yfinance API를 이용하여 만든 자산 관리 프로그램

해외주식, 국내주식, 연금저축펀드, 비트코인, 현금, 부채, 투자원금 목록은 수동으로 입력해주어야 한다.

Google Collaboratory, jupyter notebook에서 작성하였으며, 구글 드라이브와 연동하여 업데이트된 자산현황을 읽어온다.

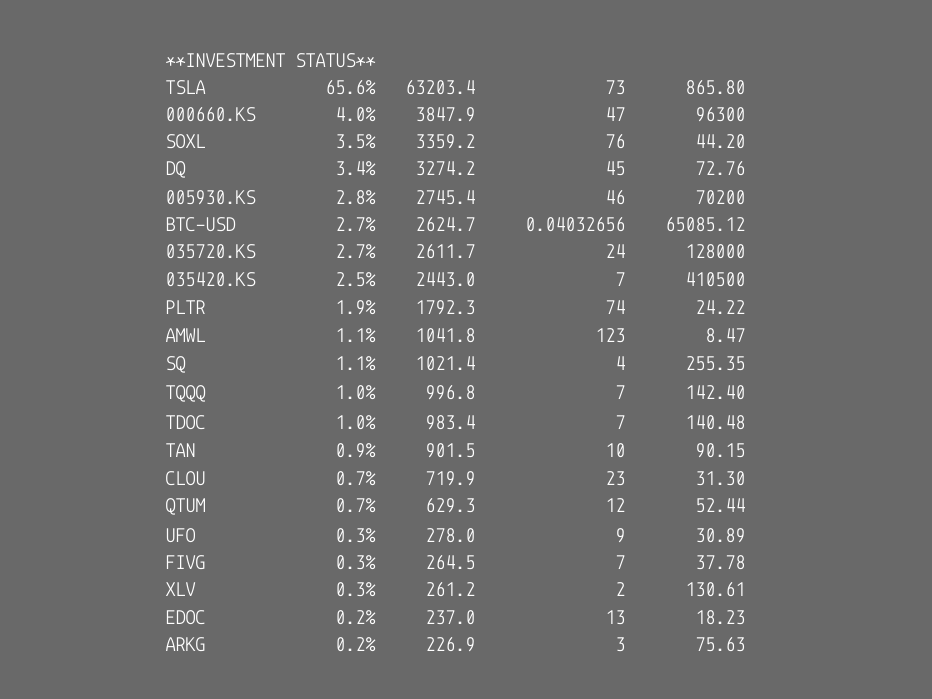

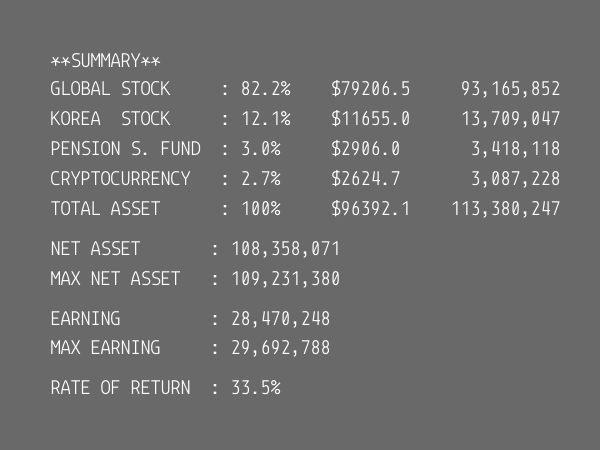

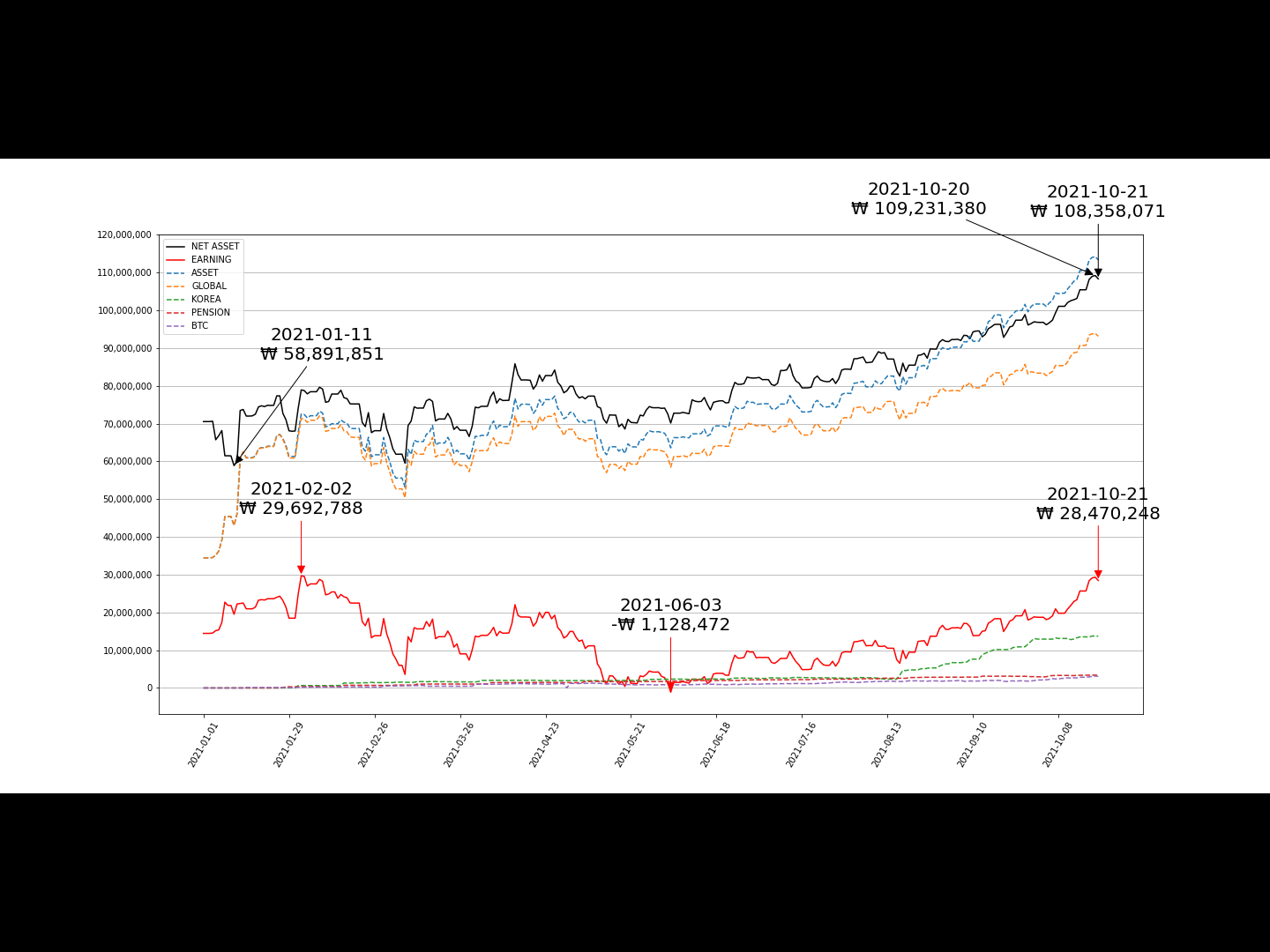

서로 다른 계좌의 자산을 통합하여 현재 어떤 비중으로 투자하고 있는지 볼 수 있고, 1월 1일부터 자산의 변화를 볼 수 있다.

매일의 주가, 비트코인 가격 및 환율을 yfinance API를 통해 입력받아, 종가 기준으로 자산평가액을 계산한다.

현재 연금 저축 펀드를 통해 투자하고 있는 ETF 두 종목은 yfinance에서 가장 최근 거래일의 종가만을 제공하고 있기 때문에, 프로그램을 실행할 때마다 각 종목의 주가를 저장 및 업데이트 하도록 구현했다.

그래프에 최저/최고/현재 자산과 최저/최고/현재 수익을 표시했다.

과거의 거래 기록을 완벽하게 복원하지 못하여 1월의 기록에는 상당한 오류가 있는데, 시간이 널널할 때 수정할 계획.

실행결과

INVESTMENT_STATUS.PNG

SUMMARY.PNG

Asset.png

코드

#code

!pip install yfinance

from pandas_datareader import data as pdr

import yfinance as yf

import datetime

import matplotlib.pyplot as plt

from PIL import Image, ImageDraw, ImageFont

import os

from google.colab import drive

drive.mount('/content/drive')

os.system('cp /content/drive/MyDrive/Stock_Record/Stock_Own_Record.txt /content/drive/MyDrive/Stock_Record/Stock_Own_Record_backup.txt')

os.system('cp /content/drive/MyDrive/Stock_Record/Stock_Price_Record.txt /content/drive/MyDrive/Stock_Record/Stock_Price_Record_backup.txt')

