prev_application 데이터 세트 기반의 EDA와 Feature Engineering 수행 후 학습 모델 생성/평가

라이브러리 및 데이터 세트 로딩. 이전 application 데이터의 FE 함수 복사

import numpy as np # 1.18.5

import pandas as pd # 0.25.1

import gc

import time

import matplotlib.pyplot as plt # 3.2.2

import seaborn as sns # 0.10.1

%matplotlib inline

import warnings

warnings.filterwarnings('ignore')

pd.set_option('display.max_rows', 100)

pd.set_option('display.max_columns', 200)app_train = pd.read_csv('application_train.csv')

app_test = pd.read_csv('application_test.csv')def get_apps_dataset():

app_train = pd.read_csv('application_train.csv')

app_test = pd.read_csv('application_test.csv')

apps = pd.concat([app_train, app_test])

return apps

apps = get_apps_dataset()<ipython-input-3-da4fa99e2eb3>:4: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

apps = pd.concat([app_train, app_test])이전 application 데이터의 feature engineering 함수 복사

def get_apps_processed(apps):

# EXT_SOURCE_X FEATURE 가공

apps['APPS_EXT_SOURCE_MEAN'] = apps[['EXT_SOURCE_1', 'EXT_SOURCE_2', 'EXT_SOURCE_3']].mean(axis=1)

apps['APPS_EXT_SOURCE_STD'] = apps[['EXT_SOURCE_1', 'EXT_SOURCE_2', 'EXT_SOURCE_3']].std(axis=1)

apps['APPS_EXT_SOURCE_STD'] = apps['APPS_EXT_SOURCE_STD'].fillna(apps['APPS_EXT_SOURCE_STD'].mean())

# AMT_CREDIT 비율로 Feature 가공

apps['APPS_ANNUITY_CREDIT_RATIO'] = apps['AMT_ANNUITY']/apps['AMT_CREDIT']

apps['APPS_GOODS_CREDIT_RATIO'] = apps['AMT_GOODS_PRICE']/apps['AMT_CREDIT']

# AMT_INCOME_TOTAL 비율로 Feature 가공

apps['APPS_ANNUITY_INCOME_RATIO'] = apps['AMT_ANNUITY']/apps['AMT_INCOME_TOTAL']

apps['APPS_CREDIT_INCOME_RATIO'] = apps['AMT_CREDIT']/apps['AMT_INCOME_TOTAL']

apps['APPS_GOODS_INCOME_RATIO'] = apps['AMT_GOODS_PRICE']/apps['AMT_INCOME_TOTAL']

apps['APPS_CNT_FAM_INCOME_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['CNT_FAM_MEMBERS']

# DAYS_BIRTH, DAYS_EMPLOYED 비율로 Feature 가공

apps['APPS_EMPLOYED_BIRTH_RATIO'] = apps['DAYS_EMPLOYED']/apps['DAYS_BIRTH']

apps['APPS_INCOME_EMPLOYED_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['DAYS_EMPLOYED']

apps['APPS_INCOME_BIRTH_RATIO'] = apps['AMT_INCOME_TOTAL']/apps['DAYS_BIRTH']

apps['APPS_CAR_BIRTH_RATIO'] = apps['OWN_CAR_AGE'] / apps['DAYS_BIRTH']

apps['APPS_CAR_EMPLOYED_RATIO'] = apps['OWN_CAR_AGE'] / apps['DAYS_EMPLOYED']

return appsprevious 데이터 로딩

prev = pd.read_csv('previous_application.csv')

print(prev.shape, apps.shape)(1670214, 37) (356255, 122)application와 previous outer 조인하고 누락된 집합들 확인.

prev.head()| SK_ID_PREV | SK_ID_CURR | NAME_CONTRACT_TYPE | AMT_ANNUITY | AMT_APPLICATION | AMT_CREDIT | AMT_DOWN_PAYMENT | AMT_GOODS_PRICE | WEEKDAY_APPR_PROCESS_START | HOUR_APPR_PROCESS_START | FLAG_LAST_APPL_PER_CONTRACT | NFLAG_LAST_APPL_IN_DAY | RATE_DOWN_PAYMENT | RATE_INTEREST_PRIMARY | RATE_INTEREST_PRIVILEGED | NAME_CASH_LOAN_PURPOSE | NAME_CONTRACT_STATUS | DAYS_DECISION | NAME_PAYMENT_TYPE | CODE_REJECT_REASON | NAME_TYPE_SUITE | NAME_CLIENT_TYPE | NAME_GOODS_CATEGORY | NAME_PORTFOLIO | NAME_PRODUCT_TYPE | CHANNEL_TYPE | SELLERPLACE_AREA | NAME_SELLER_INDUSTRY | CNT_PAYMENT | NAME_YIELD_GROUP | PRODUCT_COMBINATION | DAYS_FIRST_DRAWING | DAYS_FIRST_DUE | DAYS_LAST_DUE_1ST_VERSION | DAYS_LAST_DUE | DAYS_TERMINATION | NFLAG_INSURED_ON_APPROVAL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2030495 | 271877 | Consumer loans | 1730.430 | 17145.0 | 17145.0 | 0.0 | 17145.0 | SATURDAY | 15 | Y | 1 | 0.0 | 0.182832 | 0.867336 | XAP | Approved | -73 | Cash through the bank | XAP | NaN | Repeater | Mobile | POS | XNA | Country-wide | 35 | Connectivity | 12.0 | middle | POS mobile with interest | 365243.0 | -42.0 | 300.0 | -42.0 | -37.0 | 0.0 |

| 1 | 2802425 | 108129 | Cash loans | 25188.615 | 607500.0 | 679671.0 | NaN | 607500.0 | THURSDAY | 11 | Y | 1 | NaN | NaN | NaN | XNA | Approved | -164 | XNA | XAP | Unaccompanied | Repeater | XNA | Cash | x-sell | Contact center | -1 | XNA | 36.0 | low_action | Cash X-Sell: low | 365243.0 | -134.0 | 916.0 | 365243.0 | 365243.0 | 1.0 |

| 2 | 2523466 | 122040 | Cash loans | 15060.735 | 112500.0 | 136444.5 | NaN | 112500.0 | TUESDAY | 11 | Y | 1 | NaN | NaN | NaN | XNA | Approved | -301 | Cash through the bank | XAP | Spouse, partner | Repeater | XNA | Cash | x-sell | Credit and cash offices | -1 | XNA | 12.0 | high | Cash X-Sell: high | 365243.0 | -271.0 | 59.0 | 365243.0 | 365243.0 | 1.0 |

| 3 | 2819243 | 176158 | Cash loans | 47041.335 | 450000.0 | 470790.0 | NaN | 450000.0 | MONDAY | 7 | Y | 1 | NaN | NaN | NaN | XNA | Approved | -512 | Cash through the bank | XAP | NaN | Repeater | XNA | Cash | x-sell | Credit and cash offices | -1 | XNA | 12.0 | middle | Cash X-Sell: middle | 365243.0 | -482.0 | -152.0 | -182.0 | -177.0 | 1.0 |

| 4 | 1784265 | 202054 | Cash loans | 31924.395 | 337500.0 | 404055.0 | NaN | 337500.0 | THURSDAY | 9 | Y | 1 | NaN | NaN | NaN | Repairs | Refused | -781 | Cash through the bank | HC | NaN | Repeater | XNA | Cash | walk-in | Credit and cash offices | -1 | XNA | 24.0 | high | Cash Street: high | NaN | NaN | NaN | NaN | NaN | NaN |

prev_app_outer = prev.merge(apps['SK_ID_CURR'], on='SK_ID_CURR', how='outer', indicator=True)| SK_ID_PREV | SK_ID_CURR | NAME_CONTRACT_TYPE | AMT_ANNUITY | AMT_APPLICATION | AMT_CREDIT | AMT_DOWN_PAYMENT | AMT_GOODS_PRICE | WEEKDAY_APPR_PROCESS_START | HOUR_APPR_PROCESS_START | FLAG_LAST_APPL_PER_CONTRACT | NFLAG_LAST_APPL_IN_DAY | RATE_DOWN_PAYMENT | RATE_INTEREST_PRIMARY | RATE_INTEREST_PRIVILEGED | NAME_CASH_LOAN_PURPOSE | NAME_CONTRACT_STATUS | DAYS_DECISION | NAME_PAYMENT_TYPE | CODE_REJECT_REASON | NAME_TYPE_SUITE | NAME_CLIENT_TYPE | NAME_GOODS_CATEGORY | NAME_PORTFOLIO | NAME_PRODUCT_TYPE | CHANNEL_TYPE | SELLERPLACE_AREA | NAME_SELLER_INDUSTRY | CNT_PAYMENT | NAME_YIELD_GROUP | PRODUCT_COMBINATION | DAYS_FIRST_DRAWING | DAYS_FIRST_DUE | DAYS_LAST_DUE_1ST_VERSION | DAYS_LAST_DUE | DAYS_TERMINATION | NFLAG_INSURED_ON_APPROVAL | _merge | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2030495.0 | 271877 | Consumer loans | 1730.430 | 17145.0 | 17145.0 | 0.0 | 17145.0 | SATURDAY | 15.0 | Y | 1.0 | 0.000000 | 0.182832 | 0.867336 | XAP | Approved | -73.0 | Cash through the bank | XAP | NaN | Repeater | Mobile | POS | XNA | Country-wide | 35.0 | Connectivity | 12.0 | middle | POS mobile with interest | 365243.0 | -42.0 | 300.0 | -42.0 | -37.0 | 0.0 | both |

| 1 | 1696966.0 | 271877 | Consumer loans | 68258.655 | 1800000.0 | 1754721.0 | 180000.0 | 1800000.0 | SATURDAY | 18.0 | Y | 1.0 | 0.101325 | NaN | NaN | XAP | Refused | -472.0 | Cash through the bank | SCO | NaN | Repeater | Clothing and Accessories | POS | XNA | Regional / Local | 55.0 | Furniture | 36.0 | low_normal | POS industry with interest | NaN | NaN | NaN | NaN | NaN | NaN | both |

| 2 | 2154916.0 | 271877 | Consumer loans | 12417.390 | 108400.5 | 119848.5 | 0.0 | 108400.5 | SUNDAY | 14.0 | Y | 1.0 | 0.000000 | NaN | NaN | XAP | Approved | -548.0 | Cash through the bank | XAP | NaN | New | Furniture | POS | XNA | Stone | 196.0 | Furniture | 12.0 | middle | POS industry with interest | 365243.0 | -512.0 | -182.0 | -392.0 | -387.0 | 0.0 | both |

| 3 | 2802425.0 | 108129 | Cash loans | 25188.615 | 607500.0 | 679671.0 | NaN | 607500.0 | THURSDAY | 11.0 | Y | 1.0 | NaN | NaN | NaN | XNA | Approved | -164.0 | XNA | XAP | Unaccompanied | Repeater | XNA | Cash | x-sell | Contact center | -1.0 | XNA | 36.0 | low_action | Cash X-Sell: low | 365243.0 | -134.0 | 916.0 | 365243.0 | 365243.0 | 1.0 | both |

| 4 | 1536272.0 | 108129 | Cash loans | 21709.125 | 450000.0 | 512370.0 | NaN | 450000.0 | WEDNESDAY | 9.0 | Y | 1.0 | NaN | NaN | NaN | XNA | Approved | -515.0 | XNA | XAP | NaN | Repeater | XNA | Cash | x-sell | AP+ (Cash loan) | 6.0 | XNA | 36.0 | low_normal | Cash X-Sell: low | 365243.0 | -485.0 | 565.0 | -155.0 | -147.0 | 1.0 | both |

prev_app_outer['_merge'].value_counts()both 1670214

right_only 17398

left_only 0

Name: _merge, dtype: int64previous 컬럼 설명

| Table | 컬럼명 | 컬럼 대분류 | 컬럼 중분류 | 컬럼 설명 |

|---|---|---|---|---|

| previous_application.csv | SK_ID_PREV | 대출 | 고유ID | 과거 대출 고유 ID |

| previous_application.csv | SK_ID_CURR | 대출 | 고유ID | 현재 대출 고유 ID |

| previous_application.csv | NAME_CONTRACT_TYPE | 대출 | 대출 유형 | 대출 유형 |

| previous_application.csv | AMT_ANNUITY | 대출 | 대출 금액 | 월 대출 지급액 |

| previous_application.csv | AMT_APPLICATION | 대출 | 대출 금액 | 대출 신청 금액 |

| previous_application.csv | AMT_CREDIT | 대출 | 대출 금액 | 대출금액(허가) |

| previous_application.csv | AMT_DOWN_PAYMENT | 대출 | 대출 금액 | 대출 시 납부한 선금액 |

| previous_application.csv | AMT_GOODS_PRICE | 대출 | 대출 금액 | 소비자 대출상품액 |

| previous_application.csv | WEEKDAY_APPR_PROCESS_START | 고객 | 행동 | 대출 신청 시작 요일 |

| previous_application.csv | HOUR_APPR_PROCESS_START | 고객 | 행동 | 대출 신청 시작 시간대 |

| previous_application.csv | FLAG_LAST_APPL_PER_CONTRACT | 고객 | 행동 | 이전 계약의 마지막 대출 신청 여부 |

| previous_application.csv | NFLAG_LAST_APPL_IN_DAY | 고객 | 행동 | 하루중 마지막 대출 신청 여부(하루에 여러 번 대출 신청했을 경우) |

| previous_application.csv | NFLAG_MICRO_CASH | 대출 | 대출 유형 | 소액 대출 여부 |

| previous_application.csv | RATE_DOWN_PAYMENT | 대출 | 대출 금액 | 선금 비율(정규화됨) |

| previous_application.csv | RATE_INTEREST_PRIMARY | 대출 | 대출 금액 | 이자율 |

| previous_application.csv | RATE_INTEREST_PRIVILEGED | 대출 | 대출 금액 | 이자율 |

| previous_application.csv | NAME_CASH_LOAN_PURPOSE | 대출 | 대출 유형 | 현금 대출 목적 |

| previous_application.csv | NAME_CONTRACT_STATUS | 대출 | 대출 상태 | 대출 상태(허가, 취소) |

| previous_application.csv | DAYS_DECISION | 대출 | 대출 상태 | 과거 신청 대비 현재 신청 결정 기간 |

| previous_application.csv | NAME_PAYMENT_TYPE | 대출 | 대출 유형 | 과거 대출 신청의 납부 방법 |

| previous_application.csv | CODE_REJECT_REASON | 대출 | 대출 상태 | 과거 신청 거절 사유 |

| previous_application.csv | NAME_TYPE_SUITE | 고객 | 행동(추천) | 동행 고객 |

| previous_application.csv | NAME_CLIENT_TYPE | 고객 | 행동 | 신규 고객 또는 기존 대출 고객 여부 |

| previous_application.csv | NAME_GOODS_CATEGORY | 대출 | 대출 유형 | 대출 상품 중분류 유형 |

| previous_application.csv | NAME_PORTFOLIO | 대출 | 대출 유형 | 현금대출/POS/CAR 대출 유형 |

| previous_application.csv | NAME_PRODUCT_TYPE | 채널 | 판매 유형 | 고객이 찾아온 대출인가, 영업 대출인가 |

| previous_application.csv | CHANNEL_TYPE | 채널 | 채널 유형 | 채널 유형 |

| previous_application.csv | SELLERPLACE_AREA | 채널 | 채널 유형 | 판매자 판매 지역 |

| previous_application.csv | NAME_SELLER_INDUSTRY | 채널 | 채널 유형 | 판매자 Industry |

| previous_application.csv | CNT_PAYMENT | 대출 | 대출 금액 | 이전 대출 신청의 대출금액 관련 Term |

| previous_application.csv | NAME_YIELD_GROUP | 대출 | 대출 금액 | 집단 금리 적용 유형 |

| previous_application.csv | PRODUCT_COMBINATION | 대출 | 대출 유형 | 이전 대출 결합 상품 |

| previous_application.csv | DAYS_FIRST_DRAWING | 대출 | 상태 | 신청날짜부터 최초 대출 지급까지의 일자 |

| previous_application.csv | DAYS_FIRST_DUE | 대출 | 상태 | 신청날짜부터 마감일까지의 일자 |

| previous_application.csv | DAYS_LAST_DUE_1ST_VERSION | 대출 | 상태 | 신청날짜부터 첫 만기일까지의 일자 |

| previous_application.csv | DAYS_LAST_DUE | 대출 | 상태 | 신청날짜부터 마지막 만기일까지의 일자 |

| previous_application.csv | DAYS_TERMINATION | 대출 | 상태 | 현 대출 신청일자 대비 대출 예상 종료 일자 |

| previous_application.csv | NFLAG_INSURED_ON_APPROVAL | 대출 | 상태 | 대출 신청 시 보험가입 요청여부 |

previous 컬럼과 Null 값 조사

prev.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1670214 entries, 0 to 1670213

