The Statistics of Algotrading

VIX (Cboe Volatility Index)

- A real-time market index that represents the market's expectation of 30-day forward-looking volatility.

- Tracks volatility of the S&P 500 using weighted average of out of the money puts and calls.

- It provides a measure of market risk and investors' sentiments.

- High VIX = high volatility

- Low VIX = low volatility

- Very complicated formula

- High volumes "USUALLY BUT NOT ALWAYS" corrleate with high volatility.

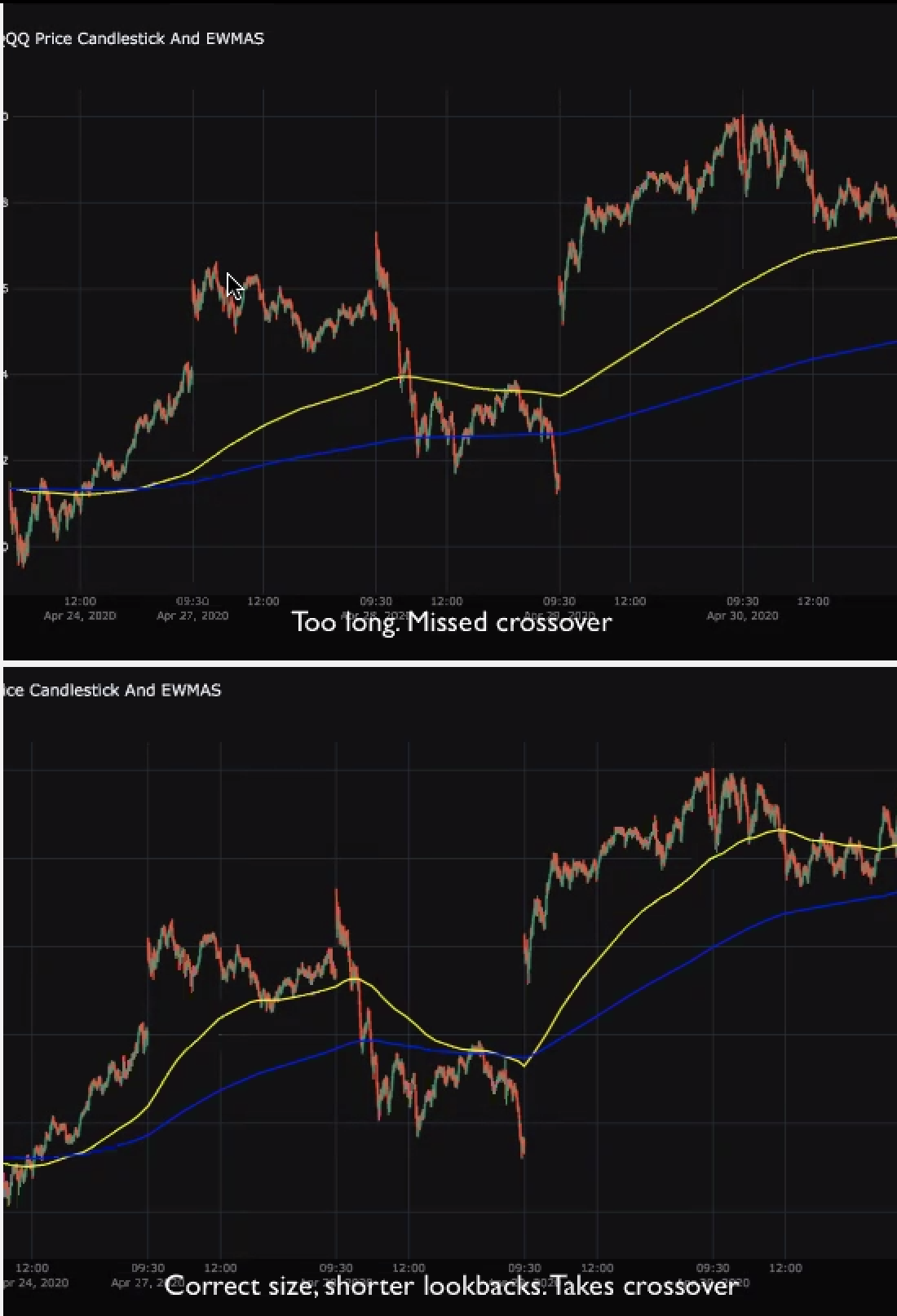

Exponential Moving Average

- Longer Lookback = Smoother Curve

- Smoother Curve = Less reactive to momentum movement signals.

