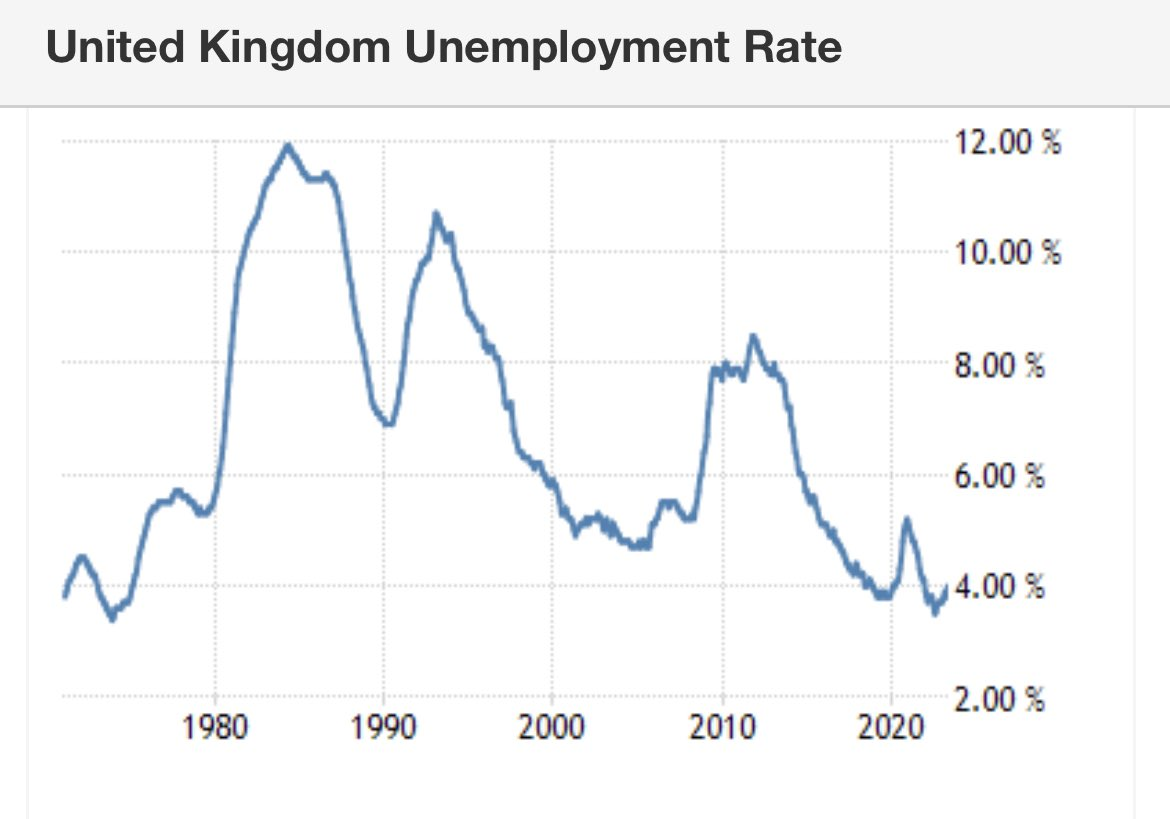

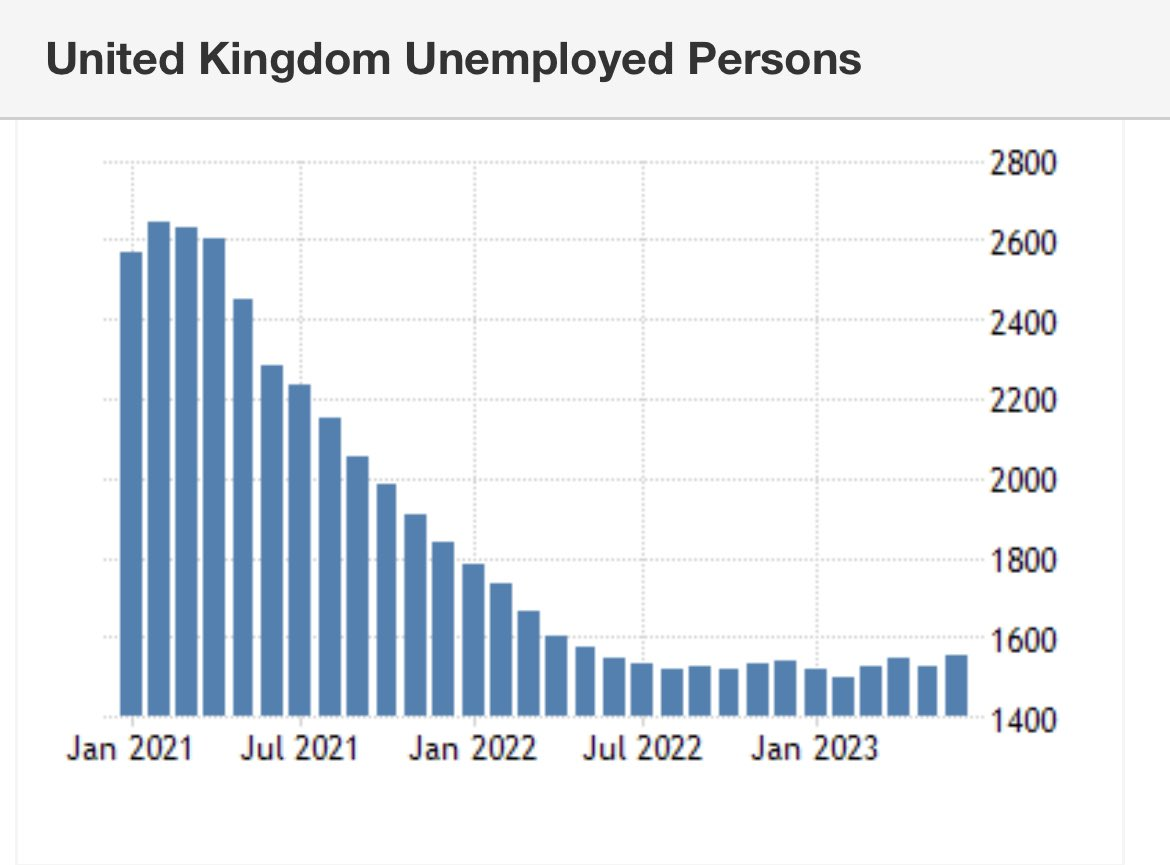

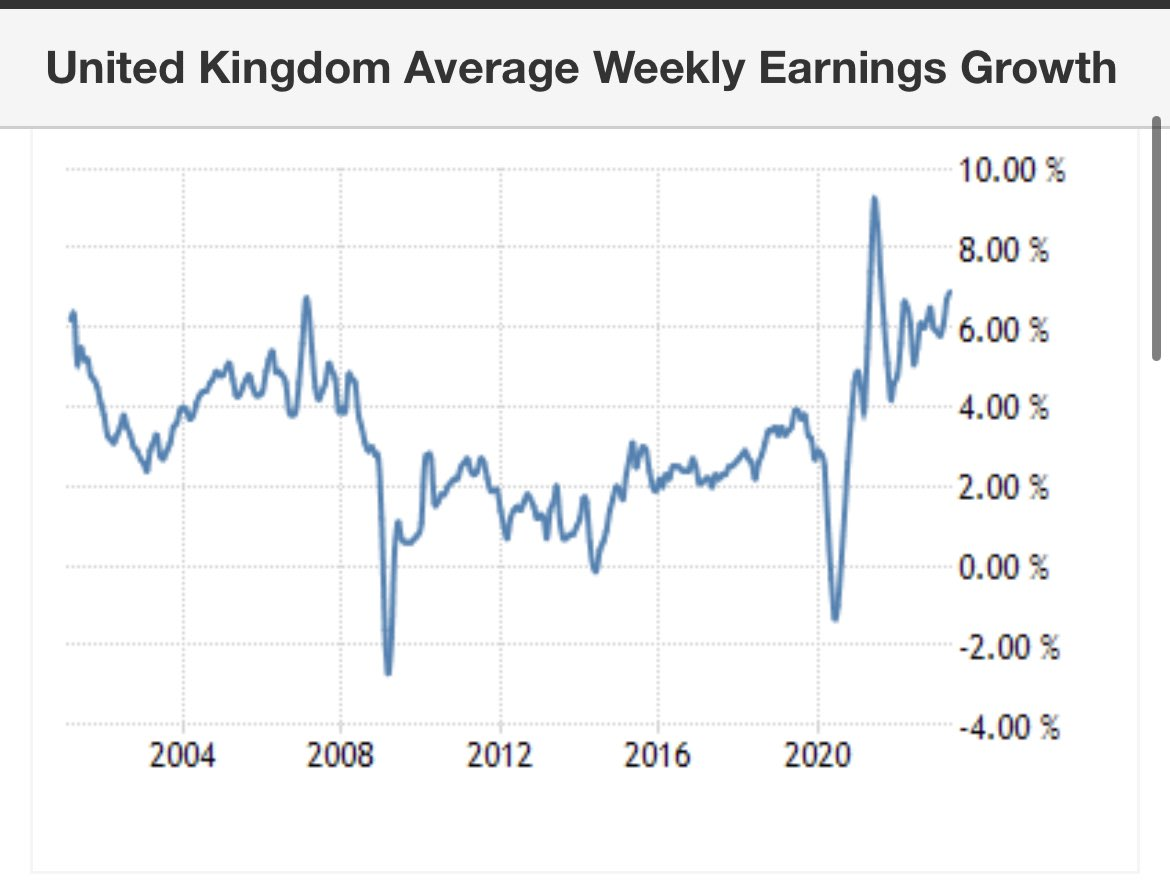

MPC again ‘surprised’ at inflation persistence, but the cause is pretty simple - secularly tight labor markets are driving elevated nominal wage growth leading to elevated inflation.

Forecasts higher

Central banks fantasize about inflation durably declining to target without a meaningful weakening of the labor market and wage pressures.

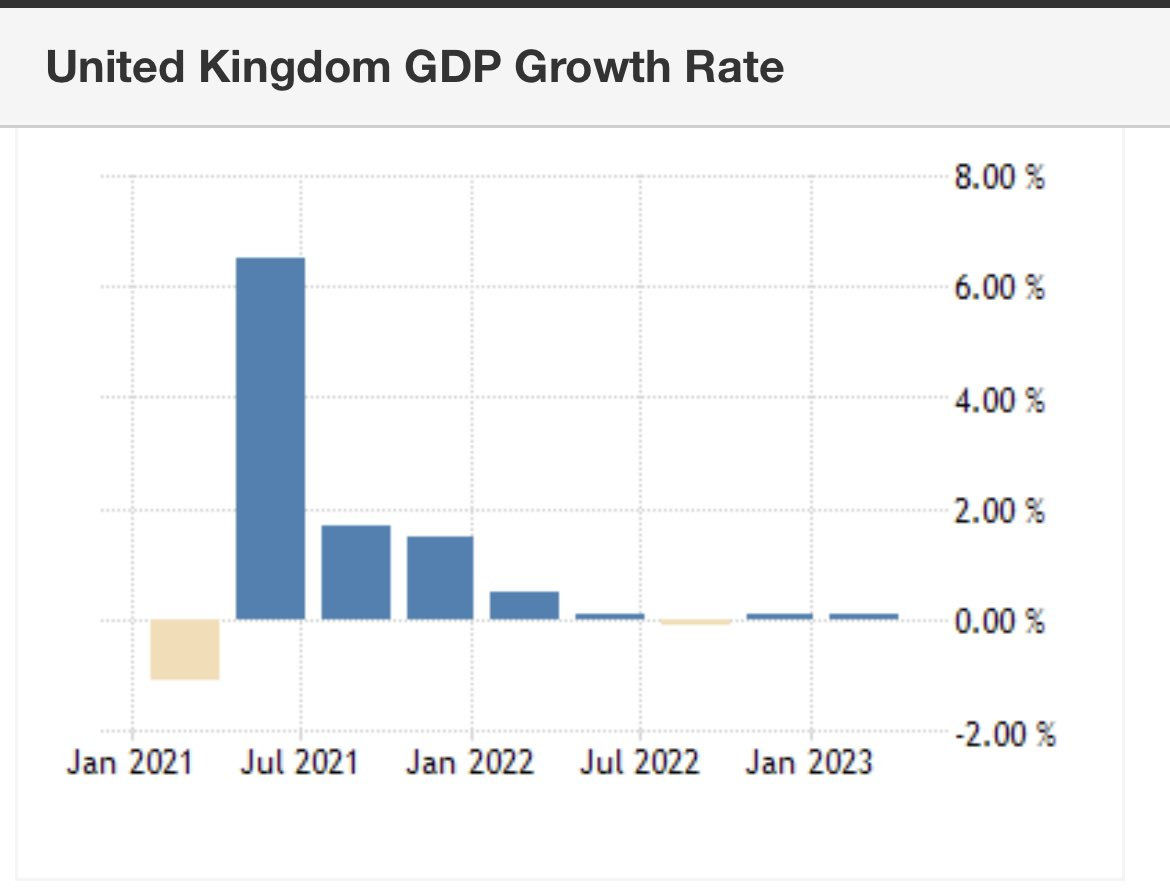

Look above, the BoE projects inflation to fall 500bps with a UE rate rise of only 0.7% and no growth contraction.