Data columns (total 37 columns):

SK_ID_PREV 1670214 non-null int64

SK_ID_CURR 1670214 non-null int64

NAME_CONTRACT_TYPE 1670214 non-null object

AMT_ANNUITY 1297979 non-null float64

AMT_APPLICATION 1670214 non-null float64

AMT_CREDIT 1670213 non-null float64

AMT_DOWN_PAYMENT 774370 non-null float64

AMT_GOODS_PRICE 1284699 non-null float64

WEEKDAY_APPR_PROCESS_START 1670214 non-null object

HOUR_APPR_PROCESS_START 1670214 non-null int64

FLAG_LAST_APPL_PER_CONTRACT 1670214 non-null object

NFLAG_LAST_APPL_IN_DAY 1670214 non-null int64

RATE_DOWN_PAYMENT 774370 non-null float64

RATE_INTEREST_PRIMARY 5951 non-null float64

RATE_INTEREST_PRIVILEGED 5951 non-null float64

NAME_CASH_LOAN_PURPOSE 1670214 non-null object

NAME_CONTRACT_STATUS 1670214 non-null object

DAYS_DECISION 1670214 non-null int64

NAME_PAYMENT_TYPE 1670214 non-null object

CODE_REJECT_REASON 1670214 non-null object

NAME_TYPE_SUITE 849809 non-null object

NAME_CLIENT_TYPE 1670214 non-null object

NAME_GOODS_CATEGORY 1670214 non-null object

NAME_PORTFOLIO 1670214 non-null object

NAME_PRODUCT_TYPE 1670214 non-null object

CHANNEL_TYPE 1670214 non-null object

SELLERPLACE_AREA 1670214 non-null int64

NAME_SELLER_INDUSTRY 1670214 non-null object

CNT_PAYMENT 1297984 non-null float64

NAME_YIELD_GROUP 1670214 non-null object

PRODUCT_COMBINATION 1669868 non-null object

DAYS_FIRST_DRAWING 997149 non-null float64

DAYS_FIRST_DUE 997149 non-null float64

DAYS_LAST_DUE_1ST_VERSION 997149 non-null float64

DAYS_LAST_DUE 997149 non-null float64

DAYS_TERMINATION 997149 non-null float64

NFLAG_INSURED_ON_APPROVAL 997149 non-null float64

dtypes: float64(15), int64(6), object(16)

memory usage: 471.5+ MB주요 컬럼 EDA 수행

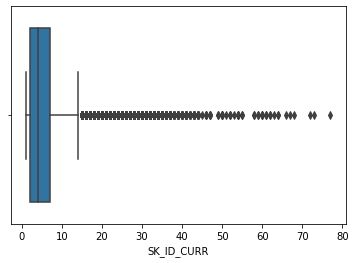

SK_ID_CURR당 평균 SK_ID_PREV 건수 구하기

- groupby 로 평균 건수 구함.

- boxplot으로 시각화

prev.groupby('SK_ID_CURR')['SK_ID_CURR'].count().mean()4.928964135313716sns.boxplot(prev.groupby('SK_ID_CURR')['SK_ID_CURR'].count())

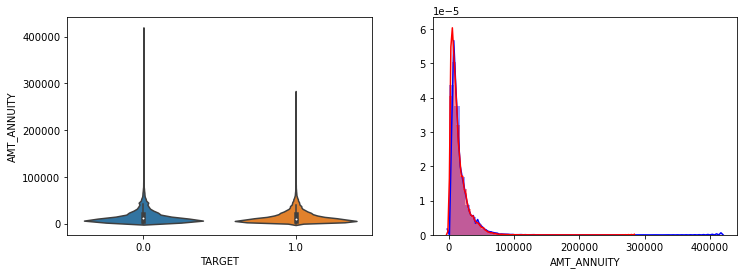

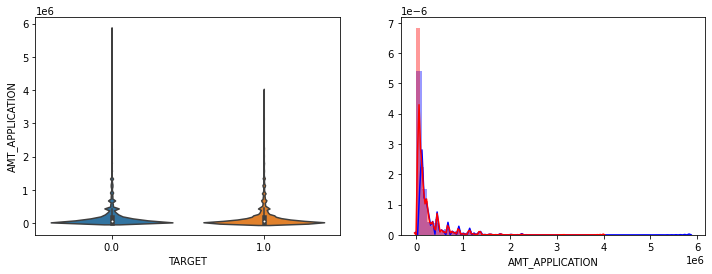

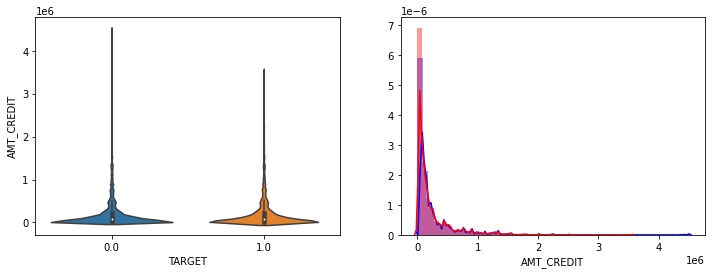

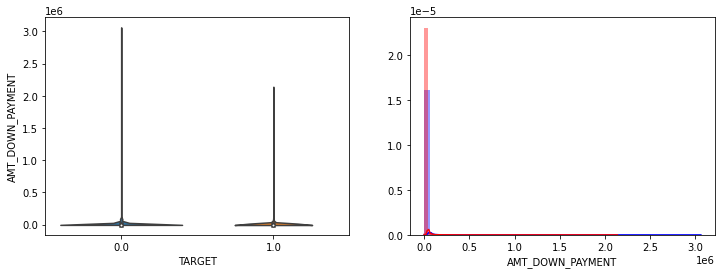

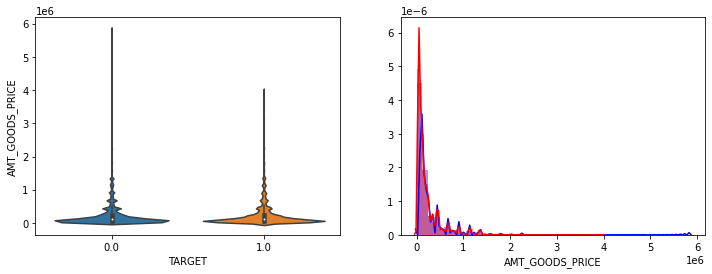

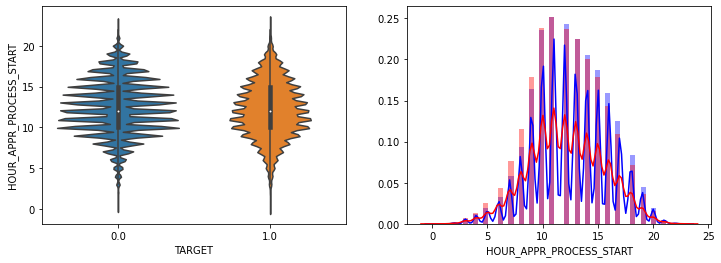

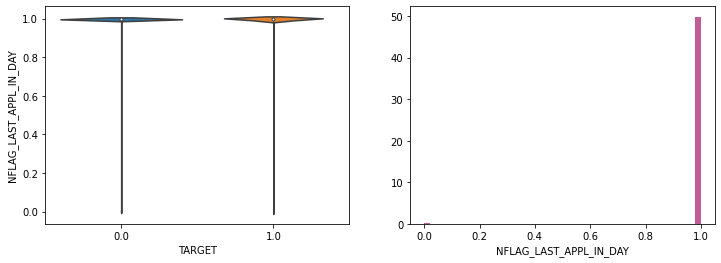

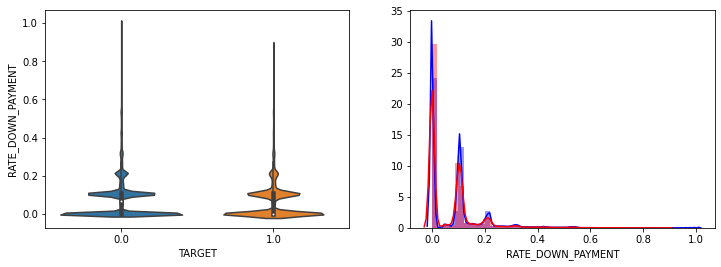

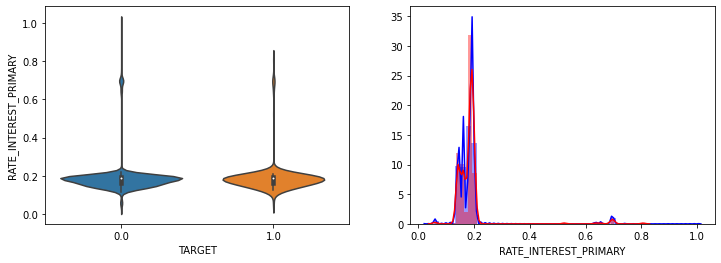

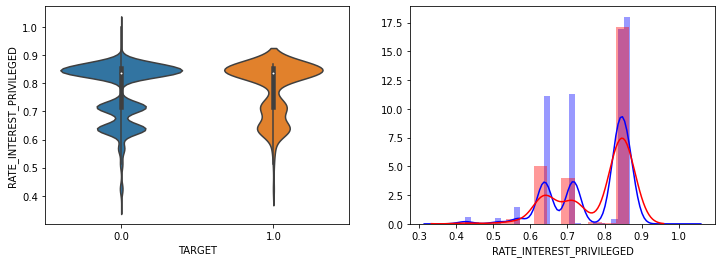

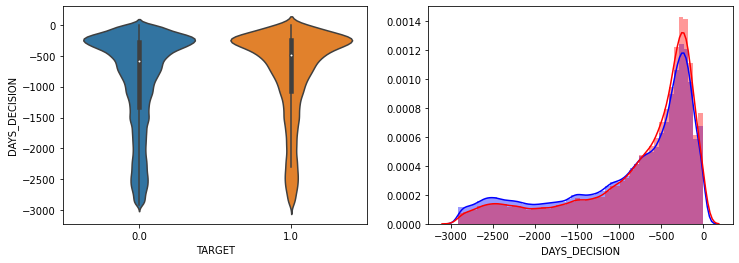

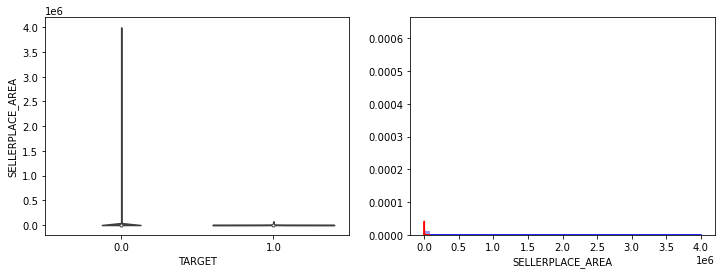

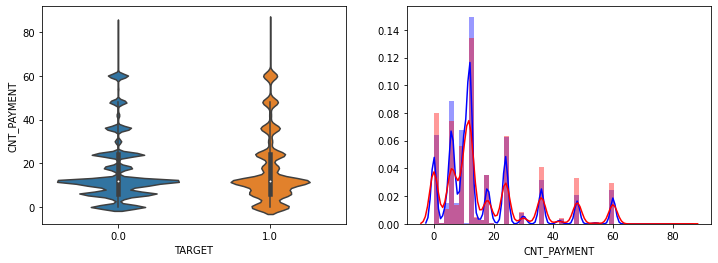

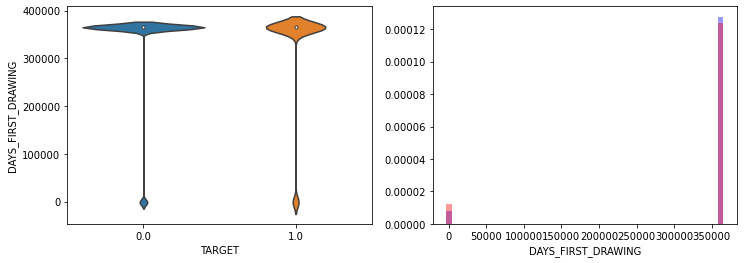

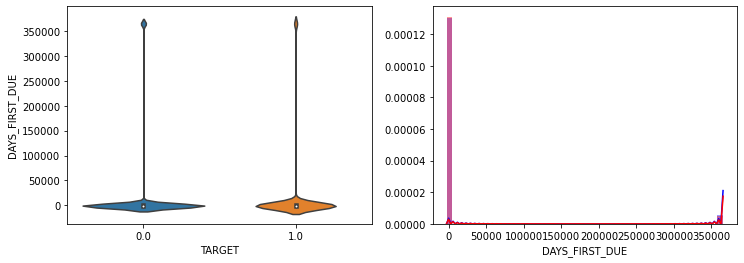

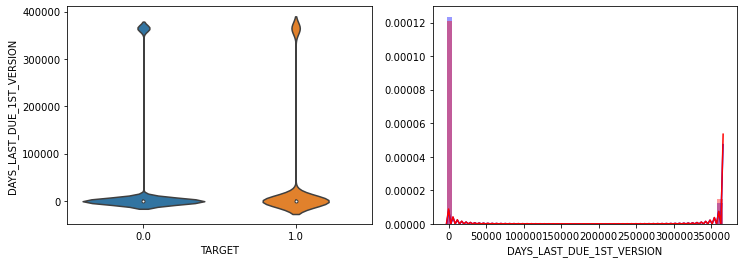

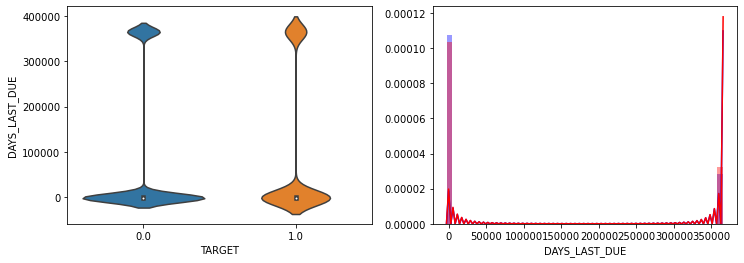

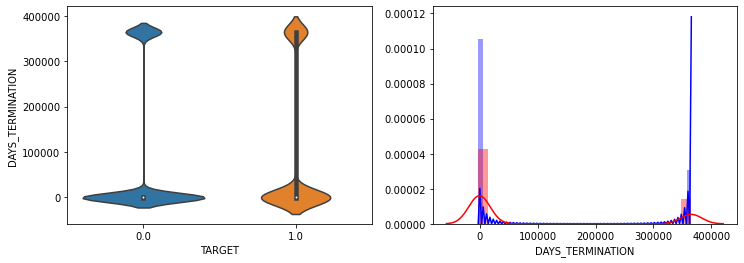

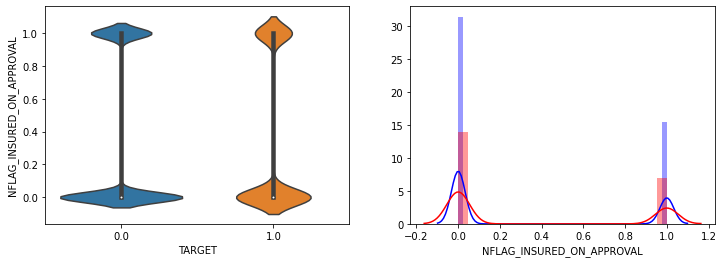

숫자형 피처들의 Histogram을 TARGET 유형에 따라 비교

- application_train의 TARGET 값을 가져오기 위해 prev와 app_train을 inner join 후 TARGET 유형에 따라 비교