- If the graph is choppy, you need to stay close to the graph.

- The choppier the graph and the larger the movements, the shorter the lookback periods there should be.

- If you're smoothing too much, you're gonna miss a lot of movements.

Example of EMA in graphs.

- This graph above is very choppy, which means high VIX.

- Again, olden Cross & Death Cross

- BUY = Short Moving Average > Longer Moving Average.

- Higher VIX (AKA Higher Volatality) = shorter lookbacks

- Lower VIX (AKA Lower Volatility) = longer lookbacks.

- Therefore, we conclude that the bottom graph is much more useful because the yellow trendline, which is a shorter lookbacks, reflect on the volatility much more than the smoother trendlines of the top graph.

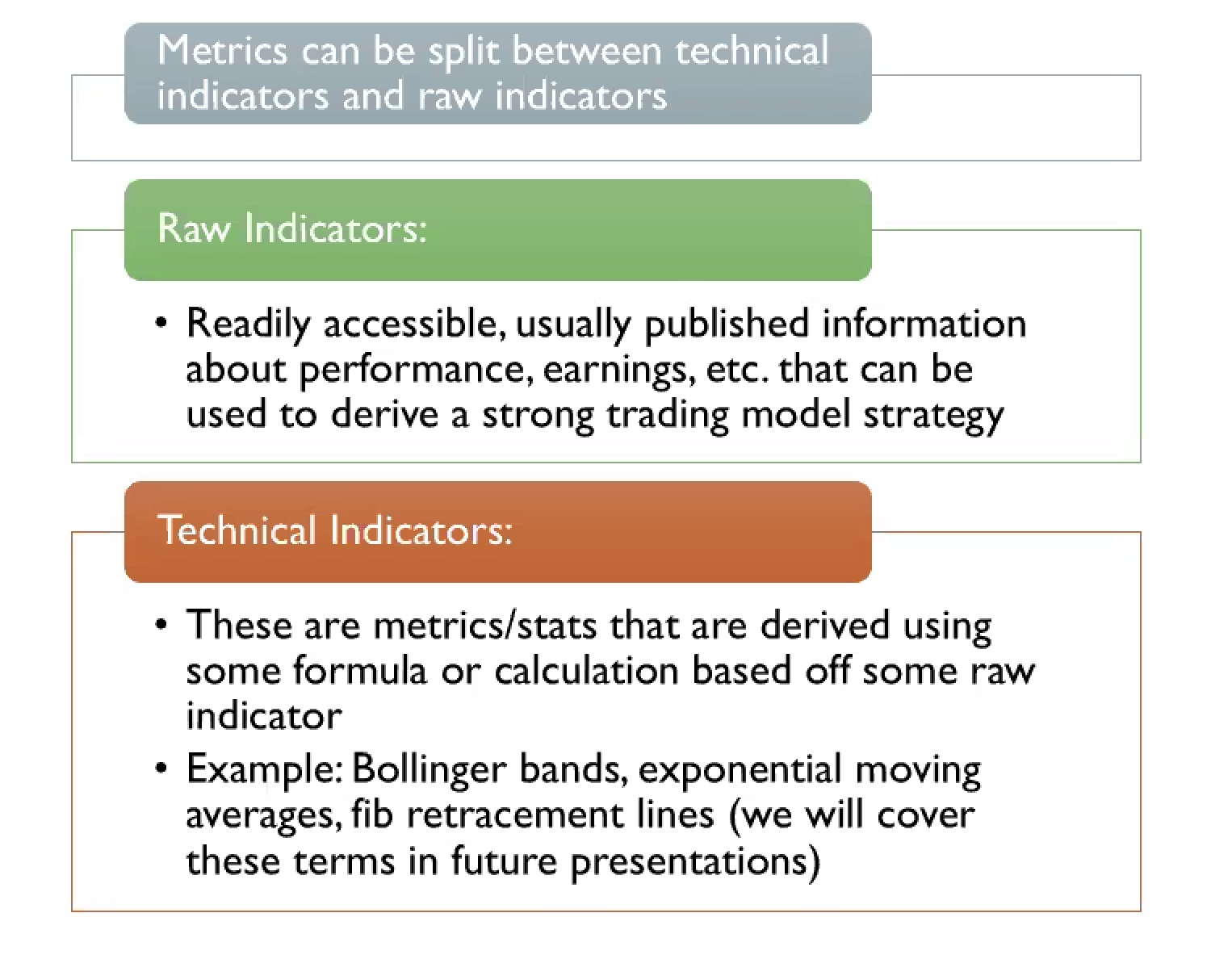

Raw Indicators vs. Technical Indicators

Examples of Raw Indicators

- Not super important for Quants because these are more about VALUE of the companies.