As a result they remain behind the curve in their pace of tightening which in turn leads to tight labor markets persisting, wage growth remaining elevated, and the banks being “surprised” when there isn’t an immaculate decline.

The UK case in many ways is simple. Growth has not slowed enough to bring down those wage pressures. Labor markets remain secularly tight

There is no meaningful weakening momentum

Given tight labor markets and elevated price pressures, not surprising that growth continues to rise rapidly.

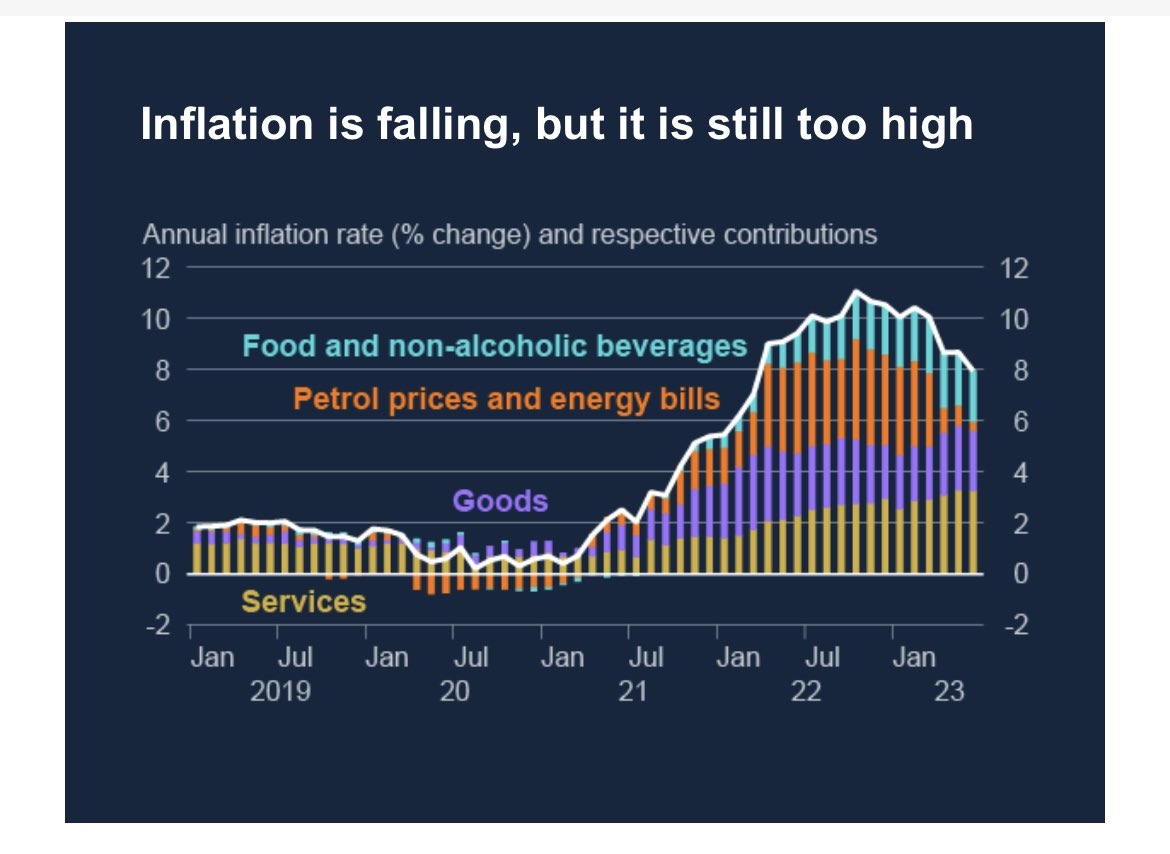

And so while we have seen a slowing in energy prices the core parts of the economy are now driving inflation in the economy.