- 숫자형 컬럼명 필터링

app_prev = prev.merge(app_train[['SK_ID_CURR', 'TARGET']], on='SK_ID_CURR', how='left')

app_prev.shape(1670214, 38)def show_hist_by_target(df, columns):

cond_1 = (df['TARGET'] == 1)

cond_0 = (df['TARGET'] == 0)

for column in columns:

fig, axs = plt.subplots(nrows=1, ncols=2, figsize=(12, 4), squeeze=False)

sns.violinplot(x='TARGET', y=column, data=df, ax=axs[0][0] )

sns.distplot(df[cond_0][column], ax=axs[0][1], label='0', color='blue')

sns.distplot(df[cond_1][column], ax=axs[0][1], label='1', color='red') num_columns = app_prev.dtypes[app_prev.dtypes != 'object'].index.tolist()

num_columns = [ column for column in num_columns if column not in ['SK_ID_PREV', 'SK_ID_CURR', 'TARGET']]

print(num_columns)['AMT_ANNUITY', 'AMT_APPLICATION', 'AMT_CREDIT', 'AMT_DOWN_PAYMENT', 'AMT_GOODS_PRICE', 'HOUR_APPR_PROCESS_START', 'NFLAG_LAST_APPL_IN_DAY', 'RATE_DOWN_PAYMENT', 'RATE_INTEREST_PRIMARY', 'RATE_INTEREST_PRIVILEGED', 'DAYS_DECISION', 'SELLERPLACE_AREA', 'CNT_PAYMENT', 'DAYS_FIRST_DRAWING', 'DAYS_FIRST_DUE', 'DAYS_LAST_DUE_1ST_VERSION', 'DAYS_LAST_DUE', 'DAYS_TERMINATION', 'NFLAG_INSURED_ON_APPROVAL']show_hist_by_target(app_prev, num_columns)/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

/Users/andylee/opt/anaconda3/lib/python3.8/site-packages/seaborn/distributions.py:369: UserWarning: Default bandwidth for data is 0; skipping density estimation.

warnings.warn(msg, UserWarning)

- AMT_ANNUITY, AMT_CREDIT, AMT_APPLICATION, AMT_GOODS_CREDIT는 TARGET=1일 경우에 소액 비율이 약간 높음(큰 차이는 아님)

- RATE_DOWN_PAYMENT는 큰 차이 없음.

- RATE_INTEREST_PRIMARY, RATE_INTEREST_PRIVILEGED 는 NULL값이 매우 많아서 판단 어려움

- DAYS_DECISION은 TARGET=1일 때 0에 가까운(최근일)값이 약간 더 많음.

- DAYS_FIRST_DRAWING, DAYS_FIRST_DUE, DAYS_LAST_DUE_1ST_VERSION, DAYS_LAST_DUE, DAYS_TERMINATION은 365243 값이 매우 많음.