now = datetime.datetime.now()

start_date = datetime.date(2021, 1, 1)

now_date = now.strftime('%Y-%m-%d')

f = open('/content/drive/MyDrive/Stock_Record/Money_Debt_Record.txt', 'r')

money = {}

housing = {}

debt = {}

global_deposit = {}

korea_deposit = {}

pension_deposit = {}

principal = {}

i = -1

while True:

line = f.readline()

if not line:

break

if line[0] == '#':

i += 1

continue

if i == 0:

money[line.split()[0]] = float(line.split()[1])

if i == 1:

housing[line.split()[0]] = float(line.split()[1])

if i == 2:

debt[line.split()[0]] = float(line.split()[1])

if i == 3:

global_deposit[line.split()[0]] = float(line.split()[1])

if i == 4:

korea_deposit[line.split()[0]] = float(line.split()[1])

if i == 5:

pension_deposit[line.split()[0]] = float(line.split()[1])

if i == 6:

principal[line.split()[0]] = float(line.split()[1])

f.close()

f = open('/content/drive/MyDrive/Stock_Record/Stock_Own_Record.txt', 'r')

ticker = []

stock_type = []

stock_own = []

i = -1

while True:

line = f.readline()

if not line:

break

if line[0] == '#':

ticker.append(line.split('#')[1])

stock_type.append(int(line.split('#')[2].split('\n')[0]))

i += 1

stock_own.append({})

continue

stock_own[i][line.split()[0]] = float(line.split()[1])

f.close()

f = open('/content/drive/MyDrive/Stock_Record/Stock_Price_Record.txt', 'r')

stock_price = []

for i in range(len(ticker)):

stock_price.append({})

i = -1

while True:

line = f.readline()

if not line:

break

if line[0] == '#':

i += 1

continue

stock_price[i][line.split()[0]] = float(line.split()[1])

f.close()

yf.pdr_override()

new_stock_price = []

for i in ticker:

new_stock_price.append(pdr.get_data_yahoo(i, start=start_date, end=now_date))

for i in range(len(ticker)):

for j in new_stock_price[i].index:

stock_price[i][j.strftime('%Y-%m-%d')] = float('{:.2f}'.format(new_stock_price[i].at[j,'Close']))

stock_price[16]['2020-12-31'] = 25.11

f = open('/content/drive/MyDrive/Stock_Record/Stock_Price_Record.txt', 'w')

for i in range(len(ticker)):

f.write('#'+ticker[i]+'\n')

for j in stock_price[i].keys():

f.write(str(j) + ' ')

f.write(str('{:.2f}'.format(stock_price[i][j])))

f.write('\n')

f.close()

dollar_price = yf.download(['USDKRW=X'],start=start_date, end=now_date)

dollar_price_record = {}

for i in dollar_price.index:

dollar_price_record[i.strftime('%Y-%m-%d')] = float('{:.2f}'.format(dollar_price.at[i,'Close']))

print()

dollarperwon = dollar_price.at[dollar_price.index[-1], 'Close']

amount = []

amount_by_type = [0, 0, 0, 0]

total_amount = 0

for i in range(len(ticker)):

temp = stock_price[i][list(stock_price[i].keys())[-1]] * stock_own[i][list(stock_own[i].keys())[-1]]

if stock_type[i] == 1 or stock_type[i] == 2:

temp /= dollarperwon

amount.append(temp)

amount_by_type[stock_type[i]] += temp

total_amount += temp

amount_by_type[0] += global_deposit[list(global_deposit.keys())[-1]]

amount_by_type[1] += korea_deposit[list(korea_deposit.keys())[-1]]/dollarperwon

amount_by_type[2] += pension_deposit[list(pension_deposit.keys())[-1]]/dollarperwon

total_amount_plus_deposit = total_amount + global_deposit[list(global_deposit.keys())[-1]] + korea_deposit[list(korea_deposit.keys())[-1]]/dollarperwon + pension_deposit[list(pension_deposit.keys())[-1]]/dollarperwon

sorted_amount_index = list(reversed(sorted(range(len(amount)), key=lambda k: amount[k])))

print('**INVESTMENT STATUS**')

for i in sorted_amount_index:

if stock_own[i][list(stock_own[i].keys())[-1]] == 0:

break

if stock_type[i] == 0:

print('{}{:10.1f}%{:10.1f}{:15.0f} {:10.2f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

if stock_type[i] == 1 or stock_type == 2:

print('{}{:10.1f}%{:10.1f}{:15.0f} {:10.0f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

if stock_type[i] == 3:

print('{}{:10.1f}%{:10.1f}{:15.8f} {:10.2f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

print()

print('**SUMMARY**')

print('GLOBAL STOCK : {:.1f}%\t${:.1f}\t₩{}'.format(amount_by_type[0]/total_amount_plus_deposit*100, amount_by_type[0], '{:,}'.format(int(amount_by_type[0]*dollarperwon))))

print('KOREA STOCK : {:.1f}% \t${:.1f} \t₩{}'.format(amount_by_type[1]/total_amount_plus_deposit*100, amount_by_type[1], '{:,}'.format(int(amount_by_type[1]*dollarperwon))))

print('PENSION S. FUND : {:.1f}% \t${:.1f} \t₩{}'.format(amount_by_type[2]/total_amount_plus_deposit*100, amount_by_type[2], '{:,}'.format(int(amount_by_type[2]*dollarperwon))))

print('CRYPTOCURRENCY : {:.1f}% \t${:.1f} \t₩{}'.format(amount_by_type[3]/total_amount_plus_deposit*100, amount_by_type[3], '{:,}'.format(int(amount_by_type[3]*dollarperwon))))

print('TOTAL ASSET : 100% \t${:.1f}\t₩{}'.format(total_amount_plus_deposit, '{:,}'.format(int(total_amount_plus_deposit*dollarperwon))))

cur = start_date

now = datetime.date(now.year, now.month, now.day)

cur_stock_price = []

cur_stock_own = []

for i in range(len(ticker)):

cur_stock_price.append(stock_price[i][list(stock_price[i].keys())[0]])

cur_stock_own.append(stock_own[i][list(stock_own[i].keys())[0]])

cur_money = money[list(money.keys())[0]]

cur_housing = housing[list(housing.keys())[0]]

cur_debt = debt[list(debt.keys())[0]]

cur_global_deposit = global_deposit[list(global_deposit.keys())[0]]

cur_korea_deposit = korea_deposit[list(korea_deposit.keys())[0]]

cur_pension_deposit = pension_deposit[list(pension_deposit.keys())[0]]

cur_dollarperwon = dollar_price_record[list(dollar_price_record.keys())[0]]

cur_principal = principal[list(principal.keys())[0]]

asset_axis = []

invest_axis = []

earning_axis = []

global_axis = []

korea_axis = []

pension_axis = []

btc_axis = []

date_axis = []

day_count = 0

for_xaxis = []

datetime_axis = []

earning_rate_axis = []

principal_axis = []

while cur <= now:

for i in range(len(ticker)):

if cur.strftime('%Y-%m-%d') in list(stock_price[i].keys()):

cur_stock_price[i] = stock_price[i][cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(stock_own[i].keys()):

cur_stock_own[i] = stock_own[i][cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(money.keys()):

cur_money = money[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(housing.keys()):

cur_housing = housing[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(debt.keys()):

cur_debt = debt[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(global_deposit.keys()):

cur_global_deposit = global_deposit[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(korea_deposit.keys()):

cur_korea_deposit = korea_deposit[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(pension_deposit.keys()):

cur_pension_deposit = pension_deposit[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(dollar_price_record.keys()):

cur_dollarperwon = dollar_price_record[cur.strftime('%Y-%m-%d')]

if cur.strftime('%Y-%m-%d') in list(principal.keys()):

cur_principal = principal[cur.strftime('%Y-%m-%d')]

temp = 0

temp_invest = 0

temp_asset = 0

temp_global = 0

temp_korea = 0

temp_pension = 0

temp_btc = 0

temp_earning = 0

for i in range(len(ticker)):

if stock_type[i] == 0:

temp_invest += cur_stock_price[i] * cur_stock_own[i] * cur_dollarperwon

temp_global += cur_stock_price[i] * cur_stock_own[i] * cur_dollarperwon

elif stock_type[i] == 1:

temp_invest += cur_stock_price[i] * cur_stock_own[i]

temp_korea += cur_stock_price[i] * cur_stock_own[i]

elif stock_type[i] == 2:

temp_invest += cur_stock_price[i] * cur_stock_own[i]

temp_pension += cur_stock_price[i] * cur_stock_own[i]

elif stock_type[i] == 3:

temp_invest += cur_stock_price[i] * cur_stock_own[i] * cur_dollarperwon

temp_btc += cur_stock_price[i] * cur_stock_own[i] * cur_dollarperwon

temp_invest += cur_global_deposit*cur_dollarperwon + cur_korea_deposit + cur_pension_deposit