- Information on Financial Statement or that doesn't require calculations

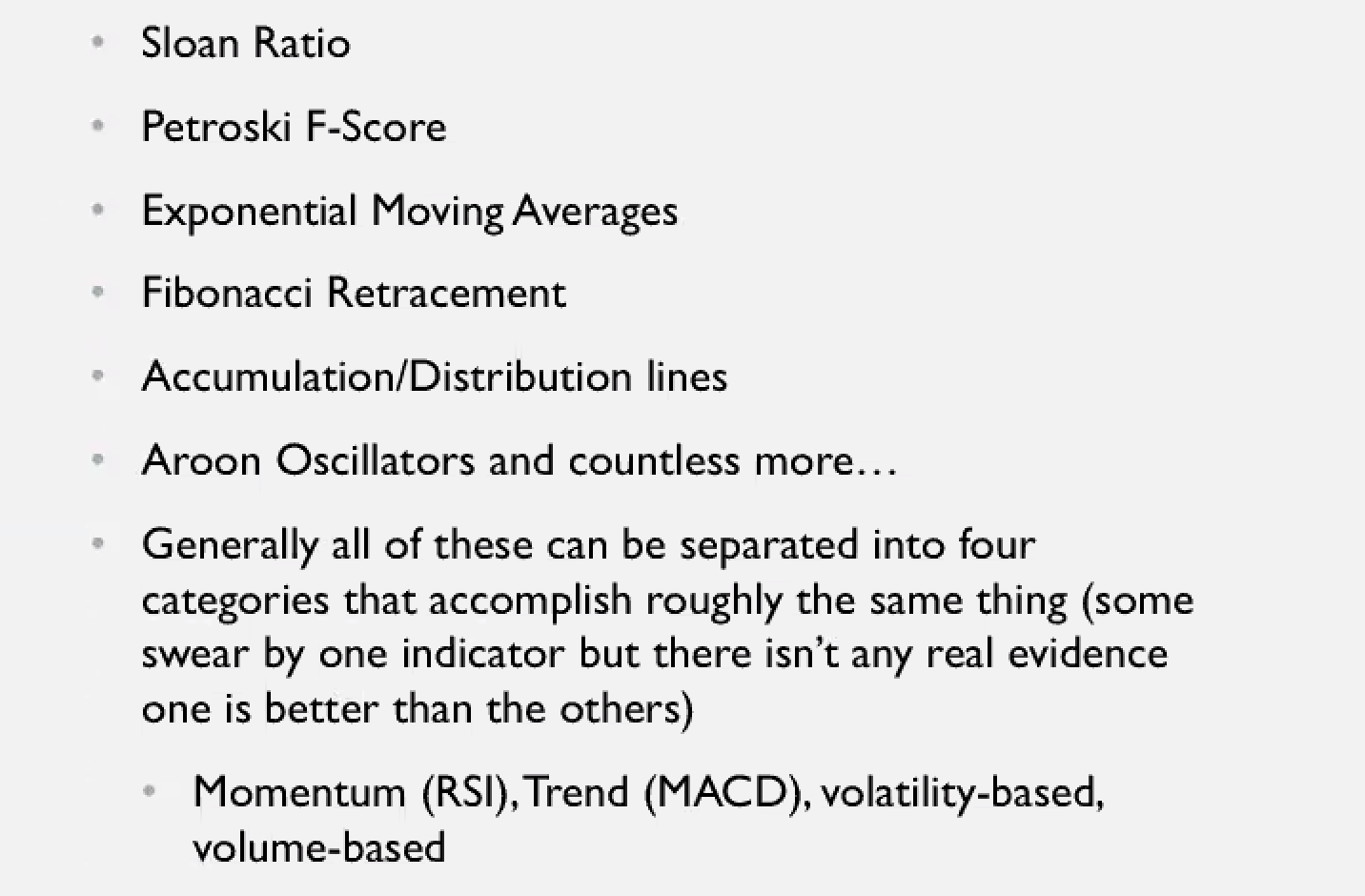

Examples of Technical Indicators

- 4 Categories: Momentum, Trend, Volatility, Volume

- In my opinion, algorithms based on news or tweets might not be the best algorithms because usually news reflect on the events that a lot of high-level investors already know.