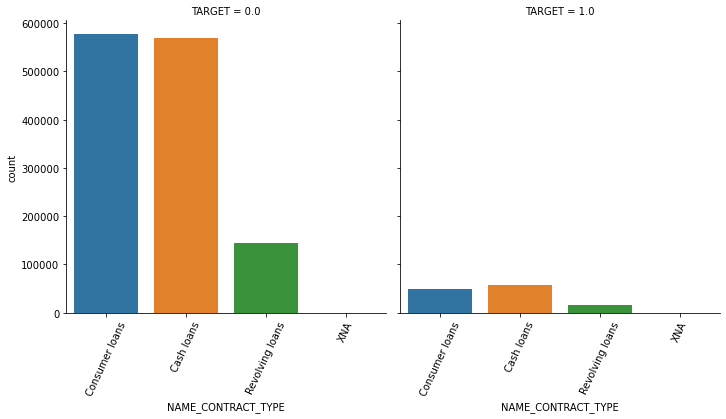

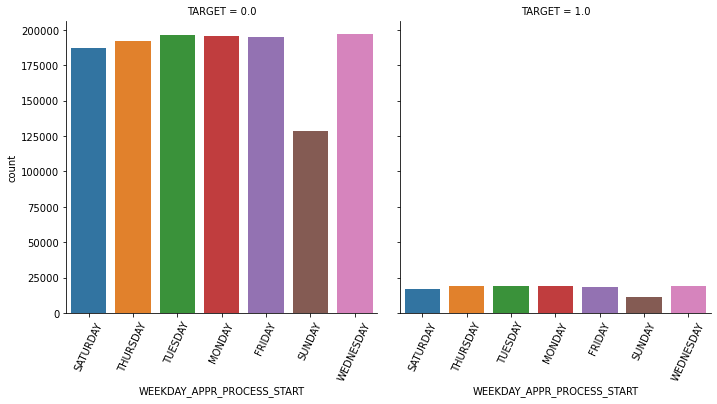

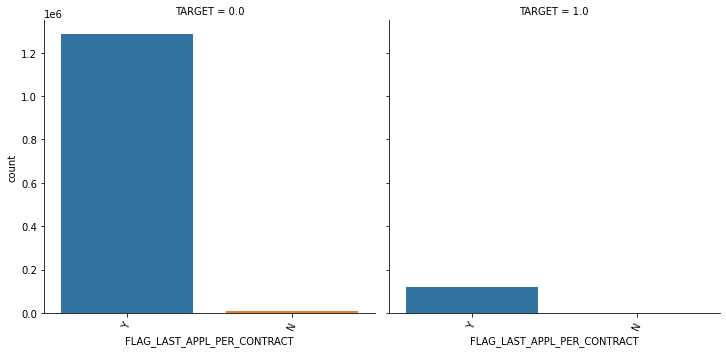

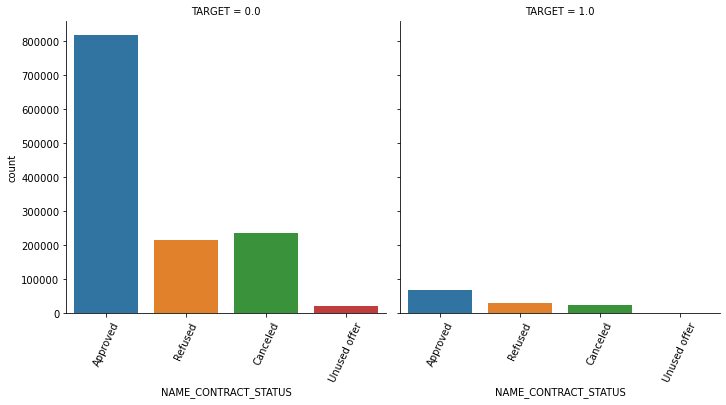

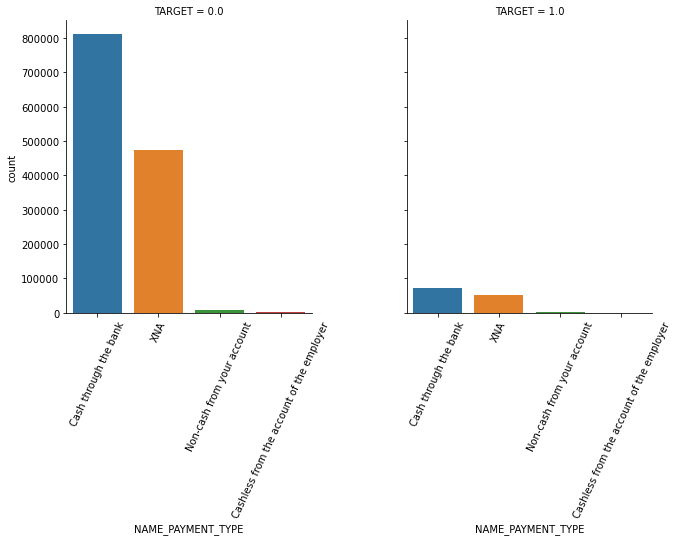

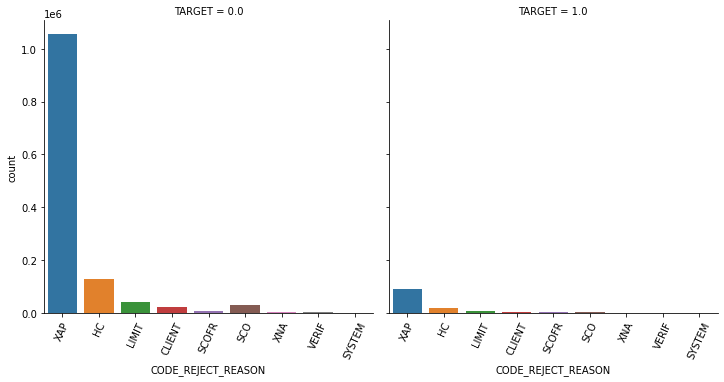

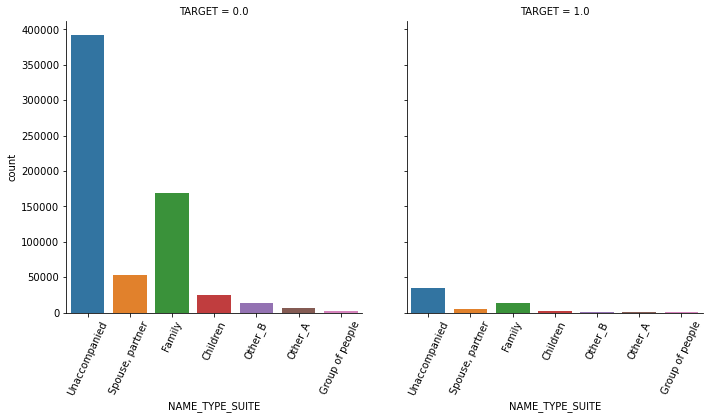

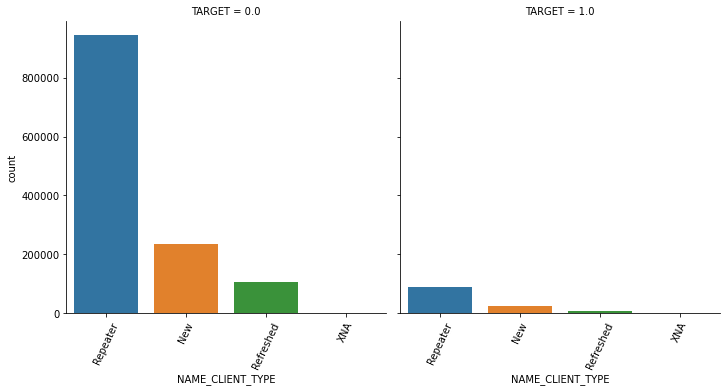

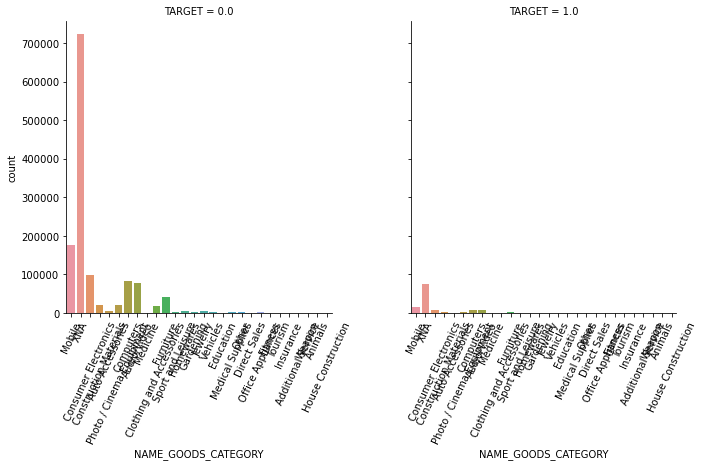

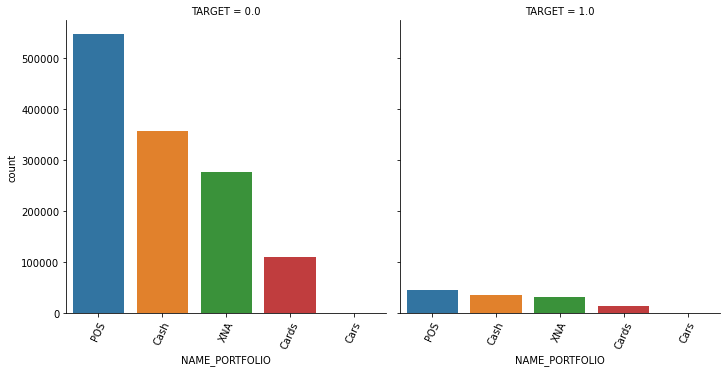

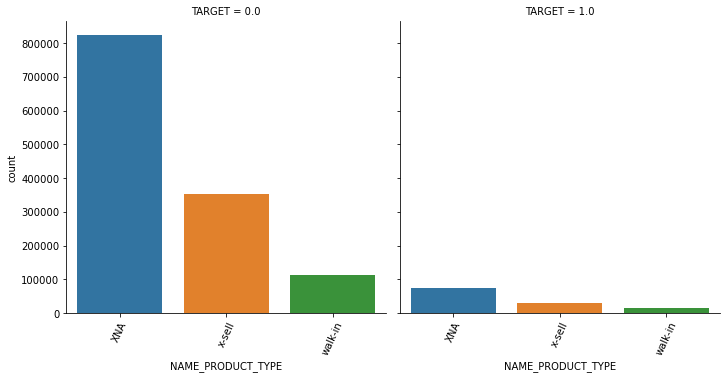

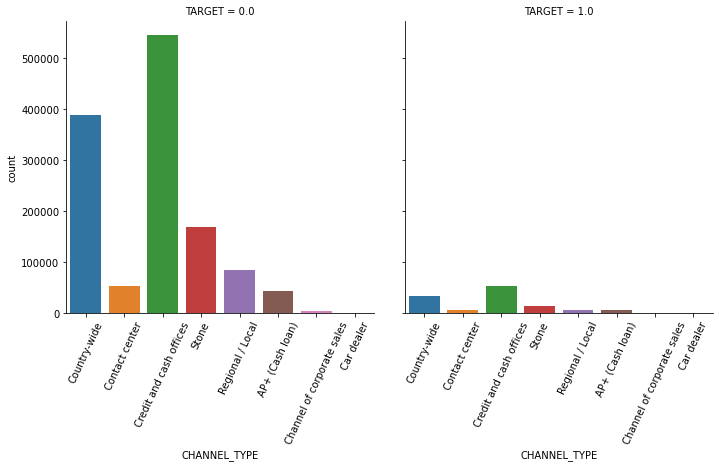

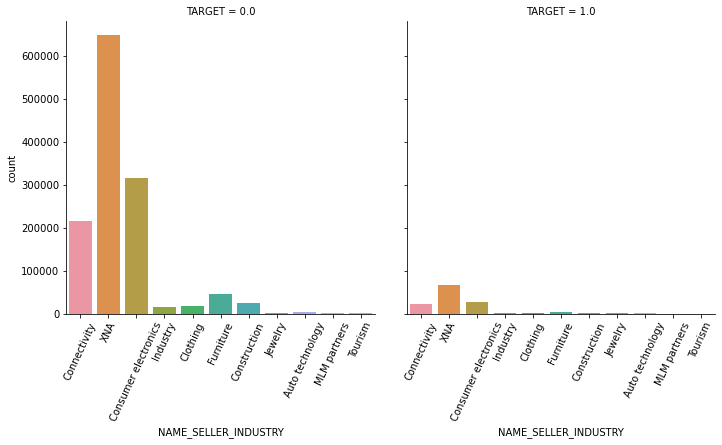

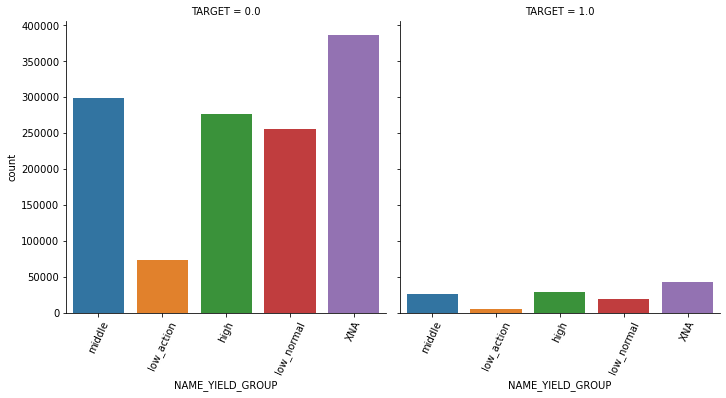

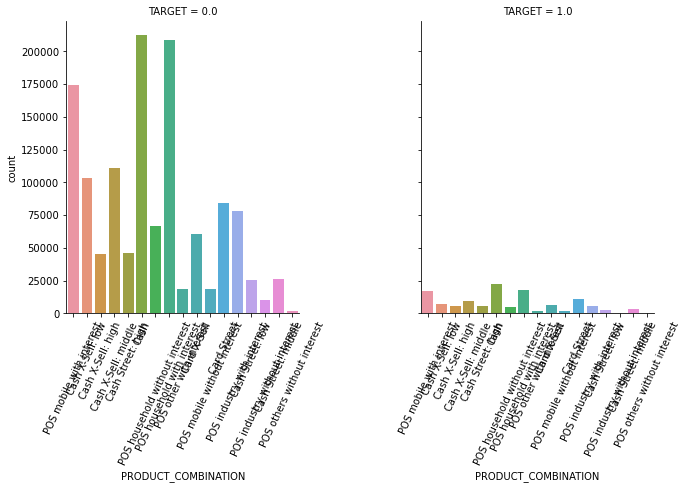

Category 피처들의 Histogram을 TARGET 유형에 따라 비교

object_columns = app_prev.dtypes[app_prev.dtypes=='object'].index.tolist()

object_columns['NAME_CONTRACT_TYPE',

'WEEKDAY_APPR_PROCESS_START',

'FLAG_LAST_APPL_PER_CONTRACT',

'NAME_CASH_LOAN_PURPOSE',

'NAME_CONTRACT_STATUS',

'NAME_PAYMENT_TYPE',

'CODE_REJECT_REASON',

'NAME_TYPE_SUITE',

'NAME_CLIENT_TYPE',

'NAME_GOODS_CATEGORY',

'NAME_PORTFOLIO',

'NAME_PRODUCT_TYPE',

'CHANNEL_TYPE',

'NAME_SELLER_INDUSTRY',

'NAME_YIELD_GROUP',

'PRODUCT_COMBINATION']def show_category_by_target(df, columns):

for column in columns:

chart = sns.catplot(x=column, col="TARGET", data=df, kind="count")

chart.set_xticklabels(rotation=65)

show_category_by_target(app_prev, object_columns)

- NAME_CONTRACT_TYPE은 TARGET=1일때 CASH_LOAN의 비중이 약간 높음

- NAME_CONTRACT_STATUS(대출허가상태)는 TARGET=1일때 상대적으로 TARGET=0 대비 (당연히) Refused의 비율이 높음.

- NAME_PAYMENT_TYPE(대출납부방법)는 TARGET=1일때 상대적으로 TARGET=0 대비 XNA의 비율이 약간 높음.

prev 데이터 세트 feature engineering 수행.

SQL 대비 Pandas groupby 사용 로직 비교

SQL로 SK_ID_CURR별 건수, 평균 AMT_CREDIT, 최대 AMT_CREDIT, 최소 AMT_CREDIT 구하기

select sk_id_curr, count(*), avg(amt_credit) , max(amt_credit), min(amt_credit) from previous group by sk_id_currpandas groupby 단일 aggregation 함수 사용

- groupby SK_ID_CURR

- SK_ID_CURR별 건수, AMT_CREDIT에 대한 평균, 최대 값

prev.groupby('SK_ID_CURR')<pandas.core.groupby.generic.DataFrameGroupBy object at 0x7fcfc8bfba90>prev_group = prev.groupby('SK_ID_CURR')

prev_agg = pd.DataFrame()

prev_agg['CNT'] = prev_group['SK_ID_CURR'].count()

prev_agg['AVG_CREDIT'] = prev_group['AMT_CREDIT'].mean()

prev_agg['MAX_CREDIT'] = prev_group['AMT_CREDIT'].max()

prev_agg['MIN_CREDIT'] = prev_group['AMT_CREDIT'].min()

prev_agg.head()| CNT | AVG_CREDIT | MAX_CREDIT | MIN_CREDIT | |

|---|---|---|---|---|

| SK_ID_CURR | ||||

| 100001 | 1 | 23787.00 | 23787.0 | 23787.0 |

| 100002 | 1 | 179055.00 | 179055.0 | 179055.0 |

| 100003 | 3 | 484191.00 | 1035882.0 | 68053.5 |

| 100004 | 1 | 20106.00 | 20106.0 | 20106.0 |

| 100005 | 2 | 20076.75 | 40153.5 | 0.0 |

groupby agg()함수를 이용하여 여러개의 aggregation 함수 적용

prev_group = prev.groupby('SK_ID_CURR')

prev_agg1 = prev_group['AMT_CREDIT'].agg(['mean', 'max', 'min'])

prev_agg2 = prev_group['AMT_ANNUITY'].agg(['mean', 'max', 'min'])

prev_agg = prev_agg1.merge(prev_agg2, on='SK_ID_CURR', how='inner')

prev_agg.head()| mean_x | max_x | min_x | mean_y | max_y | min_y | |

|---|---|---|---|---|---|---|

| SK_ID_CURR | ||||||

| 100001 | 23787.00 | 23787.0 | 23787.0 | 3951.000 | 3951.000 | 3951.000 |

| 100002 | 179055.00 | 179055.0 | 179055.0 | 9251.775 | 9251.775 | 9251.775 |

| 100003 | 484191.00 | 1035882.0 | 68053.5 | 56553.990 | 98356.995 | 6737.310 |

| 100004 | 20106.00 | 20106.0 | 20106.0 | 5357.250 | 5357.250 | 5357.250 |

| 100005 | 20076.75 | 40153.5 | 0.0 | 4813.200 | 4813.200 | 4813.200 |

agg()에 dictionary를 이용하여 groupby 적용

agg_dict = {

'SK_ID_CURR':['count'],

'AMT_CREDIT':['mean', 'max', 'sum'],

'AMT_ANNUITY':['mean', 'max', 'sum'],

'AMT_APPLICATION':['mean', 'max', 'sum'],

'AMT_DOWN_PAYMENT':['mean', 'max', 'sum'],

'AMT_GOODS_PRICE':['mean', 'max', 'sum']

}

prev_group = prev.groupby('SK_ID_CURR')

prev_amt_agg = prev_group.agg(agg_dict)

prev_amt_agg.head()| SK_ID_CURR | AMT_CREDIT | AMT_ANNUITY | AMT_APPLICATION | AMT_DOWN_PAYMENT | AMT_GOODS_PRICE | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | mean | max | sum | mean | max | sum | mean | max | sum | mean | max | sum | mean | max | sum | |

| SK_ID_CURR | ||||||||||||||||

| 100001 | 1 | 23787.00 | 23787.0 | 23787.0 | 3951.000 | 3951.000 | 3951.000 | 24835.50 | 24835.5 | 24835.5 | 2520.0 | 2520.0 | 2520.0 | 24835.5 | 24835.5 | 24835.5 |

| 100002 | 1 | 179055.00 | 179055.0 | 179055.0 | 9251.775 | 9251.775 | 9251.775 | 179055.00 | 179055.0 | 179055.0 | 0.0 | 0.0 | 0.0 | 179055.0 | 179055.0 | 179055.0 |

| 100003 | 3 | 484191.00 | 1035882.0 | 1452573.0 | 56553.990 | 98356.995 | 169661.970 | 435436.50 | 900000.0 | 1306309.5 | 3442.5 | 6885.0 | 6885.0 | 435436.5 | 900000.0 | 1306309.5 |

| 100004 | 1 | 20106.00 | 20106.0 | 20106.0 | 5357.250 | 5357.250 | 5357.250 | 24282.00 | 24282.0 | 24282.0 | 4860.0 | 4860.0 | 4860.0 | 24282.0 | 24282.0 | 24282.0 |

| 100005 | 2 | 20076.75 | 40153.5 | 40153.5 | 4813.200 | 4813.200 | 4813.200 | 22308.75 | 44617.5 | 44617.5 | 4464.0 | 4464.0 | 4464.0 | 44617.5 | 44617.5 | 44617.5 |

grouby agg 로 만들어진 Multi index 컬럼 변경.

- MultiIndex로 되어 있는 컬럼명 확인

- MultiIndex 컬럼명을 _로 연결하여 컬럼명 변경.

칼럼 인덱스가 계층 구조로 되어있어서 예를 들면 AMT_CREDIT_MEAN 이런식으로 바꾸려 함

prev_amt_agg.columnsMultiIndex([( 'SK_ID_CURR', 'count'),

( 'AMT_CREDIT', 'mean'),

( 'AMT_CREDIT', 'max'),

( 'AMT_CREDIT', 'sum'),

( 'AMT_ANNUITY', 'mean'),

( 'AMT_ANNUITY', 'max'),

( 'AMT_ANNUITY', 'sum'),

( 'AMT_APPLICATION', 'mean'),

( 'AMT_APPLICATION', 'max'),

( 'AMT_APPLICATION', 'sum'),

('AMT_DOWN_PAYMENT', 'mean'),

('AMT_DOWN_PAYMENT', 'max'),

('AMT_DOWN_PAYMENT', 'sum'),

( 'AMT_GOODS_PRICE', 'mean'),

( 'AMT_GOODS_PRICE', 'max'),

( 'AMT_GOODS_PRICE', 'sum')],

)# [(column[0]+'_'+column[1].upper()) for column in prev_amt_agg.columns]

prev_amt_agg.columns = ['PREV_' + ('_').join(column).upper() for column in prev_amt_agg.columns.ravel()]prev_amt_agg.head()| PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SK_ID_CURR | ||||||||||||||||

| 100001 | 1 | 23787.00 | 23787.0 | 23787.0 | 3951.000 | 3951.000 | 3951.000 | 24835.50 | 24835.5 | 24835.5 | 2520.0 | 2520.0 | 2520.0 | 24835.5 | 24835.5 | 24835.5 |

| 100002 | 1 | 179055.00 | 179055.0 | 179055.0 | 9251.775 | 9251.775 | 9251.775 | 179055.00 | 179055.0 | 179055.0 | 0.0 | 0.0 | 0.0 | 179055.0 | 179055.0 | 179055.0 |

| 100003 | 3 | 484191.00 | 1035882.0 | 1452573.0 | 56553.990 | 98356.995 | 169661.970 | 435436.50 | 900000.0 | 1306309.5 | 3442.5 | 6885.0 | 6885.0 | 435436.5 | 900000.0 | 1306309.5 |

| 100004 | 1 | 20106.00 | 20106.0 | 20106.0 | 5357.250 | 5357.250 | 5357.250 | 24282.00 | 24282.0 | 24282.0 | 4860.0 | 4860.0 | 4860.0 | 24282.0 | 24282.0 | 24282.0 |

| 100005 | 2 | 20076.75 | 40153.5 | 40153.5 | 4813.200 | 4813.200 | 4813.200 | 22308.75 | 44617.5 | 44617.5 | 4464.0 | 4464.0 | 4464.0 | 44617.5 | 44617.5 | 44617.5 |

prev 피처 가공. 대출 신청액 대비 다른 금액 차이 및 비율 생성.

prev['PREV_CREDIT_DIFF'] = prev['AMT_APPLICATION'] - prev['AMT_CREDIT']

prev['PREV_GOODS_DIFF'] = prev['AMT_APPLICATION'] - prev['AMT_GOODS_PRICE']

prev['PREV_CREDIT_APPL_RATIO'] = prev['AMT_CREDIT']/prev['AMT_APPLICATION']

prev['PREV_ANNUITY_APPL_RATIO'] = prev['AMT_ANNUITY']/prev['AMT_APPLICATION']

prev['PREV_GOODS_APPL_RATIO'] = prev['AMT_GOODS_PRICE']/prev['AMT_APPLICATION']DAYS_XXX 피처의 365243 을 NULL로 변환하고, 첫번째 만기일과 마지막 만기일까지의 기간 가공

prev['DAYS_FIRST_DRAWING'].replace(365243, np.nan, inplace=True)

prev['DAYS_FIRST_DUE'].replace(365243, np.nan, inplace= True)

prev['DAYS_LAST_DUE_1ST_VERSION'].replace(365243, np.nan, inplace= True)

prev['DAYS_LAST_DUE'].replace(365243, np.nan, inplace= True)

prev['DAYS_TERMINATION'].replace(365243, np.nan, inplace= True)

# 첫번째 만기일과 마지막 만기일까지의 기간

prev['PREV_DAYS_LAST_DUE_DIFF'] = prev['DAYS_LAST_DUE_1ST_VERSION'] - prev['DAYS_LAST_DUE']기존 이자율 관련 컬럼이 null이 많아서 새롭게 간단한 이자율을 대출 금액과 대출 금액 납부 횟수를 기반으로 계산

prev.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1670214 entries, 0 to 1670213

Data columns (total 43 columns):