temp_asset = temp_invest + cur_money + cur_housing - cur_debt

temp_earning = temp_invest - cur_principal

earning_axis.append(temp_earning)

asset_axis.append(temp_asset)

invest_axis.append(temp_invest)

global_axis.append(temp_global)

korea_axis.append(temp_korea)

pension_axis.append(temp_pension)

btc_axis.append(temp_btc)

date_axis.append(day_count)

datetime_axis.append(cur)

principal_axis.append(cur_principal)

earning_rate_axis.append(temp_earning/cur_principal*100)

if day_count%28 == 0:

for_xaxis.append(day_count)

day_count += 1

cur += datetime.timedelta(days=1)

cur = start_date

label_for_xaxis = []

while cur <= now:

label_for_xaxis.append(cur.strftime('%Y-%m-%d'))

cur += datetime.timedelta(weeks=4)

plt.figure(figsize=(20,10))

plt.yticks([0, 10000000, 20000000, 30000000, 40000000, 50000000, 60000000, 70000000, 80000000, 90000000, 100000000, 110000000, 120000000], labels=['0', '10,000,000', '20,000,000', '30,000,000', '40,000,000', '50,000,000', '60,000,000', '70,000,000', '80,000,000', '90,000,000', '100,000,000', '110,000,000', '120,000,000'])

plt.xticks(for_xaxis, labels=label_for_xaxis, rotation=60)

plt.plot(date_axis, asset_axis, label='NET ASSET', color='black')

plt.plot(date_axis , earning_axis, label='EARNING', color='red')

plt.plot(date_axis, invest_axis, label='ASSET', linestyle = 'dashed')

plt.plot(date_axis, global_axis, label='GLOBAL', linestyle = 'dashed')

plt.plot(date_axis, korea_axis, label='KOREA', linestyle = 'dashed')

plt.plot(date_axis, pension_axis, label='PENSION', linestyle = 'dashed')

plt.plot(date_axis, btc_axis, label='BTC', linestyle = 'dashed')

max_asset = max(asset_axis)

min_asset = min(asset_axis)

max_asset_index = asset_axis.index(max_asset)

min_asset_index = asset_axis.index(min_asset)

max_earning = max(earning_axis)

min_earning = min(earning_axis)

max_earning_index = earning_axis.index(max_earning)

min_earning_index = earning_axis.index(min_earning)

plt.annotate('{}\n{} {:,}'.format(datetime_axis[max_asset_index].strftime('%Y-%m-%d'), u"\u20A9", int(asset_axis[max_asset_index])), xy=(date_axis[max_asset_index], asset_axis[max_asset_index]), xytext=(-200,70), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='black',arrowstyle="-|>"))

plt.annotate('{}\n{} {:,}'.format(datetime_axis[min_asset_index].strftime('%Y-%m-%d'), u"\u20A9", int(asset_axis[min_asset_index])), xy=(date_axis[min_asset_index], asset_axis[min_asset_index]), xytext=(100,120), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='black',arrowstyle="-|>"))

plt.annotate('{}\n{} {:,}'.format(datetime_axis[-1].strftime('%Y-%m-%d'), u"\u20A9", int(asset_axis[-1])), xy=(date_axis[-1], asset_axis[-1]), xytext=(0,70), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='black',arrowstyle="-|>"))

plt.annotate('{}\n{} {:,}'.format(datetime_axis[max_earning_index].strftime('%Y-%m-%d'), u"\u20A9", int(earning_axis[max_earning_index])), xy=(date_axis[max_earning_index], earning_axis[max_earning_index]), xytext=(0,70), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='red',arrowstyle="-|>"))

plt.annotate('{}\n-{} {:,}'.format(datetime_axis[min_earning_index].strftime('%Y-%m-%d'), u"\u20A9", abs(int(earning_axis[min_earning_index]))), xy=(date_axis[min_earning_index], earning_axis[min_earning_index]), xytext=(0,70), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='red',arrowstyle="-|>"))

plt.annotate('{}\n{} {:,}'.format(datetime_axis[-1].strftime('%Y-%m-%d'), u"\u20A9", int(earning_axis[-1])), xy=(date_axis[-1], earning_axis[-1]), xytext=(0,70), textcoords='offset points', fontsize=20, ha='center', arrowprops=dict(color='red',arrowstyle="-|>"))

print()