- In other words, the market will reflect on the future events or possibilities. By the time, we web-crawl the Yahoo Finance and let algorithm decides if the market's bullish or bearish, the prices will already reflect those news. Unless, we have a Bloomberg Terminal, which is very expensive.

- And, we would need a very efficient/fast algorithm for web-crawling and effective classifcation of what is a good news and bad news.

Important Statistics

Alpha Calculation

- Alpha is defined as beating the market with some type of strategy. This is not solely relative to returns but also to risk.

- Example: Let's say the S&P 500 goes up 8% in a year.

- You have a momentum based strategy on airline companies that has a 12% profit at the end of the year.

- You may have made 4% "alpha". But, this needs to be consistent.

- Consistent returns are very very important for Alpha.

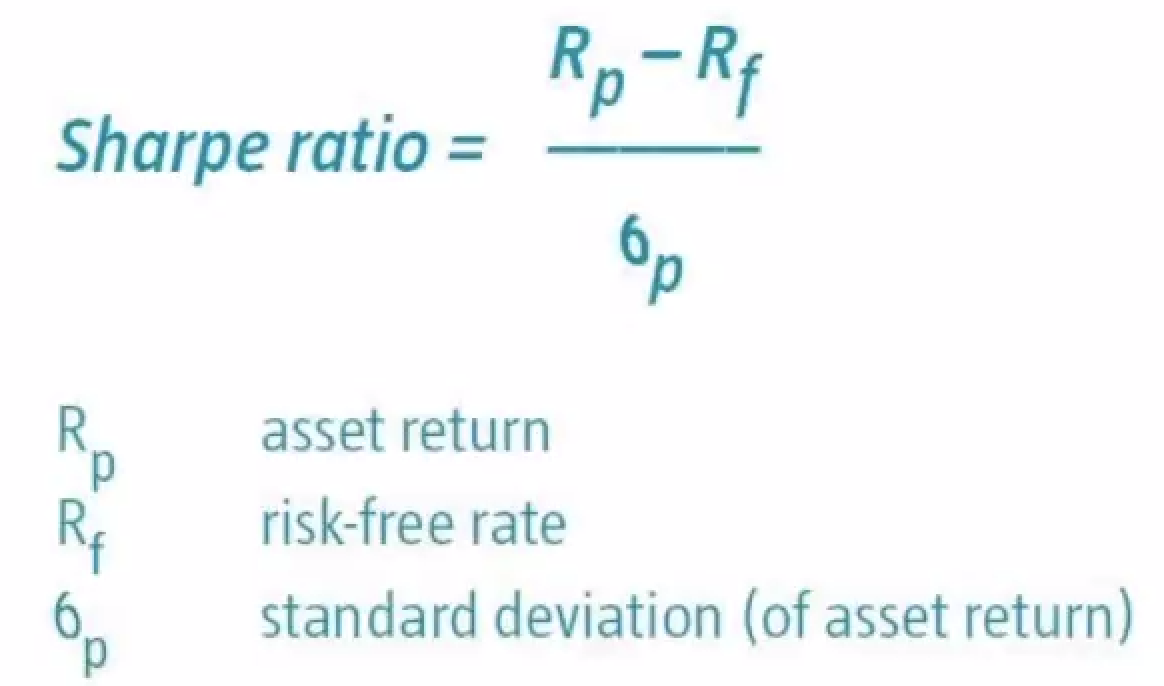

Sharpe Ratio !!!

- Designed to help understand the return of an investment versus its risk.

- Risk-free rate can change all the time, but it's usually based on 10 year US Treasuary Bond (Very low-risk).

- Calculation: Average return earned in excess of risk free rate divided by how volatile your strategy is.

- High Sharpe = More Attractive and comes from high returns with low risk.

Assignment