SK_ID_PREV 1670214 non-null int64

SK_ID_CURR 1670214 non-null int64

NAME_CONTRACT_TYPE 1670214 non-null object

AMT_ANNUITY 1297979 non-null float64

AMT_APPLICATION 1670214 non-null float64

AMT_CREDIT 1670213 non-null float64

AMT_DOWN_PAYMENT 774370 non-null float64

AMT_GOODS_PRICE 1284699 non-null float64

WEEKDAY_APPR_PROCESS_START 1670214 non-null object

HOUR_APPR_PROCESS_START 1670214 non-null int64

FLAG_LAST_APPL_PER_CONTRACT 1670214 non-null object

NFLAG_LAST_APPL_IN_DAY 1670214 non-null int64

RATE_DOWN_PAYMENT 774370 non-null float64

RATE_INTEREST_PRIMARY 5951 non-null float64

RATE_INTEREST_PRIVILEGED 5951 non-null float64

NAME_CASH_LOAN_PURPOSE 1670214 non-null object

NAME_CONTRACT_STATUS 1670214 non-null object

DAYS_DECISION 1670214 non-null int64

NAME_PAYMENT_TYPE 1670214 non-null object

CODE_REJECT_REASON 1670214 non-null object

NAME_TYPE_SUITE 849809 non-null object

NAME_CLIENT_TYPE 1670214 non-null object

NAME_GOODS_CATEGORY 1670214 non-null object

NAME_PORTFOLIO 1670214 non-null object

NAME_PRODUCT_TYPE 1670214 non-null object

CHANNEL_TYPE 1670214 non-null object

SELLERPLACE_AREA 1670214 non-null int64

NAME_SELLER_INDUSTRY 1670214 non-null object

CNT_PAYMENT 1297984 non-null float64

NAME_YIELD_GROUP 1670214 non-null object

PRODUCT_COMBINATION 1669868 non-null object

DAYS_FIRST_DRAWING 62705 non-null float64

DAYS_FIRST_DUE 956504 non-null float64

DAYS_LAST_DUE_1ST_VERSION 903285 non-null float64

DAYS_LAST_DUE 785928 non-null float64

DAYS_TERMINATION 771236 non-null float64

NFLAG_INSURED_ON_APPROVAL 997149 non-null float64

PREV_CREDIT_DIFF 1670213 non-null float64

PREV_GOODS_DIFF 1284699 non-null float64

PREV_CREDIT_APPL_RATIO 1333446 non-null float64

PREV_ANNUITY_APPL_RATIO 1296344 non-null float64

PREV_GOODS_APPL_RATIO 1277830 non-null float64

PREV_DAYS_LAST_DUE_DIFF 761917 non-null float64

dtypes: float64(21), int64(6), object(16)

memory usage: 547.9+ MBCNT_PAYMENT 는 전체 납부해야하는 횟수, AMT_ANNUITY 월 별 납부해야하는 금액 -> 이것으로 간단하게 이자율 계산

all_pay = prev['AMT_ANNUITY'] * prev['CNT_PAYMENT']

prev['PREV_INTERESTS_RATE'] = (all_pay/prev['AMT_CREDIT'] - 1)/prev['CNT_PAYMENT']prev.iloc[:, -7:].head(10)| PREV_CREDIT_DIFF | PREV_GOODS_DIFF | PREV_CREDIT_APPL_RATIO | PREV_ANNUITY_APPL_RATIO | PREV_GOODS_APPL_RATIO | PREV_DAYS_LAST_DUE_DIFF | PREV_INTERESTS_RATE | |

|---|---|---|---|---|---|---|---|

| 0 | 0.0 | 0.0 | 1.000000 | 0.100929 | 1.0 | 342.0 | 0.017596 |

| 1 | -72171.0 | 0.0 | 1.118800 | 0.041463 | 1.0 | NaN | 0.009282 |

| 2 | -23944.5 | 0.0 | 1.212840 | 0.133873 | 1.0 | NaN | 0.027047 |

| 3 | -20790.0 | 0.0 | 1.046200 | 0.104536 | 1.0 | 30.0 | 0.016587 |

| 4 | -66555.0 | 0.0 | 1.197200 | 0.094591 | 1.0 | NaN | 0.037343 |

| 5 | -25573.5 | 0.0 | 1.081186 | 0.075251 | 1.0 | 0.0 | 0.014044 |

| 6 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN |

| 7 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN |

| 8 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN |

| 9 | 0.0 | NaN | NaN | NaN | NaN | NaN | NaN |

기존 대출 금액, 대출 상태 관련 피처들과 이들을 가공하여 만들어진 새로운 컬럼들로 aggregation 수행.

agg_dict = {

# 기존 컬럼.

'SK_ID_CURR':['count'],

'AMT_CREDIT':['mean', 'max', 'sum'],

'AMT_ANNUITY':['mean', 'max', 'sum'],

'AMT_APPLICATION':['mean', 'max', 'sum'],

'AMT_DOWN_PAYMENT':['mean', 'max', 'sum'],

'AMT_GOODS_PRICE':['mean', 'max', 'sum'],

'RATE_DOWN_PAYMENT': ['min', 'max', 'mean'],

'DAYS_DECISION': ['min', 'max', 'mean'],

'CNT_PAYMENT': ['mean', 'sum'],

# 가공 컬럼

'PREV_CREDIT_DIFF':['mean', 'max', 'sum'],

'PREV_CREDIT_APPL_RATIO':['mean', 'max'],

'PREV_GOODS_DIFF':['mean', 'max', 'sum'],

'PREV_GOODS_APPL_RATIO':['mean', 'max'],

'PREV_DAYS_LAST_DUE_DIFF':['mean', 'max', 'sum'],

'PREV_INTERESTS_RATE':['mean', 'max']

}

prev_group = prev.groupby('SK_ID_CURR')

prev_amt_agg = prev_group.agg(agg_dict)

prev_amt_agg.columns = ['PREV_'+('_').join(column).upper() for column in prev_amt_agg.columns.ravel()]prev_amt_agg.head(10)| PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SK_ID_CURR | |||||||||||||||||||||||||||||||||||||||

| 100001 | 1 | 23787.000000 | 23787.0 | 23787.0 | 3951.000000 | 3951.000 | 3951.000 | 24835.500000 | 24835.5 | 24835.50 | 2520.000000 | 2520.0 | 2520.00 | 24835.500000 | 24835.5 | 24835.50 | 0.104326 | 0.104326 | 0.104326 | -1740 | -1740 | -1740.000000 | 8.000000 | 8.0 | 1048.500000 | 1048.5 | 1048.50 | 0.957782 | 0.957782 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 120.0 | 120.0 | 120.0 | 0.041099 | 0.041099 |

| 100002 | 1 | 179055.000000 | 179055.0 | 179055.0 | 9251.775000 | 9251.775 | 9251.775 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.0 | 0.00 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.000000 | 0.000000 | -606 | -606 | -606.000000 | 24.000000 | 24.0 | 0.000000 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.0 | 150.0 | 150.0 | 0.010003 | 0.010003 |

| 100003 | 3 | 484191.000000 | 1035882.0 | 1452573.0 | 56553.990000 | 98356.995 | 169661.970 | 435436.500000 | 900000.0 | 1306309.50 | 3442.500000 | 6885.0 | 6885.00 | 435436.500000 | 900000.0 | 1306309.50 | 0.000000 | 0.100061 | 0.050030 | -2341 | -746 | -1305.000000 | 10.000000 | 30.0 | -48754.500000 | 756.0 | -146263.50 | 1.057664 | 1.150980 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 50.0 | 150.0 | 150.0 | 0.015272 | 0.018533 |

| 100004 | 1 | 20106.000000 | 20106.0 | 20106.0 | 5357.250000 | 5357.250 | 5357.250 | 24282.000000 | 24282.0 | 24282.00 | 4860.000000 | 4860.0 | 4860.00 | 24282.000000 | 24282.0 | 24282.00 | 0.212008 | 0.212008 | 0.212008 | -815 | -815 | -815.000000 | 4.000000 | 4.0 | 4176.000000 | 4176.0 | 4176.00 | 0.828021 | 0.828021 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 30.0 | 30.0 | 30.0 | 0.016450 | 0.016450 |

| 100005 | 2 | 20076.750000 | 40153.5 | 40153.5 | 4813.200000 | 4813.200 | 4813.200 | 22308.750000 | 44617.5 | 44617.50 | 4464.000000 | 4464.0 | 4464.00 | 44617.500000 | 44617.5 | 44617.50 | 0.108964 | 0.108964 | 0.108964 | -757 | -315 | -536.000000 | 12.000000 | 12.0 | 2232.000000 | 4464.0 | 4464.00 | 0.899950 | 0.899950 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.0 | 90.0 | 90.0 | 0.036537 | 0.036537 |

| 100006 | 9 | 291695.500000 | 906615.0 | 2625259.5 | 23651.175000 | 39954.510 | 141907.050 | 272203.260000 | 688500.0 | 2449829.34 | 34840.170000 | 66987.0 | 69680.34 | 408304.890000 | 688500.0 | 2449829.34 | 0.108994 | 0.217830 | 0.163412 | -617 | -181 | -272.444444 | 23.000000 | 138.0 | -19492.240000 | 66987.0 | -175430.16 | 1.012684 | 1.316797 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 810.0 | 1410.0 | 1620.0 | -inf | 0.027424 |

| 100007 | 6 | 166638.750000 | 284400.0 | 999832.5 | 12278.805000 | 22678.785 | 73672.830 | 150530.250000 | 247500.0 | 903181.50 | 3390.750000 | 3676.5 | 6781.50 | 150530.250000 | 247500.0 | 903181.50 | 0.100143 | 0.218890 | 0.159516 | -2357 | -374 | -1222.833333 | 20.666667 | 124.0 | -16108.500000 | 2560.5 | -96651.00 | 1.046356 | 1.264000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 7.5 | 30.0 | 30.0 | 0.026538 | 0.036164 |

| 100008 | 5 | 162767.700000 | 501975.0 | 813838.5 | 15839.696250 | 25309.575 | 63358.785 | 155701.800000 | 450000.0 | 778509.00 | 5548.500000 | 12145.5 | 16645.50 | 194627.250000 | 450000.0 | 778509.00 | 0.000000 | 0.110243 | 0.073051 | -2536 | -82 | -1192.000000 | 14.000000 | 56.0 | -7065.900000 | 12145.5 | -35329.50 | 0.978569 | 1.115500 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 165.0 | 660.0 | 660.0 | 0.018055 | 0.034034 |

| 100009 | 7 | 70137.642857 | 98239.5 | 490963.5 | 10051.412143 | 17341.605 | 70359.885 | 76741.714286 | 110160.0 | 537192.00 | 9203.142857 | 22032.0 | 64422.00 | 76741.714286 | 110160.0 | 537192.00 | 0.000000 | 0.209525 | 0.126602 | -1562 | -74 | -719.285714 | 8.000000 | 56.0 | 6604.071429 | 17671.5 | 46228.50 | 0.916226 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.019536 | 0.030703 |

| 100010 | 1 | 260811.000000 | 260811.0 | 260811.0 | 27463.410000 | 27463.410 | 27463.410 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.0 | 0.00 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.000000 | 0.000000 | -1070 | -1070 | -1070.000000 | 10.000000 | 10.0 | -13599.000000 | -13599.0 | -13599.00 | 1.055009 | 1.055009 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.005300 | 0.005300 |

prev_amt_agg.shape(338857, 39)SK_ID_CURR별로 NAME_CONTRACT_STATUS가 Refused 일 경우의 건수 및 과거 대출건 대비 비율

Group by 기준 컬럼 기반에서 다른 컬럼들의 기준에 따라 세분화된 aggregation 수행.

prev['NAME_CONTRACT_STATUS'].value_counts()Approved 1036781

Canceled 316319

Refused 290678

Unused offer 26436

Name: NAME_CONTRACT_STATUS, dtype: int64SQL Group by Case when 과 pandas의 차이

SK_ID_CURR레벨로 groupby 된 count와 name_contract_status가 Refused일 때의 count

select sk_id_curr, cnt_refused/cnt

from

(

select sk_id_curr, count(*) cnt, count(case when name_contract_status == 'Refused' end) cnt_refused

from previous group by sk_id_curr

) Pandas는 원 DataFrame 에 groupby 적용된 DataFrame 과 세부기준으로 filtering 된 DataFrame에 groupby 적용된 DataFrame 을 조인하여 생성.

- NAME_CONTRACT_STATUS == 'Refused' 세부 기준으로 filtering 및 filtering 된 DataFrame에 groupby 적용

- groupby 완료 후 기존 prev_amt_agg와 조인

- 효율적인 오류 방지를 위해서 groupby 시 적용후 groupby key값을 DataFrame의 Index가 아닌 일반 컬럼으로 변경.

cond_refused = (prev['NAME_CONTRACT_STATUS'] == 'Refused')

prev_refused = prev[cond_refused]

prev_refused.shape, prev.shape((290678, 44), (1670214, 44))prev_refused_agg = prev_refused.groupby('SK_ID_CURR')['SK_ID_CURR'].count()

prev_refused_agg.shape, prev_amt_agg.shape((118277,), (338857, 39))prev_refused_aggSK_ID_CURR

100006 1

100011 1

100027 1

100030 10

100035 8

..

456244 1

456247 1

456249 1

456250 1

456255 2

Name: SK_ID_CURR, Length: 118277, dtype: int64# 칼럼과 인덱스 이름이 같아서 안된다. 일부러 error 냈음

prev_amt_agg.merge(prev_refused_agg, how='left', on='SK_ID_CURR')---------------------------------------------------------------------------

ValueError Traceback (most recent call last)

<ipython-input-54-3bccc0d949fd> in <module>

----> 1 prev_amt_agg.merge(prev_refused_agg, how='left', on='SK_ID_CURR')

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/frame.py in merge(self, right, how, on, left_on, right_on, left_index, right_index, sort, suffixes, copy, indicator, validate)

7319 from pandas.core.reshape.merge import merge

7320

-> 7321 return merge(

7322 self,

7323 right,

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/reshape/merge.py in merge(left, right, how, on, left_on, right_on, left_index, right_index, sort, suffixes, copy, indicator, validate)

66 validate=None,

67 ):

---> 68 op = _MergeOperation(

69 left,

70 right,

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/reshape/merge.py in __init__(self, left, right, how, on, left_on, right_on, axis, left_index, right_index, sort, suffixes, copy, indicator, validate)

624 self.right_join_keys,

625 self.join_names,

--> 626 ) = self._get_merge_keys()

627

628 # validate the merge keys dtypes. We may need to coerce

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/reshape/merge.py in _get_merge_keys(self)

973 if not is_rkey(rk):

974 if rk is not None:

--> 975 right_keys.append(right._get_label_or_level_values(rk))

976 else:

977 # work-around for merge_asof(right_index=True)

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/generic.py in _get_label_or_level_values(self, key, axis)

1767

1768 if self._is_label_reference(key, axis=axis):

-> 1769 self._check_label_or_level_ambiguity(key, axis=axis)

1770 values = self.xs(key, axis=other_axes[0])._values

1771 elif self._is_level_reference(key, axis=axis):

~/opt/anaconda3/lib/python3.8/site-packages/pandas/core/generic.py in _check_label_or_level_ambiguity(self, key, axis)

1727 label_type=label_type,

1728 )

-> 1729 raise ValueError(msg)

1730

1731 def _get_label_or_level_values(self, key, axis=0):