Cause by accelerating services price inflation now at 7%, which isn’t surprising since that’s what’s going on with wage growth rates above.

So it comes down to whether the labor market deteriorated fast enough to keep inflation pressures at bay. While the BoE had hiked in nominal terms it’s not enough to significantly put the breaks on the economy.

Growth has been close to zero for 18m. Yet, the dynamic persists

A lot of hope placed on slowing the economy from the mortgage resets. But in reality they are modest on an economy wide level and being meaningfully offset by rising interest income (yes, I know, not the same people, not perfectly matched, but it’s a big offset).

So the BoE is stuck in this loop. Not doing enough to slow the economy. Labor markets tight enough to create elevated nominal wage gains, nominal spending high enough to keep prices elevated particularly on services.

And all the while further entrenched inflation.

The UK will remain stuck until the BoE gets ahead of the curve and tightens hard enough to meaningfully slow the economy. Until then the MPC will continue being surprised by the entrenchment they see.

With UK 2s pricing in below 5pct rates over the next two years (remember core is 7%), the UK short end continues to offer one of the best sell opportunities in the market.

And while the market takes the incremental meeting as dovish, if anything it means more work to do ahead.

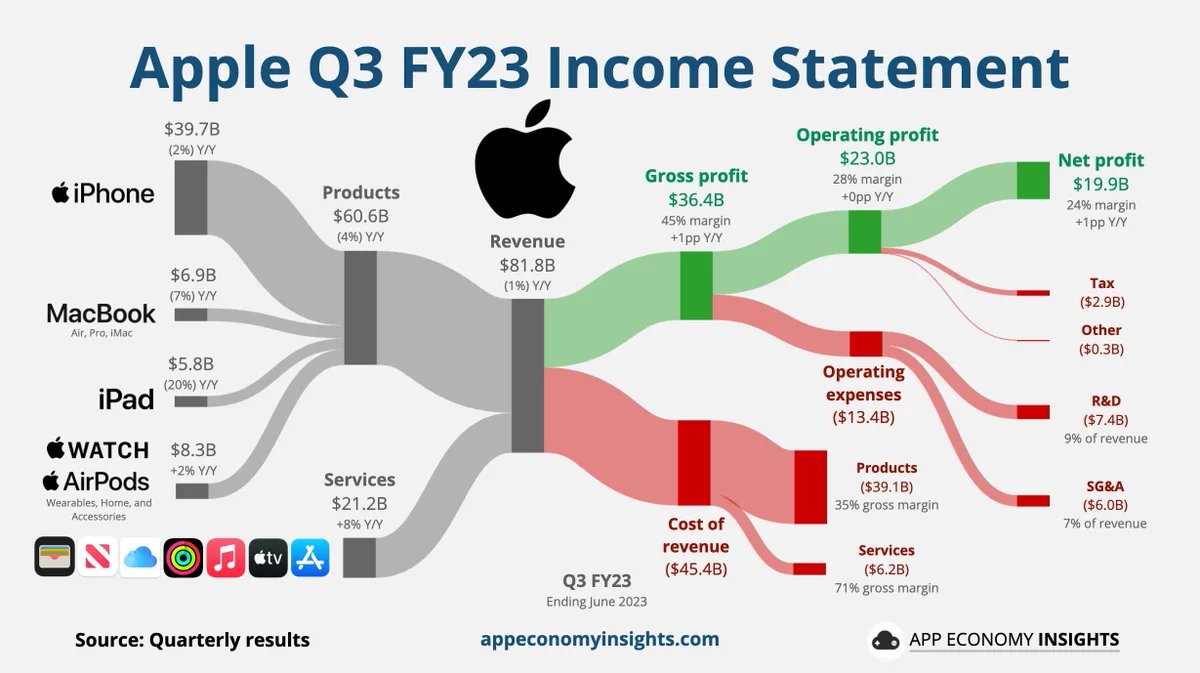

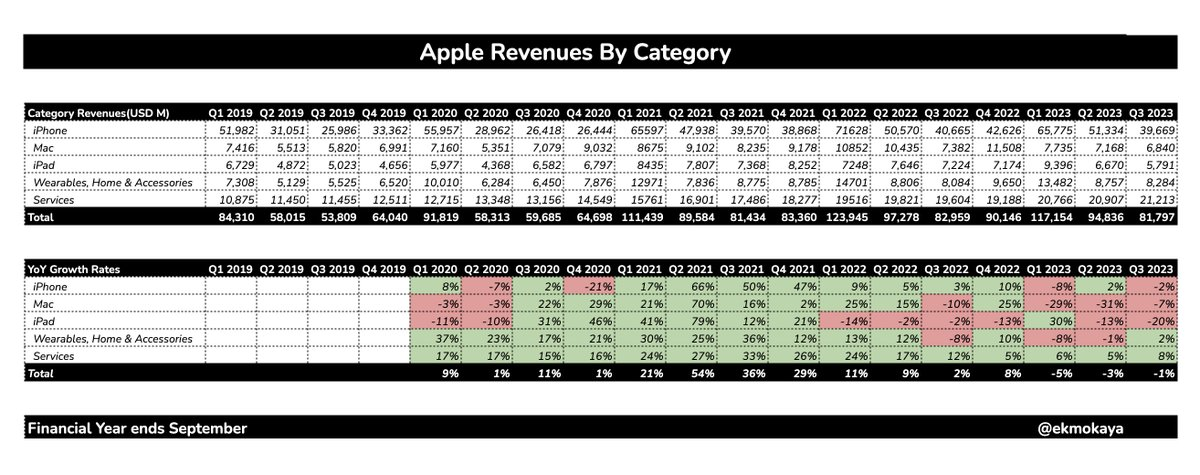

AAPL Earnings

Recap of key quotes from Apple's Q3 23 earnings call:

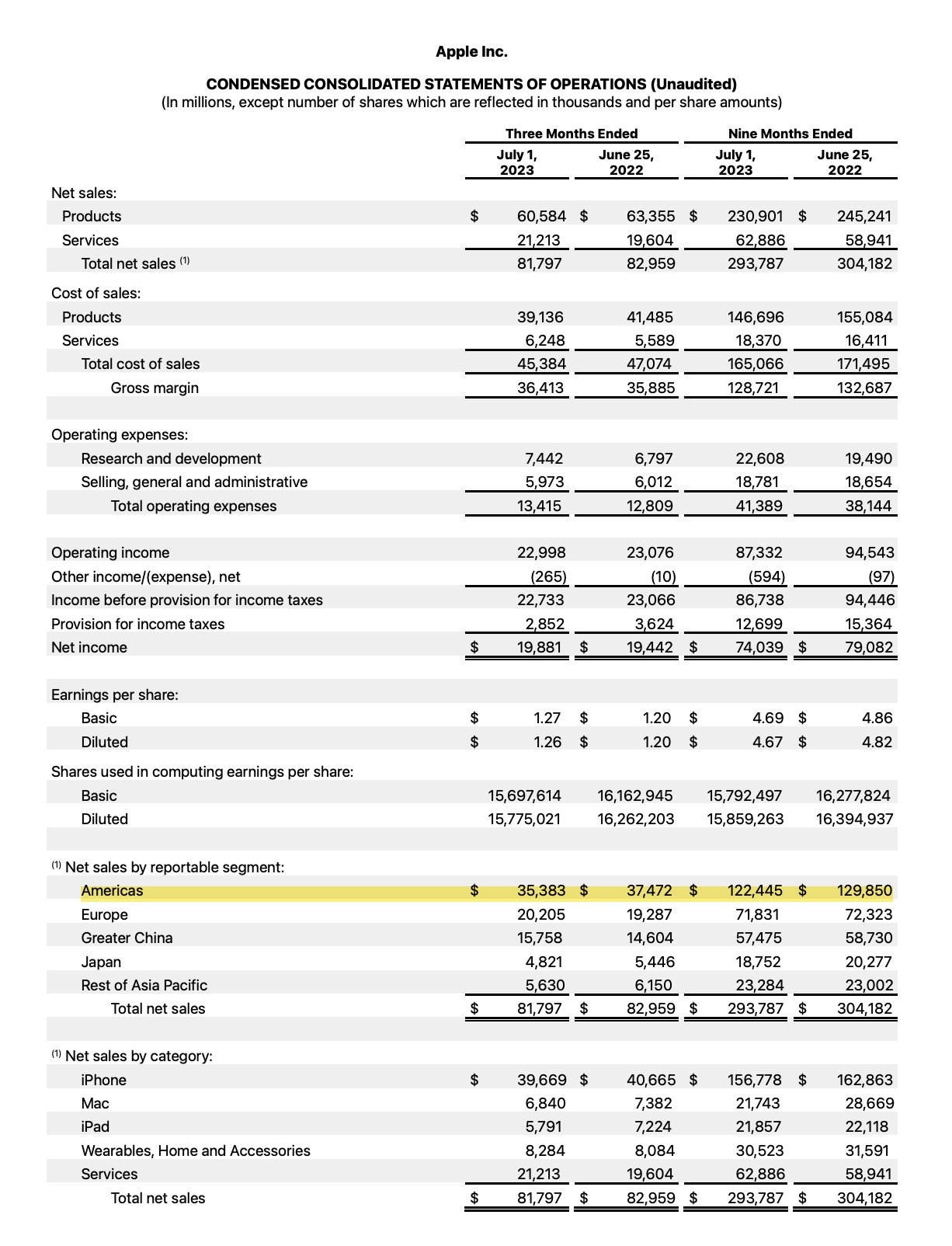

- $AAPL CEO @tim_cook starts with a summary:

"Apple is reporting revenue of $81.8B for Q3, better than our expectations..On a constant currency basis, we grew YoY in aggregate & in the majority of markets we track"

- The Messi effect being felt at Apple:

"for MLS, we could not be happier with how the partnership is going. It's clearly in early days but we're beating our expectations in terms of subscribers, & the fact that Messi went to Inter Miami helped us out there a bit" - $AAPL CEO

- The entire Mac lineup is on Apple Silicon now:

"this past quarter, we were pleased to complete the transition to Apple Silicon for the entire lineup. This transition has driven both strong upgrade activity and a high number of new customers" - $AAPL CFO

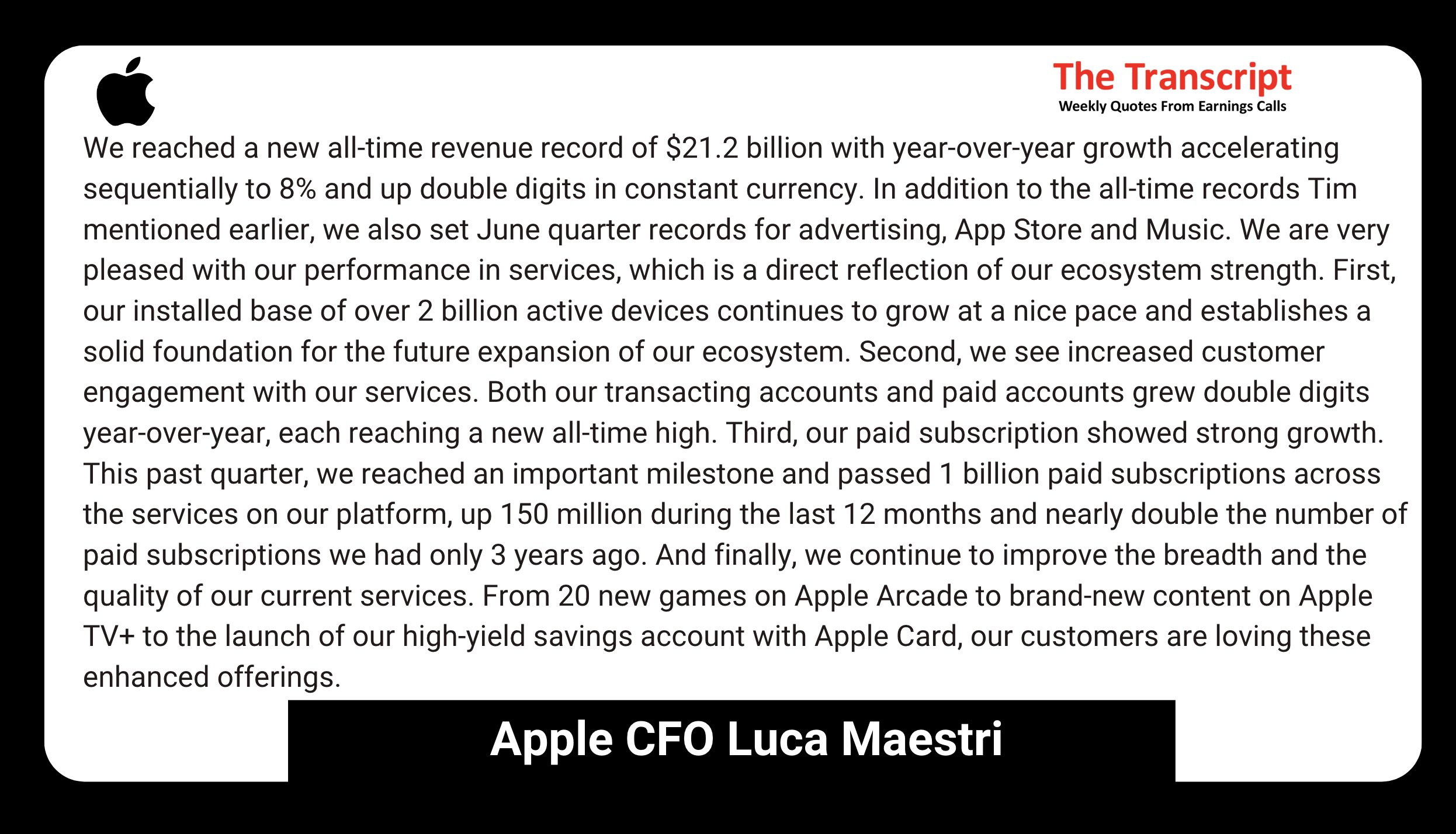

- On Services revenues

"We reached a new all-time revenue record of $21.2B with YoY growth accelerating sequentially to 8% and up double digits in constant currency...we also set June quarter records for advertising, App Store & Music" - $AAPL CFO

