Linear regression

-

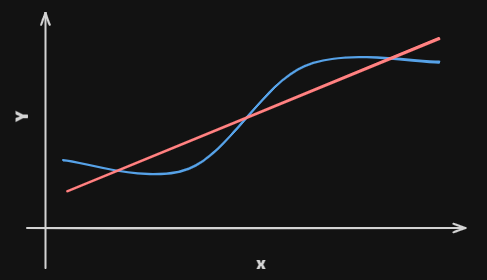

Linear regressionis a simple approach to supervised learning. It assumes that the dependence of

on islinear.True regression functions are never linear!

-

Although it may seem

overly simplistic,linear regressionis extremely useful bothconceptuallyandpractically.

Simple linear regression using a single predictor X

- We assume a model

where and are two

unkown constantsthat represent theinterceptandslope, also known ascoefficientsorparameters, and is theerror term - Where indicates a prediction of on the basis of .

The symbol denotes an estimated value

Estimation of the parameters by least squares

- Let be the prediction for based on the th value of .

Then represents the th

residual - We define the

residual sum of squares(RSS)as

or

- The

least squares approachchooses and to minimize the .The minimizing values can be shown to be

where the are the

sample means

Assessing the Accuracy of the Coefficient Estimates

-

The

standard errorof an estimator reflects how itvariesunder repeated sampling. -

These

standard errorscan be used to computeconfidence intervals -

A 95% confidence interval is defined as a range of values such that with 95% probability, the range will contain the true unknown value of the

parameter. It has the formThere is approximately a

95%chance that the intervalIt will contain the

true valueof -

For example, for the advertising data, the

95% confidence intervalfor is

Hypothesis testing

-

The most common

hypothesis testinginvolves testing thenull hypothesisofThere is no relationship between and versus the alternative hypothesisThere is some relationship between and -

Mathematically, this corresponds to testing

versus -

Since if then the model reduces to , and is not associated with

-

To test the

null hypothesis, we compute at-statistic, given by -

This will have a

t-distributionwithn-2degrees of freedom, assuming . -

p-value: probability of observing any value equal to or largerCoefficient Std. Error t-statistic p-value 7.0325 0.4578 15.36 <0.0001 0.0475 0.0027 17.67 <0.0001

Assessing the Overall Accuracy of the Model

-

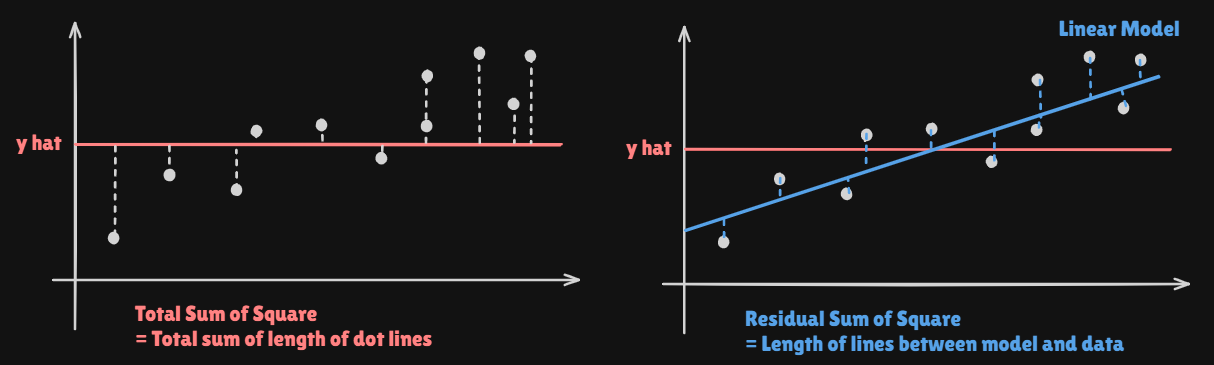

We compute the

Residual Standard Errorwhere the

residual sum-of-squaresisRSS -

or fraction of variance explained is

where the

total sum of squares(TSS) -

It can be shown that in this simple

linear regressionsetting that , where is thecorrelationbetween and :

