Types of Markets

- We are now going to discuss how

markets operateand how differenttypes of marketsserve different purposes. - Besides the obvious need to agree on

quality,quantity, andpriceof the goods, three other important matters must be decided when a buyer and a seller arrange a trade:- The time of delivery of the goods

- The mode of settlement

- Any conditions that might be attached to this transaction

1. Spot Markets

- In a

spot market, the seller delivers the goodsimmediatelyand the buyer pays for themon the spot. - No conditions are attached to the delivery

- A

spot markethas the advantage of immediacy- As a

producer, I can sell exactly the amount that I have available - As a

consumer, I can purchase exactly the amount I need

- As a

- Unfortunately,

pricesin aspot markettend to change quickly- A sudden

increase in demand(or a drop in production) sneds thepricesoaring because the stock of goods available for immediate delivery is limited - A glut in production or a dip in

demanddepresses theprice

- A sudden

Spot marketsalso react to news about thefuture availabilityof a commodity

Large and unpredictable variationsin the price of a commodity makelife harderfor both suppliers and consumers of this commodity

2. Forward Contracts and Forward Markets

-

If an

acceptable pricecan be agreed, it is ready to sign acontractwith farmer now for the delivery of his wheat harvest in a few months' time -

This

forward contractspecifies the following:- The

quantityandqualityof the wheat to be delivered - The

dateofdelivery - The

dateofpaymentfollowing delivery - The

penaltiesif either partyfailsto honor its commitment - The price to be paid

- The

-

Since a lot of that

informationis publicly available, theestimatesof both parties at any given time are unlikely to be verydifferent -

However, the

priceagreed for thecontractmaydifferfrom thebest estimatesbecause of differendces inbargaining positions -

The

differencebetween his expectation of thespot market priceand theprice agreed in the forward contractrepresents apremiumthat he is willing to pay to redudce his exposure to adownward price risk

- If the

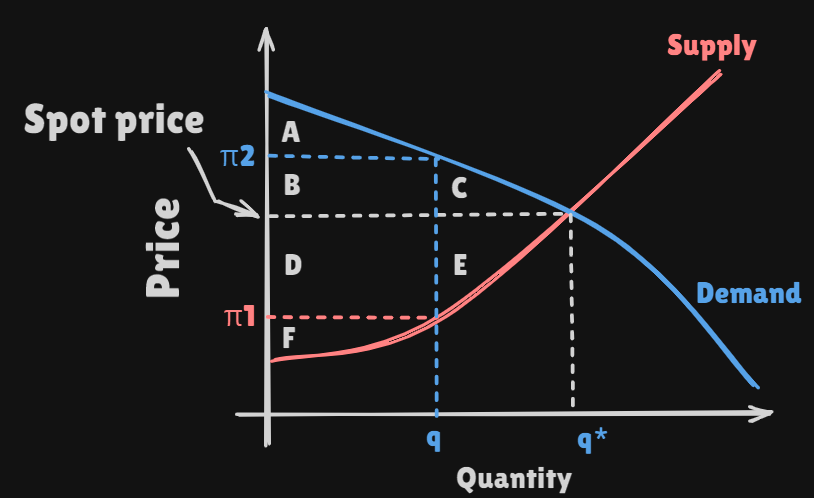

spot priceat the time of delivery ishigherthan theagreed price, theforward contractrepresents alossfor the seller and aprofitfor the buyerWhen

agreed pricewent ,buyer's profitwould be area labeled as B+D+F andseller's profitwould be area labeled as A - If the

spot priceislowerthan theagreed price, theforward contractrepresents alossfor the buyer andprofitfor the sellerWhen

agreed pricewent ,buyer's profitwould be area labeled as F andseller's profitwould be area labeled as A+B+D

- If the

-

Forward contractsmake if possible for parties to trade at a priceacceptableto both sides and hence provides a way toshare the price risk- If their

estimatesoffuture spot pricesareunbiased, in thelong runthe difference between theaverage spot priceand theaverage forward priceshould be equal to theaverage premium - The party that gets the

premiumis therefore beingremuneratedfor theacceping the price risk

- If their

3. Futures Contracts and Futures Markets

-

The

existence of a secondary marketwhere producers and consumers of the commodity can buy and sell standardizedforward contractshelps these parties manage their exposure tofluctuationsin thespot price -

A

speculatorcan sell acontract first, hoping to buy another one later at alower priceSince theses

contractsare not baked by physical delivery, they are calledfutures contractsrather thanforwards- As the date of delivery approaches, the

speculatorsmustbalance their positionbecuase they cannot produce, consume, or store the commodity - If the markets are

sufficiently competitiveand allparticipantshave access toenough information, theforward priceshould reflect the consensus expectation of thespot price

- As the date of delivery approaches, the

-

Shareholders in some companies expect

stablebut not extraordinary returnsThe managers of these

risk-aversecompanies therefore try to limit theirexposure to risksthat mightreduce profitssignificantly below expectations -

Shareholders in companies that engage in commodity speculation hope for

very high returnsbut should not be surprised byoccasional large lossesThe management of theses

rist-lovingcompanies is therefore free to takesignificant risksin order to securelarge profits -

By

diversifyinginto markets fordifferent comodities, they further reduce their exposure to risk4. Options

-

Futuresandforward contractsarefirm contractsin the sense that delivery is unconditional -

Such contracts are called

optionsand come in two varieties:callsandputscall optiongives its holder theright to buya given amount of a commodity at a price called theexercise priceput optiongives its holder theright to sella given amount of a commodity at theexercise price

-

When an

option contract is agreed, the seller of theoptionreceives anonrefundable option feefrom the holder of the option

5. Contracts for Difference

Producersandconsumersof some commodities are sometimes obliged to trade solely through acentralized market- Since they are not allowed to enter into

bilateral agreements, they do not have theoptionto useforward,futures, oroption contractsto reduce their exposure toprice risksIn such situations, parties often resort to

contracts for differencethat operate inparallelwith ehcentralized market- They agree on a

strike priceand anamount of the commodity

- They agree on a

- Once trading on the

centeralized marketiscomplete, the contract for difference is settled as follows:- If the

strike priceagreed in the contract ishigherthan thecentralized marketprice, the buyer pays the seller the difference between these two prices times the amount agreed in the contract - If the

strike priceislowerthan the market price, the seller pays the buyer the difference between these two prices times the agreed amount

- If the

6. Managing the Price Risks

- Firms that

produceorconsumelarge amounts of a commodity are exposed to other types ofrisk - Will generally try to

reduce their exposure to price risksby hedging their positions using a combination offorward,futures,options, andcontracts for difference - The volume of trades in the

spot markettherefore typically represents only asmall fractionof the volume traded on the other marketsWhile the spot market volume may be relatively small, the

spot priceis thesignalthat drives all the other markets

7. Market Efficiency

- If such transactions are to happen quicly and easily, the market must be

liquid - There sould always be

enough participantswilling to buy or sell goods- Finally, the

costsassociated with trading should represnet asmall fractionof the value of each transaction - These

transaction costsare considerablysmallerif the commodity traded is standardized in terms ofquantityandquality - A market that satisfies these criteria is said to be

efficient

- Finally, the

ss