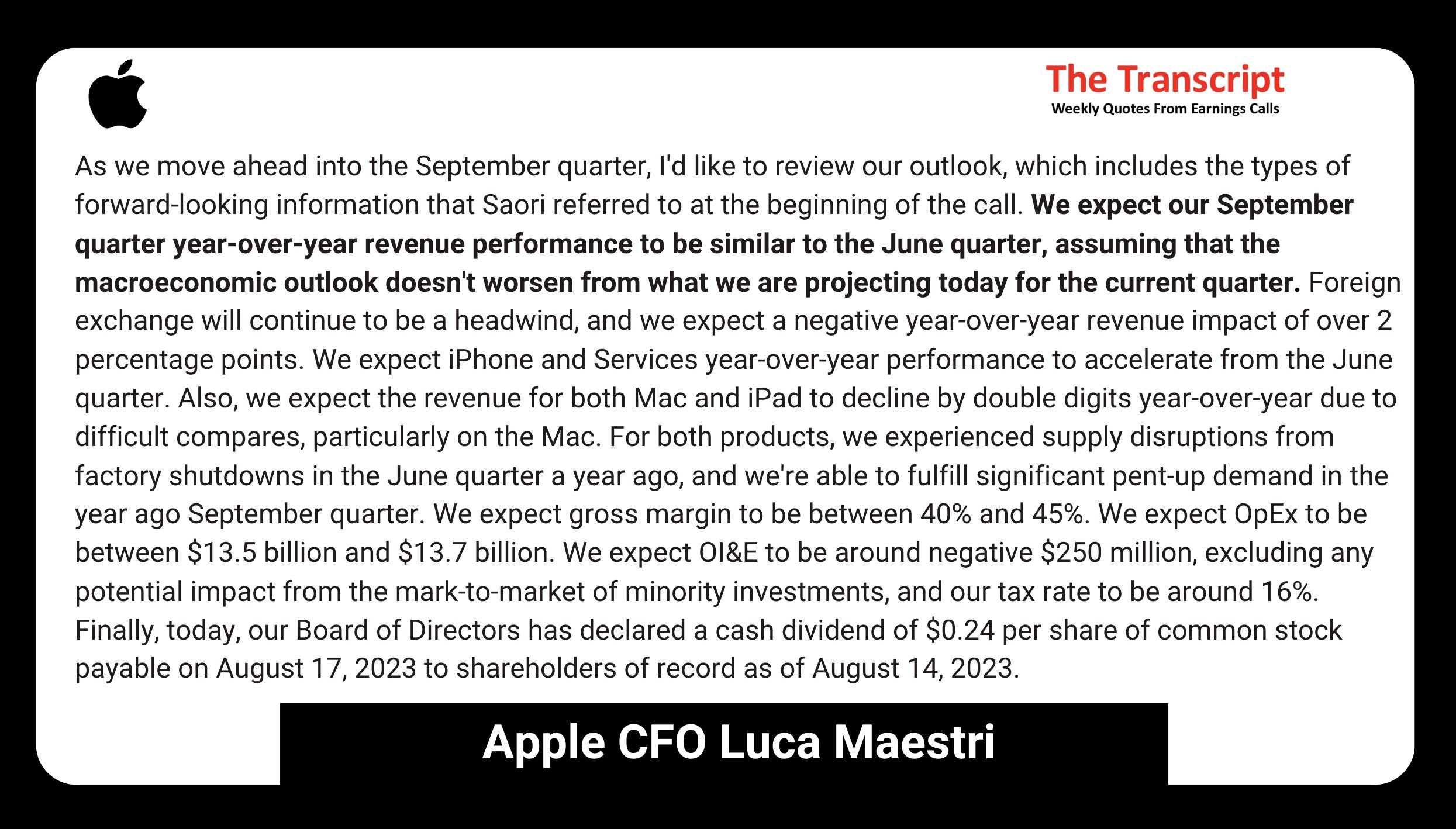

- On Q4 outlook:

"We expect our September quarter year-over-year revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn't worsen from what we are projecting today for the current quarter" - $AAPL CFO

- Strong growth in Emerging markets:

"We set June quarter records in many of the emerging markets" - $AAPL CFO

- On China:

"If you look at China, in China, we went from a negative 3 in Q2 to a plus 8 in Q3. And so in China, we had an acceleration" - $AAPL CFO

"We set a record in Greater China, in particular, and it was at the heart of our results there" - $AAPL CEO

- Record quarter in gross margins:

"We were up 20 basis points sequentially...We have a commodity environment that is favorable to us. Our product mix is quite strong at this point...we expect a similar level of gross margins for the same reasons, frankly, for Q4" - $AAPL CFO

- On the consumer in the US:

"If you look at the US,...there was also a slight acceleration sequentially, although the Americas is still declining somewhat YoY...The primary reason for that is that it's a challenging smartphone market in the U.S. currently.

- On the Apple Vision Pro:

"There's enormous excitement around the Vision Pro....We are now shipping units to the developer community for them to begin working on their apps. And we're looking forward to shipping early next year." - $AAPL CEO

- On Apple and FX risk:

"we try to hedge our foreign exchange exposures...About 60% of our business is outside the United States. So it's a very, very large and I would say, very effective hedging program" - $AAPL CFO

- On Apple's stealthy moves in AI:

"...we've been doing research across a wide range of AI technologies, including generative AI for years...as you know, we tend to announce things as they come to market, and that's our MO, and I'd like to stick to that." - $AAPL CEO

Amazon Earnings

A live $AMZN thread for the Q2 23 earnings calls:

- A bird's eye view of the quarter:

"Today, we are reporting a $134 4 billion in revenue and $7.7 billion and operating income both of which exceeded the top end of our guidance ranges" - $AMZN CEO @ajassy