Multi Linear Regression

-

Here our model is

-

We interpret as the

averageeffect on of a one unit increase in , holding all other predictors fixed

Interpreting regression coefficients

- The ideal scenario is when the

predictorsareuncorrelated: a balanced design- Each

coefficientcan be estimated and tested separately

- Each

Correlationsamongstpredictorscause problems :- The

varianceof allcoefficientstends to increase, sometimes dramatically - Interpretations become

hazardous- when changes, everything else changes

- The

Claims of causalityshould be avoided for observational data

Estimation and Prediction for Multiple Regression

- Given estimates we can make

predictionsusing the formula - We estimate as the values that minimize the

sum of squared residuals

Some important questions

- Is

at least one of the predictorsuseful in predicting the response - Do all the predictors help to explain , or is only a

subsetof thepredictorsuseful? - How well does the model fit the data?

- Given a set of

predictorvalues, what response value should we predict, andhow accurateis our prediction?

Is at least one predictor useful?

- For the first question, we can use the

F-statistic - It decits how effective each predictor was or at least one effective

- At least on coefficient Effective?

- No Predictor Effective?

Deciding on the important variable

- The most direct approach is called

all subsetsorbest subsetsregression- We compute the

least squaresfit for all possiblesubsetsand then choose between them based on some criterion that balances training error with model size

- We compute the

- But, we can not invest resources for of them. We should find

optimized subsets

Forward Selection

- Begin with the

null model - Fit simple linear regression and

add to the null modelthe variable that result in the lowestRSS - Continue until some stopping

ruleis satisfied

Backward Selection

- Start with all variables in the model

Remove the variableswith thelargest p-value- The new variable model is fit, and the variable with the largest p-value is

removed - Continue until some stopping

ruleis reached

Other Considerations in the Regression Model

Qualitative Predictors

- Some predictors are not

quantitativebut thequalitative, taking adiscrete setof values - These are also called

categoricalpredictors orfactorvariables - We can express these

qualitative predictorslike this

Qualitative predictors with more than two levels

-

With more than two levels, we create additional

dummy variables -

There will always be one fewer dummy variable than the number of levels

-

Baseline: What do you want to set asinterceptis very important

Extensions of the Linear Model

- Removing the additive assumption :

interactionsandnonlinearity

Interactions

- In out previous analysis of the

Advertisingdata, we assumed that the effect onsalesof increasing one advertising medium isindependentof the amount spent on the other media - But suppose that spending money on rdio advertising actually increases the effectiveness of TV advertising

- In marketting, this is known as a

synergy effect, and in statistics it is referred to as aninteraction effect - Then we can deal with this problem by transforming the formula

Hierarchy

- Sometimes it is the case that an

interactionterm has a very smallp-value, but the associatedmain effectsdo not - The

hierarchy principle:- If we include an interaction in a model, we should also include the main effects, even if the p-values associated with their coefficients are not significant

- The rationale for this principle is that

interactionsare hard to interpret in a model withoutmain effects - Specifically, the

interactionterms also containmain effects, if the model has no main effect terms

Interactions between qualitative and quantitative variables

- Without an

interactionterm, the model takes the form - With

interactions, it takes the form

- Same Slope

No interaction - Different Slope

With an interaction

- Same Slope

Non-Linear effects of predictors

- Some

Non-Linearstructure might be more effective

What we did not cover

OutliersNon-constant varianceof error termsHigh leverage pointsCollinearity

Next : Generalization of the Linear Model

Classification problems:logistic regression,support vector machinesNon-linearity:kernal smoothing,splinesand generalizedadditive models: nearest neighbor methodsInteractions:Tree-based methods,bagging,random forestsandboosting- These also capture

non-linearities

- These also capture

Regularized fitting:Ridgeregression andLasso