ValueError: 'SK_ID_CURR' is both an index level and a column label, which is ambiguous.pd.DataFrame(prev_refused_agg)| SK_ID_CURR | |

|---|---|

| SK_ID_CURR | |

| 100006 | 1 |

| 100011 | 1 |

| 100027 | 1 |

| 100030 | 10 |

| 100035 | 8 |

| ... | ... |

| 456244 | 1 |

| 456247 | 1 |

| 456249 | 1 |

| 456250 | 1 |

| 456255 | 2 |

118277 rows × 1 columns

prev_refused_agg.reset_index(name='PREV_REFUSED_COUNT')| SK_ID_CURR | PREV_REFUSED_COUNT | |

|---|---|---|

| 0 | 100006 | 1 |

| 1 | 100011 | 1 |

| 2 | 100027 | 1 |

| 3 | 100030 | 10 |

| 4 | 100035 | 8 |

| ... | ... | ... |

| 118272 | 456244 | 1 |

| 118273 | 456247 | 1 |

| 118274 | 456249 | 1 |

| 118275 | 456250 | 1 |

| 118276 | 456255 | 2 |

118277 rows × 2 columns

prev_refused_agg = prev_refused_agg.reset_index(name='PREV_REFUSED_COUNT')

prev_amt_agg = prev_amt_agg.reset_index()

prev_amt_refused_agg = prev_amt_agg.merge(prev_refused_agg, on='SK_ID_CURR', how='left')

prev_amt_refused_agg.head(10)| SK_ID_CURR | PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | PREV_REFUSED_COUNT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 1 | 23787.000000 | 23787.0 | 23787.0 | 3951.000000 | 3951.000 | 3951.000 | 24835.500000 | 24835.5 | 24835.50 | 2520.000000 | 2520.0 | 2520.00 | 24835.500000 | 24835.5 | 24835.50 | 0.104326 | 0.104326 | 0.104326 | -1740 | -1740 | -1740.000000 | 8.000000 | 8.0 | 1048.500000 | 1048.5 | 1048.50 | 0.957782 | 0.957782 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 120.0 | 120.0 | 120.0 | 0.041099 | 0.041099 | NaN |

| 1 | 100002 | 1 | 179055.000000 | 179055.0 | 179055.0 | 9251.775000 | 9251.775 | 9251.775 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.0 | 0.00 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.000000 | 0.000000 | -606 | -606 | -606.000000 | 24.000000 | 24.0 | 0.000000 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.0 | 150.0 | 150.0 | 0.010003 | 0.010003 | NaN |

| 2 | 100003 | 3 | 484191.000000 | 1035882.0 | 1452573.0 | 56553.990000 | 98356.995 | 169661.970 | 435436.500000 | 900000.0 | 1306309.50 | 3442.500000 | 6885.0 | 6885.00 | 435436.500000 | 900000.0 | 1306309.50 | 0.000000 | 0.100061 | 0.050030 | -2341 | -746 | -1305.000000 | 10.000000 | 30.0 | -48754.500000 | 756.0 | -146263.50 | 1.057664 | 1.150980 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 50.0 | 150.0 | 150.0 | 0.015272 | 0.018533 | NaN |

| 3 | 100004 | 1 | 20106.000000 | 20106.0 | 20106.0 | 5357.250000 | 5357.250 | 5357.250 | 24282.000000 | 24282.0 | 24282.00 | 4860.000000 | 4860.0 | 4860.00 | 24282.000000 | 24282.0 | 24282.00 | 0.212008 | 0.212008 | 0.212008 | -815 | -815 | -815.000000 | 4.000000 | 4.0 | 4176.000000 | 4176.0 | 4176.00 | 0.828021 | 0.828021 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 30.0 | 30.0 | 30.0 | 0.016450 | 0.016450 | NaN |

| 4 | 100005 | 2 | 20076.750000 | 40153.5 | 40153.5 | 4813.200000 | 4813.200 | 4813.200 | 22308.750000 | 44617.5 | 44617.50 | 4464.000000 | 4464.0 | 4464.00 | 44617.500000 | 44617.5 | 44617.50 | 0.108964 | 0.108964 | 0.108964 | -757 | -315 | -536.000000 | 12.000000 | 12.0 | 2232.000000 | 4464.0 | 4464.00 | 0.899950 | 0.899950 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.0 | 90.0 | 90.0 | 0.036537 | 0.036537 | NaN |

| 5 | 100006 | 9 | 291695.500000 | 906615.0 | 2625259.5 | 23651.175000 | 39954.510 | 141907.050 | 272203.260000 | 688500.0 | 2449829.34 | 34840.170000 | 66987.0 | 69680.34 | 408304.890000 | 688500.0 | 2449829.34 | 0.108994 | 0.217830 | 0.163412 | -617 | -181 | -272.444444 | 23.000000 | 138.0 | -19492.240000 | 66987.0 | -175430.16 | 1.012684 | 1.316797 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 810.0 | 1410.0 | 1620.0 | -inf | 0.027424 | 1.0 |

| 6 | 100007 | 6 | 166638.750000 | 284400.0 | 999832.5 | 12278.805000 | 22678.785 | 73672.830 | 150530.250000 | 247500.0 | 903181.50 | 3390.750000 | 3676.5 | 6781.50 | 150530.250000 | 247500.0 | 903181.50 | 0.100143 | 0.218890 | 0.159516 | -2357 | -374 | -1222.833333 | 20.666667 | 124.0 | -16108.500000 | 2560.5 | -96651.00 | 1.046356 | 1.264000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 7.5 | 30.0 | 30.0 | 0.026538 | 0.036164 | NaN |

| 7 | 100008 | 5 | 162767.700000 | 501975.0 | 813838.5 | 15839.696250 | 25309.575 | 63358.785 | 155701.800000 | 450000.0 | 778509.00 | 5548.500000 | 12145.5 | 16645.50 | 194627.250000 | 450000.0 | 778509.00 | 0.000000 | 0.110243 | 0.073051 | -2536 | -82 | -1192.000000 | 14.000000 | 56.0 | -7065.900000 | 12145.5 | -35329.50 | 0.978569 | 1.115500 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 165.0 | 660.0 | 660.0 | 0.018055 | 0.034034 | NaN |

| 8 | 100009 | 7 | 70137.642857 | 98239.5 | 490963.5 | 10051.412143 | 17341.605 | 70359.885 | 76741.714286 | 110160.0 | 537192.00 | 9203.142857 | 22032.0 | 64422.00 | 76741.714286 | 110160.0 | 537192.00 | 0.000000 | 0.209525 | 0.126602 | -1562 | -74 | -719.285714 | 8.000000 | 56.0 | 6604.071429 | 17671.5 | 46228.50 | 0.916226 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.019536 | 0.030703 | NaN |

| 9 | 100010 | 1 | 260811.000000 | 260811.0 | 260811.0 | 27463.410000 | 27463.410 | 27463.410 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.0 | 0.00 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.000000 | 0.000000 | -1070 | -1070 | -1070.000000 | 10.000000 | 10.0 | -13599.000000 | -13599.0 | -13599.00 | 1.055009 | 1.055009 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.005300 | 0.005300 | NaN |

prev_amt_refused_agg['PREV_REFUSED_COUNT'].value_counts(dropna=False)NaN 220580

1.0 54616

2.0 26793

3.0 14025

4.0 8243

5.0 4859

6.0 3147

7.0 2069

8.0 1247

9.0 871

10.0 656

11.0 437

12.0 340

13.0 233

14.0 157

15.0 149

16.0 94

17.0 62

18.0 54

19.0 48

20.0 28

21.0 25

22.0 21

24.0 18

25.0 12

23.0 11

26.0 11

27.0 8

28.0 5

29.0 5

32.0 4

41.0 3

31.0 3

37.0 3

30.0 3

39.0 2

35.0 2

34.0 2

33.0 2

36.0 2

68.0 1

47.0 1

43.0 1

54.0 1

51.0 1

64.0 1

58.0 1

Name: PREV_REFUSED_COUNT, dtype: int64계산된 PREV_REFUSED_COUNT 중 Null값은 0 으로 변경하고 SK_ID_CURR 개별 건수 대비 PREV_REFUSED_COUNT 비율 계산

prev_amt_refused_agg = prev_amt_refused_agg.fillna(0)

prev_amt_refused_agg['PREV_REFUSE_RATIO'] = prev_amt_refused_agg['PREV_REFUSED_COUNT'] / prev_amt_refused_agg['PREV_SK_ID_CURR_COUNT']

prev_amt_refused_agg.head(10)| SK_ID_CURR | PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | PREV_REFUSED_COUNT | PREV_REFUSE_RATIO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 1 | 23787.000000 | 23787.0 | 23787.0 | 3951.000000 | 3951.000 | 3951.000 | 24835.500000 | 24835.5 | 24835.50 | 2520.000000 | 2520.0 | 2520.00 | 24835.500000 | 24835.5 | 24835.50 | 0.104326 | 0.104326 | 0.104326 | -1740 | -1740 | -1740.000000 | 8.000000 | 8.0 | 1048.500000 | 1048.5 | 1048.50 | 0.957782 | 0.957782 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 120.0 | 120.0 | 120.0 | 0.041099 | 0.041099 | 0.0 | 0.000000 |

| 1 | 100002 | 1 | 179055.000000 | 179055.0 | 179055.0 | 9251.775000 | 9251.775 | 9251.775 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.0 | 0.00 | 179055.000000 | 179055.0 | 179055.00 | 0.000000 | 0.000000 | 0.000000 | -606 | -606 | -606.000000 | 24.000000 | 24.0 | 0.000000 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.0 | 150.0 | 150.0 | 0.010003 | 0.010003 | 0.0 | 0.000000 |

| 2 | 100003 | 3 | 484191.000000 | 1035882.0 | 1452573.0 | 56553.990000 | 98356.995 | 169661.970 | 435436.500000 | 900000.0 | 1306309.50 | 3442.500000 | 6885.0 | 6885.00 | 435436.500000 | 900000.0 | 1306309.50 | 0.000000 | 0.100061 | 0.050030 | -2341 | -746 | -1305.000000 | 10.000000 | 30.0 | -48754.500000 | 756.0 | -146263.50 | 1.057664 | 1.150980 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 50.0 | 150.0 | 150.0 | 0.015272 | 0.018533 | 0.0 | 0.000000 |

| 3 | 100004 | 1 | 20106.000000 | 20106.0 | 20106.0 | 5357.250000 | 5357.250 | 5357.250 | 24282.000000 | 24282.0 | 24282.00 | 4860.000000 | 4860.0 | 4860.00 | 24282.000000 | 24282.0 | 24282.00 | 0.212008 | 0.212008 | 0.212008 | -815 | -815 | -815.000000 | 4.000000 | 4.0 | 4176.000000 | 4176.0 | 4176.00 | 0.828021 | 0.828021 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 30.0 | 30.0 | 30.0 | 0.016450 | 0.016450 | 0.0 | 0.000000 |

| 4 | 100005 | 2 | 20076.750000 | 40153.5 | 40153.5 | 4813.200000 | 4813.200 | 4813.200 | 22308.750000 | 44617.5 | 44617.50 | 4464.000000 | 4464.0 | 4464.00 | 44617.500000 | 44617.5 | 44617.50 | 0.108964 | 0.108964 | 0.108964 | -757 | -315 | -536.000000 | 12.000000 | 12.0 | 2232.000000 | 4464.0 | 4464.00 | 0.899950 | 0.899950 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.0 | 90.0 | 90.0 | 0.036537 | 0.036537 | 0.0 | 0.000000 |

| 5 | 100006 | 9 | 291695.500000 | 906615.0 | 2625259.5 | 23651.175000 | 39954.510 | 141907.050 | 272203.260000 | 688500.0 | 2449829.34 | 34840.170000 | 66987.0 | 69680.34 | 408304.890000 | 688500.0 | 2449829.34 | 0.108994 | 0.217830 | 0.163412 | -617 | -181 | -272.444444 | 23.000000 | 138.0 | -19492.240000 | 66987.0 | -175430.16 | 1.012684 | 1.316797 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 810.0 | 1410.0 | 1620.0 | -inf | 0.027424 | 1.0 | 0.111111 |

| 6 | 100007 | 6 | 166638.750000 | 284400.0 | 999832.5 | 12278.805000 | 22678.785 | 73672.830 | 150530.250000 | 247500.0 | 903181.50 | 3390.750000 | 3676.5 | 6781.50 | 150530.250000 | 247500.0 | 903181.50 | 0.100143 | 0.218890 | 0.159516 | -2357 | -374 | -1222.833333 | 20.666667 | 124.0 | -16108.500000 | 2560.5 | -96651.00 | 1.046356 | 1.264000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 7.5 | 30.0 | 30.0 | 0.026538 | 0.036164 | 0.0 | 0.000000 |

| 7 | 100008 | 5 | 162767.700000 | 501975.0 | 813838.5 | 15839.696250 | 25309.575 | 63358.785 | 155701.800000 | 450000.0 | 778509.00 | 5548.500000 | 12145.5 | 16645.50 | 194627.250000 | 450000.0 | 778509.00 | 0.000000 | 0.110243 | 0.073051 | -2536 | -82 | -1192.000000 | 14.000000 | 56.0 | -7065.900000 | 12145.5 | -35329.50 | 0.978569 | 1.115500 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 165.0 | 660.0 | 660.0 | 0.018055 | 0.034034 | 0.0 | 0.000000 |

| 8 | 100009 | 7 | 70137.642857 | 98239.5 | 490963.5 | 10051.412143 | 17341.605 | 70359.885 | 76741.714286 | 110160.0 | 537192.00 | 9203.142857 | 22032.0 | 64422.00 | 76741.714286 | 110160.0 | 537192.00 | 0.000000 | 0.209525 | 0.126602 | -1562 | -74 | -719.285714 | 8.000000 | 56.0 | 6604.071429 | 17671.5 | 46228.50 | 0.916226 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.019536 | 0.030703 | 0.0 | 0.000000 |

| 9 | 100010 | 1 | 260811.000000 | 260811.0 | 260811.0 | 27463.410000 | 27463.410 | 27463.410 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.0 | 0.00 | 247212.000000 | 247212.0 | 247212.00 | 0.000000 | 0.000000 | 0.000000 | -1070 | -1070 | -1070.000000 | 10.000000 | 10.0 | -13599.000000 | -13599.0 | -13599.00 | 1.055009 | 1.055009 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.0 | 0.0 | 0.0 | 0.005300 | 0.005300 | 0.0 | 0.000000 |

세부 레벨 groupby 와 unstack()을 이용하여 SQL Group by Case when 구현. 세부 조건이 2개 이상일때

SQL 일 경우

SELECT COUNT(CASE WHEN == 'Approved' END) , COUNT(CASE WHEN == 'Refused' END) FROM PREV GROUP BY SK_ID_CURRPandas로 수행

prev_refused_appr_group = prev[prev['NAME_CONTRACT_STATUS'].isin(['Approved', 'Refused'])].groupby(['SK_ID_CURR', 'NAME_CONTRACT_STATUS'])

prev_refused_appr_agg = prev_refused_appr_group['SK_ID_CURR'].count().unstack()

prev_refused_appr_agg.head(10)| NAME_CONTRACT_STATUS | Approved | Refused |

|---|---|---|

| SK_ID_CURR | ||

| 100001 | 1.0 | NaN |

| 100002 | 1.0 | NaN |

| 100003 | 3.0 | NaN |

| 100004 | 1.0 | NaN |

| 100005 | 1.0 | NaN |

| 100006 | 5.0 | 1.0 |

| 100007 | 6.0 | NaN |

| 100008 | 4.0 | NaN |

| 100009 | 7.0 | NaN |

| 100010 | 1.0 | NaN |

컬럼명 변경, Null 처리, 그리고 기존의 prev_amt_agg와 조인 후 데이터 가공

prev_refused_appr_agg = prev_refused_appr_agg.fillna(0)

prev_refused_appr_agg.columns = ['PREV_APPROVED_COUNT', 'PREV_REFUSED_COUNT']

prev_refused_appr_agg = prev_refused_appr_agg.reset_index()

prev_refused_appr_agg.head(10)| SK_ID_CURR | PREV_APPROVED_COUNT | PREV_REFUSED_COUNT | |

|---|---|---|---|

| 0 | 100001 | 1.0 | 0.0 |

| 1 | 100002 | 1.0 | 0.0 |

| 2 | 100003 | 3.0 | 0.0 |

| 3 | 100004 | 1.0 | 0.0 |

| 4 | 100005 | 1.0 | 0.0 |

| 5 | 100006 | 5.0 | 1.0 |

| 6 | 100007 | 6.0 | 0.0 |

| 7 | 100008 | 4.0 | 0.0 |

| 8 | 100009 | 7.0 | 0.0 |

| 9 | 100010 | 1.0 | 0.0 |

prev_amt_agg.head()| SK_ID_CURR | PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 1 | 23787.00 | 23787.0 | 23787.0 | 3951.000 | 3951.000 | 3951.000 | 24835.50 | 24835.5 | 24835.5 | 2520.0 | 2520.0 | 2520.0 | 24835.5 | 24835.5 | 24835.5 | 0.104326 | 0.104326 | 0.104326 | -1740 | -1740 | -1740.0 | 8.0 | 8.0 | 1048.5 | 1048.5 | 1048.5 | 0.957782 | 0.957782 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 120.0 | 120.0 | 120.0 | 0.041099 | 0.041099 |

| 1 | 100002 | 1 | 179055.00 | 179055.0 | 179055.0 | 9251.775 | 9251.775 | 9251.775 | 179055.00 | 179055.0 | 179055.0 | 0.0 | 0.0 | 0.0 | 179055.0 | 179055.0 | 179055.0 | 0.000000 | 0.000000 | 0.000000 | -606 | -606 | -606.0 | 24.0 | 24.0 | 0.0 | 0.0 | 0.0 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.0 | 150.0 | 150.0 | 0.010003 | 0.010003 |

| 2 | 100003 | 3 | 484191.00 | 1035882.0 | 1452573.0 | 56553.990 | 98356.995 | 169661.970 | 435436.50 | 900000.0 | 1306309.5 | 3442.5 | 6885.0 | 6885.0 | 435436.5 | 900000.0 | 1306309.5 | 0.000000 | 0.100061 | 0.050030 | -2341 | -746 | -1305.0 | 10.0 | 30.0 | -48754.5 | 756.0 | -146263.5 | 1.057664 | 1.150980 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 50.0 | 150.0 | 150.0 | 0.015272 | 0.018533 |

| 3 | 100004 | 1 | 20106.00 | 20106.0 | 20106.0 | 5357.250 | 5357.250 | 5357.250 | 24282.00 | 24282.0 | 24282.0 | 4860.0 | 4860.0 | 4860.0 | 24282.0 | 24282.0 | 24282.0 | 0.212008 | 0.212008 | 0.212008 | -815 | -815 | -815.0 | 4.0 | 4.0 | 4176.0 | 4176.0 | 4176.0 | 0.828021 | 0.828021 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 30.0 | 30.0 | 30.0 | 0.016450 | 0.016450 |

| 4 | 100005 | 2 | 20076.75 | 40153.5 | 40153.5 | 4813.200 | 4813.200 | 4813.200 | 22308.75 | 44617.5 | 44617.5 | 4464.0 | 4464.0 | 4464.0 | 44617.5 | 44617.5 | 44617.5 | 0.108964 | 0.108964 | 0.108964 | -757 | -315 | -536.0 | 12.0 | 12.0 | 2232.0 | 4464.0 | 4464.0 | 0.899950 | 0.899950 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.0 | 90.0 | 90.0 | 0.036537 | 0.036537 |