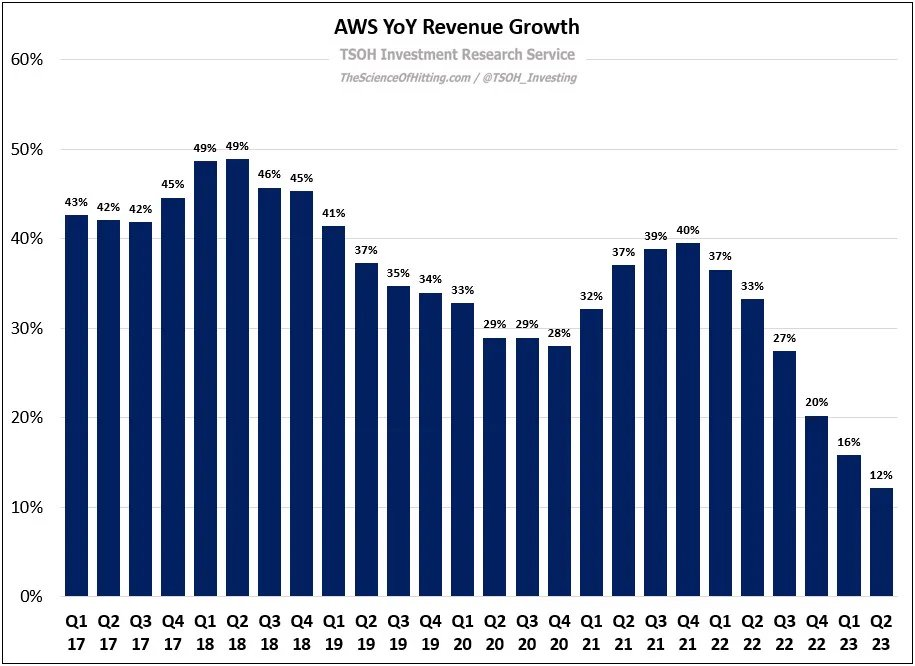

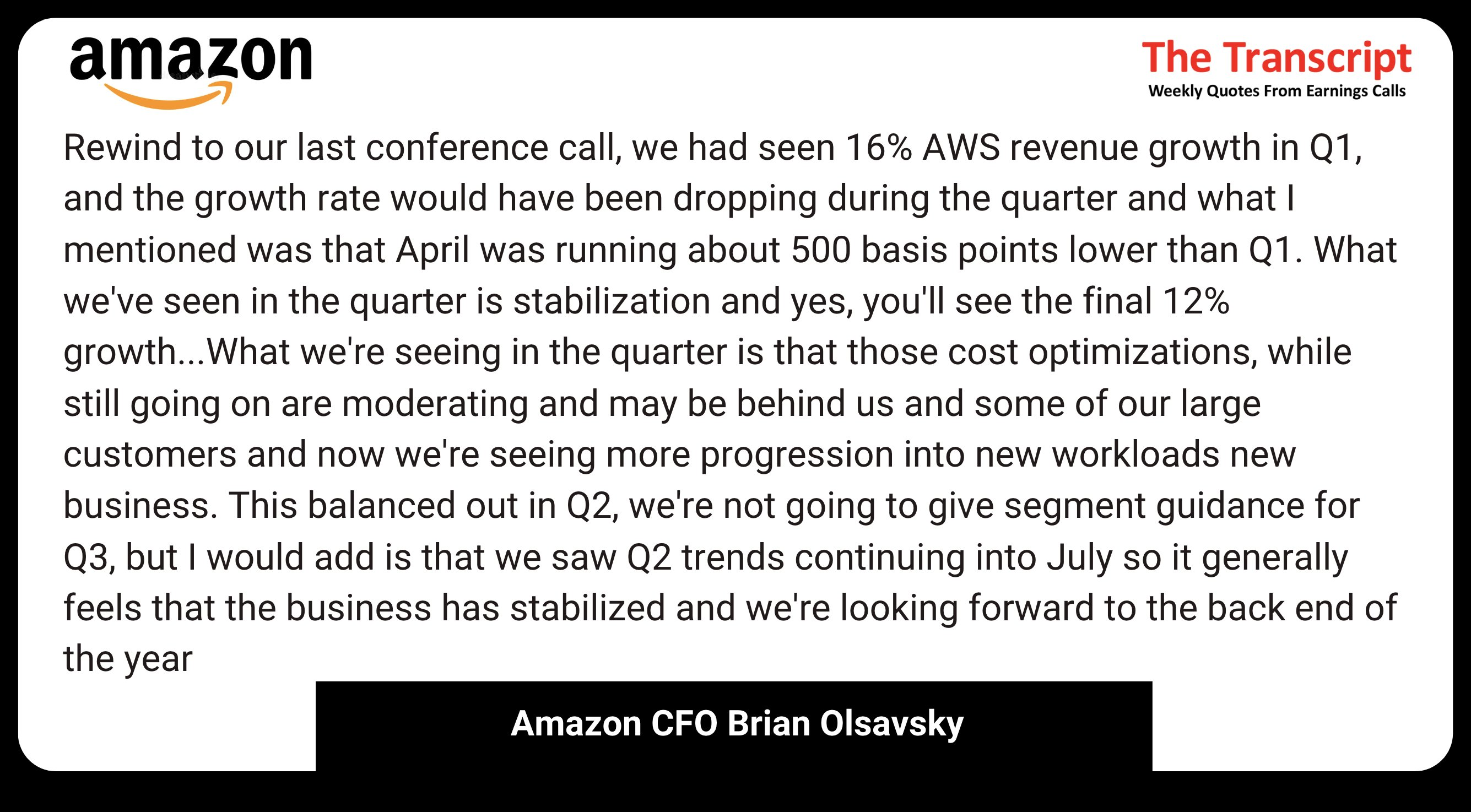

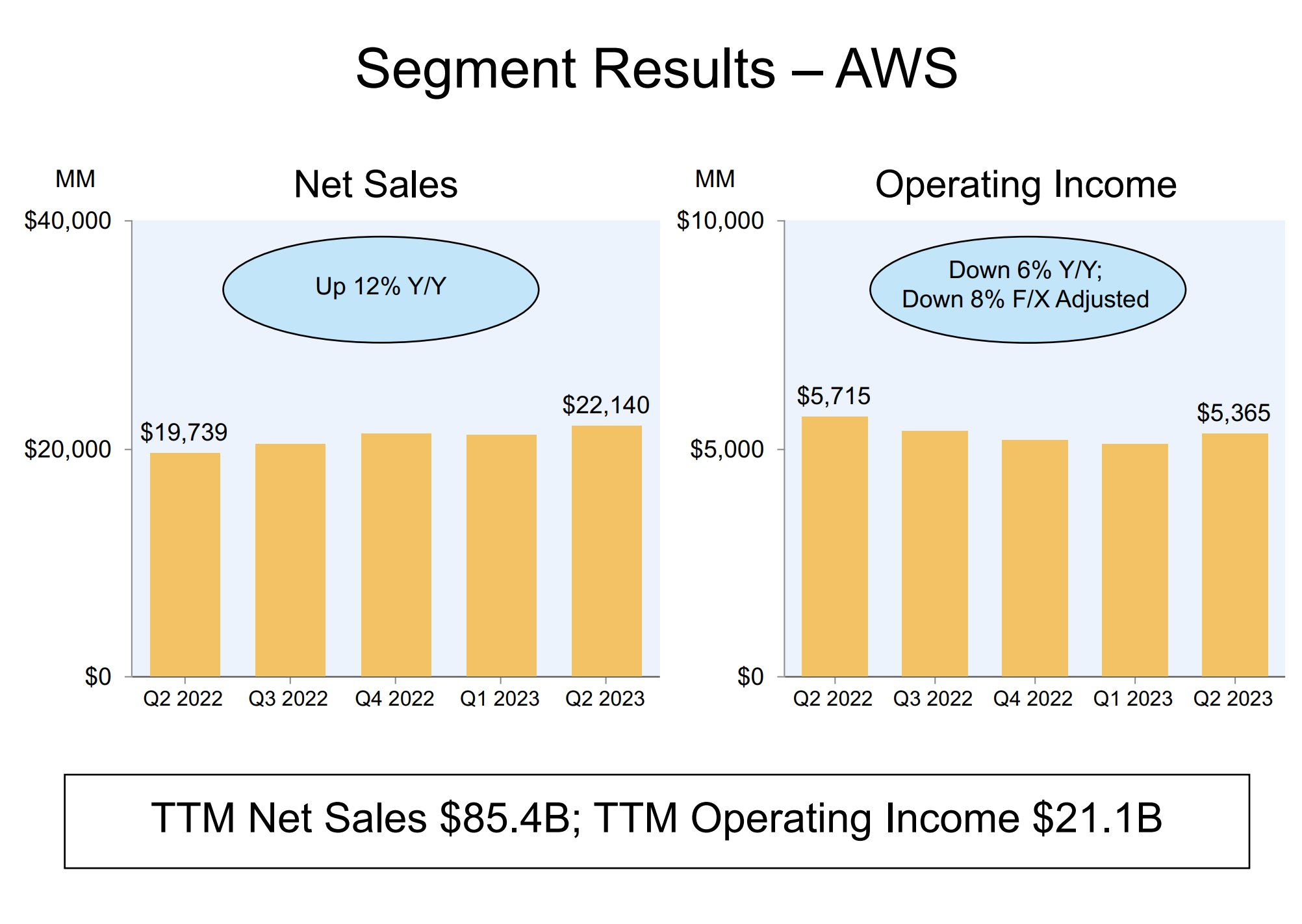

- AWS growth rates stabilized in Q2:

"we started seeing more customers shift their focus toward driving innovation and bringing new workloads to the cloud. As a result, we've seen AWS's revenue growth rates stabilized during Q2, where we reported 12% YoY growth" -$AMZN CFO