print('NET ASSET : ₩{:,}'.format(int(asset_axis[-1])))

print('MAX NET ASSET : ₩{:,}'.format(int(max_asset)))

print()

print('EARNING : ₩{:,}'.format(int(earning_axis[-1])))

print('MAX EARNING : ₩{:,}'.format(int(max_earning)))

print()

print('RATE OF RETURN : {:.1f}%'.format(earning_rate_axis[-1]))

plt.legend()

plt.grid(True, axis='y')

plt.savefig('/content/drive/MyDrive/Stock_Record/Asset.png')

old_im = Image.open('/content/drive/MyDrive/Stock_Record/Asset.png')

old_size = old_im.size

new_size = (1440, 1080)

new_im = Image.new("RGB", new_size) ## luckily, this is already black!

new_im.paste(old_im, ((int)((new_size[0]-old_size[0])/2), (int)((new_size[1]-old_size[1])/2)))

new_im.show()

new_im.save('/content/drive/MyDrive/Stock_Record/Asset.png')

bg_color = 'rgb(105,105,105)'

font = ImageFont.truetype('/content/drive/MyDrive/Stock_Record/Monoid-Retina.ttf', 15)

font_color = 'rgb(255,255,255)'

w = 932

h = 699

image = Image.new('RGB', (w,h), color=bg_color)

draw = ImageDraw.Draw(image)

x_text = 165

y_text = 50

lines = []

lines.append('**INVESTMENT STATUS**')

for i in sorted_amount_index:

if stock_own[i][list(stock_own[i].keys())[-1]] == 0:

break

if stock_type[i] == 0:

lines.append('{}{:10.1f}%{:10.1f}{:15.0f} {:10.2f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

if stock_type[i] == 1 or stock_type == 2:

lines.append('{}{:10.1f}%{:10.1f}{:15.0f} {:10.0f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

if stock_type[i] == 3:

lines.append('{}{:10.1f}%{:10.1f}{:15.8f} {:10.2f}'.format('{0: <10}'.format(ticker[i]), amount[i]/total_amount*100, amount[i], stock_own[i][list(stock_own[i].keys())[-1]], stock_price[i][list(stock_price[i].keys())[-1]]))

for line in lines:

width, height = font.getsize(line)

draw.text((x_text,y_text),line,font=font,fill=font_color)

y_text += height+10

image.save('/content/drive/MyDrive/Stock_Record/Investment_Status.png')

image

w = 600

h = 450

image1 = Image.new('RGB', (w,h), color=bg_color)

draw1 = ImageDraw.Draw(image1)

x_text = 50

y_text = 50

lines = []

lines.append('**SUMMARY**')

lines.append('GLOBAL STOCK : {:.1f}% ${:.1f} {}'.format(amount_by_type[0]/total_amount_plus_deposit*100, amount_by_type[0], '{:,}'.format(int(amount_by_type[0]*dollarperwon))))

lines.append('KOREA STOCK : {:.1f}% ${:.1f} {}'.format(amount_by_type[1]/total_amount_plus_deposit*100, amount_by_type[1], '{:,}'.format(int(amount_by_type[1]*dollarperwon))))

lines.append('PENSION S. FUND : {:.1f}% ${:.1f} {}'.format(amount_by_type[2]/total_amount_plus_deposit*100, amount_by_type[2], '{:,}'.format(int(amount_by_type[2]*dollarperwon))))

lines.append('CRYPTOCURRENCY : {:.1f}% ${:.1f} {}'.format(amount_by_type[3]/total_amount_plus_deposit*100, amount_by_type[3], '{:,}'.format(int(amount_by_type[3]*dollarperwon))))

lines.append('TOTAL ASSET : 100% ${:.1f} {}'.format(total_amount_plus_deposit, '{:,}'.format(int(total_amount_plus_deposit*dollarperwon))))

lines.append('')

lines.append('NET ASSET : {:,}'.format(int(asset_axis[-1])))

lines.append('MAX NET ASSET : {:,}'.format(int(max_asset)))

lines.append('')

lines.append('EARNING : {:,}'.format(int(earning_axis[-1])))

lines.append('MAX EARNING : {:,}'.format(int(max_earning)))

lines.append('')

lines.append('RATE OF RETURN : {:.1f}%'.format(earning_rate_axis[-1]))

for line in lines:

width, height = font.getsize(line)

draw1.text((x_text,y_text),line,font=font,fill=font_color)

y_text += height+10

image1.save('/content/drive/MyDrive/Stock_Record/Summary.png')

image1