# prev_amt_agg와 조인. prev_amt_agg와 prev_refused_appr_agg 모두 SK_ID_CURR을 INDEX로 가지고 있음.

prev_agg = prev_amt_agg.merge(prev_refused_appr_agg, on='SK_ID_CURR', how='left')

# SK_ID_CURR별 과거 대출건수 대비 APPROVED_COUNT 및 REFUSED_COUNT 비율 생성.

prev_agg['PREV_REFUSED_RATIO'] = prev_agg['PREV_REFUSED_COUNT']/prev_agg['PREV_SK_ID_CURR_COUNT']

prev_agg['PREV_APPROVED_RATIO'] = prev_agg['PREV_APPROVED_COUNT']/prev_agg['PREV_SK_ID_CURR_COUNT']

# 'PREV_REFUSED_COUNT', 'PREV_APPROVED_COUNT' 컬럼 drop

prev_agg = prev_agg.drop(['PREV_REFUSED_COUNT', 'PREV_APPROVED_COUNT'], axis=1)

# prev_amt_agg와 prev_refused_appr_agg INDEX인 SK_ID_CURR이 조인 후 정식 컬럼으로 생성됨.

prev_agg.head(30)| SK_ID_CURR | PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | PREV_REFUSED_RATIO | PREV_APPROVED_RATIO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 100001 | 1 | 23787.000000 | 23787.0 | 23787.000 | 3951.000000 | 3951.000 | 3951.000 | 24835.500000 | 24835.5 | 24835.500 | 2520.000000 | 2520.0 | 2520.00 | 24835.500000 | 24835.5 | 24835.500 | 0.104326 | 0.104326 | 0.104326 | -1740 | -1740 | -1740.000000 | 8.000000 | 8.0 | 1048.500000 | 1048.5 | 1048.50 | 0.957782 | 0.957782 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 120.00 | 120.0 | 120.0 | 0.041099 | 0.041099 | 0.000000 | 1.000000 |

| 1 | 100002 | 1 | 179055.000000 | 179055.0 | 179055.000 | 9251.775000 | 9251.775 | 9251.775 | 179055.000000 | 179055.0 | 179055.000 | 0.000000 | 0.0 | 0.00 | 179055.000000 | 179055.0 | 179055.000 | 0.000000 | 0.000000 | 0.000000 | -606 | -606 | -606.000000 | 24.000000 | 24.0 | 0.000000 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.00 | 150.0 | 150.0 | 0.010003 | 0.010003 | 0.000000 | 1.000000 |

| 2 | 100003 | 3 | 484191.000000 | 1035882.0 | 1452573.000 | 56553.990000 | 98356.995 | 169661.970 | 435436.500000 | 900000.0 | 1306309.500 | 3442.500000 | 6885.0 | 6885.00 | 435436.500000 | 900000.0 | 1306309.500 | 0.000000 | 0.100061 | 0.050030 | -2341 | -746 | -1305.000000 | 10.000000 | 30.0 | -48754.500000 | 756.0 | -146263.50 | 1.057664 | 1.150980 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 50.00 | 150.0 | 150.0 | 0.015272 | 0.018533 | 0.000000 | 1.000000 |

| 3 | 100004 | 1 | 20106.000000 | 20106.0 | 20106.000 | 5357.250000 | 5357.250 | 5357.250 | 24282.000000 | 24282.0 | 24282.000 | 4860.000000 | 4860.0 | 4860.00 | 24282.000000 | 24282.0 | 24282.000 | 0.212008 | 0.212008 | 0.212008 | -815 | -815 | -815.000000 | 4.000000 | 4.0 | 4176.000000 | 4176.0 | 4176.00 | 0.828021 | 0.828021 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 30.00 | 30.0 | 30.0 | 0.016450 | 0.016450 | 0.000000 | 1.000000 |

| 4 | 100005 | 2 | 20076.750000 | 40153.5 | 40153.500 | 4813.200000 | 4813.200 | 4813.200 | 22308.750000 | 44617.5 | 44617.500 | 4464.000000 | 4464.0 | 4464.00 | 44617.500000 | 44617.5 | 44617.500 | 0.108964 | 0.108964 | 0.108964 | -757 | -315 | -536.000000 | 12.000000 | 12.0 | 2232.000000 | 4464.0 | 4464.00 | 0.899950 | 0.899950 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.00 | 90.0 | 90.0 | 0.036537 | 0.036537 | 0.000000 | 0.500000 |

| 5 | 100006 | 9 | 291695.500000 | 906615.0 | 2625259.500 | 23651.175000 | 39954.510 | 141907.050 | 272203.260000 | 688500.0 | 2449829.340 | 34840.170000 | 66987.0 | 69680.34 | 408304.890000 | 688500.0 | 2449829.340 | 0.108994 | 0.217830 | 0.163412 | -617 | -181 | -272.444444 | 23.000000 | 138.0 | -19492.240000 | 66987.0 | -175430.16 | 1.012684 | 1.316797 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 810.00 | 1410.0 | 1620.0 | -inf | 0.027424 | 0.111111 | 0.555556 |

| 6 | 100007 | 6 | 166638.750000 | 284400.0 | 999832.500 | 12278.805000 | 22678.785 | 73672.830 | 150530.250000 | 247500.0 | 903181.500 | 3390.750000 | 3676.5 | 6781.50 | 150530.250000 | 247500.0 | 903181.500 | 0.100143 | 0.218890 | 0.159516 | -2357 | -374 | -1222.833333 | 20.666667 | 124.0 | -16108.500000 | 2560.5 | -96651.00 | 1.046356 | 1.264000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 7.50 | 30.0 | 30.0 | 0.026538 | 0.036164 | 0.000000 | 1.000000 |

| 7 | 100008 | 5 | 162767.700000 | 501975.0 | 813838.500 | 15839.696250 | 25309.575 | 63358.785 | 155701.800000 | 450000.0 | 778509.000 | 5548.500000 | 12145.5 | 16645.50 | 194627.250000 | 450000.0 | 778509.000 | 0.000000 | 0.110243 | 0.073051 | -2536 | -82 | -1192.000000 | 14.000000 | 56.0 | -7065.900000 | 12145.5 | -35329.50 | 0.978569 | 1.115500 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 165.00 | 660.0 | 660.0 | 0.018055 | 0.034034 | 0.000000 | 0.800000 |

| 8 | 100009 | 7 | 70137.642857 | 98239.5 | 490963.500 | 10051.412143 | 17341.605 | 70359.885 | 76741.714286 | 110160.0 | 537192.000 | 9203.142857 | 22032.0 | 64422.00 | 76741.714286 | 110160.0 | 537192.000 | 0.000000 | 0.209525 | 0.126602 | -1562 | -74 | -719.285714 | 8.000000 | 56.0 | 6604.071429 | 17671.5 | 46228.50 | 0.916226 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.019536 | 0.030703 | 0.000000 | 1.000000 |

| 9 | 100010 | 1 | 260811.000000 | 260811.0 | 260811.000 | 27463.410000 | 27463.410 | 27463.410 | 247212.000000 | 247212.0 | 247212.000 | 0.000000 | 0.0 | 0.00 | 247212.000000 | 247212.0 | 247212.000 | 0.000000 | 0.000000 | 0.000000 | -1070 | -1070 | -1070.000000 | 10.000000 | 10.0 | -13599.000000 | -13599.0 | -13599.00 | 1.055009 | 1.055009 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.005300 | 0.005300 | 0.000000 | 1.000000 |

| 10 | 100011 | 4 | 261840.375000 | 732915.0 | 1047361.500 | 18303.195000 | 31295.250 | 54909.585 | 202732.875000 | 675000.0 | 810931.500 | 6797.250000 | 13594.5 | 13594.50 | 270310.500000 | 675000.0 | 810931.500 | 0.000000 | 0.100010 | 0.050005 | -2508 | -1162 | -1784.500000 | 14.000000 | 42.0 | -59107.500000 | 1485.0 | -236430.00 | inf | inf | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | -inf | 0.025367 | 0.250000 | 0.750000 |

| 11 | 100012 | 4 | 74119.500000 | 158508.0 | 296478.000 | 7894.155000 | 11188.035 | 23682.465 | 60930.000000 | 135000.0 | 243720.000 | 0.000000 | 0.0 | 0.00 | 81240.000000 | 135000.0 | 243720.000 | 0.000000 | 0.000000 | 0.000000 | -1673 | -107 | -779.750000 | 18.000000 | 54.0 | -13189.500000 | 0.0 | -52758.00 | 1.236566 | 1.269700 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 100.00 | 180.0 | 300.0 | 0.033372 | 0.043775 | 0.000000 | 0.750000 |

| 12 | 100013 | 4 | 146134.125000 | 512370.0 | 584536.500 | 11478.195000 | 23153.985 | 34434.585 | 130871.250000 | 450000.0 | 523485.000 | 3375.000000 | 6750.0 | 6750.00 | 174495.000000 | 450000.0 | 523485.000 | 0.000000 | 0.134434 | 0.067217 | -1999 | -222 | -837.500000 | 17.333333 | 52.0 | -15262.875000 | 3096.0 | -61051.50 | 1.052363 | 1.138600 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 200.00 | 570.0 | 600.0 | 0.027617 | 0.036400 | 0.000000 | 0.750000 |

| 13 | 100014 | 2 | 102834.000000 | 131868.0 | 205668.000 | 12806.550000 | 14045.625 | 25613.100 | 96536.250000 | 119272.5 | 193072.500 | 0.000000 | 0.0 | 0.00 | 96536.250000 | 119272.5 | 193072.500 | 0.000000 | 0.000000 | 0.000000 | -844 | -102 | -473.000000 | 9.000000 | 18.0 | -6297.750000 | 0.0 | -12595.50 | 1.052801 | 1.105603 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.014020 | 0.023653 | 0.000000 | 1.000000 |

| 14 | 100015 | 1 | 67077.000000 | 67077.0 | 67077.000 | 7666.920000 | 7666.920 | 7666.920 | 68850.000000 | 68850.0 | 68850.000 | 6885.000000 | 6885.0 | 6885.00 | 68850.000000 | 68850.0 | 68850.000 | 0.101382 | 0.101382 | 0.101382 | -2396 | -2396 | -2396.000000 | 10.000000 | 10.0 | 1773.000000 | 1773.0 | 1773.00 | 0.974248 | 0.974248 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.014300 | 0.014300 | 0.000000 | 1.000000 |

| 15 | 100016 | 4 | 106221.375000 | 232200.0 | 424885.500 | 8593.155000 | 14480.460 | 34372.620 | 120745.125000 | 290250.0 | 482980.500 | 15690.375000 | 58050.0 | 62761.50 | 120745.125000 | 290250.0 | 482980.500 | 0.000000 | 0.217818 | 0.081682 | -2370 | -1049 | -1779.500000 | 17.000000 | 68.0 | 14523.750000 | 58050.0 | 58095.00 | 0.949761 | 1.099045 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 70.00 | 210.0 | 210.0 | 0.029580 | 0.033600 | 0.000000 | 1.000000 |

| 16 | 100017 | 2 | 175565.250000 | 198409.5 | 351130.500 | 14375.407500 | 16967.295 | 28750.815 | 176665.500000 | 195291.0 | 353331.000 | 19152.000000 | 22500.0 | 38304.00 | 176665.500000 | 195291.0 | 353331.000 | 0.102133 | 0.110926 | 0.106529 | -2441 | -612 | -1526.500000 | 17.000000 | 34.0 | 1100.250000 | 5319.0 | 2200.50 | 0.991156 | 1.015968 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.014412 | 0.017723 | 0.000000 | 1.000000 |

| 17 | 100018 | 4 | 285989.591250 | 536364.0 | 1143958.365 | 38669.703750 | 94906.035 | 154678.815 | 298363.466250 | 571774.5 | 1193453.865 | 14295.375000 | 57181.5 | 57181.50 | 298363.466250 | 571774.5 | 1193453.865 | 0.000000 | 0.108917 | 0.027229 | -1648 | -188 | -755.250000 | 10.000000 | 40.0 | 12373.875000 | 57181.5 | 49495.50 | 1.014609 | 1.158442 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | -9.00 | 0.0 | -18.0 | 0.018384 | 0.038257 | 0.000000 | 1.000000 |

| 18 | 100019 | 1 | 104683.500000 | 104683.5 | 104683.500 | 10518.615000 | 10518.615 | 10518.615 | 84136.500000 | 84136.5 | 84136.500 | 0.000000 | 0.0 | 0.00 | 84136.500000 | 84136.5 | 84136.500 | 0.000000 | 0.000000 | 0.000000 | -925 | -925 | -925.000000 | 12.000000 | 12.0 | -20547.000000 | -20547.0 | -20547.00 | 1.244210 | 1.244210 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.00 | 150.0 | 150.0 | 0.017147 | 0.017147 | 0.000000 | 1.000000 |

| 19 | 100020 | 2 | 41706.000000 | 48325.5 | 83412.000 | 7254.517500 | 8779.770 | 14509.035 | 39206.250000 | 45900.0 | 78412.500 | 0.000000 | 0.0 | 0.00 | 39206.250000 | 45900.0 | 78412.500 | 0.000000 | 0.000000 | 0.000000 | -472 | -243 | -357.500000 | 7.000000 | 14.0 | -2499.750000 | -2425.5 | -4999.50 | 1.066006 | 1.079170 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.026651 | 0.038290 | 0.000000 | 1.000000 |

| 20 | 100021 | 6 | 153615.750000 | 675000.0 | 921694.500 | 10686.165000 | 33750.000 | 64116.990 | 40961.250000 | 99189.0 | 245767.500 | 3770.100000 | 9922.5 | 18850.50 | 49153.500000 | 99189.0 | 245767.500 | 0.000000 | 0.433539 | 0.106606 | -2811 | -261 | -943.833333 | 7.000000 | 42.0 | -112654.500000 | 8928.0 | -675927.00 | inf | inf | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 90.00 | 180.0 | 270.0 | -inf | 0.034033 | 0.000000 | 1.000000 |