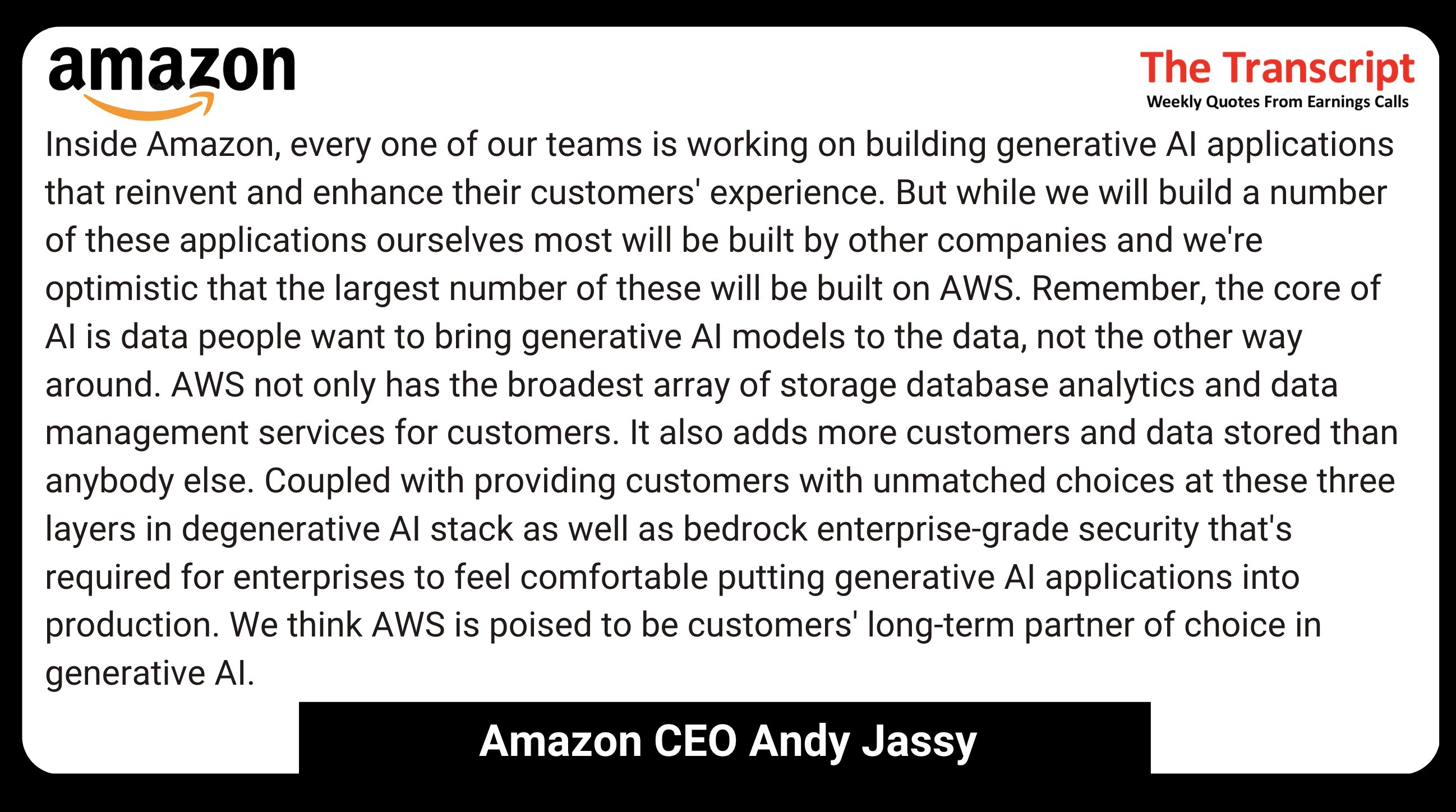

- On Amazon, AWS & AI:

"Inside Amazon, every one of our teams is working on building generative AI applications that reinvent and enhance their customers' experience" - $AMZN CEO

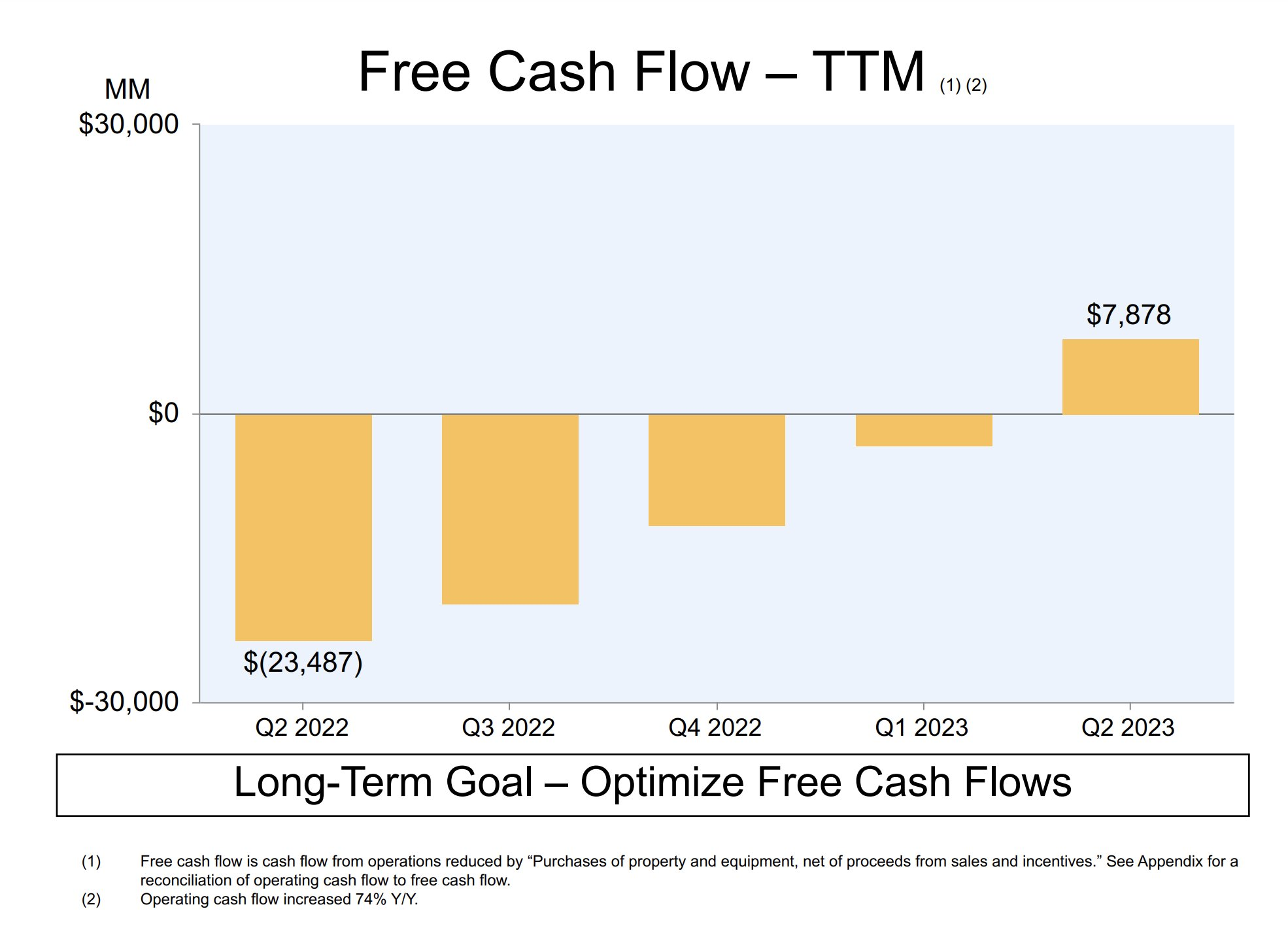

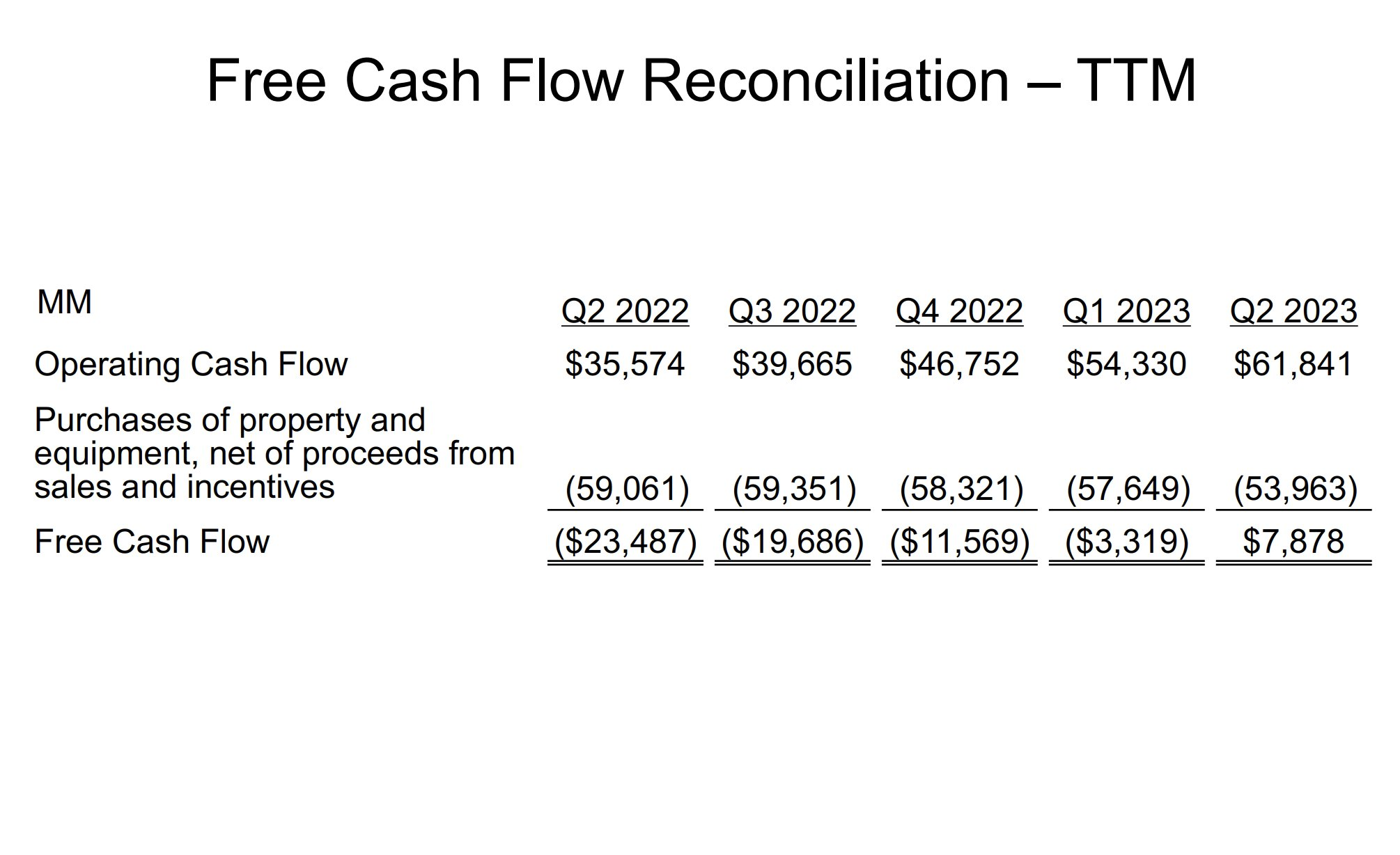

- On Amazon Free Cash flows:

"On a trailing 12-month basis free cash flow was positive and improved for the fourth sequential quarter" - $AMZN CFO

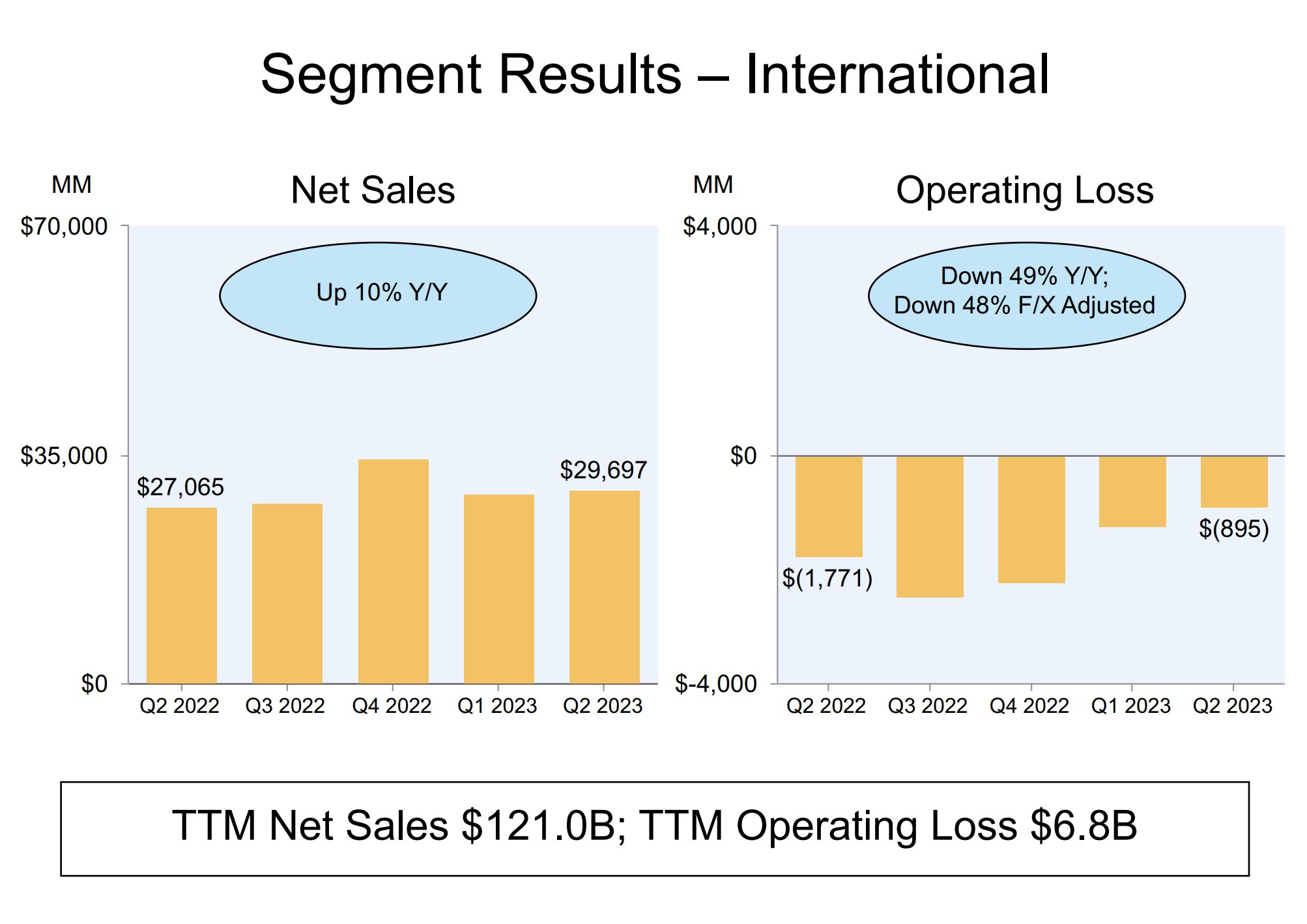

- On the international segment:

"...since our operating margin loss bottomed out in Q3 of last year, we have seen three consecutive quarters of improvement for the second quarter margin loss of -3%" - $AMZN CFO

- On AWS trends going into Q3:

"What we're seeing in the quarter is that those cost optimizations, while still going on are moderating and may be behind us and some of our large customers and now we're seeing more progression into new workloads new business" - $AMZN CFO

- On AI and monetization:

Question: "OnAI monetization, can you just talk to when you think you'll start to see that flow into the AWS business?"

Answer by CEO: "We're in the very early stages there. We're a few steps into a marathon in my opinion"

- Second time $AMZN CEO mentioned this in the earnings call so must be important:

"To grow double digits on an $88B revenue run rate business, when you're seeing that amount of cost optimization in every company in the world...to still grow double digits on a base that size means that we're acquiring a lot of new customers"

- $AMZN CEO on AWS outlook;

"...the balance of cost optimizations to actually new workloads, new migration, we saw a shift in that in Q2 & I expect that we'll continue to see that shift over time...I'm very bullish on the growth of AWS over the next several years." - $AMZN CEO

- On capex outlook for FY 2023:

"Looking ahead to the full year 2023, we expect capital investments to be slightly more than $50B vs $59B in 2022. We expect fulfillment and transportation capex to be down year over year, partially offset by increased infrastructure capex to support growth of our AWS business, including additional investments related to generative AI and large language model efforts"

- On inflation trends:

"In addition across our North America and international results inflation headwinds also continued to ease most notably in fuel prices line haul rates Ocean and rail rates" - $AMZN CFO

- On Amazon ad business:

"Advertising revenue remained strong up 22% year over year. Our performance-based advertising offerings continue to be the largest contributor to our growth" - $AMZN CFO

- Amazon business to be a $100B+ business:

"...$35 billion the annual run rate for gross sales is pretty strong growth and if you look at it year over year continues to be very strong...The team is working hard to build a $100B+ business over time"- $AMZN CEO

- $AMZN CEO gives a detailed response to their challenges with grocery:

"We're hopeful that we will find that format & that it gives us the type of results that give us confidence to want to expand more broadly. But we won't expand unless we see that type of resonance"