| 21 | 100022 | 1 | 103203.000000 | 103203.0 | 103203.000 | 6765.975000 | 6765.975 | 6765.975 | 89091.000000 | 89091.0 | 89091.000 | 0.000000 | 0.0 | 0.00 | 89091.000000 | 89091.0 | 89091.000 | 0.000000 | 0.000000 | 0.000000 | -239 | -239 | -239.000000 | 18.000000 | 18.0 | -14112.000000 | -14112.0 | -14112.00 | 1.158400 | 1.158400 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | NaN | NaN | 0.0 | 0.010004 | 0.010004 | 0.000000 | 1.000000 |

| 22 | 100023 | 4 | 113517.000000 | 239242.5 | 454068.000 | 8895.892500 | 16822.440 | 35583.570 | 98746.875000 | 180000.0 | 394987.500 | 8435.250000 | 9000.0 | 16870.50 | 98746.875000 | 180000.0 | 394987.500 | 0.095959 | 0.101380 | 0.098669 | -2424 | -262 | -1215.750000 | 12.500000 | 50.0 | -14770.125000 | 2025.0 | -59080.50 | 1.080951 | 1.329125 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 240.00 | 600.0 | 720.0 | -inf | 0.028649 | 0.000000 | 1.000000 |

| 23 | 100025 | 8 | 295425.781875 | 1042560.0 | 2363406.255 | 27645.595714 | 55678.095 | 193519.170 | 259795.344375 | 900000.0 | 2078362.755 | 5845.500000 | 23382.0 | 23382.00 | 296908.965000 | 900000.0 | 2078362.755 | 0.000000 | 0.423065 | 0.105766 | -2060 | -7 | -731.000000 | 13.714286 | 96.0 | -35630.437500 | 21645.0 | -285043.50 | 1.073930 | 1.269700 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 174.25 | 367.0 | 697.0 | 0.022884 | 0.027871 | 0.000000 | 0.875000 |

| 24 | 100026 | 3 | 292281.000000 | 744498.0 | 876843.000 | 33193.665000 | 42778.845 | 66387.330 | 269115.000000 | 675000.0 | 807345.000 | 0.000000 | 0.0 | 0.00 | 403672.500000 | 675000.0 | 807345.000 | 0.000000 | 0.000000 | 0.000000 | -1427 | -152 | -682.333333 | 21.000000 | 42.0 | -23166.000000 | 0.0 | -69498.00 | 1.051480 | 1.102960 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 510.00 | 1020.0 | 1020.0 | 0.020701 | 0.029682 | 0.000000 | 0.666667 |

| 25 | 100027 | 4 | 173795.625000 | 239850.0 | 695182.500 | 24067.755000 | 28077.570 | 72203.265 | 163621.125000 | 226984.5 | 654484.500 | 0.000000 | 0.0 | 0.00 | 218161.500000 | 226984.5 | 654484.500 | 0.000000 | 0.000000 | 0.000000 | -795 | -181 | -407.000000 | 11.333333 | 34.0 | -10174.500000 | 0.0 | -40698.00 | 1.062332 | 1.066000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.014849 | 0.017250 | 0.250000 | 0.500000 |

| 26 | 100028 | 5 | 92920.500000 | 225000.0 | 464602.500 | 8091.585000 | 11250.000 | 24274.755 | 49207.500000 | 130765.5 | 246037.500 | 3750.000000 | 11250.0 | 11250.00 | 82012.500000 | 130765.5 | 246037.500 | 0.000000 | 0.173124 | 0.057708 | -1805 | -531 | -1124.200000 | 11.333333 | 34.0 | -43713.000000 | 6435.0 | -218565.00 | inf | inf | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 75.00 | 150.0 | 150.0 | -inf | 0.017550 | 0.000000 | 0.600000 |

| 27 | 100029 | 1 | 126000.000000 | 126000.0 | 126000.000 | 22891.680000 | 22891.680 | 22891.680 | 126000.000000 | 126000.0 | 126000.000 | 0.000000 | 0.0 | 0.00 | 126000.000000 | 126000.0 | 126000.000 | 0.000000 | 0.000000 | 0.000000 | -324 | -324 | -324.000000 | 6.000000 | 6.0 | 0.000000 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 60.00 | 60.0 | 60.0 | 0.015013 | 0.015013 | 0.000000 | 1.000000 |

| 28 | 100030 | 12 | 32534.643750 | 49734.0 | 390415.725 | 4731.041250 | 9035.685 | 37848.330 | 33497.268750 | 47241.0 | 401967.225 | 1262.625000 | 6714.0 | 15151.50 | 33497.268750 | 47241.0 | 401967.225 | 0.000000 | 0.210919 | 0.044804 | -2856 | -378 | -1981.083333 | 8.625000 | 69.0 | 962.625000 | 5607.0 | 11551.50 | 0.965475 | 1.052772 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 60.00 | 90.0 | 120.0 | 0.017772 | 0.037233 | 0.833333 | 0.166667 |

| 29 | 100032 | 1 | 42255.000000 | 42255.0 | 42255.000 | 7910.145000 | 7910.145 | 7910.145 | 69255.000000 | 69255.0 | 69255.000 | 27000.000000 | 27000.0 | 27000.00 | 69255.000000 | 69255.0 | 69255.000 | 0.424597 | 0.424597 | 0.424597 | -1497 | -1497 | -1497.000000 | 6.000000 | 6.0 | 27000.000000 | 27000.0 | 27000.00 | 0.610136 | 0.610136 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 0.00 | 0.0 | 0.0 | 0.020534 | 0.020534 | 0.000000 | 1.000000 |

가공된 최종 데이터 세트 생성

이전에 application 데이터 세트의 feature engineering 수행 후 새롭게 previous 데이터 세트로 가공된 데이터를 조인.

apps_all = get_apps_processed(apps)print(apps_all.shape, prev_agg.shape)

apps_all = apps_all.merge(prev_agg, on='SK_ID_CURR', how='left')

print(apps_all.shape)(356255, 135) (338857, 42)

(356255, 176)apps_all.head()| AMT_ANNUITY | AMT_CREDIT | AMT_GOODS_PRICE | AMT_INCOME_TOTAL | AMT_REQ_CREDIT_BUREAU_DAY | AMT_REQ_CREDIT_BUREAU_HOUR | AMT_REQ_CREDIT_BUREAU_MON | AMT_REQ_CREDIT_BUREAU_QRT | AMT_REQ_CREDIT_BUREAU_WEEK | AMT_REQ_CREDIT_BUREAU_YEAR | APARTMENTS_AVG | APARTMENTS_MEDI | APARTMENTS_MODE | BASEMENTAREA_AVG | BASEMENTAREA_MEDI | BASEMENTAREA_MODE | CNT_CHILDREN | CNT_FAM_MEMBERS | CODE_GENDER | COMMONAREA_AVG | COMMONAREA_MEDI | COMMONAREA_MODE | DAYS_BIRTH | DAYS_EMPLOYED | DAYS_ID_PUBLISH | DAYS_LAST_PHONE_CHANGE | DAYS_REGISTRATION | DEF_30_CNT_SOCIAL_CIRCLE | DEF_60_CNT_SOCIAL_CIRCLE | ELEVATORS_AVG | ELEVATORS_MEDI | ELEVATORS_MODE | EMERGENCYSTATE_MODE | ENTRANCES_AVG | ENTRANCES_MEDI | ENTRANCES_MODE | EXT_SOURCE_1 | EXT_SOURCE_2 | EXT_SOURCE_3 | FLAG_CONT_MOBILE | FLAG_DOCUMENT_10 | FLAG_DOCUMENT_11 | FLAG_DOCUMENT_12 | FLAG_DOCUMENT_13 | FLAG_DOCUMENT_14 | FLAG_DOCUMENT_15 | FLAG_DOCUMENT_16 | FLAG_DOCUMENT_17 | FLAG_DOCUMENT_18 | FLAG_DOCUMENT_19 | FLAG_DOCUMENT_2 | FLAG_DOCUMENT_20 | FLAG_DOCUMENT_21 | FLAG_DOCUMENT_3 | FLAG_DOCUMENT_4 | FLAG_DOCUMENT_5 | FLAG_DOCUMENT_6 | FLAG_DOCUMENT_7 | FLAG_DOCUMENT_8 | FLAG_DOCUMENT_9 | FLAG_EMAIL | FLAG_EMP_PHONE | FLAG_MOBIL | FLAG_OWN_CAR | FLAG_OWN_REALTY | FLAG_PHONE | FLAG_WORK_PHONE | FLOORSMAX_AVG | FLOORSMAX_MEDI | FLOORSMAX_MODE | FLOORSMIN_AVG | FLOORSMIN_MEDI | FLOORSMIN_MODE | FONDKAPREMONT_MODE | HOUR_APPR_PROCESS_START | HOUSETYPE_MODE | LANDAREA_AVG | LANDAREA_MEDI | LANDAREA_MODE | LIVE_CITY_NOT_WORK_CITY | LIVE_REGION_NOT_WORK_REGION | LIVINGAPARTMENTS_AVG | LIVINGAPARTMENTS_MEDI | LIVINGAPARTMENTS_MODE | LIVINGAREA_AVG | LIVINGAREA_MEDI | LIVINGAREA_MODE | NAME_CONTRACT_TYPE | NAME_EDUCATION_TYPE | NAME_FAMILY_STATUS | NAME_HOUSING_TYPE | NAME_INCOME_TYPE | NAME_TYPE_SUITE | NONLIVINGAPARTMENTS_AVG | NONLIVINGAPARTMENTS_MEDI | NONLIVINGAPARTMENTS_MODE | NONLIVINGAREA_AVG | NONLIVINGAREA_MEDI | NONLIVINGAREA_MODE | OBS_30_CNT_SOCIAL_CIRCLE | OBS_60_CNT_SOCIAL_CIRCLE | OCCUPATION_TYPE | ORGANIZATION_TYPE | OWN_CAR_AGE | REGION_POPULATION_RELATIVE | REGION_RATING_CLIENT | REGION_RATING_CLIENT_W_CITY | REG_CITY_NOT_LIVE_CITY | REG_CITY_NOT_WORK_CITY | REG_REGION_NOT_LIVE_REGION | REG_REGION_NOT_WORK_REGION | SK_ID_CURR | TARGET | TOTALAREA_MODE | WALLSMATERIAL_MODE | WEEKDAY_APPR_PROCESS_START | YEARS_BEGINEXPLUATATION_AVG | YEARS_BEGINEXPLUATATION_MEDI | YEARS_BEGINEXPLUATATION_MODE | YEARS_BUILD_AVG | YEARS_BUILD_MEDI | YEARS_BUILD_MODE | APPS_EXT_SOURCE_MEAN | APPS_EXT_SOURCE_STD | APPS_ANNUITY_CREDIT_RATIO | APPS_GOODS_CREDIT_RATIO | APPS_ANNUITY_INCOME_RATIO | APPS_CREDIT_INCOME_RATIO | APPS_GOODS_INCOME_RATIO | APPS_CNT_FAM_INCOME_RATIO | APPS_EMPLOYED_BIRTH_RATIO | APPS_INCOME_EMPLOYED_RATIO | APPS_INCOME_BIRTH_RATIO | APPS_CAR_BIRTH_RATIO | APPS_CAR_EMPLOYED_RATIO | PREV_SK_ID_CURR_COUNT | PREV_AMT_CREDIT_MEAN | PREV_AMT_CREDIT_MAX | PREV_AMT_CREDIT_SUM | PREV_AMT_ANNUITY_MEAN | PREV_AMT_ANNUITY_MAX | PREV_AMT_ANNUITY_SUM | PREV_AMT_APPLICATION_MEAN | PREV_AMT_APPLICATION_MAX | PREV_AMT_APPLICATION_SUM | PREV_AMT_DOWN_PAYMENT_MEAN | PREV_AMT_DOWN_PAYMENT_MAX | PREV_AMT_DOWN_PAYMENT_SUM | PREV_AMT_GOODS_PRICE_MEAN | PREV_AMT_GOODS_PRICE_MAX | PREV_AMT_GOODS_PRICE_SUM | PREV_RATE_DOWN_PAYMENT_MIN | PREV_RATE_DOWN_PAYMENT_MAX | PREV_RATE_DOWN_PAYMENT_MEAN | PREV_DAYS_DECISION_MIN | PREV_DAYS_DECISION_MAX | PREV_DAYS_DECISION_MEAN | PREV_CNT_PAYMENT_MEAN | PREV_CNT_PAYMENT_SUM | PREV_PREV_CREDIT_DIFF_MEAN | PREV_PREV_CREDIT_DIFF_MAX | PREV_PREV_CREDIT_DIFF_SUM | PREV_PREV_CREDIT_APPL_RATIO_MEAN | PREV_PREV_CREDIT_APPL_RATIO_MAX | PREV_PREV_GOODS_DIFF_MEAN | PREV_PREV_GOODS_DIFF_MAX | PREV_PREV_GOODS_DIFF_SUM | PREV_PREV_GOODS_APPL_RATIO_MEAN | PREV_PREV_GOODS_APPL_RATIO_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_MEAN | PREV_PREV_DAYS_LAST_DUE_DIFF_MAX | PREV_PREV_DAYS_LAST_DUE_DIFF_SUM | PREV_PREV_INTERESTS_RATE_MEAN | PREV_PREV_INTERESTS_RATE_MAX | PREV_REFUSED_RATIO | PREV_APPROVED_RATIO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 24700.5 | 406597.5 | 351000.0 | 202500.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 1.0 | 0.0247 | 0.0250 | 0.0252 | 0.0369 | 0.0369 | 0.0383 | 0 | 1.0 | M | 0.0143 | 0.0144 | 0.0144 | -9461 | -637 | -2120 | -1134.0 | -3648.0 | 2.0 | 2.0 | 0.00 | 0.00 | 0.0000 | No | 0.0690 | 0.0690 | 0.0690 | 0.083037 | 0.262949 | 0.139376 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | N | Y | 1 | 0 | 0.0833 | 0.0833 | 0.0833 | 0.1250 | 0.1250 | 0.1250 | reg oper account | 10 | block of flats | 0.0369 | 0.0375 | 0.0377 | 0 | 0 | 0.0202 | 0.0205 | 0.022 | 0.0190 | 0.0193 | 0.0198 | Cash loans | Secondary / secondary special | Single / not married | House / apartment | Working | Unaccompanied | 0.0000 | 0.0000 | 0.0 | 0.0000 | 0.00 | 0.0 | 2.0 | 2.0 | Laborers | Business Entity Type 3 | NaN | 0.018801 | 2 | 2 | 0 | 0 | 0 | 0 | 100002 | 1.0 | 0.0149 | Stone, brick | WEDNESDAY | 0.9722 | 0.9722 | 0.9722 | 0.6192 | 0.6243 | 0.6341 | 0.161787 | 0.092026 | 0.060749 | 0.863262 | 0.121978 | 2.007889 | 1.733333 | 202500.0 | 0.067329 | -317.896389 | -21.403657 | NaN | NaN | 1.0 | 179055.00 | 179055.0 | 179055.0 | 9251.775 | 9251.775 | 9251.775 | 179055.00 | 179055.0 | 179055.00 | 0.00 | 0.0 | 0.00 | 179055.00 | 179055.0 | 179055.00 | 0.000000 | 0.000000 | 0.000000 | -606.0 | -606.0 | -606.000000 | 24.000000 | 24.0 | 0.00 | 0.0 | 0.00 | 1.000000 | 1.000000 | 0.0 | 0.0 | 0.0 | 1.0 | 1.0 | 150.0 | 150.0 | 150.0 | 0.010003 | 0.010003 | 0.000000 | 1.000000 |